Market overview

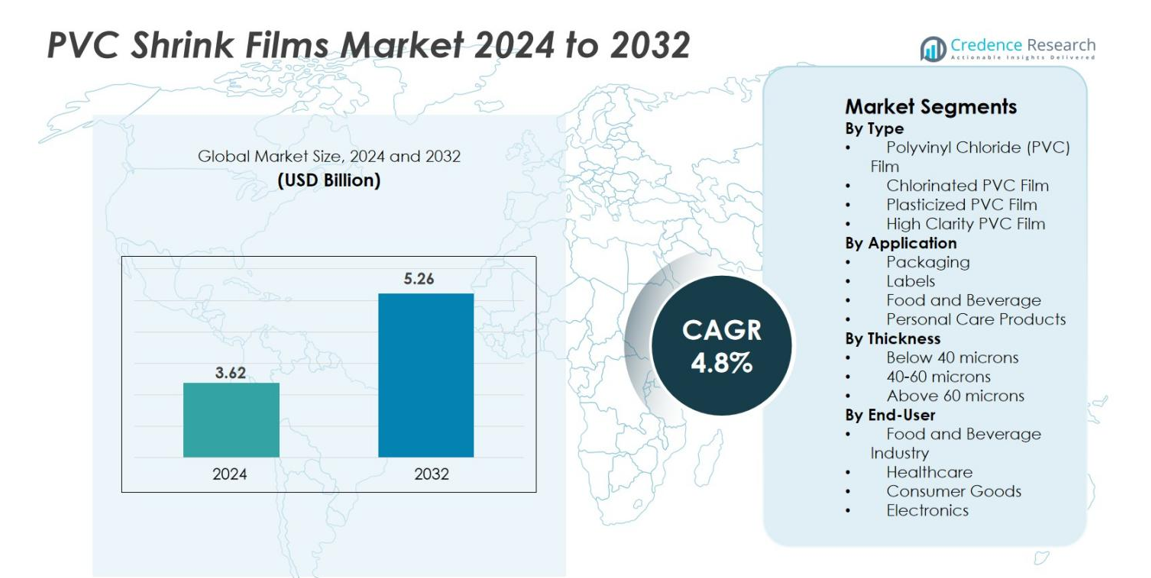

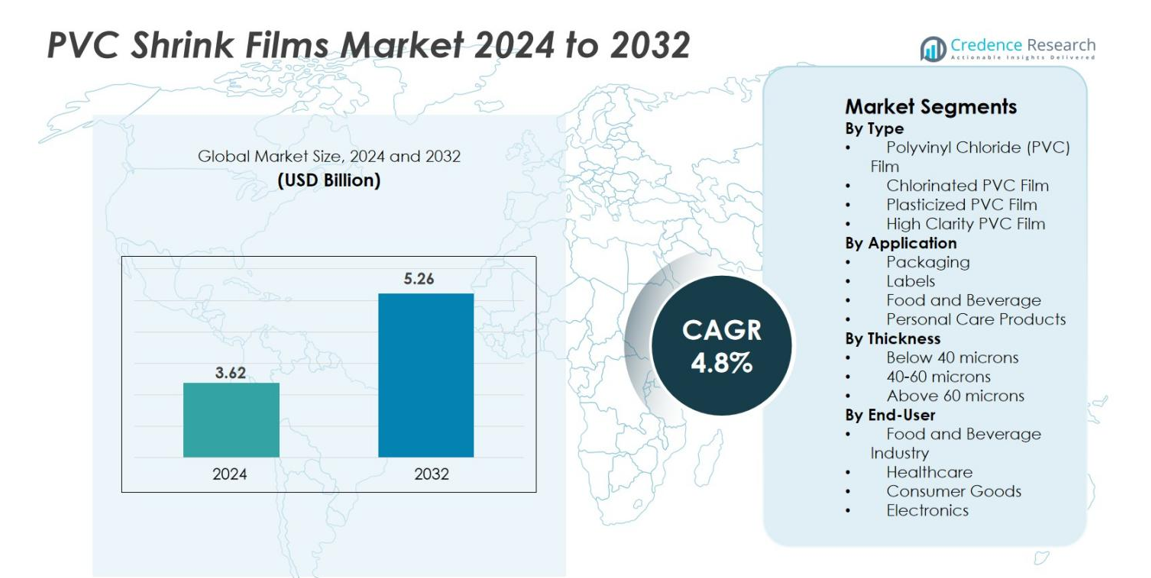

PVC Shrink Films Market size was valued at USD 3.62 billion in 2024 and is anticipated to reach USD 5.26 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PVC Shrink Films Market Size 2024 |

USD 3.62 billion |

| PVC Shrink Films Market, CAGR |

4.8% |

| PVC Shrink Films Market Size 2032 |

USD 5.26 billion |

The PVC Shrink Films Market is led by major companies such as Sealed Air Corporation, Berry Global Group, Coveris Holdings S.A., Transcendia Inc., Filmquest Group Inc., American Eagle Packaging Corporation, Adex Plastics & Machinery Inc., Bonset America Corporation, Anchor Packaging, and Intertape Polymer Group. These players dominate through advanced film processing technologies, sustainable product development, and extensive distribution networks. Asia-Pacific remains the leading region with a 38.2% market share, driven by rapid industrialization and expanding food packaging demand. North America follows with 33.4%, supported by technological innovation and strong consumer packaging standards.

Market Insights

- The PVC Shrink Films Market was valued at USD 3.62 billion in 2024 and is projected to reach USD 5.26 billion by 2032, growing at a CAGR of 4.8%.

- Strong demand from food, beverage, and personal care industries drives market growth, with packaging applications holding a 54.2% segment share due to rising preference for tamper-evident and high-clarity wrapping solutions.

- Growing sustainability trends and advances in co-extrusion and printing technologies are reshaping production, supporting recyclable and eco-efficient film development.

- Competition among key players such as Sealed Air Corporation, Berry Global Group, and Coveris Holdings centers on innovation, product diversification, and capacity expansion amid raw material price volatility.

- Asia-Pacific leads the market with a 38.2% share, followed by North America at 33.4% and Europe at 27.1%, reflecting strong industrial infrastructure and increasing consumption of packaged food products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The polyvinyl chloride (PVC) film segment dominates the PVC Shrink Films Market with a 46.8% share in 2024. Its strong demand stems from high transparency, cost efficiency, and suitability for diverse packaging formats. Industries such as food, pharmaceuticals, and consumer goods rely on PVC film for excellent shrinkage and printability. Chlorinated and plasticized PVC films follow due to their enhanced durability and flexibility. High clarity PVC films are also gaining traction, driven by premium product presentation needs in retail packaging applications.

- For instance, Specialty Polyfilms launched its Forvara® End & Bottom Seal Stretch Shrink Films at the IPPE 2024 show, engineered to emulate the cling, transparency, and softness of PVC films for meat packaging, meeting stringent quality standards and achieving an AA+ BRCGS certification for food safety.

By Application

The packaging segment leads the PVC Shrink Films Market with a 54.2% market share. It benefits from rising demand for tamper-evident seals and improved product visibility across food, beverage, and consumer goods industries. Shrink films offer superior protection and aesthetic appeal, making them ideal for retail-ready packaging. The food and beverage sub-segment continue to expand rapidly, supported by increased adoption of hygienic wrapping solutions. Labels and personal care products segments also show steady growth, driven by branding and sustainability preferences among manufacturers.

- For instance, Dallas Plastics highlights the use of shrink film in securing multipacks of water bottles, improving stability during transport while boosting brand visibility on retail shelves.

By Thickness

Films with a thickness range of 40–60 microns account for 49.7% of the market share, emerging as the dominant sub-segment. This range offers an optimal balance of strength, flexibility, and clarity, supporting applications in food packaging and product labeling. Below 40-micron films cater to lightweight wrapping uses, whereas films above 60 microns target heavy-duty industrial applications. The growing need for durable, puncture-resistant materials in logistics and retail packaging continues to favor mid-range thickness films, strengthening their adoption across global manufacturing sectors.

Key Growth Drivers

Rising Demand in Food and Beverage Packaging

The increasing consumption of packaged and ready-to-eat food products drives the PVC Shrink Films Market significantly. Food and beverage manufacturers prefer PVC shrink films for their clarity, seal strength, and ability to conform tightly to diverse product shapes. The material provides strong protection against moisture, dust, and contamination while ensuring superior product visibility. Expanding retail networks and e-commerce distribution have further amplified packaging requirements that enhance product appeal and shelf life. This trend continues to support high-volume adoption across frozen foods, dairy, confectionery, and bottled beverage segments.

- For instance, shrink film is commonly used by water bottle manufacturers to secure multipacks, ensuring stability and protection during bulk transportation and retail handling.

Expanding Personal Care and Household Product Applications

PVC shrink films are widely adopted in personal care and household product packaging due to their tamper-evident and flexible sealing properties. The growth of cosmetic and hygiene product categories has increased the use of shrink sleeves and multipack wraps. Manufacturers leverage these films for branding and visual appeal through high-quality printing and labeling. The rising consumer inclination toward convenience and premium product aesthetics further fuels demand. With global brands emphasizing safe, recyclable, and visually distinct packaging, the segment’s contribution to market growth remains robust.

- For instance, Allen Industries Co., Ltd provides PVC shrink films known for excellent clarity and strong sealing, enhancing product visibility and protection in cosmetic packaging lines.

Advancements in Printing and Film Processing Technologies

Technological innovation has significantly enhanced the performance and versatility of PVC shrink films. Modern extrusion and co-extrusion technologies enable higher clarity, strength, and shrink ratios, improving film adaptability to complex container geometries. Digital and flexographic printing advancements allow manufacturers to achieve vibrant, customized graphics that elevate brand identity. Companies are also investing in environmentally improved formulations with reduced additives to meet regulatory standards. These innovations collectively strengthen product value and production efficiency, accelerating adoption across high-volume packaging applications.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Shrink Films

The global packaging industry’s sustainability focus has created opportunities for eco-friendly PVC shrink films. Manufacturers are developing recyclable grades and optimizing resin compositions to minimize environmental impact. Growing regulatory pressure to reduce single-use plastics encourages product reformulation, such as chlorine-free alternatives. Companies focusing on material recovery and closed-loop recycling systems are likely to gain a competitive advantage. This trend aligns with brand owners’ sustainability commitments and positions PVC films as a transitional solution in the shift toward circular packaging systems.

- For instance, Thunderbird Plastics is advancing closed-loop recycling technologies that enable mechanical and chemical recycling of plastics, enhancing circular packaging systems and reducing environmental leakage.

Rising Adoption in E-commerce and Retail Packaging

E-commerce expansion has amplified demand for durable, flexible packaging materials capable of safeguarding products during transit. PVC shrink films offer an ideal solution due to their high tensile strength, shrink uniformity, and tamper evidence. The films enhance product display in retail-ready formats while minimizing secondary packaging. Retailers increasingly use printed shrink sleeves for branding consistency across multiple SKUs. As online shopping continues to rise globally, the role of shrink packaging in ensuring product protection and aesthetic presentation becomes a major growth opportunity.

- For instance, Traco’s PVC shrink films are widely recognized for their smooth surface and high clarity, ensuring product protection while meeting stringent packaging standards.

Key Challenges

Environmental Concerns and Regulatory Restrictions

The PVC Shrink Films Market faces challenges from environmental regulations limiting chlorine-based plastics. Disposal and recycling difficulties, coupled with harmful emissions during incineration, create compliance barriers. Many regions are adopting stricter sustainability mandates, compelling manufacturers to explore alternative materials or reformulate existing ones. These regulatory shifts can increase production costs and limit adoption in environmentally sensitive sectors. Addressing these challenges requires significant investment in green chemistry and advanced recycling technologies.

Volatility in Raw Material Prices

Fluctuations in raw material costs, particularly polyvinyl chloride resins and additives, affect production economics. Price instability stems from crude oil market dynamics and supply chain disruptions. Manufacturers often face margin pressures as they struggle to balance material costs with competitive pricing. Dependence on petrochemical feedstocks also heightens exposure to global trade and logistics uncertainties. To mitigate this, producers are focusing on long-term supplier contracts, raw material diversification, and operational efficiency improvements to stabilize profitability.

Regional Analysis

North America

North America holds a 33.4% share of the PVC Shrink Films Market, driven by strong demand from the food, beverage, and personal care sectors. The region benefits from advanced packaging technology adoption and established distribution networks. Major companies like Berry Global Group and Sealed Air Corporation lead innovations in recyclable shrink films and high-clarity packaging. The U.S. market dominates regional growth due to widespread retail penetration and consumer preference for convenience packaging. Increasing investment in sustainable film production also strengthens the region’s leadership in the global market.

Europe

Europe accounts for 27.1% of the PVC Shrink Films Market, supported by high regulatory standards promoting recyclable packaging materials. Countries such as Germany, France, and the U.K. lead the demand for high-performance shrink films in food labeling and personal care packaging. The presence of key players like Coveris Holdings and Filmquest Group enhances local supply capabilities. Sustainable production initiatives and strict plastic waste directives drive innovation in low-chlorine formulations. Continuous growth in premium packaged goods and private-label brands sustains steady market expansion across the region.

Asia-Pacific

Asia-Pacific dominates the global PVC Shrink Films Market with a 38.2% market share. The region’s growth is fueled by rapid industrialization, rising disposable income, and expansion in food processing and retail sectors. China, India, and Japan are key contributors, supported by cost-effective manufacturing and strong domestic consumption. Growing export activities and investments in flexible packaging infrastructure further strengthen regional production capacity. The shift toward packaged food and beverage consumption in urban centers continues to drive sustained market growth across the region.

Latin America

Latin America captures 6.3% of the PVC Shrink Films Market, with Brazil and Mexico serving as major contributors. Expanding retail chains and the beverage industry’s packaging upgrades support market progress. Local manufacturers are increasingly adopting cost-efficient film technologies for food and consumer goods packaging. Government support for manufacturing expansion and economic recovery initiatives enhances production output. The market’s gradual transition toward improved packaging aesthetics and sustainability offers further potential for regional players.

Middle East & Africa

The Middle East & Africa region holds a 4.9% share of the PVC Shrink Films Market. Demand is driven by growing food processing industries and urban retail expansion across Gulf nations and South Africa. The region’s packaging sector benefits from increased infrastructure development and industrial diversification. Manufacturers are investing in flexible and heat-resistant PVC shrink films suited for extreme climatic conditions. The rising focus on sustainable material adoption and import substitution policies is gradually supporting local production growth and regional market penetration.

Market Segmentations

By Type

- Polyvinyl Chloride (PVC) Film

- Chlorinated PVC Film

- Plasticized PVC Film

- High Clarity PVC Film

By Application

- Packaging

- Labels

- Food and Beverage

- Personal Care Products

By Thickness

- Below 40 microns

- 40-60 microns

- Above 60 microns

By End-User

- Food and Beverage Industry

- Healthcare

- Consumer Goods

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PVC Shrink Films Market is moderately consolidated, with leading players focusing on technological advancement, product innovation, and sustainability to strengthen market positioning. Key companies include Sealed Air Corporation, Berry Global Group, Coveris Holdings S.A., Transcendia Inc., Filmquest Group Inc., American Eagle Packaging Corporation, Adex Plastics & Machinery Inc., Bonset America Corporation, Anchor Packaging, and Intertape Polymer Group. These players compete through product diversification, capacity expansion, and regional partnerships to enhance production efficiency and customer reach. Major manufacturers are investing in eco-friendly PVC formulations and recyclable shrink films to comply with evolving environmental regulations. Companies such as Sealed Air and Berry Global emphasize lightweight, high-clarity, and tamper-resistant solutions for food and beverage packaging. Strategic collaborations and R&D investments aimed at improving film strength, gloss, and printability further define the competitive environment, ensuring sustained innovation and growth within the global PVC shrink films industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bonset America Corporation (United States)

- Adex Plastics & Machinery, Inc. (United States)

- Intertape Polymer Group (Canada)

- Filmquest Group Inc. (United States)

- Coveris Holdings S.A. (United States)

- Anchor Packaging (United States)

- Berry Global Group, Inc. (United States)

- American Eagle Packaging Corporation (United States)

- Transcendia Inc. (United States)

- Sealed Air Corporation (United States)

Recent Developments

- In February 2025, Berry Global launched its next-generation Bontite® Sustane™ Stretch Film featuring 30% certified post-consumer recycled content, signaling a move toward sustainability in film products.

- In March 2024, Berry Global, Inc. announced an expansion of recycling capacity across three of its European facilities supporting its flexible‑films business and enabling higher recycled‑content films used in applications including collation and shrink films.

- In February 2024, Intertape Polymer Group launched its ExlfilmPlus PCR polyolefin shrink film with ~35% recycled content.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Thickness, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for PVC shrinks films will grow steadily with rising global packaging needs.

- Manufacturers will focus on developing recyclable and eco-friendly film formulations.

- Technological improvements in co-extrusion and printing will enhance film clarity and strength.

- Food and beverage packaging will remain the primary growth driver across key markets.

- Companies will invest more in lightweight and tamper-resistant packaging designs.

- E-commerce expansion will increase demand for durable and flexible shrink films.

- Sustainability regulations will push producers toward greener material innovation.

- Strategic partnerships and mergers will strengthen global supply networks.

- Asia-Pacific will continue leading market expansion with strong production capacity.

- Digital printing and customization trends will create new opportunities for brand differentiation.