Market Overview

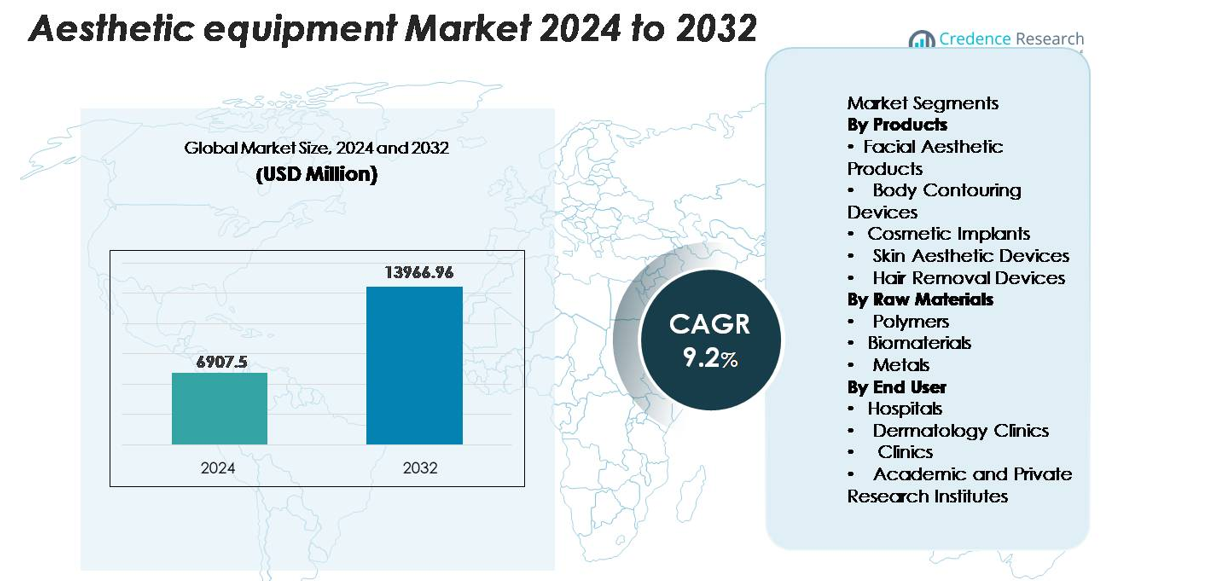

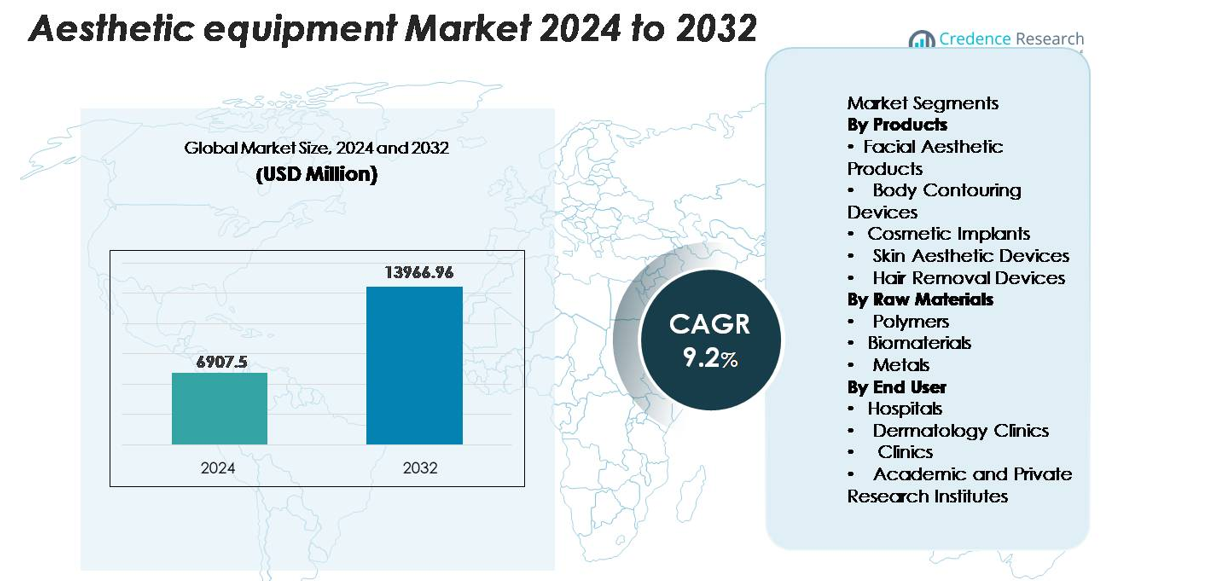

The global aesthetic equipment market was valued at USD 6,907.5 million in 2024 and is projected to reach USD 13,966.96 million by 2032, expanding at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aesthetic Equipment Market Size 2024 |

USD 6,907.5 million |

| Aesthetic Equipment Market, CAGR |

9.2% |

| Aesthetic Equipment Market Size 2032 |

USD 13,966.96 million |

The aesthetic equipment market is shaped by leading players such as Allergan Aesthetics, Lumenis, Cynosure, Alma Lasers, Cutera, Candela Medical, Galderma, Fotona, Syneron, and Solta Medical, each offering advanced laser, RF, ultrasound, and minimally invasive treatment platforms. These companies maintain strong clinical partnerships, continuous product innovation, and global distribution networks that reinforce their competitive positions. North America leads the market with an exact share of 35%, driven by high device adoption and strong consumer demand, followed by Europe at 28% and Asia-Pacific at 25%, where rapid technological expansion and increasing aesthetic awareness continue to fuel strong growth momentum.

Market Insights

- The global aesthetic equipment market reached USD 6,907.5 million in 2024 and is projected to hit USD 13,966.96 million by 2032, expanding at a 9.2% CAGR, supported by rising adoption of advanced facial and body enhancement technologies.

- Market growth is driven by surging demand for minimally invasive procedures, strong consumer preference for anti-aging solutions, and rapid technological upgrades across laser, RF, and ultrasound-based platforms, especially within the dominant facial aesthetic products segment.

- Key trends include the integration of AI-guided diagnostics, expansion of multi-application energy-based devices, and increasing uptake of non-surgical body contouring, alongside rising consumer interest in home-use aesthetic technologies.

- Competitive intensity remains high as leaders such as Allergan Aesthetics, Cynosure, Alma Lasers, and Cutera focus on R&D investments, product diversification, and strategic clinical partnerships to strengthen global positioning.

- Regionally, North America holds 35%, Europe 28%, and Asia-Pacific 25%, reflecting strong procedure volumes and widening adoption across hospitals, dermatology clinics, and specialty aesthetic centers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Products

Facial aesthetic products represent the dominant sub-segment, holding the largest market share due to their extensive use in non-invasive rejuvenation, wrinkle reduction, and facial enhancement procedures. Their demand is driven by the rising preference for minimally invasive treatments, shorter recovery times, and wider adoption of injectables, micro-needling tools, and energy-based facial systems. Body contouring devices are growing rapidly as consumers seek non-surgical fat reduction and skin tightening solutions. Additionally, cosmetic implants, skin aesthetic devices, and hair removal devices continue to expand their footprint as technology advancements improve treatment precision, safety, and patient experience.

- For instance, Allergan’s Juvéderm VYC-20L dermal filler (marketed in the U.S. as Juvéderm Voluma XC) incorporates a precise formulation of 20 mg/mL hyaluronic acid combined with 0.3% lidocaine, supporting deep facial volumization and enhanced patient comfort during mid-face contouring procedures.

By Raw Materials

Polymers form the leading raw material sub-segment, accounting for the majority share due to their flexibility, durability, and compatibility in manufacturing implants, casings for devices, and components used in aesthetic equipment. Their advantages include lightweight structure, ease of molding, and suitability for both disposable and reusable devices. Biomaterials are witnessing strong adoption as manufacturers integrate biocompatible materials for implants and fillers. Metals remain essential for creating high-strength structural components, surgical tools, and precision parts used in energy-based aesthetic systems. The shift toward advanced materials enhances product performance, safety, and lifecycle reliability.

- For instance, Allergan’s Natrelle® INSPIRA® breast implants utilize TruForm® 1, TruForm® 2, and TruForm® 3 cohesive silicone gels, each engineered with distinct cohesivity levels that determine firmness, resistance to deformation, and shape retention.

By End User

Hospitals dominate the end-user segment, supported by their advanced infrastructure, higher treatment volumes, and capability to deploy high-value aesthetic systems for complex and multidisciplinary procedures. Their share is strengthened by growing demand for medical-grade aesthetic interventions and availability of trained specialists. Dermatology clinics follow closely as they remain primary hubs for minimally invasive treatments, skin rejuvenation procedures, and laser-based therapies. Stand-alone clinics also maintain significant adoption of portable and mid-range aesthetic devices. Academic and private research institutes contribute to the segment by advancing product innovation, clinical trials, and therapeutic technique development.

Key Growth Drivers

Rising Demand for Minimally Invasive Aesthetic Procedures

The global aesthetic equipment market is expanding rapidly as consumers increasingly prefer minimally invasive and non-invasive procedures that deliver visible results with minimal downtime. Technologies such as laser resurfacing systems, radiofrequency devices, micro-focused ultrasound platforms, and advanced injectables have become the cornerstone of modern cosmetic treatments. The shift is driven by growing awareness of anti-aging solutions, social media influence, and broader acceptance of aesthetic enhancements across age groups and genders. Clinics and hospitals continue to upgrade portfolios with multifunctional devices capable of skin tightening, pigmentation correction, and facial contouring, further accelerating adoption. Advancements in cooling technologies, real-time imaging, and automated treatment settings also improve safety and consistency, encouraging greater consumer trust. Overall, the preference for non-surgical solutions remains a key driver reshaping the industry landscape and expanding patient volumes globally.

- For instance, Ulthera’s Ultherapy® system—FDA-cleared for non-surgical lifting—delivers micro-focused ultrasound at precise depths of 3.0 mm and 4.5 mm, targeting the SMAS layer traditionally addressed in surgical facelifts.

Rapid Technological Advancements in Aesthetic Systems

Continuous innovation in aesthetic technologies significantly drives market growth as manufacturers introduce devices with enhanced precision, automation, and multi-modal treatment capabilities. The integration of AI-based skin analysis, robotic-assisted energy delivery, and smart sensors has improved treatment accuracy and clinical outcomes. Multi-application platforms that combine laser, IPL, RF, and ultrasound technologies allow providers to address pigmentation, vascular lesions, hair removal, and rejuvenation in a single system, improving cost efficiency and clinic productivity. New laser wavelengths, non-ablative technologies, and fractional delivery mechanisms also broaden the patient base by offering gentler yet effective treatments. Additionally, rising R&D investments support the development of compact, portable devices suitable for small clinics and home-based applications. These advancements enhance usability, reduce procedure time, and ensure safer treatment profiles, making next-generation aesthetic systems highly attractive to providers.

- For instance, Lumenis’ Stellar M22™ platform integrates four technologies—IPL, ResurFX™, Nd:YAG, and Q-Switched—with over 30 preset treatment modules and a 1565 nm fractional laser capable of delivering up to 300 microbeams per shot, enabling comprehensive treatment of vascular and pigmentary conditions.

Increasing Awareness and Acceptance of Aesthetic Wellness

A growing emphasis on personal appearance, holistic wellness, and self-confidence is fueling widespread adoption of aesthetic equipment. Consumers across both mature and emerging markets are increasingly open to anti-aging treatments, preventive skincare measures, and body enhancement procedures. The influence of digital media, celebrity endorsements, and medical tourism has normalized aesthetic interventions, reducing stigma and encouraging first-time users. Younger demographics seek early anti-aging prevention, while older populations look for restorative treatments, creating robust multi-age demand. Corporate wellness programs, lifestyle shifts, and rising disposable incomes further expand the target audience. Clinics and hospitals now emphasize patient-centric care, offering personalized treatment plans supported by diagnostic imaging and tailored device settings. This expanding cultural acceptance strengthens long-term demand for high-performance aesthetic equipment.

Key Trends & Opportunities

Growth of AI-Driven Personalization and Digital Treatment Planning

AI-enabled diagnostic tools and digital visualization platforms are emerging as transformative trends in the aesthetic equipment industry. Clinics increasingly use AI to analyze skin conditions, simulate treatment outcomes, and design personalized protocols based on real-time data. Digital imaging systems allow practitioners to track progress across sessions, enhancing accuracy and patient satisfaction. This trend creates opportunities for equipment manufacturers to integrate intelligent software with hardware systems, improving decision support and enabling predictive treatment adjustments. AI-driven customization enhances clinical consistency, reduces treatment errors, and enables providers to deliver high-value, tailored experiences. As consumers demand transparency and outcome predictability, digital tools become integral to aesthetic workflows, supporting both clinical excellence and operational efficiency.

- For instance, Canfield Scientific’s VISIA® Skin Analysis system captures images using 8 standardized lighting modalities, including cross-polarized and UV fluorescence, and quantifies over 10 distinct skin parameters such as porphyrins, wrinkles, texture, and erythema with pixel-level accuracy.

Expansion of Non-Surgical Body Contouring and Wellness-Based Aesthetics

Non-surgical body contouring continues to gain momentum as consumers seek alternatives to invasive liposuction and surgical reconstruction. Devices leveraging cryolipolysis, high-intensity focused electromagnetic energy, ultrasound cavitation, and RF-based fat reduction offer painless, downtime-free solutions. This trend aligns with increasing fitness consciousness and demand for body sculpting, cellulite reduction, and muscle toning treatments. The convergence of aesthetic care and wellness—such as hormone balancing, metabolic optimization, and regenerative skin therapies—also opens opportunities for device manufacturers to enter interdisciplinary markets. Providers offering combined facial and body protocols experience higher retention rates, making multi-functional body-centric equipment a key investment opportunity for facilities worldwide.

- For instance, Allergan’s CoolSculpting® Elite system delivers controlled cryolipolysis at tissue temperatures reaching as low as −11°C, enabling precise adipocyte crystallization while protecting the skin surface with real-time thermal monitoring.

Rising Adoption of Home-Use and Portable Aesthetic Devices

Consumer preference for at-home beauty solutions is accelerating demand for safe, compact, and easy-to-operate aesthetic devices. The market is witnessing growth in portable laser hair removal units, LED phototherapy masks, microcurrent tools, acne treatment devices, and handheld skin-tightening systems. This trend emerged strongly post-pandemic as users sought convenience and cost-effective maintenance routines, and it continues to rise as device safety and efficacy improve. Manufacturers leverage this opportunity by integrating app connectivity, treatment tracking, and safety lock features, appealing to tech-savvy consumers. The growth of this segment complements, rather than replaces, clinical aesthetics by promoting continuous care and long-term engagement with aesthetic routines.

Key Challenges

High Cost of Advanced Aesthetic Systems and Limited Accessibility

Although demand for aesthetic treatments is increasing, the high cost of advanced laser, RF, ultrasound, and body-contouring devices remains a significant barrier for small clinics and emerging markets. Premium systems require substantial upfront investments, along with ongoing maintenance, consumables, and periodic software upgrades. The financial burden limits adoption among independent practitioners and reduces treatment accessibility for cost-sensitive populations. Insurance typically does not cover aesthetic procedures, further restricting patient volumes in price-sensitive regions. As technology becomes more sophisticated, the cost gap may widen unless manufacturers develop flexible pricing models, leasing programs, or modular device architectures to support broader market penetration.

Regulatory Complexities and Safety Concerns in Aesthetic Procedures

The aesthetic equipment market faces stringent regulatory requirements related to device safety, patient protection, and clinical efficacy. Obtaining approvals from authorities such as the FDA or CE involves extensive testing, documentation, and time-consuming validation processes. Variability in global regulatory frameworks complicates international market expansion, especially for emerging technologies and multifunctional devices. Additionally, improper device usage, inadequate training, and counterfeit products raise safety concerns, potentially leading to adverse events and reputational risks for providers. These issues require manufacturers to invest in robust training programs, standardized certification, and continuous monitoring to maintain compliance and ensure safe clinical adoption.

Regional Analysis

North America

North America holds the largest market share, accounting for around 35%, supported by strong consumer spending on aesthetic enhancement and high adoption of advanced laser, RF, and ultrasound-based equipment. The U.S. remains the central hub due to its extensive network of dermatology clinics, medical spas, and hospitals equipped with premium systems. High awareness of non-invasive cosmetic treatments, rapid adoption of AI-integrated diagnostic tools, and continuous device innovation by U.S.-based manufacturers further strengthen regional growth. Strong regulatory frameworks, combined with increasing male aesthetics participation, continue to reinforce North America’s leadership position.

Europe

Europe represents approximately 28% of the global market, driven by high demand for anti-aging solutions, expanding medical tourism in Germany, France, Italy, and Spain, and a well-established network of aesthetic dermatology centers. The region benefits from growing adoption of energy-based devices, advanced facial aesthetic products, and body contouring technologies. Strict regulatory approvals ensure high device safety and treatment quality, enhancing consumer confidence. The rise of minimally invasive cosmetic procedures and increasing preference for clinically proven technologies continue to fuel market penetration across Western and Northern Europe, with Eastern Europe emerging as a fast-growing secondary market.

Asia-Pacific

Asia-Pacific captures around 25% of global share and stands as the fastest-growing region due to rising disposable incomes, expanding urban populations, and strong cultural emphasis on appearance enhancement. Countries such as China, South Korea, Japan, and India drive rapid adoption of facial aesthetic products, skin rejuvenation systems, and hair removal technologies. South Korea remains a global leader in cosmetic innovation and medical tourism, while China accelerates growth through local manufacturing advancements. Increasing availability of cost-effective procedures, rapid clinic proliferation, and government support for medical technology development strengthen APAC’s long-term market potential.

Latin America

Latin America accounts for about 7% of the market, supported by strong aesthetic treatment demand in Brazil, Mexico, Colombia, and Argentina. Brazil remains the region’s dominant market due to a well-established cosmetic procedure culture and widespread adoption of body contouring, laser therapy, and facial enhancement technologies. Medical tourism continues to boost equipment demand as clinics upgrade to advanced, minimally invasive systems. Despite economic fluctuations, rising consumer interest in anti-aging and skin treatments, along with growing investments in dermatology centers, contributes to steady regional expansion and increasing acceptance of energy-based aesthetic devices.

Middle East & Africa

The Middle East & Africa region holds around 5% market share, with rapid growth concentrated in the UAE, Saudi Arabia, Qatar, and South Africa. Wealthy urban populations, strong medical tourism inflows, and rising investment in premium aesthetic clinics support adoption of high-end laser, RF, and body contouring devices. The UAE and Saudi Arabia lead due to increasing demand for luxury cosmetic treatments and government initiatives encouraging healthcare modernization. While Africa remains an emerging market, rising awareness of non-invasive procedures and expanding private healthcare facilities are gradually increasing the uptake of aesthetic equipment.

Market Segmentations:

By Products

- Facial Aesthetic Products

- Body Contouring Devices

- Cosmetic Implants

- Skin Aesthetic Devices

- Hair Removal Devices

By Raw Materials

- Polymers

- Biomaterials

- Metals

By End User

- Hospitals

- Dermatology Clinics

- Clinics

- Academic and Private Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aesthetic equipment market is defined by a blend of established global manufacturers and rapidly expanding innovators focused on advancing energy-based and minimally invasive technologies. Leading companies such as Allergan Aesthetics, Lumenis, Cynosure, Alma Lasers, Candela Medical, Cutera, Fotona, Galderma, Syneron, and Solta Medical maintain strong market positions through continuous R&D investment, diversified product portfolios, and extensive distribution networks. These players emphasize multi-application platforms integrating laser, RF, IPL, ultrasound, and combination therapies to enhance clinical outcomes and treatment versatility. Strategic partnerships with dermatology clinics, hospitals, and aesthetic centers support deeper market penetration, while frequent product launches strengthen competitiveness. Manufacturers increasingly focus on AI-enabled diagnostics, ergonomic device designs, and safety-enhancing features to differentiate offerings. Rising demand from emerging markets also encourages companies to expand manufacturing footprints, enhance after-sales support, and introduce cost-optimized models. Overall, competition intensifies as firms balance innovation with regulatory compliance and evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cynosure (U.S.)

- Medytox (South Korea)

- Bausch Health Companies Inc. (Canada)

- BTL (Czech Republic)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (China)

- AbbVie Inc. (U.S.)

- Candela Medical (U.S.)

- SharpLight Technologies Inc. (Israel)

- LUTRONIC INC. (South Korea)

- Cutera (U.S.)

Recent Developments

- In April 2025, BTL Industries announced on April 8 that its EMFACE® Eye non-invasive under-eye aging treatment surpassed 1 million treatments globally and achieved ~70% growth in Q1 2025.

- In April 2025, Bausch Health Companies Inc. Its aesthetics business (Solta Medical) launched the next-generation Fraxel FTX™ skin-resurfacing laser at the ASLMS 2025 conference on April 25

Report Coverage

The research report offers an in-depth analysis based on Products, Raw materials, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive and non-invasive aesthetic procedures will continue rising across all major demographics.

- Adoption of AI-driven skin analysis and digital treatment planning tools will become standard in clinics.

- Multi-application platforms combining laser, RF, IPL, and ultrasound technologies will gain broader clinical preference.

- Body contouring, fat reduction, and muscle-toning devices will expand rapidly as wellness and aesthetics converge.

- Portable and home-use aesthetic devices will witness strong consumer adoption supported by improved safety features.

- Manufacturers will invest more in ergonomic designs and energy-efficient systems to enhance user experience.

- Emerging markets in Asia-Pacific, the Middle East, and Latin America will drive the next phase of market expansion.

- Strategic partnerships between device manufacturers and dermatology chains will strengthen brand presence.

- Regulatory compliance and device safety validation will become more stringent globally.

- Continuous innovation in biomaterials and device components will enhance treatment precision and long-term performance.