Market Overview

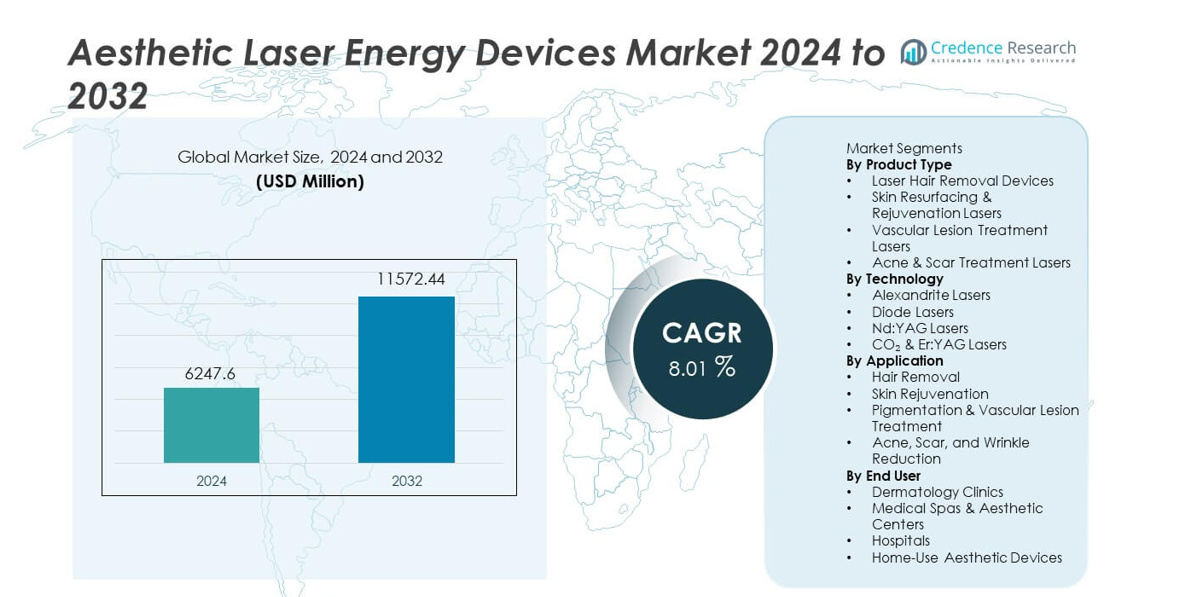

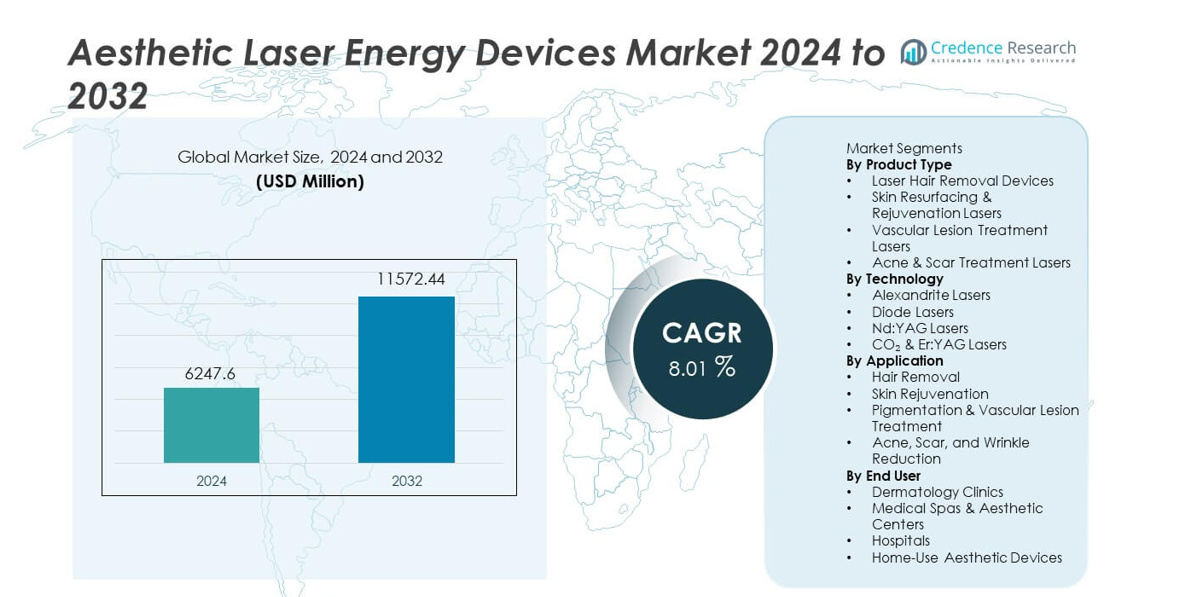

The Aesthetic Laser Energy Devices Market was valued at USD 6,247.6 million in 2024 and is projected to reach USD 11,572.44 million by 2032, registering a CAGR of 8.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aesthetic Laser Energy Devices Market Size 2024 |

USD 6,247.6 million |

| Aesthetic Laser Energy Devices Market, CAGR |

8.01% |

| Aesthetic Laser Energy Devices Market Size 2032 |

USD 11,572.44 million |

The Aesthetic Laser Energy Devices market features leading players such as Cynosure LLC, Cutera Inc., Lumenis Ltd., Alma Lasers, Candela Corporation, Fotona, Lutronic Corporation, Sciton Inc., El.En. Group, and BISON Medical. These companies strengthen their positions through multi-application platforms, improved precision, and advanced cooling systems that enhance treatment outcomes. North America leads the global market with a 37% share, driven by high patient demand, strong clinical infrastructure, and early adoption of premium laser technologies. Europe follows with a 28% share, supported by strong regulatory standards and growing interest in non-invasive aesthetic procedures across key economies.

Market Insights

- The market reached USD 6,247.6 million in 2024 and will hit USD 11,572.44 million by 2032 at a CAGR of 8.01%, showing strong long-term growth.

- Demand rises due to higher adoption of non-invasive treatments, with laser hair removal leading the product segment with a 32% share supported by strong clinic usage.

- Trends focus on hybrid and multi-application laser systems, with Asia Pacific gaining momentum as rising beauty awareness drives its 26% regional share.

- Competition intensifies as key players invest in multi-wavelength devices and expand partnerships with dermatology clinics to strengthen service quality and upgrade treatment outcomes.

- Market restraints include high device costs and skill-based operational needs, while regional performance remains led by North America with a 37% share, followed by Europe at 28%, reflecting advanced healthcare access and strong cosmetic procedure demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Laser hair removal devices lead the product type segment with a 32% share due to strong demand for long-term hair reduction solutions in clinics and medical spas. Their quick treatment cycles and ability to target large areas support wide adoption. Skin resurfacing and rejuvenation lasers also gain traction as consumers seek solutions for texture, tone, and age-related concerns. Vascular lesion treatment and acne or scar lasers expand use cases in dermatology practices. Rising focus on non-invasive aesthetics continues to push innovation in wavelength control and cooling systems, which strengthens growth across all product categories.

- For instance, Alma Lasers upgraded its Soprano Titanium platform with an especially large spot size applicator, known as the Trio Max, that delivers three combined wavelengths simultaneously in a single pulse. The device supports a rapid repetition rate output for faster sessions using the “In-Motion” technique.

By Technology

Diode lasers dominate the technology segment with a 34% share because they offer fast pulse delivery, strong safety profiles, and effective outcomes across varied skin types. Their compact design and low maintenance needs make them popular among high-volume aesthetic centers. Nd:YAG lasers gain attention for deeper skin penetration and suitability for darker skin tones. Alexandrite platforms remain preferred for lighter skin and fine hair. CO₂ and Er:YAG lasers support advanced resurfacing procedures. Growing interest in hybrid systems and multi-wavelength platforms drives broader technology adoption in both premium and mid-range devices.

- For instance, Candela enhanced its GentleMax Pro Plus system by integrating both Alexandrite and Nd:YAG sources. The system features a large spot size that cuts treatment time per session by a significant amount.

By Application

Hair removal holds the largest share in the application segment at 38%, supported by strong consumer demand for long-lasting and low-pain cosmetic solutions. Clinics favor laser platforms that deliver high speed and stable energy output for efficient throughput. Skin rejuvenation also sees steady growth as patients seek treatments for fine lines, sun damage, and texture issues. Pigmentation and vascular lesion treatment attract need-based demand from individuals dealing with melasma, rosacea, or visible veins. Rising focus on acne, scar, and wrinkle reduction further expands clinical use, driven by improved precision and reduced downtime in modern aesthetic systems.

Key Growth Driver

Rising Demand for Non-Invasive Aesthetic Procedures

Growing preference for non-invasive treatments drives rapid adoption of aesthetic laser energy devices. Consumers seek solutions that offer minimal downtime, quick sessions, and visible results. Dermatology clinics expand service portfolios to meet rising demand for hair removal, skin rejuvenation, and pigmentation correction. Advancements in device safety and cooling technology also improve patient comfort. Increased social media influence and broader acceptance of cosmetic treatments further push market penetration across age groups. As more users prioritize appearance-enhancing procedures, clinics invest in high-performance laser platforms to support continuous service growth.

- For instance, Lumenis reported strong adoption of its LightSheer QUATTRO platform, which offers two diode wavelengths. The device uses ChillTip technology that cools skin significantly during operation, providing increased comfort.

Technological Advancements in Laser Platforms

Innovations in multi-wavelength systems, pulse control, and energy delivery strengthen clinical outcomes and expand treatment versatility. Manufacturers integrate AI-based calibration, smart sensors, and improved cooling modules to enhance precision and reduce treatment risks. Hybrid laser platforms support multiple indications in one device, improving cost efficiency for clinics. Enhanced compatibility with various skin types also expands the patient pool. Technology upgrades help providers achieve consistent results, which increases patient satisfaction and repeat visits. These developments accelerate adoption across dermatology centers, medical spas, and outpatient aesthetic clinics.

- For instance, Fotona advanced its SP Dynamis Pro system by pairing Er:YAG at 2940 nm with Nd:YAG at 1064 nm in one platform. The device delivers pulse durations as short as 0.1 ms for controlled ablation.

Expanding Medical Spa and Dermatology Clinic Network

A growing number of medical spas and aesthetic centers directly supports market expansion. Clinics adopt laser devices to provide competitive service portfolios and attract wider consumer groups. Increased availability of trained practitioners strengthens device utilization across urban and semi-urban regions. Affordable service bundles and subscription-based aesthetic packages boost service demand. Many facilities upgrade device fleets to meet rising expectations for safety and treatment quality. As access to cosmetic services improves, the market experiences steady growth driven by broader adoption and rising patient flows.

Key Trend & Opportunity

Growth of Multi-Application and Hybrid Laser Systems

Clinics increasingly prefer multi-application platforms that handle hair removal, rejuvenation, pigmentation, and vascular treatments in one system. These devices lower operational costs and improve treatment flexibility. Hybrid lasers combine wavelengths for deeper penetration and higher precision, making them attractive for both new and established centers. The trend supports higher return on investment for providers. As patient demand for combination treatments grows, hybrid systems create significant opportunities for device manufacturers to introduce advanced and more customizable solutions.

- For instance, Sciton enhanced its Joule X platform by integrating various compatible modules, including BBL Hero and ProFractional Er:YAG, within one chassis. The system delivers substantial energy for a wide range of applications, including highly effective resurfacing treatments.

Rising Adoption of Home-Use Aesthetic Laser Devices

Home-use devices gain traction as consumers seek convenient, low-cost cosmetic solutions. Compact diode and IPL-based systems enable basic hair removal and skin enhancement without clinical visits. Growing e-commerce availability boosts adoption, especially among younger users. Manufacturers focus on safety locks, low-energy modes, and ergonomic designs to improve at-home experience. This trend unlocks new revenue streams and expanded customer bases. Though clinical-grade devices remain dominant, home-use solutions offer strong potential for mass-market penetration.

- For instance, Philips Lumea Prestige uses an IPL lamp rated for 250,000 flashes, supporting long-term use without replacement. The device offers four smart attachments with skin-contact sensors that adjust intensity based on detected tone.

Key Challenge

High Cost of Laser Devices and Maintenance

Aesthetic laser energy systems require substantial capital investment, which limits adoption among small clinics. Maintenance costs, consumables, and the need for periodic calibration further raise operational expenses. Clinics must ensure consistent patient volumes to recover device costs. High pricing also restricts access in developing regions. Budget constraints cause providers to delay upgrades or choose low-cost alternatives with fewer capabilities. These factors create barriers for new entrants and slow widespread adoption.

Risk of Adverse Effects and Need for Skilled Operators

Laser procedures require trained practitioners to manage energy settings, skin assessments, and cooling controls. Inexperienced use increases the risk of burns, pigmentation changes, and scarring. Clinics must invest in training programs to ensure safe treatments, which adds to operating costs. Regulatory bodies emphasize safety compliance, raising standards for device handling. Misuse or poor outcomes can affect patient trust and reduce repeat visits. As demand rises, the industry must balance growth with consistent safety and practitioner expertise.

Regional Analysis

North America

North America holds the leading position in the market with a 37% share, driven by strong consumer spending on cosmetic procedures and widespread access to advanced dermatology clinics. The region benefits from early adoption of laser technologies and a high concentration of premium aesthetic centers. Regulatory support for safe device usage enhances patient trust and accelerates procedure uptake. Manufacturers launch upgraded multi-application systems to meet rising demand for non-invasive treatments. Growing medical spa networks and increased emphasis on wellness and appearance continue to support regional expansion across both the United States and Canada.

Europe

Europe accounts for a 28% share, supported by strong demand in countries such as Germany, France, Italy, and the United Kingdom. The region values clinical-quality outcomes, which drives adoption of advanced resurfacing and rejuvenation lasers. A growing aging population increases the need for wrinkle reduction, vascular lesion treatment, and pigmentation correction. Strict regulatory standards ensure high device safety, encouraging consumer confidence. Expansion of aesthetic service chains and rising uptake of combination treatments strengthen market presence. Favorable reimbursement for select dermatology procedures in some countries further helps drive adoption across clinical settings.

Asia Pacific

Asia Pacific captures a 26% share, reflecting rising consumer interest in beauty treatments and rapid growth of medical spas. High population density and increasing disposable incomes in China, Japan, South Korea, and India boost demand for hair removal, pigmentation correction, and skin brightening procedures. Regional manufacturers introduce cost-effective devices, broadening access for smaller clinics. South Korea leads innovation with advanced laser systems used in cosmetic dermatology. Social media influence and a strong beauty culture accelerate adoption. Expanding urban healthcare infrastructure helps support steady growth across emerging markets within the region.

Latin America

Latin America holds a 6% share, driven by strong interest in aesthetic procedures in Brazil, Mexico, and Argentina. Growing popularity of hair removal, skin rejuvenation, and scar treatment fuels clinic investments in advanced laser platforms. Medical tourism also contributes, as international patients seek affordable yet high-quality cosmetic services. Expanding dermatology practices and rising awareness of minimally invasive treatments support demand. Economic fluctuations pose challenges, but premium clinics maintain stable device purchases. Adoption continues to grow as providers introduce flexible pricing models and broaden their aesthetic service portfolios.

Middle East & Africa

The Middle East & Africa region holds a 3% share, supported by rising demand for cosmetic enhancement in the UAE, Saudi Arabia, and South Africa. High interest in skin rejuvenation and pigmentation correction encourages adoption of premium laser systems in urban centers. Medical tourism contributes to market expansion as patients seek advanced aesthetic services in Gulf countries. Dermatology clinics invest in multi-wavelength devices to serve diverse skin types. Limited access in rural areas slows broader uptake, yet strong private healthcare growth continues to drive adoption in key metropolitan markets.

Market Segmentations:

By Product Type

- Laser Hair Removal Devices

- Skin Resurfacing & Rejuvenation Lasers

- Vascular Lesion Treatment Lasers

- Acne & Scar Treatment Lasers

By Technology

- Alexandrite Lasers

- Diode Lasers

- Nd:YAG Lasers

- CO₂ & Er:YAG Lasers

By Application

- Hair Removal

- Skin Rejuvenation

- Pigmentation & Vascular Lesion Treatment

- Acne, Scar, and Wrinkle Reduction

By End User

- Dermatology Clinics

- Medical Spas & Aesthetic Centers

- Hospitals

- Home-Use Aesthetic Devices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Cynosure LLC, Cutera Inc., Lumenis Ltd., Alma Lasers, Candela Corporation, Fotona d.o.o., Lutronic Corporation, Sciton Inc., El.En. Group, and BISON Medical. Companies compete through continuous innovation in multi-wavelength platforms, enhanced cooling technologies, and AI-supported treatment optimization. Leading manufacturers focus on expanding product portfolios to address hair removal, skin rejuvenation, pigmentation correction, and vascular applications across diverse skin types. Many players strengthen market reach through partnerships with dermatology clinics and medical spas. Training programs, after-sales support, and device safety certifications further differentiate brands. Firms also invest in compact, portable systems to meet rising demand from emerging markets. As competition intensifies, emphasis shifts toward hybrid lasers, cost-efficient service models, and digital integration to boost user experience and treatment accuracy.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cynosure LLC

- Cutera Inc.

- Lumenis Ltd.

- Alma Lasers (Sisram Medical)

- Candela Corporation

- Fotona d.o.o.

- Lutronic Corporation

- Sciton Inc.

- En. Group

- BISON Medical Co., Ltd.

Recent Developments

- In September 2025, Sciton Inc. unveiled HALO TRIBRID, described as the “world’s first 3-in-1 customizable resurfacing laser.”

- In April 2025, Candela Corporation launched Vbeam Pro at the annual meeting of the American Society for Laser Medicine and Surgery (ASLMS); the platform targets dermatologic and vascular conditions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive cosmetic treatments will continue to rise across global markets.

- Clinics will adopt more hybrid laser systems to offer multi-application services.

- AI-guided energy calibration will enhance treatment precision and safety.

- Home-use aesthetic devices will gain traction among younger consumers.

- Manufacturers will expand training programs to improve practitioner skill levels.

- Device portability and ergonomic designs will drive adoption in smaller clinics.

- Emerging markets will experience faster growth due to rising beauty awareness.

- Regulatory frameworks will strengthen focus on safety and device performance.

- Competition will increase as companies launch advanced multi-wavelength platforms.

- Medical spas will expand service menus, boosting device utilization and repeat procedures.