Market Overview

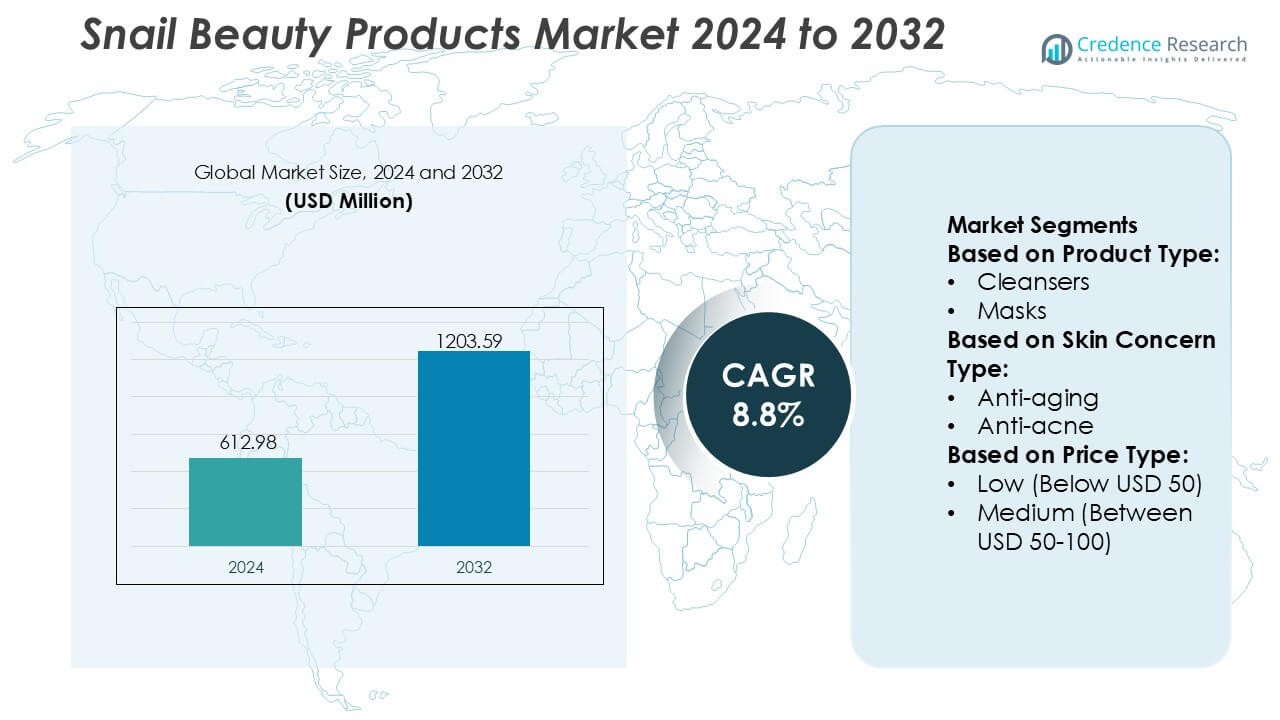

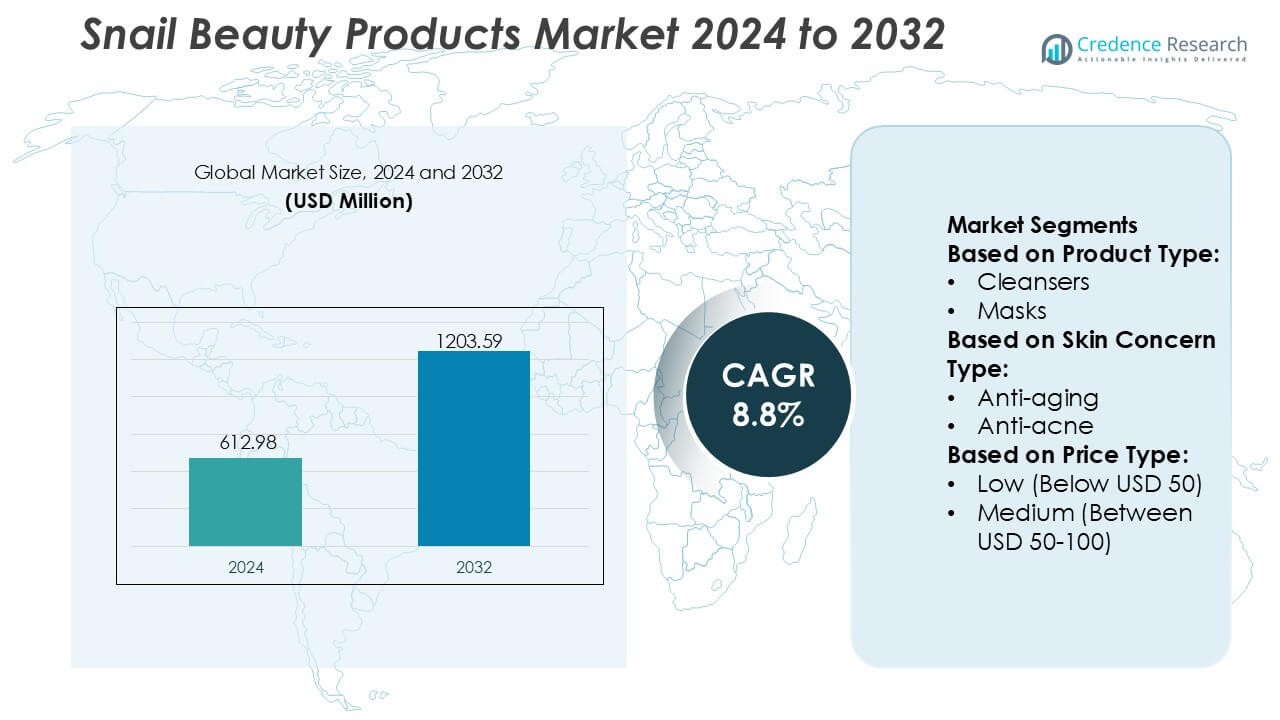

Snail Beauty Products Market size was valued USD 612.98 million in 2024 and is anticipated to reach USD 1203.59 million by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Snail Beauty Products Market Size 2024 |

USD 612.98 Million |

| Snail Beauty Products Market, CAGR |

8.8% |

| Snail Beauty Products Market Size 2032 |

USD 1203.59 Million |

The Snail Beauty Products Market is shaped by major players including Kao Corporation, ORIFLAME COSMETICS S.A., Estée Lauder, Coty Inc., L’Oréal S.A., Shiseido, Unilever, AVON PRODUCTS, INC, Revlon, and Procter & Gamble, each leveraging advanced formulation science and broad retail networks to strengthen category competitiveness. These companies expand premium and mid-tier mucin-based skincare lines, focusing on hydration, repair, and anti-aging benefits to meet rising global demand. Asia-Pacific leads the market with an exact 39% share, supported by strong K-Beauty influence, rapid product innovation, and high consumer adoption of multi-step skincare routines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Snail Beauty Products Market size was valued at USD 612.98 million in 2024 and will reach USD 1203.59 million by 2032, reflecting a CAGR of 8.8% during the forecast period.

- Strong demand for multi-functional skincare drives growth, with creams & moisturizers holding a 35% segment share due to their effectiveness in hydration, repair, and anti-aging performance.

- Trends highlight rising adoption of premium mucin-based serums and essences, increasing focus on high-purity formulations, and growing global influence of K-Beauty routines.

- Competitive momentum intensifies as Kao Corporation, Estée Lauder, L’Oréal S.A., Shiseido, and others expand advanced mucin portfolios, emphasizing performance, texture innovation, and broader distribution reach.

- Asia-Pacific leads with a 39% regional share, followed by North America and Europe, while restraints stem from sourcing challenges, ethical concerns, and competition from alternative bio-active skincare ingredients.

Market Segmentation Analysis:

By Product Type

Creams & moisturizers lead the Snail Beauty Products Market with an estimated 34–36% share, driven by strong consumer preference for barrier-repair formulations and high mucin concentrations that improve elasticity and hydration. Serums & essence follow due to their lightweight textures and high absorption profiles, while toners & mists particularly hydrating toners gain traction among users seeking fast moisture replenishment. Exfoliators show steady demand as chemical formats outperform physical variants for gentle resurfacing. Cleansers, masks, and other niche items such as eye patches sustain engagement by supporting multi-step skincare routines and enhancing product layering benefits.

- For instance, Kao Corporation integrated its proprietary Fine Fiber Technology into moisturizing creams, creating an ultra-thin polymer network of approximately 500–900 nanometers that enhances the even distribution and retention of cosmetic ingredients on the skin, improving moisture retention and providing a breathable barrier against dryness.

By Skin Concern Type

Anti-aging remains the dominant sub-segment, holding 38–40% of total demand, supported by snail mucin’s proven role in promoting cell turnover, reducing fine lines, and improving collagen regeneration. Collagen production-focused products strengthen their appeal among mature consumers seeking firmer and more resilient skin. Anti-acne solutions expand rapidly due to mucin’s soothing and repairing attributes, while dryness-related concerns drive adoption of hydrating creams and serums. Other concerns such as oil control and spot reduction maintain relevance in younger demographics prioritizing balanced skin tone and reduced blemishes.

- For instance, Estée Lauder uses its patented SIRTIVITY‑LP™ technology backed by 29 global patents which targets sirtuin-regulated “longevity proteins” to influence skin cell mechanobiology and reverse signs of aging.

By Price Type

The medium price segment leads with an estimated 46–48% market share, driven by its balance of premium ingredients, visible results, and accessible pricing that appeals to mass and mid-premium consumers. High-priced offerings gain momentum among skincare enthusiasts who value advanced formulations containing purified or fermented snail filtrate. Low-priced products retain steady volume sales, primarily in emerging markets where affordability drives trial adoption. Growth in the mid-tier category reflects rising brand competition, stronger retail presence, and increased consumer willingness to invest in clinically backed mucin-based skincare solutions.

Key Growth Drivers

Growing Demand for Functional, High-Performance Skincare

Rising consumer focus on multifunctional skincare solutions acts as a core growth driver in the Snail Beauty Products Market. Snail mucin delivers hydration, repair, elasticity improvement, and barrier-strengthening benefits in a single formulation, prompting strong adoption across creams, serums, and masks. The ingredient’s proven ability to support collagen synthesis and skin regeneration increases its appeal among users seeking visible results. Expanding awareness through dermatology-backed endorsements and social media accelerates product penetration, especially within anti-aging and dryness-focused categories.

- For instance, L’Oréal’s CeraVe brand utilizes its proprietary MVE (MultiVesicular Emulsion) Release System to provide controlled lipid and ceramide delivery to the skin over a prolonged period. This technology delivers essential moisturizing ingredients for up to 24 hours, a benefit verified through clinical studies including transepidermal water loss measurements and corneometer readings.

Expansion of Premium and Mid-Premium Beauty Categories

Premiumization plays a decisive role in market expansion as consumers show greater willingness to invest in advanced mucin-based formulations. Brands leverage purified and fermented snail filtrate to deliver higher efficacy, supporting growth in medium and high-price segments. Enhanced manufacturing standards, clinical-grade ingredient processing, and stronger claims validation further strengthen trust. This shift favors companies offering targeted serums, essence concentrates, and firming creams, enabling consistent value creation and improved margins across global retail and e-commerce channels.

- For instance, Avon further documents that its Anew Clinical products using Protinol™ delivered a clinically proven reduction of visible fine lines and wrinkles, demonstrating quantifiable improvements in skin density and firmness that strengthen consumer confidence. The technology is proven to help restore up to 7 years of collagen loss in just 7 days, providing firmer, smoother-looking skin.

Rising Influence of K-Beauty and Global Skincare Rituals

K-Beauty’s global appeal continues to propel demand for snail-based products, as consumers increasingly adopt multi-step routines emphasizing hydration and skin renewal. Korean brands drive innovation through lightweight textures, microbiome-supportive blends, and rapid-absorbing serums that boost overall market visibility. International expansion of Korean skincare retailers, coupled with widespread online distribution, strengthens global accessibility. The trend reinforces mucin’s positioning as a science-backed, results-driven ingredient and stimulates category growth across North America, Europe, and Southeast Asia.

Key Trends & Opportunities

Surging Innovation in Bioactive Formulations

Innovation centered on bioactive complexes unlocks new opportunities for formulators seeking enhanced efficacy from snail mucin. Companies incorporate peptides, hyaluronic acid, niacinamide, and fermented extracts to improve skin repair functions and boost hydration performance. Advancements in filtration technology refine mucin purity, reducing irritation potential and enabling its use in sensitive-skin lines. Continuous R&D promotes the development of lightweight essences, resurfacing exfoliators, and barrier-repair creams that strengthen consumer engagement and broaden application across skin concerns.

- For instance, Hanson Medical holds FDA 510(k) clearance (K071018) for the MONARCH Nasal Implant as an internal nasal prosthesis soft-solid silicone implants ready for immediate shipment, with custom orders built to exact specifications down to durometer (firmness) grade.

E-Commerce Acceleration and Global Brand Expansion

The rapid expansion of online beauty retail creates new opportunities for market penetration, particularly in emerging economies. Influencer-driven content, user-generated reviews, and algorithm-based recommendations support stronger consumer education on mucin benefits. Brands scale faster through subscription models, cross-border shipping, and marketplace partnerships that enhance reach and repeat purchase frequency. Digital platforms also enable personalized skincare guidance, helping brands position snail-based solutions for anti-aging, acne repair, and hydration-focused routines.

- For instance, Sientra publishes long-term clinical data showing complication rates from its 10-year core study, which involved 1,788 patients (3,506 implants). The study reported a rupture-free rate of 91.4% by patient, while the capsular contracture (Baker Grade III/IV) incidence was 13.5%.

Key Challenges

Supply Variability and Sustainability Concerns

Fluctuations in snail mucin sourcing present challenges for manufacturers, especially in maintaining consistent quality and yield. Ethical extraction practices require controlled environments, raising production costs and limiting scale for smaller brands. Growing consumer scrutiny regarding ingredient sustainability and animal welfare pressures companies to adopt transparent sourcing and verify cruelty-free processes. These constraints may affect pricing stability and supply chain resilience, influencing product accessibility across categories.

Intensifying Competitive Landscape and Ingredient Substitution

Stronger competition in the skincare market challenges snail-based products as brands introduce alternative bio-actives such as peptides, ceramides, and botanical complexes with similar claims. Consumers increasingly compare efficacy, texture, and value, reducing automatic preference for mucin-based solutions. High market saturation in creams and serums demands continuous innovation and differentiation. Without distinctive formulations and strong clinical positioning, snail beauty brands risk losing share to newer, technology-driven skincare options targeting anti-aging and hydration benefits.

Regional Analysis

North America

North America holds a solid 27–29% share of the Snail Beauty Products Market, supported by strong adoption of science-backed skincare and rising consumer interest in anti-aging and barrier-repair solutions. The region benefits from high product visibility across specialty retailers, dermatology clinics, and direct-to-consumer brands that emphasize clinically validated snail mucin formulations. Growth accelerates through increasing demand for premium serums, moisturizers, and multi-functional products. Expanding awareness of Korean beauty routines strengthens category relevance, while e-commerce platforms enhance accessibility and repeat purchase frequency across U.S. and Canadian consumer segments.

Europe

Europe accounts for an estimated 22–24% share, driven by mature skincare markets and a strong preference for high-efficacy, ingredient-focused formulations. Demand grows as consumers prioritize collagen-boosting and repair-oriented products aligned with aging population needs. Regulatory emphasis on transparency and clean formulations encourages brands to introduce sustainably sourced and dermatologically tested snail mucin lines. The region sees continued expansion in Germany, France, and the U.K., where premium beauty retail and pharmacy channels integrate snail-based solutions. Increasing exposure to K-Beauty trends further supports adoption across both value and mid-premium product categories.

Asia-Pacific

Asia-Pacific dominates the market with a 38–40% share, anchored by South Korea’s leadership in snail mucin innovation and its broad influence on global skincare routines. High consumer acceptance of multi-step skincare regimes and rapid product experimentation drive significant volume growth. Japan, China, and Southeast Asia exhibit strong demand for hydrating serums, toners, and anti-aging creams, supported by robust e-commerce penetration. Continuous advancements in mucin extraction, fermentation, and formulation technologies strengthen regional product differentiation. Expanding affordability tiers enable wide market reach across both urban and emerging consumer segments.

Latin America

Latin America captures around 6–7% of the market, supported by rising interest in hydrating and repair-focused skincare driven by climatic conditions and increasing urbanization. Brazil and Mexico serve as primary demand centers where consumers show growing preference for Korean-inspired formulations. Expanding middle-income groups encourage adoption of mid-priced snail creams and serums that target acne scars, dryness, and early aging concerns. E-commerce channels accelerate category visibility, although limited local manufacturing keeps reliance on imports. Rising influencer marketing and beauty education further stimulate awareness and trial of mucin-based products.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–5% share, with demand concentrated in Gulf markets where premium beauty adoption is high. Consumers prioritize hydration, brightening, and anti-aging benefits, making snail mucin appealing for addressing dryness and environmental stressors. Retail expansion through pharmacies, luxury beauty stores, and online platforms improves category accessibility. Growth remains steady as international brands strengthen distribution partnerships and tailor formulations to sensitive and dry-skin conditions prevalent in the region. Increasing interest in clinically effective and clean-label skincare supports gradual market penetration across key urban clusters.

Market Segmentations:

By Product Type:

By Skin Concern Type:

By Price Type:

- Low (Below USD 50)

- Medium (Between USD 50-100)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Snail Beauty Products Market includes Kao Corporation, ORIFLAME COSMETICS S.A., Estée Lauder, Coty Inc., L’Oréal S.A., Shiseido, Unilever, AVON PRODUCTS, INC, Revlon, and Procter & Gamble. These companies strengthen market positioning through advanced formulation science, premium product lines, and strong global distribution networks. Leading brands invest in high-purity or fermented snail mucin technologies that enhance absorption, boost collagen regeneration, and support barrier repair, enabling differentiation in anti-aging and hydration categories. Expansion across e-commerce, specialty retail, and dermo-cosmetic channels improves consumer reach, while influencer-driven marketing accelerates visibility among younger demographics. Strategic initiatives such as ingredient refinement, sustainability commitments, and targeted product innovations reinforce competitiveness and help brands address varied skin concerns across multiple price tiers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kao Corporation

- ORIFLAME COSMETICS S.A.

- Estée Lauder

- Coty Inc.

- L’Oréal S.A.

- Shiseido

- Unilever

- AVON PRODUCTS, INC

- Revlon

- Procter & Gamble

Recent Developments

- In July 2025, India’s booming Beauty & Personal Care (BPC) market saw major global players eye consolidation as local digital leader Nykaa thrived, leveraging its strong online/offline presence, premium brand additions (like Chanel), and customer growth, signaling a mature market with high demand for prestige beauty, as Nykaa focused on strategy and new beauty subsidiaries to capture this growth.

- In April 2025, Clariant launched its unified personal care portfolio under the new positioning “Clariant Beauty”, which combines the expertise of Clariant and Lucas Meyer Cosmetics. The new solutions are designed to address key consumer trends with sustainable, high-performance ingredients.

- In April 2025, Vantage launched four new natural, efficacy-focused ingredients for beauty & personal care at in-cosmetics Global, part of their “Vantage Oasis: The Beauty in Balance” concept, emphasizing natural-fueled solutions for skin & hair care, aligning with industry trends towards natural ingredients and holistic wellness.

- In April 2024, Moyani’s April 2024 launch of organic personal care products, which blends traditional African beauty with modern sustainability, emphasizing health, heritage, and environmental care through ethically sourced, culturally inspired items like hair serums and skin creams.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Skin Concern Type, Price Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers increasingly prefer clinically backed, multi-functional skincare solutions derived from snail mucin.

- Demand for high-purity and fermented mucin formulations will rise as brands emphasize efficacy and faster visible results.

- Premium and mid-premium categories will grow as consumers invest more in targeted serums, moisturizers, and repair-focused products.

- Innovation in bioactive ingredient blends will strengthen product differentiation and support broader skin concern coverage.

- E-commerce platforms will drive accelerated global reach and higher repeat purchase rates.

- K-Beauty influence will remain strong, propelling ongoing adoption of snail-based products worldwide.

- Brands will enhance sustainability and ethical sourcing practices to address rising consumer scrutiny.

- Personalization technologies will shape product development, offering customized solutions for hydration, aging, and repair.

- Emerging markets will contribute significant volume growth through improved accessibility and affordable product tiers.

- Competitive intensity will increase as alternative bio-actives push brands to innovate continuously and refine mucin-based formulations.