Market Overview

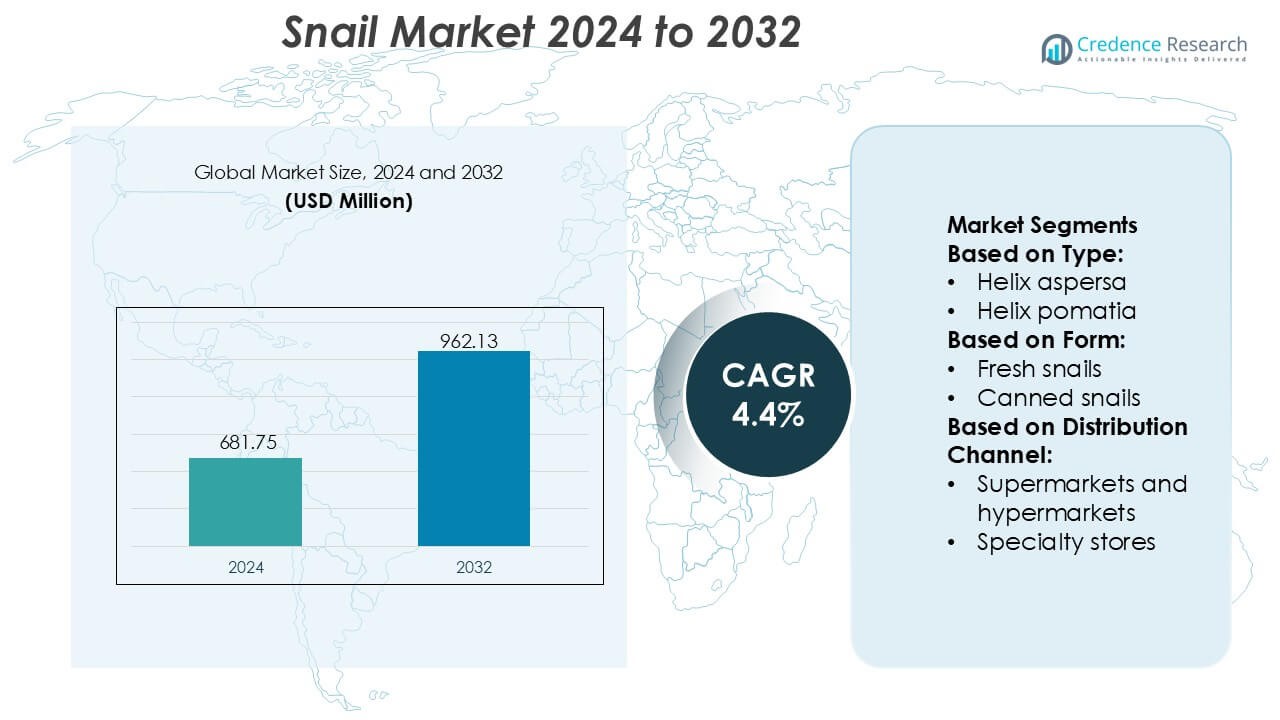

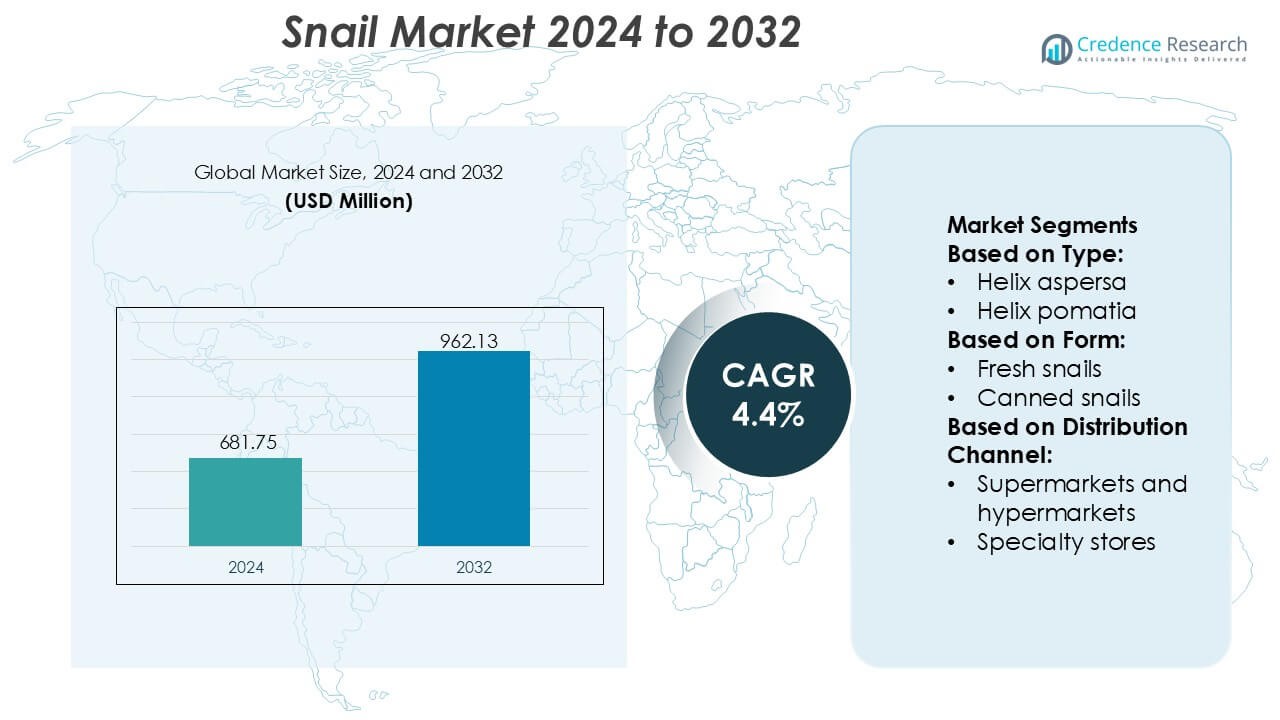

Snail Market size was valued USD 681.75 million in 2024 and is anticipated to reach USD 962.13 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Snail Market Size 2024 |

USD 681.75 Million |

| Snail Market, CAGR |

4.4% |

| Snail Market Size 2032 |

USD 962.13 Million |

The Snail Market features a competitive mix of established and emerging players, including Helifresh Escargots, Romania Snail Farming, Petralana, L’Escargot du Périgord, Snails House, Greek Snail Farms, and Escargots de Bourgogne. These companies strengthen the market through advanced heliciculture practices, controlled-environment breeding, and expanding export networks that support food, cosmetic, and nutraceutical applications. Europe remains the leading region with an exact 38% market share, driven by deep-rooted culinary traditions, regulated farming systems, and high consumption in France, Italy, and Spain. Strong processing infrastructure and traceability standards further reinforce Europe’s dominant competitive position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Snail Market reached USD 681.75 million in 2024 and is set to hit USD 962.13 million by 2032, progressing at a 4.4% CAGR, reflecting stable demand across culinary, cosmetic, and nutraceutical sectors.

- Strong market drivers include rising consumption of premium escargot, rapid adoption of controlled-environment heliciculture, and expanding utilization of snail mucin in skincare formulations, boosting multi-industry integration.

- Key trends highlight automation in breeding systems, higher investment in export-grade processing, and the growing appeal of eco-farmed snail species, with Helix aspersa holding the dominant 42% segment share due to scalability and global culinary preference.

- Competitive activity strengthens through capacity expansions and quality-certified production led by Helifresh Escargots, Snails House, Greek Snail Farms, and Petralana, each improving traceability, sustainability, and international distribution reach.

- Europe maintains leadership with an exact 38% regional share, supported by structured farming regulations and strong gastronomy markets, while Asia-Pacific accelerates with rising cosmetic applications and expanding B2C demand.

Market Segmentation Analysis:

By Type

Helix aspersa holds the dominant position with an estimated 42–45% market share, driven by its faster reproduction rate, consistent meat quality, and wide acceptance across culinary and cosmetic applications. Producers prefer Helix aspersa due to its adaptability to controlled farming environments and lower feed conversion ratios, which reduce operational costs. Helix pomatia secures a notable premium niche supported by its richer flavor profile, while Achatina fulica and Otala lactea expand steadily in regions adopting diversified snail-farming models to meet rising demand from gourmet food processors, nutraceutical manufacturers, and traditional remedy markets.

- For instance, NextProtein increased the company secured funding to open a second, large-scale facility designed to produce 12,000 tons of insect-based ingredients annually, including an estimated 2,500 tons of protein powder (nextMeal) per year.

By Form

Fresh snails lead the segment with an estimated 48–50% share, supported by strong demand from restaurants, gourmet kitchens, and processors prioritizing high-moisture, unaltered meat quality for value-added preparations. Their dominance reflects increasing adoption of controlled cold-chain systems that preserve texture and shelf life. Canned and frozen formats follow, each gaining traction through longer storage stability and export suitability. Dried snails and other specialty forms grow within herbal, pharmaceutical, and ethnic cuisine markets, benefiting from lightweight transport, extended shelf life, and suitability for powdered or extract-based formulations.

- For instance, HiProMine operates a production facility in Karkoszów (Lubuskie Voivodeship, Poland), described by the company as “the largest facility of its kind in Europe,” with a production capacity of up to 60,000 tonnes annually.

By Distribution Channel

B2B accounts for the largest share at 52–55%, powered by consistent procurement from food manufacturers, cosmetic formulators, hospitality chains, and large-scale distributors seeking reliable supply volumes and standardized quality grades. The segment benefits from formalized sourcing contracts and rising integration between snail farms and processing units. B2C channels expand steadily through specialty stores and supermarkets offering packaged edible snails to urban consumers. Online retail accelerates with increasing visibility of snail-derived wellness products and convenience-focused purchasing, while smaller channels contribute marginally through localized trade networks and niche culinary markets.

Key Growth Drivers

Rising Demand for Protein-Rich and Functional Foods

The snail market benefits from growing consumer interest in nutrient-dense protein sources, particularly in regions with established culinary traditions for escargot and gourmet dishes. Snails provide high-quality protein, essential minerals, and low-fat content, appealing to health-conscious consumers seeking alternatives to conventional meat. Restaurants and foodservice providers expand their menus with premium snail dishes, boosting demand across B2B channels. The increasing visibility of sustainable protein consumption further accelerates market adoption, positioning edible snails as a niche yet rapidly expanding segment in global food markets.

- For instance, EnviroFlight partnered with Entocycle to trial a cutting-edge optical dosing solution Entosight Neo at its R&D center in Apex, North Carolina. The trials achieved a neonate-dosing accuracy above 95%, with a mean absolute percentage error of 4.52%, while maintaining high BSFL survival rates.

Expansion of Cosmetic and Skincare Applications

Strong innovation momentum in the beauty industry drives large-scale adoption of snail mucin for anti-aging, moisturizing, and regenerative skincare formulations. Brands develop diverse product lines, including serums, moisturizers, and masks, to meet rising consumer preference for bioactive and multifunctional ingredients. The proven efficacy of snail secretion filtrate in promoting collagen synthesis and skin repair strengthens its appeal across premium and mass-market segments. Growing penetration in Asian beauty markets, especially K-beauty, significantly elevates global consumption and encourages suppliers to scale extraction, processing technologies, and supply chain capabilities.

- For instance, Beta Hatch previously operated a 50,000-square-foot automated mealworm production facility in Cashmere, Washington, engineered for continuous vertical rearing and capable of processing approximately 1,000 tons of feedstock annually.

Growing Commercial Farming and Supply Chain Standardization

The expansion of regulated snail farming operations strengthens the market by improving product availability, consistency, and traceability. Modern heliciculture practices introduce controlled breeding, optimized feeding systems, and improved environmental management to increase yield and quality. Producers adopt standardized cleaning, preservation, and packaging methods to meet international export requirements, boosting cross-border trade. Rising support from agricultural programs further enables small and medium farmers to participate in commercial snail production. These advancements reduce supply volatility and enable manufacturers to meet the increasing demand from food, cosmetic, and nutraceutical sectors.

Key Trends & Opportunities

Premiumization and Value-Added Product Development

Manufacturers capitalize on premiumization trends by developing ready-to-cook, seasoned, frozen, and canned snail products that appeal to convenience-driven consumers. Value-added formats enhance shelf life, simplify preparation, and expand access to markets beyond traditional consumption regions. Gourmet brands invest in specialty flavors and organic certifications to differentiate offerings for luxury retail and hospitality channels. This shift toward higher-margin products creates new revenue opportunities and enables producers to target both urban consumers and export destinations with evolving culinary preferences.

- For instance, Blue Buffalo, which is owned by General Mills, operates a large manufacturing and research and development complex on an 89-acre site in Richmond, Indiana.

Growing Interest in Sustainable and Low-Impact Protein Sources

Rising awareness of sustainable food systems positions snail farming as an environmentally efficient protein alternative. Snails require significantly lower land, feed, and water resources compared to livestock, supporting the market’s alignment with global sustainability goals. Producers highlight minimal greenhouse gas emissions to attract eco-conscious consumers and investors. Growth opportunities increase as governments and organizations promote low-impact protein options, enabling snail producers to secure certifications, expand organic farming, and integrate circular agriculture practices that improve environmental performance and strengthen market credibility.

- For instance, Mars invests in regenerative agriculture, including a 2024 pilot program that began covering more than 10,000 acres annually through a partnership with the Soil and Water Outcomes Fund.

Expansion of E-Commerce and Direct-to-Consumer Channels

E-commerce platforms create new growth avenues by enabling small farms, specialty retailers, and gourmet suppliers to reach broader consumer bases. Online channels support transparent marketing of snail varieties, freshness, origin, and quality certifications, helping build trust in premium snail products. Subscription services and curated gourmet boxes introduce snails to new customer segments while enhancing repeat purchase rates. Digital marketplaces also support cross-border sales, allowing producers to participate in international demand trends without large-scale distribution partnerships, strengthening market accessibility and revenue diversification.

Key Challenges

Supply Chain Fragility and Quality Variability

The snail market faces structural challenges linked to inconsistent farming practices, limited cold-chain infrastructure, and sensitivity of snails to environmental changes. Variations in feed, habitat conditions, and handling procedures affect yield, size, and meat quality, limiting standardization. Exporters face additional hurdles related to compliance with hygiene, safety, and certification standards in international markets. Seasonal supply constraints also disrupt continuity for foodservice and cosmetic manufacturers. Addressing these limitations requires investment in controlled farming systems, robust logistics, and unified quality benchmarks across producing regions.

Low Consumer Awareness and Cultural Acceptance Barriers

Despite rising global demand, snails remain a niche protein in many markets due to limited cultural familiarity and perceived aversion among mainstream consumers. Misconceptions about taste, texture, and safety hinder adoption outside traditional European, African, and Asian consumption zones. Retailers face difficulty promoting snail-based products without extensive education campaigns. Beauty manufacturers also need to overcome skepticism regarding snail mucin, particularly in regions less exposed to K-beauty trends. Expanding awareness, transparent sourcing communication, and targeted promotional strategies are essential to unlocking the market’s full potential.

Regional Analysis

North America

North America accounts for an estimated 22% share of the snail market, supported by rising consumption of high-protein specialty foods and expanding adoption of snail mucin in premium skincare lines. The United States drives regional growth through strong demand from gourmet restaurants and increasing penetration of K-beauty brands. Import-dependent supply chains encourage partnerships with European and African producers to maintain product consistency. Growth accelerates as foodservice operators introduce innovative snail-based menus and skincare brands invest in clinical-grade mucin formulations, strengthening long-term demand across both food and cosmetic applications.

Europe

Europe dominates the global snail market with an approximate 38% share, driven by deep-rooted culinary traditions and strong commercial farming activity across France, Spain, Italy, and Greece. High consumption of escargot and established processing standards reinforce regional leadership. The region also advances innovation in packaged and ready-to-cook snail products, enhancing retail penetration. European cosmetic manufacturers increasingly incorporate snail mucin into organic and anti-aging product lines, expanding demand beyond gastronomy. Robust regulatory frameworks, traceability practices, and export-oriented production models further solidify Europe’s position as the largest global supplier and consumer of snails.

Asia-Pacific

Asia-Pacific holds nearly 28% of the global market, driven by rising culinary acceptance, large-scale snail farming, and rapidly growing demand for snail mucin-based skincare products. China, South Korea, Thailand, and Vietnam lead consumption, supported by expanding beauty retail networks and strong influence of K-beauty trends. Regional producers scale heliciculture operations using controlled breeding and efficient feed systems to meet export needs. Increasing disposable incomes and preference for functional foods further expand demand. The region strengthens its position as a major processing and innovation hub for snail mucin extraction, attracting both cosmetic and nutraceutical manufacturers.

Latin America

Latin America represents roughly 7% of the snail market, supported by growing farming activity in Brazil, Chile, and Colombia. The region sees rising interest from restaurants and specialty food retailers introducing gourmet snail dishes to urban consumers. Export-focused farming models help producers supply European markets, strengthening revenue streams. Adoption of snail mucin in cosmetics increases gradually as local skincare brands integrate bioactive ingredients into mid-range product lines. Challenges remain due to limited processing infrastructure, yet government support for small-scale agriculture and expansion of niche protein markets continue to create new commercial opportunities.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global share, driven primarily by active farming and traditional consumption in West and Central Africa. Nigeria, Ghana, and Côte d’Ivoire remain key producers, supplying both domestic and export markets. Urbanization and rising incomes support increased demand for processed and packaged snail meat. Growth opportunities expand as farms adopt improved breeding and climate-controlled systems to reduce mortality and enhance yield. In the Middle East, demand grows moderately through gourmet dining channels, while limited cold-chain capabilities continue to restrict large-scale commercialization.

Market Segmentations:

By Type:

- Helix aspersa

- Helix pomatia

By Form:

- Fresh snails

- Canned snails

By Distribution Channel:

- Supermarkets and hypermarkets

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Snail Market features a diversified set of emerging and sustainability-driven players, including NextProtein, Hexafly Biotech, Protix, Nutrition Technologies, Ynsect SAS, HiProMine S.A, INSECTIFii, Innovafeed, Enviroflight, and BETA HATCH. These companies strengthen market competitiveness through advancements in alternative protein systems, controlled-environment farming, and bioactive ingredient extraction technologies. Although their primary focus spans insect-based nutrition and biotechnology, their operational capabilities in high-efficiency cultivation, waste-to-value systems, and precision breeding parallel the technical demands of modern snail farming. This alignment encourages cross-sector innovation, particularly in feed optimization, vertical farming modules, and organic waste valorization. Companies emphasize sustainability credentials, scalable production models, and integration of automated monitoring tools to improve yield consistency and environmental performance. Strategic collaborations, R&D investments, and expansion into cosmetic, nutraceutical, and specialty food applications create a competitive framework that accelerates technological upgrades and supports global market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NextProtein

- Hexafly Biotech

- Protix

- Nutrition Technologies

- Ynsect SAS

- HiProMine S.A

- INSECTIFii

- Innovafeed

- Enviroflight

- BETA HATC

Recent Developments

- In October 2024, London welcomes its first fully bug-based restaurant and Euronews Culture was in the queue to sample its intriguing menu based on the humble cricket. This establishment aims to revolutionize the food industry by demonstrating how edible insects can contribute to a more sustainable and healthier food system.

- In January 2024, Nutrinsect, an Italian company, became the first in Italy authorized to sell cricket flour for human consumption, a significant step overcoming prior restrictions and defiance of some traditionalists, opening the door for insect-based foods in Italy.

- In November 2023, Singapore-based Entobel inaugurated the largest insect protein production facility in Vietnam, Asia. The state-of-the-art facility, dedicated to producing black soldier fly larvae, boasts an annual production capacity of 10,000 tons of protein meal.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for sustainable and alternative protein sources increases across global consumer segments.

- Snail mucin will gain deeper penetration in skincare portfolios as brands prioritize regenerative and bioactive formulations.

- Commercial snail farming will adopt automated climate-control and feeding systems to improve yield consistency and scale production.

- Ready-to-cook and value-added snail products will strengthen retail presence, especially in urban and premium food markets.

- Cross-border trade will grow as producers comply with stricter safety, hygiene, and export certification standards.

- Investments in R&D will enhance mucin extraction efficiency and unlock new applications in nutraceuticals and dermatology.

- E-commerce platforms will elevate accessibility, enabling farms and specialty brands to reach broader consumer bases.

- Sustainability-driven policies will accelerate adoption of low-impact protein sources, supporting farm expansion.

- Emerging markets in Asia-Pacific and Latin America will show increased consumption due to rising culinary acceptance.

- Strategic collaborations between food, cosmetic, and biotech companies will shape innovation and long-term market competitiveness.