Market Overview

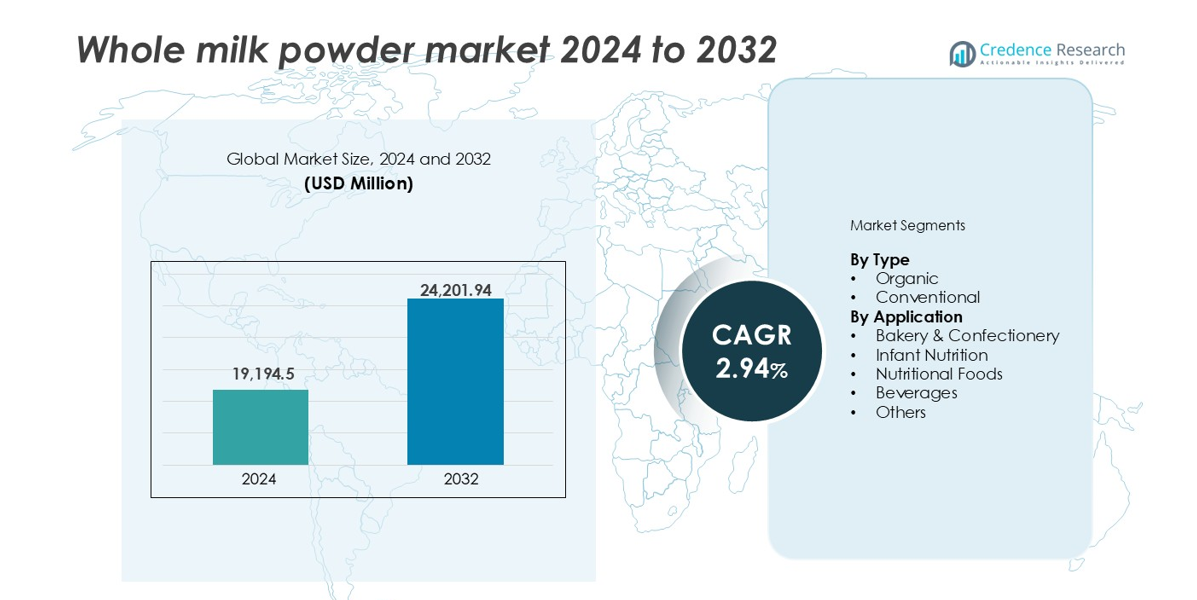

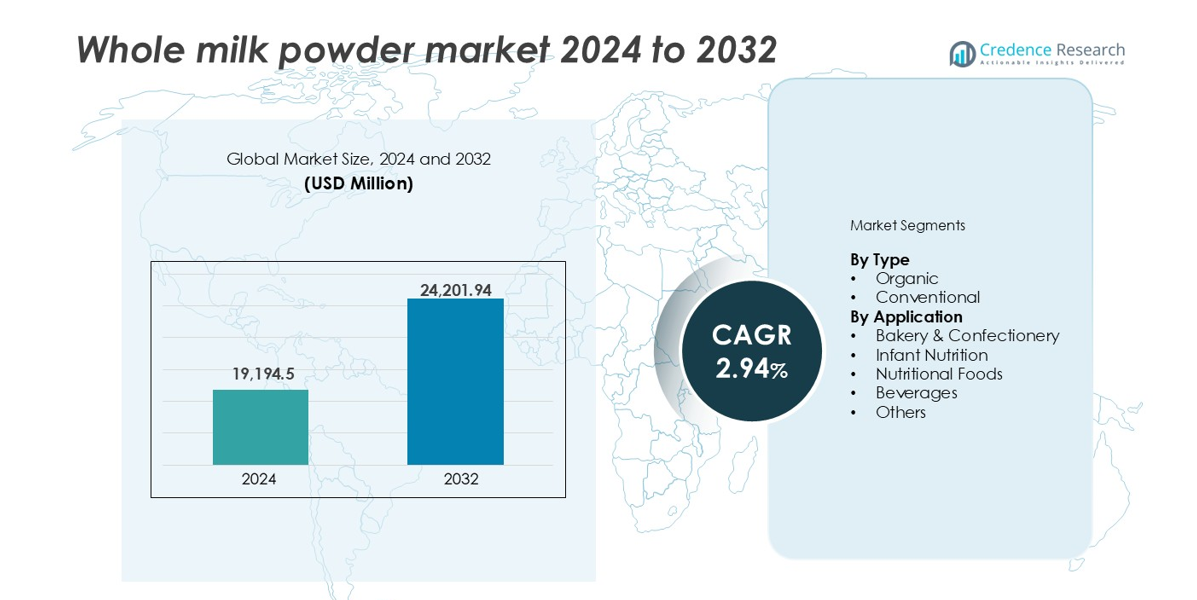

The Whole Milk Powder Market size was valued at USD 19,194.5 million in 2024 and is anticipated to reach USD 24,201.94 million by 2032, at a CAGR of 2.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Whole Milk Powder Market Size 2024 |

USD 19,194.5 million |

| Whole Milk Powder Market, CAGR |

2.94% |

| Whole Milk Powder Market Size 2032 |

USD 24,201.94 million |

The Whole Milk Powder market is led by key players including Fonterra Co-Operative Group, Arla Foods amba, Dairy Farmers of America, Amul (GCMMF), and Vinamilk. These companies maintain strong global positions through robust milk collection networks, advanced processing facilities, and wide export reach. Fonterra remains the top exporter, while Arla and DFA dominate in Europe and North America. Amul leads the Indian market with extensive domestic distribution, and Vinamilk drives growth in Southeast Asia. Asia-Pacific holds the largest regional share at 40%, supported by high infant nutrition demand and strong import volumes from China and Southeast Asian countries.

Market Insights

- The Whole Milk Powder market was valued at USD 19,194.5 million in 2024 and is projected to reach USD 24,201.94 million by 2032, growing at a CAGR of 2.94% during the forecast period.

- Rising demand from the infant nutrition sector, especially in Asia-Pacific, drives consistent consumption due to its nutritional profile and shelf stability.

- Trends such as clean-label preference and growing interest in organic milk powder boost product innovation and premium offerings across Europe and North America.

- The market features strong competition among players like Fonterra, Arla Foods, DFA, Amul, and Vinamilk, with export capabilities, product variety, and processing efficiency shaping leadership.

- Asia-Pacific holds a 40% market share, making it the dominant region, while the conventional type segment accounts for nearly 75% share, supported by affordability and mass-scale applications in bakery, beverages, and nutritional products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Whole Milk Powder market shows clear dominance from the conventional segment. Conventional whole milk powder holds nearly 75% market share due to broad availability and cost efficiency. Large-scale dairy processors prefer conventional variants for stable supply and pricing control. Food manufacturers use conventional powder for consistent fat and protein content. Strong demand from mass food production supports volume growth. Organic whole milk powder holds the remaining share, driven by health-focused consumers. Higher prices and limited raw milk supply restrain faster organic adoption.

- For instance, Fonterra processes over 1.4 million metric tons of whole milk powder annually from its conventional dairy farms across New Zealand, supplying global food brands.

By Application

Infant nutrition dominates application demand with about 35% market share in the Whole Milk Powder market. Manufacturers value whole milk powder for balanced fat content and digestibility. Rising birth rates in developing regions support steady demand. Nutritional foods follow, driven by sports and medical nutrition use. Bakery and confectionery applications rely on flavor and texture benefits. Beverage manufacturers use the powder for milk-based drinks and mixes. Other applications include foodservice and household consumption, supporting diversified demand.

- For instance, Danone uses skimmed milk (or dairy-based blends that include skimmed milk) as a base ingredient in its Aptamil and Nutricia infant nutrition lines, serving over 120 global markets.

Key Growth Drivers

Rising Demand from Infant Nutrition and Health-Focused Formulations

Infant nutrition remains the most critical growth driver in the whole milk powder market. The product delivers essential fats, proteins, and minerals needed in early-stage nutrition, supporting its widespread use in baby formulas. It offers good digestibility and supports immune system development. Rapid population growth in Asia-Pacific and Africa accelerates volume demand from infant food producers. Governments and health agencies also support fortified milk powder use in child development programs. Consumers increasingly seek safe and nutritionally complete powdered formulas. The consistency, shelf life, and ease of blending with other ingredients further drive adoption in this segment. This strong demand from global infant nutrition continues to underpin market expansion.

- For instance, Mead Johnson (a Reckitt brand) utilizes significant volumes of milk-based ingredients annually for its Enfamil line, with major manufacturing hubs located in the U.S., Mexico, and China. While specific sourcing volumes are proprietary, the company primarily uses nonfat milk and lactose to formulate its infant products.

Shelf Stability and Export-Oriented Dairy Processing Models

Whole milk powder offers high shelf life and easy transport, making it ideal for international dairy trade. Exporters in New Zealand, Europe, and Latin America rely heavily on powder processing to reach distant markets without refrigeration. Reconstituting powder with water yields milk suitable for consumption and processing, increasing flexibility. Governments promote dairy exports to drive rural incomes and trade surplus. Powdered milk also enables strategic stockpiling in regions with seasonal milk supply or infrastructure gaps. These attributes support food security planning in import-dependent regions. The product’s stability, long-term storage, and reduced freight costs reinforce its relevance in global dairy supply chains.

- For instance, Arla Foods exports over 90,000 metric tons of whole milk powder annually to markets in West Africa, the Middle East, and Asia, driven by its shelf-stable value.

Industrial Food Manufacturing and Versatile Formulation Benefits

Whole milk powder functions as a key ingredient across bakery, confectionery, nutrition bars, and ready-to-mix beverages. It enhances product creaminess, texture, and shelf life. Food processors value its uniform quality and ease of handling compared to liquid milk. Rising demand for packaged food and ready-to-eat products strengthens its application. Manufacturers prefer whole milk powder for its 26–28% fat content, supporting flavor and caloric density in formulations. The ingredient aligns with growing protein-rich and high-fat product innovation. Global foodservice chains also use it to optimize supply logistics. These formulation advantages continue to support the growth of whole milk powder across industrial food applications.

Key Trends & Opportunities

Growth of Organic and Clean-Label Dairy Products

Organic whole milk powder is gaining attention as consumers prioritize food transparency and clean labels. Though it accounts for a smaller share, demand for organic-certified powder is rising in North America and Europe. Brands use organic powder in premium nutrition drinks, baby foods, and health snacks. Strict sourcing from grass-fed, hormone-free farms adds consumer trust. Clean-label product developers seek whole milk powder with minimal processing and clear origin. This trend aligns with wellness movements and regulatory clarity on labeling. The organic segment shows growth despite higher pricing, supported by urban health-focused consumers and specialty food retailers.

- For example, Organic Valley collects milk from over 1,600 family farms, ensuring non-GMO feed and no synthetic growth hormones, processing over 12,000 metric tons of organic milk powder yearly.

Market Expansion in Africa and Southeast Asia

Emerging economies in Africa and Southeast Asia present major expansion opportunities for whole milk powder suppliers. Local milk production often fails to meet demand, creating reliance on imports. Governments in these regions support school feeding and nutrition programs that use milk powder. Urbanization increases demand for convenient dairy-based products like instant milk, beverages, and bakery items. Population growth and rising incomes improve market penetration. Companies can leverage trade agreements and invest in regional distribution hubs. These markets offer long-term growth potential for both conventional and fortified whole milk powder categories.

Key Challenges

Price Volatility Linked to Global Milk Supply

Milk powder pricing is vulnerable to fluctuations in global milk production and feed costs. Droughts, disease outbreaks, or regulatory changes can reduce raw milk supply. Input costs, including energy and logistics, directly affect powder processing margins. Export-dependent markets like New Zealand and the EU face currency risks and trade barriers. Price instability impacts purchasing strategies in developing countries. Food manufacturers delay or shift sourcing due to unpredictable costs. This volatility pressures supplier margins and complicates demand forecasting. Managing these risks remains a key challenge across the value chain.

Regulatory and Quality Compliance Across Borders

Exporters must meet strict regulatory and food safety standards in importing countries. These include microbiological limits, traceability, and labeling rules. Any contamination incident damages brand reputation and restricts market access. Countries like China enforce stringent standards for infant-grade milk powder, requiring detailed audits and certifications. For organic products, compliance with USDA, EU, or other certification frameworks adds complexity and cost. Maintaining consistent quality across batches also demands strong process control. Failure to meet these standards can lead to product recalls or trade restrictions, limiting international growth potential.

Regional Analysis

North America

North America holds approximately 18% market share in the global whole milk powder market. Demand is driven by the food processing sector and rising consumption of high-protein, dairy-based products. The U.S. leads due to its strong bakery and infant nutrition markets. Whole milk powder is used in instant mixes, confectionery, and sports nutrition. Although fluid milk consumption is declining, powder forms support export and shelf-stable dairy categories. Canada’s demand also grows through its bakery sector and clean-label trends. Continued innovation in nutritional powders and specialty foods supports regional growth.

Europe

Europe accounts for around 22% market share, supported by robust dairy exports and advanced processing infrastructure. Countries like Germany, France, Ireland, and the Netherlands are key suppliers of both conventional and organic whole milk powder. Strong demand in bakery, confectionery, and infant formula industries boosts regional sales. EU dairy processors benefit from subsidies and export incentives. High production standards and traceability also support export competitiveness. Organic variants see growing traction in Germany and Scandinavia due to consumer preference for clean-label, non-GMO dairy products. Europe’s strategic position in global dairy trade sustains its share.

Asia-Pacific

Asia-Pacific dominates the whole milk powder market with a 40% share, led by China, India, Australia, and New Zealand. China remains the largest importer, with demand fueled by infant nutrition and dairy-based packaged food. New Zealand is a major global supplier, with Fonterra exporting high volumes across Asia. India sees increasing domestic use in confectionery and beverages. Rising middle-class income and urbanization drive consumption in Southeast Asia. Export relationships between Oceania and East Asia strengthen trade. Growing population and government-supported nutrition programs continue to push regional demand upward.

Latin America

Latin America holds nearly 10% market share, with Brazil, Argentina, and Uruguay as key players. Argentina and Uruguay export large volumes of whole milk powder to Africa and Asia. Brazil sees domestic consumption rising in food processing and bakery sectors. Trade agreements with China and Middle Eastern countries drive export volumes. Government support for dairy cooperatives and infrastructure modernization aids regional competitiveness. Local food industries use powdered milk for cost-effective dairy formulations. The market grows steadily due to expanding demand in both domestic and export markets.

Middle East & Africa (MEA)

MEA represents about 10% of the global market, mainly driven by import demand. Countries such as Saudi Arabia, the UAE, Nigeria, and South Africa depend on whole milk powder to meet dairy needs. Limited local milk production and hot climates increase reliance on powdered dairy. Governments run feeding and food security programs that use milk powder in schools and aid supplies. African nations see rising demand from urban centers for affordable milk-based beverages and infant nutrition. Regional growth depends on supply chain improvements and continued foreign trade relationships.

Market Segmentations:

By Type

By Application

- Bakery & Confectionery

- Infant Nutrition

- Nutritional Foods

- Beverages

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Whole Milk Powder market features a mix of global dairy cooperatives, regional processors, and private-label suppliers. Leading players such as Fonterra Co-Operative Group, Arla Foods, and Dairy Farmers of America dominate due to strong supply chains and export capabilities. These companies leverage advanced drying technologies, large-scale milk collection networks, and established distribution partnerships to maintain market leadership. Firms like Amul and Vinamilk expand regionally through government-backed dairy programs and rising domestic demand. Product differentiation focuses on organic variants, infant-grade formulations, and clean-label offerings. Strategic collaborations, certifications, and facility expansions help firms meet evolving regulatory and quality standards. Competitive intensity remains high as companies target fast-growing regions and diversify applications. Cost control, innovation, and traceability continue to define success in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arla Foods amba

- All American Foods

- Vinamilk

- Fonterra Co-Operative Group Limited

- Chicago Dairy Corporation

- Z Natural Foods

- Amul (GCMMF)

- Westland Milk Products

- Dairy Farmers of America, Inc.

- Agri-Dairy Products, Inc.

- Lactalis Ingredients

Recent Developments

- In January 2025, Lactalis Ingredients completed a new drying tower at the Walhorn Dairy. The modernization of this production aims to improve the quality of high-quality dairy products, meet customer needs, and ensure sustainability.

- In 2024, Danone India to re-enter dairy market after pulling out in 2018, plans to collaborate with BAIF for supporting over 5,000 dairy farmers of Punjab, invests €20 Million (USD 20.56 Million) in Lalru facility upgrade focusing on sustainable farming and dairy production at the local level.

- In September 2024, Fonterra announced an investment of approximately NZD 150 million for a new cool store at its Whareroa site in Taranaki.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for whole milk powder will continue rising due to expanding infant nutrition and food manufacturing needs.

- Long shelf life, cost-effective storage, and easy transport will sustain industrial and export demand.

- Growth in organic variants and clean-label preferences will shape premium segment expansion.

- Leading players will focus on capacity expansion, product innovation, and traceability compliance.

- Volatile milk prices and supply fluctuations may affect profitability across production and export chains.

- Asia-Pacific will remain the top region, holding 40% share due to strong import demand from China and Southeast Asia.

- North America and Europe will show moderate growth driven by bakery and sports nutrition applications.

- The conventional type segment will maintain its dominance with over 70% share due to affordability and availability.

- Expansion into Africa and Southeast Asia will open long-term market entry opportunities for global exporters.

- Regulatory compliance, food safety, and sustainability certifications will shape competitive positioning.