| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Cardiovascular Devices Market Size 2024 |

USD 1,316.11 Million |

| Africa Cardiovascular Devices Market, CAGR |

3.3% |

| Africa Cardiovascular Devices Market Size 2032 |

USD 1,778.22 Million |

Market Overview

The Africa Cardiovascular Devices Market is projected to grow from USD 1,316.11 million in 2024 to an estimated USD 1,778.22 million by 2032, with a compound annual growth rate (CAGR) of 3.3% from 2025 to 2032. This growth is primarily driven by the rising prevalence of cardiovascular diseases (CVDs) in the region and increasing healthcare expenditures.

The market is supported by several key drivers and trends. There is an increasing focus on improving healthcare access and affordability in African countries, which is likely to contribute to the growth of cardiovascular device adoption. Technological advancements in medical devices, including the development of more cost-effective and efficient solutions, are also playing a pivotal role in driving market expansion. Moreover, growing awareness of preventive healthcare and the rising burden of lifestyle diseases like hypertension and diabetes are expected to further fuel demand for cardiovascular devices in the region.

Geographically, the African market for cardiovascular devices is experiencing steady growth, with South Africa leading the market due to its well-established healthcare infrastructure and higher healthcare spending. Other regions, such as North Africa and East Africa, are also witnessing increased investments in healthcare systems. Key players in the African cardiovascular devices market include Medtronic, Abbott Laboratories, Boston Scientific, and Johnson & Johnson, who are strengthening their presence through strategic partnerships and innovations in product offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Africa Cardiovascular Devices Market is projected to grow from USD 1,316.11 million in 2024 to USD 1,778.22 million by 2032, with a CAGR of 3.3% from 2025 to 2032.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- Rising prevalence of cardiovascular diseases, growing healthcare expenditures, and advancements in medical technologies are key drivers fueling market growth.

- Limited healthcare infrastructure in rural regions, high cost of advanced devices, and a lack of skilled medical professionals pose challenges to widespread market adoption.

- North Africa leads the market, particularly in countries like Egypt and Morocco, due to strong healthcare infrastructure and higher healthcare spending.

- Sub-Saharan Africa, though facing healthcare challenges, is experiencing growth driven by increasing investments in healthcare infrastructure and rising CVD prevalence.

- Continuous innovation in cardiovascular devices, such as AI-powered diagnostic tools and minimally invasive devices, is improving patient outcomes and driving market expansion.

- Major players include Medtronic, Abbott Laboratories, Boston Scientific, and Johnson & Johnson, who are expanding their market presence through strategic partnerships and product innovations.

Report Scope

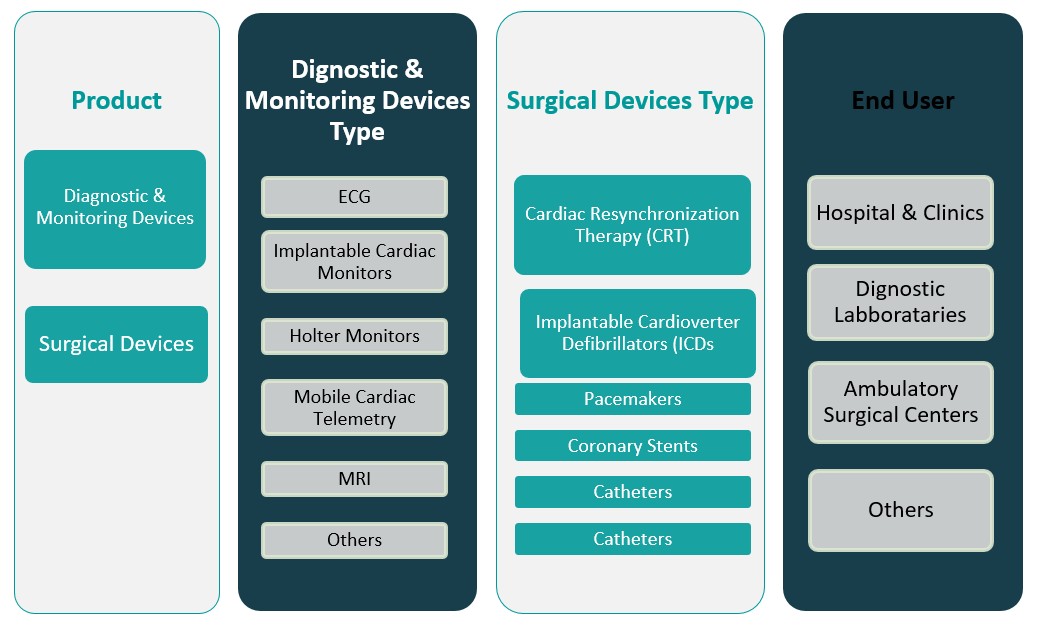

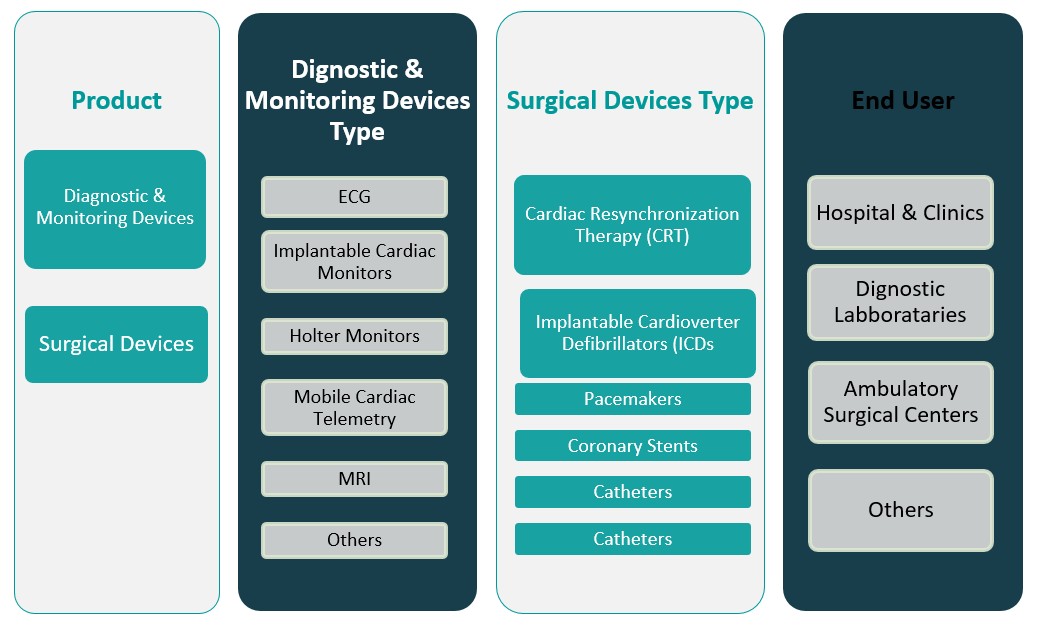

This report segments the Africa Cardiovascular Devices Market as follows:

Market Drivers

Increasing Prevalence of Cardiovascular Diseases (CVDs)

The rising incidence of cardiovascular diseases (CVDs) is one of the primary drivers of the Africa Cardiovascular Devices Market. Africa is experiencing a significant health transition, with non-communicable diseases (NCDs), including heart disease, becoming more prevalent. According to the World Health Organization (WHO), CVDs account for a substantial share of total mortality across Africa, particularly due to factors such as urbanization, lifestyle changes, and an aging population. For instance, Africa records millions of new CVD cases annually, with hypertension affecting over 90 million individuals across the continent. The growing prevalence of risk factors like hypertension, diabetes, obesity, and tobacco use further accelerates the rise in CVD cases. This, in turn, is driving the demand for advanced cardiovascular devices such as stents, pacemakers, defibrillators, and diagnostic tools. The impact of CVDs is particularly pronounced in middle-income countries, where healthcare infrastructure is improving but often unable to adequately meet the rising demand for specialized treatments.

Improvement in Healthcare Infrastructure and Access

One of the key enablers of the Africa Cardiovascular Devices Market is the ongoing improvement in healthcare infrastructure across the continent. Over the past decade, several African countries have been investing heavily in upgrading their healthcare systems. This includes building more modern hospitals, expanding healthcare facilities, and incorporating advanced diagnostic and treatment technologies. For instance, African nations have allocated billions of dollars toward healthcare modernization, leading to the establishment of over 500 new hospitals and specialized cardiovascular treatment centers. Healthcare access is improving, particularly in urban areas and growing regional health hubs. Governments and private entities are focusing on improving accessibility to healthcare services through public-private partnerships, expansion of health insurance coverage, and mobile health initiatives. As access to quality healthcare improves, the adoption of advanced cardiovascular devices will likely rise, significantly enhancing the capacity of healthcare systems to treat heart diseases.

Technological Advancements in Cardiovascular Devices

The rapid pace of innovation in cardiovascular device technologies is another major driver of the Africa Cardiovascular Devices Market. Advances in medical technology have led to the development of more efficient, durable, and cost-effective cardiovascular devices. Key innovations include the introduction of minimally invasive procedures, which have gained widespread adoption due to their reduced recovery times, lower complication risks, and better outcomes compared to traditional open surgeries. These technological advancements not only improve patient outcomes but also make cardiovascular treatment more accessible, especially in resource-limited settings. Furthermore, the development of next-generation stents, pacemakers, defibrillators, and diagnostic devices is enhancing the ability of healthcare professionals to manage cardiovascular diseases more effectively. For example, newer stents with drug-eluting capabilities have been shown to reduce the risk of restenosis, significantly improving long-term outcomes for patients. Additionally, the introduction of wearable devices and mobile health applications is allowing for continuous monitoring of cardiovascular health, empowering patients to take control of their conditions and reducing hospital readmission rates. These technological developments make cardiovascular devices more effective and are expected to drive greater adoption across Africa, particularly as healthcare infrastructure continues to improve.

Rising Health Awareness and Preventive Healthcare Initiatives

Growing awareness of cardiovascular health and the increasing adoption of preventive healthcare measures are playing a significant role in the expansion of the Africa Cardiovascular Devices Market. In recent years, there has been a heightened focus on educating the public about the risks of heart disease and the importance of regular health screenings. Various government bodies, non-governmental organizations (NGOs), and health advocacy groups are working to raise awareness about heart disease, its risk factors, and the benefits of early detection and intervention. The rise in health-consciousness is also leading to lifestyle changes, with more individuals adopting healthier diets, engaging in regular physical activities, and seeking medical checkups for early detection of potential cardiovascular risks. As a result, the demand for diagnostic cardiovascular devices, such as blood pressure monitors, ECG machines, and cholesterol test kits, is rising. Moreover, preventive healthcare initiatives supported by both public and private sectors are further encouraging the use of cardiovascular devices for early diagnosis and risk assessment. This trend is particularly important in Africa, where many cardiovascular conditions remain undiagnosed until they reach advanced stages. As health awareness increases, there is likely to be greater adoption of preventive technologies, which will, in turn, drive the demand for cardiovascular devices across the continent.

Market Trends

Adoption of Minimally Invasive Cardiovascular Procedures

A significant trend in the Africa Cardiovascular Devices Market is the increasing adoption of minimally invasive cardiovascular procedures. These procedures, which involve smaller incisions and reduced recovery times, are becoming more prevalent due to their numerous benefits, including shorter hospital stays and reduced risks of complications. Technologies like catheter-based interventions for stenting and balloon angioplasty are being increasingly utilized across the continent. A systematic review of minimally invasive cardiac surgery in Africa found that Egypt, South Africa, Tanzania, and Morocco have published research on these procedures, with a total sample size of 1,357 patients. For instance, the study reported that minimally invasive cardiac surgeries in Africa have comparable outcomes to those in other regions, despite socio-economic factors limiting widespread adoption. As healthcare systems in Africa continue to evolve, the shift toward minimally invasive techniques is being driven by both patient preference and the desire for more efficient, cost-effective healthcare delivery. This trend is further supported by advancements in device technology, such as drug-eluting stents and specialized catheters, which are improving the success rates of these procedures. With rising healthcare demands and the need to reduce healthcare costs, the growing preference for minimally invasive cardiovascular devices is expected to continue, positively impacting market growth.

Integration of Artificial Intelligence and Machine Learning in Cardiovascular Devices

Another emerging trend in the Africa Cardiovascular Devices Market is the integration of artificial intelligence (AI) and machine learning (ML) technologies into cardiovascular devices. AI and ML algorithms are increasingly being used to enhance diagnostic accuracy, improve treatment planning, and monitor patient health in real-time. A review on AI in cardiovascular healthcare in Africa highlights its potential to revolutionize CVD care, particularly in diagnosis, treatment optimization, and remote patient monitoring. For instance, AI-powered devices are being deployed to assist clinicians in interpreting ECGs, detecting irregularities, and predicting potential cardiovascular events. This technology allows for quicker decision-making, reduces human error, and ensures more precise treatments. In Africa, where healthcare systems often face resource constraints, AI and ML integration can help bridge gaps in expertise, particularly in remote and underserved areas. The use of AI in monitoring patient data, such as heart rate and blood pressure, also enables continuous management of cardiovascular health. As AI technologies continue to advance and become more accessible, their integration into cardiovascular devices is expected to significantly transform the healthcare landscape in Africa.

Expansion of Telemedicine and Remote Monitoring Solutions

The rise of telemedicine and remote patient monitoring is another key trend in the Africa Cardiovascular Devices Market. As healthcare access improves across the continent, telemedicine is becoming a vital tool in extending cardiovascular care to remote areas where specialized services may be limited. Remote monitoring devices, such as wearable ECG monitors, blood pressure cuffs, and pulse oximeters, are enabling patients to track their cardiovascular health from the comfort of their homes. These devices can transmit real-time data to healthcare providers, allowing for timely interventions without the need for in-person visits. The COVID-19 pandemic accelerated the adoption of telemedicine and remote health monitoring, and this trend is expected to continue as it proves effective in reducing hospital visits and healthcare costs. With the growing use of smartphones and internet penetration across Africa, the integration of telemedicine and remote monitoring into cardiovascular care is poised to enhance patient outcomes and broaden the accessibility of cardiovascular devices across the region.

Focus on Local Manufacturing and Affordable Cardiovascular Devices

An emerging trend in the Africa Cardiovascular Devices Market is the growing emphasis on local manufacturing to address affordability and accessibility challenges. Many African countries have traditionally relied on imported cardiovascular devices, which can be costly due to tariffs and shipping expenses. To combat these issues, local manufacturers are increasingly stepping up to produce more affordable cardiovascular devices tailored to the unique needs of African populations. Governments and private sector players are also supporting the development of local manufacturing capabilities through incentives and investments in research and development. This trend not only helps lower the cost of devices but also promotes self-sufficiency in healthcare, reducing reliance on imports and improving the overall healthcare ecosystem. Local production of cardiovascular devices is expected to drive market growth by making these essential technologies more accessible and affordable for a broader segment of the population, particularly in low- and middle-income countries across Africa.

Market Challenges

Limited Healthcare Infrastructure and Access

One of the significant challenges faced by the Africa Cardiovascular Devices Market is the limited healthcare infrastructure across many regions of the continent. While some African countries have made strides in improving healthcare facilities, many still lack the necessary infrastructure to support the effective use of advanced cardiovascular devices. Hospitals and clinics in rural and underserved areas often struggle with inadequate equipment, limited access to specialized care, and a shortage of trained medical professionals. This infrastructure gap hinders the widespread adoption of cardiovascular devices, as these devices require well-equipped medical environments and skilled personnel for effective use and maintenance. Additionally, in many parts of Africa, access to healthcare is restricted by economic factors, with a large proportion of the population unable to afford expensive treatments or medical devices. While health insurance coverage is growing in some areas, the majority of people still pay out-of-pocket for treatments, creating financial barriers to accessing life-saving cardiovascular devices. For instance, in Nigeria, the cost of an implantable cardiac defibrillator ranges from $4,000 to $10,000, making it unaffordable for most patients and limiting access to critical care. The cost of importing high-quality cardiovascular devices remains a burden for many healthcare providers, especially in low-income countries. Reports indicate that the market includes diagnostic, monitoring, and surgical devices used to treat heart diseases. The demand for these devices is steadily increasing due to the rising prevalence of cardiovascular diseases. Governments and private sectors are working collectively to strengthen healthcare infrastructure, further boosting demand for these devices. However, the lack of adequate access to healthcare services and financial constraints significantly limit the market potential for cardiovascular devices, hindering their widespread adoption across the continent.

Regulatory and Market Access Barriers

The regulatory landscape in Africa presents another major challenge for the cardiovascular devices market. While some countries, such as South Africa and Egypt, have relatively well-established regulatory frameworks, many other nations still lack cohesive and standardized regulatory systems for medical devices. This inconsistency can result in delays in product approval, making it difficult for manufacturers to introduce new cardiovascular devices to the market in a timely manner. Additionally, some countries have stringent import regulations, which can increase the time and cost associated with bringing new devices into the market. Another challenge lies in the fragmentation of the African market. The continent is made up of diverse regions with different legal, cultural, and economic conditions, making it difficult for global manufacturers to implement uniform market strategies. Each country may have its own set of regulatory requirements, taxes, and tariffs, further complicating market access. Moreover, the lack of harmonization between regulatory bodies across the continent increases the complexity of bringing new cardiovascular devices to various markets. Manufacturers must navigate these regulatory hurdles while managing the high costs associated with compliance, slowing the overall growth of the cardiovascular devices market in Africa.

Market Opportunities

Growth of Preventive Healthcare and Health Screening Initiatives

A significant opportunity for growth in the Africa Cardiovascular Devices Market lies in the increasing focus on preventive healthcare and early detection of cardiovascular diseases (CVDs). Governments, NGOs, and healthcare organizations across Africa are prioritizing health education and promoting early screenings to address the growing burden of heart disease. As awareness around cardiovascular health expands, there is a rising demand for diagnostic devices such as ECG machines, blood pressure monitors, and cholesterol testing kits. Furthermore, the push for national health programs aimed at screening and managing CVDs presents an opportunity for cardiovascular device manufacturers to collaborate with governments and healthcare providers to introduce more accessible and affordable solutions. These initiatives are expected to drive higher adoption rates of cardiovascular devices, particularly in emerging markets where early diagnosis is still limited. As health screening becomes a more integral part of healthcare systems in Africa, the demand for cardiovascular devices is set to grow substantially.

Untapped Potential in Local Manufacturing and Distribution

Another promising opportunity in the Africa Cardiovascular Devices Market is the development of local manufacturing and distribution capabilities. The reliance on imported devices presents a significant market gap that local manufacturers can capitalize on. By establishing production facilities within Africa, manufacturers can reduce costs, increase the affordability of cardiovascular devices, and improve accessibility across the continent. Governments are increasingly offering incentives and support for local manufacturing to boost economic development and self-sufficiency in healthcare. Additionally, local production can be tailored to the specific needs of African populations, such as producing devices suitable for the unique demographic and healthcare challenges of the region. This growing emphasis on local production, coupled with expanding distribution networks, offers manufacturers an opportunity to tap into underserved markets and foster long-term growth in the cardiovascular device sector.

Market Segmentation Analysis

By Product

The Africa Cardiovascular Devices Market is broadly segmented into Diagnostic & Monitoring Devices and Surgical Devices. Diagnostic & Monitoring Devices hold a significant share in the market due to the increasing demand for early detection and continuous monitoring of cardiovascular diseases (CVDs). Devices like electrocardiograms (ECGs), blood pressure monitors, and holter monitors are widely used across healthcare settings in Africa. These devices are crucial for the early diagnosis of heart diseases, especially in regions where healthcare access is limited, and preventive healthcare initiatives are on the rise. On the other hand, Surgical Devices include stents, pacemakers, defibrillators, and heart valves, which are essential for treating patients with advanced heart conditions. The demand for surgical devices is also increasing due to the rising prevalence of cardiovascular diseases and the growing adoption of advanced medical technologies across hospitals in Africa.

By End User

The Africa Cardiovascular Devices Market can also be segmented based on End User into Hospitals & Clinics, Diagnostic Laboratories, Ambulatory Surgical Centers, and Others. Hospitals & Clinics account for the largest share, as they are the primary locations for both diagnosing and treating cardiovascular conditions. With the expanding healthcare infrastructure and increasing investments in the region, hospitals are being equipped with advanced cardiovascular diagnostic and surgical devices. Diagnostic Laboratories are also crucial end-users, particularly for diagnostic and monitoring devices. These laboratories provide specialized testing for heart conditions and support early intervention. Ambulatory Surgical Centers are gaining traction in Africa as they offer an alternative to traditional hospitals for certain cardiovascular procedures, such as angioplasty or pacemaker implantation. They are becoming more popular due to their cost-effectiveness and shorter patient recovery times. The Others category includes specialized care centers, home healthcare settings, and long-term care facilities that cater to specific patient needs.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Regional Analysis

North Africa (45%)

North Africa holds the largest market share in the Africa Cardiovascular Devices Market, accounting for approximately 45% of the total market. Countries such as Egypt, Morocco, Algeria, and Tunisia dominate the region due to their well-established healthcare infrastructure and higher healthcare expenditure. North Africa benefits from a relatively strong medical device industry, with both government and private sectors investing heavily in healthcare advancements. The rising incidence of cardiovascular diseases, coupled with growing healthcare awareness, is fueling the demand for both diagnostic and surgical cardiovascular devices in these countries. Furthermore, North African nations have been focusing on improving access to advanced medical technologies, leading to greater adoption of cutting-edge cardiovascular devices. The region’s proximity to Europe and ongoing collaborations with international organizations also contribute to its strong position in the market.

Sub-Saharan Africa (35%)

Sub-Saharan Africa, accounting for around 35% of the total market, is experiencing rapid growth, although it lags behind North Africa in terms of market share and healthcare infrastructure. Sub-Saharan Africa faces numerous challenges, including limited access to healthcare in rural areas, a lack of skilled professionals, and financial constraints. Despite these challenges, the region is seeing increased investments in healthcare infrastructure, with several countries improving the quality and availability of medical care. This is driving the demand for cardiovascular diagnostic and surgical devices, especially as the prevalence of non-communicable diseases like cardiovascular diseases continues to rise. Nations like South Africa, Nigeria, and Kenya are at the forefront of this growth, as they invest in better healthcare systems and higher adoption of advanced medical technologies. However, the region still faces significant barriers related to affordability and accessibility, which could impact the pace of market growth.

Key players

- Abbott

- GE HealthCare

- Medtronic

- Siemens Healthineers

- Philips Healthcare

- Boston Scientific

- Biotronik

- Flexicare

- CardioTech

- Biovac Institute

- Vita Medical

- Africa Medical Supplies Platform

- Shenzhen Mindray Bio-Medical Electronics

- Gulf Medical

- Biosense Webster

Competitive Analysis

The Africa Cardiovascular Devices Market is highly competitive, with a mix of global and regional players vying for market share. Leading companies like Medtronic, Siemens Healthineers, and Philips Healthcare dominate the market due to their established product portfolios, strong brand presence, and extensive distribution networks across Africa. These companies have significant advantages in terms of technological innovation, product variety, and market reach, enabling them to cater to both developed and emerging markets. Abbott and Boston Scientific also play a key role in driving market growth with their advanced cardiovascular devices, including stents, pacemakers, and diagnostic equipment. However, regional players like Africa Medical Supplies Platform and Biovac Institute are emerging, focusing on local production and addressing affordability challenges, which gives them a competitive edge in underserved markets. Shenzhen Mindray Bio-Medical Electronics and Biotronik are expanding their presence in Africa, offering cost-effective solutions that meet local needs. The competition is expected to intensify as these companies continue to innovate and expand their product offerings, addressing the unique healthcare challenges across the continent.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The Africa Cardiovascular Devices Market exhibits moderate to high concentration, with a few major global players, such as Medtronic, Siemens Healthineers, Philips Healthcare, and Boston Scientific, holding a significant share of the market. These companies dominate due to their well-established presence, comprehensive product portfolios, and strong distribution networks across the continent. However, the market is also characterized by the growing presence of regional players, such as Africa Medical Supplies Platform and Biovac Institute, which focus on locally manufactured devices to address affordability and access issues in underserved areas. The market is highly dynamic, with increasing investments in healthcare infrastructure, rising demand for cardiovascular devices, and a push for more affordable and effective solutions. As a result, there is a mix of global innovation and local adaptation, driving both competition and growth in the cardiovascular devices sector across Africa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As awareness around cardiovascular diseases (CVDs) increases, preventive healthcare initiatives will gain momentum, leading to higher demand for diagnostic and monitoring devices across Africa.

- Ongoing innovations in cardiovascular technology, such as AI-powered diagnostic tools and minimally invasive devices, will improve treatment outcomes and enhance device adoption in the region.

- With a focus on affordability, there will be an increased market for cost-effective cardiovascular devices that cater to both emerging and underserved markets in Africa.

- Continued investments in healthcare infrastructure, particularly in Sub-Saharan Africa, will enable broader access to advanced cardiovascular devices, driving market growth.

- Government-driven healthcare reforms and policies aimed at tackling non-communicable diseases like CVDs will foster the growth of the cardiovascular devices market across the continent.

- As local manufacturing capabilities expand, there will be a rise in regionally produced cardiovascular devices, which will reduce costs and increase market accessibility.

- The growing prevalence of cardiovascular diseases due to lifestyle changes and urbanization will continue to drive the demand for cardiovascular devices in Africa.

- The adoption of telemedicine and remote health monitoring will expand access to cardiovascular care, especially in rural areas, creating new market opportunities for monitoring devices.

- Collaborative efforts between global device manufacturers and local players will facilitate the introduction of advanced cardiovascular technologies in underserved markets, enhancing device availability and affordability.

- The shift towards patient-centric care models, supported by wearable devices and personalized treatment, will increase demand for innovative cardiovascular solutions across the region.