| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Sodium Silicate Market Size 2024 |

USD 807.28 million |

| Africa Sodium Silicate Market, CAGR |

4.25% |

| Africa Sodium Silicate Market Size 2032 |

USD 1,125.85 million |

Market Overview

The Africa Sodium Silicate Market is projected to grow from USD 807.28 million in 2024 to an estimated USD 1,125.85 million by 2032, with a compound annual growth rate (CAGR) of 4.25% from 2025 to 2032. This growth is driven by increasing demand across various industries, including construction, detergents, and water treatment, as well as the region’s growing industrialization and urbanization.

Key drivers of the market include the rising demand for sodium silicate in the production of construction materials, where it serves as an essential binder and additive. The detergent industry is another significant factor contributing to growth, as sodium silicate enhances the cleaning power of detergents. Additionally, the growing need for efficient water treatment solutions in the region is boosting the use of sodium silicate in water purification processes.

Geographically, the market is dominated by countries with rapidly developing industries, such as South Africa, Egypt, and Nigeria. These nations have witnessed an increase in infrastructure development, leading to higher demand for sodium silicate in construction applications. Key players in the African sodium silicate market include global and regional producers like BASF SE, Naoetec, and other local suppliers, who cater to the expanding industrial base in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Africa Sodium Silicate Market is projected to grow from USD 807.28 million in 2024 to USD 1,125.85 million by 2032, with a CAGR of 4.25% from 2025 to 2032, driven by increasing demand across multiple industries.

- The global sodium silicate market is projected to grow from USD 10,277.26 million in 2024 to USD 15,183.45 million by 2032, with a CAGR of 5.00% from 2025 to 2032. It is driven by diverse applications across industries such as detergents, construction, and water treatment.

- Key drivers include rising demand for sodium silicate in construction, detergents, and water treatment industries, spurred by urbanization and industrialization across the region.

- The expanding construction industry, especially in countries like Nigeria, South Africa, and Egypt, is a significant contributor to the increasing need for sodium silicate.

- The rising middle class in Africa has led to greater demand for detergents and cleaning products, further increasing the consumption of sodium silicate in the region.

- Sodium silicate’s use in water purification and wastewater treatment is gaining momentum as Africa faces water scarcity challenges, driving its adoption across the continent.

- Challenges include limited local production capacity, reliance on imports, and supply chain disruptions, which can lead to price volatility and inconsistent availability.

- North Africa leads the market, followed by Sub-Saharan Africa, with growth driven by expanding industrial activities, urbanization, and the increasing demand for sodium silicate in various sectors.

Report Scope

This report segments the Africa Sodium Silicate Market as follows:

Market Drivers

Growing Construction Industry

The expansion of the construction industry across Africa is a major driver for the growth of the sodium silicate market. Sodium silicate, commonly known as water glass, plays an important role in various construction applications. It is widely used as a binder in the production of cement and concrete, as well as in the creation of specialized concrete products such as bricks, tiles, and blocks. For instance, research from the University of Pretoria highlights that sodium silicate solutions derived from South African coal fly ash have been successfully used in cement applications. Additionally, a study published by the University of the Witwatersrand reports that sodium silicate extracted from coal fly ash has been tested as an extender in oil well cement applications, improving the compressive strength of cement slurries. As urbanization accelerates and infrastructure development intensifies, the demand for construction materials, including those enhanced with sodium silicate, continues to rise. Additionally, the growing trend toward sustainable construction materials further boosts the demand for sodium silicate, given its ability to contribute to the durability and longevity of construction products. The increased focus on industrialization in African economies, especially in fast-growing economies like Nigeria, South Africa, and Kenya, has led to an upsurge in large-scale infrastructure projects, further driving the need for sodium silicate in construction.

Rising Demand for Detergents and Cleaning Products

Another key market driver for sodium silicate in Africa is the growing demand for detergents and cleaning products. Sodium silicate is used in the formulation of household and industrial detergents because of its excellent properties as a water softener and detergent builder. It enhances the effectiveness of surfactants in cleaning products, making them more efficient in breaking down grease and stains. For instance, Shreeji Chemicals Ltd, the largest producer of sodium silicate in East and Central Africa, operates manufacturing facilities in Kenya, Uganda, and Tanzania, with a combined production capacity of 450 metric tons per day. The company supplies sodium silicate for detergent manufacturing, ensuring stability and effectiveness in cleaning formulations. Additionally, PQ Corporation provides sodium silicate solutions for detergent applications, supporting industrial and household cleaning product manufacturers. As the middle class in many African countries expands, there is an increase in the consumption of household products, particularly in urban areas. This rise in demand for detergents and cleaning products is not only driven by household needs but also by growing industrial sectors, including food processing and manufacturing, where industrial cleaning and hygiene are crucial. Moreover, as the African population becomes more aware of hygiene and sanitation, the demand for high-quality cleaning agents continues to rise, further contributing to the growth of sodium silicate consumption.

Water Treatment Applications

Sodium silicate is widely utilized in water treatment processes across Africa, contributing to the market’s growth. Water treatment plays a critical role in addressing water scarcity and ensuring access to clean water in many African nations. Sodium silicate is used in the purification of drinking water, where it aids in coagulation, flocculation, and the removal of heavy metals. Additionally, it is employed in the treatment of wastewater, particularly in industries like textiles and paper, where chemical contamination is common. As the demand for clean and safe drinking water increases, particularly in regions facing water stress like parts of East and Southern Africa, the role of sodium silicate in water treatment becomes more significant. The rising need for effective water treatment solutions due to urbanization, population growth, and climate change further drives the adoption of sodium silicate in various water treatment facilities across the continent. The increasing investment in infrastructure to improve water availability and quality, particularly in large African cities, strengthens the demand for sodium silicate in these applications.

Industrial Growth and Manufacturing Sector Expansion

The continuous industrial growth in Africa, fueled by a diversification of the economy in key regions, is another vital factor driving the demand for sodium silicate. Industries such as paper and pulp, textiles, and chemicals are the major consumers of sodium silicate, which is used in a variety of processes ranging from fiber and fabric treatment to chemical formulations. As Africa continues to experience significant industrialization, the use of sodium silicate across these sectors is projected to increase. Manufacturing activities are particularly growing in nations such as Nigeria, South Africa, and Egypt, where the industrial output continues to rise in response to domestic and international market demands. In addition to its role in the production of industrial materials, sodium silicate’s use as a catalyst in manufacturing processes further boosts its demand. The expansion of these manufacturing sectors is driving the need for efficient and cost-effective chemical solutions, like sodium silicate, which support industrial activities. Furthermore, the African Continental Free Trade Area (AfCFTA), which aims to create a single market for goods and services across the continent, is expected to stimulate further industrial activities, creating even more opportunities for sodium silicate utilization in the manufacturing industry.

Market Trends

Shift Towards Eco-Friendly and Sustainable Products

In the Africa Sodium Silicate Market, there is a growing trend toward eco-friendly and sustainable products. As global environmental concerns intensify, African industries are increasingly adopting green solutions in manufacturing and construction. Sodium silicate, being an eco-friendly chemical, is gaining popularity due to its non-toxic nature and its ability to contribute to sustainable production processes. For instance, PQ Corporation, a leading global producer of sodium silicate, reported a revenue of $1.5 billion in 2022 and has integrated sodium silicate into its sustainable product portfolio. Occidental Petroleum Corporation (OxyChem), with a revenue of $7 billion in 2022, has developed sodium silicate-based adhesives and coatings that minimize environmental impact. BASF, headquartered in Germany, recorded $78 billion in revenue in 2022 and has focused on sustainable solutions, utilizing sodium silicate in water treatment applications. In the construction industry, where the demand for energy-efficient and environmentally friendly materials is rising, sodium silicate-based products are being used to enhance the durability of cement, concrete, and other construction materials. Similarly, in the detergent industry, the demand for sustainable and biodegradable cleaning agents is driving manufacturers to incorporate sodium silicate, which is both effective and safe for the environment. This shift towards sustainability is being supported by stricter regulations and consumer demand for green products, making sodium silicate a preferred choice in various industrial applications across the continent.

Technological Advancements in Sodium Silicate Production

Technological advancements in the production of sodium silicate are playing a significant role in shaping the Africa Sodium Silicate Market. New production technologies are making the manufacturing process more cost-effective and efficient, thereby enhancing the availability of sodium silicate at competitive prices. For instance, Evonik Industries, a German specialty chemicals company, has invested in advanced manufacturing techniques to enhance sodium silicate purity and efficiency. Merck Group, another German-based company, has implemented smart production technologies to optimize resource usage and reduce environmental impact. Tokuyama Corporation, a Japanese firm with operations in Africa, has developed innovative sodium silicate formulations for high-tech applications. Innovations, such as the development of energy-efficient production techniques and the use of waste materials, are improving the overall sustainability of sodium silicate manufacturing. Additionally, advances in automated processes and digitalization in production facilities are improving product consistency and quality, addressing the increasing demand for high-grade sodium silicate in various industries, including construction, detergents, and water treatment. These technological developments are also helping to minimize the environmental footprint of sodium silicate production, contributing to its growing appeal in Africa’s industrial sector.

Increasing Use in Water Treatment and Pollution Control

The Africa Sodium Silicate Market is witnessing an increase in the use of sodium silicate for water treatment and pollution control. With water scarcity becoming a pressing issue in many African countries, the need for effective water treatment solutions is rising. Sodium silicate is widely used in water purification processes, such as coagulation, flocculation, and the removal of heavy metals and toxins from wastewater. Its role in the treatment of industrial wastewater, particularly in sectors like mining, textiles, and chemicals, is also expanding. Additionally, as urbanization and industrialization accelerate across Africa, the demand for advanced pollution control measures is increasing, further driving the use of sodium silicate. The compound’s ability to remove contaminants from water sources, along with its cost-effectiveness and eco-friendly nature, positions it as a key player in tackling water pollution challenges across the continent.

Growth in the Detergent and Household Cleaning Sector

The detergent and household cleaning sector is one of the key drivers of the Africa Sodium Silicate Market. As urbanization grows and incomes rise across Africa, there is a marked shift in consumer behavior, with increased demand for household cleaning products. Sodium silicate is widely used in the production of detergents because of its excellent properties as a water softener and its ability to enhance the cleaning power of surfactants. The growing awareness of hygiene and sanitation, particularly in urban areas, has resulted in higher consumption of cleaning products, further fueling the demand for sodium silicate. Additionally, as consumers become more conscious of the safety and environmental impact of the products they use, there is a rising preference for non-toxic and biodegradable cleaning solutions. Sodium silicate’s eco-friendly characteristics and its ability to improve the efficacy of cleaning agents make it a popular choice among detergent manufacturers in Africa. This trend is expected to continue as the demand for high-quality and effective household cleaning products grows across the region.

Market Challenges

Limited Production Capacity and Supply Chain Constraints

One of the key challenges facing the Africa Sodium Silicate Market is the limited production capacity and ongoing supply chain constraints. While the demand for sodium silicate is increasing across various sectors, including construction, detergents, and water treatment, the production capacity within the region remains relatively underdeveloped compared to other global markets. A large portion of sodium silicate is still imported, leading to reliance on international suppliers. For instance, reports indicate that sodium silicate imports in Africa saw disruptions in 2024 due to logistical challenges and increased transportation costs. This import dependency makes the market vulnerable to fluctuations in global supply chains, which can result in inconsistent availability and price volatility. Additionally, the infrastructure to support large-scale, efficient sodium silicate production is lacking in many African countries, hindering the market’s ability to meet growing demand. Local production facilities often face challenges such as insufficient technological advancements, limited access to raw materials, and the high costs associated with setting up and maintaining production units. Some manufacturers have begun investing in local production facilities to reduce dependency on imports and stabilize supply chains. These limitations restrict the growth potential of the market and may contribute to rising costs for manufacturers and end-users. Overcoming these production capacity and supply chain issues will be crucial for ensuring a stable supply of sodium silicate and promoting long-term market growth across Africa.

Economic Instability and Regulatory Challenges

Another significant challenge affecting the Africa Sodium Silicate Market is the economic instability and regulatory hurdles faced by businesses operating within the region. Many African countries experience political instability, fluctuating economic conditions, and unpredictable fiscal policies, which can create an uncertain environment for investment in industrial sectors like chemical manufacturing. These economic fluctuations can disrupt production activities, raise operational costs, and hinder the development of infrastructure essential for sodium silicate production. Additionally, regulatory challenges, including varying standards across countries, lack of uniformity in environmental regulations, and inconsistent enforcement of policies, pose a risk to market growth. Manufacturers often face difficulties navigating complex regulations related to product quality, safety, and environmental compliance, which can lead to increased costs and delays. These factors can create barriers for both local producers and international suppliers, limiting the market’s expansion and making it more difficult for businesses to plan for the long term. Addressing these economic and regulatory challenges will be essential for fostering a more conducive environment for sodium silicate production and consumption in Africa.

Market Opportunities

Expansion of Infrastructure Development and Urbanization

The ongoing infrastructure development and urbanization across Africa present significant opportunities for the sodium silicate market. As the region continues to urbanize rapidly, there is a growing demand for construction materials, including cement, concrete, and specialized building products that incorporate sodium silicate. The use of sodium silicate as a binder and strengthening agent in these materials helps enhance durability and resistance to environmental factors, making it highly desirable in large-scale construction projects. The African Union’s Agenda 2063, coupled with government initiatives aimed at improving infrastructure, is driving investments in road networks, housing, and commercial buildings. Additionally, the rise of smart cities and the emphasis on sustainable building practices in African nations will further fuel the demand for eco-friendly and durable construction materials, where sodium silicate can play a key role. As more countries focus on improving their infrastructure, sodium silicate will continue to be a vital component in meeting the growing demand for construction and building products.

Growth in Water Treatment and Environmental Sustainability Initiatives

Another promising market opportunity for sodium silicate in Africa lies in the growing emphasis on water treatment and environmental sustainability. As many African nations face water scarcity and pollution challenges, the need for advanced water treatment solutions is becoming more critical. Sodium silicate is used in water purification processes to help remove contaminants, such as heavy metals, from both industrial and potable water. With governments and organizations focusing on improving access to clean water and addressing environmental pollution, sodium silicate’s role in wastewater treatment is gaining traction. Additionally, sodium silicate’s environmentally friendly properties make it a suitable solution in pollution control efforts, particularly in industries like mining and textiles, which are prominent in Africa. These factors create an expanding market for sodium silicate, particularly in the water treatment and environmental sectors.

Market Segmentation Analysis

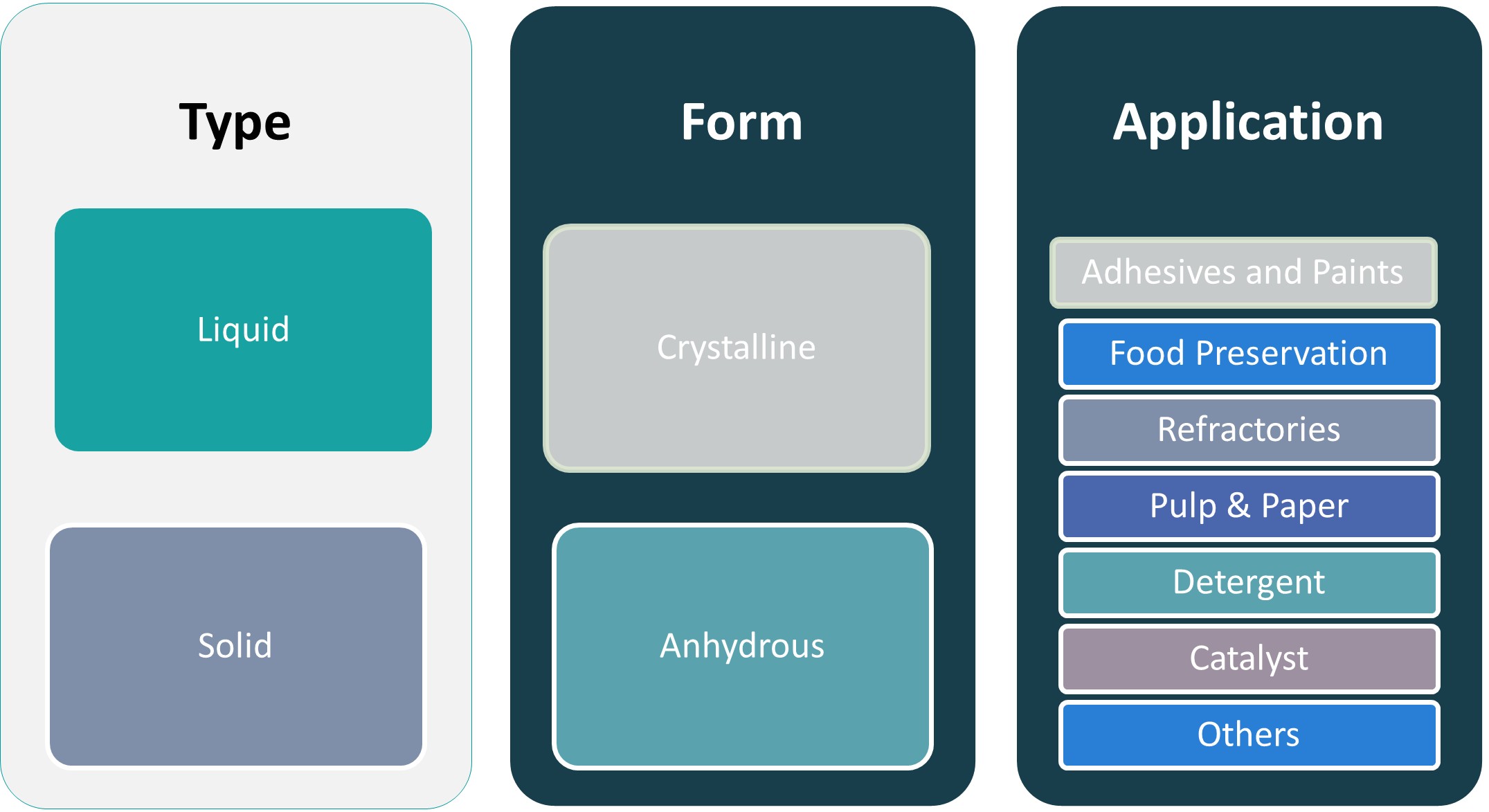

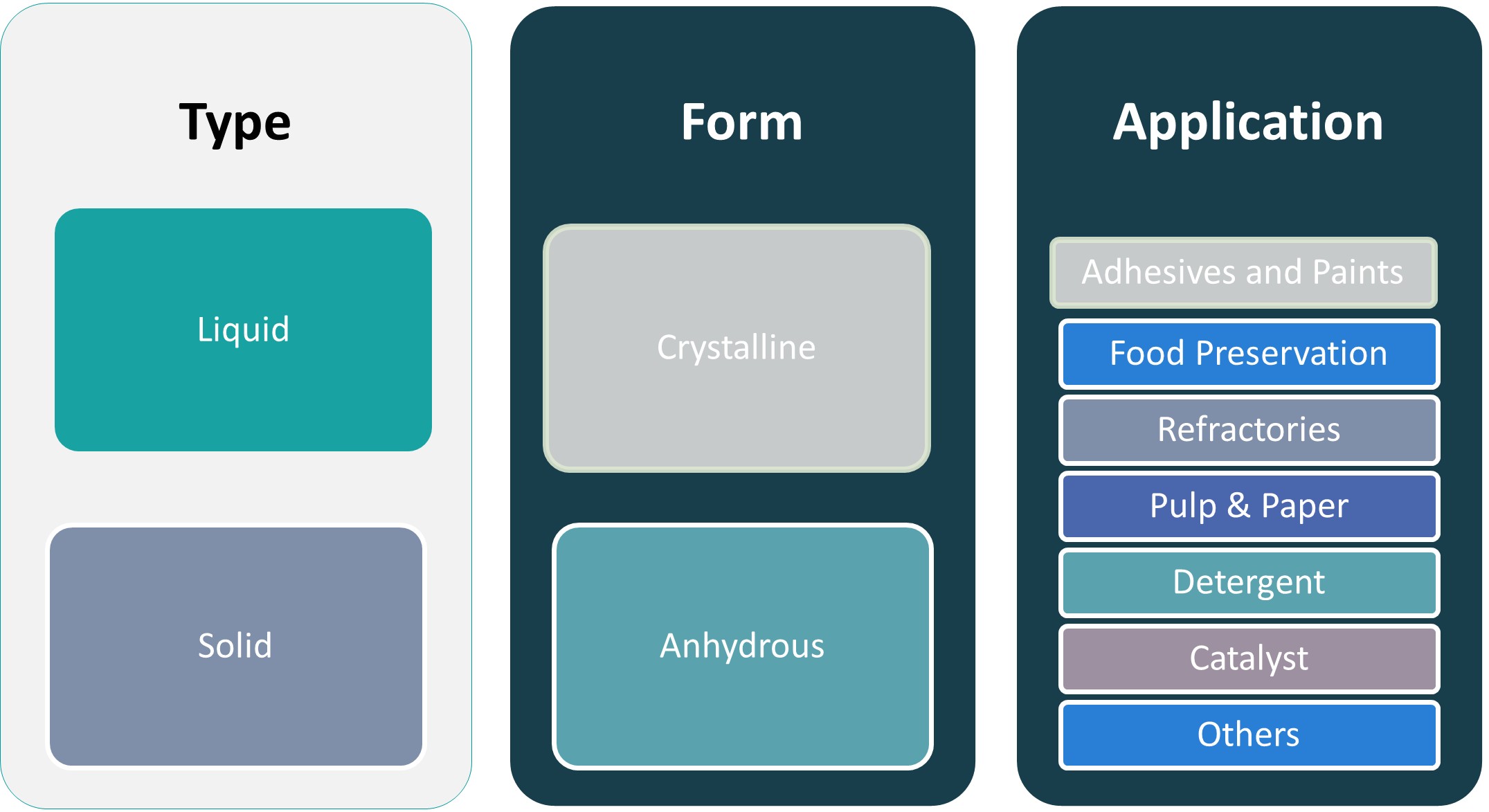

By Type

The Africa Sodium Silicate Market is segmented based on type into liquid and solid forms. Liquid sodium silicate dominates the market due to its wide applicability and ease of use in various industries. It is often preferred for applications requiring a quick and easy solution, such as in detergents, water treatment, and construction materials. Liquid sodium silicate is typically utilized in manufacturing processes where it can be easily mixed with other chemicals or used as a binding agent. On the other hand, solid sodium silicate is increasingly being used in industrial applications such as glass production and as a catalyst in chemical reactions due to its higher stability and ease of handling in bulk quantities. Both forms are integral to the market, with liquid sodium silicate taking a larger share due to its versatility and cost-effectiveness in large-scale industrial applications.

By Form

The market for sodium silicate in Africa is also divided into crystalline and anhydrous forms. Crystalline sodium silicate is more commonly used in industries such as detergents and paper production due to its superior consistency and ability to maintain its structure during processing. Crystalline sodium silicate also has applications in the manufacturing of soap and cleaning agents, where its properties as a water softener are highly valued. Anhydrous sodium silicate, however, is favored in applications requiring a more concentrated form of sodium silicate, such as in catalysts, industrial adhesives, and refractories. The anhydrous form has a higher stability and is utilized when a dry or powdered form is necessary, making it suitable for industries where moisture content must be minimized.

Segments

Based on Type

Based on Form

Based on Application

- Adhesives and Paints

- Food Preservation

- Refractories

- Pulp & Paper

- Detergent

- Catalyst

- Others

Based on Region

- North Africa

- Sub-Saharan Africa

- others

Regional Analysis

North Africa (45%)

North Africa holds the largest share of the Africa Sodium Silicate Market, accounting for approximately 45% of the total market. This region’s dominance is driven by well-established industrial sectors, particularly in Egypt, Morocco, and Algeria, where there is significant demand for sodium silicate in construction, detergents, and water treatment applications. North Africa’s industrialization, coupled with ongoing infrastructure development, contributes to the robust growth of sodium silicate usage in the construction and adhesive sectors. Moreover, the region’s growing demand for detergents and cleaning agents supports the need for sodium silicate, which is crucial for enhancing cleaning effectiveness. The steady expansion of manufacturing capacities and the increasing focus on environmental sustainability further bolster the demand for sodium silicate in North Africa.

Sub-Saharan Africa (40%)

Sub-Saharan Africa is a rapidly growing market for sodium silicate, accounting for about 40% of the overall market share. The region’s economic expansion, driven by increased urbanization, infrastructure development, and a rising middle class, is fostering a strong demand for sodium silicate. Countries like Nigeria, South Africa, and Kenya are leading the growth, with significant investments in construction and manufacturing sectors. In South Africa, the chemical industry is a key consumer of sodium silicate, particularly in the production of detergents, water treatment processes, and adhesives. The rise in industrialization in countries such as Kenya and Nigeria is contributing to a rising demand for sodium silicate in various applications like catalysts, paper production, and food preservation. Sub-Saharan Africa’s growing construction sector, especially in urban areas, is also playing a crucial role in the increasing use of sodium silicate.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Magadi Soda Company

- Virgo Chemicals Ltd

- Msufini Tanzania Limited

- Nakfa Corporation

- Sasol

Competitive Analysis

The Africa Sodium Silicate Market is highly competitive, with several established players contributing to market dynamics. Magadi Soda Company holds a significant position, leveraging its strong manufacturing capabilities and extensive product portfolio. Virgo Chemicals Ltd and Msufini Tanzania Limited are key regional players, focusing on providing tailored sodium silicate solutions for industries such as construction and detergents. Nakfa Corporation, while smaller, has established itself in niche markets, particularly in East Africa. Sasol, with its global reach and expertise in chemicals, also plays a crucial role in the African market, offering advanced production technologies and large-scale supply capabilities. These players adopt various strategies such as product diversification, partnerships, and local manufacturing to enhance their market presence. The growing demand for sodium silicate, particularly in the construction and detergent sectors, offers significant growth opportunities for all players in this competitive landscape.

Recent Developments

- In May 2025, Evonikannounced a global net price increase of up to 5–8% for its MetAMINO (DL-methionine 99% feed grade) product, effective immediately. All existing contracts and supply agreements will be honored.

- In November 2024, Kraton announced a global price increase of \$330 per metric ton for all SIS polymer products, effective January 1, 2025. This decision was driven by rising raw material and process chemical costs.

- In September 2024, CIECH Vitrosilicon initiated the construction of a new warehouse at its Żary plant to enhance sodium silicate production capabilities and logistics efficiency.

- In May 2024,Orablue Chem Pvt. Ltd. participated in ChemExpo 2024 in Mumbai, showcasing its range of sodium metabisulphite and sodium metasilicate products.

- In April 2024,Wacker Chemie AG reported a 22% decline in sales for 2023, attributed to lower prices and volumes, reflecting challenges in the global chemical market.

- In March 2024, Sasol announced plans to expand its sodium silicate production capacity to meet increasing demand in the detergent and water treatment sectors.

Market Concentration and Characteristics

The Africa Sodium Silicate Market exhibits a moderate level of market concentration, with a mix of established global players and regional producers. Major companies like Magadi Soda Company, Sasol, and Virgo Chemicals Ltd dominate the market, controlling a significant share due to their extensive manufacturing capabilities and established distribution networks across Africa. However, there is also room for smaller, regional players such as Msufini Tanzania Limited and Nakfa Corporation, which focus on local markets and specific applications. The market is characterized by a strong demand for sodium silicate in construction, detergents, and water treatment, driving competition among both large and emerging players. As industrialization and urbanization continue across Africa, the market dynamics are evolving, with increasing opportunities for companies that can offer cost-effective, high-quality solutions tailored to regional needs. The competitive landscape is also shaped by factors such as technological advancements, local manufacturing, and product diversification.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Africa Sodium Silicate Market is expected to grow steadily in the coming years, driven by increased demand in sectors like construction, detergents, and water treatment.

- With rapid urbanization and large-scale infrastructure projects, the demand for sodium silicate in construction materials will continue to rise across Africa.

- As water scarcity becomes a more pressing issue, sodium silicate’s role in water purification and wastewater treatment will see increased adoption throughout the continent.

- The growing middle class in Africa is boosting the demand for household products, particularly detergents, which will drive further sodium silicate consumption in the cleaning sector.

- Advances in sodium silicate production technology will lead to more cost-effective and environmentally sustainable manufacturing processes, benefiting both producers and consumers.

- A shift towards sustainable and eco-friendly products will encourage the use of sodium silicate, particularly in green construction and biodegradable cleaning products.

- While North Africa remains dominant, Sub-Saharan Africa will experience faster growth, particularly in countries like Nigeria, South Africa, and Kenya, where industrialization is on the rise.

- The establishment of local production facilities by global players will help meet the growing demand for sodium silicate in Africa, reducing import reliance and lowering costs.

- Governments across the continent are expected to continue investing in industrial and infrastructure development, further driving the demand for sodium silicate in multiple sectors.

- The competitive landscape will become more dynamic, with new entrants and regional players innovating to meet the diverse needs of the African market, intensifying competition in the long term.