Market Overview:

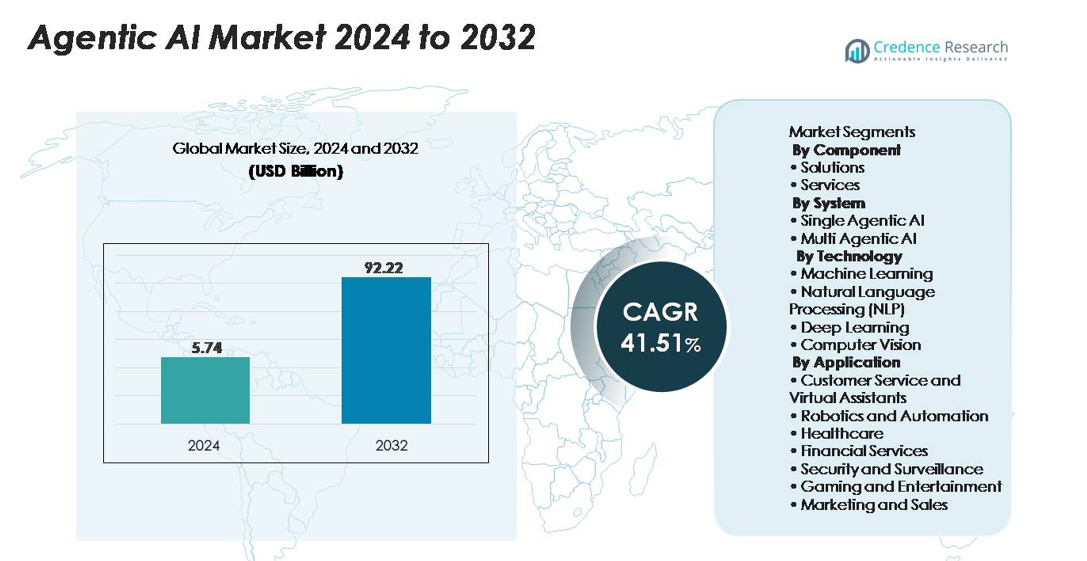

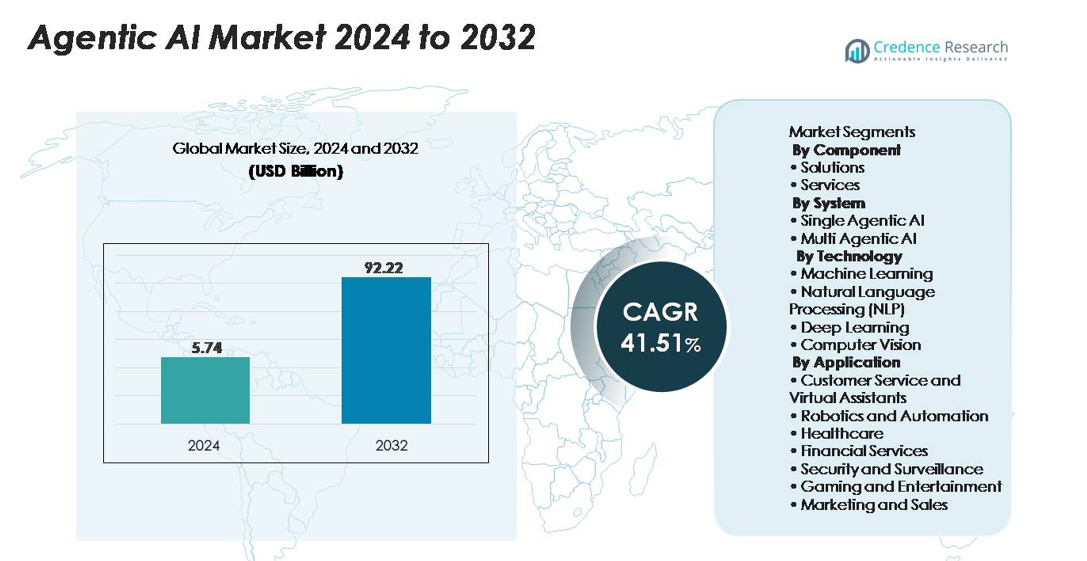

Agentic AI Market was valued at USD 5.74 billion in 2024 and is projected to reach USD 92.22 billion by 2032, growing at a CAGR of 41.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agentic AI Market Size 2024 |

SD 5.74 billion |

| Agentic AI Market, CAGR |

41.51% |

| Agentic AI Market Size 2032 |

USD 92.22 billion |

Leading companies in the Agentic AI Market include major cloud providers, enterprise software vendors, and AI-focused startups that develop autonomous agents for workflow automation, customer engagement, and decision intelligence. Key players focus on scalable multi-agent architectures, secure data processing, and integration with CRM, ERP, RPA, and analytics platforms. North America leads the global market with 41% share, driven by strong digital infrastructure and early enterprise adoption across finance, healthcare, retail, and logistics. Europe follows with 26% share, supported by strict data governance and investments in explainable AI. Asia-Pacific remains the fastest-growing region with 22% share, backed by large consumer markets, cloud adoption, and government-supported AI programs.

Market Insights

- The Agentic AI Market reached USD 5.74 billion in 2024 and will grow at a CAGR of 41.51% through 2032.

- Solutions dominated with 63% share as enterprises adopted autonomous decision systems that integrate with CRM, ERP, and RPA platforms.

- Demand rises due to automation of customer service, fraud monitoring, workflow orchestration, and predictive analytics, supporting large-scale digital transformation.

- North America led with 41% share, followed by Europe at 26% and Asia-Pacific at 22%, driven by cloud adoption and government-backed AI innovation.

- Competition grows as vendors advance multi-agent systems, self-correcting models, and secure data pipelines, while high deployment cost and integration complexity remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

Solutions held the largest share of the Agentic AI Market in 2024, accounting for 63% of overall revenue. Businesses prefer ready-to-deploy platforms that integrate automated reasoning, task planning, and autonomous decision execution. These solutions support complex workflows across customer service, healthcare triage, supply chains, and financial risk investigation. Vendors enhance value with low-code customization, cloud interoperability, and plug-and-play APIs. The Services segment grows steadily as enterprises require consulting, deployment, model optimization, and managed support. Rising demand for scalable automation, reduced human intervention, and improved accuracy keeps the Solutions segment dominant during the forecast period.

- For instance, Microsoft reported that GitHub Copilot’s agent mode (or a related internal AI tool) scanned nearly four million lines of production code and generated over 30,000 pull requests during a large-scale internal deployment test.

By System:

Multi Agentic AI dominated with 58% share in 2024 as organizations adopted autonomous agents that collaborate, negotiate, and divide tasks. Multi-agent systems handle parallel planning, fraud detection, logistics orchestration, and real-time decision loops better than single agents. They reduce processing time and improve system resilience by distributing workloads across independent agents. Single Agentic AI finds adoption in consumer chatbots, simple virtual assistants, and workflow automation. However, increasing enterprise demand for complex reasoning, task-splitting, and large-scale optimization keeps multi-agent architectures ahead in the market.

- For instance, Google DeepMind’s AlphaStar used a population of cooperating agents trained with reinforcement learning, executing up to 200 actions per minute in StarCraft II, demonstrating high-speed coordinated strategy execution across multiple agents.

By Technology:

Machine Learning remained the leading technology with 39% share in 2024, driven by enterprise demand for pattern recognition, predictive analytics, and autonomous task execution. NLP gained fast momentum as AI agents processed instructions, documents, emails, and conversational tasks with high accuracy. Deep Learning and Computer Vision enable autonomous robots, surveillance, healthcare imaging, and process automation. Vendors combine hierarchical reinforcement learning and transformer-based architectures to achieve reasoning, self-correction, and multi-step decision workflows. The dominance of Machine Learning continues as enterprises rely on scalable models and real-time data training to improve agent performance across sectors.

Key Growth Drivers

Rising Demand for Autonomous Decision-Making

Enterprises adopt agentic AI to reduce human intervention in repetitive and high-volume tasks. These systems analyze data, plan actions, and execute tasks without manual prompts. Autonomous agents support healthcare triage, legal documentation checks, cybersecurity monitoring, and financial fraud alerts. Businesses replace static chatbots with agents that learn, reason, and self-correct in real time. This shift lowers operational costs and speeds up service delivery. Cloud-based deployment also allows faster scaling. As enterprises seek higher accuracy, faster turnaround, and independent workflow execution, demand for autonomous systems strengthens the growth of the agentic AI market.

- For instance, UiPath’s autonomous RPA bots are designed to execute unattended workflows without human involvement in enterprise environments.

Expansion of AI-Assisted Customer Service and Virtual Assistants

Companies deploy agentic AI to improve customer response time and personalization. Agents extract context from messages, understand intent, and deliver accurate replies without escalation to human teams. The retail, telecom, banking, and travel industries benefit from 24×7 support and language flexibility. Positive customer experience increases brand loyalty and lowers call-center workload. These systems also escalate complex cases to human agents with structured reports. Enterprises invest in agentic AI to enhance customer satisfaction, reduce staffing pressure, and manage rising query volumes, driving strong adoption worldwide.

- For instance, Alibaba’s AI-powered customer service system AliMe processes more than 3 million queries per day, automatically resolving order-status, refund, and delivery questions with NLP engines trained on billions of text samples.

Integration with Analytics, RPA, and Enterprise Software

Businesses integrate agentic AI with robotic process automation, ERP, CRM, and analytics tools. Agents complete multi-step tasks, such as invoice approval, onboarding, compliance checks, and workflow scheduling. This improves transparency, productivity, and decision quality. Manufacturing, logistics, and energy companies use autonomous agents to forecast failures, optimize maintenance, and coordinate resources. This interoperability helps enterprises extract value from existing systems without redesigning frameworks. Growing compatibility with APIs, cloud services, and edge devices strengthens the market and encourages cross-industry adoption.

Key Trends & Opportunities

Growth of Multi-Agent Systems for Complex Operations

Multi-agent models gain attention due to their ability to share tasks, negotiate outcomes, and manage dynamic environments. Industries such as finance, transportation, and defense rely on multiple autonomous agents that monitor data, detect anomalies, and respond instantly. Businesses apply these systems for fleet routing, supply chain orchestration, energy grid optimization, and high-frequency trading. Multi-agent designs also improve resilience, as workflow continues even if one agent fails. As companies expand automation across departments, multi-agent infrastructure becomes a major opportunity for vendors.

- For instance, Siemens uses decentralized agent control in microgrid systems where autonomous agents balance load across turbines and batteries, and documented field trials showed continued operation even after failure of individual control nodes.

Emergence of AI Agents in Healthcare, HR, and Legal Workflows

Hospitals use AI agents for clinical triage, patient tracking, image analysis, and treatment planning. HR teams automate recruitment screening, scheduling, performance tracking, and documentation audits. In legal compliance, agents scan large document sets, summarize risks, and flag violations. These specialized applications reduce human burden and prevent errors. Vendors build domain-specific agents that follow strict regulatory and security standards. Expanding opportunities across non-traditional industries position agentic AI as a core enterprise tool.

- For instance, Google DeepMind’s medical imaging agent achieved documented analysis of more than 15,000 retinal OCT scans, detecting over 50 eye conditions with automated referral decisions validated against specialist review.

Key Challenges

Ethical Risks and Data Privacy Concerns

Agentic AI collects and processes sensitive information, such as personal identity, financial history, medical records, and strategic business data. Unauthorized access or inaccurate decisions can lead to legal consequences. Countries enforce strict rules on explainability, transparency, consent, and model bias. Enterprises must verify that autonomous decisions follow compliance standards. Maintaining trust requires secure data pipelines, encryption, and human supervision. Ethical risks limit rapid adoption, especially in healthcare, banking, and government sectors.

High Deployment Costs and Integration Complexity

Building agentic systems requires advanced computing infrastructure, training data, and model tuning. Many enterprises face challenges integrating autonomous agents with legacy software, on-premise systems, and fragmented datasets. Skilled developers and AI experts are also limited, increasing labor costs. Small organizations hesitate due to long implementation cycles and operational disruption. Vendors address this challenge with cloud-based solutions, low-code platforms, and API-driven deployment, but high upfront investment remains a key barrier for widespread adoption.

Regional Analysis

North America

North America held the largest share of the Agentic AI Market in 2024, accounting for 41% of global revenue. Strong technology infrastructure, early enterprise adoption, and high investments in autonomous decision systems support market dominance. Major sectors such as BFSI, healthcare, retail, and logistics deploy agentic platforms for workflow automation, virtual assistants, fraud monitoring, and predictive analytics. The U.S. drives most demand with large-scale cloud integration and AI research hubs. Vendor partnerships with cloud service providers and software firms stimulate commercialization. Regulatory attention on data transparency and ethical AI also pushes companies to adopt secure and compliant platforms.

Europe

Europe captured 26% share in 2024, supported by enterprise digitization programs and government-backed AI ethics frameworks. Companies deploy agentic AI for manufacturing automation, smart mobility, and cybersecurity. Germany, France, and the U.K. lead adoption due to strong industrial automation and automotive innovation. The region focuses on explainable AI, data privacy, and secure processing under GDPR, pushing vendors to build transparent decision systems. Financial services, public administration, and e-commerce sectors use autonomous agents to enhance customer service, compliance checks, and multi-language communication. Growing investment in multi-agent research strengthens Europe’s position in the global market.

Asia-Pacific

Asia-Pacific held 22% share in 2024 and remains the fastest-growing region due to expanding digital infrastructure, cloud adoption, and AI-driven automation. China, Japan, India, and South Korea invest in agentic systems for robotics, surveillance, fintech, e-commerce, and manufacturing analytics. The consumer sector shows strong adoption in virtual assistants and retail personalization. Government programs supporting AI innovation encourage local tech vendors to develop autonomous software and multi-agent frameworks. Rising use of AI in healthcare diagnostics, banking risk detection, and logistics optimization accelerates market expansion. The region’s large enterprise base strengthens long-term growth potential.

Latin America

Latin America accounted for 6% share in 2024, supported by rising cloud migration and enterprise demand for automation. Brazil and Mexico lead adoption across banking, telecom, and e-commerce. Companies invest in AI agents for customer support, fraud analytics, and process automation to reduce workforce pressure and operational delays. Growth remains gradual due to limited technical expertise and high deployment costs. However, investments from global vendors and regional digital transformation programs encourage broader adoption. The increasing use of Spanish-language and Portuguese-language virtual assistants strengthens market opportunities in the coming years.

Middle East & Africa

The Middle East & Africa captured 5% share in 2024, with adoption led by the UAE, Saudi Arabia, and South Africa. Smart city programs, digital banking, and public sector modernization drive the use of autonomous agents. Organizations deploy AI for customer service automation, document processing, and predictive maintenance in utilities and energy industries. Regional governments push AI policies and training initiatives to build technical capacity. Despite slower adoption in smaller economies, investments in cloud infrastructure and cybersecurity accelerate future demand. Partnerships between international vendors and local enterprises support market expansion across the region.

Market Segmentations:

By Component

By System

- Single Agentic AI

- Multi Agentic AI

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Computer Vision

By Application

- Customer Service and Virtual Assistants

- Robotics and Automation

- Healthcare

- Financial Services

- Security and Surveillance

- Gaming and Entertainment

- Marketing and Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Agentic AI Market is defined by technology developers, cloud platforms, and enterprise software vendors offering autonomous agents for decision-making and workflow execution. Leading companies focus on multi-agent systems, self-correcting models, and integration with ERP, CRM, and analytics tools. Vendors expand capabilities through partnerships with hyperscale cloud providers and enterprise automation firms. Startups innovate in domain-specific areas such as healthcare triage, legal documentation review, fintech risk assessment, and industrial maintenance. Competition also centers on data privacy, transparent decision logic, and secure deployment. Low-code customization, multilingual support, and API-based scaling create strong differentiation. As enterprises shift from static chatbots to intelligent agents that plan, reason, and act independently, vendors race to deliver reliable autonomy, regulatory compliance, and real-time analytics. Continuous advancements in deep learning, NLP, reinforcement learning, and transformer architectures further intensify market competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zycus Inc. (U.S.)

- SAP SE (Germany)

- Google LLC (U.S.)

- Anthropic PBC (U.S.)

- Oracle Corporation (U.S.)

- Microsoft (U.S.)

- UiPath (U.S.)

- Nvidia Corporation (U.S.)

- IBM Corporation (U.S.)

- OpenAI Corporation (U.S.)

Recent Developments

- In 2025, Anthropic PBC released its framework for safe and trustworthy agentic systems, focusing on operational transparency, controlled autonomy, and governance standards for high-risk environments.

- In February 2025, Zycus Inc. launched its “Merlin Agentic AI Platform” to enable autonomous workflows in procurement.

Report Coverage

The research report offers an in-depth analysis based on Component, System, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of multi-agent systems will expand as enterprises automate complex workflows.

- Agentic AI will support self-learning and self-correction to reduce human supervision.

- Customer service, healthcare, finance, and logistics will adopt domain-specific autonomous agents.

- Integration with RPA, ERP, CRM, and analytics platforms will improve workflow continuity.

- Cloud and edge deployment will make autonomous agents scalable for global operations.

- Vendors will focus on transparent decision logic to meet data privacy regulations.

- Autonomous cybersecurity agents will detect anomalies and respond in real time.

- Low-code customization will help enterprises build agents without deep technical skills.

- Partnerships between cloud providers and AI startups will accelerate product innovation.

- Enterprises will combine multimodal AI, NLP, and reinforcement learning to enhance reasoning and planning.