Market Overview:

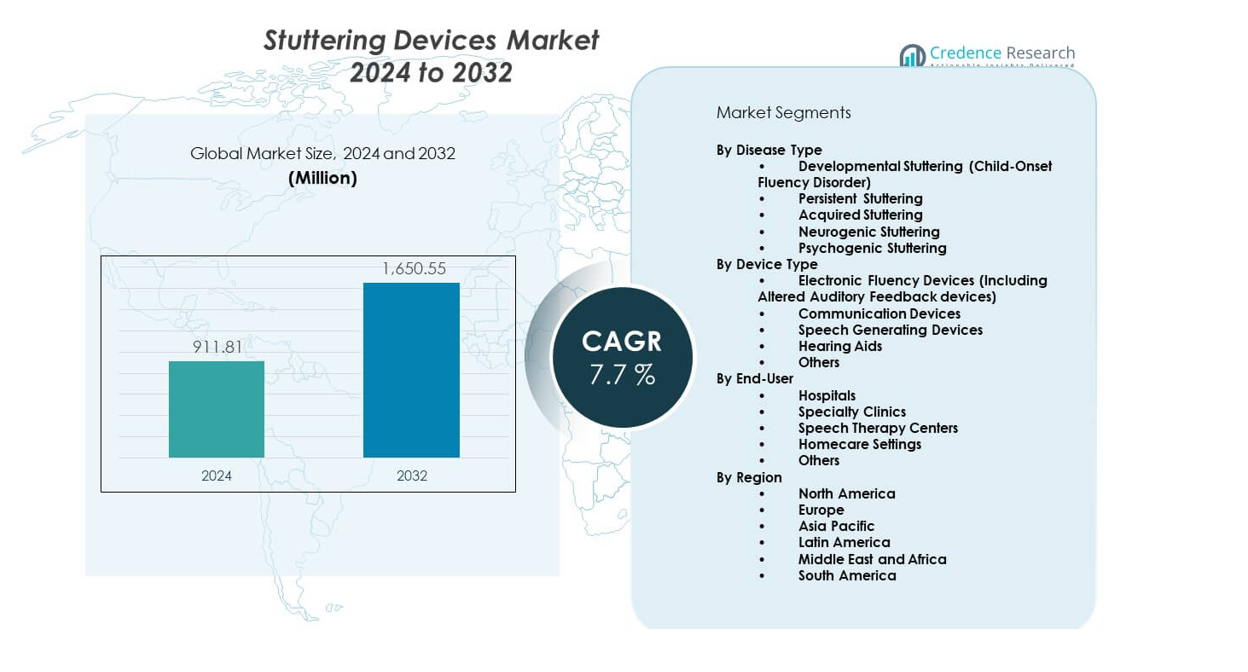

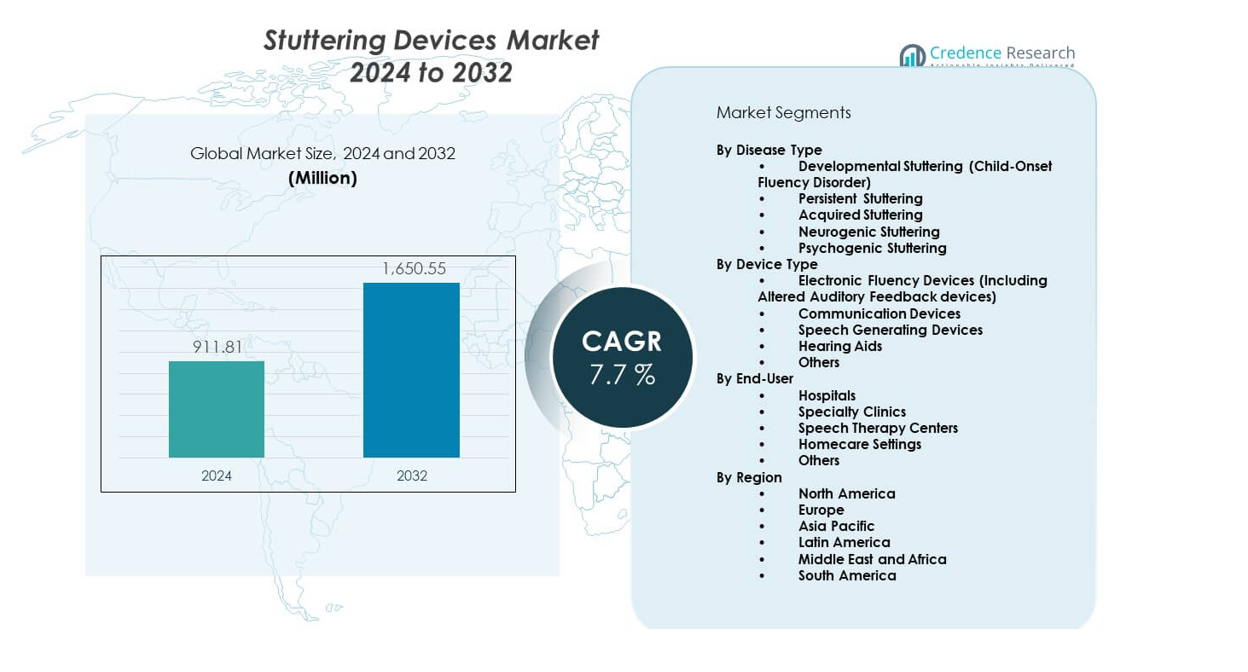

The Stuttering devices market is projected to grow from USD 911.81 million in 2024 to an estimated USD 1,650.55 million by 2032, with a compound annual growth rate (CAGR) of 7.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stuttering Devices Market Size 2024 |

USD 911.81 million |

| Stuttering Devices Market, CAGR |

7.7% |

| Stuttering Devices Market Size 2032 |

USD 1,650.55 million |

The market drivers include strong demand for non-invasive tools that improve speech flow. Users seek portable devices that support real-time feedback during routine tasks. Hospitals expand speech therapy units to handle more cases each year. Parents prefer early device adoption to support better progress in children. Makers focus on lighter designs that improve comfort for long use. Therapy groups promote updated device models to speed practice sessions. Support programs widen access in schools. These drivers build steady interest across different age groups.

North America leads due to high device adoption and strong clinic presence. Europe follows with wide use of digital aids in structured therapy systems. Asia Pacific emerges as a fast-growing region due to rising awareness and large patient pools. Demand grows in China and India as therapy access expands. Latin America shows steady uptake due to improving speech care centers. The Middle East and Africa gain momentum with new rehabilitation units. Regional growth patterns reflect rising access and strong public outreach.

Market Insights:

- The Stuttering devices market reached USD 911.81 million in 2024 and is projected to hit USD 1,650.55 million by 2032, registering a 7% CAGR supported by rising therapy adoption and broader device availability.

- North America holds about 38% share, driven by strong clinical infrastructure and early diagnosis programs; Europe holds nearly 27%, supported by structured speech therapy systems; Asia Pacific accounts for around 22%, backed by improving access to therapy services.

- Asia Pacific stands as the fastest-growing region with about 22% share, expanding rapidly due to rising awareness, growing young populations, and increasing investments in modern speech-support tools.

- Electronic Fluency Devices dominate with roughly 42% share, supported by high preference for altered auditory feedback systems across clinics and homecare users.

- Developmental Stuttering represents about 48% of disease-type share, reflecting strong pediatric demand and expanding early-intervention programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Early Therapy Support and Non-Invasive Assistance Tools

Growing awareness pushes many families to seek early care for speech issues. Clinics report higher footfall from younger age groups each year. The Stuttering devices market gains steady traction due to rising comfort with digital aids. Users prefer compact devices that improve clarity during speech practice. Therapy teams promote tools that help reduce stress during daily communication. Schools support early trials for children who show visible speech blocks. Buyers seek solutions that enhance long-term progress. Broader adoption strengthens confidence in structured therapy plans.

- For instance, while a significant need for speech-support technologies exists, access is often limited. Globally, nearly 97 million individuals and around 5 million Americans are estimated to be unable to rely on their natural speech to communicate and could potentially benefit from augmentative and alternative communication (AAC) devices.

Strong Uptake of Portable and User-Friendly Smart Devices for Daily Practice

Many users select devices that support flexible use at home or work. Makers design products that provide real-time feedback to guide speech flow. Therapists highlight benefits of lighter devices that promote long practice hours. The Stuttering devices market grows as users value discreet designs. Demand rises for devices that pair with apps for guided sessions. Care providers recommend models that improve comfort during routine speaking tasks. Families look for tools that track progress over time. Strong focus on ease of use supports higher adoption.

- For instance, SpeechEasy International’s altered auditory feedback device has been evaluated in more than 15 clinical studies across U.S. therapy settings.

Growing Integration of Therapy Devices With Digital Platforms and Coaching Tools

Developers expand features that link devices to structured digital coaching programs. Therapists prefer systems that store progress data for review. The Stuttering devices market gains lift from platforms that support remote follow-up. Users trust tools that sync with mobile screens for guided training. Digital reminders help maintain discipline in daily practice. Clinics deploy hybrid systems that combine in-person sessions with app-based tasks. Families like centralized dashboards that show monthly gains. Broader integration helps users stay consistent.

Expanding Clinical Investment in Advanced Assistive Technologies Across Settings

Hospitals allocate larger budgets for modern speech improvement systems. Therapy centers upgrade units to handle rising patient loads. The Stuttering devices market benefits from stronger institutional support. New clinics add trial zones for device-assisted sessions. Rehabilitation units promote structured device-based pathways. Providers explore new models that reduce fatigue during extended sessions. Public programs highlight benefits of speech-support technologies. Investments stimulate wider trust among first-time users.

Market Trends:

Rising Shift Toward AI-Based Speech Modulation and Real-Time Monitoring Features

AI tools enter therapy devices to refine speech control patterns. Makers add algorithms that detect blocks and guide smoother flow. The Stuttering devices market evolves with smarter analytical features. Users choose models that give instant cues without manual inputs. Clinics test software that adapts tone and rhythm cues for each user. Digital engines improve accuracy in tracking small progress shifts. Developers work on advanced models that support adaptive prompts. Trend strength rises due to strong trust in AI support.

- For instance, More than 10,000 people have used Lingraphica AAC (Augmentative and Alternative Communication) devices to communicate since the company’s founding in 1990.

Growing Preference for Wearable Designs With Higher Discretion and Everyday Usability

Wearable formats attract users who want unobtrusive support during busy days. Makers produce smaller designs that attach easily without discomfort. The Stuttering devices market shifts toward discreet ear-level units. Users appreciate models that keep hands free during tasks. Travel-friendly formats gain attention among young adults. Therapists promote wearables for outdoor practice. New materials improve comfort during extended use. Wearables support steady skill building through frequent use.

- For instance, AbleNet offers several models of its QuickTalker multi-message speech devices, such as the QuickTalker 7, QuickTalker 12, and QuickTalker 23, which are portable and widely used in various settings, from classrooms to homes. These devices feature user-friendly FeatherTouch technology and integrated handles designed to facilitate communication for non-verbal individuals in go-anywhere scenarios.

Increasing Adoption of Remote Therapy Integration Through Connected Platforms

Connected systems help therapists review user progress without physical visits. Many users support devices that sync with digital dashboards. The Stuttering devices market gains traction from teletherapy expansion. Remote features allow flexible scheduling for busy families. Care teams track usage patterns to refine training plans. Cloud tools store insights that guide monthly adjustments. Users like the convenience of home-based monitoring. Remote links strengthen continuity in long treatment cycles.

Growing Use of Data-Driven Personalization in Speech Improvement Devices

Data engines collect detailed patterns to tailor user-specific cues. Makers design models that refine output based on daily trends. The Stuttering devices market grows with greater preference for personalized aids. Therapists value systems that adjust frequency cues over time. Multiple age groups respond well to adaptive speech patterns. Data logs show clear progress that motivates steady use. Developers expand tools that support narrow training goals. Personalization builds strong user confidence.

Market Challenges Analysis:

High Device Costs and Limited Insurance Support Across Many Regions

Many families struggle with high prices that limit early adoption. Insurance plans often exclude assistive speech tools. The Stuttering devices market faces slower uptake in low-income zones. Clinics hesitate to upgrade units due to cost constraints. Users delay purchases when trial access is limited. Public programs rarely fund high-tech devices. Makers face pressure to reduce costs for wider access. These barriers restrict steady progress in several regions.

Low Awareness Levels and Shortage of Skilled Speech Therapy Professionals

Awareness gaps delay early therapy decisions in many communities. Users often lack exposure to structured device-based solutions. The Stuttering devices market experiences uneven adoption due to skill shortages. Rural areas have fewer trained therapists to guide device use. Families skip advanced tools due to limited local support. Clinics operate with small teams that handle heavy workloads. Training shortages weaken long-term outcomes. These issues create slow adoption cycles across developing regions.

Market Opportunities:

Rising Scope for AI-Powered Tools and Personalized Therapy Ecosystems

AI-driven guidance opens new adoption channels across therapy settings. Developers expand features that refine user-specific cues. The Stuttering devices market gains strong potential from adaptive systems. Clinics show interest in models that speed measurable progress. Data-based insights improve user motivation during training. Schools open doors for early AI-based screenings. Growth in home-based digital coaching strengthens long-term use. Expanding smart ecosystems unlock wider user reach.

Increasing Focus on Affordable Devices and Wider Access Across Emerging Regions

Makers explore low-cost designs to support large user groups. Public programs highlight the need for early access solutions. The Stuttering devices market benefits from rising interest in budget models. Community centers promote guided trials for families. Local suppliers enter markets with simplified tools. Clinics value devices that reduce maintenance needs. Broader access helps build strong adoption patterns. These shifts open promising growth lanes in new regions.

Market Segmentation Analysis:

By Disease Type

The Stuttering devices market expands across varied disease categories with strong clinical demand. Developmental stuttering holds a major share due to rising early diagnosis among children. Persistent stuttering drives steady adoption among adults seeking daily communication support. Acquired and neurogenic stuttering segments record higher device use in rehabilitation programs. Psychogenic stuttering remains smaller but gains attention through targeted therapy pathways. Each category shows different device preferences based on severity and therapy goals. Structured treatment plans encourage wider device adoption across all groups. This diversity strengthens the long-term growth of the market.

- For instance, PRC-Saltillo’s Unity® language system supports tens of thousands of AAC users, many connected to long-term therapy pathways.

By Device Type

Electronic fluency devices lead due to strong interest in altered auditory feedback tools that support smoother speech flow. Communication devices and speech-generating systems attract users who require enhanced control during structured practice. Hearing aids serve patients who benefit from auditory modulation within therapy sessions. Other device formats address niche needs across varied age groups. The Stuttering devices market gains support from ongoing design improvements that increase comfort during routine tasks. It grows further as users look for flexible tools that integrate with therapy plans. Broad device availability supports strong adoption across regions.

- For instance, Lingraphica’s speech-generating devices are used by tens of thousands of registered users across clinical and home settings, demonstrating strong reliance on communication hardware.

By End-User

Hospitals remain key adopters due to advanced diagnostic units and higher patient volumes. Specialty clinics depend on device-assisted therapy pathways to improve outcomes. Speech therapy centers record strong use among children and young adults. Homecare settings gain traction through portable devices that support daily practice. Other end-users include community centers and rehabilitation units with growing interest in structured speech tools. Rising awareness strengthens user engagement across each end-user segment. This spread of adoption supports stable expansion across long-term therapy needs.

Segmentation:

By Disease Type

- Developmental Stuttering (Child-Onset Fluency Disorder)

- Persistent Stuttering

- Acquired Stuttering

- Neurogenic Stuttering

- Psychogenic Stuttering

By Device Type

- Electronic Fluency Devices (Including Altered Auditory Feedback devices)

- Communication Devices

- Speech Generating Devices

- Hearing Aids

- Others

By End-User

- Hospitals

- Specialty Clinics

- Speech Therapy Centers

- Homecare Settings

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Stuttering devices market due to strong clinical adoption and high awareness levels. Hospitals and therapy centers invest in advanced digital devices that support structured intervention plans. Users show high acceptance of portable fluency tools that improve daily communication. The region benefits from strong reimbursement pathways that support wider access. It also records high uptake among children due to early diagnosis programs. Product makers test new models in this region before global launch. Strong infrastructure maintains North America’s leading share.

Europe

Europe secures a significant share supported by structured therapy systems and strong clinical networks. The Stuttering devices market grows in this region due to rising demand from rehabilitation units and specialty clinics. Users adopt devices that pair with digital platforms for progress tracking. Governments promote speech therapy access through public programs that widen usage. Demand remains high among both adult and pediatric groups across major countries. Clinics follow standardized guidelines that encourage device-assisted interventions. This consistent growth pattern maintains Europe’s strong regional share.

Asia Pacific

Asia Pacific represents the fastest-growing share supported by expanding patient awareness and rising access to speech therapy services. The Stuttering devices market gains traction due to high demand from urban centers with young populations. Users show growing interest in compact and low-cost devices that support daily practice. Hospitals and therapy centers increase investments in modern systems to serve larger patient volumes. Regional growth accelerates through new training programs that strengthen therapist availability. Homecare adoption rises due to flexible device options for children. These factors elevate Asia Pacific’s overall share at a rapid pace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Takalam Tech

- Casa Futura Technologies

- SpeechEasy International LLC

- Tobii Dynavox AB

- PRC-Saltillo

- DrSpectra

- Attainment Company, Inc.

- Lingraphica

- Numotion

- AbleNet, Inc.

- VoiceAmp

- SpeakFluent

Competitive Analysis:

The Stuttering devices market features a mix of established assistive-technology brands and emerging digital therapy innovators. Key players compete through advanced fluency tools, compact wearable formats, and software-linked coaching features. Companies strengthen portfolios with portable altered auditory feedback devices that support daily communication. Product differentiation focuses on comfort, ease of use, and integration with digital therapy systems. It grows through strong emphasis on design updates that help users maintain routine practice. Firms expand global reach through partnerships with clinics and therapy networks. Continuous improvements in device accuracy and user experience shape overall competition.

Recent Developments:

- SpeechEasy International LLC, known for its fluency-enhancing devices that use Altered Auditory Feedback (AAF) technology, continues to lead in innovative stuttering assistance products, maintaining market presence with its hearing aid-like devices.

- In 2025, Tobii Dynavox AB extended its contract for five years involving a SEK 100 million deal focused on eye tracking components crucial for communication devices, strengthening its technology partnership and product supply chain.

- PRC-Saltillo made a strategic acquisition in October 2025, acquiring Invention Labs Engineering Products and Avaz Inc. This move strengthens PRC-Saltillo’s augmentative and alternative communication (AAC) offerings and enhances its service capabilities in India and globally.

Report Coverage:

The research report offers an in-depth analysis based on Disease Type and Device Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for portable fluency devices will support stronger global adoption.

- AI-enabled speech monitoring tools will enhance personalization.

- Home-use devices will gain wider acceptance among young users.

- Clinics will integrate device-assisted therapy into structured care plans.

- Partnerships between device makers and therapy centers will expand.

- Cloud-linked progress dashboards will strengthen user engagement.

- Low-cost device innovations will support emerging markets.

- Wearable formats will attract adults needing discreet support.

- Early-intervention programs will drive pediatric segment growth.

- Broader digital health inclusion will reinforce long-term market momentum.