Market Overview:

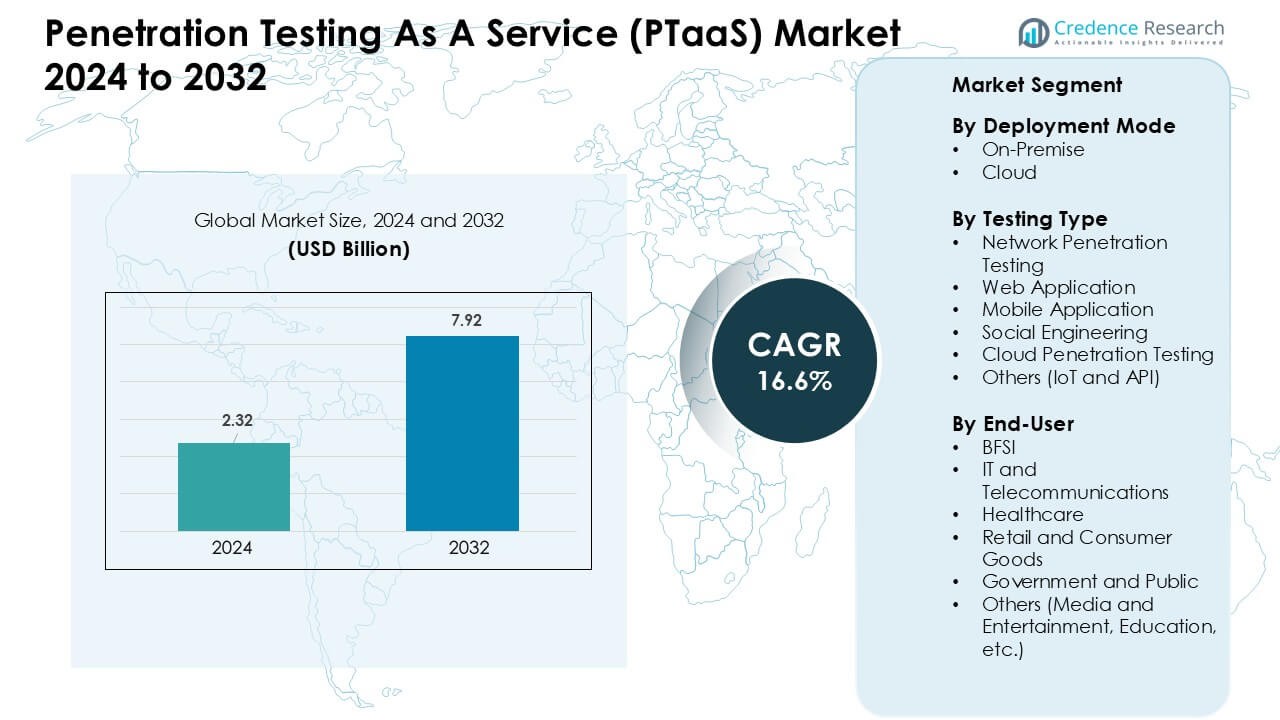

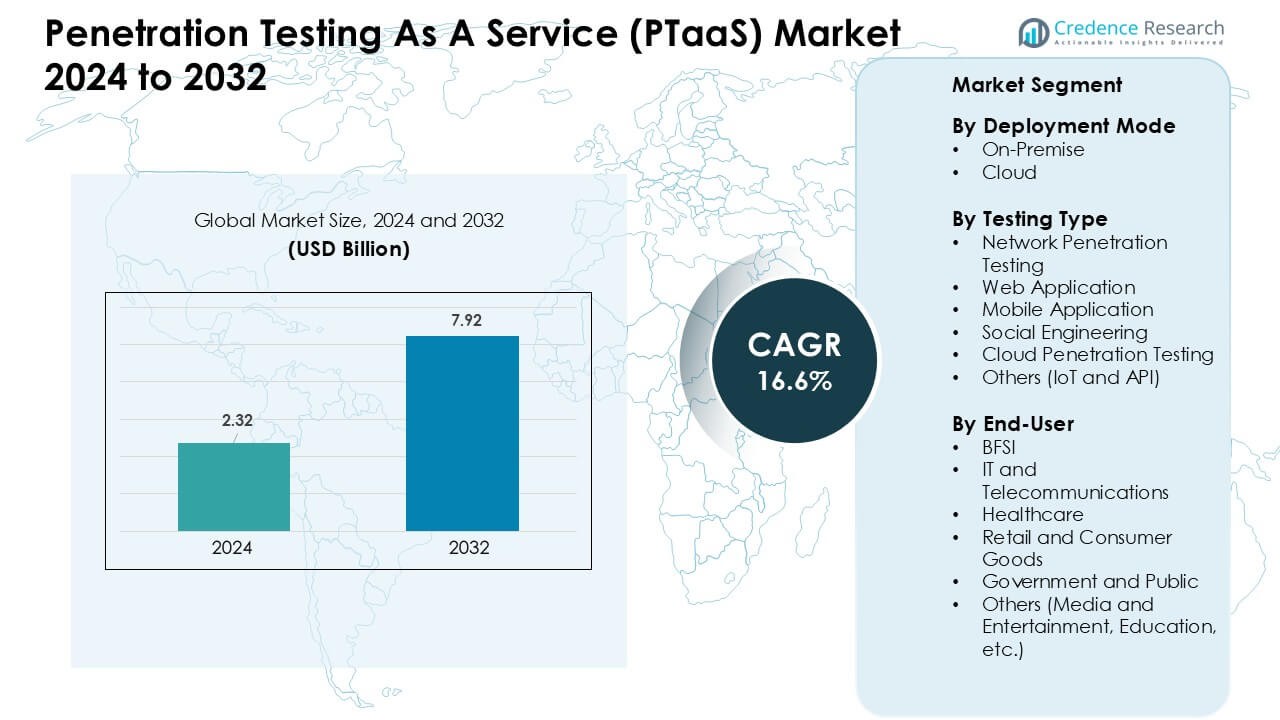

Penetration Testing As A Service (PTaaS) Market was valued at USD 2.32 billion in 2024 and is anticipated to reach USD 7.92 billion by 2032, growing at a CAGR of 16.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Penetration Testing As A Service (PTaaS) Market Size 2024 |

USD 2.32 Billion |

| Penetration Testing As A Service (PTaaS)Market, CAGR |

16.6 % |

| Penetration Testing As A Service (PTaaS) Market Size 2032 |

USD 7.92 Billion |

The Penetration Testing As A Service (PTaaS) market is shaped by leading players such as BreachLock Inc., Rapid7, Indusface, ASTRA IT, THREATSPIKE LABS, Synopsys, IBM Corporation, CrowdStrike, Secureworks, and Invicti. These companies strengthened their positions by expanding continuous testing services, improving automation, and integrating AI-driven vulnerability analysis to support faster remediation. Cloud-native testing, API security, and DevSecOps alignment remained core focus areas as enterprises increased digital adoption. North America led the global PTaaS market in 2024 with an estimated 39% share, supported by strong regulatory pressure, high cyberattack frequency, and the presence of major cybersecurity vendors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Penetration Testing As A Service (PTaaS) market reached USD 2.32 billion in 2024 and is projected to hit USD 7.92 billion by 2032, growing at a CAGR of 16.6%.

- Demand grew as firms expanded cloud workloads and required continuous testing; cloud deployment held the largest share due to easier scaling and faster updates.

- Trends centered on API security, AI-supported vulnerability detection, and stronger DevSecOps integration as enterprises shifted to rapid release cycles.

- Competition intensified among vendors such as CrowdStrike, Rapid7, IBM, Secureworks, Invicti, BreachLock, and Indusface, each expanding automated testing and real-time reporting features; restraints included skill shortages and complex hybrid environments.

- North America led the market with 39% share, followed by Europe and Asia-Pacific; BFSI remained the top end-user segment, while network penetration testing held the highest share among testing types.

Market Segmentation Analysis:

By Deployment Mode

Cloud deployment held the leading share in 2024 with strong uptake across enterprises. Firms preferred cloud PTaaS because updates rolled out faster, tests scaled on demand, and workloads stayed secure without heavy in-house tools. Cloud models also reduced hardware costs and aligned well with remote teams that needed continuous testing cycles. On-premise adoption remained relevant in regulated sectors that required strict data control, yet wider digital migration kept cloud deployment ahead due to better agility and improved integration with existing DevSecOps pipelines.

- For instance, Synack offers a cloud PTaaS platform backed by a community of over 1,500 vetted security researchers enabling organizations to kick off penetration tests in days rather than waiting weeks.

By Testing Type

Network penetration testing dominated the segment in 2024 with the highest share. Demand remained strong as organizations focused on detecting misconfigurations, credential flaws, and lateral-movement risks across expanding networks. Rising threats linked to remote work and cloud expansion pushed buyers to prioritize network security audits over other testing types. Web and mobile application testing grew with heavier use of digital services, while cloud, IoT, and API testing expanded as attack surfaces widened. Social engineering gained steady traction due to higher phishing risks.

- For instance, Pentera launched in 2024 its automated cloud security‑validation solution Pentera Cloud enabling on‑demand cloud penetration testing for hybrid and multi‑cloud infrastructures and allowing organizations to assess exploitable misconfigurations across cloud workloads and identities.

By End-User

BFSI held the dominant share in 2024 due to strict compliance rules and high-value data protection needs. Banks and insurers relied on PTaaS to manage continuous threat exposure, support audit readiness, and secure growing digital banking platforms. IT and telecommunications firms increased use as network loads expanded, while healthcare and retail adopted testing to protect patient and payment data. Government bodies strengthened deployments to guard critical services, and media and education applied PTaaS as platforms shifted to cloud and mobile channels.

Key Growth Drivers:

Rising Cyberattacks and Expanding Attack Surfaces

Global cyberattacks increased across industries, which pushed more firms to adopt PTaaS solutions. Organizations faced new risks from cloud workloads, hybrid networks, and connected devices, creating larger attack surfaces that required frequent testing. Traditional annual or quarterly penetration tests no longer matched the pace of threats, so companies shifted to PTaaS models that delivered continuous, on-demand security checks. Remote work, API-driven systems, and third-party integrations also raised exposure levels, making automated reporting and real-time visibility essential. These factors strengthened PTaaS demand across large enterprises and mid-sized firms seeking faster detection of vulnerabilities and better response readiness.

- For instance, according to research by Check Point Research, the average number of weekly attacks per organization globally reached 1,636 attacks/week in Q2 2024.

Regulatory Compliance Pressure and Audit Requirements

Stricter global compliance rules increased the need for verified, frequent, and well-documented penetration testing. Industries like BFSI, healthcare, and government had to follow standards such as PCI DSS, HIPAA, GDPR, and ISO 27001, which required proof of strong security controls. PTaaS platforms helped teams meet these demands through automated evidence collection, structured reports, and audit-ready dashboards. Firms also used PTaaS to track remediation progress and maintain compliance during software updates and infrastructure changes. Continuous monitoring further supported risk teams by helping them detect weaknesses early. These compliance needs kept PTaaS adoption high, especially among regulated industries and global enterprises with multi-region operations.

- For instance, the PCI DSS standard explicitly mandates internal and external penetration tests at least annually and after any significant infrastructure or application change a requirement that organizations must meet to remain compliant.

Shift Toward DevSecOps and Continuous Security Integration

Enterprises embraced DevSecOps to improve software delivery and reduce delays linked to security testing. PTaaS fit well into this shift because the service integrated easily with CI/CD pipelines and enabled security checks during development, staging, and production phases. Development teams relied on PTaaS to detect issues earlier, reduce patching costs, and shorten release cycles without compromising security. Automated workflows also improved collaboration between developers and security teams by offering clear vulnerability data and reproducible test results. As cloud-native applications, APIs, and microservices grew, firms needed tools that aligned with agile development, making PTaaS a preferred choice for continuous testing environments.

Key Trends & Opportunities:

Growth of API, Cloud, and IoT Ecosystems

Enterprises expanded cloud workloads, API-driven systems, and IoT deployments, which opened new security gaps that required specialized testing. PTaaS providers responded with deeper coverage for cloud configurations, API endpoints, and device ecosystems. Demand increased as attackers targeted misconfigured storage, exposed keys, and unsecured IoT firmware. Companies needed scalable testing that followed rapid infrastructure updates, and PTaaS platforms delivered this by offering automated tests for dynamic environments. This shift created new opportunities for vendors to add cloud posture scans, API fuzzing, and device-layer assessments to their service portfolios.

- For instance, many major cloud‑penetration testing incidents stem from misconfigured storage buckets or overly permissive Identity and Access Management (IAM) roles such as public S3 or blob storage being left accessible, or service‑account permissions granting administrative‑level access which cloud penetration tests aim to uncover before exploitation.

AI-Enhanced Testing and Automated Reporting

AI and automation improved testing accuracy and reduced manual work for security teams. PTaaS platforms integrated machine learning to detect patterns, prioritize vulnerabilities, and reduce false positives. Automated reporting helped IT teams respond faster and allocate time to high-risk areas. These features attracted firms with limited in-house expertise and supported adoption in mid-sized organizations. Vendors used AI to speed up test cycles, simulate real attack paths, and deliver more contextual insights. This trend created opportunities for differentiation as security platforms competed on real-time analysis, intelligent remediation guidance, and predictive risk scoring.

- For instance, Pentera a PTaaS / automated security‑validation vendor uses machine learning to emulate real‑world attacks across network and application layers, enabling continuous security validation with minimal manual intervention.

Increasing Demand for Continuous and Real-Time Security Validation

More companies sought ongoing validation instead of periodic audits due to rising threats. PTaaS platforms offered continuous scanning and real-time insights that improved operational security. Industries with fast release cycles, such as retail, fintech, and telecommunications, used these capabilities to track changes that introduced new risks. Vendors gained opportunities to expand add-on services like continuous monitoring, cloud posture assessment, and configuration testing. The shift toward real-time validation also encouraged platforms to build stronger integrations with SIEM, SOAR, and DevOps tools.

Key Challenges:

Shortage of Skilled Cybersecurity Professionals

A global shortage of security specialists made it difficult for companies to run in-house penetration testing teams. PTaaS adoption increased as firms used managed testing to bridge talent gaps and maintain consistent assessments. However, the shortage also created challenges because organizations struggled to interpret results and prioritize remediation without skilled staff. Smaller firms faced additional constraints due to limited budgets. Vendors needed to provide simpler dashboards, automated guidance, and expert support to help clients act on findings. Without these enhancements, firms risked leaving vulnerabilities unresolved for longer periods.

Complexity of Modern IT Environments

Hybrid clouds, microservices, SaaS platforms, and distributed networks increased the complexity of enterprise environments. This made penetration testing harder, especially when applications changed frequently. PTaaS needed to evolve to test dynamic infrastructures and support rapid scaling. Companies struggled with tracking all assets, maintaining test coverage, and ensuring that scans reflected real usage. Integrations with DevSecOps tools helped, but many firms still faced difficulties keeping pace with continuous updates. Vendors had to improve orchestration features, asset discovery, and automated workflows to address this complexity.

Regional Analysis:

North America

North America held the largest share at about 39% in 2024, driven by high demand from BFSI, IT, and government users. The region adopted PTaaS fast due to frequent cyberattacks and strict rules such as HIPAA, PCI DSS, and NIST. Growth rose as firms expanded cloud use and needed ongoing tests for hybrid networks. Large security vendors and advanced testing tools supported broad uptake. SMEs also increased use as subscription models became common. Rising online banking and tougher regulations kept North America ahead in PTaaS spending.

Europe

Europe captured about 28% in 2024, supported by GDPR rules, strong privacy culture, and more cyber threats. BFSI, healthcare, and telecom groups raised testing activity to protect sensitive data. Cloud projects in Germany, France, and the U.K. drove more interest in continuous testing. Mid-sized firms used PTaaS for automated reports and easier compliance tracking. Growth stayed steady as companies secured web apps, APIs, and multi-cloud systems.

Asia-Pacific

Asia-Pacific held roughly 22% in 2024, showing the fastest growth due to rising digital use in India, China, Japan, and Southeast Asia. Cloud migration, e-commerce growth, and fintech use expanded attack surfaces and lifted demand for continuous tests. Government cyber programs and new data laws also helped adoption. Telecom, IT, and financial firms led early use, while SMEs joined due to flexible pricing. Strong mobile and API growth made Asia-Pacific the most dynamic PTaaS region.

Latin America

Latin America reached about 7% in 2024, supported by digital banking growth and rising cyberattacks in Brazil and Mexico. Firms worked to improve incident readiness and fix cloud-linked risks. Financial sector rules pushed more frequent and structured testing. SMEs started using PTaaS due to low upfront cost and easy setup. Limited in-house security teams increased interest in managed testing and automated reports.

Middle East & Africa

The Middle East & Africa held around 5% in 2024, driven by digital growth across banking, government, and energy. GCC nations invested in cybersecurity upgrades and cloud systems, which encouraged PTaaS use. More cyberattacks on oil, gas, and public services raised testing needs. Growth also came from mobile banking and digital government tools. Some African markets grew slower due to fewer skilled workers and tight budgets, but managed testing models gained traction.

Market Segmentations:

By Deployment Mode

By Testing Type

- Network Penetration Testing

- Web Application

- Mobile Application

- Social Engineering

- Cloud Penetration Testing

- Others (IoT and API)

By End-User

- BFSI

- IT and Telecommunications

- Healthcare

- Retail and Consumer Goods

- Government and Public

- Others (Media and Entertainment, Education, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Penetration Testing As A Service (PTaaS) market features key players such as CrowdStrike, Rapid7, IBM Corporation, Synopsys, Secureworks, Invicti, BreachLock, Indusface, ASTRA IT, and ThreatSpike Labs. These companies competed by expanding continuous testing capabilities, integrating AI-driven vulnerability analysis, and improving real-time reporting. Vendors focused on cloud-native testing, multi-vector assessments, and stronger DevSecOps integrations to support rapid application development. Many providers enhanced automated remediation guidance and attack-path visualization to help enterprises reduce risk faster. Strategic partnerships with cloud platforms and MSSPs strengthened service delivery, while mergers and security tech acquisitions broadened product portfolios. As cyberattacks grew more complex, firms differentiated through continuous monitoring, API testing depth, and global compliance support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BreachLock Inc. (The Netherlands)

- Rapid7 (U.S.)

- Indusface (India)

- ASTRA IT, Inc. (U.S.)

- THREATSPIKE LABS (U.K.)

- Synopsys, Inc. (U.S.)

- IBM Corporation (U.S.)

- CrowdStrike (U.S.)

- Secureworks, Inc. (U.S.)

- Invicti (U.S.)

Recent Developments:

- In September 2025, Indusface published a series of application-security updates and research in September 2025 including its State of Application Security / H1 2025 findings (large volumes of blocked attacks and rising API threats) and PTaaS positioning materials that emphasize continuous, hybrid (automated + human) PTaaS tied to its WAS/WAAP offerings for faster remediation and partner enablement. These moves underline Indusface’s focus on PTaaS as part of a broader app-security platform.

- In August 2025, BreachLock published its 2025 Pentesting Intelligence Report (covering ~4,200+ pentests) sharing trends and high-risk patterns found across engagements positioning the company as a data-driven PTaaS provider and using report insights to refine service coverage.

- In January 2025, BreachLock Inc.unveiled a Unified Security Testing Platform that consolidates PTaaS, attack-surface management (ASM), continuous pentesting and red-teaming into one platform to give customers a single pane of glass for testing and remediation workflows.

Report Coverage:

The research report offers an in-depth analysis based on Deployment mode, Testing type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continuous penetration testing will become a standard requirement across regulated industries.

- AI-driven vulnerability detection will speed up analysis and reduce false positives.

- API, cloud, and microservices testing will gain stronger adoption as attack surfaces expand.

- Integration with DevSecOps pipelines will grow to support faster and secure software releases.

- Automated remediation guidance will help teams close security gaps more quickly.

- Demand for managed testing services will rise due to persistent cybersecurity talent shortages.

- Real-time attack simulation tools will enhance risk visibility for large enterprises.

- SMEs will adopt PTaaS more widely as subscription pricing becomes more flexible.

- Multi-cloud security validation will become essential for hybrid digital environments.

- Regional cybersecurity regulations will push organizations to increase testing frequency and documentation.