Market overview

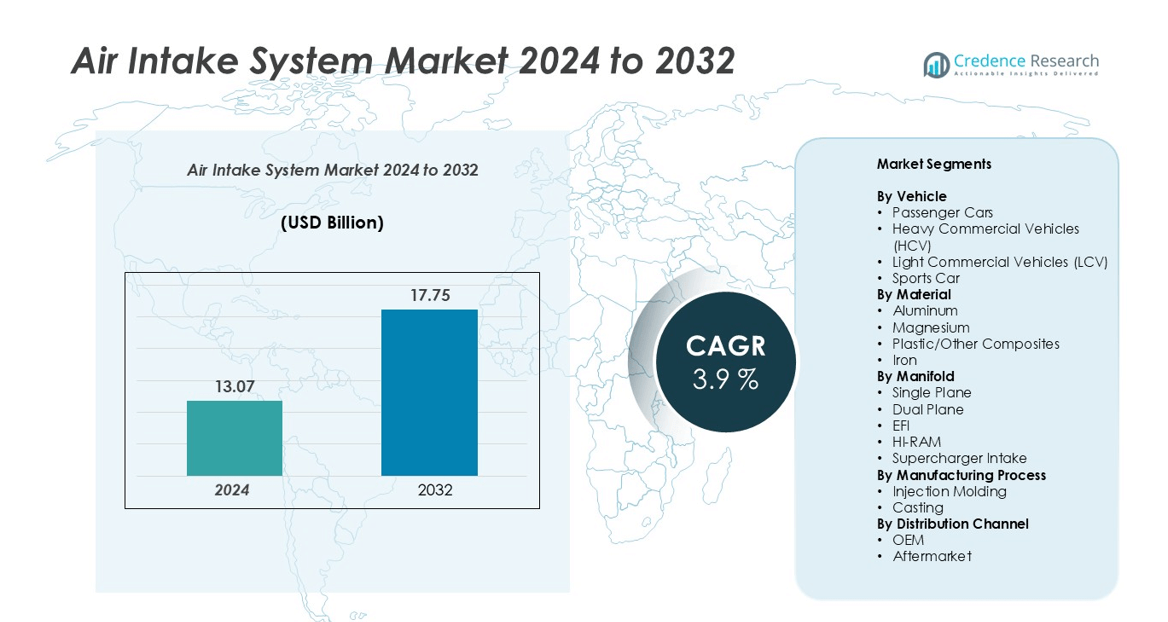

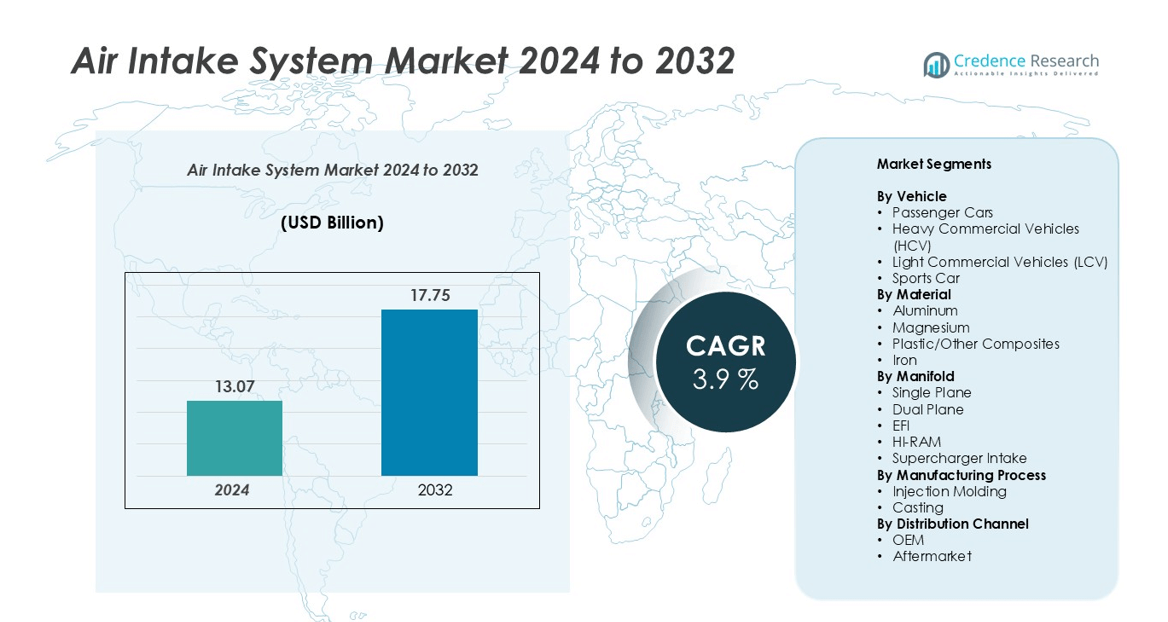

The Air Intake System Market size was valued at USD 13.07 billion in 2024 and is anticipated to reach USD 17.75 billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Intake System Market Size 2024 |

USD 13.07 billion |

| Air Intake System Market, CAGR |

3.9% |

| Air Intake System Market Size 2032 |

USD 17.75 billion |

The Air Intake System market is driven by the strong presence of leading players such as MANN+HUMMEL, Magneti Marelli, Toyota Boshoku Corporation, BorgWarner, MAHLE GmbH, Lear Corporation, Sogefi Group, Donaldson Company, Dana Incorporated, and Aisin Seiki. These companies lead through innovation in lightweight materials, advanced filtration, and smart airflow management technologies. They also focus on strategic partnerships with OEMs to expand their global footprint and strengthen product integration. Asia-Pacific leads the market with a 34% share, supported by high vehicle production. North America follows with 31%, driven by performance and regulatory compliance, while Europe holds 28%, backed by advanced engineering and strict emission norms.

Market Insights

- The Air Intake System market was valued at USD 13.07 billion in 2024 and is projected to reach USD 17.75 billion by 2032, growing at a CAGR of 3.9%.

- Rising vehicle production and strict emission norms drive demand for lightweight and efficient intake systems, with passenger cars holding the largest segment share.

- Growing adoption of EFI manifolds and advanced filtration technologies is shaping product innovation and supporting hybrid vehicle integration.

- Leading players such as MANN+HUMMEL, BorgWarner, MAHLE GmbH, and Toyota Boshoku focus on R&D, lightweight materials, and OEM partnerships to strengthen their positions.

- Asia-Pacific leads the market with a 34% share, followed by North America at 31% and Europe at 28%, while Rest of the World holds 7%, driven by aftermarket expansion and increasing vehicle demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Passenger cars hold the dominant share in the Air Intake System market. High vehicle production volumes and rising demand for efficient fuel management drive this dominance. Passenger cars integrate advanced intake manifolds that improve engine performance and reduce emissions. Heavy commercial vehicles and light commercial vehicles follow, supported by the growing logistics and e-commerce industries. Sports cars form a niche but high-value segment due to performance-focused designs. The increasing adoption of turbocharged engines and lightweight components further strengthens the passenger car segment’s market position.

- For instance, BMW’s TwinPower Turbo technology integrates variable valve control and high-precision injection to enhance intake efficiency, achieving a power output of 190 kW from a 2.0-liter engine.

By Material

Aluminum dominates the material segment due to its lightweight properties and excellent heat dissipation. Its high strength-to-weight ratio enhances engine efficiency and supports better fuel economy. Plastic and other composites rank second, gaining traction in mass-produced vehicles because of their cost-effectiveness and corrosion resistance. Iron remains significant for heavy-duty applications, while magnesium is used selectively in performance vehicles for additional weight reduction. The rising focus on emission regulations and vehicle efficiency continues to push manufacturers toward aluminum-based air intake solutions.

- For instance, BASF’s Ultramid® Endure polyamide material is used by Alfa Romeo in composite air intake manifolds that maintain heat resistance up to 220 °C, replacing heavier metal parts.

By Manifold

The EFI manifold segment leads the market due to its superior air-fuel mixing and improved engine performance. EFI systems offer better fuel control, increased power output, and reduced emissions compared to traditional designs. Dual plane and single plane manifolds serve both commercial and passenger vehicle applications, while HI-RAM and supercharger intakes cater to high-performance and sports car segments. The growth of EFI is strongly linked to stringent emission standards and increasing preference for fuel-efficient engines. This segment’s technological advancement supports long-term market expansion.

Key Growth Drivers

Rising Vehicle Production and Electrification Integration

The rapid growth of global vehicle production is a major driver for the Air Intake System market. Passenger and commercial vehicle manufacturers are adopting advanced intake technologies to improve engine performance and meet emission regulations. The increasing integration of air intake systems with electrified powertrains is enhancing engine breathing efficiency and enabling better thermal management. Compact and lightweight designs support hybrid and plug-in hybrid vehicle platforms, reducing overall vehicle weight and improving fuel efficiency. OEMs are also investing in intake system optimization to reduce pressure drop and improve combustion quality. This trend aligns with the growing demand for performance-oriented and low-emission vehicles across key automotive markets.

- For instance, Bosch is a major supplier of components for 48V mild-hybrid systems, which can use electric compressors to optimize air delivery and improve engine performance. While the use of 48V systems with high-speed electric compressors is a proven and established technology in the automotive industry.

Strict Emission Regulations and Fuel Efficiency Norms

Stringent emission regulations are pushing automakers to use efficient air intake systems to optimize engine combustion. Enhanced air intake improves fuel-air mixing, reduces unburned hydrocarbons, and lowers carbon emissions. Governments across North America, Europe, and Asia-Pacific are enforcing tight CO₂ reduction targets, driving technology adoption. Advanced manifolds and filtration units enable cleaner combustion and support compliance with global standards such as Euro 6 and EPA Tier 3. Automakers are focusing on lightweight materials and precision-engineered designs to improve volumetric efficiency. This regulatory push significantly boosts demand for high-performance air intake systems across various vehicle categories.

- For instance, Mahle developed a high-efficiency air intake module with a multi-cyclone pre-separator that can remove up to 99.98% of harmful dust particles, which helps minimize engine wear and optimize performance to meet stringent emission standards like Euro 6.

Advancements in Lightweight Materials and Design

Material innovation is a key growth driver in the Air Intake System market. The shift from cast iron to aluminum and composite materials has resulted in better weight reduction, improved thermal conductivity, and lower manufacturing costs. These advanced materials help improve overall vehicle performance, reduce fuel consumption, and comply with stringent emission standards. Lightweight designs also support downsized turbocharged engines, enhancing power-to-weight ratios. Manufacturers are leveraging advanced molding and casting processes to produce complex geometries with improved durability and airflow. This innovation is enabling OEMs to balance performance, cost efficiency, and sustainability goals effectively.

Key Trends & Opportunities

Growing Adoption of Electric and Hybrid Vehicles

The rise of electric and hybrid powertrains is reshaping the air intake system landscape. While traditional internal combustion engines remain dominant, hybrid vehicles still require efficient air intake components to support auxiliary power units and thermal management. Lightweight, compact, and thermally efficient designs are increasingly in demand. Leading manufacturers are integrating smart sensors and control modules to enhance airflow regulation. This shift offers significant opportunities for suppliers to design customized solutions for different vehicle architectures. The expanding EV and hybrid vehicle ecosystem is expected to open new revenue channels for intake system manufacturers.

- For instance, Hitachi Astemo is developing and providing electric powertrain systems, including inverters and motors for electric and hybrid vehicles, to reduce emissions and improve efficiency.

Integration of Smart and Adaptive Intake Technologies

Intelligent air intake systems with adaptive flow control are emerging as a major trend. These systems adjust air delivery based on engine load, temperature, and driving conditions, improving combustion efficiency. Advanced sensors and electronic control units enable precise regulation, reducing emissions and improving mileage. Adaptive intake systems also support performance tuning in sports and luxury vehicles. This integration of electronics with mechanical components creates opportunities for advanced product development and strategic collaborations. The trend aligns with the automotive industry’s move toward connected and software-defined vehicles.

Expansion of Aftermarket Opportunities

The aftermarket segment is expanding due to rising demand for performance upgrades and vehicle maintenance. Consumers are opting for high-flow filters, performance intake manifolds, and cold air intake systems to enhance engine output. The growing popularity of sports and customized vehicles further supports aftermarket growth. Manufacturers and distributors are offering modular, easy-to-install solutions catering to both mass-market and niche segments. This trend creates steady revenue streams beyond OEM contracts, particularly in North America and Asia-Pacific. Strong aftermarket networks provide an opportunity for brands to strengthen market presence and customer loyalty.

Key Challenges

High Cost of Advanced Air Intake Technologies

The development and integration of advanced air intake systems involve high material and manufacturing costs. Lightweight materials like magnesium and composites, along with smart sensors and control modules, increase production expenses. This cost is often transferred to end users, limiting adoption in budget-sensitive segments. OEMs face challenges in balancing performance with cost efficiency, especially in price-competitive markets. High tooling costs and precision manufacturing requirements also affect mass-scale implementation. These factors create barriers for smaller suppliers and slow down the widespread adoption of advanced intake systems.

Shifting Focus Toward Full Electrification

The increasing focus on full battery electric vehicles poses a long-term challenge to the air intake system market. Unlike internal combustion engines, BEVs have minimal or no need for traditional intake components. As governments push for zero-emission mobility, demand for air intake systems in conventional vehicles may decline. Manufacturers must diversify product portfolios to stay relevant in this changing landscape. Developing components that support thermal management for EVs could offset some of the demand loss. However, this transition requires significant R&D investment and strategic adaptation, which can be challenging for traditional suppliers.

Regional Analysis

North America

North America holds a 31% share of the Air Intake System market, driven by strong automotive manufacturing and high adoption of advanced engine technologies. The U.S. leads the region, supported by the presence of major OEMs and performance vehicle manufacturers. Increasing demand for fuel-efficient passenger cars and commercial vehicles boosts the use of lightweight intake systems. The region’s strict emission standards encourage the integration of EFI and advanced manifold designs. Canada and Mexico support growth through expanding automotive component production and aftermarket demand. The focus on electrified powertrains also drives innovation in intake system design.

Europe

Europe accounts for a 28% share of the Air Intake System market, supported by a strong regulatory environment and advanced automotive engineering. Germany leads the market due to its large premium vehicle segment and technology-focused OEMs. France, Italy, and the U.K. contribute through strong manufacturing capabilities and high export volumes. Strict Euro 6 and upcoming Euro 7 norms push manufacturers to adopt lightweight and thermally efficient intake systems. The growing hybrid vehicle segment further boosts demand for precision-engineered manifolds. Rising investments in research and development strengthen the region’s position in intake system innovation.

Asia-Pacific

Asia-Pacific dominates the Air Intake System market with a 34% share, driven by high vehicle production in China, Japan, India, and South Korea. Rapid urbanization, increasing vehicle ownership, and strong OEM presence make the region a key growth hub. Automakers are investing heavily in cost-effective and lightweight intake solutions to meet rising consumer demand for efficient vehicles. Strict emission regulations in countries like China and India accelerate the adoption of advanced manifold systems. The aftermarket segment is also expanding, supported by growing performance modification trends. This combination positions Asia-Pacific as the fastest-growing regional market.

Rest of the World (RoW)

The Rest of the World holds a 7% share of the Air Intake System market, with growth led by Latin America, the Middle East, and Africa. Brazil and Argentina are key contributors due to steady vehicle production and expanding aftermarket networks. Gulf countries show increasing demand for performance vehicles, driving intake system adoption. Africa is witnessing gradual growth, supported by rising vehicle imports and expanding service infrastructure. While the region has lower regulatory pressure, OEMs are introducing efficient intake systems to enhance performance and fuel economy. Strategic partnerships are strengthening market penetration in these emerging economies.

Market Segmentations:

By Vehicle

- Passenger Cars

- Heavy Commercial Vehicles (HCV)

- Light Commercial Vehicles (LCV)

- Sports Car

By Material

- Aluminum

- Magnesium

- Plastic/Other Composites

- Iron

By Manifold

- Single Plane

- Dual Plane

- EFI

- HI-RAM

- Supercharger Intake

By Manufacturing Process

- Injection Molding

- Casting

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Air Intake System market features a competitive landscape dominated by global Tier-1 suppliers and component manufacturers. Key players such as MANN+HUMMEL, Magneti Marelli, Toyota Boshoku Corporation, BorgWarner, MAHLE GmbH, Lear Corporation, Sogefi Group, Donaldson Company, Dana Incorporated, and Aisin Seiki focus on product innovation, lightweight design, and advanced filtration technologies to strengthen their market positions. Companies are investing in R&D to develop intake systems that enhance engine performance, reduce emissions, and support hybrid and electric vehicle platforms. Strategic collaborations with automakers help expand product reach and improve technological integration. Many players are also enhancing their aftermarket presence through performance intake components and filtration solutions. The competition is shaped by factors such as cost efficiency, design flexibility, regulatory compliance, and regional manufacturing capabilities, driving continuous product upgrades and portfolio diversification across key markets.

Key Player Analysis

- MANN+HUMMEL

- Magneti Marelli

- Toyota Boshoku Corporation

- BorgWarner

- MAHLE GmbH

- Lear Corporation

- Sogefi Group

- Donaldson Company

- Dana Incorporated

- Aisin Seiki

Recent Developments

- In January 2024, Bosch announced that the company is replacing the proven FILTER+ cabin filter with the enhanced FILTER+pro. Following extensive air-quality tests, the independent certification body OFI CERT, based in Vienna, Austria, had previously confirmed the product’s excellent filtration performance.

- In July 2024, DMZ Engineering pioneered the use of HP’s Multi Jet Fusion (MJF) technology for producing structural automotive engine parts, marking a significant advancement in additive manufacturing within the automotive sector. This innovative approach leverages the capabilities of MJF to create lightweight, robust components that meet stringent performance standards. Intake manifolds benefit from MJF’s ability to create complex internal geometries that enhance airflow and improve engine efficiency.

- In June 2024, Wilson Manifold introduced a billet aluminum intake manifold designed for the LT2 engine, catering specifically to high-performance applications that may require forced induction. This new offering is engineered to support significant power outputs, making it an attractive option for automotive enthusiasts looking to enhance their vehicle’s performance. The manifold is made from 100% billet aluminum, ensuring durability and resistance to heat and pressure. It boasts a plenum volume capable of supporting up to 2,000 horsepower, making it suitable for applications involving naturally aspirated setups, nitrous, or remote inter-cooled boost systems.

- In January 2023, the MANN+HUMMEL Group announced that the company had made a strategic investment in M-Filter Group. The company’s majority of growth investment will be used to drive product expansion and allow it to invest in sales and operational capabilities. The agreement would help strengthen the European footprint and unlock growth opportunities in Scandinavia and the Baltic states.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Material, Manifold, Manufacturing Process, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of lightweight materials to improve engine performance.

- EFI manifolds will gain more traction as emission regulations become stricter.

- Hybrid and electric vehicle platforms will drive demand for advanced intake technologies.

- Integration of smart sensors will enhance airflow efficiency and engine control.

- Aftermarket sales will expand with growing interest in performance upgrades.

- OEM partnerships will strengthen product innovation and global distribution networks.

- Asia-Pacific will remain the dominant regional market with strong production growth.

- Advanced manufacturing processes will reduce production costs and improve component durability.

- Leading players will focus on sustainable designs to meet environmental goals.

- Continuous R&D investment will support the development of adaptive and efficient intake systems.