Market Overview

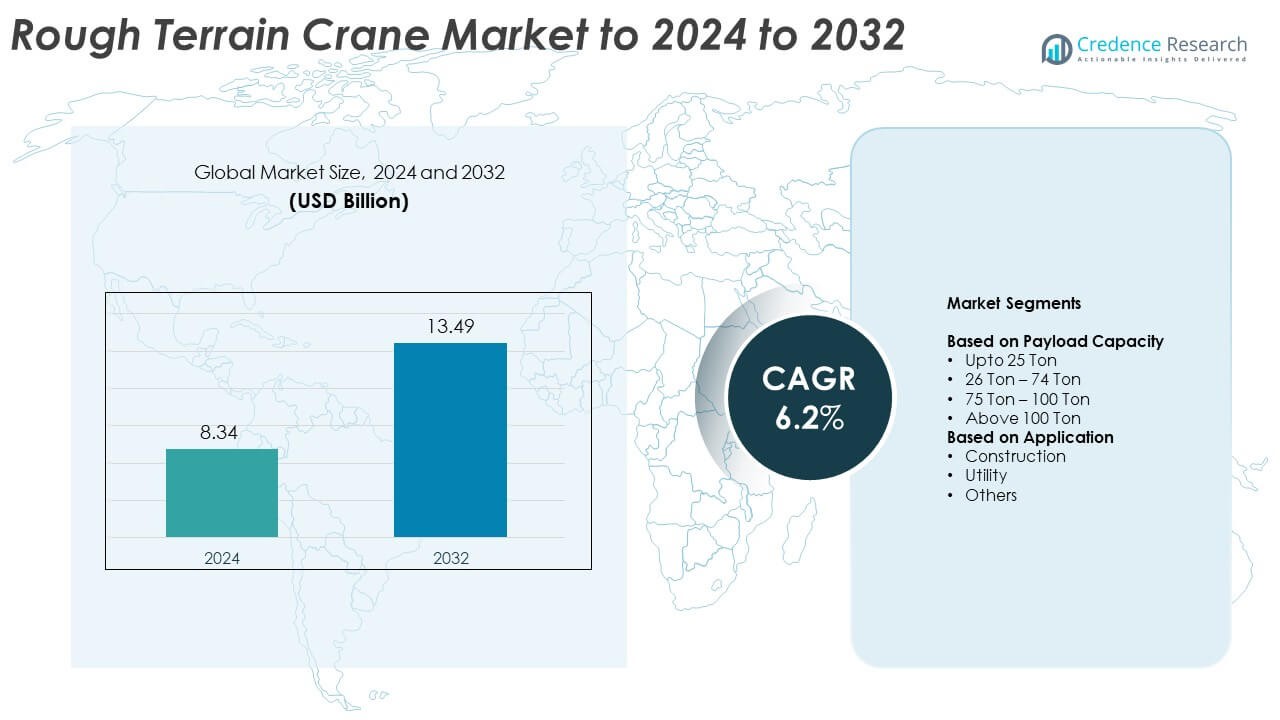

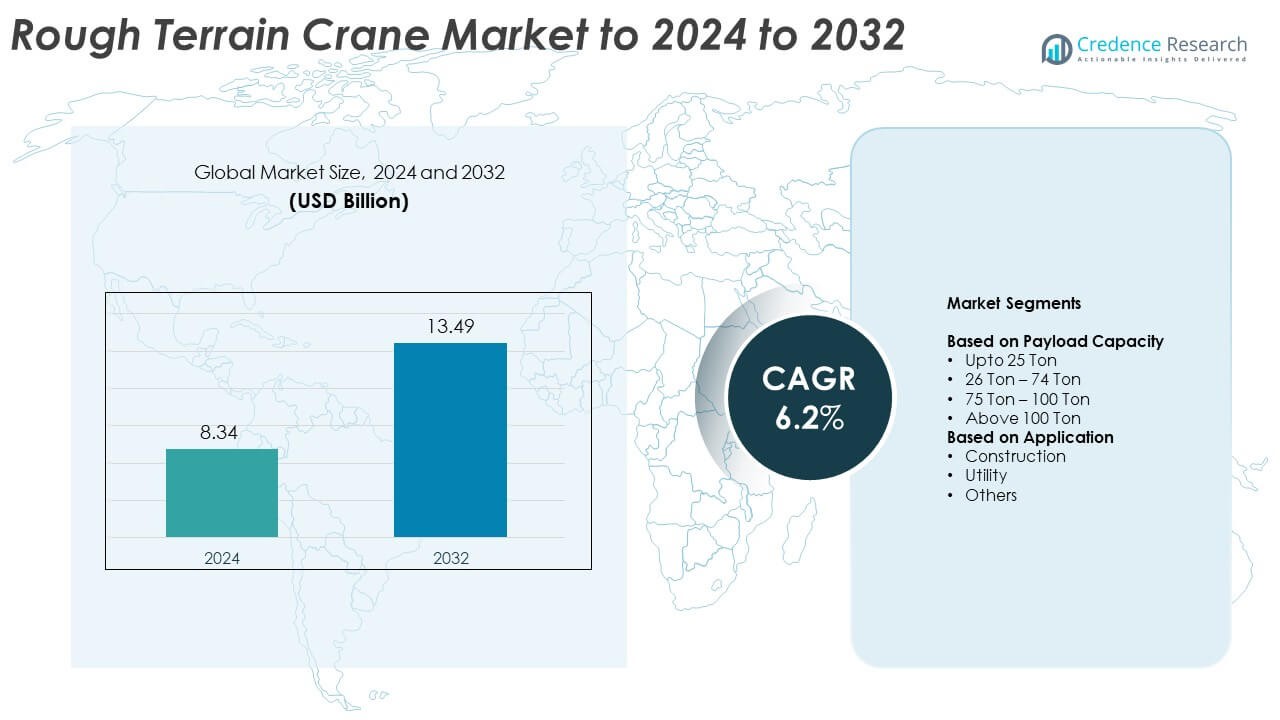

The Rough Terrain Crane Market size was valued at USD 8.34 billion in 2024 and is anticipated to reach USD 13.49 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rough Terrain Crane Market Size 2024 |

USD 8.34 Billion |

| Rough Terrain Crane Market, CAGR |

6.2% |

| Rough Terrain Crane Market Size 2032 |

USD 13.49 Billion |

The rough terrain crane market is led by major players such as Tadano Ltd, Liebherr Group, Terex Corporation, SANY Group, Manitowoc Company, Konecranes, Zoomlion, Manitex International, Xuzhou Construction Machinery Group Co, TIL Limited, and KATO WORKS CO LTD. These companies compete through continuous innovation, strong distribution networks, and diverse product portfolios. North America emerged as the leading region in 2024, commanding a 37.2% market share, supported by large-scale infrastructure and energy projects. Asia-Pacific followed with 28.9%, driven by industrialization and government-funded construction programs, while Europe maintained a stable position through technological advancements and sustainability-focused crane manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rough terrain crane market was valued at USD 8.34 billion in 2024 and is expected to reach USD 13.49 billion by 2032, growing at a CAGR of 6.2%.

- Growth is primarily driven by rising infrastructure development, energy projects, and industrial construction across developed and emerging regions.

- Advancements in telematics, automation, and hybrid power systems are shaping modern crane designs, improving operational efficiency and sustainability.

- The market remains competitive with leading players focusing on product innovation, regional expansion, and rental service growth to strengthen their positions.

- North America held the largest regional share of 37.2% in 2024, followed by Asia-Pacific with 28.9%, while the 26–74 ton payload capacity segment dominated globally with a 43.6% share, reflecting strong demand for versatile, mid-capacity cranes used in construction and energy applications.

Market Segmentation Analysis:

By Payload Capacity

The 26–74 ton segment dominated the rough terrain crane market in 2024, accounting for a 43.6% share. Its leadership is driven by strong demand for mid-capacity lifting solutions across industrial, construction, and energy sectors. These cranes provide an ideal balance between maneuverability and lifting power, supporting complex infrastructure and refinery projects. Increasing deployment in port maintenance and bridge construction has reinforced segment dominance. Companies such as Tadano and Liebherr are advancing medium-capacity models with enhanced telematics and low-emission engines to improve performance and sustainability.

- For instance, Tadano’s GR-800XL-4 is rated 72.6 t with a 12–47 m boom and 64.4 m max tip height.

By Application

The construction segment held the largest share of 59.4% in 2024, fueled by ongoing urbanization and infrastructure expansion across emerging economies. Rough terrain cranes are preferred for handling heavy materials efficiently in confined and uneven construction sites. Their high mobility and fast setup times make them essential for road, bridge, and commercial building projects. Rising investments in renewable energy and smart city developments are further accelerating adoption. Manufacturers such as Terex and Zoomlion are focusing on compact, high-lift cranes designed for improved onsite versatility and operator safety.

- For instance, Zoomlion ZRT1100 rough-terrain crane is that it is rated for a maximum lifting capacity of 110 tonnes, with a five-section main boom that extends to a maximum length of 49 meters.

Key Growth Drivers

Infrastructure Expansion and Urbanization

Rapid infrastructure development across emerging economies is a major growth catalyst for the rough terrain crane market. Rising investments in highways, bridges, metro systems, and renewable energy installations are boosting equipment demand. Governments in Asia-Pacific and the Middle East are prioritizing transportation modernization, leading to steady procurement of high-capacity cranes. These cranes enable efficient material handling in constrained sites and rough landscapes, making them indispensable for urban and industrial construction projects.

- For instance, Liebherr’s LRT 1100-2.1 is HVO-ready and can cut CO₂ emissions “up to 90%” during operation.

Rising Demand from Energy and Utility Projects

The growing number of power generation, oil & gas, and wind energy projects significantly supports market growth. Rough terrain cranes are preferred for their ability to operate in uneven terrain during equipment installation and maintenance. The ongoing transition toward renewable energy, including wind and solar farms, has expanded the utility sector’s crane needs. Global energy infrastructure upgrades and refineries modernization are further propelling adoption, especially in North America and the Middle East.

- For instance, SANY’s SRC900T offers 90 t max capacity, 47 m boom, and 65.5 m max lifting height for energy sites.

Technological Advancements in Crane Design

Continuous innovation in lifting technology and machine automation is driving equipment efficiency and safety. Integration of load monitoring systems, telematics, and advanced hydraulic controls has improved precision and reliability in lifting operations. Manufacturers are also focusing on hybrid power systems and low-emission engines to meet environmental standards. These advancements enhance crane productivity, reduce maintenance downtime, and extend operational life, making technologically advanced models more attractive to contractors and equipment rental companies.

Key Trends & Opportunities

Adoption of Telematics and IoT Integration

The growing adoption of telematics and IoT solutions is transforming fleet management and operational efficiency. Real-time data analytics enables remote monitoring of crane performance, fuel consumption, and predictive maintenance. Rental fleet operators are using these technologies to optimize equipment utilization and reduce unplanned downtime. The trend toward digitalized construction machinery supports greater safety compliance and asset visibility, driving demand for connected cranes across both developed and developing markets.

- For instance, Manitowoc’s Grove CONNECT enables real-time monitoring; new RTs add a 20° tilting cab and a 30 cm CCS display for operators.

Growth of Rental and Leasing Services

The rising preference for rental and leasing models presents significant opportunities for market expansion. Contractors and project developers prefer renting cranes to minimize upfront capital costs and maintenance expenses. Equipment rental companies are expanding fleets with mid and high-capacity rough terrain cranes to meet increasing construction and energy sector demand. This trend ensures wider accessibility of advanced models, especially in developing regions with limited procurement budgets.

- For instance, XCMG’s RT100 provides 100 t capacity with a 48 m main boom and 68.6 m boom-plus-jib length, fitting rental fleet needs.

Key Challenges

High Equipment Cost and Maintenance Burden

The high initial investment and maintenance requirements of rough terrain cranes pose a major challenge for small and medium contractors. Regular inspections, spare parts replacement, and specialized operator training add to operational costs. Limited resale value and high insurance expenses further impact affordability. These financial constraints often push buyers toward used or rental equipment, restraining new crane sales, particularly in cost-sensitive markets across Latin America and Africa.

Supply Chain Disruptions and Component Shortages

The global supply chain instability has led to delays in component availability and increased production costs. Shortages of steel, hydraulic parts, and electronic components affect manufacturing timelines and delivery schedules. Logistics bottlenecks and fluctuating raw material prices have pressured manufacturers to adjust pricing strategies. Prolonged disruptions in key sourcing regions continue to limit inventory availability, creating uncertainty for both producers and end users in large-scale infrastructure projects.

Regional Analysis

North America

North America held the largest share of 37.2% in the rough terrain crane market in 2024. The region’s growth is driven by strong construction activity, oil and gas exploration, and utility infrastructure projects. The United States leads demand, supported by ongoing energy transition projects and equipment replacement initiatives. Increasing investment in renewable energy and heavy industrial construction enhances the adoption of medium and high-capacity cranes. Major manufacturers, including Terex and Manitowoc, have established extensive service networks, ensuring continuous supply and aftermarket support across major metropolitan and industrial hubs.

Europe

Europe accounted for a 25.6% share of the rough terrain crane market in 2024, supported by steady infrastructure modernization and renewable energy expansion. Germany, the United Kingdom, and France remain key contributors due to high investments in road upgrades, rail transport, and offshore wind projects. Environmental regulations promoting cleaner construction equipment encourage adoption of hybrid and low-emission cranes. Increasing rental demand from large construction firms also contributes to regional market stability. Manufacturers in the region are focusing on advanced safety features and compact designs for urban project applications.

Asia-Pacific

Asia-Pacific captured a 28.9% share in 2024 and is expected to experience the fastest growth through 2032. Rapid industrialization and large-scale infrastructure development in China, India, and Japan are driving equipment demand. Expanding urban centers and government initiatives for transport and energy projects further fuel adoption. Increasing foreign investment in heavy manufacturing and petrochemical sectors is boosting crane utilization. Local production capabilities by companies like Kobelco and Tadano provide cost-effective options and improve supply chain reliability, making Asia-Pacific a key growth engine in the global market.

Latin America

Latin America represented a 5.1% share of the rough terrain crane market in 2024, primarily driven by growth in mining and energy projects. Brazil and Mexico are leading markets due to ongoing investments in oil exploration, power transmission, and infrastructure rehabilitation. Despite economic fluctuations, government-backed public works and renewable energy projects sustain moderate crane demand. The adoption of rental services is rising as contractors seek cost-efficient equipment solutions. Expanding partnerships between global manufacturers and local distributors are strengthening aftermarket service accessibility across the region.

Middle East & Africa

The Middle East & Africa accounted for a 3.2% share in 2024, supported by increasing oilfield development, urban expansion, and infrastructure investments. The Gulf countries, particularly Saudi Arabia and the UAE, continue to drive demand through large-scale construction and energy diversification projects. Africa’s emerging markets, including South Africa and Nigeria, are seeing gradual adoption in mining and road development. Government initiatives to modernize logistics infrastructure and industrial zones are further encouraging crane utilization. Strong manufacturer presence and dealership networks ensure steady equipment availability in the region.

Market Segmentations:

By Payload Capacity

- Upto 25 Ton

- 26 Ton – 74 Ton

- 75 Ton – 100 Ton

- Above 100 Ton

By Application

- Construction

- Utility

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rough terrain crane market features leading manufacturers such as Tadano Ltd, Liebherr Group, Terex Corporation, SANY Group, Manitowoc Company, Konecranes, Zoomlion, Manitex International, Xuzhou Construction Machinery Group Co, TIL Limited, and KATO WORKS CO LTD. The market is characterized by continuous innovation in lifting technology, automation, and energy efficiency. Major players focus on expanding production capacities and enhancing product portfolios through strategic alliances and regional partnerships. Companies are also emphasizing after-sales services, operator training programs, and telematics integration to strengthen brand reliability. Growing demand from construction, energy, and industrial projects is pushing manufacturers to develop more compact, fuel-efficient, and environmentally compliant crane models. The rise in rental and leasing demand further encourages manufacturers to deliver durable, cost-effective solutions that meet diverse operational requirements across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tadano Ltd

- Liebherr Group

- Terex Corporation

- SANY Group

- Manitowoc Company

- Konecranes

- Zoomlion

- Manitex International

- Xuzhou Construction Machinery Group Co

- TIL Limited

- KATO WORKS CO LTD

Recent Developments

- In 2024, Tadano unveiled its first electric rough-terrain crane, the eGR-1000XLL-1, in North America.

- In 2024, Konecranes unveiled its X-Series Crane with an S-Series Low Headroom Hoist at bauma CONEXPO India in Greater Noida.

- In 2023, Liebherr supplied various LRT rough-terrain cranes to clients, showcasing the existing range’s popularity, particularly in the North American market.

Report Coverage

The research report offers an in-depth analysis based on Payload Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by infrastructure and industrial expansion.

- Demand for medium-capacity cranes will remain dominant due to versatility in urban projects.

- Technological innovation will focus on telematics, automation, and fuel-efficient engines.

- Rental and leasing services will expand as companies seek cost-effective project solutions.

- Hybrid and electric-powered cranes will gain traction with stricter emission regulations.

- Asia-Pacific will emerge as the fastest-growing regional market, supported by urbanization.

- North America will maintain strong demand from energy, oil, and utility sectors.

- Manufacturers will invest in safety systems and operator-assist technologies.

- Supply chain optimization and local assembly plants will enhance product availability.

- Increased focus on sustainable materials and digital integration will shape future designs.