Market overview

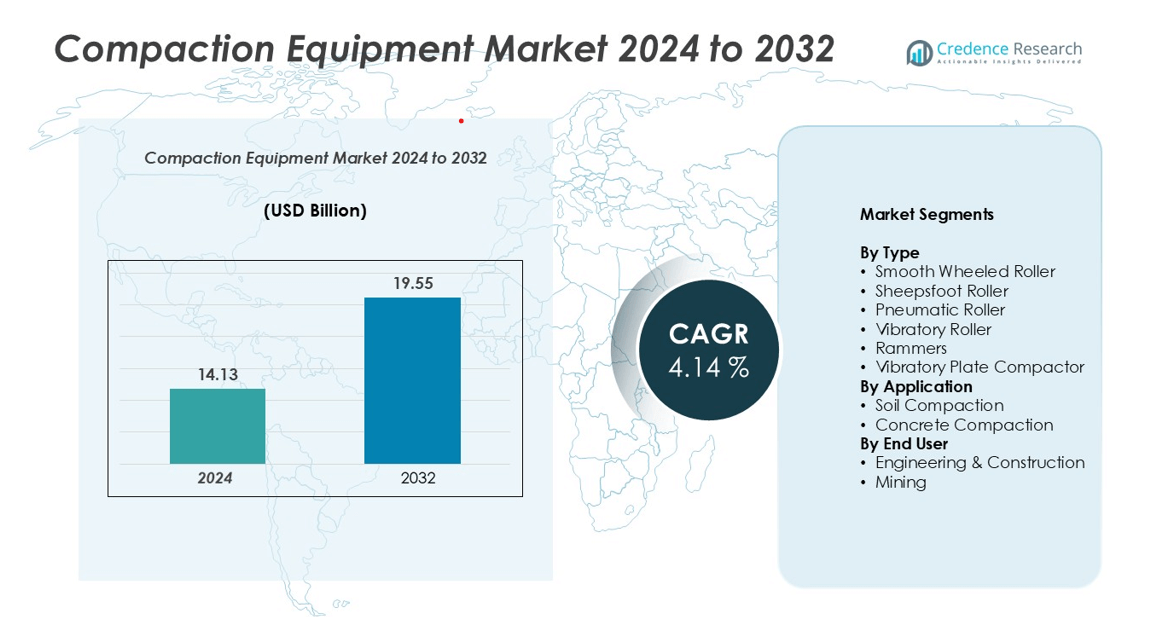

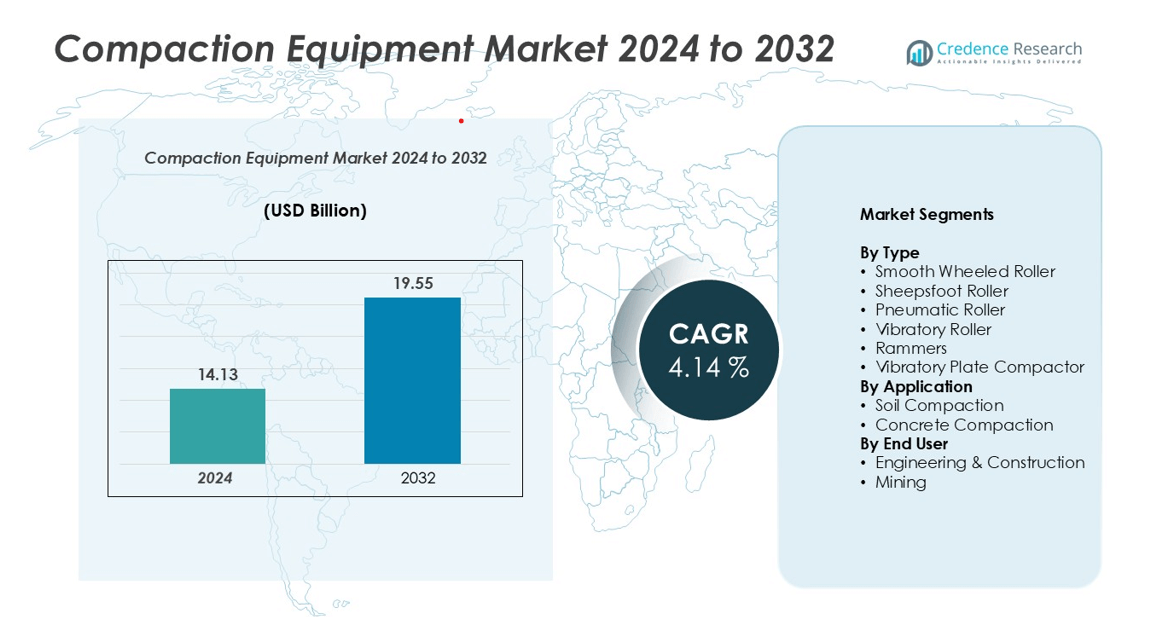

Compaction Equipment Market size was valued USD 14.13 billion in 2024 and is anticipated to reach USD 19.55 billion by 2032, at a CAGR of 4.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compaction Equipment Market Size 2024 |

USD 14.13 billion |

| Compaction Equipment Market, CAGR |

4.14% |

| Compaction Equipment Market Size 2032 |

USD 19.55 billion |

The compaction equipment market is dominated by major players such as AB Volvo, Atlas Copco AB, BOMAG GmbH, Ammann Group, Altrad Belle, Hitachi Construction Machinery Co., Ltd., Caterpillar, Deere & Company, CNH Industrial America LLC., and J C Bamford Excavators Ltd. These companies lead through advanced product innovation, strong distribution networks, and strategic expansion into high-growth regions. North America emerges as the leading region with a 32% market share, driven by robust infrastructure investments and rapid adoption of intelligent compaction systems. Asia-Pacific follows with a 28% share, supported by urbanization and construction growth in China and India. Europe holds a 26% share, backed by modernization projects and sustainable equipment adoption.

Market Insights

- The compaction equipment market was valued at USD 14.13 billion in 2024 and is projected to reach USD 19.55 billion by 2032, growing at a CAGR of 4.14%.

- Rising infrastructure development and construction activities are driving strong demand for advanced rollers and compactors across multiple industries.

- Intelligent compaction systems, automation, and rental fleet expansion are key trends shaping market growth and technology adoption.

- Major players such as AB Volvo, Atlas Copco AB, BOMAG GmbH, Ammann Group, and Caterpillar lead through innovation and global expansion, while high equipment costs act as a restraint in cost-sensitive regions.

- North America holds a 32% share, Asia-Pacific 28%, and Europe 26%, with Vibratory Rollers dominating the type segment and Soil Compaction leading in application share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Sementation Analysis:

By Type

The compaction equipment market is segmented into Smooth Wheeled Roller, Sheepsfoot Roller, Pneumatic Roller, Vibratory Roller, Rammers, and Vibratory Plate Compactor. Vibratory Roller dominates this segment with the largest market share. This sub-segment leads due to its high efficiency in large-scale infrastructure projects, including road construction and airport runways. The demand is rising as governments increase investments in transportation networks. Vibratory rollers offer superior compaction depth and performance, which improves project timelines and structural stability. This efficiency makes them the preferred choice across developed and developing regions.

- For instance, Caterpillar introduced the CB10 Vibratory Asphalt Compactor with standard dual amplitude settings and a 1,700 mm drum width. Depending on the specific configuration, the compactor offers different frequency options, some of which exceed 40 Hz, for versatile compaction on various asphalt layers.

By Application

The application segment includes Soil Compaction and Concrete Compaction. Soil Compaction holds the dominant market share in this segment. Growing investments in roadways, bridges, and rail networks drive demand for advanced soil compaction solutions. Infrastructure development projects require efficient ground preparation to ensure stability and load-bearing capacity. The growing adoption of heavy-duty rollers for highways and expressways further supports segment growth. This trend reflects the increasing focus on improving infrastructure quality and lifespan through better compaction technology.

- For instance, The BOMAG BW 213 DH-5 single drum roller offers a static linear load of approximately 35.5 kg/cm (355 kg/m) and two amplitude settings: a high amplitude of 2.10 mm and a low amplitude of 1.10 mm. This capability allows the machine to achieve uniform soil density across wide compaction areas by providing different levels of compaction energy.

By End User

Based on end users, the market is segmented into Engineering & Construction and Mining. Engineering & Construction dominates the market with the highest share. Rising urbanization and industrial expansion are driving demand for modern compaction equipment in construction projects. These machines help reduce construction time, enhance surface stability, and improve structural quality. Governments and private developers are investing heavily in commercial and residential infrastructure, boosting equipment adoption. The need for reliable and cost-effective machinery strengthens this segment’s leadership position.

Key Growth Drivers

Rising Infrastructure Development

The rapid expansion of transportation and urban infrastructure is a major growth driver for the compaction equipment market. Governments and private players are investing heavily in roadways, bridges, airports, and smart city projects. These developments require efficient compaction machinery to ensure strong foundations and long-lasting surfaces. Vibratory rollers and pneumatic rollers are increasingly preferred for large-scale projects because of their speed and compaction quality. The surge in highway and urban development programs across Asia-Pacific and North America is boosting equipment demand. Additionally, rising investments in renewable energy and logistics infrastructure further strengthen the market outlook.

- For instance, AB Volvo’s DD105 double drum compactor features a 1,680 mm drum width and delivers up to 151 kN of centrifugal force, which improves asphalt layer stability in large infrastructure projects.

Technological Advancements in Equipment

The market is benefiting from continuous technological upgrades aimed at improving operational efficiency and precision. Manufacturers are integrating telematics, GPS tracking, and intelligent compaction systems to enhance machine performance. Advanced sensors help operators monitor soil density and compaction levels in real time. These innovations reduce rework, lower operational costs, and improve project timelines. Automation and hybrid models are also gaining traction for their energy efficiency. Such developments appeal to contractors looking to optimize labor and fuel use while improving productivity, making technologically advanced rollers and compactors a key focus of investment.

- For instance, BOMAG’s Asphalt Manager system utilizes real-time compaction control and accelerometers to automatically adjust amplitude, allowing operators to achieve uniform compaction efficiently.

Increasing Mining and Construction Activities

Rising construction activity in emerging economies and increased mining operations are fueling market growth. The demand for stable ground preparation in mining sites and large infrastructure projects is increasing rapidly. Engineering and construction companies are investing in high-performance equipment to meet tight project deadlines. Vibratory plate compactors and rammers are widely used in foundation work and site preparation. Moreover, mining projects require durable and powerful machinery capable of operating under tough conditions. This expanding demand from industrial and commercial construction segments creates consistent growth opportunities for manufacturers.

Key Trends & Opportunities

Integration of Smart and Automated Systems

The integration of smart technologies into compaction equipment is shaping the market’s future. Manufacturers are focusing on developing automated rollers and compactors with real-time data monitoring features. These machines allow operators to track performance remotely, improving accuracy and reducing downtime. Smart systems help ensure uniform compaction quality, minimizing manual intervention. The adoption of intelligent compaction systems is growing, particularly in regions with advanced infrastructure standards. This trend supports higher productivity and better project outcomes, creating significant opportunities for companies investing in automation and digital solutions.

- For instance, Hamm introduced the HC series rollers, which are equipped with the Smart Doc app and interfaces for telematics, enabling real-time compaction data collection and automated reporting features. For more precise positioning than a smartphone provides, Hamm recommends using its Smart Receiver GNSS device.

Expansion of Rental Equipment Market

The rental market for compaction equipment is growing rapidly due to its cost benefits. Many contractors and construction firms prefer renting machines rather than purchasing them, which lowers capital investment. Equipment rental companies are expanding their fleets with advanced models, including vibratory rollers and plate compactors. This shift supports greater market penetration, especially in small and medium-sized projects. It also encourages faster adoption of the latest technologies, as rental firms frequently update their inventory. This trend creates growth opportunities for both manufacturers and rental service providers.

- For instance, United Rentals offers a variety of vibratory rollers from manufacturers including BOMAG and Wacker Neuson for rent and sale. Some of the company’s equipment, particularly larger models, is capable of delivering high compaction forces, though the specific force varies by model.

Key Challenges

High Initial Cost of Advanced Equipment

One of the major challenges in the market is the high upfront cost of advanced compaction equipment. Machines equipped with intelligent compaction and GPS technology require significant investment, which can deter small and medium contractors. High ownership costs also include maintenance and skilled labor requirements for operation. This limits adoption in cost-sensitive markets, particularly in developing regions. As infrastructure development expands, balancing cost and technology remains a critical issue. Companies are addressing this challenge through leasing models, but affordability remains a key concern for many end users.

Skilled Labor Shortage and Operational Complexity

The growing operational complexity of advanced compaction equipment demands skilled operators. However, many construction and mining sites face a shortage of trained personnel capable of handling intelligent and automated systems. This gap increases the risk of inefficient use, maintenance errors, and project delays. Training programs and operator certification are becoming essential to overcome this issue. While automation reduces dependency on manual labor, a minimum skill level is still required to manage these systems. Bridging the skill gap is crucial for improving market adoption and maximizing productivity.

Regional Analysis

North America

North America leads the global compaction equipment market with a 32% market share. The region benefits from strong investments in transportation and commercial infrastructure projects. Large-scale development of highways, airports, and smart cities supports strong demand for advanced rollers and plate compactors. The U.S. remains the key contributor, driven by rising construction spending and modernization initiatives. High adoption of intelligent compaction systems further boosts equipment demand. The presence of leading manufacturers and rental companies strengthens the region’s market position, supported by strict quality and safety regulations.

Europe

Europe holds a 26% market share in the compaction equipment market, supported by strong regulatory frameworks and infrastructure investments. Road and railway modernization programs in Germany, France, and the UK are key demand drivers. The region is seeing increased adoption of sustainable and energy-efficient equipment to meet environmental standards. Technological upgrades and automation also influence purchasing decisions. Construction firms prioritize machines with real-time monitoring features to ensure project quality and speed. Strong public–private partnerships continue to boost infrastructure activity, reinforcing Europe’s strong position in the global market.

Asia-Pacific

Asia-Pacific accounts for a 28% market share and is the fastest-growing regional market. Rapid urbanization, population growth, and infrastructure expansion are driving large-scale investments in construction and mining projects. China, India, and Japan are leading contributors, focusing on expressways, rail networks, and industrial zones. Governments are promoting modernization initiatives, increasing demand for high-performance rollers and compactors. Rising equipment rental trends also support broader adoption. The region’s strong growth outlook is reinforced by foreign direct investments and technology adoption aimed at boosting infrastructure efficiency.

Latin America

Latin America captures a 7% market share in the compaction equipment market. Countries like Brazil and Mexico are investing heavily in transportation infrastructure, urban housing, and resource-based industries. Growth is supported by a rising number of public infrastructure programs and foreign investments in construction. Rental services are expanding, making advanced equipment accessible to contractors with lower capital budgets. However, market growth depends on stable economic conditions and project financing. The demand for mid-range and cost-efficient models is expected to rise in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 7% market share, with demand concentrated in the Gulf Cooperation Council (GCC) countries and parts of Sub-Saharan Africa. Large-scale infrastructure programs, including smart cities, airports, and energy projects, are key growth drivers. The UAE and Saudi Arabia lead in adopting modern compaction technologies. African nations are focusing on improving basic road infrastructure, which supports steady market growth. Rising foreign investments and government initiatives to modernize transportation networks further contribute to equipment adoption across the region.

Market Segmentations:

By Type

- Smooth Wheeled Roller

- Sheepsfoot Roller

- Pneumatic Roller

- Vibratory Roller

- Rammers

- Vibratory Plate Compactor

By Application

- Soil Compaction

- Concrete Compaction

By End User

- Engineering & Construction

- Mining

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the compaction equipment market is defined by strong global players and their continuous focus on innovation, product expansion, and strategic partnerships. Leading companies such as AB Volvo, Atlas Copco AB, BOMAG GmbH, Ammann Group, Altrad Belle, Hitachi Construction Machinery Co., Ltd., Caterpillar, Deere & Company, CNH Industrial America LLC., and J C Bamford Excavators Ltd. dominate the market through advanced product portfolios and extensive distribution networks. These firms are investing in intelligent compaction systems, GPS-enabled rollers, and fuel-efficient technologies to enhance performance and meet strict environmental standards. Strategic acquisitions and expansions into emerging markets strengthen their competitive edge. Many players are also focusing on expanding rental offerings and after-sales services to increase customer retention. This strong competitive environment is driving technological advancements and price competitiveness, supporting market growth across both developed and developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AB Volvo

- Atlas Copco AB

- BOMAG GmbH

- Ammann Group

- Altrad Belle

- Hitachi Construction Machinery Co., Ltd.

- Caterpillar

- Deere & Company

- CNH Industrial America LLC.

- J C Bamford Excavators Ltd.

Recent Developments

- In March 2024, Caterpillar Inc. made announcements regarding the upgrades to its series of mid-sized asphalt compactors. The Cat® CB7, CB8, and CB10 Asphalt Compactors enhance the established performance of their previous models by offering edge-management choices, an optional cab, optional split drums, and a redesigned mapping display.

- In February 2023, Trimble introduced an innovative path-planning technology that aims to assist contractors & equipment manufacturers in automating the design of trajectories, speeds, and overall paths for heavy machinery

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced compaction equipment will rise with large-scale infrastructure investments.

- Intelligent compaction systems will see wider adoption in construction projects.

- Rental services will grow as contractors seek cost-effective equipment access.

- Asia-Pacific will continue to be the fastest-growing regional market.

- North America and Europe will maintain steady growth with high technology adoption.

- Manufacturers will focus on automation and energy-efficient models.

- Partnerships and acquisitions will strengthen market presence for key players.

- Sustainable and low-emission equipment will gain strong market traction.

- Demand from mining and engineering sectors will support long-term growth.

- Increased government infrastructure spending will create strong opportunities globally.