| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Separation Plant Market Size 2024 |

USD 5,464.66 million |

| Air Separation Plant Market, CAGR |

4.96% |

| Air Separation Plant Market Size 2032 |

USD 8,019.58 million |

Market Overview:

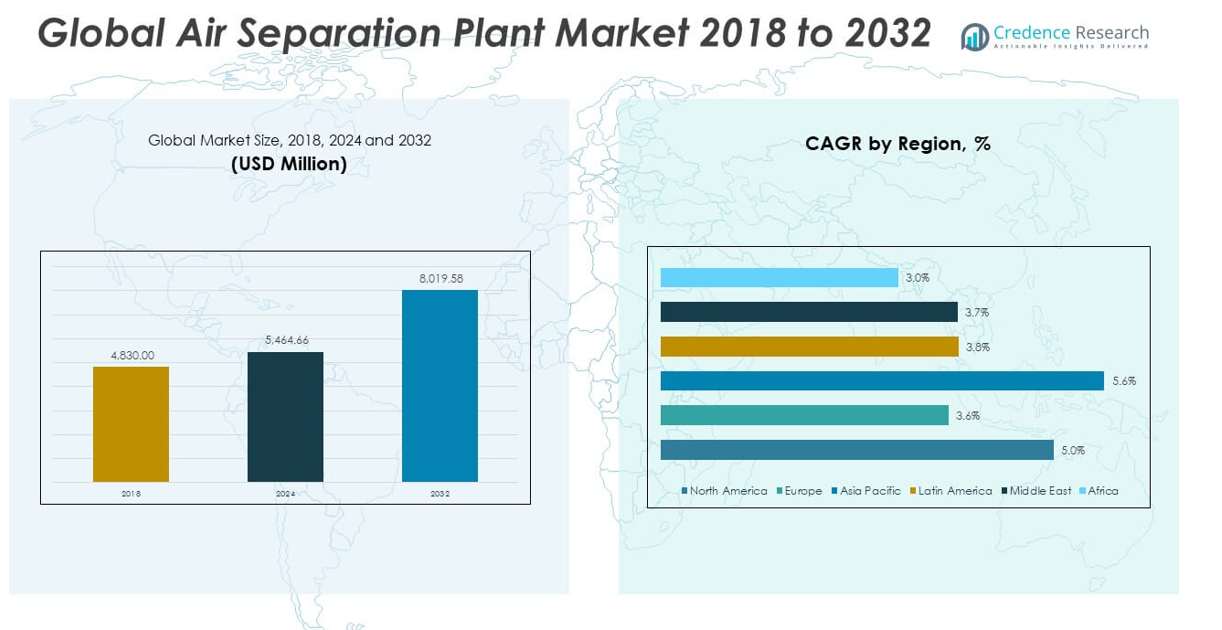

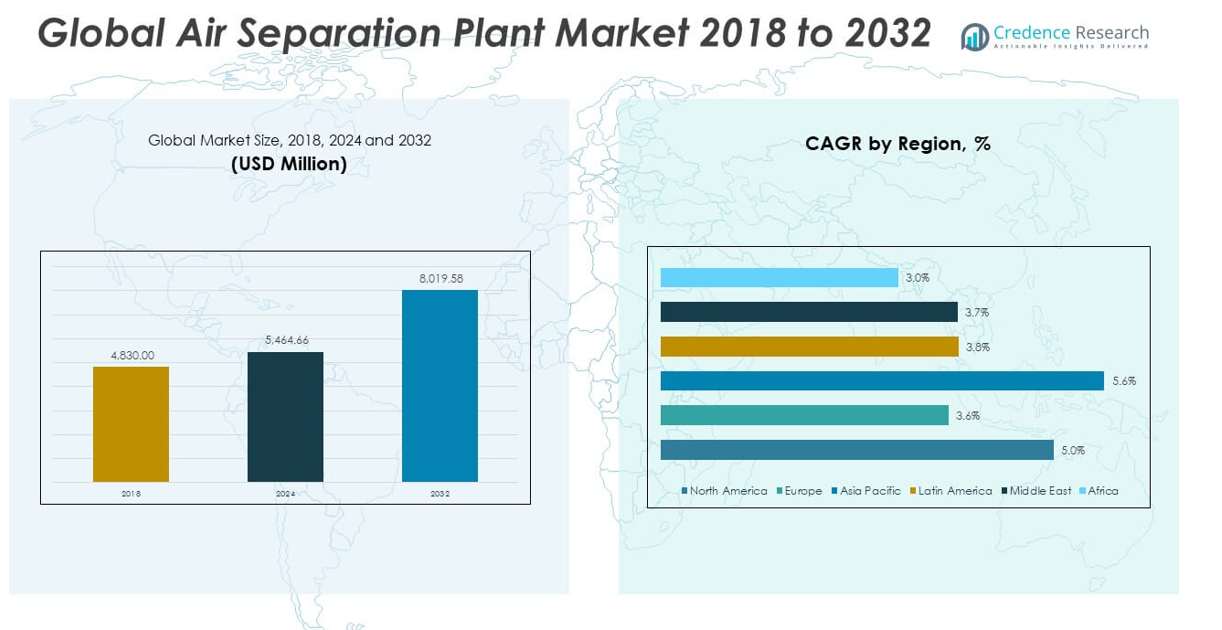

The Global Air Separation Plant Market size was valued at USD 4,830.00 million in 2018 to USD 5,464.66 million in 2024 and is anticipated to reach USD 8,019.58 million by 2032, at a CAGR of 4.96% during the forecast period.

Key drivers fueling the air separation plant market include rapid industrialization, rising energy demand, and the increasing use of industrial gases in sectors such as steel manufacturing, petrochemicals, oil and gas, healthcare, and electronics. The global emphasis on cleaner energy sources and more efficient industrial processes is encouraging the use of air separation units (ASUs) in liquefied natural gas (LNG) projects, gas-to-liquid conversion, and coal gasification. Moreover, technological advancements in cryogenic and non-cryogenic air separation methods are improving energy efficiency and reducing operational costs, making these systems more attractive to end users. The growing need for high-purity gases in medical and semiconductor industries, along with stricter safety and quality standards, is further propelling market growth.

Regionally, the Asia-Pacific region dominates the global air separation plant market, accounting for the largest revenue share. Countries such as China, India, and South Korea are leading investments in steel production, energy infrastructure, and electronics manufacturing, all of which heavily rely on air separation technologies. North America and Europe follow closely, supported by established industrial bases, technological innovation, and stringent regulatory environments promoting clean and efficient gas production. Meanwhile, the Middle East & Africa and Latin America are emerging as high-potential markets due to new gasification, refinery, and infrastructure projects. Overall, regional dynamics reflect a growing global dependence on industrial gas systems, with Asia-Pacific firmly positioned as the market’s primary growth engine.

Market Insights:

- The Global Air Separation Plant Market size was valued at USD 4,830.00 million in 2018, rose to USD 5,464.66 million in 2024, and is anticipated to reach USD 8,019.58 million by 2032, at a CAGR of 4.96% during the forecast period.

- Rapid industrialization and rising energy demand across steel, petrochemicals, and oil & gas sectors are major drivers, requiring high volumes of oxygen, nitrogen, and argon for processes like smelting, refining, and inerting.

- Asia-Pacific dominates the market with the largest revenue share, led by China, India, and South Korea, where investments in steel, electronics, and clean energy infrastructure remain high.

- Healthcare and semiconductor industries are expanding their use of medical-grade and ultra-high-purity gases, increasing demand for precision air separation systems.

- Projects in LNG, coal gasification, and hydrogen production are incorporating large-scale air separation units to meet processing and decarbonization needs.

- Cryogenic systems continue to lead the market, but non-cryogenic technologies like PSA and membrane systems are gaining popularity for small-scale, energy-efficient applications.

- High capital investment and operational complexity present challenges, with long payback periods and energy intensity limiting adoption in cost-sensitive or emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Industrial Gases Across Key End-Use Sectors:

The Global Air Separation Plant Market is experiencing steady expansion driven by the rising need for industrial gases in sectors such as steel manufacturing, petrochemicals, and energy production. Oxygen, nitrogen, and argon are essential for combustion, refining, cooling, and inerting processes. Steel plants depend heavily on large volumes of oxygen for smelting and decarburization, while nitrogen finds critical use in inert atmospheres within chemical and electronics manufacturing. Rapid industrialization across emerging economies amplifies this demand, prompting new investments in gas production infrastructure. It plays a vital role in supporting continuous operations and meeting the technical specifications of modern manufacturing facilities. This surge in demand sustains long-term growth for air separation units across regional and global markets.

- For instance, Linde commissioned a new air separation unit in Texas in 2024 with a production capacity of 1,000 metric tons per day of oxygen and 1,200 metric tons per day of nitrogen, specifically to supply the needs of steel and petrochemical clients, as detailed in Linde’s official project documentation.

Increased Use of Medical and High-Purity Gases in Healthcare and Electronics:

Expanding applications of medical-grade gases and ultra-high-purity industrial gases are contributing significantly to market growth. The healthcare industry requires a consistent supply of oxygen for respiratory treatments, anesthesia, and surgical environments, especially with rising patient volumes and aging populations. The electronics and semiconductor sectors depend on high-purity nitrogen and argon for wafer production, chamber cleaning, and microprocessor fabrication. Strict quality and contamination standards elevate the need for advanced separation systems capable of delivering precise purity levels. The Global Air Separation Plant Market benefits from these requirements, encouraging manufacturers to invest in more sophisticated equipment. It positions air separation as a strategic capability in high-tech and medical industries.

- For instance, Air Liquide nitrogen generator technologies for the electronics market can produce ultra-pure nitrogen with purity levels up to 99.9999% (6.0 grade), meeting the stringent requirements of advanced chip manufacturing. These systems are deployed in major semiconductor facilities across Asia, including South Korea, and are documented in Air Liquide’s technical datasheet.

Integration of Air Separation Systems in Energy and Clean Fuel Projects:

Large-scale integration of air separation plants in gasification, LNG, and hydrogen production is a major growth factor. LNG facilities require substantial volumes of nitrogen and oxygen for cooling and gas processing, while gasification processes depend on oxygen for the conversion of coal or biomass into syngas. Hydrogen production, increasingly promoted for decarbonization, often involves oxygen-intensive processes like steam methane reforming and electrolysis. These projects demand scalable and energy-efficient air separation units that can operate continuously in demanding environments. The Global Air Separation Plant Market aligns with national and corporate energy strategies focused on low-carbon transitions. It remains central to enabling cleaner energy pathways through gas handling and supply precision.

Technological Advancements in Cryogenic and Non-Cryogenic Systems:

Progress in air separation technologies has significantly improved plant efficiency, reliability, and cost-effectiveness. Cryogenic processes remain dominant due to their capacity to produce large volumes of gases at high purity, but non-cryogenic systems such as pressure swing adsorption (PSA) and membrane technologies are gaining traction for smaller-scale, decentralized applications. Automation, digital controls, and improved heat exchangers contribute to lower energy consumption and faster system response times. These innovations enhance plant lifecycle economics and support custom-built solutions for varied industrial needs. The Global Air Separation Plant Market gains from this innovation wave, making modern air separation systems more adaptable and sustainable. It attracts both greenfield and retrofit investments across mature and developing regions.

Market Trends:

Adoption of Modular and Containerized Air Separation Units for Flexibility:

The increasing demand for flexible and scalable gas production is driving the trend toward modular and containerized air separation units. These systems allow quick deployment in remote or space-constrained industrial sites without the need for complex civil infrastructure. Companies are adopting compact, plug-and-play units to serve on-site gas needs in mining, manufacturing, and construction zones. The Global Air Separation Plant Market reflects this shift by supporting decentralized operations that require lower initial capital investment and shorter lead times. It offers users faster commissioning and easier relocation of gas production assets based on evolving industrial demands. Modular units also align with lean manufacturing practices by reducing idle capacity and enhancing operational agility.

- Messer Group, for instance, is constructing a new state-of-the-art air separation unit in Berryville, Arkansas, with a strategic investment of over $70 million. This facility will enhance production capacity and provide a dependable supply of industrial gases like oxygen and nitrogen to meet evolving customer needs in various industries.

Rising Integration of Digital Monitoring and Predictive Maintenance Technologies:

The integration of digital technologies into air separation plant operations is gaining strong momentum. Plant operators are adopting advanced sensors, automation systems, and data analytics to monitor gas purity, energy efficiency, and equipment health in real-time. Predictive maintenance tools are being implemented to detect component fatigue, pressure fluctuations, or thermal anomalies before they result in system failure. The Global Air Separation Plant Market is aligning with broader trends in industrial automation and smart manufacturing to reduce downtime and extend asset life. It helps operator’s lower maintenance costs and ensure continuous, high-purity gas delivery. Digital platforms also enhance safety by enabling remote monitoring and diagnostics in hazardous environments.

- For instance, Air Products’ Smart Technology Suite enables continuous monitoring of key process parameters, predictive maintenance, and real-time data analysis. This platform helps operators reduce downtime, lower maintenance costs, and ensure continuous delivery of high-purity gases by providing configurable maintenance alerts and remote diagnostics.

Strategic Collaborations for On-Site and Long-Term Gas Supply Agreements:

Companies are entering long-term partnerships to secure on-site air separation capabilities and ensure uninterrupted gas supply. These collaborations often involve build-own-operate (BOO) or build-own-operate-transfer (BOOT) contracts between gas producers and end-use industries such as steel, refining, and healthcare. The Global Air Separation Plant Market reflects this trend as industrial consumers seek cost-efficient, reliable access to large volumes of customized gas mixtures. It encourages gas producers to design site-specific plants with optimized layouts and integrated logistics. Long-term contracts enhance project bankability, reduce risk, and offer predictable revenue streams for suppliers. These agreements also foster innovation in plant design tailored to unique operational needs.

Growing Interest in Low-Carbon Air Separation Solutions:

The push for sustainability is prompting manufacturers to explore low-carbon air separation technologies. This includes optimizing cryogenic systems for energy recovery, integrating renewable electricity sources, and using alternative refrigerants with lower global warming potential. The Global Air Separation Plant Market is responding to stricter emission targets and environmental regulations across industrialized nations. It supports efforts to reduce the carbon footprint of gas production and increase process sustainability. Companies are also publishing environmental impact assessments and lifecycle analyses to align with ESG goals. These trends are reshaping investment criteria and technology choices across the air separation value chain.

Market Challenges Analysis:

High Capital Investment and Long Payback Periods Restrain Adoption:

Air separation plants require significant upfront capital investment, particularly for large-scale cryogenic units used in steel, petrochemical, and energy sectors. Designing, engineering, and commissioning such systems involves complex infrastructure, specialized materials, and extended construction timelines. Many end users, especially in developing regions, face financial constraints that limit their ability to invest in these facilities without long-term supply agreements or government support. The Global Air Separation Plant Market experiences delays in project execution due to the difficulty of securing financing and regulatory clearances. It also faces challenges in aligning capital expenditure with volatile demand patterns across industries. Long payback periods further discourage smaller enterprises from committing to in-house gas production solutions.

Operational Complexity and Energy Intensity Impact Sustainability Goals:

Operating air separation units, particularly cryogenic systems, involves high energy consumption and strict process control. These plants require continuous power input for compressors, refrigeration cycles, and distillation columns, which can elevate operational costs and carbon emissions. The Global Air Separation Plant Market is under pressure to align with global sustainability targets while managing energy efficiency and environmental compliance. It must also address issues related to skilled workforce shortages, as the operation and maintenance of ASUs demand specialized knowledge. Unplanned downtimes, equipment wear, and integration with downstream processes introduce additional layers of complexity. These factors create operational and strategic challenges that affect plant reliability, profitability, and environmental performance.

Market Opportunities:

Expansion of Green Hydrogen and Clean Energy Projects Creates New Growth Avenues:

The global transition toward low-carbon energy systems is creating significant opportunities for air separation plant manufacturers. Green hydrogen production relies on large volumes of high-purity oxygen, which air separation units supply as a by-product of electrolysis support systems. The Global Air Separation Plant Market can benefit from growing investments in hydrogen fuel infrastructure and carbon capture initiatives. It supports emerging applications across fuel cells, synthetic fuels, and ammonia production. Governments and private sector stakeholders are allocating substantial funding to clean energy technologies, creating a favorable environment for integrated air separation solutions. These projects require scalable, energy-efficient systems that align with environmental goals.

Industrial Modernization in Emerging Economies Fuels Long-Term Demand:

Rapid industrial growth across Asia-Pacific, Africa, and Latin America presents long-term opportunities for market expansion. Developing countries are investing in steel plants, refineries, and chemical complexes that depend on reliable gas supply systems. The Global Air Separation Plant Market is positioned to meet this demand through both large-scale and modular installations. It offers value to customers seeking localized production, improved supply chain control, and compliance with evolving safety standards. Industrial modernization also increases demand for automation, digital monitoring, and operational efficiency—areas where modern ASUs add strategic value. These trends support market penetration in new geographies and customer segments.

Market Segmentation Analysis:

By Process

The Global Air Separation Plant Market is segmented into cryogenic and non-cryogenic processes. Cryogenic plants dominate the segment due to their capacity to produce large volumes of high-purity gases, especially for applications in steelmaking, petrochemicals, and energy production. Their efficiency and scalability make them the preferred option for large-scale industrial users. Non-cryogenic processes, such as pressure swing adsorption (PSA) and membrane-based systems, are gaining popularity in decentralized and low-to-medium purity applications. These systems offer flexibility, faster setup, and lower energy consumption, appealing to smaller industrial users and on-site gas generation facilities.

- For example, Praxair India (a Linde company) commissioned a new air separation unit in Hyderabad in October 2023, producing 250 tonnes per day of gases, including liquid medical oxygen, nitrogen, and argon, to meet the needs of healthcare, pharma, and industrial sectors.

By Gas

Among gases, nitrogen holds the largest share due to its broad use in inerting, blanketing, purging, and cooling across industries such as electronics, food processing, and chemicals. Oxygen follows closely, driven by extensive use in iron and steel production and growing demand from the healthcare sector. Argon serves specialized applications in welding, lighting, and semiconductor manufacturing. The “others” category includes gases such as carbon dioxide and rare gases used in niche applications, contributing to overall market diversity.

- For example, Argon is used in specialized applications like welding, lighting, and semiconductor manufacturing. Messer’s air separation units can produce nitrogen with purity up to 99.9999%, oxygen up to 99.999%, and argon up to 99.9999%, as documented in their technical literature.

By End-Use

The iron and steel segment accounts for the highest market share, owing to its significant requirement for oxygen in smelting and processing operations. Oil and gas industries rely on nitrogen and oxygen for refining, gas treatment, and enhanced recovery. The chemical sector uses a broad range of gases for synthesis, processing, and safety applications. Healthcare demand is rising with the growing need for medical-grade oxygen in hospitals and clinics. Other industries, including electronics and food & beverage, drive demand for specialized and high-purity gases. The market reflects the growing integration of air separation technologies across traditional and emerging end-use sectors.

Segmentation:

By Process

By Gas

- Nitrogen

- Oxygen

- Argon

- Others

By End-Use

- Iron & Steel

- Oil & Gas

- Chemical

- Healthcare

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Air Separation Plant Market size was valued at USD 1,029.76 million in 2018 to USD 1,140.99 million in 2024 and is anticipated to reach USD 1,670.49 million by 2032, at a CAGR of 5.0% during the forecast period. North America accounts for 21% of the Global Air Separation Plant Market, supported by a mature industrial base and growing demand for high-purity gases in healthcare, oil & gas, and chemicals. The United States leads the region, driven by expanding LNG infrastructure and advanced manufacturing. Technological innovation in cryogenic systems and increasing investment in clean fuel projects sustain regional demand. Strategic collaborations between gas suppliers and end-use industries promote large-scale plant deployments. It benefits from strong regulatory frameworks that encourage safe and efficient industrial gas handling. High capital investment capacity ensures consistent project execution across energy-intensive sectors.

Europe

The Europe Air Separation Plant Market size was valued at USD 739.96 million in 2018 to USD 781.30 million in 2024 and is anticipated to reach USD 1,034.15 million by 2032, at a CAGR of 3.6% during the forecast period. Europe holds 13% of the Global Air Separation Plant Market, driven by stringent environmental regulations and a strong emphasis on sustainable industrial practices. Germany, France, and the UK lead regional demand across chemical, healthcare, and steel sectors. Increasing use of industrial gases in semiconductor manufacturing and clean energy projects adds to market momentum. Advanced R&D capabilities in cryogenic processing and energy-efficient technologies help reduce operational costs. It continues to attract investments in on-site gas production for industrial parks and refineries. European companies also export plant solutions to other regions, strengthening global influence.

Asia Pacific

The Asia Pacific Air Separation Plant Market size was valued at USD 2,482.62 million in 2018 to USD 2,868.10 million in 2024 and is anticipated to reach USD 4,421.20 million by 2032, at a CAGR of 5.6% during the forecast period. Asia Pacific commands a 55% share of the Global Air Separation Plant Market, reflecting rapid industrialization and infrastructure development. China, India, and South Korea invest heavily in steel production, electronics, and clean hydrogen projects. The region sees rising demand for oxygen and nitrogen in healthcare and energy sectors. Local manufacturers focus on scalable, cost-effective air separation systems to meet diverse needs. Government-backed energy and manufacturing policies further strengthen deployment across industrial zones. It remains the primary growth engine of the global market, supported by strong domestic consumption and exports.

Latin America

The Latin America Air Separation Plant Market size was valued at USD 247.30 million in 2018 to USD 276.46 million in 2024 and is anticipated to reach USD 369.46 million by 2032, at a CAGR of 3.8% during the forecast period. Latin America represents 5% of the Global Air Separation Plant Market, with Brazil and Mexico at the forefront of regional demand. Expanding oil & gas activities, industrial recovery, and increased investments in healthcare infrastructure support growth. The region is focusing on modernizing its manufacturing sector, which requires a stable supply of industrial gases. Demand for nitrogen and oxygen in refining, food processing, and metal fabrication drives installations. It benefits from improved energy access and logistics that facilitate plant deployment. Market players focus on project partnerships and localized services to enhance competitiveness.

Middle East

The Middle East Air Separation Plant Market size was valued at USD 199.00 million in 2018 to USD 211.99 million in 2024 and is anticipated to reach USD 283.14 million by 2032, at a CAGR of 3.7% during the forecast period. The Middle East holds 4% of the Global Air Separation Plant Market, primarily driven by energy diversification and industrial expansion. GCC countries are investing in gas-based projects and petrochemical complexes that require oxygen and nitrogen. Growing demand from hydrogen and gas-to-liquid plants supports air separation plant integration. Governments promote local gas production as part of economic transformation agendas. It benefits from high-volume projects that require reliable and scalable gas systems. Regional players are adopting advanced technology to improve efficiency in high-temperature environments.

Africa

The Africa Air Separation Plant Market size was valued at USD 131.38 million in 2018 to USD 185.82 million in 2024 and is anticipated to reach USD 241.14 million by 2032, at a CAGR of 3.0% during the forecast period. Africa captures 3% of the Global Air Separation Plant Market, showing steady growth in industrial gas demand. South Africa, Egypt, and Nigeria lead regional expansion with rising investments in energy and mining. Industrialization, urbanization, and healthcare improvements drive oxygen consumption across sectors. Financial and infrastructural constraints limit large-scale adoption but create opportunities for modular systems. It shows promise in supporting domestic manufacturing and energy security goals. Multinational players are entering partnerships to deploy smaller plants in strategic locations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Air Liquide S.A.

- Linde AG

- Messer Group GmbH

- Air Products and Chemicals, Inc.

- Taiyo Nippon Sanso Corporation

- Praxair, Inc.

- Oxyplants

- AMCS Corporation

- Enerflex Ltd

- Technex Ltd.

Competitive Analysis:

The Global Air Separation Plant Market features a competitive landscape dominated by a mix of multinational corporations and regional players. Key companies include Linde plc, Air Liquide S.A., Praxair Technology, Inc., Mitsubishi Heavy Industries, Ltd., and Taiyo Nippon Sanso Corporation. These firms maintain strong market positions through technological innovation, strategic partnerships, and extensive global footprints. The Global Air Separation Plant Market favors companies that offer turnkey solutions, energy-efficient designs, and long-term service agreements. It rewards suppliers capable of delivering customized systems that meet specific purity, volume, and operational requirements across industries. New entrants face high entry barriers due to capital intensity, technical expertise, and established client relationships. Leading players continue to invest in research and development, automation, and sustainability-driven upgrades to strengthen their competitive edge and secure large-scale contracts in both mature and emerging markets.

Recent Developments:

- In June 2025, Linde announced a new long-term agreement to supply industrial gases to Blue Point Number One, a joint venture developing a world-scale low-carbon ammonia facility in Louisiana, USA. This partnership will see Linde provide oxygen and nitrogen to support the production of low-carbon ammonia, reinforcing its commitment to decarbonization and the growing hydrogen economy.

- In April 2025, Messer Group broke ground on a new state-of-the-art air separation unit (ASU) in Berryville, Arkansas, USA. The company is investing over $70 million in this facility, which is expected to be operational in the second half of 2026. The new ASU will enhance Messer’s production capacity for oxygen and nitrogen, supporting customers in the food, healthcare, metals, and chemical industries across the southern United States.

- In April 2025, Air Liquide secured Germany’s first Renewable Fuels of Non-Biological Origin (RFNBO) certification for renewable hydrogen, marking a significant step in the company’s efforts to support the energy transition and decarbonization in Europe. Additionally, in March 2025, Air Liquide Egypt signed a memorandum of understanding with United Energy Group (UEG) to develop green ammonia projects based on renewable hydrogen, further expanding its portfolio in sustainable industrial gas solutions.

- In February 2025, Air Products announced its decision to exit three major U.S.-based projects, including the termination of a sustainable aviation fuel expansion project in California, the cancellation of a planned green liquid hydrogen facility in New York, and the discontinuation of a carbon monoxide project in Texas. This strategic move is part of a broader restructuring to focus on core business areas and improve capital allocation.

- In February 2025, Taiyo Nippon Sanso Corporation (TNSC) signed an agreement to acquire the exhaust gas abatement equipment business from Resonac Corporation in Japan and Taiwan. The acquisition, scheduled for completion in June 2025, will strengthen TNSC’s capabilities in providing exhaust gas abatement solutions for the semiconductor industry and expand its product lineup in East Asia.

Market Concentration & Characteristics:

The Global Air Separation Plant Market exhibits moderate to high market concentration, with a few major players controlling a significant share of global revenues. It is characterized by capital-intensive projects, long development cycles, and complex engineering requirements. Leading firms maintain a competitive edge through proprietary technologies, global project execution capabilities, and long-term client relationships. The Global Air Separation Plant Market demands technical precision, operational reliability, and compliance with stringent safety and environmental standards. It is driven by long-term contracts, on-site production models, and integrated service offerings. The market favors established players with strong financial backing and the ability to deliver customized, scalable solutions across diverse industrial applications.

Report Coverage:

The research report offers an in-depth analysis based on by process, gas type, and end-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-purity industrial gases will grow due to advancements in electronics, healthcare, and clean energy sectors.

- Expansion of green hydrogen and carbon capture projects will drive integration of large-scale air separation units.

- Modular and containerized systems will gain traction for flexible deployment in remote or temporary industrial sites.

- Asia-Pacific will maintain market dominance, supported by rapid industrialization and infrastructure investment.

- Cryogenic technology will continue to lead due to its high efficiency in producing bulk gases at required purity.

- Adoption of digital monitoring, automation, and predictive maintenance will enhance operational efficiency.

- Long-term on-site gas supply contracts will become more common, strengthening vendor-client partnerships.

- Energy-efficient plant designs and low-emission technologies will see rising adoption under ESG mandates.

- Emerging economies in Latin America and Africa will present new opportunities for localized production facilities.

- Competition will intensify as new players enter with innovative, cost-effective, and scalable air separation solutions.