Market Overview

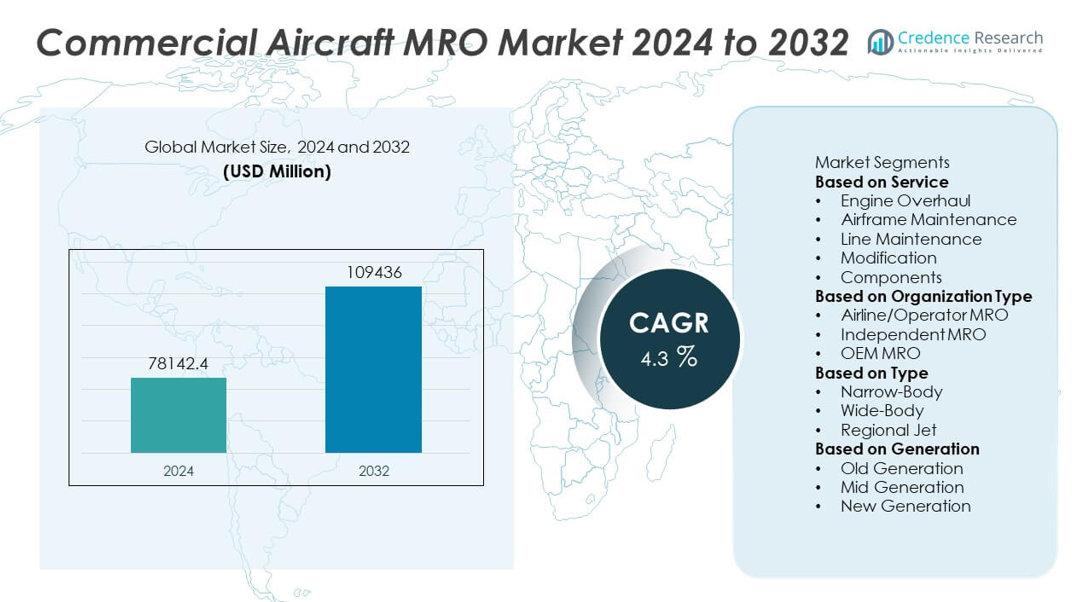

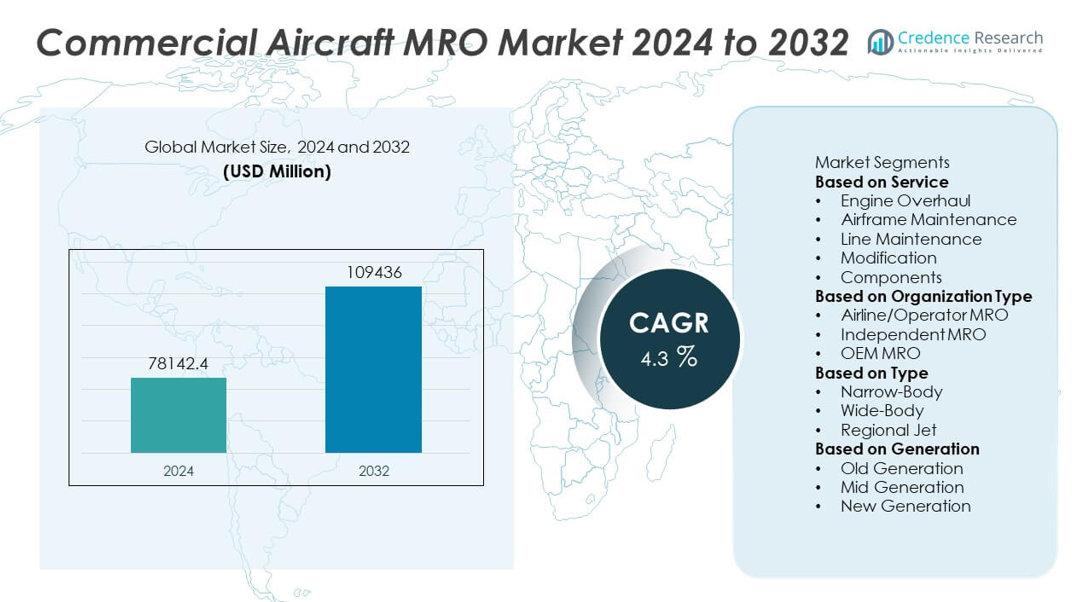

The Commercial Aircraft MRO Market was valued at USD 78,142.4 million in 2024 and is projected to reach USD 109,436 million by 2032, registering a CAGR of 4.3% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Aircraft MRO Market Size 2024 |

USD 78,142.4 million |

| Commercial Aircraft MRO Market, CAGR |

4.3% |

| Commercial Aircraft MRO Market Size 2032 |

USD 109,436 million |

The Commercial Aircraft MRO Market grows steadily, driven by the expansion of global airline fleets and the need to ensure operational reliability. Rising air passenger traffic increases aircraft utilization, creating higher demand for scheduled maintenance and overhauls. Airlines prioritize cost-efficient MRO solutions to extend aircraft service life and optimize performance. Advancements in predictive maintenance technologies enhance efficiency and reduce downtime. The market trends toward greater adoption of digital tools, robotics, and advanced materials to streamline repair processes.

The Commercial Aircraft MRO Market demonstrates strong geographical diversity, with North America, Europe, Asia-Pacific, the Middle East, and Latin America serving as major operational hubs. North America benefits from a large fleet size and the presence of advanced MRO infrastructure, while Europe maintains strong capabilities supported by established aviation clusters. Asia-Pacific experiences rapid expansion due to growing airline fleets and rising passenger traffic, prompting significant investments in maintenance facilities. The Middle East strengthens its role through strategic positioning as a global transit hub, while Latin America focuses on fleet modernization. Key players shaping the market include Lufthansa Technik, Singapore Technologies Engineering Ltd, AAR Corp., and Delta TechOps.

Market Insights

- The Commercial Aircraft MRO Market was valued at USD 78,142.4 million in 2024 and is projected to reach USD 109,436 million by 2032, growing at a CAGR of 4.3% during the forecast period.

- Airlines focus on operational reliability and safety, driving demand for comprehensive MRO services covering airframe, engine, and component maintenance.

- Digital transformation and predictive maintenance adoption are shaping service models, with AI and IoT enabling real-time monitoring and reduced turnaround times.

- The market features strong competition among global and regional players such as Lufthansa Technik, ST Engineering, AAR Corp., and Delta TechOps, each leveraging global networks and specialized expertise.

- High maintenance costs and limited availability of skilled labor in certain regions present operational challenges, increasing reliance on outsourcing and joint ventures.

- North America leads with advanced MRO infrastructure, Europe holds a robust base of legacy operators, Asia-Pacific expands rapidly with rising fleets, the Middle East invests in hub-based MRO facilities, and Latin America focuses on modernization.

- Strategic collaborations, expanded service capabilities, and investment in advanced repair technologies are expected to create new growth avenues for market participants worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Fleet Expansion and Aging Aircraft Driving MRO Demand

The Commercial Aircraft MRO Market benefits from the simultaneous growth of global aircraft fleets and the aging of existing models. Airlines continue to acquire new aircraft to meet increasing passenger demand while operating older fleets that require frequent maintenance. It ensures that both scheduled checks and unscheduled repairs remain a constant requirement. Aging aircraft demand heavy checks, component replacements, and structural upgrades to maintain airworthiness. This trend supports sustained revenue streams for MRO providers worldwide. Expansion in emerging markets adds further volume to maintenance demand.

- For instance, United Airlines operates approximately 1,040 mainline aircraft with an average fleet age of 15.6 years, driving demand for heavy checks such as C- or D-checks on long-serving jets.

Stringent Safety Regulations and Compliance Standards

Global aviation authorities enforce rigorous maintenance and inspection requirements, fueling demand for MRO services. The Commercial Aircraft MRO Market is shaped by compliance with standards set by bodies such as the FAA and EASA. It compels operators to maintain strict adherence to maintenance schedules and certified repair processes. These regulations protect passenger safety and enhance operational reliability. The demand for certified MRO facilities increases as airlines seek to avoid costly operational disruptions. Continuous updates to safety directives ensure consistent market activity.

- For instance, Airbus A220 operators must conduct an A-check every 850 flight hours, with the check itself reduced from 5 hours to under 3 hours within an 8-hour shift, and a C-check every 8,500 flight hours—translating to around 3½ years of operation.

Technological Advancements in Maintenance Practices

Advances in predictive analytics, digital twin technology, and automated inspection tools enhance efficiency in MRO operations. The Commercial Aircraft MRO Market integrates technologies that reduce turnaround times and optimize parts usage. It enables data-driven decision-making for component replacements and system upgrades. Adoption of advanced diagnostic tools minimizes downtime and improves cost efficiency for operators. Such innovations also extend the operational lifespan of aircraft while maintaining optimal performance. These technology-driven capabilities create a competitive advantage for leading MRO providers.

Rising Demand for Component and Engine Overhauls

Engines and critical components represent the most expensive and maintenance-intensive areas in aviation. The Commercial Aircraft MRO Market experiences steady demand for engine overhauls due to their complex maintenance cycles. It requires specialized facilities and highly skilled technicians to perform high-value repair work. Airlines prioritize partnerships with MRO providers capable of handling large-scale engine maintenance contracts. Component MRO, including avionics, landing gear, and auxiliary power units, also drives market growth. Continuous investments in capabilities for these segments strengthen market resilience.

Market Trends

Growing Integration of Digital and Predictive Maintenance Solutions

The Commercial Aircraft MRO Market is witnessing a shift toward predictive maintenance powered by big data and advanced analytics. Airlines and MRO providers deploy digital twin models to simulate performance and predict component failures before they occur. It reduces unplanned downtime and optimizes maintenance scheduling. AI-driven systems enhance fault detection accuracy, leading to cost savings and improved safety. Cloud-based platforms allow real-time monitoring of aircraft health across global fleets. The trend strengthens operational efficiency and competitiveness among service providers.

- For instance, Airbus introduced its Skywise Health Monitoring platform to over 9,000 aircraft in operation by mid-2024, enabling predictive fault detection and reducing unscheduled maintenance events by up to 30%

Expansion of OEM Participation in Aftermarket Services

Original Equipment Manufacturers are expanding their presence in the MRO sector to secure long-term service contracts. The Commercial Aircraft MRO Market reflects a growing preference for OEM-backed maintenance programs, especially for engines and avionics. It ensures access to proprietary parts, technical expertise, and software updates. Airlines value the reliability and warranty benefits of OEM-led solutions. Joint ventures between OEMs and independent MRO firms are increasing to meet regional service demand. This integration blurs traditional boundaries between manufacturing and maintenance sectors.

- For instance, Rolls-Royce’s TotalCare® program supported over 5,700 engines globally by Q1 2024, with advanced engine health monitoring that tracks more than 70 million data points per flight day.

Rising Demand for Sustainable and Green MRO Practices

Sustainability goals are shaping operational strategies in the Commercial Aircraft MRO Market. Airlines and service providers adopt eco-friendly maintenance practices such as water-based cleaning systems and biodegradable lubricants. It aligns with global initiatives to reduce aviation’s environmental footprint. Energy-efficient hangar operations and waste-reduction programs are becoming industry standards. Use of refurbished and recycled aircraft components is gaining traction. Regulatory pressure and airline sustainability commitments accelerate adoption of these green solutions.

Growth of Regional MRO Hubs to Support Global Fleets

Regional expansion of maintenance facilities is a key trend in the Commercial Aircraft MRO Market. Service providers are investing in strategically located hubs to reduce aircraft ferrying time and operational costs. It enables faster turnaround for airlines and enhances service availability. Asia-Pacific, the Middle East, and Eastern Europe are emerging as major MRO centers. Partnerships with local airlines and governments help secure market presence in these regions. This geographic diversification strengthens resilience against global supply chain disruptions.

Market Challenges Analysis

Rising Labor Shortages and Skill Gaps in the Maintenance Workforce

The Commercial Aircraft MRO Market faces persistent challenges from labor shortages and a widening skills gap in specialized maintenance roles. The industry requires highly trained technicians to manage advanced aircraft systems, yet the supply of qualified personnel remains limited. It creates pressure on service timelines and can impact operational efficiency for airlines. The retirement of experienced workers accelerates the shortage, while training new staff to required standards demands significant time and investment. High competition for skilled labor across regions further intensifies the problem. Service providers must enhance recruitment, retention, and training strategies to sustain performance levels.

Supply Chain Disruptions and Rising Costs of Spare Parts

The Commercial Aircraft MRO Market encounters ongoing difficulties from global supply chain instability. Delays in sourcing spare parts, components, and materials disrupt scheduled maintenance operations. It increases the risk of extended aircraft downtime and impacts airline profitability. Rising raw material costs and logistical challenges push operational expenses higher for MRO providers. Dependence on OEM-controlled supply networks adds complexity, especially for older aircraft models with limited part availability. Companies are forced to balance cost control with ensuring timely access to critical components. Strengthening supplier relationships and diversifying sourcing channels are essential to mitigate these risks.

Market Opportunities

Growing Demand for Next-Generation Aircraft Maintenance Solutions

The Commercial Aircraft MRO Market presents significant opportunities through the adoption of advanced maintenance technologies for next-generation aircraft. Increasing use of composite materials, sophisticated avionics, and connected systems creates demand for specialized repair capabilities. It allows MRO providers to expand service offerings and attract long-term airline partnerships. Predictive maintenance powered by real-time data analytics enables faster turnaround times and reduced unscheduled downtime. Airlines seek service providers with expertise in modern fleet requirements to maximize operational efficiency. Companies investing in training, tooling, and advanced diagnostic equipment stand to capture a larger market share.

Expanding Aftermarket Services in Emerging Aviation Hubs

The Commercial Aircraft MRO Market benefits from growth in emerging aviation hubs across Asia-Pacific, the Middle East, and Latin America. Rising air traffic in these regions drives demand for localized maintenance facilities to reduce ferry costs and improve service speed. It offers MRO providers a strategic opportunity to establish regional bases and partnerships with local carriers. The expansion of low-cost carriers and regional airlines further fuels requirements for cost-effective yet high-quality maintenance. Governments in these regions support aviation infrastructure development, creating favorable conditions for investment. Early market entry and tailored service packages can secure a competitive edge for global MRO players.

Market Segmentation Analysis:

By Service

The Commercial Aircraft MRO Market is segmented by service into engine overhaul, airframe maintenance, line maintenance, and modifications. Engine overhaul dominates due to its critical role in ensuring performance, reliability, and compliance with safety regulations. It requires high technical expertise, specialized tooling, and OEM-approved facilities. Airframe maintenance focuses on structural repairs, corrosion control, and component replacements, often during scheduled heavy checks. Line maintenance remains essential for day-to-day operational readiness, addressing minor repairs, system inspections, and troubleshooting at turnaround points. Modifications, including cabin refurbishments and avionics upgrades, support airlines in enhancing passenger experience and meeting evolving regulatory standards. Each service category benefits from increasing fleet size and aging aircraft requiring frequent maintenance cycles.

- For instance, Lufthansa Technik’s global network performed over 1.2 million line maintenance events across 60 stations in 2023. Modifications, including cabin refurbishments and avionics upgrades, support airlines in enhancing passenger experience and meeting evolving regulatory standards.

By Organization Type

The Commercial Aircraft MRO Market is classified into independent MRO providers, airline-operated MRO facilities, and OEM-affiliated MROs. Independent MRO providers hold a strong presence due to their ability to serve multiple aircraft types and offer competitive pricing. It enables airlines to access flexible maintenance schedules and avoid capacity constraints. Airline-operated facilities prioritize in-house maintenance for fleet optimization and operational control. OEM-affiliated MROs leverage proprietary technologies, original parts access, and deep product knowledge to deliver high-quality service. Strategic partnerships between these organization types are becoming common to balance cost, turnaround time, and technical expertise.

- For instance, HAECO maintains multi-hangar capability across Asia and the Americas with integrated back-shops that support complex heavy checks and avionics mod work.

By Type

The Commercial Aircraft MRO Market is divided into heavy maintenance, component maintenance, and line maintenance. Heavy maintenance involves C and D checks, requiring extensive disassembly, inspection, and reassembly, often taking several weeks. Component maintenance focuses on the repair and overhaul of specific systems, such as landing gear, hydraulics, and avionics. Line maintenance supports immediate operational needs, ensuring aircraft readiness between flights. It plays a crucial role in minimizing disruptions and keeping fleets airworthy. The increasing use of predictive analytics and digital tracking in all types of MRO work enhances efficiency, reduces errors, and supports higher aircraft utilization rates. Each type remains integral to sustaining fleet safety and operational performance.

Segments:

Based on Service

- Engine Overhaul

- Airframe Maintenance

- Line Maintenance

- Modification

- Components

Based on Organization Type

- Airline/Operator MRO

- Independent MRO

- OEM MRO

Based on Type

- Narrow-Body

- Wide-Body

- Regional Jet

Based on Generation

- Old Generation

- Mid Generation

- New Generation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 33% of the Commercial Aircraft MRO Market share, driven by its large commercial fleet, strong airline networks, and advanced aviation infrastructure. The United States leads regional activity, supported by major MRO hubs in states such as Texas, Florida, and Georgia. It benefits from the presence of established players like AAR Corp., Delta TechOps, and Boeing Global Services, which offer extensive capabilities across engine, airframe, and component maintenance. The region invests heavily in predictive maintenance technologies, data analytics, and automation to improve turnaround times. High demand for retrofit programs, including cabin upgrades and avionics modernization, further strengthens the MRO market in North America. Steady fleet expansion and aging aircraft in service sustain long-term maintenance requirements.

Europe

Europe holds around 28% of the Commercial Aircraft MRO Market share, supported by strong aviation regulations, a dense air traffic network, and the presence of global MRO providers. Major hubs in Germany, France, and the United Kingdom serve both regional and international carriers. Companies such as Lufthansa Technik, AFI KLM E&M, and SR Technics lead the market with broad technical expertise and advanced repair facilities. The region focuses on sustainability in MRO processes, including eco-friendly materials and waste reduction initiatives. It sees significant growth in component and line maintenance services as airlines adapt to evolving passenger demands. Collaborative agreements between airlines and MRO providers are expanding to optimize capacity utilization and service quality.

Asia-Pacific

Asia-Pacific represents about 25% of the Commercial Aircraft MRO Market share, fueled by rapid airline expansion, growing passenger traffic, and a surge in low-cost carriers. China, Singapore, and India are key centers for MRO activity, with increasing investments in state-of-the-art maintenance facilities. Leading regional providers such as ST Engineering Aerospace and HAECO Group deliver comprehensive MRO solutions for both narrow-body and wide-body fleets. It benefits from competitive labor costs and strategic geographic positioning for servicing aircraft operating between major global routes. Rising demand for component repair, cabin reconfiguration, and digital maintenance solutions enhances market growth in the region. Government initiatives to boost local MRO capabilities further strengthen Asia-Pacific’s competitive position.

Middle East & Africa

The Middle East & Africa collectively hold about 8% of the Commercial Aircraft MRO Market share, with the Middle East serving as a primary hub due to its strategic location between Europe, Asia, and Africa. Countries such as the UAE, Qatar, and Saudi Arabia have invested heavily in advanced MRO facilities to serve global carriers. Emirates Engineering and Etihad Airways Engineering lead regional operations with capabilities in airframe, engine, and component services. Africa’s MRO sector is smaller but growing, with opportunities emerging in South Africa, Ethiopia, and Morocco. It gains momentum from regional airline expansion, fleet modernization, and partnerships with global MRO firms.

Latin America

Latin America accounts for approximately 6% of the Commercial Aircraft MRO Market share, with Brazil and Mexico leading regional activity. The market benefits from a combination of domestic and international carriers seeking cost-effective maintenance solutions. Providers such as Aeroman and TAP M&E Brazil offer competitive service packages for narrow-body and regional aircraft. It experiences rising demand for heavy checks and component repairs as fleets age and air travel demand recovers. Government policies supporting aviation growth, along with strategic investments in maintenance facilities, are expected to enhance Latin America’s role in the global MRO sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MTU Aero Engines AG

- Delta Airlines, Inc. (Delta TechOps)

- TAP Maintenance & Engineering (TAP Air Portugal)

- Lufthansa Technik

- Hong Kong Aircraft Engineering Company Limited

- Airbus SE

- KLM UK Engineering Limited

- Raytheon Technologies Corporation

- Singapore Technologies Engineering Ltd

- AAR Corp.

Competitive Analysis

The Commercial Aircraft MRO Market features intense competition among globally recognized players, including Lufthansa Technik, ST Engineering, AAR Corp., Delta TechOps, Airbus SE, MTU Aero Engines AG, KLM UK Engineering Limited, TAP Maintenance & Engineering, Raytheon Technologies Corporation, and Hong Kong Aircraft Engineering Company Limited. These companies leverage extensive technical expertise, global service networks, and advanced repair capabilities to strengthen their market presence. Lufthansa Technik maintains a dominant position through its diversified MRO services, covering airframe, engine, and component solutions with over 30 subsidiaries worldwide. ST Engineering emphasizes integrated solutions, supported by its strong foothold in Asia-Pacific and a growing portfolio of digital maintenance platforms. AAR Corp. specializes in flexible, cost-efficient MRO programs tailored for both commercial airlines and government fleets. Delta TechOps, the largest airline MRO provider in North America, combines operational experience with advanced predictive maintenance systems. Airbus SE and Raytheon Technologies Corporation integrate OEM capabilities with aftermarket services, ensuring access to proprietary technologies and certified parts. MTU Aero Engines focuses on high-performance engine maintenance and has expanded its global partnerships. KLM UK Engineering and TAP Maintenance & Engineering strengthen the European network with specialized regional capabilities, while Hong Kong Aircraft Engineering Company Limited continues to expand its presence in Asian hub airports.

Recent Developments

- In April 2025, MTU and Pratt & Whitney expanded their Geared Turbofan (GTF) engine MRO network, increasing MTU’s annual capacity to 600 shop visits across all GTF models.

- In June 2025, Delta TechOps initiated the rollout of Trax eMRO and eMobility software across its line maintenance network, which includes over 6,000 technicians. The full deployment of this system is expected to extend into late 2026.

- In November 2023, Airbus partnered with Hindustan Aeronautics Limited (HAL) to support establishment of an A320-family MRO hub in Nashik, India, including delivery of tool kits, AirbusWorld digital access, and training support.

Market Concentration & Characteristics

The Commercial Aircraft MRO Market demonstrates a moderate to high level of concentration, with a few multinational players dominating global service capacity and technological capabilities. It is characterized by long-term maintenance contracts, extensive regulatory compliance requirements, and significant capital investment in advanced repair facilities. Leading companies leverage integrated service portfolios covering airframe, engine, and component maintenance to secure customer loyalty and maintain competitive advantage. The market benefits from digital maintenance solutions, predictive analytics, and automation, which enhance efficiency and reduce turnaround time. It maintains high entry barriers due to certification standards, specialized workforce requirements, and costly tooling. Strategic partnerships between OEMs, airlines, and MRO providers continue to shape service offerings and geographical reach. The competitive landscape remains dynamic, with established players expanding regional capabilities and emerging providers targeting niche segments to capture specific fleet support opportunities.

Report Coverage

The research report offers an in-depth analysis based on Service, Organization Type, Type, Generation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digitalization will enhance predictive maintenance capabilities across global fleets.

- Airlines will increase outsourcing of maintenance services to specialized MRO providers.

- Engine maintenance demand will grow with the expansion of next-generation aircraft fleets.

- Regional MRO hubs will expand to support faster turnaround times and localized services.

- Sustainability initiatives will drive the adoption of greener maintenance processes and materials.

- Advanced training programs will address skilled labor shortages in the MRO sector.

- OEM-MRO partnerships will strengthen to deliver integrated lifecycle support.

- Data-driven maintenance planning will improve operational efficiency and cost control.

- Retrofit and modification services will rise to meet evolving safety and passenger comfort standards.

- Investment in automation and robotics will optimize maintenance workflows and reduce downtime.