Market Overview:

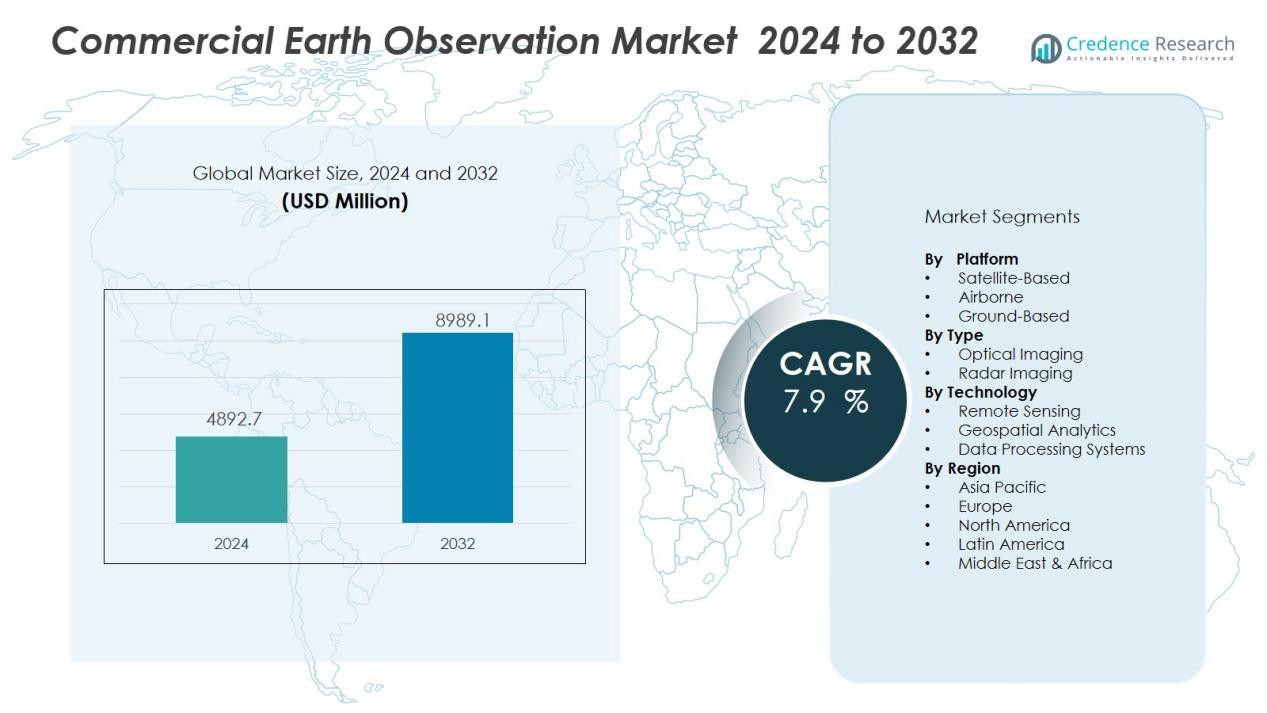

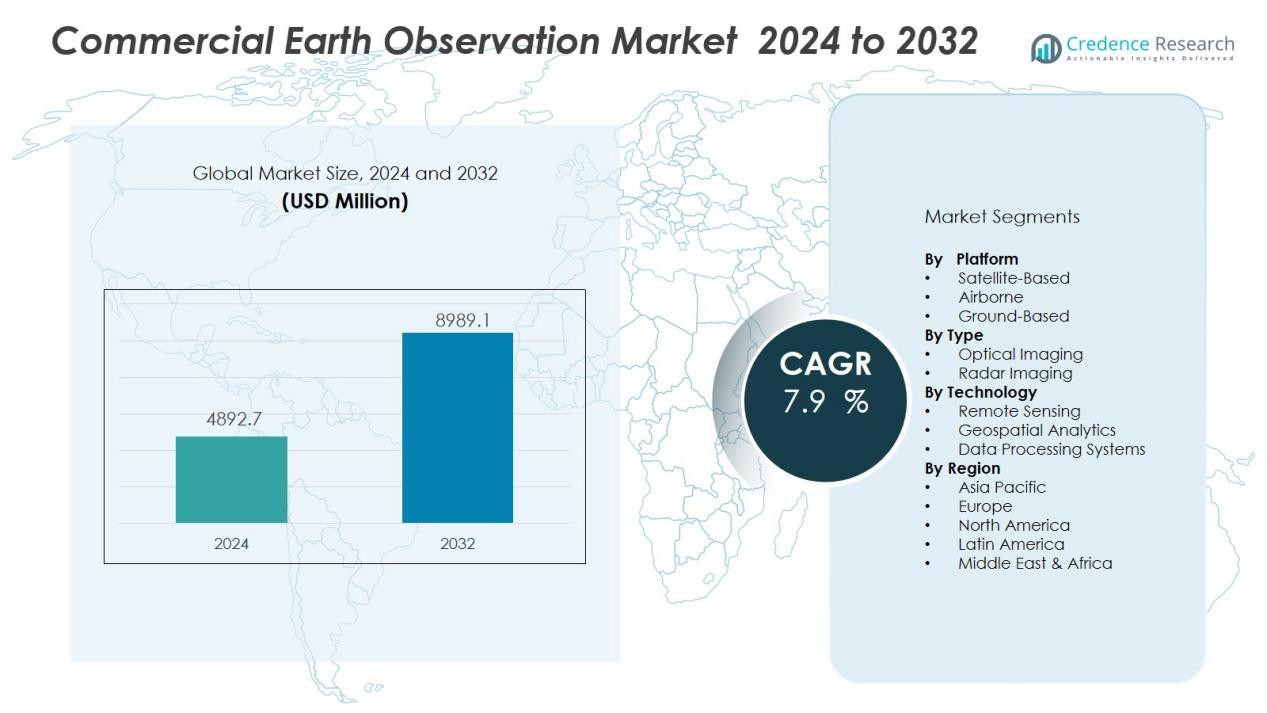

The Commercial earth observation market size was valued at USD 4892.7 million in 2024 and is anticipated to reach USD 8989.1 million by 2032, at a CAGR of 7.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Earth Observation Market Size 2024 |

USD 4892.7 Million |

| Commercial Earth Observation Market, CAGR |

7.9 % |

| Commercial Earth Observation Market Size 2032 |

USD 8989.1 Million |

Market growth is driven by the rising demand for near real-time data to support decision-making, growing applications of geospatial intelligence in commercial sectors, and the adoption of AI and machine learning for automated image interpretation. The increasing role of earth observation in climate change monitoring, natural resource management, and infrastructure development is further boosting demand. Additionally, public-private partnerships and the commercialization of space technologies are expanding service offerings and reducing operational costs.

Regionally, North America dominates the commercial earth observation market due to its robust space infrastructure, strong presence of leading satellite operators, and high defense and security spending. Europe follows closely, supported by the Copernicus program and private sector innovation. The Asia-Pacific region is expected to witness the fastest growth, driven by rapid satellite deployment programs in China, India, and Japan, along with increasing utilization of geospatial data in agriculture, disaster management, and urban planning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The commercial earth observation market was valued at USD 4,892.7 million in 2024 and is projected to reach USD 8,989.1 million by 2032, registering a CAGR of 7.9% from 2024 to 2032.

- Growing demand for high-resolution and near real-time imagery from sectors such as agriculture, mining, oil and gas, infrastructure, and environmental monitoring is a key growth driver.

- Technological advancements in satellite miniaturization, sensor capability, and AI-driven analytics are improving performance, cost efficiency, and accessibility of earth observation services.

- Geospatial intelligence is playing an increasingly vital role in strategic decision-making for both businesses and governments in applications such as border surveillance, infrastructure planning, and disaster preparedness.

- High capital requirements for satellite manufacturing, launch, and maintenance, along with stringent international regulations and data privacy concerns, present significant operational challenges.

- North America leads with 38.6% market share in 2024, supported by advanced space infrastructure, strong defense spending, and a concentration of key industry players, followed by Europe with 29.4% and Asia-Pacific with 22.8%.

- Public-private collaborations and the commercialization of space technologies are expanding service offerings, improving affordability, and fostering innovation, driving long-term market sustainability.

Market Drivers:

Growing Demand for High-Resolution and Real-Time Satellite Imagery:

The commercial earth observation market is witnessing robust growth due to increasing demand for high-resolution and near real-time imagery across multiple sectors. Industries such as agriculture, mining, oil and gas, infrastructure, and environmental monitoring are leveraging satellite data for operational planning and efficiency enhancement. The capability to capture detailed geospatial information enables accurate mapping, resource assessment, and risk management. Governments and private organizations are increasingly adopting these services for disaster response and security applications. This expanding scope of end-use applications continues to accelerate market adoption.

- For instance, Maxar’s WorldView-3 satellite delivers native commercial satellite imagery at a remarkable 31cm ground sample distance, enabling detailed analysis for applications such as urban planning and precision agriculture, and can collect up to 680,000km² of high-resolution imagery per day.

Advancements in Satellite Technology and Data Analytics:

Technological progress in satellite design, miniaturization, and sensor capability is significantly boosting the performance and cost efficiency of earth observation systems. It is now possible to deploy small satellite constellations capable of providing daily or even hourly updates. Integration of artificial intelligence and machine learning in data analytics enables automated image processing, pattern recognition, and predictive modeling. These advancements improve data delivery speed and accuracy, making satellite imagery more accessible to commercial users. Continuous innovation is enhancing the market’s value proposition for various industries.

- For instance, Planet Labs operates a constellation of over 200 Dove satellites that deliver multispectral imagery of the entire Earth with a spatial resolution of 3-5m, achieving near-daily coverage since 2017; the newer SuperDoves, introduced in 2021, offer enhanced imaging with eight spectral bands.

Rising Role of Geospatial Intelligence in Decision-Making:

The integration of geospatial intelligence into business and governmental decision-making processes is a key driver for the commercial earth observation market. Industries are increasingly relying on satellite-derived insights for market analysis, infrastructure planning, and environmental impact assessment. Governments use these capabilities for border surveillance, resource allocation, and disaster preparedness. It supports strategic planning by providing objective, accurate, and timely information. The growing recognition of geospatial intelligence as a vital tool is expanding its adoption across sectors.

Increased Public-Private Collaborations and Space Commercialization:

Collaboration between government space agencies and private companies is accelerating the availability and affordability of commercial earth observation services. Public investments in satellite infrastructure and open-access programs are fostering private innovation and market entry. It benefits from a growing number of partnerships focused on launching new satellites, improving imaging capabilities, and expanding distribution networks. Space commercialization trends are driving competitive pricing and broader service portfolios. These collaborations are ensuring long-term sustainability and scalability for the industry.

Market Trends:

Integration of Artificial Intelligence and Cloud-Based Platforms in Earth Observation Services:

A key trend shaping the commercial earth observation market is the integration of artificial intelligence (AI) and cloud-based platforms to enhance data accessibility and analytical capabilities. AI algorithms are increasingly applied to automate image classification, detect changes over time, and generate predictive insights for industries such as agriculture, energy, and urban development. Cloud platforms enable users to store, process, and share large volumes of satellite imagery without the need for complex on-premise infrastructure. This combination of AI and cloud technology reduces data processing time, improves accuracy, and allows for scalable, on-demand access to geospatial intelligence. It is enabling businesses and governments to derive actionable insights faster, increasing the value and application scope of satellite data. The shift toward AI-driven, cloud-enabled solutions is expected to accelerate innovation and adoption across commercial sectors.

- For instance, Planet Labs migrated its entire imagery processing pipeline to Google Cloud Platform, achieving a 6× increase in daily processing capacity. This shift has accelerated analytic feed delivery and supported processing of over 7 TB of data every 24 hours.

Expansion of Small Satellite Constellations and High-Revisit Capabilities:

The commercial earth observation market is experiencing rapid expansion in small satellite constellations, which provide high-revisit rates and frequent imaging capabilities. Companies are deploying fleets of compact, cost-efficient satellites that can capture images of the same location multiple times a day. This trend supports applications that require near real-time monitoring, such as disaster response, crop health tracking, maritime surveillance, and infrastructure management. The reduced manufacturing and launch costs of small satellites are encouraging both established players and new entrants to expand their fleets. It is also driving competition in offering higher resolution, wider coverage, and faster delivery of imagery. This growth in small satellite deployment is reshaping the market landscape, enabling more organizations to access timely and affordable earth observation data.

- For instance, BlackSky’s small satellite constellation achieved a world-leading revisit rate of up to 15 hourly visits per day over specific locations with its fleet of 12 high-resolution satellites, enhancing rapid monitoring for critical infrastructure and disaster response.

Market Challenges Analysis:

High Operational Costs and Capital-Intensive Infrastructure Requirements:

The commercial earth observation market faces significant challenges due to the high costs associated with satellite development, launch, and maintenance. Building advanced imaging satellites requires substantial investment in engineering, manufacturing, and testing. Launch expenses remain a major barrier for new entrants, despite declining prices from emerging space transportation providers. It must also contend with ongoing operational costs for ground stations, data storage, and processing infrastructure. These financial demands limit participation to well-funded organizations and slow market penetration in cost-sensitive sectors.

Regulatory Restrictions and Data Privacy Concerns:

Strict international regulations on satellite imaging and data distribution present another obstacle for the commercial earth observation market. Many countries enforce limitations on resolution, frequency of imaging, and access to sensitive geographic areas. Data privacy concerns, particularly in relation to surveillance and national security, can delay or restrict commercial applications. It must navigate complex compliance frameworks to operate across different jurisdictions. Regulatory uncertainty and evolving policies create operational risks for service providers. These constraints can limit market growth potential, especially for companies seeking to scale globally.

Market Opportunities:

Rising Demand for Climate Monitoring and Sustainable Resource Management:

The commercial earth observation market holds significant opportunities in supporting global climate monitoring and sustainability initiatives. Governments, NGOs, and private organizations are increasingly investing in satellite-based solutions to track deforestation, monitor water resources, and measure greenhouse gas emissions. It can deliver accurate, time-sensitive data to aid in climate resilience planning and environmental protection. Expanding commitments to net-zero targets are driving demand for high-quality geospatial intelligence. These applications open new revenue streams for service providers while contributing to environmental stewardship.

Growth Potential in Emerging Economies and Industry-Specific Applications:

Emerging economies in Asia, Africa, and Latin America are creating new opportunities for the commercial earth observation market through infrastructure development, smart city projects, and agricultural modernization. It can address sector-specific needs, such as precision farming, disaster management, and energy exploration, by providing targeted insights. Increasing affordability of small satellites and subscription-based data services is making adoption feasible for a wider range of users. Collaboration with local governments and industries can further expand market reach. These trends position the sector for sustained growth across diverse geographic and industrial landscapes.

Market Segmentation Analysis:

By Platform:

The commercial earth observation market is segmented into satellite-based, airborne, and ground-based platforms. Satellite-based platforms dominate due to their ability to provide global coverage, high-resolution imagery, and consistent data acquisition. Airborne platforms, including drones and aircraft, are gaining traction for localized, high-frequency monitoring needs, particularly in agriculture, infrastructure inspection, and disaster response. Ground-based platforms support calibration, validation, and data integration for end-user applications.

- For instance, ICEYE operates a synthetic aperture radar constellation with a mean revisit time of 20 hours at the equator, offering customers global access to sub-daily imagery; its fleet is continually growing, aiming for 18 satellites to provide persistent change detection and daily monitoring worldwide.

By Type:

The market is categorized into optical imaging and radar imaging. Optical imaging holds the largest share due to its wide adoption in mapping, environmental monitoring, and urban planning. It offers detailed, high-resolution imagery under clear weather conditions. Radar imaging is expanding in demand due to its capability to capture data in all weather and lighting conditions, making it critical for defense, maritime surveillance, and disaster management.

- For instance, ICEYE’s small synthetic-aperture radar microsatellites achieve a 25 cm azimuth resolution in spotlight mode, enabling vessel identification in ports under cloud cover or darkness. (25 cm).

By Technology:

Key technologies include remote sensing, geospatial analytics, and data processing systems. Remote sensing forms the backbone of data acquisition, while geospatial analytics transforms raw imagery into actionable insights. It is increasingly supported by AI and machine learning for automated classification, anomaly detection, and predictive modeling. Data processing systems are evolving toward cloud-based solutions, enabling scalable, real-time analysis and improved accessibility for diverse industry applications.

Segmentations:

By Platform:

- Satellite-Based

- Airborne

- Ground-Based

By Type:

- Optical Imaging

- Radar Imaging

By Technology:

- Remote Sensing

- Geospatial Analytics

- Data Processing Systems

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America accounted for 38.6% market share in the commercial earth observation market in 2024, supported by its advanced space infrastructure and strong presence of key industry players. The region benefits from high government spending on defense, homeland security, and environmental monitoring programs. Established satellite operators and analytics firms are driving innovation through AI integration and advanced imaging technologies. It also benefits from extensive commercial applications in agriculture, energy, and urban planning. Regulatory support for commercial space ventures is fostering new investments and partnerships. The combination of technological leadership and high demand from multiple sectors secures North America’s dominant position.

Europe:

Europe held 29.4% market share in 2024, driven by robust government-backed initiatives such as the Copernicus program and increased private sector participation. The region has a strong track record in satellite manufacturing, remote sensing, and climate monitoring services. It benefits from a coordinated approach between public institutions and commercial enterprises to expand data accessibility. European companies are focusing on high-resolution imaging, maritime surveillance, and environmental applications. The market is further supported by EU policies promoting open data and sustainable resource management. Rising investments in analytics platforms and downstream services enhance Europe’s competitive advantage.

Asia-Pacific :

Asia-Pacific captured 22.8% market share in 2024 and is projected to register the fastest growth during the forecast period. The region’s expansion is fueled by large-scale satellite deployment programs in China, India, and Japan. Governments and private firms are investing heavily in space capabilities to support national security, disaster management, and agricultural productivity. It is also witnessing increased adoption of geospatial intelligence in infrastructure planning and environmental monitoring. Lower satellite production costs and growing local manufacturing capacity are boosting accessibility to advanced imaging services. Rising commercial and governmental collaborations are further strengthening the regional market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AIRBUS

- Maxar Technologies

- Planet Labs PBC.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation.

- Northrop Grumman.

- SARsat Arabia

- ICEYE

- Thales

- ImageSat International NV

Competitive Analysis:

The Commercial earth observation market t features intense competition driven by advancements in satellite technology, data analytics, and AI integration. Leading players such as Airbus, Maxar Technologies, Planet Labs PBC, L3Harris Technologies, Inc., Lockheed Martin Corporation, Northrop Grumman, and SARsat Arabia leverage extensive satellite constellations and diversified service portfolios to cater to defense, environmental monitoring, and commercial applications. It benefits from high entry barriers due to significant capital requirements, regulatory compliance, and the need for specialized expertise. Companies focus on strategic partnerships, mergers, and technology upgrades to expand global coverage and improve data resolution. Emerging private players are intensifying competition by offering cost-effective small-satellite solutions. The market rewards innovation, operational efficiency, and reliability, prompting continuous investment in high-throughput satellites and real-time imaging capabilities. Strong brand reputation, long-term contracts, and integration with downstream analytics platforms remain critical for sustaining market leadership.

Recent Developments:

- In July 2025, Airbus Helicopters began flight-testing the H160M Guépard, the militarized version of the H160 developed for the French Armed Forces as part of the Joint Light Helicopter programme.

- In June 2025, Maxar signed a strategic partnership agreement with Saab to co-develop space-based C5ISR systems and autonomous battlespace solutions for Europe, leveraging Maxar’s geospatial intelligence products.

- In January 2025, Planet Labs successfully launched the high-resolution Pelican-2 satellite and 36 SuperDoves as part of SpaceX’s Transporter-12 rideshare mission, expanding its Earth imaging fleet.

Market Concentration & Characteristics:

The commercial earth observation market is moderately concentrated, with a mix of established global players and emerging technology-driven entrants. It features strong competition among satellite operators, analytics providers, and integrated service companies, each aiming to expand capabilities in high-resolution imaging, rapid data delivery, and advanced analytics. Leading participants maintain an edge through proprietary satellite constellations, strategic partnerships, and government contracts. The market is characterized by high capital requirements, stringent regulatory compliance, and continual innovation in imaging technology and data processing. Growing adoption across defense, agriculture, infrastructure, and environmental sectors sustains demand, while advancements in small satellite technology and AI integration are reshaping competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on Platform, Type, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing integration of AI, machine learning, and cloud computing will enhance data processing speed and analytical accuracy.

- Expansion of small satellite constellations will improve revisit times and enable near real-time global monitoring capabilities.

- Rising demand for climate monitoring and disaster management solutions will create new growth avenues for service providers.

- Enhanced affordability of satellite data through subscription-based and pay-per-use models will broaden user adoption across sectors.

- Collaboration between public agencies and private companies will drive innovation and expand service portfolios.

- Growing adoption of geospatial intelligence in infrastructure planning, precision agriculture, and energy exploration will diversify revenue streams.

- Technological advancements in hyperspectral and radar imaging will enable deeper insights and broaden application scope.

- Emerging economies will increase investments in space technology to boost national security, resource management, and economic development.

- Regulatory evolution toward open data policies will improve market access and stimulate downstream service growth.

- Continued miniaturization of satellites and cost-efficient launch solutions will lower entry barriers and intensify market competition.