Market Overview

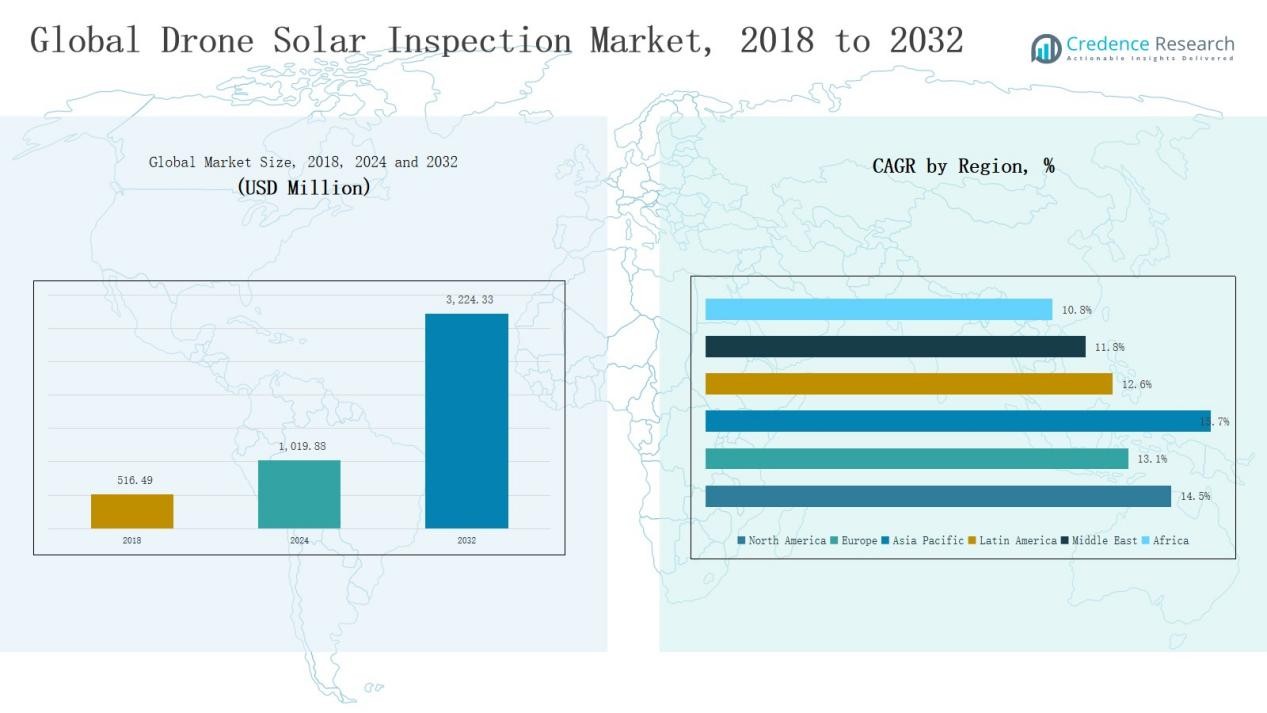

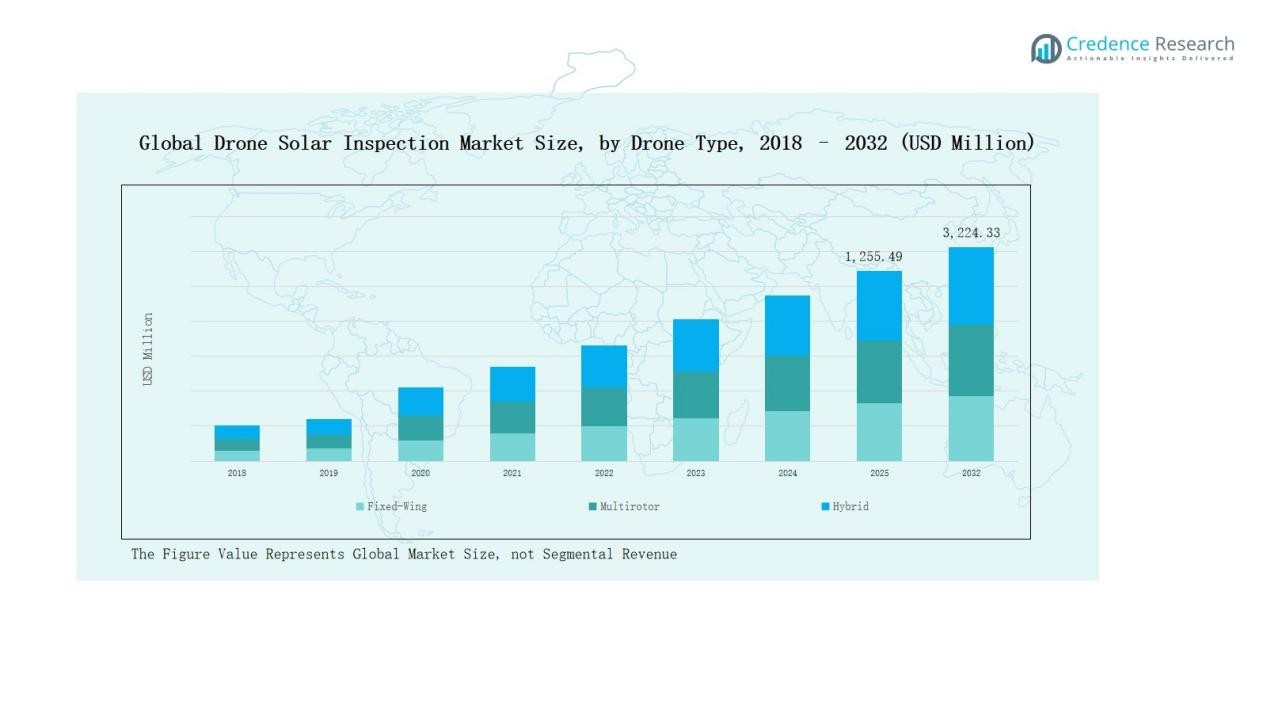

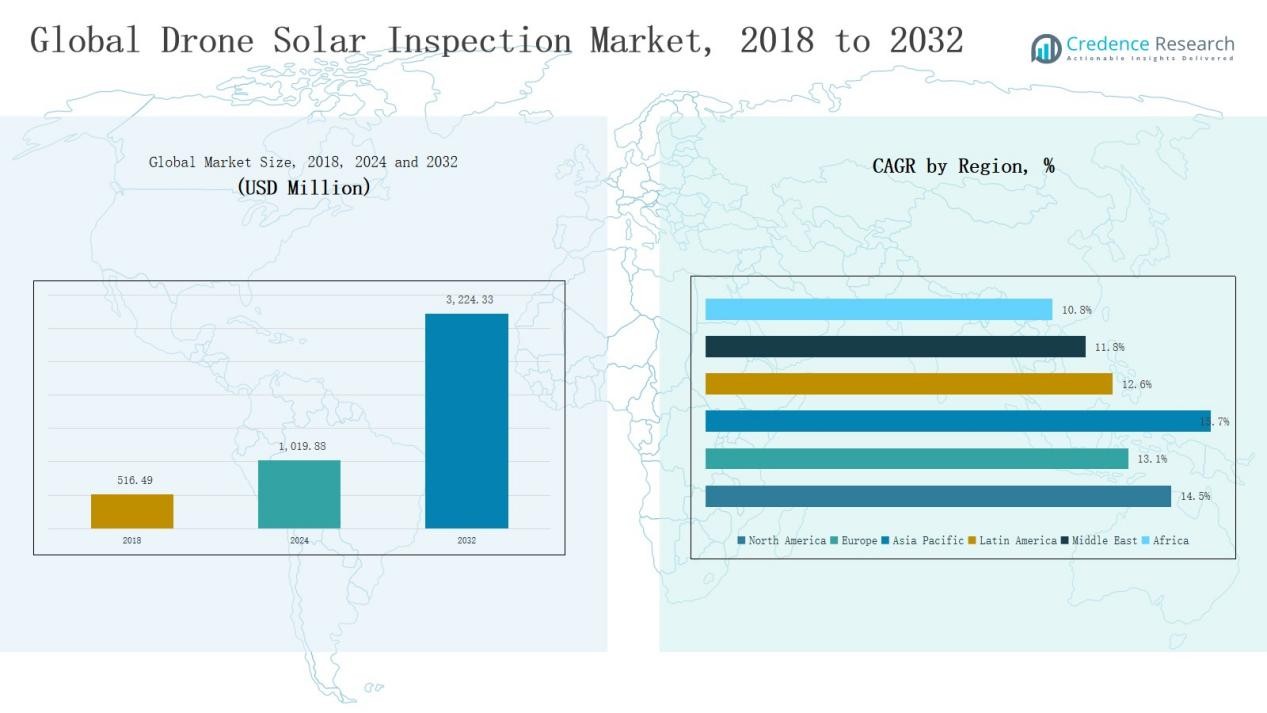

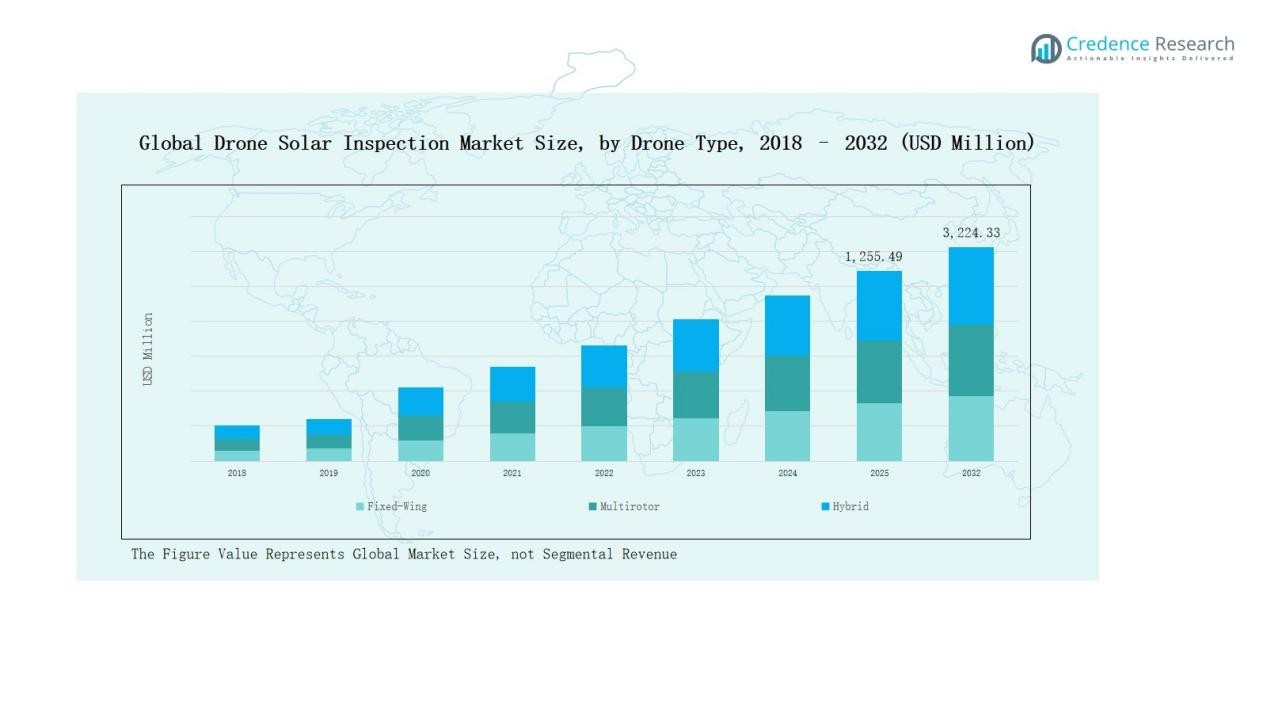

Global Drone Solar Inspection Market size was valued at USD 516.49 million in 2018 to USD 1,019.88 million in 2024 and is anticipated to reach USD 3,224.33 million by 2032, at a CAGR of 14.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Solar Inspection Market Size 2024 |

USD 1,019.88 Million |

| Drone Solar Inspection Market, CAGR |

14.42% |

| Drone Solar Inspection Market Size 2032 |

USD 3,224.33 Million |

The Global Drone Solar Inspection Market is shaped by leading players such as DJI Enterprise, Terra Drone, Aerodyne Measure, DroneDeploy, Parrot Group, ABJ Drones, DRONE VOLT Group, Airpix, Sitemark, Skylark Drones, and PrecisionXYZ. These companies strengthen their positions through advanced drone portfolios, AI-driven analytics, and strategic partnerships with solar operators. They focus on enhancing inspection accuracy, expanding service offerings, and scaling operations across key solar markets. Regionally, North America leads the market with a 38% share in 2024, driven by large-scale solar farm deployments, advanced infrastructure, and early adoption of drone-based predictive maintenance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Drone Solar Inspection Market grew from USD 516.49 million in 2018 to USD 1,019.88 million in 2024, expanding at 14.42% CAGR.

- Multirotor drones lead by drone type with a 65% share in 2023, while fixed-wing drones grow fastest due to demand in large-scale solar farms.

- Thermal inspection dominates applications, accounting for 80% of revenue, supported by predictive maintenance needs in PV farms, while panel soiling detection shows rising importance.

- Utility-scale solar farms hold over 56% of market revenue, driven by frequent inspection needs and advanced analytics, followed by commercial rooftops and residential installations.

- North America leads with 38% share in 2024, Asia Pacific grows fastest with 26%, while Europe follows with 16%, supported by strong renewable adoption policies.

Market Segment Insights

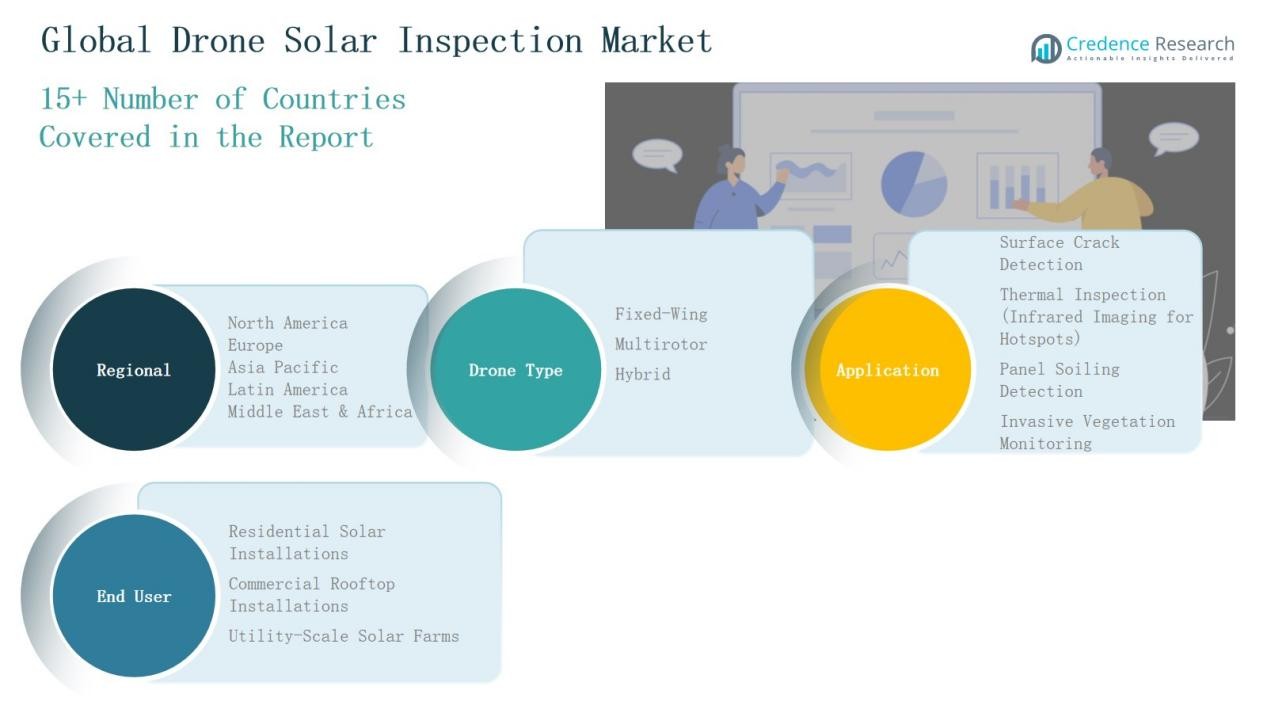

By Drone Type

Multirotor drones dominate the global drone solar inspection market with 65% share as of 2023. Fixed-wing drones hold the remaining ~35% but are the fastest-growing sub-segment. Multirotor’s dominance stems from its agility, ability to hover, ease of deployment, and suitability for close-up inspections. Fixed-wing is driven by demand in large solar farms, where long flight duration and coverage per flight matter. Hybrid drones are emerging but constitute a smaller portion currently, due to higher cost and complexity.

- For instance, DJI launched the Mavic 3 Multispectral, integrating a multispectral sensor for precision agricultural and solar panel inspections, reinforcing the dominance of multirotor platforms.

By Application

Thermal inspection (infrared imaging for hotspots) serves as a core driver, especially in large-scale PV farms needing predictive maintenance. Visual methods like surface crack detection and soiling detection follow, but thermal leads due to its ability to detect faults before failure. In terms of share, 80% of drone solar inspection revenue comes from PV-related inspection applications. Panel soiling detection is increasing, driven by efficiency losses from dust and environmental debris. Invasive vegetation monitoring is a niche but growing segment in utility-scale installations. Surface crack detection remains important for warranty, quality control, and maintenance tasks.

- For instance, EVT deployed their EyeCheck Thermo thermal camera system on drones for large-scale solar farms, achieving over 70% reduction in inspection time while detecting early faults like hotspots and defective modules.

By End User

Utility-scale solar farms represent the dominant end user segment, capturing the majority of market revenue, often over 56%, thanks to scale, frequent inspection needs, and large installations. Commercial rooftop installations follow, driven by regulatory requirements and efficiency mandates. Residential solar installations are smaller in revenue share but growing quickly due to declining panel costs and incentives. Utility-scale users demand long-flight drones, high throughput data processing, and predictive analytics to minimize downtime. Commercial and residential users emphasize safety, cost, ease of deployment, and smaller drones.

Key Growth Drivers

Rising Demand for Efficient Solar Asset Management

The increasing global solar capacity is creating a strong need for reliable inspection solutions. Drone-based solar inspections enable faster detection of defects compared to manual methods, reducing downtime and improving energy yield. Their ability to cover large-scale solar farms with precision and efficiency makes them a preferred choice among utility operators. Growing focus on predictive maintenance and minimizing operational costs further strengthens adoption. This efficiency factor continues to drive strong demand, particularly in regions with expanding solar infrastructure.

- For instance, Robotics company Percepto received FAA approval for its drone-in-a-box system, enabling fully autonomous solar site inspections in the United States, significantly lowering operational costs for large utility operators.

Advancements in Drone and Imaging Technologies

Rapid improvements in drone hardware, thermal imaging sensors, and AI-powered analytics are boosting inspection accuracy. High-resolution imaging and advanced data processing platforms allow operators to detect surface cracks, hotspots, and soiling with better precision. The integration of autonomous flight features reduces dependency on skilled pilots, lowering operational barriers. These technological enhancements not only optimize inspection quality but also reduce costs. As drone and imaging technology continues to evolve, solar inspection efficiency is expected to increase significantly, reinforcing market growth.

- For instance, GeoWGS84 deployed drone inspections across utility-scale solar farms, utilizing thermal imaging and AI analytics to reduce manual inspection time by 75%, enabling faster detection of panel hotspots and dirt accumulation.

Supportive Regulations and Renewable Energy Policies

Government initiatives promoting renewable energy adoption are indirectly driving demand for drone-based solar inspections. Many countries are implementing ambitious solar capacity targets, which increase the need for efficient monitoring solutions. Supportive regulations around drone usage for industrial applications are also enabling faster market adoption. Subsidies, tax benefits, and renewable energy mandates encourage large-scale solar deployment, where drones become essential for maintenance. With strong policy backing, both developed and emerging economies are witnessing accelerated adoption of drone inspection solutions in solar energy projects.

Key Trends & Opportunities

Integration of Artificial Intelligence and Predictive Analytics

AI-driven platforms are emerging as a major trend in drone solar inspections. Advanced algorithms enable predictive maintenance by analyzing inspection data to forecast potential failures. This reduces downtime and improves solar farm efficiency. AI also enhances defect classification, automates data reporting, and supports decision-making for asset managers. The integration of machine learning into drone systems creates significant opportunities for software developers, analytics providers, and inspection service companies. This trend is expected to transform solar O&M practices globally.

- For instance, Folio3 AI’s drone software uses thermal imaging to identify hotspots, diode failures, shattered panels, and dirt accumulation, enabling rapid and precise defect detection to maximize solar farm efficiency.

Expansion of Utility-Scale Solar Projects in Emerging Markets

The growing adoption of solar energy in countries such as India, China, Brazil, and South Africa presents major opportunities for drone inspection providers. Utility-scale projects in these markets are expanding rapidly, requiring efficient, scalable inspection solutions. Drones help reduce inspection time and ensure higher return on investment for large solar operators. Local governments’ focus on renewable energy expansion and improving grid reliability further boosts demand. This expansion into emerging economies is expected to be a key growth opportunity in the coming decade.

- For instance, Tata Power Solar commissioned a 150 MW solar project in Rajasthan, India, leveraging drone inspections to optimize maintenance and reduce downtime. This large-scale initiative supports India’s growing renewable energy goals.

Key Challenges

High Initial Costs of Advanced Drone Systems

While drones reduce long-term inspection costs, the initial investment in advanced hardware and software remains high. Thermal imaging drones and AI-powered analytics platforms involve significant capital expenditure. Small-scale solar operators, especially in developing countries, may find it challenging to afford such solutions. Limited budgets often restrict adoption, slowing market penetration in cost-sensitive regions. Addressing affordability through leasing models or shared service platforms is crucial to overcoming this challenge.

Regulatory Restrictions and Airspace Limitations

Strict drone regulations in several countries pose hurdles for widespread adoption. Airspace restrictions, licensing requirements, and operational limitations often delay deployment in large solar farms. Compliance with varying international and local regulatory frameworks adds complexity for service providers. These challenges restrict scalability and discourage new entrants in the market. Evolving regulations are expected to gradually ease restrictions, but navigating compliance remains a major challenge for stakeholders in the short term.

Data Management and Security Concerns

Drone solar inspections generate vast amounts of image and thermal data, requiring secure storage and processing. Managing large datasets poses challenges for both operators and clients, particularly in regions with limited digital infrastructure. Concerns around data privacy, cybersecurity, and integration with existing asset management systems also affect adoption. Without robust cloud platforms and security measures, stakeholders face risks of data breaches or loss. Building secure, scalable data management solutions is essential to addressing this challenge effectively.

Regional Analysis

North America

North America leads the global drone solar inspection market with a 38% share in 2024, valued at USD 440.39 million, up from USD 225.37 million in 2018. The market is projected to reach USD 1,396.17 million by 2032, advancing at a CAGR of 14.5%. The region’s growth is supported by advanced solar infrastructure, early adoption of drone analytics, and strong policy incentives. The U.S. dominates due to large utility-scale solar farms and established drone service providers, ensuring continuous demand for efficient inspection solutions.

Europe

Europe accounts for a 16% share in 2024, valued at USD 187.55 million, rising from USD 100.26 million in 2018. The market is forecast to reach USD 541.35 million by 2032 at a CAGR of 13.1%. Growth is driven by stringent energy efficiency regulations, strong renewable targets, and widespread solar adoption across Germany, France, and Spain. Drone inspections are gaining momentum in utility-scale projects to enhance operational efficiency and reduce maintenance costs. Favorable policies and cross-border energy initiatives continue to strengthen Europe’s role in the global market.

Asia Pacific

Asia Pacific is the fastest-growing region, holding a 26% share in 2024, valued at USD 305.21 million, compared to USD 146.23 million in 2018. By 2032, the market is expected to reach USD 1,054.03 million, expanding at a CAGR of 15.7%. Growth is fueled by massive solar expansion in China, India, and Japan, along with large-scale renewable energy targets. Drones provide efficient solutions for monitoring vast installations, optimizing performance, and reducing downtime. Strong government support, coupled with digital transformation in asset management, positions Asia Pacific as the key growth hub globally.

Latin America

Latin America represents a 4% share in 2024, worth USD 46.67 million, up from USD 23.94 million in 2018. The market is projected to grow to USD 130.26 million by 2032, at a CAGR of 12.6%. Brazil and Mexico lead adoption, driven by favorable renewable policies and rapid solar capacity expansion. Drone solutions are increasingly valued for lowering inspection costs and improving efficiency in large solar farms. Rising private investments and regional efforts to diversify energy portfolios beyond fossil fuels are expected to further accelerate adoption.

Middle East

The Middle East holds a 2% share in 2024, valued at USD 24.30 million, up from USD 13.55 million in 2018. The market is expected to reach USD 63.93 million by 2032, registering a CAGR of 11.8%. Countries such as the UAE and Saudi Arabia are spearheading growth with mega solar projects aligned with national energy diversification strategies. Drones are increasingly deployed for inspection in challenging desert environments, reducing downtime and ensuring efficiency. Government commitments to renewable energy expansion support steady adoption in the region.

Africa

Africa contributes a 1% share in 2024, valued at USD 15.76 million, compared to USD 7.14 million in 2018. The market is projected to reach USD 38.60 million by 2032, growing at a CAGR of 10.8%. Adoption remains modest but is gaining traction in South Africa, Egypt, and Kenya. Drones are helping reduce maintenance costs and improve inspection efficiency for both utility-scale and off-grid solar projects. Expanding electrification initiatives, rural solar programs, and international funding are expected to gradually accelerate drone-based solar inspections in the region.

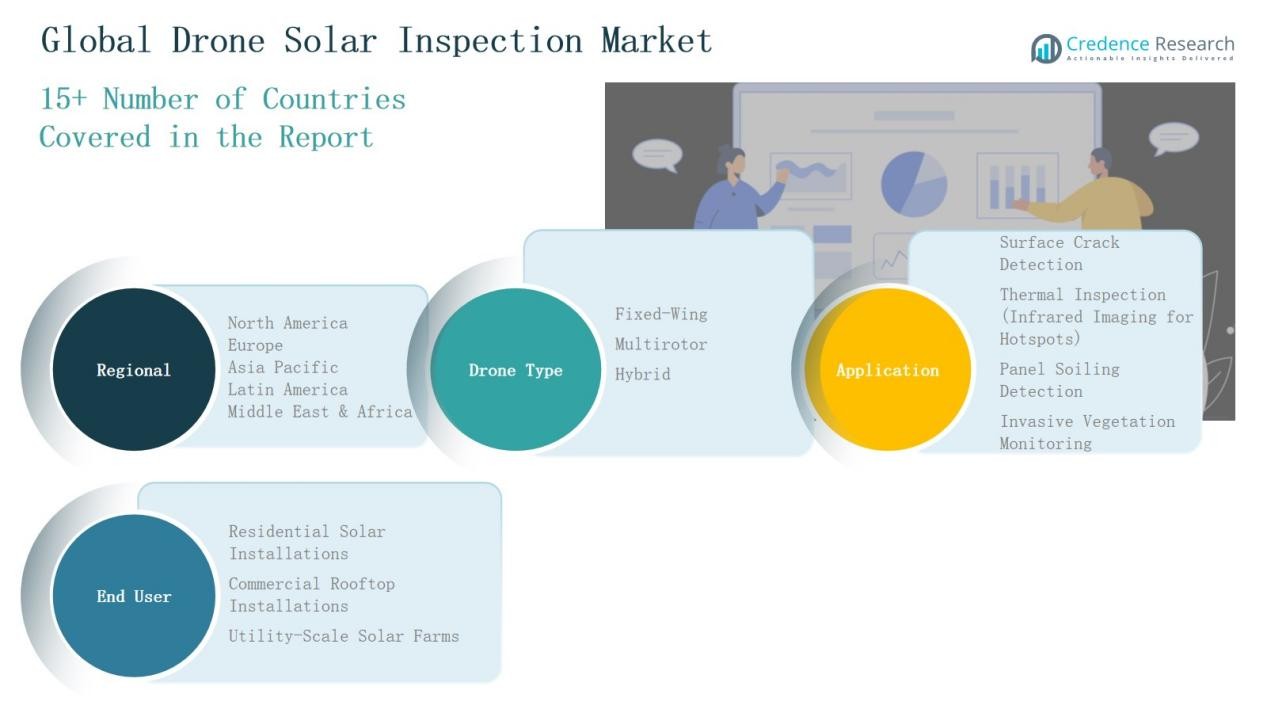

Market Segmentations:

By Drone Type

- Fixed-Wing

- Multirotor

- Hybrid

By Application

- Surface Crack Detection

- Thermal Inspection (Infrared Imaging for Hotspots)

- Panel Soiling Detection

- Invasive Vegetation Monitoring

By End User

- Residential Solar Installations

- Commercial Rooftop Installations

- Utility-Scale Solar Farms

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The global drone solar inspection market is characterized by a moderately consolidated structure, with several leading players leveraging advanced technologies to strengthen market presence. Key companies such as DJI Enterprise, Terra Drone, Aerodyne Measure, DroneDeploy, and Parrot Group dominate through diverse drone portfolios, thermal imaging solutions, and AI-driven analytics platforms. These players emphasize innovation in data processing, predictive maintenance, and autonomous flight systems to enhance inspection efficiency. Regional providers, including ABJ Drones, Skylark Drones, and Airpix, cater to localized demand, offering cost-effective services tailored to utility and commercial solar projects. Strategic partnerships with solar farm operators and renewable energy developers are common, enabling firms to expand service reach and build long-term client networks. Additionally, companies are focusing on acquisitions and R&D investments to diversify offerings and remain competitive. The landscape continues to evolve as new entrants introduce niche inspection services, while established players consolidate through technological advancements and global expansion strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- DJI Enterprise

- Terra Drone

- Aerodyne Measure

- DroneDeploy

- Parrot Group

- ABJ Drones

- DRONE VOLT Group

- Airpix

- Sitemark

- Skylark Drones

- PrecisionXYZ

Recent Developments

- In December 2024, Raptor Maps, a solar drone inspection software company, secured $35 million in Series C funding led by Maverix Private Equity. This funding will support enhancements in solar automation, work management, machine-learning insights, and product development aimed at improving solar asset management globally.

- In January 2025, Hylio launched a new drone designed to automate solar panel maintenance, including cleaning panels and treating weeds, marking a product launch in the drone solar inspection and maintenance market.

- In July 2025, Nextracker launched a new AI & Robotics business after acquiring key technologies to strengthen drone-based solar inspection and automation.

- In July 2025, Horizonview Technologies unveiled its new Aerial Inspection Platform (Software 2.0) designed to improve efficiency in solar project inspections.

Report Coverage

The research report offers an in-depth analysis based on Drone Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of drones will increase as solar projects continue expanding worldwide.

- Multirotor drones will remain the preferred choice for detailed and flexible inspections.

- Fixed-wing and hybrid drones will gain traction in large-scale solar farms requiring long coverage

- AI-driven analytics will transform inspection data into predictive maintenance insights.

- Thermal imaging will remain central for hotspot detection and efficiency monitoring.

- Panel soiling detection will see higher demand as operators focus on performance optimization.

- Utility-scale farms will drive most inspection demand due to operational complexity.

- Service providers will expand offerings through partnerships with solar developers and operators.

- Regional adoption will grow rapidly in Asia Pacific and emerging solar markets.

- Data management and integration with asset monitoring platforms will become a key differentiator.