Market Overview:

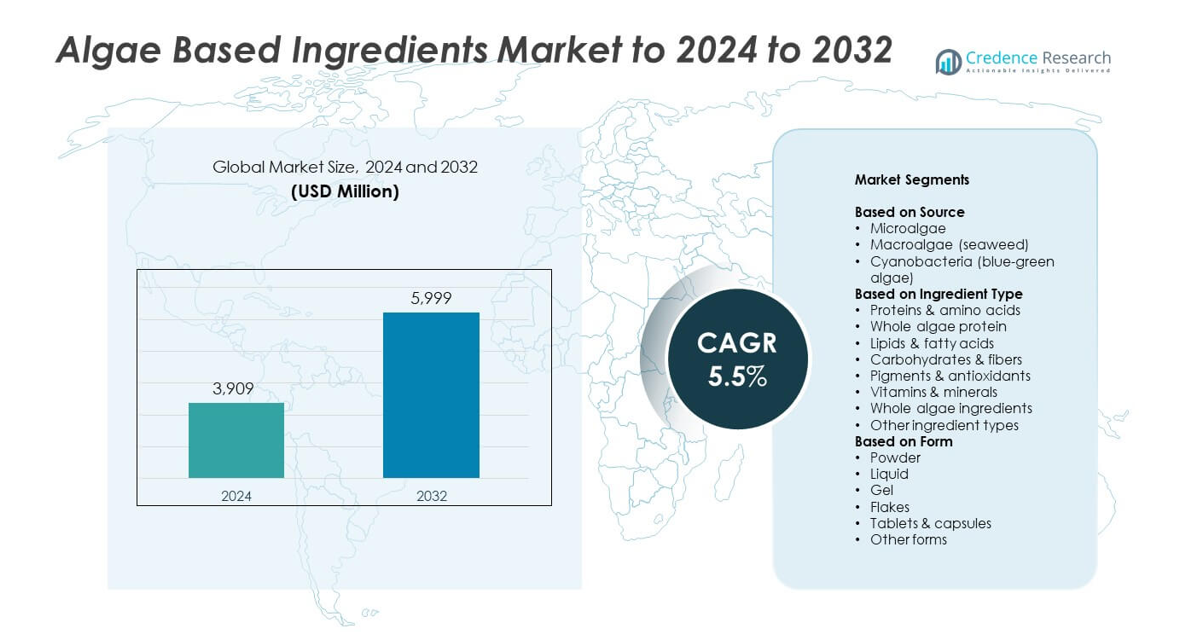

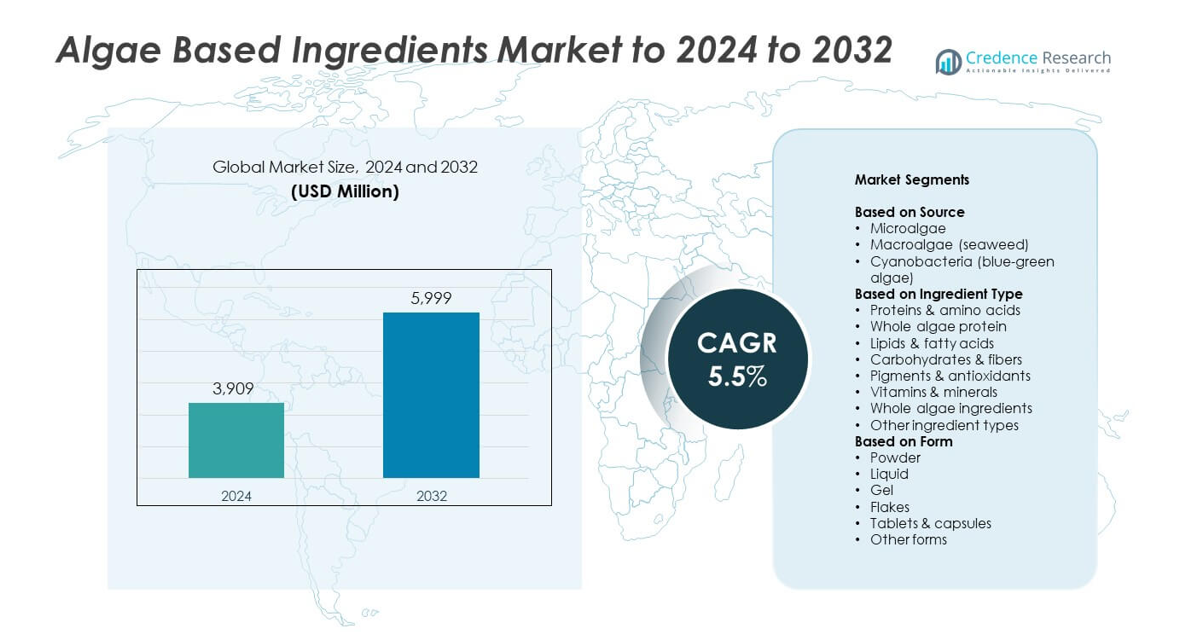

Algae Based Ingredients Market size was valued at USD 3,909 million in 2024 and is anticipated to reach USD 5,999 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Based Ingredients Market Size 2024 |

USD 3,909 million |

| Algae Based Ingredients Market, CAGR |

5.5% |

| Algae Based Ingredients Market Size 2032 |

USD 5,999 million |

The algae-based ingredients market is led by major players including Corbion, dsm-firmenich, Cargill Inc., Triton, Aliga Microalgae, and CP Kelco USA Inc., which collectively dominate global production through advanced biotechnology and sustainable sourcing practices. These companies focus on expanding algae cultivation and extraction capacities to meet rising demand across food, nutraceutical, and cosmetic applications. North America emerged as the leading region with a 34.2% market share in 2024, driven by strong investment in algae-based nutrition and functional ingredients. Europe followed closely with a 30.5% share, supported by strict sustainability regulations and growing consumer preference for natural, plant-based products.

Market Insights

- The algae-based ingredients market was valued at USD 3,909 million in 2024 and is projected to reach USD 5,999 million by 2032, growing at a CAGR of 5.5%.

- Rising consumer demand for plant-based, nutrient-rich, and sustainable ingredients is driving adoption across food, nutraceutical, and cosmetic industries.

- Increasing applications in functional foods, supplements, and natural colorants are shaping market trends, supported by technological advancements in algae cultivation and extraction.

- The market is competitive, with players focusing on R&D, sustainable sourcing, and partnerships to enhance scalability and product innovation.

- North America led the market with a 34.2% share, followed by Europe at 30.5% and Asia-Pacific at 25.7%, while the microalgae segment dominated by source with a 52.7% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The microalgae segment dominated the algae-based ingredients market with a 52.7% share in 2024. Microalgae are rich in proteins, omega-3 fatty acids, and antioxidants, making them ideal for food, nutraceutical, and cosmetic applications. Their rapid growth cycle and minimal resource requirements also support large-scale sustainable production. Demand is increasing as companies adopt photobioreactor technologies to enhance yield efficiency. Firms such as Corbion and AlgaEnergy are expanding microalgae-based ingredient portfolios for functional foods, promoting clean-label and plant-based formulations that align with global dietary shifts.

- For instance, Allmicroalgae reports total production volume of 2,000 m³ and delivers about 100 tons of dried microalgal biomass per year, supporting large-scale microalgae supply.

By Ingredient Type

Proteins and amino acids led the segment with a 38.6% market share in 2024. Their high nutritional profile and digestibility drive inclusion in functional foods, sports nutrition, and dietary supplements. The growing preference for plant-based protein sources supports adoption across vegan product lines. Innovations in extraction technologies enhance protein purity and concentration from algae strains. Companies such as Algatech and Triton Algae Innovations are advancing algae-derived protein formulations with superior amino acid balance, appealing to manufacturers seeking sustainable and allergen-free protein alternatives.

- For instance, Cyanotech’s Hawaiian Spirulina Pacifica™ powder contains approximately 67 grams of protein per 100 grams, as stated in a typical analysis document on their website. Furthermore, a document detailing the company’s “Gold Standard for Spirulina” specifies a standard of “pure c-Phycocyanin greater than 5%

By Form

The powder segment held the largest share at 47.9% in 2024, driven by its ease of storage, longer shelf life, and compatibility with food and cosmetic formulations. Powdered algae ingredients are used extensively in beverages, bakery, and supplement products due to high nutrient density and flexible application. The form also offers efficient blending and transport benefits for industrial users. Manufacturers such as Allmicroalgae and Cyanotech Corporation are investing in advanced drying technologies to retain bioactive compound stability and improve nutritional performance in powdered algae ingredients.

Key Growth Drivers

Rising Demand for Plant-Based and Sustainable Ingredients

The growing preference for natural, plant-based, and environmentally sustainable ingredients is driving algae-based ingredient adoption. Consumers are increasingly choosing vegan and clean-label products with high nutritional value. Algae provide proteins, omega-3 fatty acids, and antioxidants, making them suitable for functional foods, cosmetics, and dietary supplements. Their low environmental footprint compared to traditional crops enhances their appeal for eco-conscious brands. Major food manufacturers are integrating algae-derived proteins and lipids into new product lines to meet sustainability goals and evolving consumer expectations.

- For instance, dsm-firmenich’s life’sDHA® B54-0100 provides 545 mg DHA and 80 mg EPA per gram, enabling compact, plant-based omega-3 dosing for clean-label foods and supplements.

Expanding Applications Across Food, Nutraceutical, and Cosmetic Industries

The versatility of algae-based ingredients across multiple industries significantly boosts market growth. These ingredients are widely used in food and beverages, dietary supplements, pharmaceuticals, and personal care formulations. In the nutraceutical sector, algae-derived omega-3 fatty acids are emerging as a sustainable alternative to fish oil. Similarly, cosmetics increasingly use algae extracts for their anti-aging and moisturizing properties. The broad functional benefits of algae-based ingredients continue to attract manufacturers seeking natural, multifunctional, and performance-enhancing compounds for high-value applications.

- For instance, Sophie’s Bionutrients demonstrated a microalgae-based burger patty delivering about 25 g protein in a ~60 g serving, showing high-protein, allergen-lean applications in mainstream foods.

Technological Advancements in Algae Cultivation and Extraction

Continuous progress in cultivation systems and extraction processes is accelerating algae ingredient commercialization. Advanced photobioreactors, controlled fermentation, and enzyme-assisted extraction techniques are improving yield, purity, and nutrient retention. These innovations enable consistent large-scale production while reducing operational costs and carbon emissions. The adoption of precision biotechnology supports the development of strain-specific ingredients tailored for food, cosmetic, and pharmaceutical applications. Improved scalability and efficiency are making algae-based ingredients a cost-effective and reliable alternative to conventional plant or marine sources.

Key Trends & Opportunities

Emergence of Functional Food and Beverage Products

The rise of functional food and beverages represents a major opportunity for algae-based ingredients. Consumers are increasingly turning to nutrient-rich products that support immunity, heart health, and cognitive performance. Algae-derived proteins, lipids, and pigments are being incorporated into smoothies, dairy alternatives, and snacks. Their natural colorants and antioxidant properties also enhance product appeal. The shift toward wellness-driven consumption continues to expand algae ingredient integration across mainstream food brands and private-label functional product portfolios.

- For instance, AstaReal commercializes finished softgels with 2, 4, 6, or 12 mg natural astaxanthin per capsule, matching the surge in functional supplements and fortified beverages.

Growing Investment in Bioinnovation and Circular Economy

Rising global investment in biotechnology and the circular economy is opening new avenues for algae-based ingredient producers. Algae offer the potential for carbon capture and wastewater utilization, making them central to sustainable production models. Companies are leveraging these features to position algae as a key bioresource for future green industries. Collaborations between food, cosmetic, and energy sectors are fostering new product development pipelines, encouraging large-scale algae cultivation and extraction facilities in Europe, North America, and Asia-Pacific.

- For instance, AstaReal’s Gustavsberg operation feeds more than 15 million kWh of recovered heat yearly into the local network, illustrating circular-economy gains tied to algae cultivation.

Key Challenges

High Production and Processing Costs

Despite strong market potential, algae-based ingredient production remains cost-intensive. Cultivation, harvesting, and extraction processes require sophisticated equipment and energy inputs, which limit scalability. High operational costs restrict market access for smaller players and raise end-product prices. Manufacturers are focusing on optimizing supply chains and adopting automation to reduce expenses. Achieving cost parity with conventional plant-based ingredients remains a critical challenge that must be addressed to sustain long-term market growth and competitiveness.

Regulatory and Standardization Barriers

Regulatory uncertainty and lack of standardized quality parameters hinder the broader acceptance of algae-based ingredients. Approval timelines for food and cosmetic applications vary across regions, creating delays in product launches. Inconsistent labeling and safety standards affect consumer trust and international trade. The industry needs harmonized global regulations to ensure transparency, safety, and efficacy. Clearer guidelines for algae species, cultivation methods, and permissible concentrations would accelerate market adoption and encourage greater investment in the sector.

Regional Analysis

North America

North America held a 34.2% share of the algae-based ingredients market in 2024, driven by strong demand for natural and sustainable food additives, supplements, and cosmetics. The United States dominates regional growth due to increasing investments in biotechnology and algae cultivation facilities. Companies focus on incorporating algae-derived proteins, lipids, and pigments into plant-based foods and nutraceuticals. Supportive regulations promoting bio-based products and a growing consumer preference for vegan diets further enhance adoption. Expanding applications in pharmaceuticals and personal care products continue to boost market penetration across the region.

Europe

Europe accounted for a 30.5% share of the global algae-based ingredients market in 2024. The region benefits from stringent sustainability regulations, government support for algae farming, and strong R&D investments. Countries such as Germany, France, and the Netherlands lead advancements in microalgae production and extraction technologies. The expanding functional food and cosmetics sectors drive consistent demand for algae proteins and pigments. European consumers’ preference for natural, traceable ingredients fuels market expansion, while the EU’s Green Deal and carbon neutrality goals encourage industrial adoption of algae as a sustainable bioresource.

Asia-Pacific

Asia-Pacific captured a 25.7% share of the algae-based ingredients market in 2024, fueled by rising consumption of functional foods, dietary supplements, and personal care products. China, Japan, and South Korea remain key markets due to large-scale seaweed cultivation and established supply chains. Expanding urban populations and growing health awareness support the use of algae-based proteins and omega-3 alternatives. Companies are investing in advanced extraction technologies and large cultivation facilities to enhance yield efficiency. Government initiatives promoting marine biotechnology and sustainable aquaculture further accelerate regional market growth and export opportunities.

Latin America

Latin America represented a 5.4% share of the algae-based ingredients market in 2024, driven by expanding seaweed farming activities in Chile, Peru, and Brazil. The region’s favorable coastal environment supports algae cultivation for food, feed, and cosmetic industries. Increasing awareness of sustainable nutrition and functional ingredients is promoting local production of algae-based proteins and antioxidants. Ongoing collaborations with global biotechnology firms help improve processing capabilities and product quality. While growth remains moderate, improving research infrastructure and trade partnerships are expected to strengthen Latin America’s role in global supply chains.

Middle East & Africa

The Middle East and Africa held a 4.2% share of the global algae-based ingredients market in 2024. The region is gradually adopting algae-based ingredients, supported by investments in sustainable food production and aquaculture. Countries such as the UAE and South Africa are developing pilot projects for microalgae cultivation to reduce reliance on imported protein and feed sources. Growing interest in natural cosmetics and dietary supplements also supports market uptake. Although infrastructure limitations persist, supportive government initiatives for food security and renewable bioresources create new prospects for future market expansion.

Market Segmentations:

By Source

- Microalgae

- Macroalgae (seaweed)

- Cyanobacteria (blue-green algae)

By Ingredient Type

- Proteins & amino acids

- Whole algae protein

- Lipids & fatty acids

- Carbohydrates & fibers

- Pigments & antioxidants

- Vitamins & minerals

- Whole algae ingredients

- Other ingredient types

By Form

- Powder

- Liquid

- Gel

- Flakes

- Tablets & capsules

- Other forms

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The algae-based ingredients market is characterized by the presence of leading companies such as Corbion, dsm-firmenich, Cargill Inc., Triton, Aliga Microalgae, Bioriginal Food & Science Corp, CP Kelco USA Inc, JRS Group, Hispanagar SA, Marine Hydrocolloids, AEP Colloids, AgarGel, Gino Biotech, and Taiwan Chlorella Manufacturing Company. The competitive landscape reflects a strong focus on expanding production capabilities, enhancing sustainability, and developing advanced extraction and cultivation technologies. Market participants are actively investing in biotechnological innovations to improve yield efficiency and nutrient concentration. Strategic collaborations with food, cosmetic, and nutraceutical manufacturers are strengthening supply chains and enabling new product development. Companies are also emphasizing clean-label and vegan-certified ingredient portfolios to align with shifting consumer preferences. Continuous R&D efforts toward improving bioactive compound stability and functionality are shaping differentiation strategies. Overall, competition remains intense, with firms prioritizing scalability, regulatory compliance, and sustainability to strengthen their global market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Corbion

- dsm-firmenich

- Cargill Inc.

- Triton

- Aliga Microalgae

- Bioriginal Food & Science Corp

- CP Kelco USA Inc

- JRS Group

- Hispanagar SA

- Marine Hydrocolloids

- AEP Colloids

- AgarGel

- Gino Biotech

- Taiwan Chlorella Manufacturing Company

Recent Developments

- In Oct 2024, dsm-firmenich Launched life’sDHA B54-0100, a high-potency algal oil for the dietary supplement market. This product is formulated to provide a high concentration of 545 mg DHA and 80 mg EPA per gram.

- In 2023, Corbion launched its expanded AlgaVia, an algal product rich in omega-3 and omega-9 fatty acids, specifically designed for applications in dietary supplements.

- In 2023, JRS Group (J. Rettenmaier & Söhne) Completed the acquisition of Algaia SA, a French bio-marine ingredients company specializing in seaweed extracts, a strategic move to expand the group’s production capabilities and R&D in the marine ingredients sector.

Report Coverage

The research report offers an in-depth analysis based on Source, Ingredient Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing consumer demand for plant-based and sustainable ingredients will continue to drive market expansion.

- Technological innovations in algae cultivation and extraction will improve efficiency and scalability.

- Food and beverage manufacturers will increasingly use algae-derived proteins and pigments for clean-label products.

- The nutraceutical sector will adopt more algae-based omega-3 and antioxidant formulations for health supplements.

- Investments in biorefineries and integrated algae production systems will enhance cost competitiveness.

- Cosmetic brands will expand algae ingredient use for anti-aging and skin-repair formulations.

- Strategic partnerships among biotech firms and food companies will strengthen product diversification.

- Government initiatives promoting sustainable aquaculture will boost large-scale algae farming projects.

- Expanding algae research for pharmaceutical and bioactive compound applications will open new revenue streams.

- Rising consumer awareness of carbon-neutral and eco-friendly products will sustain long-term market growth.