Market Overview:

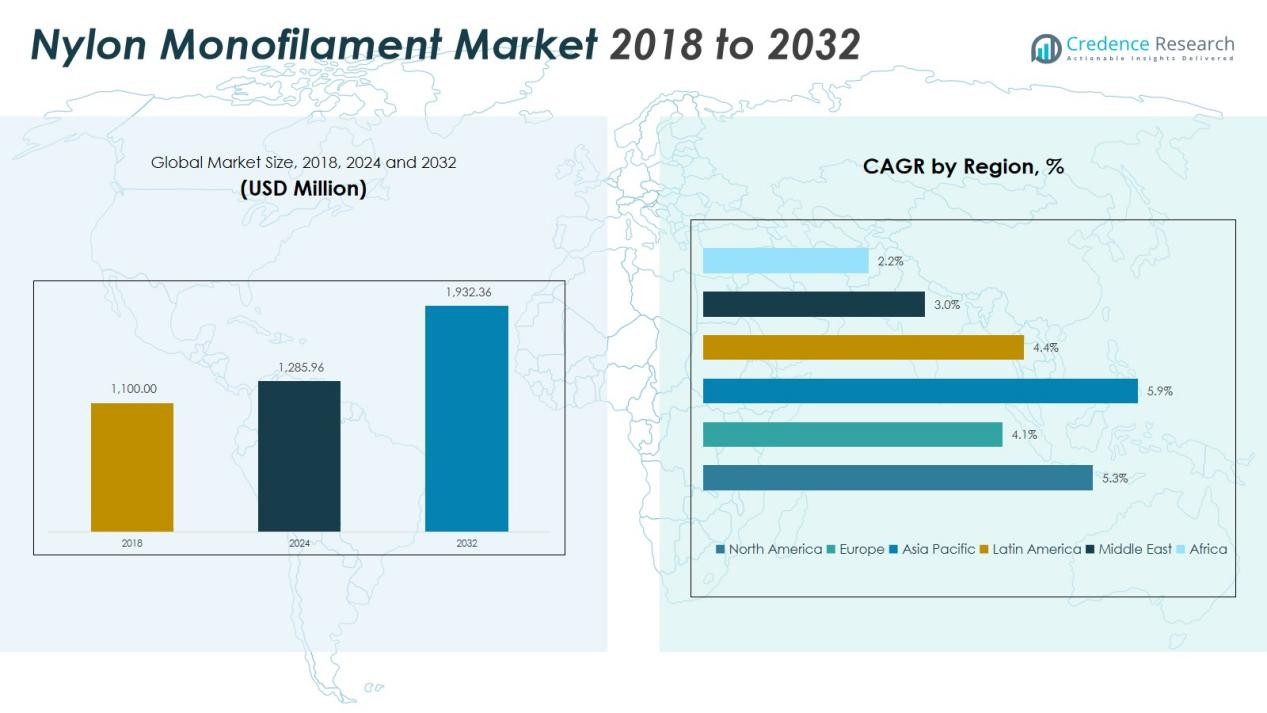

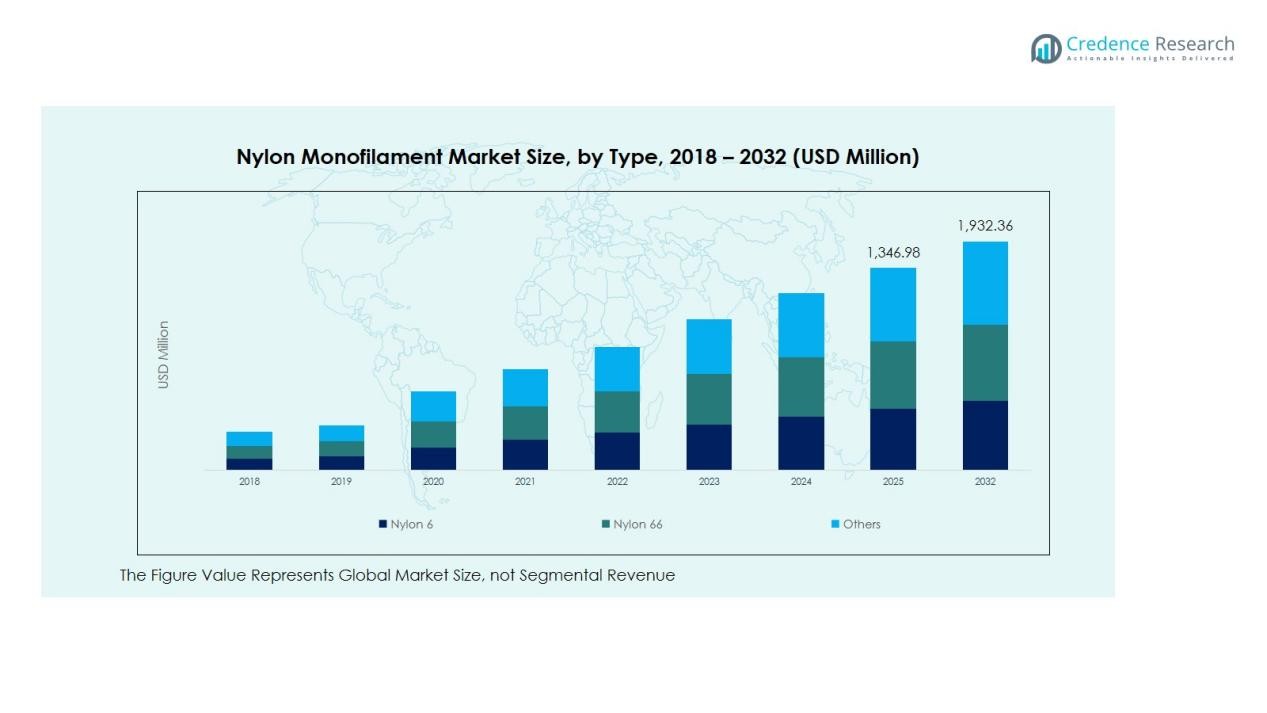

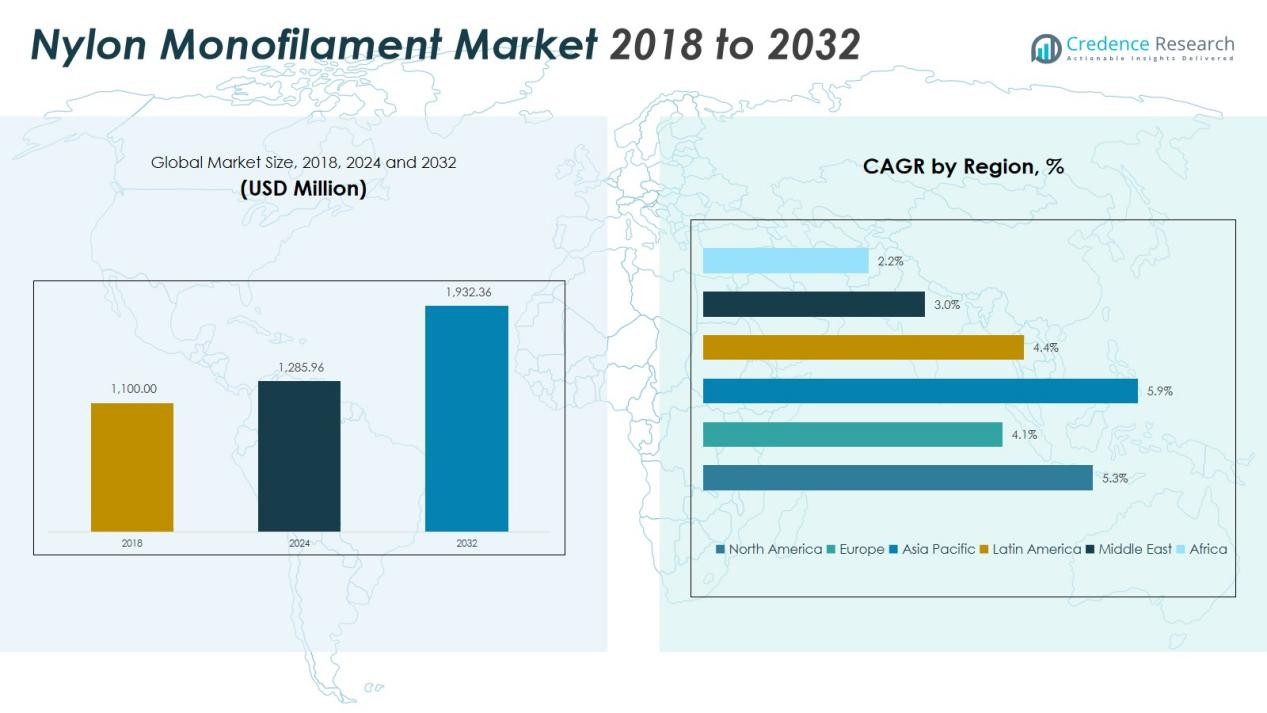

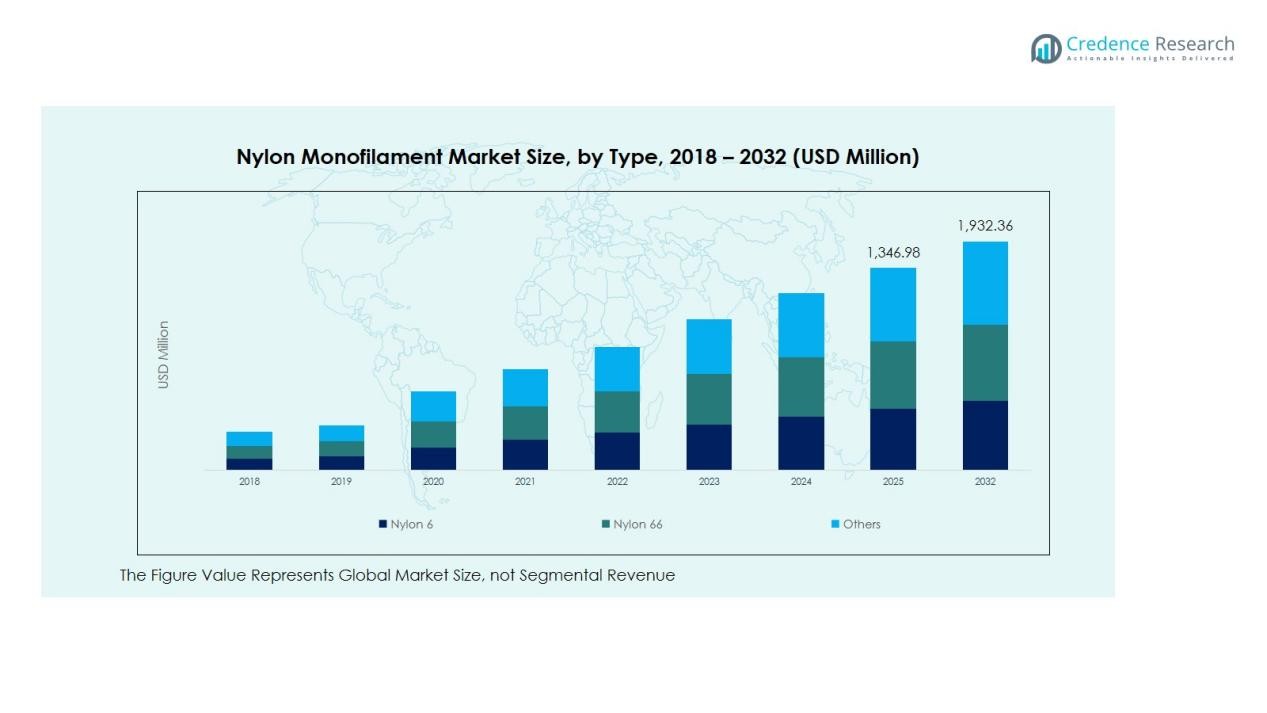

The Global Nylon Monofilament Market size was valued at USD 1,100 million in 2018 to USD 1,285.96 million in 2024 and is anticipated to reach USD 1,932.36 million by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nylon Monofilament Market Size 2024 |

USD 1,285.96 Million |

| Nylon Monofilament Market, CAGR |

5.29% |

| Nylon Monofilament Market Size 2032 |

USD 1,932.36 Million |

Key drivers include increasing usage in filtration media, technical textiles, and industrial brushes. Growing investments in healthcare and automotive sectors enhance product adoption for sutures, seat belts, and reinforcement materials. Advancements in polymer processing technologies improve the performance characteristics of nylon monofilament, expanding its applicability in high-precision and lightweight components. Sustainability initiatives are also prompting manufacturers to develop recyclable and eco-friendly variants to align with global environmental standards.

Regionally, Asia-Pacific dominates the Global Nylon Monofilament Market due to strong manufacturing bases in China, Japan, and India. North America follows, supported by advanced medical and automotive industries. Europe demonstrates steady growth, driven by rising demand for high-quality industrial fabrics and fishing gear, while emerging economies in Latin America and the Middle East & Africa present lucrative future opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Nylon Monofilament Market was valued at USD 1,100 million in 2018, reached USD 1,285.96 million in 2024, and is projected to attain USD 1,932.36 million by 2032, growing at a CAGR of 5.29% from 2024 to 2032.

- Asia Pacific holds the largest share of 47%, driven by extensive manufacturing in China, Japan, and India, supported by industrial growth in fishing, textiles, and automotive sectors.

- North America accounts for 20% of the global share, led by strong demand from the medical and automotive industries, while Europe contributes 17%, supported by innovation in technical textiles and eco-friendly materials.

- Asia Pacific is the fastest-growing region, expanding at a CAGR of 5.9%, due to rising aquaculture, automation, and sustainable production investments.

- By type, Nylon 6 dominates with nearly 55% share for its strength and versatility, while by application, the fishing nets segment leads with about 30% share due to its durability and water resistance.

Market Drivers:

Expanding Use in Industrial and Automotive Applications

The Global Nylon Monofilament Market gains momentum from rising demand in industrial and automotive sectors. It is increasingly used in conveyor belts, filtration fabrics, and tire reinforcement due to its superior strength and flexibility. Automotive manufacturers value nylon monofilament for lightweight yet durable components that enhance vehicle performance. Growing production of electric and hybrid vehicles further fuels its adoption in wiring harnesses and precision components. Continuous innovation in polymer processing also improves dimensional stability and wear resistance for heavy-duty uses.

- For instance, ContiTech manufactures heavy-duty conveyor belts with breaking strengths up to 900 kN/m, utilizing nylon carcass constructions that provide exceptional rip and tear resistance 2-3 times greater than conventional conveyor belting, delivering reliable performance in long-distance bulk material transportation.

Rising Demand from Medical and Healthcare Sectors

The healthcare industry contributes significantly to the market’s growth through applications in surgical sutures, dental floss, and catheters. Nylon monofilament’s biocompatibility and high tensile strength make it ideal for sterile medical products. The ongoing development of advanced surgical materials expands its relevance in minimally invasive procedures. Growing healthcare infrastructure and spending in developing regions create new opportunities for suppliers. It benefits from rising focus on patient safety and quality materials in medical devices.

- For instance, biocompatible nylon monofilament is used in several sterile medical devices, including sutures, with tensile strength typically reaching several hundred MPa (e.g., often exceeding 300 MPa and up to around 900 MPa) for standard and high-strength applications in general and orthopedic sutures

Growing Popularity in Fishing, Textile, and Consumer Goods

Nylon monofilament remains essential in fishing lines, nets, and fabrics for sportswear and accessories. The material’s resilience and elasticity make it a preferred choice for marine applications. The textile industry uses it for monofilament yarns that enhance strength and durability in woven fabrics. Expanding outdoor recreation and aquaculture industries continue to drive demand. It also finds increasing use in household products such as brushes and trimmers.

Technological Advancements and Sustainability Focus

Innovation in extrusion and polymer blending technologies supports high-performance and eco-friendly product development. Manufacturers are creating recyclable and bio-based monofilaments to reduce environmental impact. Advanced coating and heat stabilization techniques improve product quality and lifespan. Regulatory pressure toward sustainable manufacturing accelerates adoption of cleaner production methods. It strengthens the competitive edge of companies investing in green and high-efficiency solutions.

Market Trends:

Shift Toward Sustainable and Bio-Based Nylon Monofilament Production

The Global Nylon Monofilament Market is witnessing a clear transition toward eco-friendly and bio-based raw materials. Manufacturers are focusing on developing nylon derived from renewable feedstocks such as castor oil and other plant-based polymers. This shift aligns with global sustainability targets and helps reduce carbon emissions in production. Leading companies are investing in cleaner extrusion technologies and adopting closed-loop recycling systems to minimize waste. The integration of green chemistry practices enhances product appeal among environmentally conscious end users. It continues to benefit from government policies promoting sustainable industrial manufacturing across Europe and Asia-Pacific.

- For Instance, BASF launched loopamid, a recycled polyamide 6 made entirely from textile waste, with its first commercial-scale production facility in Shanghai, China, operating at a capacity of 500 tonnes per year and certified to convert textile waste into virgin-quality nylon through molecular recycling technology.

Rising Adoption of Advanced Processing and Customization Technologies

The industry is observing a growing trend toward precision extrusion and customization of nylon monofilaments for specialized applications. Companies are leveraging automation, AI-driven monitoring, and digital twin technologies to achieve consistent quality and performance. Demand for monofilaments with specific diameters, tensile strengths, and surface finishes is expanding across sectors such as medical, textile, and automotive. The introduction of UV-resistant and high-temperature variants supports applications in harsh environmental conditions. Continuous R&D efforts are improving product flexibility and extending service life. It reflects a broader movement toward high-performance materials designed for next-generation manufacturing and consumer needs.

- For Instance, Techflex nylon monofilament braided sleeving, made from 12 mil Nylon 6-6 polyamide, operates within a temperature range of -49°F to 302°F (-45°C to 150°C) and has a melt temperature of 493°F (256°C).

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Constraints

The Global Nylon Monofilament Market faces challenges due to unstable prices of caprolactam and other petrochemical feedstocks. Frequent fluctuations in crude oil prices directly affect production costs and profit margins. Disruptions in global supply chains, including shipping delays and trade restrictions, further limit raw material availability. It increases operational costs and impacts timely delivery to end users. Manufacturers must focus on strategic sourcing and localized production to mitigate these risks.

Environmental Regulations and Competitive Substitutes

Stringent environmental regulations on plastic waste management and emissions present major challenges for nylon monofilament producers. Governments across regions are enforcing strict policies promoting biodegradable or recyclable alternatives. The availability of substitutes such as polyester and polypropylene monofilaments intensifies competition in several end-use industries. It pressures companies to innovate and shift toward sustainable manufacturing technologies. The high cost of compliance with evolving standards also affects small and medium manufacturers, limiting their expansion capabilities.

Market Opportunities:

Rising Demand for High-Performance and Specialized Monofilaments

The Global Nylon Monofilament Market offers strong opportunities through the development of customized, high-performance materials. Industries such as automotive, medical, and aerospace are seeking lightweight, durable, and precision-engineered components. Manufacturers can gain advantage by offering nylon monofilaments with enhanced properties like UV resistance, flame retardancy, and high-temperature tolerance. Growth in 3D printing and additive manufacturing creates demand for specialty nylon grades. It benefits from the expanding need for advanced materials in technical textiles, filtration systems, and industrial applications.

Expansion Across Emerging Economies and Green Innovation

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East opens new avenues for nylon monofilament adoption. Rising investments in manufacturing, aquaculture, and healthcare sectors drive consumption in these regions. The shift toward sustainable and recyclable nylon products aligns with global environmental priorities. Manufacturers introducing bio-based or low-carbon monofilament variants can capture early mover advantage. It also gains traction through government initiatives supporting clean technology and circular economy practices, strengthening long-term growth potential.

Market Segmentation Analysis:

By Type

The Global Nylon Monofilament Market is segmented into Nylon 6, Nylon 66, and others. Nylon 6 holds the dominant share due to its superior elasticity, abrasion resistance, and cost-effectiveness. It is widely used in fishing lines, fabrics, and industrial applications. Nylon 66 offers higher tensile strength and thermal stability, making it suitable for demanding automotive and engineering uses. The “others” segment includes specialty nylon variants designed for niche applications such as filtration and precision medical tools. It benefits from ongoing advancements in polymer engineering that enhance performance and sustainability across end-use sectors.

- For instance, Celanese’s Zytel® nylon 6 general-purpose grades typically exhibit a tensile strength at yield of around 84 MPa (in dry-as-molded condition), with an elongation at break of approximately 35-40%.

By Application

The market is divided into consumer goods, medical, fishing nets, automotive, and others. The fishing nets segment leads the market due to nylon’s lightweight, strength, and water resistance. The consumer goods sector follows, driven by strong usage in brushes, sports equipment, and textile products. The medical segment is growing rapidly with increasing demand for nylon-based sutures and catheters. Automotive applications continue to expand, supported by the push for durable, lightweight materials. It also finds emerging use in technical textiles and industrial components, reflecting the material’s adaptability and superior mechanical properties.

- For instance, one common type of commercial nylon knotless fishing net can have a breaking strength of approximately 1,800 N (or 180 kgf) for a strand of roughly 2.0 mm diameter, and typically includes UV stabilization treatment to provide a service life of several years in harsh marine environments, though specific exposure hours vary by manufacturer and conditions.

Segmentations:

By Type:

By Application:

- Consumer Goods

- Medical

- Fishing Nets

- Automotive

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Nylon Monofilament Market size was valued at USD 213.73 million in 2018, reached USD 244.20 million in 2024, and is anticipated to attain USD 365.99 million by 2032, at a CAGR of 5.3% during the forecast period. North America holds 20% of the global market share, driven by strong demand from automotive, medical, and consumer goods industries. The United States dominates the region, supported by advanced polymer manufacturing capabilities and robust R&D infrastructure. The market benefits from rising adoption of nylon monofilament in healthcare applications, including sutures and surgical threads. It also experiences consistent demand from industrial brushes and textile products. Expanding electric vehicle production enhances opportunities for lightweight and durable materials.

Europe

The Europe Global Nylon Monofilament Market size was valued at USD 181.50 million in 2018, grew to USD 199.03 million in 2024, and is expected to reach USD 271.99 million by 2032, at a CAGR of 4.1% during the forecast period. Europe accounts for 17% of the global share, supported by well-established automotive and textile sectors. Germany, France, and Italy lead adoption due to strong industrial standards and sustainability initiatives. Demand for eco-friendly monofilaments is rising with the region’s focus on circular economy practices. It benefits from innovation in technical textiles and high-performance fabrics used across industrial and medical fields. Continuous product advancement and stringent regulatory compliance sustain regional growth.

Asia Pacific

The Asia Pacific Global Nylon Monofilament Market size was valued at USD 589.60 million in 2018, increased to USD 703.22 million in 2024, and is projected to reach USD 1,107.83 million by 2032, at a CAGR of 5.9% during the forecast period. Asia Pacific holds 47% of the global market share. China, Japan, and India are the major contributors, supported by rapid industrialization and large-scale manufacturing. The market benefits from strong demand in fishing, textile, and automotive sectors. Expanding aquaculture and industrial automation further strengthen regional consumption. It continues to gain traction through cost-effective production and supportive government initiatives promoting industrial growth.

Latin America

The Latin America Global Nylon Monofilament Market size was valued at USD 71.50 million in 2018, reached USD 82.80 million in 2024, and is forecasted to attain USD 115.69 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America holds 7% of the global share, driven by growing demand in Brazil, Argentina, and Chile. Expanding automotive and consumer goods sectors support steady consumption. Increasing focus on local manufacturing and textile exports boosts regional opportunities. The region benefits from rising use of nylon monofilament in fishing nets and sports equipment. It also experiences gradual growth in healthcare applications due to expanding medical infrastructure.

Middle East

The Middle East Global Nylon Monofilament Market size was valued at USD 26.40 million in 2018, increased to USD 27.77 million in 2024, and is anticipated to reach USD 34.99 million by 2032, at a CAGR of 3.0% during the forecast period. The Middle East holds 4% of the global market share. GCC countries drive the demand through infrastructure development and industrial activities. Nylon monofilament is used widely in filtration and construction materials. The region is gradually shifting toward value-added manufacturing and non-oil-based industries. It gains growth support from increasing investment in packaging and textile manufacturing facilities.

Africa

The Africa Global Nylon Monofilament Market size was valued at USD 17.27 million in 2018, rose to USD 28.94 million in 2024, and is projected to reach USD 35.88 million by 2032, at a CAGR of 2.2% during the forecast period. Africa holds 5% of the global market share, with growth led by South Africa and Egypt. Demand is mainly concentrated in fishing, textiles, and basic consumer applications. Rising urbanization and gradual industrial expansion support moderate market progress. The region faces infrastructure and cost challenges but holds potential in coastal economies with strong fisheries. It benefits from increasing foreign investment in light manufacturing and trade expansion.

Key Player Analysis:

Competitive Analysis:

The Global Nylon Monofilament Market features strong competition among key players such as Toray Industries, Inc., BASF SE, DuPont, Royal DSM, Solvay, and Evonik Industries AG. These companies focus on expanding product portfolios, improving polymer performance, and strengthening global distribution networks. It emphasizes continuous innovation in extrusion technology and the development of bio-based and recyclable monofilament variants. Strategic mergers, acquisitions, and regional expansions enhance competitiveness across diverse industries including automotive, medical, and textiles. Leading manufacturers invest in R&D to improve durability, flexibility, and chemical resistance while maintaining cost efficiency. It also focuses on forming long-term partnerships with end users to ensure consistent product supply and quality standards, positioning established brands strongly against emerging regional competitors.

Recent Developments:

- In October 2025, BASF and IFF announced a strategic collaboration aimed at next-generation enzyme and polymer innovations, signaling a joint development effort in sustainability-focused materials.

- In October 2025, Toray Industries engaged in strategies around advanced materials with external partners, including possible mobility materials collaborations with automotive players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Nylon Monofilament Market is expected to witness steady growth driven by expanding demand in industrial, medical, and consumer sectors.

- Rising adoption of high-performance and lightweight materials across automotive and aerospace industries will strengthen long-term market potential.

- Sustainability trends will encourage manufacturers to shift toward bio-based and recyclable nylon monofilaments.

- Technological innovation in extrusion and precision engineering will improve product quality and operational efficiency.

- Expansion of aquaculture and fishing industries, especially in Asia-Pacific, will create significant opportunities for monofilament applications.

- Healthcare demand will rise with increasing use of nylon-based sutures, catheters, and surgical threads.

- Automation and digital monitoring in manufacturing will enhance production consistency and cost control.

- Collaborations between global and regional players will promote innovation and product diversification.

- Emerging economies in Latin America, the Middle East, and Africa will see gradual demand growth due to industrial expansion.

- It will continue to evolve through sustainable manufacturing practices, advanced materials research, and strategic investments in new applications.