| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Almond Drink Market Size 2024 |

USD 5,491.35 million |

| Almond Drink Market, CAGR |

5.34% |

| Almond Drink Market Size 2032 |

USD 8,582.79 million |

Market Overview:

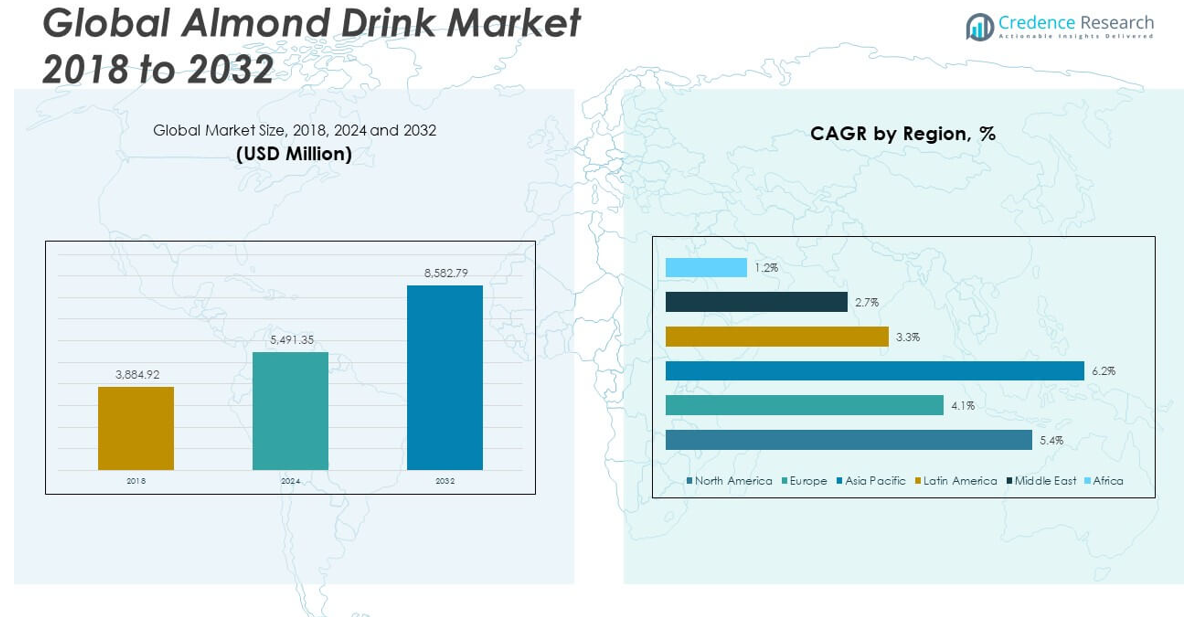

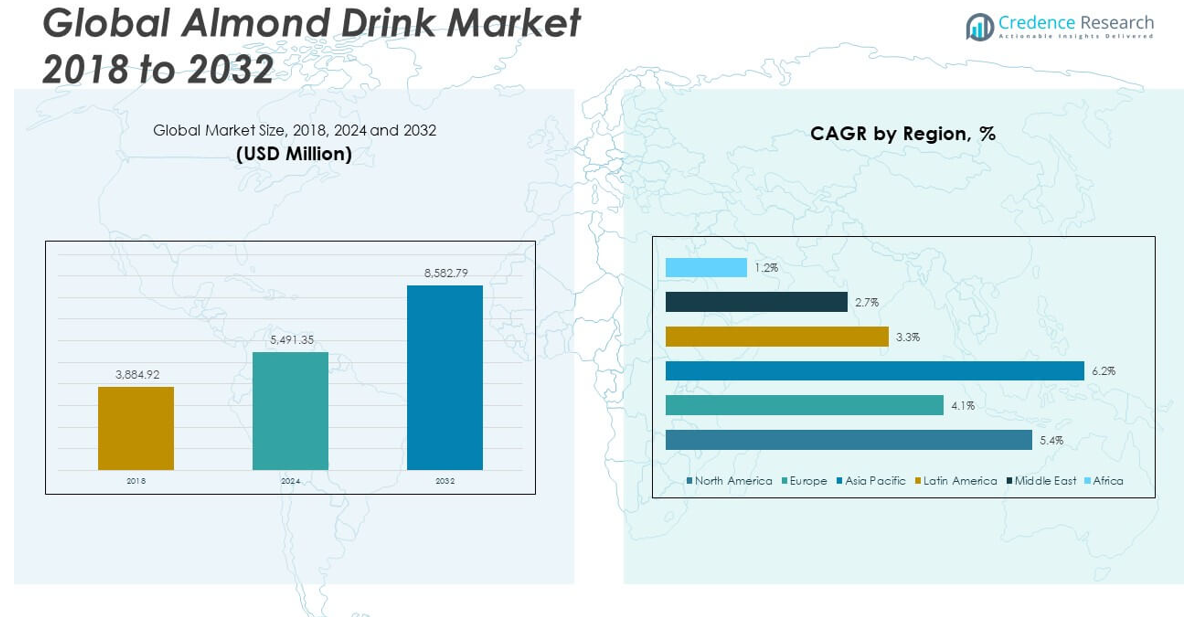

The Global Almond Drink Market size was valued at USD 3,884.92 million in 2018 to USD 5,491.35 million in 2024 and is anticipated to reach USD 8,582.79 million by 2032, at a CAGR of 5.34% during the forecast period.

The global almond drink market is experiencing substantial growth due to several key drivers. Increasing health-consciousness among consumers has led to a surge in demand for plant-based, dairy-free beverages, with almond drinks being perceived as a nutritious, low-calorie, and cholesterol-free option. This is further supported by the growing number of individuals with lactose intolerance, who are seeking suitable alternatives to traditional dairy milk. Additionally, the rising awareness of environmental sustainability and the ethical concerns surrounding dairy production have contributed to the growing preference for plant-based products. Almond drinks are often seen as eco-friendlier; as almond farming generally has a lower environmental impact compared to dairy farming. Furthermore, the continuous innovation in product offerings, such as new flavors and fortified variants, is making almond drinks even more appealing to a broader consumer base, further fueling market growth.

The almond drink market is witnessing varied growth across different regions. In North America, particularly the United States, the market is expanding rapidly due to the increasing popularity of plant-based diets, heightened awareness of lactose intolerance, and the availability of diverse almond drink options. Meanwhile, the Asia-Pacific (APAC) region leads the global market in terms of consumption, driven by rising health awareness and an increasing shift towards plant-based beverages in countries like China and India. The region’s large population and growing disposable income levels are contributing significantly to market expansion. Europe is also witnessing robust growth, as consumers are increasingly making environmentally conscious purchasing decisions, favoring sustainable and plant-based alternatives like almond drinks. The Latin American and Middle East & Africa (MEA) regions are gradually catching up, with rising urbanization and greater awareness of dietary restrictions further driving the demand for almond-based beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global almond drink market size was valued at USD 3,884.92 million in 2018 and is expected to grow to USD 5,491.35 million by 2024, reaching USD 8,582.79 million by 2032 at a CAGR of 5.34%.

- Health-conscious consumers are driving demand for plant-based, low-calorie, and cholesterol-free beverages, with almond drinks emerging as a preferred choice.

- Lactose intolerance is contributing significantly to almond drink consumption, as it provides a nutritious alternative to dairy for those with digestive difficulties.

- The rising awareness of environmental sustainability and ethical concerns surrounding dairy farming is increasing the demand for plant-based drinks like almond beverages.

- Almond drink manufacturers are innovating with new flavors, fortified variants, and nutrient-enhanced options to meet the diverse preferences of health-conscious consumers.

- Supply chain challenges related to almond crop yields and weather conditions can impact production costs and pricing, affecting the overall market dynamics.

- Regulatory and labeling complexities across regions pose challenges to almond drink manufacturers, with varying standards for plant-based beverage labeling impacting market expansion.

Market Drivers:

Health-Conscious Consumer Preferences

The global almond drink market is expanding due to the increasing consumer demand for healthier beverage alternatives. People are becoming more conscious of their health and nutrition, leading them to choose products that align with their wellness goals. Almond drinks are perceived as a healthier option compared to dairy milk because they are lower in calories, contain no cholesterol, and are rich in nutrients such as vitamin E, omega-3 fatty acids, and antioxidants. These benefits cater to individuals seeking weight management, heart health, and improved skin health. The growing preference for plant-based diets, driven by awareness of the health risks associated with excessive dairy consumption, is further fueling the growth of the market.

- For instance, alpro’s Roasted Almond Drinkis formulated to deliver 2.2 mg of vitamin E and 0.75 µg of vitamin D per 100 ml, with a low-fat profile of just 1.1 g per 100 ml, supporting both cardiovascular and skin health while providing essential micronutrients.

Lactose Intolerance and Dairy-Free Alternatives

Lactose intolerance is a significant factor contributing to the demand for almond drinks, particularly in regions where a large portion of the population suffers from this condition. For many individuals who experience difficulty in digesting lactose, almond drink offers a suitable and nutritious alternative to traditional dairy milk. It provides a similar taste and texture, making it an appealing choice for those seeking to eliminate dairy from their diets without compromising on flavor or consistency. The rising prevalence of lactose intolerance worldwide is influencing the growing adoption of almond-based beverages, contributing to the overall growth of the global almond drink market.

Environmental Sustainability and Ethical Considerations

Environmental and ethical concerns surrounding dairy production are increasingly influencing consumer purchasing decisions. Almond drinks are considered more sustainable than dairy milk due to the lower carbon footprint associated with almond farming compared to dairy farming. Almond drink production requires less water and generates fewer greenhouse gas emissions, making it an appealing choice for environmentally conscious consumers. The ethical implications of dairy farming, including animal welfare concerns, have prompted many consumers to switch to plant-based alternatives. This shift toward more sustainable and humane options is driving the demand for almond drinks, particularly among younger generations concerned about environmental impact.

- For example, according to the Almond Board of California, over 80% of almond farmers in California have adopted micro-irrigation systems, such as drip and microsprinklers, which deliver water directly to the root zones of trees.This method has enabled farmers to reduce water usage by approximately 33% over the past two decades, producing more crop per drop

Product Innovation and Flavor Diversification

Innovation plays a crucial role in driving the growth of the almond drink market. Manufacturers are constantly introducing new flavors and formulations to cater to a wide range of consumer tastes. From vanilla and chocolate to matcha and caramel, almond drinks are available in a variety of exciting flavors that appeal to diverse preferences. In addition to flavored variants, companies are developing almond drinks fortified with added nutrients, such as calcium, protein, and vitamins, to enhance their nutritional profile. These innovations help meet the evolving needs of health-conscious consumers and further expand the market reach, positioning almond drinks as versatile beverages for various dietary needs.

Market Trends:

Increasing Demand for Organic Almond Drinks

The global almond drink market is witnessing a surge in demand for organic almond beverages. Consumers are increasingly prioritizing products that are free from artificial additives, preservatives, and pesticides, and are seeking beverages made from organically grown almonds. Organic almond drinks align with the growing preference for clean-label products that offer natural, wholesome ingredients. As awareness about the potential health risks of conventional farming practices increases, more consumers are willing to pay a premium for organic almond-based beverages. This trend is reshaping the almond drink market, as manufacturers strive to meet consumer expectations for more sustainable and naturally sourced options.

- For instance, Califia Farmsexpanded its Simple & Organic line launching USDA Certified Organic Vanilla Almondmilk made from just four ingredients: water, organic almonds, pure vanilla extract, and sea salt, with no gums or oils.

Rise of Almond Drink-Based Product Innovations

Innovation in the global almond drink market is moving beyond just new flavors to include functional benefits. Brands are increasingly incorporating additional ingredients to enhance the nutritional profile of almond drinks, such as probiotics, plant-based proteins, and adaptogens. This trend caters to consumers seeking functional foods that support digestive health, immunity, and overall well-being. Almond drinks fortified with vitamins and minerals, such as calcium, vitamin D, and B12, are gaining traction among those looking to improve their diet without resorting to dairy or other animal products. Such innovations expand the product offerings and attract a more diverse consumer base seeking enhanced health benefits.

- For example, leading brands such as Silk, So Delicious Dairy Free, and Califia Farmshave introduced almond drinks fortified with calcium (up to 450 mg per 240 ml serving), vitamin D (2.5 mcg per serving), and vitamin B12 (1.2 mcg per serving) to match or exceed the nutritional profile of dairy milk.

Growing Popularity of Almond Drink in the Foodservice Industry

The expansion of almond drink consumption is not limited to retail sales. The foodservice industry, including coffee shops, restaurants, and cafes, is embracing almond drinks as a key ingredient in their menus. Coffee shops, particularly in Western markets, are introducing almond milk as a popular alternative to dairy milk in various beverages, such as lattes and cappuccinos. This trend has gained momentum with the increasing demand for plant-based options in the foodservice sector. By offering almond-based beverages, foodservice providers cater to a broader audience, including vegans, lactose-intolerant individuals, and those seeking dairy-free alternatives. The inclusion of almond drinks in foodservice establishments plays a significant role in expanding the market reach.

Global Expansion of Almond Drink Market in Emerging Economies

The global almond drink market is experiencing growth in emerging economies, particularly in regions like Asia-Pacific and Latin America. The increasing availability of almond drinks in supermarkets, convenience stores, and health food outlets across these regions has led to greater market penetration. Changing lifestyles, rising disposable incomes, and growing awareness of plant-based diets are key factors driving the adoption of almond-based beverages in these regions. In countries like China, India, and Brazil, the rising middle class and growing urbanization are contributing to the demand for healthier, dairy-free beverage options. The global expansion of almond drink availability in these emerging markets is fueling market growth and creating new opportunities for brands.

Market Challenges Analysis:

Supply Chain and Production Costs

The global almond drink market faces challenges related to the supply chain and production costs. Almond cultivation is heavily dependent on specific climatic conditions, and any disruption, such as droughts or adverse weather events, can impact almond crop yields and quality. This, in turn, leads to higher raw material costs for almond-based beverages, affecting the pricing structure of the final product. Manufacturers also face challenges related to the cost of sourcing organic almonds, which are generally more expensive due to stringent farming practices. These factors contribute to fluctuating production costs, making it difficult for some companies to maintain consistent pricing, especially when trying to appeal to cost-conscious consumers in competitive markets.

Regulatory and Labeling Constraints

The global almond drink market is subject to stringent regulatory standards and labeling requirements, which can pose challenges for manufacturers. Different regions have varying regulations concerning the labeling of plant-based beverages, particularly when it comes to terms like “milk.” These inconsistencies in regulatory frameworks can create confusion for both consumers and producers. Additionally, in certain markets, plant-based drinks, including almond beverages, are required to meet specific nutritional labeling standards, which can be complex and costly to adhere to. These regulatory and labeling challenges increase the operational burden for manufacturers and may hinder market expansion in regions with more restrictive regulations.

Market Opportunities:

Expanding Consumer Awareness and Health Trends

The global almond drink market has significant growth potential driven by expanding consumer awareness of health and wellness. As more people prioritize plant-based diets and seek alternatives to dairy, the demand for almond drinks continues to rise. With increasing concerns about health issues such as lactose intolerance, obesity, and heart disease, almond drinks offer a compelling, nutritious alternative. Manufacturers can capitalize on this opportunity by developing new, healthier products and targeting health-conscious consumers. With the growing interest in functional foods, almond drinks enriched with vitamins, proteins, and other nutrients present an opportunity to attract a broader market.

Growth in Emerging Markets and Global Distribution

There is a considerable opportunity for the global almond drink market to expand in emerging economies where plant-based beverage demand is gaining traction. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing rising disposable incomes and a shift toward healthier, plant-based diets. As urbanization increases, consumers are seeking convenient and nutritious options. Expanding distribution networks in these regions, alongside localized marketing efforts, can help brands tap into these burgeoning markets. By making almond drinks more accessible and affordable, companies can significantly boost their market share and growth potential in these regions.

Market Segmentation Analysis:

The global almond drink market is segmented by form, application, and distribution channel, each contributing to the market’s expansion.

By Form Segment, almond drinks are available in sweetened, unsweetened, and flavored varieties. Sweetened almond drinks are popular due to their enhanced taste, appealing to a broad consumer base. Unsweetened variants cater to health-conscious individuals seeking low-calorie and sugar-free options. Flavored almond drinks, including vanilla, chocolate, and seasonal flavors, attract consumers looking for variety and novelty in their plant-based beverages.

- For example, Blue Diamond Growers Almond Breeze Sweetened Almondmilk contains added sugar to enhance taste, making it popular among a broad consumer base.

By Application Segment includes food & beverages, cosmetics, and other applications. Almond drinks are primarily used in the food & beverages sector, especially as a dairy substitute in coffee, smoothies, and baked goods. In cosmetics, almond milk is utilized for its moisturizing properties in skincare products. Other applications involve its use in animal feed and other niche sectors.

- For instance, the Body Shop Almond Milk Body Butter utilizes almond milk for its moisturizing properties, showcasing its application in skincare products.

By Distribution Channel Segment comprises hypermarkets/supermarkets, department & grocery stores, online retailers, and other outlets. Hypermarkets and supermarkets dominate almond drink distribution, offering consumers a wide range of products under one roof. Department and grocery stores also play a key role, while online retailers are becoming increasingly popular as e-commerce continues to grow, providing convenience for consumers to purchase almond drinks from the comfort of their homes.

Segmentation:

By Form Segment:

- Sweetened

- Unsweetened

- Flavored

By Application Segment:

- Food & Beverages

- Cosmetics

- Others

By Distribution Channel Segment:

- Hypermarkets/Supermarkets

- Department & Grocery Stores

- Online Retailers

- Others

By Region Segment:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Almond Drink Market

The North America almond drink market size was valued at USD 1,263.92 million in 2018 to USD 1,761.65 million in 2024 and is anticipated to reach USD 2,763.70 million by 2032, at a CAGR of 5.4% during the forecast period. North America holds a significant share in the global almond drink market, driven by the growing demand for plant-based, dairy-free alternatives. The United States leads the region, where health-conscious consumers increasingly prefer almond drinks due to their lower calorie content and nutritional benefits. The market growth is also supported by the rising number of lactose-intolerant individuals and the growing awareness of the environmental benefits associated with plant-based diets. As more brands introduce innovative almond drink products, such as fortified variants, North America is set to maintain its dominant position.

Europe Almond Drink Market

The Europe almond drink market size was valued at USD 724.34 million in 2018 to USD 967.70 million in 2024 and is anticipated to reach USD 1,375.16 million by 2032, at a CAGR of 4.1% during the forecast period. Europe’s market is growing steadily, driven by consumers’ increasing preference for healthier and more sustainable food and beverage options. Countries like the U.K., Germany, and France are at the forefront of adopting almond drinks as part of the broader trend toward plant-based diets. The market is also propelled by the demand for organic and clean-label products. Europe’s regulatory environment encourages the growth of plant-based drinks, while innovations in product flavors and formulations continue to expand consumer options.

Asia Pacific Almond Drink Market

The Asia Pacific almond drink market size was valued at USD 1,613.41 million in 2018 to USD 2,369.16 million in 2024 and is anticipated to reach USD 3,940.14 million by 2032, at a CAGR of 6.2% during the forecast period. The Asia Pacific region represents one of the fastest-growing markets for almond drinks, driven by urbanization, increasing disposable incomes, and a shift toward healthier lifestyles. Countries such as China, India, and Japan are seeing a surge in the demand for plant-based beverages due to the growing awareness of lactose intolerance and health-conscious diets. The market is also benefiting from the expanding availability of almond drinks in supermarkets and retail chains. As the demand for dairy alternatives grows, almond drinks continue to capture a larger share of the beverage market in the region.

Latin America Almond Drink Market

The Latin America almond drink market size was valued at USD 145.49 million in 2018 to USD 202.43 million in 2024 and is anticipated to reach USD 270.38 million by 2032, at a CAGR of 3.3% during the forecast period. Latin America is witnessing moderate growth in the almond drink market, driven by rising awareness of health and dietary restrictions. Countries like Brazil and Mexico are showing increased adoption of plant-based beverages, particularly in urban areas where consumers are more inclined to explore alternative milk options. With rising income levels and more access to health-conscious products, almond drinks are gaining traction as a nutritious, lactose-free alternative to dairy.

Middle East Almond Drink Market

The Middle East almond drink market size was valued at USD 94.13 million in 2018 to USD 119.84 million in 2024 and is anticipated to reach USD 152.98 million by 2032, at a CAGR of 2.7% during the forecast period. The Middle East almond drink market is experiencing gradual growth, with consumers in countries like the UAE and Saudi Arabia becoming more health-conscious and adopting plant-based diets. The increasing awareness of lactose intolerance and the desire for more sustainable beverage options are contributing to the rise in almond drink consumption. Supermarket and retail expansion in the region further supports the growth of almond drinks, providing better accessibility to consumers seeking dairy alternatives.

Africa Almond Drink Market

The Africa almond drink market size was valued at USD 43.63 million in 2018 to USD 70.57 million in 2024 and is anticipated to reach USD 80.43 million by 2032, at a CAGR of 1.2% during the forecast period. The African market for almond drinks is still in its early stages but is showing promising growth due to rising urbanization and health awareness. Consumers in South Africa, Egypt, and Nigeria are increasingly adopting plant-based beverages as alternatives to dairy. As disposable incomes rise and more people seek lactose-free options, almond drinks are becoming a viable choice. The growing retail presence of almond drinks and the availability of affordable variants will further expand the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Blue Diamond Growers

- Califia Farms LLC

- Daiya Foods Inc.

- Earth’s Own Food Company Inc.

- Hain Celestial Group

- Hiland Dairy Foods

- Malk Organics LLC

- Pacific Foods of Oregon LLC

- Sanitarium

- SunOpta Inc.

Competitive Analysis:

The global almond drink market is highly competitive, with key players striving to capture market share through product differentiation and innovation. Major companies such as Blue Diamond Growers, Califia Farms, and Alpro dominate the market by offering a wide range of almond-based beverages. These companies focus on enhancing their product offerings with fortified versions, new flavors, and organic variants to appeal to health-conscious consumers. Regional players also compete by catering to local tastes and preferences, especially in emerging markets like Asia Pacific and Latin America. The market is characterized by increasing investments in marketing and distribution channels to expand brand visibility. To maintain a competitive edge, players are focusing on sustainability initiatives and clean-label products, as consumers demand transparency and ethical practices. The competitive landscape is expected to intensify as new entrants and private-label brands seek to capitalize on the growing demand for plant-based drinks.

Recent Developments:

- In March 2024, MALK Organics, a prominent player in the alternative milk sector, announced the closure of an internal investment round led by Benvolio Group and Rotor Capital. Alongside this funding, MALK revealed significant distribution expansion and the launch of three new products: Cashew MALK, Shelf Stable Unsweetened Almond MALK, and Shelf Stable Original Oat MALK.

- In April 2025, Blue Diamond Growersunveiled a new package redesign for its Barista Blend Almondmilk, emphasizing its support for small family-owned almond orchards and coffee shops. This updated branding debuted at the Specialty Coffee Expo in Houston and highlights the cooperative’s century-long legacy. The Barista Blend, designed for foodservice locations, is formulated to froth, steam, and blend seamlessly into coffee beverages, providing both taste and performance.

Market Concentration & Characteristics:

The global almond drink market is moderately concentrated, with a few key players holding significant market share, while regional brands also contribute to competition. Major companies such as Blue Diamond Growers, Califia Farms, and Alpro lead the market by offering a wide range of products, focusing on product innovation and sustainability. Smaller players and private-label brands are emerging, particularly in regional markets, increasing competition through local production and unique flavor offerings. The market is characterized by a high degree of product differentiation, as brands develop variants that cater to specific consumer preferences, such as organic, fortified, or flavored almond drinks. The growing consumer shift toward plant-based and sustainable products drives innovation, with many companies investing in environmentally friendly production processes and clean-label offerings. This dynamic market structure allows for continued competition and the emergence of new players seeking to tap into the expanding demand for almond beverages.

Report Coverage:

The research report offers an in-depth analysis based on form, application, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global almond drink market will continue to expand as more consumers shift toward plant-based diets.

- Increased awareness of health benefits such as low-calorie content and lactose-free properties will drive demand.

- Innovation in product offerings, including new flavors and fortified versions, will cater to diverse consumer preferences.

- Organic and clean-label products will see significant growth as consumers prioritize transparency and sustainability.

- The rising popularity of almond drinks in foodservice channels, including cafes and restaurants, will contribute to market growth.

- Emerging markets in Asia Pacific and Latin America will become key regions for almond drink adoption.

- Private-label brands will increase competition by offering more affordable alternatives in retail spaces.

- Sustainability and eco-friendly packaging will become essential factors for consumers and brands alike.

- The market will experience a shift towards premium products, with consumers willing to pay more for health-focused and ethical options.

- Advancements in production techniques and sourcing will help manage costs and improve product availability globally.