Market Overview:

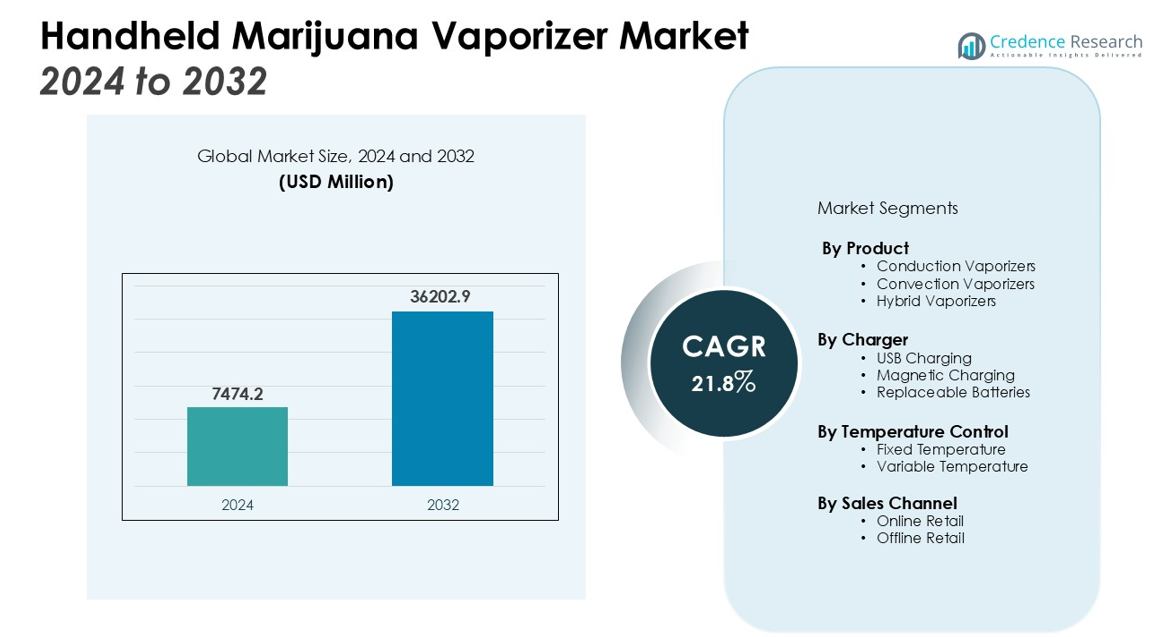

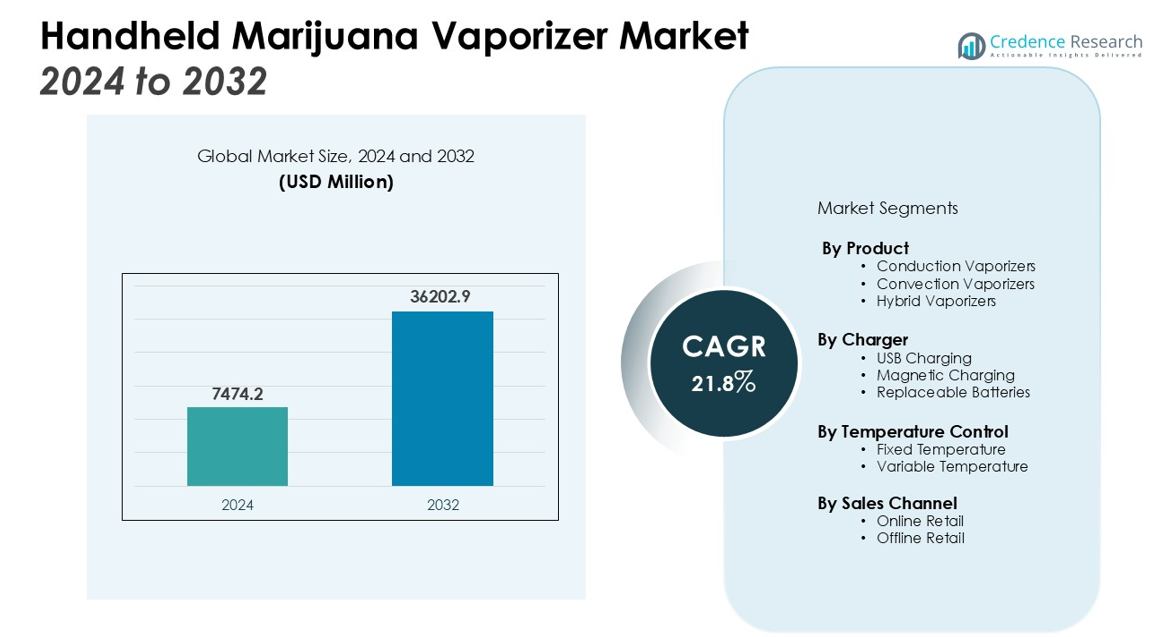

The Handheld Marijuana Vaporizer Market size was valued at USD 7474.2 million in 2024 and is anticipated to reach USD 36202.9 million by 2032, at a CAGR of 21.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Handheld Marijuana Vaporizer Market Size 2024 |

USD 7474.2 million |

| Handheld Marijuana Vaporizer Market, CAGR |

21.8% |

| Handheld Marijuana Vaporizer Market Size 2032 |

USD 36202.9 million |

Market growth is driven by ongoing legalization initiatives, a shift toward healthier consumption alternatives, and continuous innovation in vaporization technology. Devices with precision temperature control, improved battery life, and smart connectivity are increasing their appeal to both medical users seeking accurate dosing and recreational users prioritizing portability and ease of use. Expanding product portfolios, strategic branding, and targeted marketing are further broadening the consumer base across diverse age groups and lifestyles.

North America dominates the market due to its favorable regulatory environment, mature distribution infrastructure, and high consumer adoption. Europe is steadily expanding with evolving regulations and wellness-focused consumption patterns, while the Asia-Pacific region is emerging rapidly as regulatory reforms and awareness drive new adoption opportunities. The competitive landscape is intensifying as both established players and new entrants invest heavily in R&D to capture market share and differentiate through product innovation.

Market Insights:

- The Handheld Marijuana Vaporizer Market is valued at USD 7,474.2 million and is projected to reach USD 36,202.9 million by 2032, registering a CAGR of 21.8% during the forecast period.

- Legalization of cannabis for medical and recreational purposes is expanding the customer base and enabling structured industry growth.

- Consumer preference for health-conscious alternatives is driving demand for vaporizers that offer cleaner consumption without combustion.

- Technological advancements, including precision temperature control, extended battery life, and smart connectivity, are enhancing product appeal and functionality.

- North America leads with 48% share, followed by Europe at 27% and Asia-Pacific at 15%, supported by distinct regulatory and adoption trends in each region.

- Market challenges include inconsistent regulations, compliance costs, counterfeit products, and intense price competition in cost-sensitive markets.

- Strategic branding, product diversification, and targeted marketing are strengthening brand loyalty and expanding reach across diverse consumer demographics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Legalization of Cannabis Driving Widespread Adoption

The Handheld Marijuana Vaporizer Market benefits significantly from the expanding legalization of cannabis for both medical and recreational purposes across various regions. Governments are introducing favorable regulatory frameworks that encourage legal sales and consumption. This shift is increasing consumer confidence and expanding the potential customer base. It is also enabling manufacturers and retailers to operate openly, invest in product development, and enhance distribution networks. The legal environment continues to be a central catalyst for sustained demand growth.

- For instance, in response to the growing market, DaVinci developed the IQ3 vaporizer, which is powered by a 21700 lithium-ion battery, providing up to 90 minutes of continuous performance.

Shift Toward Health-Conscious Consumption Preferences

Consumers are increasingly prioritizing healthier alternatives to traditional smoking, and this is reinforcing demand for vaporizers. The technology allows cannabis consumption without combustion, reducing exposure to harmful toxins. It is appealing to both medical patients seeking controlled dosing and recreational users interested in a cleaner experience. The growing awareness of these benefits is encouraging first-time users to adopt vaporization as their preferred method. This trend is expected to remain a major driver for the industry.

Technological Innovation Enhancing Product Appeal

Ongoing advancements in vaporizer design and technology are boosting market growth. Features such as precision temperature control, extended battery life, and smart connectivity are improving performance and convenience. It is creating strong differentiation among brands and encouraging repeat purchases from existing users. Product innovation is also expanding the appeal across various price points, making advanced vaporizers accessible to a wider audience. These developments are positioning the market for long-term competitive growth.

- For instance, Storz & Bickel’s Volcano Digital vaporizer provides granular control over the user experience by offering a precise temperature selection range between 104°F and 446°F, allowing for detailed adjustments to suit individual preferences.

Marketing Strategies Expanding Consumer Base

Companies are leveraging targeted branding and product diversification to strengthen their market presence. Strategic partnerships with dispensaries and lifestyle brands are enhancing visibility and trust. It is enabling businesses to reach different demographic segments, from young recreational users to older medical patients. Promotional campaigns focused on quality, safety, and innovation are building brand loyalty. This marketing-driven approach is playing a key role in sustaining the momentum of the Handheld Marijuana Vaporizer Market.

Market Trends:

Rising Demand for Portable, Technology-Integrated Devices

The Handheld Marijuana Vaporizer Market is witnessing a surge in demand for compact devices equipped with advanced technological features. Consumers increasingly prefer models with precision temperature control, customizable settings, and extended battery performance for a more tailored experience. It is driving manufacturers to integrate smart connectivity, allowing users to monitor and adjust device functions via mobile applications. The appeal of discreet, travel-friendly designs is also expanding the customer base across both recreational and medical segments. Brands are focusing on lightweight materials and ergonomic designs to enhance portability without compromising durability. The emphasis on technology-driven differentiation is shaping purchasing decisions and influencing product innovation strategies across the industry.

- For instance, the Arizer Solo 3 vaporizer’s battery offers up to 3 hours of continuous use on a single charge.

Expansion of Premium Product Lines and Wellness-Oriented Offerings

A growing trend toward premiumization is redefining consumer expectations in the Handheld Marijuana Vaporizer Market. High-end devices with sleek aesthetics, superior materials, and precision engineering are attracting users seeking an elevated experience. It is also aligning with a broader shift toward wellness-oriented cannabis consumption, where vaporization is seen as a cleaner, safer alternative to smoking. Manufacturers are responding by introducing models with medical-grade components and advanced filtration systems to cater to health-conscious users. Collaborations with lifestyle and wellness brands are further enhancing product positioning in niche market segments. The combination of luxury appeal and functional health benefits is expected to strengthen market growth in the coming years.

- For instance, the AUXO Calent vaporizer features a unique 360° rotatable mouthpiece crafted from medical-grade zirconia.

Market Challenges Analysis:

Regulatory Uncertainty and Compliance Barriers

The Handheld Marijuana Vaporizer Market faces significant challenges from inconsistent cannabis regulations across different regions. Varying legal frameworks on product usage, marketing, and distribution create operational complexities for manufacturers and retailers. It limits the ability to standardize products and scale operations globally. Frequent changes in compliance requirements increase costs for testing, certification, and labeling. The uncertainty also affects consumer confidence in emerging markets where legalization remains under debate. Navigating these regulatory hurdles is a critical challenge for sustaining growth.

Counterfeit Products and Price Competition Pressures

An influx of low-quality and counterfeit vaporizers is undermining consumer trust and brand reputation in the Handheld Marijuana Vaporizer Market. Inferior products compromise safety and performance, leading to potential legal liabilities for sellers. It forces established brands to invest heavily in quality assurance, brand protection, and consumer education. Intense price competition from low-cost producers also pressures margins, especially in price-sensitive markets. The need to balance affordability with product innovation and safety standards remains a complex challenge. Maintaining differentiation in a crowded market requires consistent investment in R&D and brand-building strategies.

Market Opportunities:

Expansion into Emerging Legal Cannabis Markets

The Handheld Marijuana Vaporizer Market has significant growth potential in regions where cannabis legalization is gaining momentum. Countries in Latin America, parts of Asia, and Europe are exploring regulatory reforms that could open new sales channels. It offers manufacturers an opportunity to establish early market presence and build brand loyalty before competition intensifies. Strategic partnerships with local distributors and licensed producers can accelerate entry into these untapped markets. Rising consumer awareness of vaporization’s health benefits is expected to support rapid adoption. Early movers with compliance-ready products are positioned to capture substantial market share.

Product Diversification and Wellness Integration

Evolving consumer preferences toward wellness-focused lifestyles present strong opportunities for product innovation in the Handheld Marijuana Vaporizer Market. Manufacturers can expand portfolios with devices featuring medical-grade materials, advanced filtration, and precise dosing capabilities. It allows brands to target both recreational and medical cannabis users seeking safer and more controlled consumption. Collaborations with wellness, technology, and lifestyle brands can strengthen positioning in premium segments. Offering customizable features, eco-friendly designs, and sustainable packaging can further enhance appeal to environmentally conscious consumers. Aligning product development with health, sustainability, and personalization trends is expected to drive long-term competitive advantage.

Market Segmentation Analysis:

By Product

The Handheld Marijuana Vaporizer Market is divided into conduction vaporizers, convection vaporizers, and hybrid models. Conduction vaporizers dominate due to their affordability, ease of use, and quick heating capabilities. Convection models are gaining traction among experienced users seeking smoother vapor quality and consistent heating. Hybrid devices that combine both methods are appealing to consumers who value versatility and performance. It is driving manufacturers to innovate across all product types to capture varied user preferences.

- For instance, Storz & Bickel’s Volcano Hybrid integrates a double helix heat exchanger that allows the device to heat up and be ready for use in just 40 seconds.

By Charger

The market is segmented into USB charging, magnetic charging, and replaceable batteries. USB charging leads in adoption because of its convenience and compatibility with multiple devices. Magnetic charging is increasing in popularity due to its ease of connection and reduced wear on charging ports. Replaceable battery models attract heavy users who require uninterrupted use and prefer swapping batteries over downtime for recharging. This variety in charging options supports greater market accessibility and user satisfaction.

- For instance, Delta Electronics has developed the first commercially available USB-C charger that adheres to the USB PD 3.1 standard, delivering up to 240W of power to support high-demand devices like gaming laptops.

By Temperature Control

The market is classified into fixed and variable control devices. Variable temperature models are preferred by advanced users who seek precise customization for vapor density and flavor optimization. Fixed temperature devices maintain strong demand among casual users valuing simplicity and affordability. It is encouraging manufacturers to offer models across both categories, ensuring appeal to both entry-level and experienced consumers. The variety in control settings continues to drive innovation and competitive differentiation in the market.

Segmentations:

- By Product:

- Conduction Vaporizers

- Convection Vaporizers

- Hybrid Vaporizers

- By Charger:

- USB Charging

- Magnetic Charging

- Replaceable Batteries

- By Temperature Control:

- Fixed Temperature

- Variable Temperature

- By Sales Channel:

- Online Retail

- Offline Retail

- By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Maintaining Market Leadership

North America accounts for 48% of the Handheld Marijuana Vaporizer Market, making it the leading regional contributor. The United States drives the majority of sales, supported by widespread recreational and medical cannabis legalization. Canada’s fully legalized framework enables consistent product innovation and expansion into diverse consumer segments. It benefits from a mature retail infrastructure and a growing e-commerce network that enhances accessibility. Continuous investment in advanced technologies and aggressive marketing strategies sustains strong regional performance. The concentration of top manufacturers further reinforces North America’s leadership position.

Europe Experiencing Gradual yet Steady Expansion

Europe holds 27% of the Handheld Marijuana Vaporizer Market, supported by evolving cannabis regulations in countries such as Germany, the Netherlands, and the United Kingdom. Rising acceptance of medical cannabis is driving demand for vaporization devices that align with wellness-focused consumption. It is also benefiting from the popularity of premium, design-oriented devices that combine functionality and style. Collaborations between manufacturers and healthcare providers are facilitating product integration into medical cannabis programs. The gradual liberalization of cannabis-related laws creates a favorable environment for further growth. Targeted marketing and localized product strategies are enhancing competitive positioning in the region.

Asia-Pacific Gaining Traction through Regulatory Reforms

Asia-Pacific represents 15% of the Handheld Marijuana Vaporizer Market, with rapid growth potential as more countries explore legalization for medical purposes. Increasing consumer awareness and shifting attitudes toward cannabis consumption are creating new business opportunities. It is attracting global brands to enter through partnerships and local manufacturing arrangements. Rising disposable incomes and a preference for portable, discreet consumption methods are stimulating device adoption. Regulatory uncertainty persists in certain markets, but ongoing policy discussions signal long-term opportunities. Early market entrants stand to secure strong positioning as the legal cannabis landscape evolves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- PAX Labs, Inc

- DaVinci, Arizer

- Vape Elevate

- MyNextVape

- Boundless CF/CFX

- Grenco Science, Inc.

- Apollo AirVape

- STORZ & BICKEL

- Vapium

- PAX Labs Inc.

- Crafty, FireFly

- Ghost Herbal Concepts Ltd.

- Planet of the Vapes

Competitive Analysis:

The Handheld Marijuana Vaporizer Market is highly competitive, with established brands and emerging players striving to capture market share through product innovation, strategic partnerships, and targeted marketing. Leading companies focus on enhancing device performance through precision temperature control, improved battery efficiency, and ergonomic design. It is driving differentiation in both premium and mass-market segments. Competitors are also expanding distribution networks, leveraging e-commerce platforms, and forming alliances with cannabis producers to strengthen market presence. Branding strategies emphasize product quality, safety, and user experience to build customer loyalty. The market is witnessing increased investment in research and development to introduce technologically advanced and compliance-ready devices. It is fostering a dynamic competitive landscape where innovation speed and regulatory adaptability remain critical for sustained growth and positioning.

Recent Developments:

- In August 2025, PAX Labs launched the PAX FLOW, its most powerful dry herb cannabis vaporizer, which features a hybrid heating system.

- In June 2025, Greenlane Holdings, Inc. and PAX Labs, Inc. renewed their distribution agreement, reinforcing Greenlane’s role as a key U.S. distributor for PAX’s dry herb and oil vaporizer products, such as the PAX Plus and PAX Mini.

Market Concentration & Characteristics:

The Handheld Marijuana Vaporizer Market displays a moderate to high concentration, with a mix of dominant global brands and innovative niche players. Leading companies hold significant influence through strong brand recognition, extensive distribution channels, and continuous product innovation. It is characterized by rapid technological advancements, a growing focus on portability, and increasing integration of smart features. Regulatory compliance and product safety standards play a crucial role in shaping competitive strategies. The market demonstrates high consumer loyalty in premium segments, while price sensitivity drives competition in entry-level categories. It continues to evolve through product diversification, strategic partnerships, and expanding legal cannabis markets.

Report Coverage:

The research report offers an in-depth analysis based on Product, Charger, Temperature Control, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Legal cannabis expansion across new markets will create significant opportunities for product adoption and brand growth.

- Advancements in vaporization technology will improve device efficiency, user customization, and overall performance.

- Growing consumer preference for discreet and health-conscious cannabis consumption will sustain demand momentum.

- Integration of smart connectivity features will enhance user control and engagement through mobile applications.

- Premium product segments will expand as consumers seek high-quality materials, advanced features, and aesthetic designs.

- Partnerships between device manufacturers and licensed cannabis producers will strengthen product-market fit and distribution reach.

- E-commerce growth will increase product accessibility, especially in regions with limited physical retail presence.

- Competitive differentiation will rely on innovation speed, design appeal, and compliance with evolving regulations.

- Eco-friendly materials and sustainable packaging will gain traction as environmental awareness influences purchase decisions.

- Entry of new players into emerging legal cannabis regions will intensify competition and encourage localized product strategies.