Market Overview:

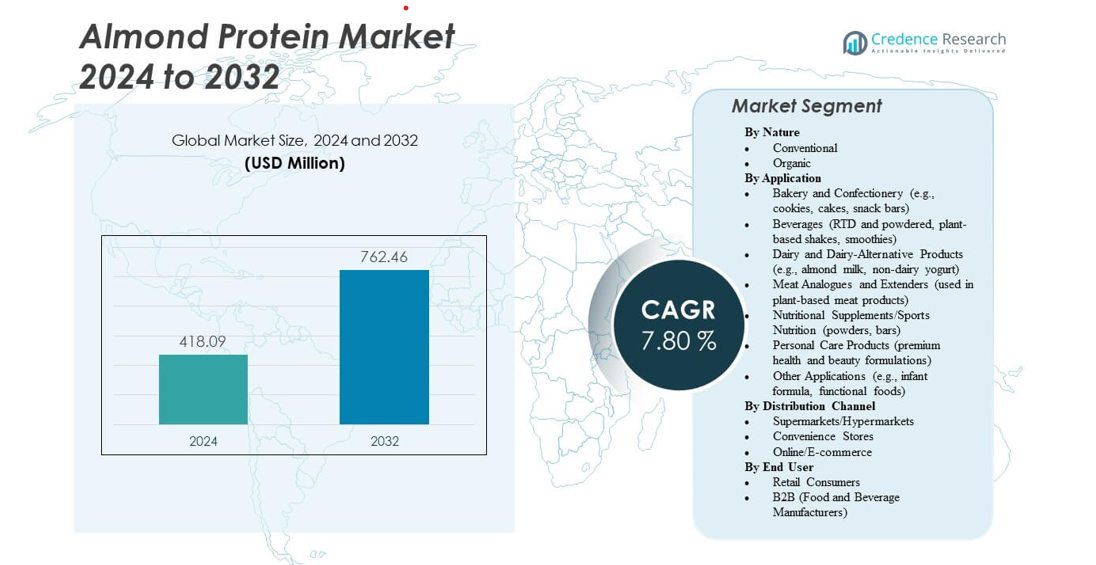

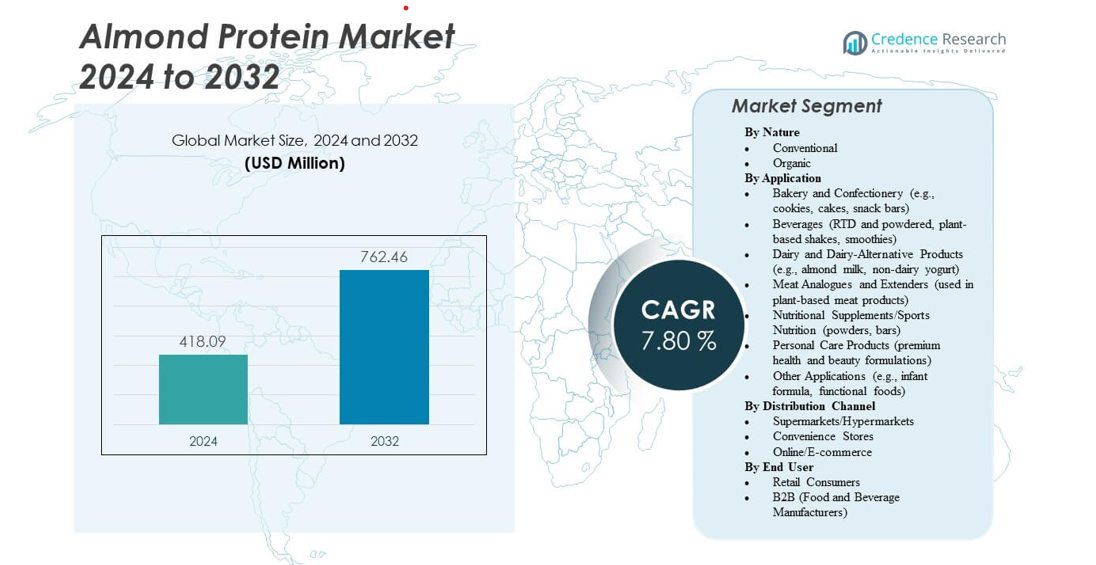

The Almond Protein Market is projected to grow from USD 418.09 million in 2024 to an estimated USD 762.46 million by 2032, with a compound annual growth rate (CAGR) of 7.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Almond Protein Market Size 2024 |

USD 418.09 million |

| Almond Protein Market, CAGR |

7.8% |

| Almond Protein Market Size 2032 |

USD 762.46 million |

Rising consumer awareness of plant-based nutrition and the shift toward vegan and allergen-free diets are driving the market’s expansion. Almond protein is gaining popularity for its clean-label composition, smooth texture, and superior digestibility compared to other plant proteins. It is widely used in functional foods, beverages, and dietary supplements due to its high amino acid content and sustainability credentials. Increasing demand for fortified, protein-rich products among health-conscious consumers continues to boost market adoption.

North America leads the market due to high awareness of plant-based proteins and widespread adoption in functional food and beverage applications. Europe follows closely, supported by sustainability initiatives and a growing preference for organic and non-GMO protein sources. The Asia-Pacific region is emerging rapidly, driven by rising disposable incomes, urbanization, and increasing adoption of Western dietary habits that emphasize nutrition and wellness.

Market Insights:

- The Almond Protein Market is valued at USD 418.09 million in 2024 and projected to reach USD 762.46 million by 2032, growing at 7.8% CAGR.

- Rising adoption of plant-based diets and clean-label products is driving consistent market demand.

- Increasing use of almond protein in beverages, functional foods, and supplements supports product diversification.

- Growing health awareness and preference for allergen-free, gluten-free ingredients enhance consumer engagement.

- Technological progress in cold-pressing and enzymatic hydrolysis improves protein purity and stability.

- North America leads due to strong product innovation and established processing infrastructure.

- Asia-Pacific emerges as a key growth hub, supported by rising income, urbanization, and Western dietary influence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Shift Toward Plant-Based and Sustainable Protein Sources

Consumer preference is moving rapidly toward plant-based proteins due to health and environmental awareness. The Almond Protein Market benefits from this trend as consumers seek natural, vegan, and lactose-free alternatives to animal protein. Almond protein is valued for its clean-label and non-GMO attributes, aligning with the growing demand for transparent ingredient sourcing. Food and beverage companies are reformulating products to include almond protein in smoothies, snacks, and dairy substitutes. It gains traction among fitness enthusiasts for muscle recovery and energy balance. Growing environmental concerns also push brands to replace soy and whey protein. Manufacturers highlight its low carbon footprint and water efficiency during cultivation. This demand reinforces almond protein’s position as a sustainable, health-forward ingredient.

- For instance, Blue Diamond Growers highlights that its Almond Protein Powder offers a neutral taste and smooth texture, making it suitable for applications in smoothies, nutrition bars, and dairy alternatives, according to its official ingredient documentation.

Expanding Functional Food and Beverage Applications

Functional food innovation is a major force behind the Almond Protein Market. The ingredient’s high amino acid content, mild taste, and texture compatibility allow integration into multiple product lines. Companies are using almond protein in bakery items, meal replacements, and sports nutrition formulations to meet the high-protein trend. It supports digestive wellness and heart health, making it appealing to health-conscious consumers. Beverage manufacturers are incorporating almond protein into dairy alternatives to enhance nutritional content. Rising adoption of protein-fortified drinks in gyms and retail chains boosts commercial demand. It helps brands differentiate through nutritional superiority and cleaner profiles. The trend supports a strong market foundation for sustained growth.

- For instance, Archer Daniels Midland (ADM) has expanded its plant-based protein portfolio through innovations in pea and soy protein isolates, focusing on improved amino acid profiles, solubility, and functionality to meet the rising demand for clean-label, high-protein formulations in food and beverages.

Technological Innovations in Extraction and Processing Efficiency

Advancements in extraction and processing are improving the efficiency and purity of almond protein. The Almond Protein Market benefits from innovations such as cold-pressing and enzymatic hydrolysis, which enhance yield and functional quality. These methods improve solubility, texture, and shelf stability, expanding its usability across multiple formulations. Processing innovations help minimize nutrient loss, ensuring better protein retention. It strengthens the market’s competitiveness against other plant proteins like pea and soy. Manufacturers invest in proprietary technologies to lower production costs and maintain flavor integrity. The integration of automation and AI in quality control further ensures consistent product standards. Such technological progress increases consumer trust and long-term scalability.

Growing Health Awareness and Lifestyle Shifts Among Consumers

Health-conscious lifestyles are reshaping dietary habits, favoring high-protein and low-fat nutrition options. The Almond Protein Market gains attention from consumers aiming for balanced diets without artificial ingredients. Its allergen-free and gluten-free profile attracts individuals with dietary sensitivities. It supports energy balance, weight management, and muscle recovery, driving interest across fitness communities. Consumers perceive almond protein as a natural and nutrient-rich supplement for daily wellness. The influence of online nutrition education increases awareness of almond-based ingredients. Retailers and e-commerce platforms are amplifying accessibility through protein powders, bars, and beverages. Such lifestyle-driven demand positions almond protein as a premium, health-oriented ingredient in global markets.

Market Trends

Rise of Clean Label and Minimal Ingredient Formulations

Consumers increasingly prefer clean-label foods emphasizing transparency and simplicity. The Almond Protein Market aligns with this trend through products containing minimal and natural ingredients. Brands highlight “no artificial additives” and “plant-based purity” to attract label-conscious buyers. Manufacturers reformulate existing items to meet clean-label standards while maintaining taste and texture. It pushes the development of almond protein products in bars, cereals, and dairy alternatives. Certification standards such as organic and non-GMO labeling are now essential differentiators. Companies leveraging traceable almond sources strengthen consumer confidence and brand loyalty. This shift drives innovation across global food and supplement categories.

- For instance, Blue Diamond Growers launched its Almond Protein Powder with Non-GMO Project Verified and USDA Organic certifications, containing five or fewer key ingredients and offering full traceability to grower-owned California farms.

Expansion of Vegan and Flexitarian Diet Adoption

Global dietary preferences are evolving toward vegan and flexitarian lifestyles. The Almond Protein Market benefits as consumers reduce dependence on animal proteins for ethical and health reasons. Almond protein is favored due to its mild flavor, digestibility, and sustainable profile. Food manufacturers are creating hybrid and fully plant-based formulations featuring almond protein. It addresses the growing interest in natural proteins that align with ethical food consumption. Celebrity endorsements and fitness influencers further accelerate awareness of plant nutrition. Retail availability of vegan products in mainstream stores expands reach among diverse demographics. This diet evolution sustains long-term growth in the almond protein segment.

Integration into High-Performance Nutrition and Sports Applications

Almond protein is gaining presence in sports and performance nutrition segments. The Almond Protein Market is witnessing collaborations between fitness brands and supplement manufacturers. Its natural protein profile appeals to athletes seeking non-dairy, easily digestible protein sources. Companies are integrating almond protein into pre- and post-workout products. It provides essential amino acids supporting endurance, recovery, and muscle repair. Clean-label sports nutrition formulations are now preferred over synthetic blends. Marketing campaigns emphasize plant-powered strength and natural recovery benefits. This trend diversifies product portfolios across the health and wellness industry.

- For instance, research supported by the Almond Board of California found that consuming 2 ounces of almonds daily reduced post-exercise muscle damage markers, including creatine kinase, and supported faster recovery in athletes. These findings highlight almonds’ potential role in performance nutrition.

Innovative Product Development Through Blended Protein Solutions

Manufacturers are developing blended protein products combining almond protein with pea, rice, or oat protein. The Almond Protein Market gains from such synergies offering better taste and complete amino acid profiles. Blended formulations help overcome solubility challenges and improve texture consistency. These combinations appeal to manufacturers looking for cost-efficient and nutritionally balanced options. It supports wider applications in bakery, beverages, and nutritional supplements. R&D investments focus on improving sensory quality while retaining nutritional benefits. Companies promote these blends as next-generation plant proteins. The strategy strengthens product acceptance in competitive plant-based markets.

Market Challenges Analysis

Fluctuating Raw Material Prices and Limited Almond Supply Chain Stability

Volatile almond prices and supply chain constraints remain major hurdles for the Almond Protein Market. Almond production heavily depends on favorable climate conditions, making it sensitive to drought and temperature shifts. It creates unpredictability in pricing and availability for manufacturers. High procurement costs directly affect profitability and product pricing. The concentration of almond cultivation in specific regions limits global production scalability. Supply disruptions during harvest cycles lead to inconsistent raw material flow. It forces companies to explore alternative sourcing partnerships to stabilize supply. Such challenges impact the long-term cost structure and competitiveness of almond-based protein ingredients.

High Production Costs and Functional Limitations in Product Formulation

Almond protein extraction involves advanced processing, leading to higher costs than competing proteins. The Almond Protein Market faces challenges due to expensive equipment and limited yield efficiency. The ingredient’s solubility and texture variability create formulation difficulties in beverages and high-protein foods. It requires specialized blending techniques to maintain product quality. Manufacturers must balance taste, shelf stability, and nutrition without additives. Regulatory compliance for allergen labeling also increases operational complexity. These factors limit small and mid-scale producers from entering the market. Overcoming production inefficiencies and achieving consistent quality remain critical to enhancing affordability and market reach.

Market Opportunities

Expanding Applications in Nutraceuticals and Functional Beverages

The rising demand for functional beverages and nutritional supplements presents major opportunities for the Almond Protein Market. Almond protein offers superior nutritional composition with essential amino acids and fiber content. It supports digestive wellness and promotes heart health, aligning with wellness-focused consumer priorities. Nutraceutical brands are developing almond protein-based shakes and supplements. It helps diversify portfolios toward plant-based formulations with clean nutrition appeal. Collaboration between beverage manufacturers and ingredient suppliers is expanding innovation capacity. Product launches featuring fortified almond drinks in health retail chains are increasing visibility. These opportunities elevate the market’s growth potential in wellness-oriented consumer categories.

Rising Adoption Across Emerging Economies and Premium Food Categories

Emerging markets are witnessing growing demand for plant-based and premium food ingredients. The Almond Protein Market stands to benefit from urbanization, rising disposable incomes, and dietary modernization. Consumers in Asia-Pacific and Latin America are shifting toward protein-rich diets influenced by Western trends. It offers opportunities for regional producers to expand distribution networks and processing facilities. Premium categories like dairy alternatives, confectionery, and high-protein snacks are integrating almond protein. Marketing strategies emphasizing sustainability and ethical sourcing attract eco-conscious buyers. Expansion into these markets strengthens global brand presence and supports sustainable value chain development.

Market Segmentation Analysis:

By Nature

The Almond Protein Market is segmented into conventional and organic varieties. Conventional almond protein dominates due to wider availability and lower production costs. It is widely used in processed foods, beverages, and supplements targeting mainstream consumers. Organic almond protein is gaining traction in premium and clean-label product categories. It appeals to health-conscious buyers seeking pesticide-free and sustainably sourced ingredients. Growing regulatory support for organic certifications strengthens its presence. Both segments continue to expand due to shifting consumer focus toward natural and transparent nutrition sources.

- For instance, Blue Diamond Growers partnered with Divert, Inc. in September 2024 to convert almond processing by-products into renewable energy at a new facility in Turlock, California. The project is designed to generate enough energy to power approximately 3,000 homes each year, demonstrating a strong commitment to sustainability and waste-to-energy innovation.

By Application

The market spans diverse applications including bakery, beverages, dairy alternatives, meat analogues, sports nutrition, personal care, and functional foods. Bakery and confectionery use almond protein for texture and protein enrichment in cookies, bars, and cakes. Beverage manufacturers integrate it into plant-based shakes and smoothies for nutritional value. Dairy alternatives such as almond milk and yogurt rely on it for protein fortification. Meat analogues and sports nutrition products use it to enhance texture and amino acid balance. Personal care applications are rising due to its moisturizing and antioxidant properties.

By Distribution Channel

Supermarkets and hypermarkets remain key retail platforms for almond protein-based foods and supplements. These outlets offer strong visibility and diverse product availability. Convenience stores serve on-the-go consumers seeking quick nutrition. Online and e-commerce channels are expanding rapidly due to direct-to-consumer sales and global reach. It benefits from digital promotions, subscription models, and wider consumer accessibility. Growing online demand supports smaller brands in scaling their reach across multiple regions efficiently.

By End User

Retail consumers represent a large portion of demand, driven by rising awareness of plant-based and high-protein diets. They prefer almond protein powders, snacks, and beverages for daily nutrition. The B2B segment, including food and beverage manufacturers, is expanding through product innovation and ingredient integration. It plays a key role in scaling supply chains and ensuring consistent ingredient quality. Both segments contribute to strong global adoption, ensuring diverse growth across consumer and industrial applications.

- For instance, Noosh Brands produces almond protein powder made from cold-pressed California almonds, maintaining the natural amino acid profile and clean flavor. The company highlights its single-ingredient, gluten-free formulation as part of its commitment to transparent, plant-based nutrition.

Segmentation:

By Nature

By Application

- Bakery and Confectionery (e.g., cookies, cakes, snack bars)

- Beverages (RTD and powdered, plant-based shakes, smoothies)

- Dairy and Dairy-Alternative Products (e.g., almond milk, non-dairy yogurt)

- Meat Analogues and Extenders (used in plant-based meat products)

- Nutritional Supplements/Sports Nutrition (powders, bars)

- Personal Care Products (premium health and beauty formulations)

- Other Applications (e.g., infant formula, functional foods)

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online/E-commerce

By End User

- Retail Consumers

- B2B (Food and Beverage Manufacturers)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Almond Protein Market with 38%. The region leads due to strong consumer awareness of plant-based nutrition and wide product adoption across food, beverage, and sports nutrition categories. The U.S. drives market demand through innovation in functional foods and dairy alternatives. It benefits from advanced processing technologies and a mature retail infrastructure. Major companies are expanding almond-based product lines to meet clean-label and vegan trends. Growing demand from health-focused consumers continues to strengthen regional leadership in global exports and formulation innovation.

Europe accounts for 29% of the global share, supported by a well-established plant-based food industry and growing preference for organic protein ingredients. The region experiences strong traction in markets such as Germany, the U.K., and France, where consumers emphasize sustainability and ethical sourcing. It benefits from strict labeling regulations promoting transparency and product quality. Food manufacturers are incorporating almond protein into bakery, snacks, and dairy-free applications. The demand for organic and allergen-free alternatives continues to accelerate across European households. Strategic collaborations among ingredient suppliers and consumer brands reinforce market expansion.

Asia-Pacific represents 24% of the market share and is emerging as the fastest-growing region. Rapid urbanization and increasing disposable incomes are driving consumer interest in healthy protein sources. The Almond Protein Market in Asia-Pacific is expanding through rising vegan adoption in countries such as China, Japan, and India. It benefits from western dietary influence and increasing awareness of nutritional balance. Local manufacturers are investing in new processing facilities to meet rising domestic demand. The region’s growth is supported by e-commerce penetration and retail modernization enhancing product accessibility. Latin America and the Middle East & Africa together account for 9%, showing gradual adoption led by urban lifestyle changes and health-focused consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Blue Diamond Growers

- Olam Food Ingredients (ofi)

- Harris Woolf Almonds

- Archer Daniels Midland Company (ADM)

- Ingredion Incorporated

- Axiom Foods

- The Wonderful Company

- Batory Foods

- Austrade Inc.

- All Organic Treasures GmbH

- Noosh Brands

- Sabinsa Corporation (Promond)

- Z-Company B.V.

- OPW Ingredients

- Eklavya Biotech Private Limited

Competitive Analysis:

The Almond Protein Market features a moderately competitive landscape with a blend of global and regional players. Leading companies such as Blue Diamond Growers, Olam Food Ingredients, and Archer Daniels Midland Company focus on product innovation, sustainability, and advanced processing technologies. It remains competitive due to continuous R&D in protein extraction and flavor improvement. Firms like Harris Woolf Almonds and The Wonderful Company strengthen supply chains through vertical integration and quality assurance. Emerging participants including Noosh Brands and Z-Company B.V. are gaining attention with premium clean-label offerings. Strategic partnerships, product diversification, and regional expansions define competition dynamics. The focus on organic certification, allergen-free formulations, and eco-efficient production continues to shape brand positioning and market leadership.

Recent Developments:

- In September 2025, Almond Board of California entered a strategic partnership with EAT to advance sustainable and healthy diets, reinforcing almond-based proteins in sustainable food systems.

- In August 2025, Blue Diamond Growers extended their partnership as the “Official Snack” of the Big Ten Conference, highlighting their almond products including those high in protein.

- In November 2024, Blue Diamond launched a new seasonal “Frosted Brownie Almonds” product ahead of the holiday season, expanding the company’s portfolio and responding to continued consumer interest in almond-based, high-protein snacks.

- In September 2024, Blue Diamond Growers entered into a partnership with Divert, Inc. to transform almond processing byproducts, including almond protein, into renewable energy. This collaboration leverages Divert’s advanced technologies to convert processing waste into sustainable energy sources, contributing to California’s broader net-zero ambitions.

Report Coverage:

The research report offers an in-depth analysis based on Nature, Application, Distribution Channel and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for plant-based proteins will continue to strengthen almond protein adoption across food and beverage sectors.

- Expansion of vegan and flexitarian lifestyles will create new opportunities in functional foods and clean-label nutrition.

- Technological improvements in extraction and processing will enhance product quality and lower production costs.

- Increased investment in R&D will drive innovation in flavor enhancement and protein solubility.

- The rise of personalized nutrition will boost almond protein use in dietary supplements and sports nutrition.

- Premiumization trends will expand organic almond protein applications in high-end consumer products.

- Strategic collaborations between ingredient suppliers and consumer brands will improve market penetration.

- E-commerce growth will expand accessibility, especially across Asia-Pacific and emerging economies.

- Sustainability goals and traceable sourcing practices will enhance brand trust and consumer loyalty.

- Continuous expansion in food technology will integrate almond protein into hybrid and blended protein systems.