CHAPTER NO. 1 : INTRODUCTION 22

1.1. Report Description 22

Purpose of the Report 22

USP & Key Offerings 22

1.2. Key Benefits for Stakeholders 23

1.3. Target Audience 23

CHAPTER NO. 2 : EXECUTIVE SUMMARY 24

CHAPTER NO. 3 : PHILIPPINES AND GLOBAL SUSTAINABLE SEAFOOD MARKET FORCES & INDUSTRY PULSE 27

3.1. Foundations of Change – Market Overview 27

3.2. Catalysts of Expansion – Key Market Drivers 29

3.3. Momentum Boosters – Growth Triggers 30

3.4. Innovation Fuel – Disruptive Technologies 30

3.5. Headwinds & Crosswinds – Market Restraints 31

3.6. Regulatory Tides – Compliance Challenges 32

3.7. Economic Frictions – Inflationary Pressures 32

3.8. Untapped Horizons – Growth Potential & Opportunities and Strategic Navigation – Industry Frameworks 33

3.9. Market Equilibrium – Porter’s Five Forces 34

3.10. Ecosystem Dynamics – Value Chain Analysis 36

3.11. Macro Forces – PESTEL Breakdown 38

3.12. Price Trend Analysis 40

3.12.1. Country-wise Price Trend 41

3.12.2. Price Trend by Product 41

3.12.3. Price and Consumer Behavior 41

3.13. Buying Criteria 42

3.14. Top 20 Seafood in the Philippines 43

3.15. Share of Business of Fresh, Frozen, dried, and processed seafood in the Philippine Market 44

3.16. Key Insights National Capital Region (NCR) 45

CHAPTER NO. 4 : COMPETITION ANALYSIS 46

4.1. Company Market Share Analysis 46

4.1.1. Philippines and Global Sustainable Seafood Market Company Volume Market Share 46

4.1.2. Philippines and Global Sustainable Seafood Market Company Revenue Market Share 48

4.2. Strategic Developments 50

4.2.1. Acquisitions & Mergers 50

4.2.2. New Product Launch 51

4.2.3. Agreements & Collaborations 52

4.3. Competitive Dashboard 53

4.4. Company Assessment Metrics, 2024 54

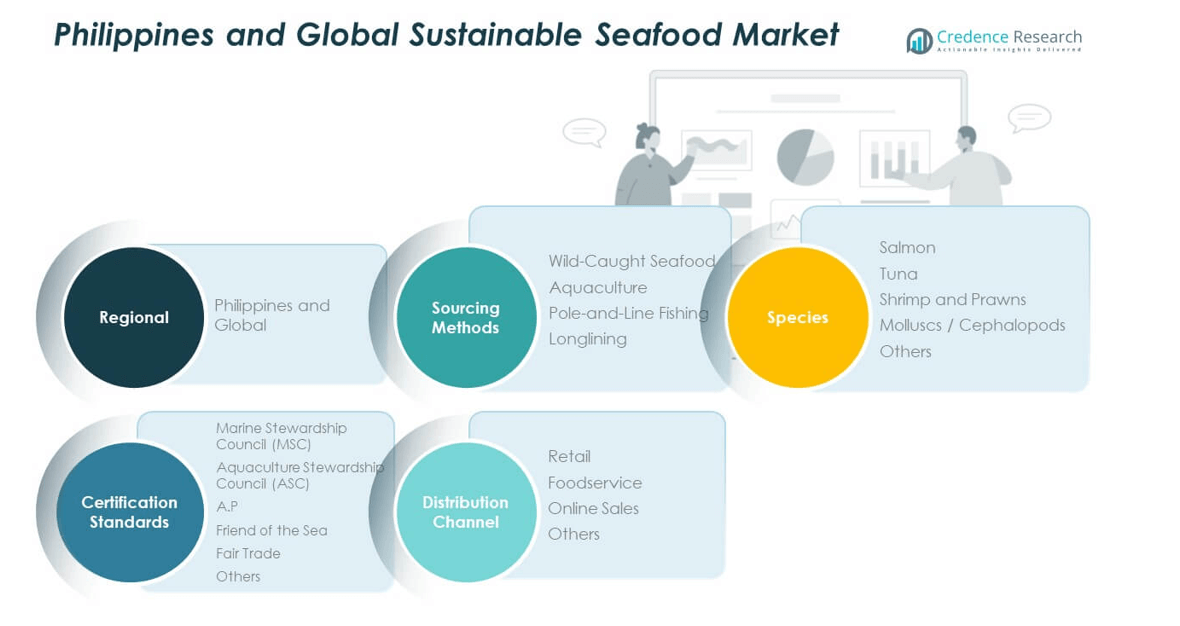

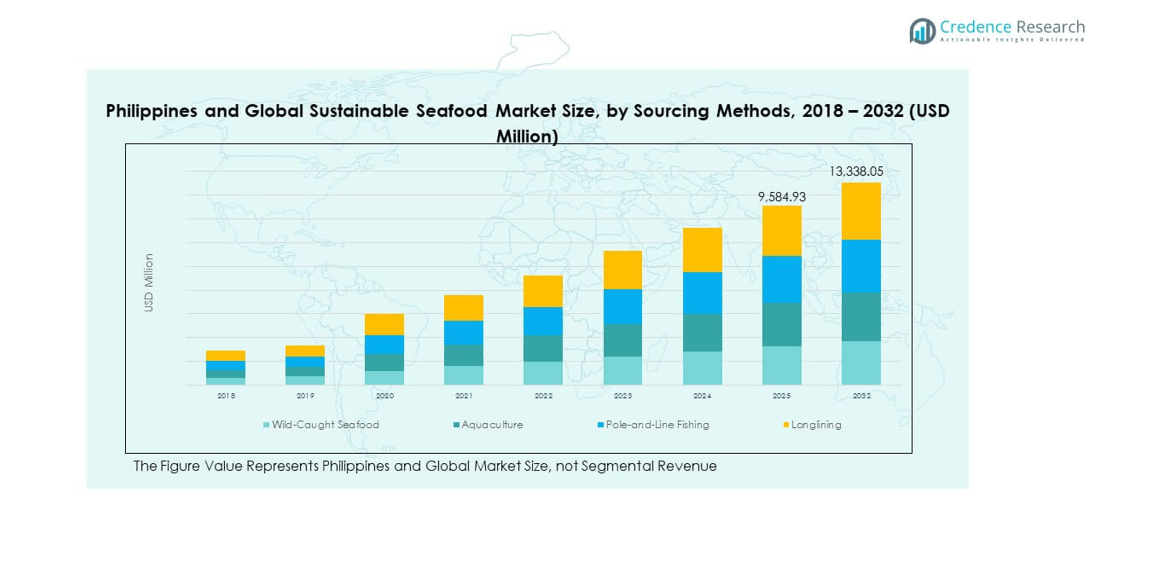

CHAPTER NO. 5 : PHILIPPINES MARKET ANALYSIS, INSIGHTS & FORECAST, BY SOURCING METHODS 55

CHAPTER NO. 6 : PHILIPPINES MARKET ANALYSIS, INSIGHTS & FORECAST, BY SPECIES 59

CHAPTER NO. 7 : PHILIPPINES MARKET ANALYSIS, INSIGHTS & FORECAST, BY CERTIFICATION STANDARDS 64

CHAPTER NO. 8 : PHILIPPINES MARKET ANALYSIS, INSIGHTS & FORECAST, BY DISTRIBUTION CHANNEL 69

CHAPTER NO. 9 : PHILIPPINES AND GLOBAL MARKET ANALYSIS, INSIGHTS & FORECAST 74

CHAPTER NO. 10 : COMPANY PROFILE 86

10.1. Phil Union Frozen Foods, Inc. (PUFFI) 86

10.2. Meliomar Inc. 89

10.3. Century Pacific Food, Inc. 89

10.4. Fisher Farms Incorporated 89

10.5. Philbest Canning Co. 89

10.6. Akai Foods, Inc. 89

10.7. Better Seafood Philippines 89

10.8. Company 8 89

10.9. Company 9 89

10.10. Company 10 89

10.11. Company 11 89

10.12. Company 12 89

10.13. Company 13 89

10.14. Company 14 89

List of Figures

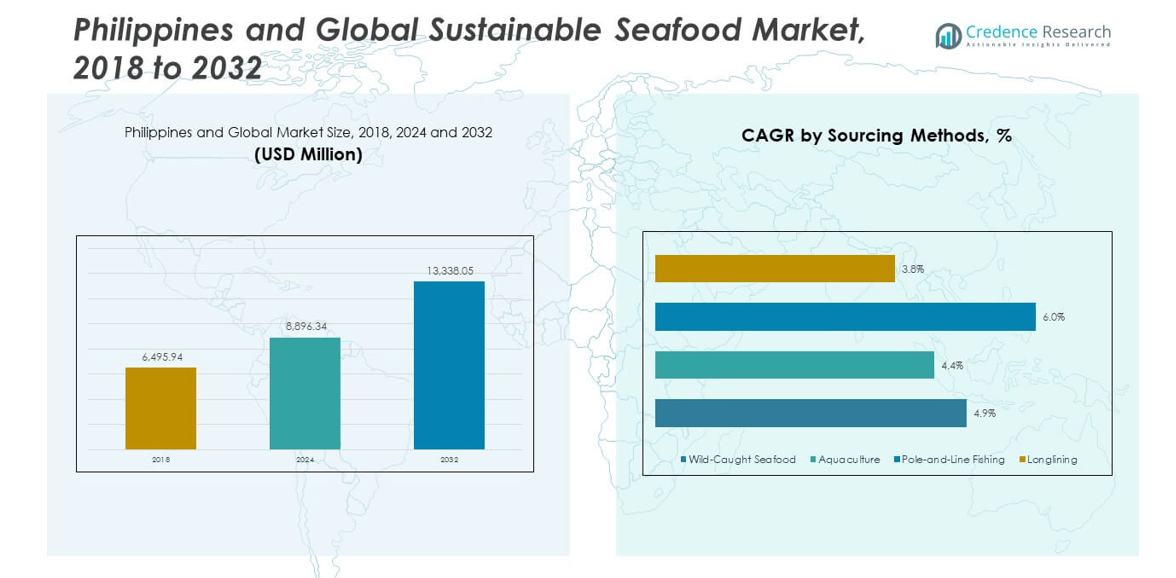

FIG NO. 1. Sustainable Seafood Market Revenue Share, By Sourcing Methods, 2026 & 2030 55

FIG NO. 2. Market Attractiveness Analysis, By Sourcing Methods 56

FIG NO. 3. Incremental Revenue Growth Opportunity by Sourcing Methods, 2026 – 2030 57

FIG NO. 4. Sustainable Seafood Market Revenue Share, By Species, 2026 & 2030 59

FIG NO. 5. Incremental Revenue Growth Opportunity by Species, 2026 – 2030 60

FIG NO. 6. Incremental Revenue Growth Opportunity by Species, 2026 – 2030 61

FIG NO. 7. Sustainable Seafood Market Revenue Share, By Certification Standards, 2026 & 2030 64

FIG NO. 8. Market Attractiveness Analysis, By Certification Standards 65

FIG NO. 9. Incremental Revenue Growth Opportunity by Certification Standards, 2026 – 2030 66

FIG NO. 10. Sustainable Seafood Market Revenue Share, By Distribution Channel, 2026 & 2030 69

FIG NO. 11. Market Attractiveness Analysis, By Distribution Channel 70

FIG NO. 12. Incremental Revenue Growth Opportunity by Distribution Channel, 2026 – 2030 71

FIG NO. 13. Sustainable Seafood Market Revenue Share, By Region, 2026 & 2030 74

FIG NO. 14. Market Attractiveness Analysis, By Region 75

FIG NO. 15. Incremental Revenue Growth Opportunity by Region, 2026 – 2030 76

List of Tables

TABLE NO. 1. : Top 20 Seafood in the Philippines 43

TABLE NO. 2. : Share of Business of Fresh, Frozen, dried, and processed seafood in the Philippine Market 44

TABLE NO. 3. : Philippines Sustainable Seafood Market Revenue, By Sourcing Methods, 2026 – 2030 (USD Million) 58

TABLE NO. 4. : Philippines Sustainable Seafood Market Volume, By Sourcing Methods, 2026 – 2030 (Metric Tons) 58

TABLE NO. 5. : Philippines Sustainable Seafood Market Revenue, By Species, 2026 – 2030 (USD Million) 62

TABLE NO. 6. : Philippines Sustainable Seafood Market Volume, By Species, 2026 – 2030 (Metric Tons) 63

TABLE NO. 7. : Philippines Sustainable Seafood Market Revenue, By Certification Standards, 2026 – 2030 (USD Million) 67

TABLE NO. 8. : Philippines Sustainable Seafood Market Volume, By Certification Standards, 2026 – 2030 (Metric Tons) 68

TABLE NO. 9. : Philippines Sustainable Seafood Market Revenue, By Distribution Channel, 2026 – 2030 (USD Million) 72

TABLE NO. 10. : Philippines Sustainable Seafood Market Volume, By Distribution Channel, 2026 – 2030 (Metric Tons) 73

TABLE NO. 11. : Global Sustainable Seafood Market Revenue, By Region, 2026 – 2030 (USD Million) 77

TABLE NO. 12. : Global Sustainable Seafood Market Volume, By Region, 2026 – 2030 (Metric Tons) 78

TABLE NO. 13. : Global Sustainable Seafood Market Revenue, By Sourcing Methods, 2026 – 2030 (USD Million) 79

TABLE NO. 14. : Global Sustainable Seafood Market Volume, By Sourcing Methods, 2026 – 2030 (Metric Tons) 79

TABLE NO. 15. : Global Sustainable Seafood Market Revenue, By Species, 2026 – 2030 (USD Million) 80

TABLE NO. 16. : Global Sustainable Seafood Market Volume, By Species, 2026 – 2030 (Metric Tons) 81

TABLE NO. 17. : Global Sustainable Seafood Market Revenue, By Certification Standards, 2026 – 2030 (USD Million) 82

TABLE NO. 18. : Global Sustainable Seafood Market Volume, By Certification Standards, 2026 – 2030 (Metric Tons) 83

TABLE NO. 19. : Global Sustainable Seafood Market Revenue, By Distribution Channel, 2026 – 2030 (USD Million) 84

TABLE NO. 20. : Global Sustainable Seafood Market Volume, By Distribution Channel, 2026 – 2030 (Metric Tons) 85