Market Overview:

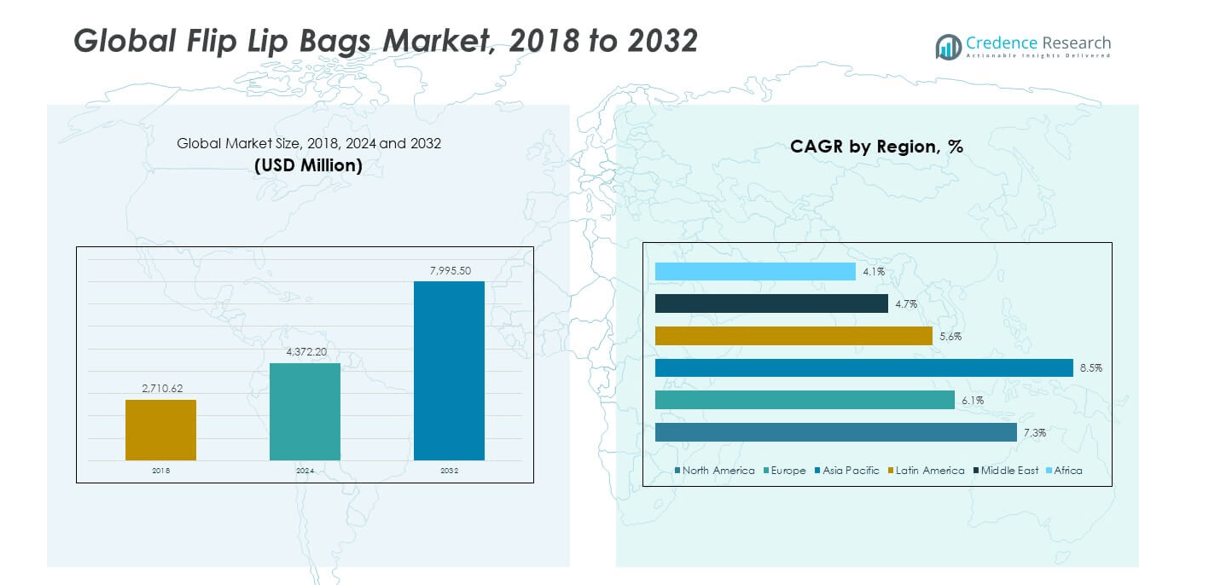

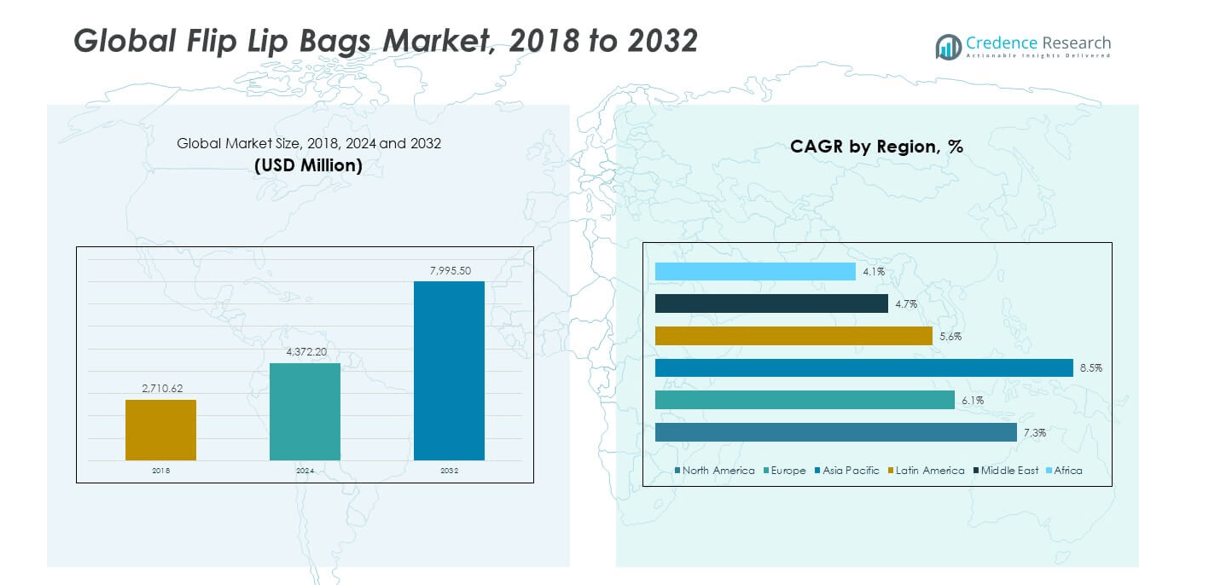

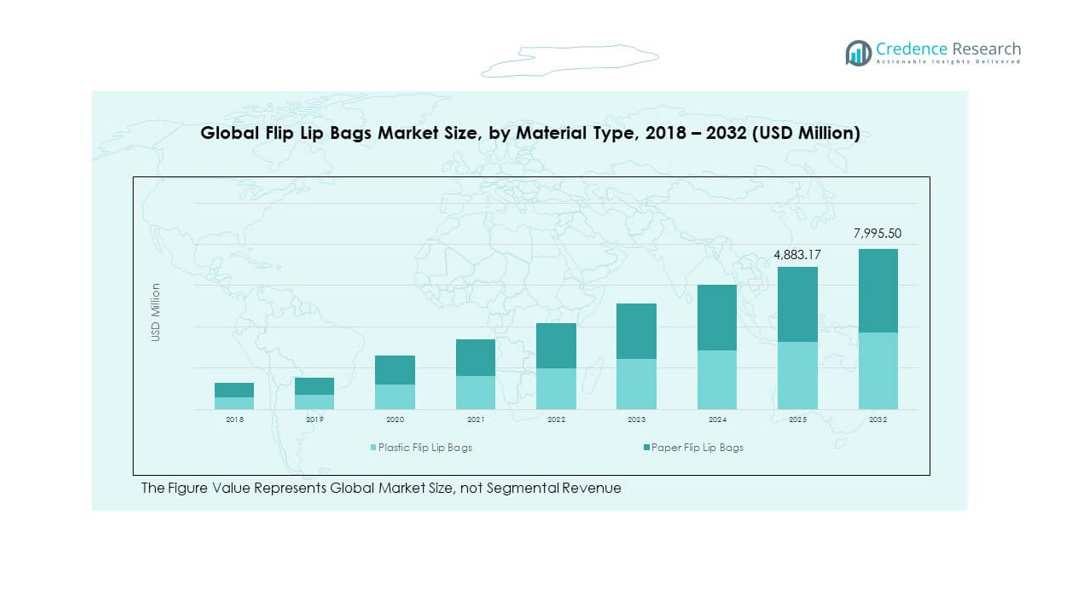

The Global Flip Lip Bags Market size was valued at USD 2,710.62 million in 2018 to USD 4,372.20 million in 2024 and is anticipated to reach USD 7,995.50 million by 2032, at a CAGR of 7.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flip Lip Bags Market Size 2024 |

USD 4,372.20 million |

| Flip Lip Bags Market, CAGR |

7.30% |

| Flip Lip Bags Market Size 2032 |

USD 7,995.50 million |

Growing demand for convenient and eco-friendly packaging solutions is driving the market expansion. The rising focus on sustainable materials, such as biodegradable plastics and paper-based bags, is encouraging product innovation. Brands are adopting flip lip bags for easy resealability and enhanced product protection. The surge in e-commerce and retail sectors further boosts demand, as these bags improve customer convenience while maintaining product freshness and integrity during transit.

Geographically, North America and Europe dominate the market due to strong retail infrastructure, higher environmental awareness, and the presence of leading packaging manufacturers. Asia-Pacific is emerging rapidly, driven by growing retail networks, urbanization, and rising consumer preference for sustainable and lightweight packaging. Countries such as China and India are witnessing strong production capabilities, making the region a key manufacturing hub for flip lip bags.

Market Insights:

- The Global Flip Lip Bags Market was valued at USD 2,710.62 million in 2018, reached USD 4,372.20 million in 2024, and is projected to hit USD 7,995.50 million by 2032, registering a CAGR of 7.30% during the forecast period.

- Asia Pacific (33%), North America (30.5%), and Europe (18.7%) dominate the market due to strong retail infrastructure, consumer awareness of sustainable packaging, and rapid adoption of resealable formats across food and personal care sectors.

- Asia Pacific remains the fastest-growing region, supported by expanding e-commerce, industrial packaging capabilities, and rising demand for lightweight, eco-friendly materials in developing economies like China and India.

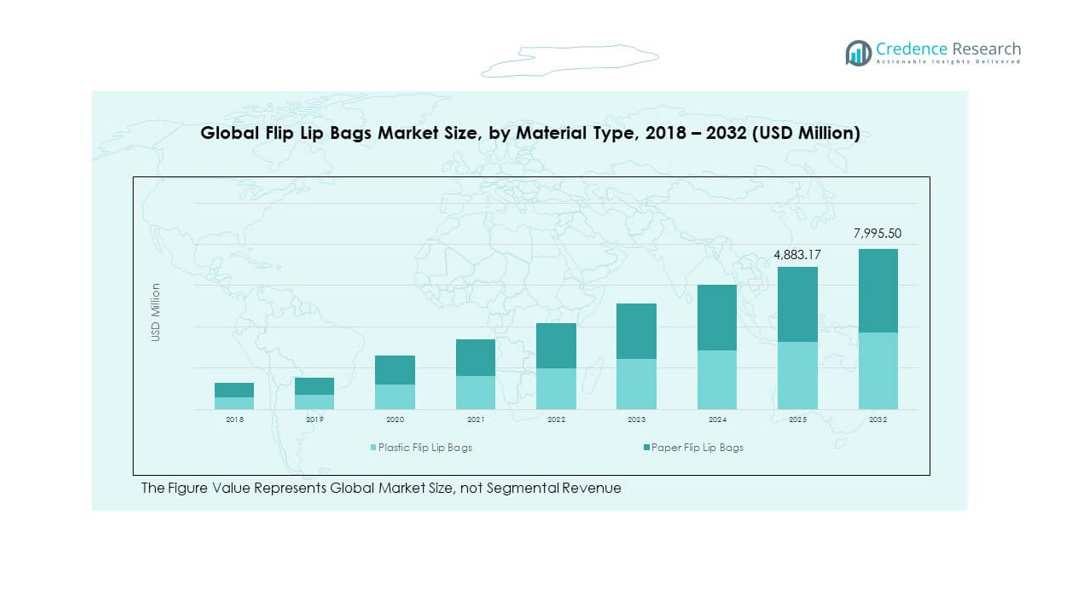

- Plastic flip lip bags account for roughly 70% of total market share, driven by cost efficiency, durability, and widespread use in food and retail packaging.

- Paper flip lip bags represent around 30%, gaining popularity through sustainability-driven innovation and regulatory pressure favoring biodegradable and recyclable packaging materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Convenient and Resealable Packaging Solutions

The Global Flip Lip Bags Market is driven by growing consumer preference for easy-to-use, resealable packaging. Flip lip bags offer convenience for on-the-go lifestyles, helping preserve product freshness and quality. Food, cosmetic, and pharmaceutical brands favor these bags due to their hygienic sealing and user-friendly design. The increasing demand for portion-controlled packaging in urban areas supports market expansion. Manufacturers focus on improving seal strength and material flexibility to enhance user experience. E-commerce growth also drives adoption, as these bags ensure product safety during shipping. Retailers view them as cost-effective options for flexible packaging formats. This growing functional versatility makes flip lip bags a preferred solution across industries.

- For instance, Sealed Air Corporation launched its CRYOVAC® AutoWrap Lite system that reduces plastic usage by up to 65% and extends shelf-life to nearly 100 days, verified in collaboration trials with Bradbury’s Cheese in 2024.

Sustainability and Shift Toward Eco-Friendly Packaging Materials

Sustainability is a major growth driver influencing global packaging strategies. Consumers and regulators are pressuring brands to move away from single-use plastics toward recyclable and biodegradable options. The Global Flip Lip Bags Market benefits from this transition, with brands adopting paper-based or compostable polymer materials. Manufacturers are developing plant-based films and reusable closures to reduce environmental impact. Governments across Europe and North America promote green packaging policies, encouraging wider adoption. Companies integrate eco-friendly inks and water-based adhesives to align with circular economy goals. These sustainability efforts strengthen brand reputation and customer loyalty. The trend toward environmentally responsible packaging directly supports the market’s long-term growth.

Expansion of E-Commerce and Retail Distribution Networks

The rise of online retailing plays a significant role in expanding market demand. E-commerce platforms rely heavily on secure, lightweight, and tamper-evident packaging solutions. Flip lip bags meet these needs while offering strong shelf appeal for both physical and online retail. The Global Flip Lip Bags Market benefits from rapid digital commerce expansion in developing countries. Retailers value the bags for their cost efficiency and printability, allowing improved branding and labeling flexibility. The surge in online food delivery and cosmetics sales accelerates usage across multiple product categories. Manufacturers are introducing durable laminates to withstand logistics challenges. The alignment of packaging innovation with e-commerce logistics continues to drive strong growth momentum.

Technological Advancements in Packaging Machinery and Design Customization

Ongoing automation in packaging production enhances consistency and scalability. The Global Flip Lip Bags Market experiences growth through improved manufacturing speed and material optimization. Modern sealing technologies reduce waste and improve product integrity. Digital printing and precision cutting allow custom designs tailored to brand identity. Companies integrate barrier coatings that extend product shelf life and protect contents from moisture or oxygen exposure. Technological upgrades lower production costs, enabling competitive pricing for large orders. Continuous R&D investment supports innovations in fold structure and reseal mechanisms. These advancements enhance both efficiency and aesthetics, strengthening the market’s appeal to diverse industries.

Market Trends:

Growing Popularity of Transparent and Windowed Bag Designs

Consumers prefer packaging that allows easy visibility of products inside. Transparent and windowed flip lip bags are gaining traction among food, confectionery, and cosmetic brands. The Global Flip Lip Bags Market is experiencing rising adoption of clear film laminates that enhance product appeal. This trend helps build trust by allowing visual verification before purchase. Brands use innovative shapes and die-cut windows to attract customers. Retailers favor such designs for displaying freshness and authenticity. The adoption of windowed variants aligns with premium packaging strategies in health and beauty segments. This growing design preference contributes to market differentiation and brand loyalty.

- For instance, Perfetti Van Melle’s Mentos Pure Fresh Gum and Fruit-tella Curiosities were awarded Product of the Year in 2024 following their launch in paperboard bottle and windowed formats, marking the brand’s expansion into visible, eco-differentiated packaging designs.

Integration of Smart and Interactive Packaging Technologies

Smart packaging innovations such as QR codes, NFC tags, and tracking labels are becoming common. These features enable traceability and enhance customer engagement through digital interaction. The Global Flip Lip Bags Market benefits from these advancements, especially in premium and export-oriented goods. Smart tags offer consumers information about product origin, freshness, or authenticity. Food safety regulations encourage adoption of traceable packaging formats in global supply chains. Brands leverage this integration to strengthen transparency and consumer trust. Smart features also aid in logistics management by providing real-time tracking data. This convergence of packaging and digital technology is reshaping brand-consumer relationships.

- For instance, Avery Dennison’s atma.io platform tracked the lifecycle and impact of billions of product items in 2024, providing factories and brands with real-time RFID validation and critical supply chain traceability for major global clients including adidas and retailers in the apparel sector.

Increasing Customization and Brand Differentiation Through Flexible Printing

Packaging is becoming a key element of brand storytelling. The Global Flip Lip Bags Market witnesses growing investment in digital and flexographic printing to achieve vivid, high-resolution graphics. Companies personalize packaging for limited editions, promotional campaigns, or targeted audiences. Improved ink adhesion and quick color change systems allow faster turnaround. Flexible packaging printers use solvent-free inks to meet sustainability goals while maintaining visual appeal. Customization enhances shelf presence and strengthens emotional connection with consumers. Small and medium brands adopt these innovations to compete effectively with established players. The rise of digital printing accelerates innovation cycles and supports marketing creativity.

Adoption of Minimalistic and Functional Aesthetic Designs

Modern consumers value simplicity, clean graphics, and purposeful design in product packaging. The Global Flip Lip Bags Market reflects this aesthetic shift through minimal branding, monochrome tones, and eco-conscious finishes. Functional design choices such as easy-open tabs and smooth reseal features add value without clutter. Brands emphasize usability and recyclability over flashy visuals. This design philosophy resonates with younger demographics seeking authenticity and sustainability. Manufacturers streamline production by using lighter materials with high barrier performance. Functional minimalism reduces waste and simplifies recycling. This design trend continues to shape packaging strategies across industries.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatile prices of polymers, adhesives, and packaging films pose major challenges for manufacturers. The Global Flip Lip Bags Market faces uncertainty due to oil price fluctuations affecting raw material costs. Supply chain disruptions caused by geopolitical tensions and shipping delays further strain profitability. Manufacturers struggle to balance sustainability goals with affordability. Limited availability of eco-friendly resins increases procurement complexity. Small producers are more vulnerable to pricing pressure and inventory shortages. The shift toward renewable materials demands new sourcing networks and supplier reliability. Companies must strengthen supplier relationships and invest in localized production to mitigate risks.

Environmental Compliance and Recycling Limitations in Developing Markets

Strict environmental regulations require brands to adopt recyclable or biodegradable materials. The Global Flip Lip Bags Market encounters challenges in meeting regional compliance standards. Developing markets often lack proper recycling infrastructure to support circular packaging practices. Non-uniform labeling and limited consumer awareness hinder waste segregation efforts. Manufacturers face higher costs for certification and eco-friendly production lines. Balancing product protection with sustainability remains complex, especially in humid climates. Companies must innovate to ensure durability without compromising recyclability. Strengthening global recycling systems and harmonizing standards are essential to address these structural challenges.

Market Opportunities:

Rising Penetration of Sustainable Packaging in Emerging Economies

Emerging markets offer strong growth prospects for eco-conscious packaging manufacturers. The Global Flip Lip Bags Market is expected to benefit from growing demand for biodegradable, recyclable, and reusable materials. Government initiatives promoting sustainable packaging encourage local adoption. Expanding consumer awareness and retailer participation in green campaigns support market development. Brands entering developing economies are investing in sustainable designs to appeal to younger demographics. Manufacturers leveraging local raw material availability can gain cost advantages. The transition toward circular packaging solutions opens significant expansion opportunities.

Innovation in High-Performance and Smart Packaging Solutions

Technological innovation creates opportunities for advanced bag designs and functional upgrades. The Global Flip Lip Bags Market is evolving with improved sealing mechanisms, moisture barriers, and sensor-integrated packaging. Smart features like freshness indicators enhance customer satisfaction in food and healthcare applications. New bio-based films deliver superior strength and heat resistance. Companies introducing dual-layer bags or resealable adhesives can capture premium market segments. Collaboration between packaging firms and material scientists accelerates product differentiation. Continuous product innovation ensures long-term competitiveness and supports market leadership.

Market Segmentation Analysis:

By Material Type

The Global Flip Lip Bags Market is segmented into plastic and paper-based bags. Plastic flip lip bags hold a major share due to their strength, flexibility, and moisture resistance, making them ideal for perishable goods and retail packaging. It offers durability, transparency, and cost-effectiveness, which suit large-scale food and consumer product packaging. Paper flip lip bags are gaining traction due to rising environmental awareness and regulatory restrictions on single-use plastics. Their recyclable nature and premium appeal attract eco-conscious consumers and sustainable brands. Growing investments in biodegradable and compostable paper variants further enhance their adoption across developed markets.

- For instance, Huhtamaki’s launch of recyclable fiber-based foodservice cups and lids in collaboration with Slush Helsinki in November 2024 enabled closed-loop recycling during the event—showcasing scale-up in Europe and setting industry standards for circularity in high-volume packaging usage.

By Application

The market is categorized into meat packaging, nuts, other food products, personal care, and others. Meat packaging dominates due to the need for secure sealing and freshness retention in temperature-sensitive goods. Flip lip bags prevent contamination and leakage, supporting hygienic handling in retail and food processing units. The nuts segment benefits from growing demand for portable and resealable snack packaging. Other food products, including bakery and confectionery, use these bags for easy storage and visibility. In personal care, brands prefer them for compactness and spill-proof properties. The others category includes healthcare and household applications, driven by increasing focus on convenience and sustainable packaging formats.

- For instance, in September 2023, Constantia Flexibles won the Green Packaging Star Award for its EcoLamHighPlus recyclable mono-material laminate, which delivered barrier properties comparable to composites and was adopted for nuts, baby food, health, and household goods packaging, certified by RecyClass validation in Europe.

Segmentation:

By Material Type:

- Plastic Flip Lip Bags

- Paper Flip Lip Bags

By Application:

- Meat Packaging

- Nuts

- Other Food Products

- Personal Care

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Flip Lip Bags Market size was valued at USD 1,182.77 million in 2018 to USD 1,887.96 million in 2024 and is anticipated to reach USD 3,462.13 million by 2032, at a CAGR of 7.3% during the forecast period. North America holds around 30.5% of the global market share, driven by strong retail networks and rising demand for resealable, sustainable packaging. The region’s advanced packaging infrastructure supports high-quality product development and innovation. The U.S. leads with widespread adoption in food, pharmaceuticals, and personal care sectors. Increasing consumer awareness about hygiene and sustainability fuels growth in biodegradable packaging. Companies focus on digital printing and recyclable films to align with green policies. Strong e-commerce penetration enhances usage in secondary packaging. It continues to experience stable growth supported by technology upgrades and eco-label compliance.

Europe

The Europe Global Flip Lip Bags Market size was valued at USD 521.37 million in 2018 to USD 796.25 million in 2024 and is anticipated to reach USD 1,328.19 million by 2032, at a CAGR of 6.1% during the forecast period. Europe contributes about 18.7% of the global share, supported by strict environmental regulations and a well-established packaging ecosystem. The region promotes recyclable and compostable solutions under EU Green Deal initiatives. The UK, Germany, and France dominate production due to technological capabilities and consumer preference for sustainable options. Demand is high across food, bakery, and cosmetic packaging industries. Brands emphasize low-carbon packaging and recycled content integration. Strong collaborations between manufacturers and retailers ensure innovation in design and material sourcing. It remains a mature yet evolving market that balances functionality with environmental responsibility.

Asia Pacific

The Asia Pacific Global Flip Lip Bags Market size was valued at USD 773.16 million in 2018 to USD 1,317.64 million in 2024 and is anticipated to reach USD 2,630.59 million by 2032, at a CAGR of 8.5% during the forecast period. Asia Pacific commands nearly 33% of the market share, making it the largest and fastest-growing region. Rapid urbanization, expanding retail chains, and a booming e-commerce industry drive market momentum. China, India, and Japan account for significant consumption across food and personal care packaging. Rising disposable incomes and lifestyle changes increase demand for convenience-focused packaging. Local manufacturers benefit from cost-effective raw materials and large-scale production capacity. Governments support sustainable initiatives to reduce plastic waste and promote recyclable materials. It continues to attract global players seeking regional manufacturing hubs and new customer bases.

Latin America

The Latin America Global Flip Lip Bags Market size was valued at USD 125.32 million in 2018 to USD 199.58 million in 2024 and is anticipated to reach USD 322.12 million by 2032, at a CAGR of 5.6% during the forecast period. Latin America accounts for around 4.1% of the global market share, supported by gradual retail modernization and rising consumer spending. Brazil and Mexico are the key contributors, with strong food packaging demand. Local producers focus on affordability and efficient distribution channels. Sustainable material adoption is increasing with growing awareness of eco-friendly alternatives. The region’s packaging innovation is improving through partnerships with global suppliers. Demand from processed food and beverage sectors continues to strengthen market potential. It offers promising opportunities for cost-competitive, recyclable packaging solutions in the mid-term outlook.

Middle East

The Middle East Global Flip Lip Bags Market size was valued at USD 68.40 million in 2018 to USD 99.81 million in 2024 and is anticipated to reach USD 150.54 million by 2032, at a CAGR of 4.7% during the forecast period. The Middle East represents about 2.7% of the global market share, driven by expansion in food processing, retail, and hospitality sectors. GCC countries lead with investments in advanced packaging facilities. Consumer preference for durable and moisture-resistant bags supports steady growth. Regional governments promote recycling and waste reduction programs to meet sustainability goals. Packaging demand in the cosmetics and healthcare sectors is increasing due to lifestyle shifts. It is gradually adopting bio-based materials to align with global green trends. Continuous import of advanced machinery enhances local production efficiency and quality.

Africa

The Africa Global Flip Lip Bags Market size was valued at USD 39.60 million in 2018 to USD 70.95 million in 2024 and is anticipated to reach USD 101.93 million by 2032, at a CAGR of 4.1% during the forecast period. Africa holds nearly 1% of the global market share, with demand concentrated in South Africa, Egypt, and Nigeria. Expanding retail and food distribution networks are driving gradual adoption. Cost sensitivity remains high, limiting premium product uptake. Local manufacturers are introducing affordable, recyclable alternatives to meet basic sustainability standards. Government programs encouraging waste management and plastic reduction support growth. Packaging innovations in agriculture and consumer goods segments show early promise. It is expected to benefit from foreign investments aimed at strengthening regional manufacturing capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Flip Lip Bags Market is moderately fragmented, with several regional and international manufacturers competing on innovation, quality, and sustainability. Leading players focus on eco-friendly materials, improved sealing technologies, and customizable printing solutions to strengthen brand value. It is marked by continuous R&D investment in biodegradable films and paper-based alternatives to meet regulatory norms. Strategic mergers and acquisitions enhance production capacity and market presence. Companies also emphasize lightweight packaging to reduce logistics costs. The market exhibits strong rivalry due to low switching costs and price sensitivity among end users. Growing emphasis on circular packaging models drives differentiation and collaboration across the value chain.

Recent Developments:

- In September 2025, Emerald Packaging partnered with Walmart and Idaho Package to launch the first 30% post-consumer recycled (PCR) bag for the retail potato market, signifying a major sustainability milestone in flexible packaging for produce and retail bags. In October 2025, Emerald Packaging formed a new partnership with Sustainable Solutionz to responsibly manage end-of-life printing plates, advancing green initiatives within packaging production.

- In February 2025, EZ CERT — a service under Program Insurance Group, connected with EZ Products — was acquired by Higginbotham, one of the leading insurance, financial, and HR firms in the U.S. The acquisition aimed to strengthen franchise certificate tracking services and expand its national reach in coverage management for franchise operations.

Report Coverage:

The research report offers an in-depth analysis based on material type and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of recyclable and compostable packaging materials.

- Increased automation in production lines to enhance cost efficiency.

- Growing use of bio-based plastics for premium flip lip bag designs.

- Expansion of online retail fueling demand for resealable packaging.

- Rising collaborations between film producers and packaging converters.

- Introduction of digital printing technologies for brand personalization.

- Accelerated growth in Asia Pacific supported by retail modernization.

- Increased R&D investment in biodegradable and moisture-resistant coatings.

- Growing preference for lightweight, eco-friendly alternatives in food packaging.

- Strong focus on circular economy initiatives shaping product innovation.