Market Overview

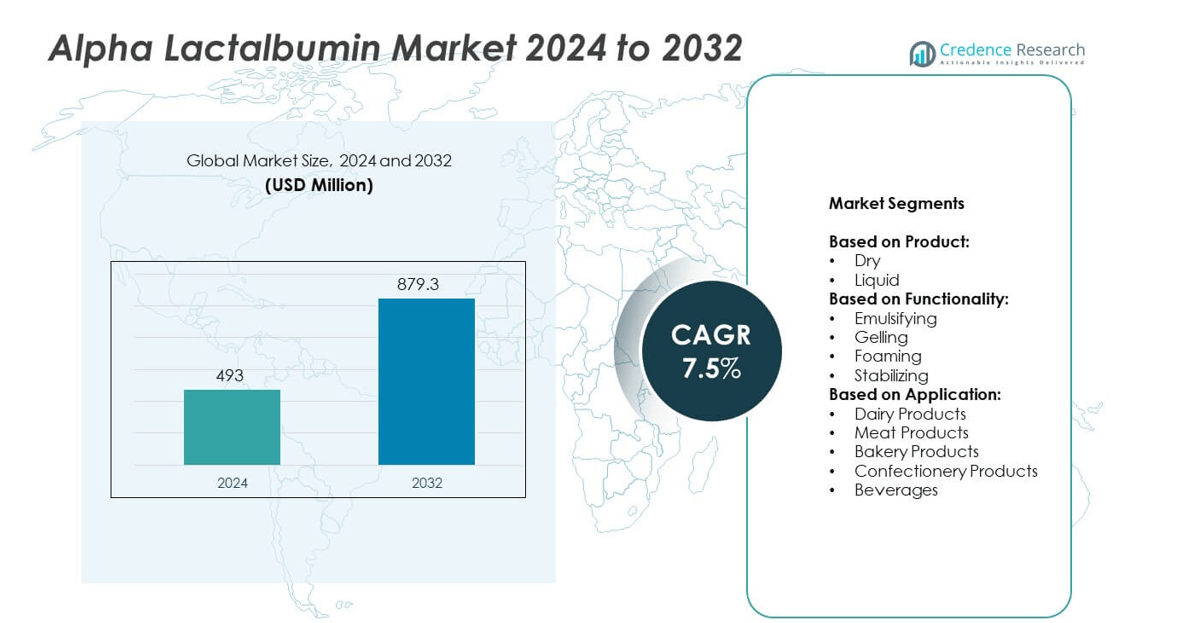

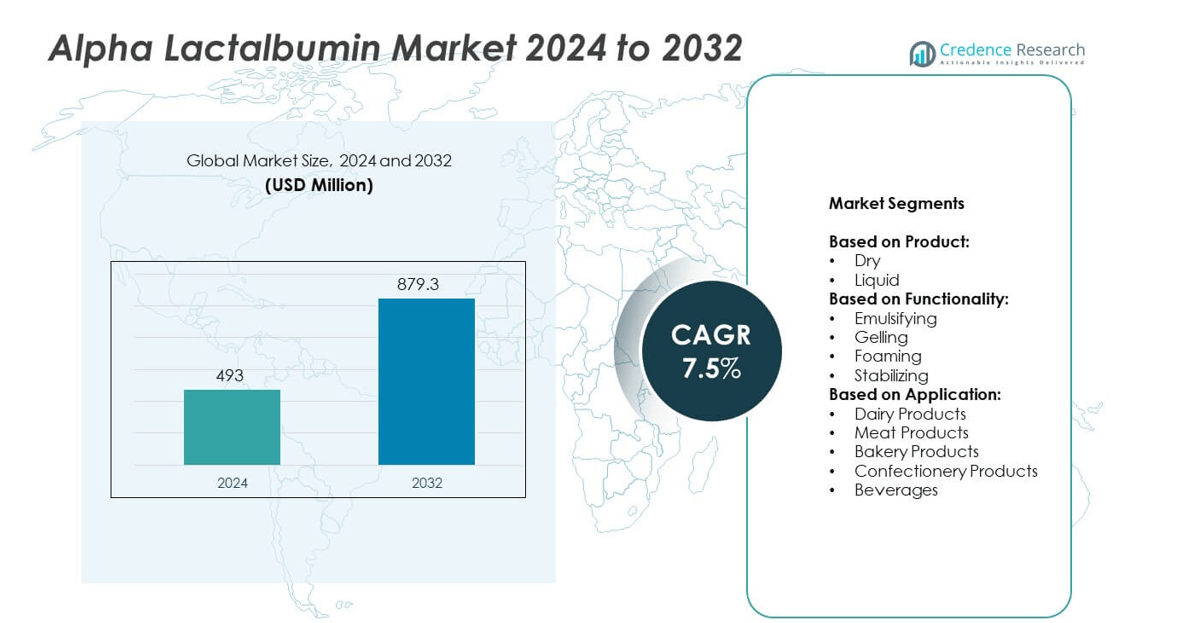

Alpha Lactalbumin market size was valued at USD 493 million in 2024 and is projected to reach USD 879.3 million by 2032, growing at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Lactalbumin Market Size 2024 |

USD 493 million |

| Alpha Lactalbumin Market, CAGR |

7.5% |

| Alpha Lactalbumin Market Size 2032 |

USD 879.3 million |

Alpha Lactalbumin market grows with rising demand for premium infant formula, sports nutrition, and clinical nutrition products. Advancements in membrane filtration and biotechnology improve purity and production efficiency. Consumers seek clean-label, functional ingredients, encouraging companies to invest in sustainable sourcing and traceability. Expanding applications in adult and elderly nutrition support market diversification. Growing awareness of protein quality drives adoption across regions. Regulatory approvals and global health initiatives further strengthen market penetration and encourage continuous product innovation.

North America leads the Alpha Lactalbumin market due to strong infant formula demand and advanced dairy processing. Europe follows with strict quality standards and innovation in functional nutrition. Asia-Pacific shows fastest growth supported by rising birth rates and urbanization. Key players include Morinaga Milk Industry, Glanbia, FrieslandCampina, and Nestlé, who focus on production capacity expansion, product innovation, and strategic collaborations. These companies strengthen distribution networks and invest in R&D to meet global demand across diverse applications and regions.

Market Insights

- Alpha Lactalbumin market was valued at USD 493 million in 2024 and is projected to reach USD 879.3 million by 2032, growing at a CAGR of 7.5%.

- Rising demand for infant formula, sports nutrition, and clinical nutrition drives adoption of alpha lactalbumin globally.

- Premiumization trend boosts demand for high-purity, bioactive-rich protein ingredients with proven health benefits.

- Leading players such as Morinaga Milk Industry, Glanbia, FrieslandCampina, and Nestlé invest in R&D and capacity expansion to maintain competitiveness.

- High production costs and dependence on milk supply chain remain major challenges for manufacturers.

- North America leads with strong demand from infant formula and functional food industries, while Asia-Pacific records fastest growth supported by rising population and urbanization.

- Focus on sustainability, traceability, and personalized nutrition solutions creates opportunities for innovation and market expansion worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Infant Nutrition Products

Alpha Lactalbumin market grows due to strong demand for high-quality infant nutrition products. The protein supports optimal growth and development, making it vital in infant formulas. Manufacturers include it to closely replicate the nutritional profile of human milk. It enhances digestibility and provides essential amino acids for infants. Leading formula brands invest in research to improve purity and bioavailability. Growing urbanization and working mothers drive consumption of convenient, science-backed formulas worldwide.

- For instance, Arla Foods Ingredients markets Lacprodan® ALPHA-10, a whey protein concentrate with 41% alpha-lactalbumin content and 88% total protein in dry matter. For its intended use in infant formula at levels up to 2.5 grams per liter (g/L), the product has been granted Generally Recognized As Safe (GRAS) status, supported by a “no-questions letter” from the FDA in 2019.

Increasing Applications in Sports and Clinical Nutrition

Alpha Lactalbumin market benefits from rising interest in protein-rich diets for athletes and patients. It supports muscle recovery and immune function, making it valuable in sports nutrition products. Clinical nutrition segments adopt it for patients needing easy-to-digest protein sources. It improves nitrogen retention, supporting better recovery outcomes. Product launches in protein powders and medical nutrition drinks fuel adoption. Growing awareness of protein quality over quantity strengthens its demand in these applications.

- For instance, the Swedish “ALFoNS” trial recruited 328 infants to compare growth between formula groups with different alpha-lactalbumin enrichment (27% or 14%) and total protein content (≈1.75-1.76 g/100 kcal) vs standard 2.20 g/100 kcal.

Advancements in Production Technology and Processing

Alpha Lactalbumin market sees growth from innovations in separation and purification processes. Modern membrane filtration technology delivers higher yield and purity. It enables manufacturers to reduce production costs while improving quality consistency. Companies expand production capacity to meet growing demand across applications. Advances in biotechnology also help produce alpha lactalbumin with better functionality. Improved scalability ensures wider availability for both large-scale and specialty product manufacturers.

Regulatory Support and Focus on Functional Ingredients

Alpha Lactalbumin market benefits from supportive regulations promoting safe and nutritious ingredients. Food authorities approve its use in infant formula and functional foods, increasing trust. It meets international quality standards, ensuring acceptance across global markets. Rising consumer focus on functional and health-enhancing ingredients drives product adoption. Companies highlight its role in immune support and cognitive development to strengthen marketing claims. This regulatory and consumer alignment supports sustained market expansion.

Market Trends

Growing Focus on Premium and Fortified Formulations

Alpha Lactalbumin market witnesses strong trend toward premium nutrition products. Brands launch fortified infant formulas with higher protein concentration for enhanced health benefits. It helps achieve better amino acid balance, supporting infant growth and immunity. Companies highlight clinical evidence to differentiate products in competitive markets. Demand rises in regions with growing middle-class populations seeking premium options. This focus encourages investment in advanced formulation development and product innovation.

- For instance, Agropur offers BiPRO® Alpha 9000, which is a highly isolated form of alpha-lactalbumin; it is considered among the purest commercially available isolates.

Expansion into Adult and Senior Nutrition Segments

Alpha Lactalbumin market sees wider use beyond infant nutrition. It finds applications in adult and elderly dietary supplements targeting muscle health and immune support. Rising aging population drives demand for easily digestible, high-quality proteins. It supports better recovery in hospitalized patients and elderly care settings. Manufacturers promote it for sarcopenia prevention and metabolic health benefits. Expanding product launches in ready-to-drink and powder formats strengthens presence in this category.

- For instance, Hilmar Ingredients offers a product called Hilmar 8800, which is an alpha-lactalbumin-enriched whey protein concentrate with 80% protein content and elevated levels of branched-chain amino acids (BCAAs).

Sustainability and Ethical Sourcing Initiatives

Alpha Lactalbumin market trends include growing emphasis on sustainable production practices. Dairy producers adopt energy-efficient processes and reduce water consumption during protein extraction. It supports environmental goals while improving brand reputation. Companies invest in traceability systems to ensure ethical sourcing and animal welfare compliance. Certifications like organic and grass-fed labeling gain popularity among premium buyers. These initiatives align with rising consumer preference for environmentally responsible products.

Technological Integration for Enhanced Functionality

Alpha Lactalbumin market benefits from integration of advanced processing technologies. Novel filtration techniques improve protein solubility and taste profile. It enables manufacturers to expand use in beverages, bars, and high-protein snacks. Companies explore recombinant production methods to ensure supply security. Partnerships with biotech firms accelerate research into bioactive peptides derived from alpha lactalbumin. This focus on innovation creates opportunities for differentiated, science-backed nutritional products.

Market Challenges Analysis

High Production Costs and Limited Supply Chain Efficiency

Alpha Lactalbumin market faces challenges due to expensive production processes and limited raw material availability. It requires advanced membrane filtration and purification technologies that raise manufacturing costs. Fluctuations in milk supply affect consistency and pricing of raw whey proteins. Companies struggle to maintain profitability while offering competitive pricing. It pressures smaller manufacturers with limited scale and capital. Optimizing production and building efficient supply chains remain critical for sustaining growth.

Regulatory Compliance and Product Standardization Issues

Alpha Lactalbumin market encounters strict regulations for use in infant formula and medical nutrition. It must meet regional quality standards, which vary across markets. Companies face delays in product approvals, slowing time-to-market. It increases compliance costs for manufacturers operating in multiple geographies. Product standardization challenges affect consistency in nutritional value and functionality. Addressing these issues is essential for improving trust among consumers and healthcare professionals.

Market Opportunities

Expansion into Emerging Markets and New Consumer Segments

Alpha Lactalbumin market holds strong potential in emerging economies with rising disposable incomes. Growing awareness about child nutrition increases demand for premium infant formulas. It enables global brands to expand into Asia-Pacific, Latin America, and Middle East markets. Companies can introduce localized products tailored to regional dietary preferences. Rising health awareness creates opportunities in sports and medical nutrition categories. This expansion strengthens revenue streams and reduces dependence on mature markets.

Innovation in Functional and Personalized Nutrition Products

Alpha Lactalbumin market gains opportunities through innovation in personalized and functional nutrition. It supports development of specialized formulations targeting immunity, gut health, and cognitive support. Manufacturers invest in research to unlock bioactive peptides and novel health claims. It opens possibilities for premium supplements, beverages, and therapeutic foods. Collaborations with biotech firms help scale recombinant production methods for consistent supply. These innovations create new value propositions and attract health-conscious consumers worldwide.

Market Segmentation Analysis:

By Product:

Dry and liquid forms, each serving distinct needs. Dry alpha lactalbumin dominates due to its stability, longer shelf life, and ease of transport. It is widely used in infant formula, sports nutrition powders, and clinical nutrition products. Liquid form finds use in specialized formulations requiring higher solubility and rapid blending. It supports quick processing in dairy plants and beverage applications. Growing demand for convenient and consistent protein sources drives investments in both product types to ensure supply flexibility.

- For instance, a study quantified alpha-lactalbumin in cow milk with the concentration ranging from 0.5 to 1.9 g per liter across individual cows, with an average around 1.1 g per liter.

By Functionality:

Alpha Lactalbumin market is divided into emulsifying, gelling, foaming, and stabilizing segments. Emulsifying holds a significant share, supporting texture and uniformity in infant formulas and dairy products. Gelling properties enhance firmness and structure in desserts and high-protein snacks. It provides foaming ability for whipped dairy toppings and specialty bakery items. Stabilizing function maintains product consistency during storage and transportation. It allows manufacturers to create premium products with desirable mouthfeel and extended shelf life.

- For instance, 21st.BIO has started a development program for bovine alpha-lactalbumin using a Novonesis-derived microbial strain. Their aim is to produce α-lactalbumin with high purity via precision fermentation, where normally one kilogram of α-lac requires fractionating around 1,000 liters of milk.

By Application:

Alpha Lactalbumin market spans dairy products, meat products, bakery products, confectionery products, and beverages. Dairy products lead the segment, driven by strong demand for infant nutrition and fortified dairy drinks. It improves protein quality in yogurts, milk powders, and cheese formulations. Meat products use it to improve water retention and texture. Bakery and confectionery benefit from its ability to enhance aeration and softness. It also supports growth in functional beverages, including protein-rich drinks targeting athletes and health-conscious consumers. Expanding application range strengthens market growth across multiple industries.

Segments:

Based on Product:

Based on Functionality:

- Emulsifying

- Gelling

- Foaming

- Stabilizing

Based on Application:

- Dairy Products

- Meat Products

- Bakery Products

- Confectionery Products

- Beverages

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Alpha Lactalbumin market with 35% of global revenue. Strong presence of infant formula manufacturers and advanced dairy processing facilities drives regional dominance. It benefits from high consumer awareness regarding protein quality and nutritional benefits. Stringent regulatory frameworks such as FDA approvals ensure product safety, boosting consumer confidence. The region sees consistent demand from sports nutrition and clinical nutrition sectors, supporting volume growth. Rising health-conscious population and focus on premium products enhance market opportunities. Companies expand production capacity in the U.S. and Canada to meet growing demand and reduce dependency on imports.

Europe

Europe accounts for 28% share of the Alpha Lactalbumin market, supported by established dairy industry and innovation in nutrition solutions. The region focuses on high-quality standards and strict EU regulations, driving adoption of premium proteins. Rising demand for infant formula in markets such as Germany, France, and the U.K. sustains growth. Functional food and beverage manufacturers incorporate alpha lactalbumin to improve protein profile and health benefits. Consumers prioritize clean-label and traceable ingredients, encouraging companies to invest in sustainable production. Europe also leads in research on bioactive peptides and product formulation innovation. Continuous investment in dairy technology and R&D strengthens the regional market position.

Asia-Pacific

Asia-Pacific holds 25% share of the Alpha Lactalbumin market and is the fastest-growing region. Rising birth rates and increasing disposable incomes in China, India, and Southeast Asia drive infant formula demand. Rapid urbanization boosts consumption of packaged nutritional products. Governments promote infant nutrition programs and encourage safe and fortified products, supporting wider adoption. Local and international players invest in manufacturing plants to cater to regional demand efficiently. Expanding sports nutrition and clinical nutrition sectors contribute to volume growth. Increasing awareness of protein quality strengthens the role of alpha lactalbumin across multiple applications.

Latin America

Latin America represents 7% share of the Alpha Lactalbumin market, driven by growing awareness of child health and nutrition. Brazil and Mexico are key contributors, with rising demand for premium infant formulas. Expanding middle-class population seeks fortified dairy and functional beverages. Regional dairy cooperatives invest in modern processing technologies to improve product quality. Partnerships with international nutrition companies strengthen supply and distribution networks. Growth potential remains strong due to under-penetration of premium protein ingredients. Continued efforts to improve healthcare access and nutrition education support future market expansion.

Middle East and Africa

Middle East and Africa account for 5% share of the Alpha Lactalbumin market, showing steady but emerging growth. Rising birth rates and growing health awareness create opportunities for infant formula and fortified dairy products. Countries such as Saudi Arabia, UAE, and South Africa drive regional demand. Limited local production capacity leads to reliance on imports, encouraging investment in regional facilities. Consumers show interest in functional foods that support immunity and overall well-being. International brands collaborate with local distributors to expand market reach. Gradual improvements in regulatory frameworks and income levels support long-term growth prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Morinaga Milk Industry

- Glanbia

- FrieslandCampina

- Hoogwegt

- Saputo

- Nestlé

- Davisco Foods International

- Sigma-Aldrich

- Arla Foods

- Lactalis

- NZMP

- Meggle

- Ingredia

- Fonterra

- Milei

Competitive Analysis

The competitive landscape of the Alpha Lactalbumin market features leading players such as Morinaga Milk Industry, Glanbia, FrieslandCampina, Hoogwegt, Saputo, Nestlé, Davisco Foods International, Sigma-Aldrich, Arla Foods, Lactalis, NZMP, Meggle, Ingredia, Fonterra, and Milei. These companies focus on high-purity alpha lactalbumin production and invest in advanced filtration technologies to maintain consistent quality. Strategic expansions of manufacturing facilities help secure reliable supply for infant formula, sports nutrition, and medical applications. Players actively engage in research to develop functional ingredients with improved bioavailability and health benefits. Mergers, acquisitions, and partnerships strengthen their market presence and distribution networks across multiple regions. Sustainability initiatives, including energy-efficient production and ethical sourcing, enhance brand reputation and meet consumer expectations. Companies compete by differentiating through product innovation, clinical validation, and regulatory compliance. Strong collaborations with biotech firms and food manufacturers enable development of customized formulations for diverse applications. Continuous investment in quality control and traceability ensures compliance with global food safety standards, helping maintain competitive advantage

Recent Developments

- In 2025, FrieslandCampina Ingredients released its fifth annual nutritional trends report, which did highlight the growing importance of protein in diets for all age groups.

- In 2024, Morinaga Milk Industry, in collaboration with Kyoto University, published research showing HRB strains convert indole into beneficial metabolites (indole-3-lactic acid), impacting immune and gut health.

- In 2023, Arla Foods Ingredients launched a new alpha-lactalbumin-rich ingredient called Lacprodan® ALPHA-50 for use by infant formula manufacturers. The ingredient is a whey protein isolate with a high concentration of alpha-lactalbumin, which provides an enhanced amino acid profile compared to standard whey proteins

Report Coverage

The research report offers an in-depth analysis based on Product, Functionality, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Alpha Lactalbumin market will see steady growth driven by rising infant formula demand.

- Companies will invest in advanced filtration technologies to improve purity and yield.

- Sports nutrition applications will expand with higher focus on muscle recovery products.

- Clinical nutrition sector will adopt alpha lactalbumin for patient recovery and immunity support.

- Emerging markets will contribute strongly with growing middle-class populations seeking premium nutrition.

- Sustainable production and traceable sourcing will become critical for brand positioning.

- Product innovation will focus on bioactive peptides and functional health claims.

- Partnerships between dairy producers and biotech firms will secure stable supply chains.

- Personalized nutrition solutions will gain popularity, increasing use in specialized formulations.

- Regulatory approvals will streamline market entry and build consumer trust globally.