Market Overview

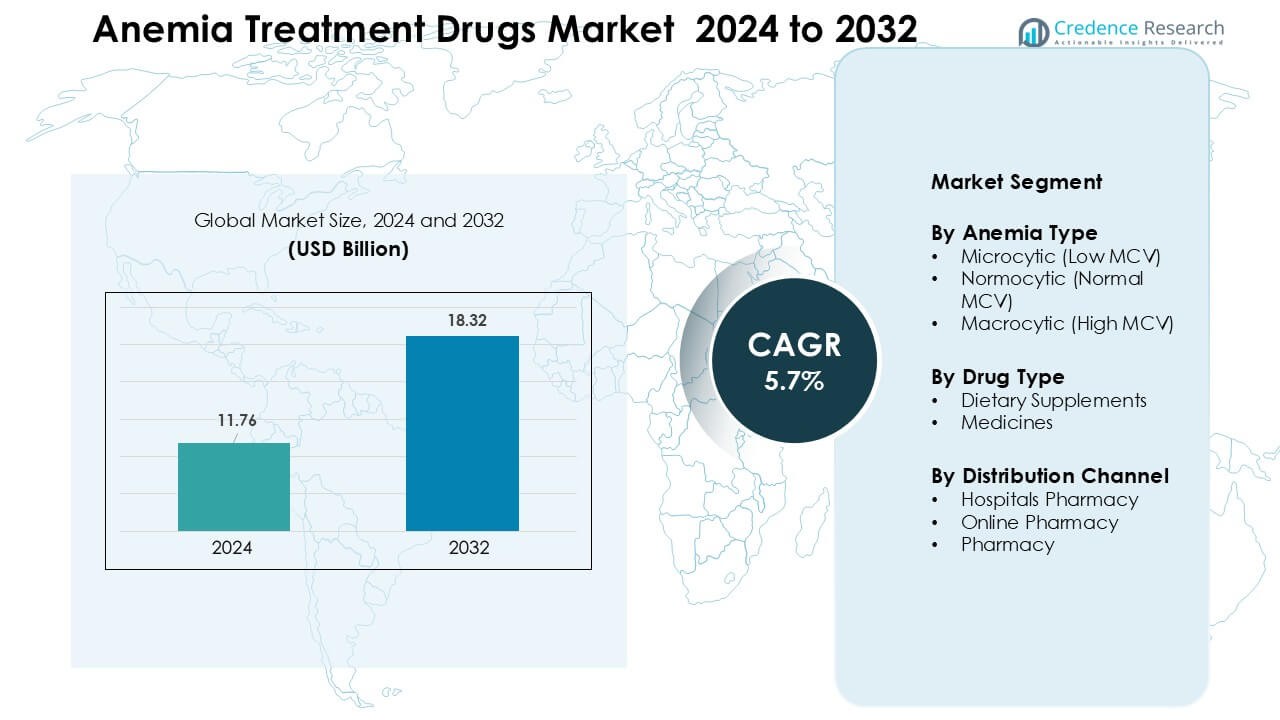

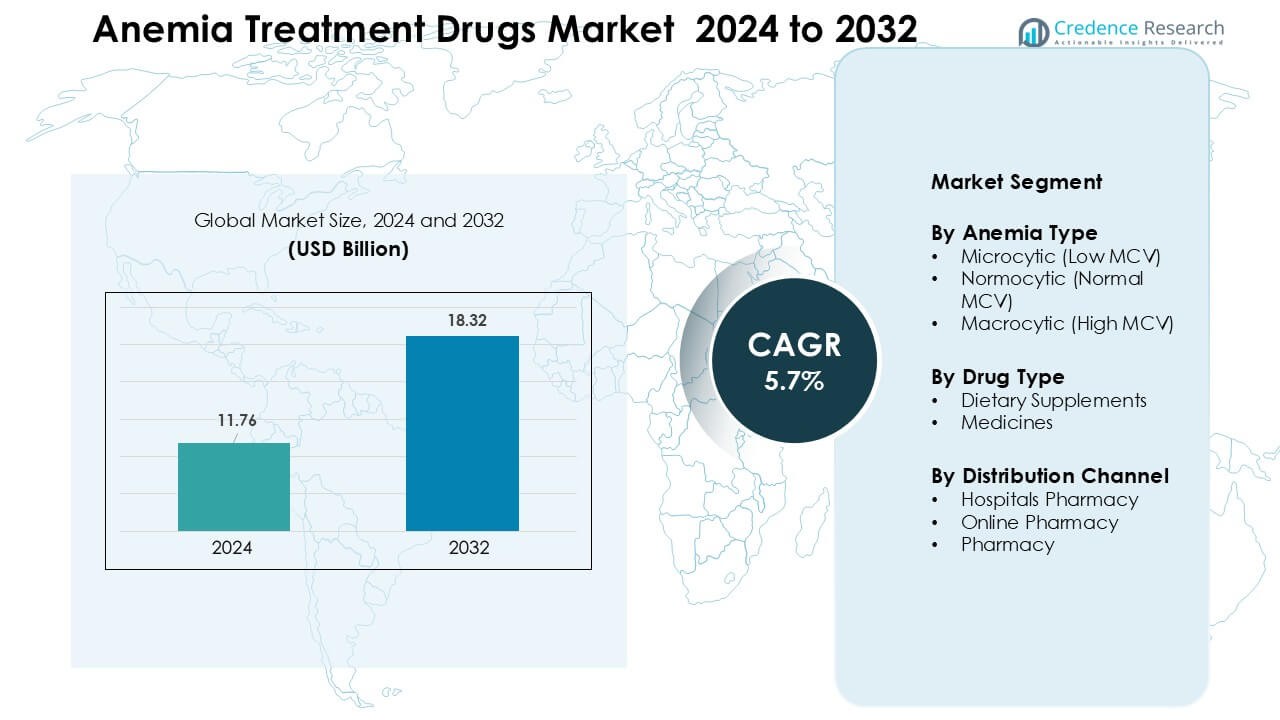

Anemia Treatment Drugs Market was valued at USD 11.76 billion in 2024 and is anticipated to reach USD 18.32 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anemia Treatment Drugs Market Size 2024 |

USD 11.76 Billion |

| Anemia Treatment Drugs Market, CAGR |

5.7% |

| Anemia Treatment Drugs Market Size 2032 |

USD 18.32 Billion |

The anemia treatment drugs market is shaped by key players such as Amgen Inc., Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc, Janssen Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, AMAG Pharmaceuticals, Rockwell Medical, Akebia Therapeutics, and Vifor Pharma Management Ltd. These companies strengthen their presence through advanced IV iron therapies, improved oral formulations, and erythropoiesis-stimulating agents widely used in chronic kidney disease and oncology care. North America remained the leading region in 2024 with 34% share, supported by high diagnosis rates, strong healthcare infrastructure, and broad access to innovative treatment options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global anemia treatment drugs market was valued at USD 11.76 billion in 2024 and is expected to grow at a CAGR of 5.7 % through 2032.

- Rising iron-deficiency anemia especially microcytic cases among women and children drives strong demand for supplements and therapies.

- Growing adoption of intravenous iron therapies and erythropoiesis-stimulating agents reflects a shift from oral treatments toward faster, hospital-delivered options.

- Major players such as Amgen, Novartis, Pfizer, Roche, and Vifor Pharma intensify competition with improved formulations, global distribution, and regulatory approvals, strengthening their global presence.

- North America held about 34% regional share in 2024, while microcytic anemia treatments represented nearly 62% of demand by anemia type, signaling high concentration in these leading segments.

Market Segmentation Analysis:

By Anemia Type

Microcytic anemia led the segment in 2024 with about 62% share due to its high global prevalence, largely driven by iron deficiency in women, children, and low-income groups. Treatment demand grew as clinicians prioritized early detection using CBC and ferritin tests. Governments expanded nutritional programs to reduce iron-deficiency cases, which further pushed the need for supplements and functional therapies. The strong volume of diagnosed patients kept microcytic anemia ahead of normocytic and macrocytic forms, which showed steady but lower treatment uptake.

- For instance, according to a systematic review covering 33,869 pregnant women, iron-deficiency anemia affected 18.98% of them.

By Drug Type

Dietary supplements dominated this segment with nearly 58% share in 2024 because iron, folic acid, and vitamin B12 supplements remained first-line therapy across most patient groups. Physicians preferred supplements for early-stage cases, mild deficiencies, and preventive care, which supported strong sales in both retail and clinical settings. Growing use of OTC iron tablets and fortified formulations increased adoption among self-managing individuals. Medicines followed with rising demand for erythropoiesis-stimulating agents and intravenous iron for moderate to severe cases.

- For instance, the World Health Organization (WHO) recommends intermittent iron and folic acid supplementation for menstruating women in settings where anemia prevalence is high, underscoring the widespread reliance on oral supplements among women of reproductive age.

By Distribution Channel

Hospital pharmacies held the leading position with around 49% share in 2024 because hospitals managed severe anemia, chronic kidney disease-related anemia, and cases requiring IV iron or transfusions. Strong physician oversight and assured product availability supported higher patient flow. Online pharmacies expanded rapidly as consumers chose doorstep delivery and broader product access. Retail pharmacies remained vital for recurring supplement purchases, but hospital pharmacies continued to dominate due to complex case management, diagnostic integration, and adherence-focused care pathways.

Key Growth Drivers

Key Growth Drivers

Rising Global Prevalence of Iron-Deficiency Anemia

Iron-deficiency anemia continues to rise worldwide, and this trend drives strong demand for anemia treatment drugs. Higher cases among women of reproductive age, young children, and low-income groups increase the need for iron supplements, folate tablets, and vitamin B12 therapies. Many regions report growing dietary gaps due to limited nutrient intake and changing food habits, which further accelerates treatment uptake. Expanding screening programs in schools, maternal-health clinics, and community centers strengthen early diagnosis, pushing timely medication use. Healthcare providers also adopt updated clinical guidelines that recommend structured supplementation for at-risk groups, improving treatment volume. Together, these factors ensure sustained demand for primary and advanced therapies across global markets.

- For instance, according to the World Health Organization (WHO), in 2023 about 30.7% of women aged 15-49 years globally had anemia.

Advancements in Therapeutic Approaches and Drug Formulations

Innovation in drug formulations acts as a major driver in the anemia treatment drugs market. Manufacturers focus on developing fast-absorbing oral iron, reduced-side-effect supplements, and improved intravenous iron therapies that enhance patient compliance. Modern formulations offer better bioavailability and shorter treatment durations, helping reduce resistance toward traditional iron salts. Biopharmaceutical companies also expand erythropoiesis-stimulating agents for anemia linked to chronic kidney disease, cancer therapy, and autoimmune conditions. These innovations support broader clinical adoption and allow physicians to tailor treatments more effectively. As safety improves through controlled-release tablets and new-generation IV iron, patient acceptance increases, strengthening global therapy penetration across mild, moderate, and severe anemia cases.

- For instance, advanced intravenous formulations such as Ferric carboxymaltose and Ferric derisomaltose enable high-dose iron repletion in fewer infusions and with a lower risk of infusion-related side effects making them more practical for patients intolerant to oral iron.

Government Nutrition Programs and Public Health Initiatives

Large-scale public health programs have become strong drivers of the anemia treatment drugs market. Governments invest in national iron-fortification schemes, maternal-nutrition programs, school supplementation initiatives, and rural-health outreach, all of which increase early detection and treatment access. Many countries mandate iron-fortified flour, rice, or salt to reduce anemia cases at the population level. Partnerships between health ministries, NGOs, and global agencies enhance resource distribution and increase awareness of dietary deficiency risks. Free or subsidized supplementation for pregnant women and adolescents strengthens adherence and drives consistent medication demand. As these initiatives expand, treatment adoption grows across both urban and underserved regions, lifting overall market growth.

Key Trends & Opportunities

Shift Toward Advanced Intravenous Iron Therapies

A major trend shaping the anemia treatment drugs market is the rising shift from traditional oral supplements to advanced intravenous iron formulations. Patients with chronic kidney disease, inflammatory disorders, or absorption issues increasingly require IV iron due to faster replenishment and reduced gastrointestinal side effects. Healthcare systems adopt these therapies to meet clinical demand for predictable dosing and improved hemoglobin correction rates. This trend opens opportunities for manufacturers to introduce safer, high-dose IV iron options that reduce infusion time and hospital visits. Growing physician preference for efficient therapies strengthens long-term adoption in specialized care.

- For instance, a randomized trial comparing IV Ferric carboxymaltose (FCM) to oral ferrous sulfate in non-dialysis CKD patients found that those receiving FCM were nearly twice as likely to achieve a hemoglobin increase of ≥ 1.0 g/dL compared with oral iron recipients.

Growing Consumer Preference for Nutraceutical and OTC Supplements

Another key trend is rising consumer interest in nutraceutical-based anemia products, including plant-based iron, herbal blends, and functional supplements. Increased awareness of preventive health encourages individuals to self-manage mild deficiencies without direct clinical intervention. Online retail platforms expand these opportunities by offering large product variety and easy availability. Manufacturers respond by launching fortified gummies, sprays, and liquid formulations that appeal to younger users and elderly patients with swallowing difficulties. This shift opens new commercial pathways beyond traditional prescription drugs.

- For instance, a recent review demonstrated that plant-based iron supplementation (especially when combined with vitamin C) significantly improved hemoglobin and other hematological parameters in adults with iron deficiency, indicating efficacy even outside formal clinical prescriptions.

Opportunity in Digital Health and Remote Monitoring

Expanding digital health platforms offer significant opportunities for this market. Telehealth consultations support faster diagnosis, routine monitoring, and improved patient adherence. Mobile apps help track hemoglobin levels, supplement intake, and dietary habits, ensuring better treatment outcomes. Pharmaceutical companies collaborate with digital-health firms to integrate reminders, symptom checkers, and virtual nutrition coaching. These digital tools reduce treatment gaps and encourage consistent medication use, creating value in both chronic and mild anemia management.

Key Challenges

Side Effects and Poor Tolerance to Oral Iron Supplements

One of the major challenges in the anemia treatment drugs market is low tolerance to oral iron supplements. Many patients experience constipation, nausea, metallic taste, or gastric irritation, reducing adherence and extending recovery time. These side effects lead patients to discontinue therapy or shift to alternatives, affecting the uptake of traditional iron salts. Physicians must often adjust dosage or switch medications, adding complexity to treatment plans. Although newer controlled-release formulations help, intolerance remains a major barrier to consistent treatment adherence.

Limited Access to Advanced Therapies in Low-Income Regions

Access gaps remain a significant challenge for advanced anemia therapies, particularly intravenous iron and erythropoiesis-stimulating agents. High treatment costs, limited insurance coverage, and uneven distribution of specialized healthcare facilities restrict adoption in rural and low-income regions. Many patients rely on basic supplements that may not be sufficient for severe cases, leading to prolonged symptoms and repeated clinical visits. Health systems face resource constraints that slow deployment of screening, diagnostics, and advanced treatment options. This disparity limits overall market penetration and slows progress toward improved anemia management worldwide.

Regional Analysis

North America

North America held the leading position with about 34% share in 2024 due to strong healthcare infrastructure, high diagnosis rates, and broad use of advanced therapies such as intravenous iron and erythropoiesis-stimulating agents. The U.S. reported rising anemia cases linked to chronic kidney disease, cancer treatments, and aging populations, which strengthened drug demand. Widespread insurance coverage and consistent treatment guidelines supported high adoption across hospitals and specialty clinics. Expanding research on improved formulations and strong distribution networks kept North America ahead of other regions.

Europe

Europe accounted for roughly 28% share in 2024, supported by strong public-health programs, fortified-food policies, and established screening systems across major countries such as Germany, France, and the U.K. High awareness of nutritional deficiencies and steady use of oral iron and B12 supplements contributed to stable growth. Demand increased as chronic diseases and elderly populations expanded across the region. Government-led maternal-health programs and structured anemia management frameworks strengthened treatment adherence. Strong pharmaceutical manufacturing also supported broad product availability across retail and clinical channels.

Asia-Pacific

Asia-Pacific secured around 26% share in 2024, driven by high anemia prevalence among women and children and growing investment in national nutrition programs. Countries such as India, China, and Indonesia expanded supplementation schemes and fortified food initiatives to address widespread iron-deficiency anemia. Rising incomes, improved healthcare access, and rapid growth of online pharmacies increased drug consumption. Urban hospitals adopted more IV iron therapies as diagnostic capabilities improved. Large population size and expanding healthcare reforms positioned Asia-Pacific as the fastest-growing region in the market.

Latin America

Latin America captured nearly 7% share in 2024, supported by rising awareness campaigns, maternal-nutrition programs, and improving access to primary healthcare. Brazil and Mexico experienced increasing diagnosis rates due to expanding screening in public hospitals and community health centers. Economic disparities limited uniform access to advanced therapies, but demand for low-cost oral supplements remained strong. Growing partnerships between government bodies and NGOs helped improve pediatric and maternal anemia management. Retail pharmacies also played a major role in supporting supplement availability across urban and semi-urban areas.

Middle East & Africa

The Middle East & Africa region accounted for about 5% share in 2024, influenced by high anemia prevalence but limited access to specialized treatment across several countries. Increased humanitarian health programs and nutrition-focused initiatives helped improve demand for iron and folate supplements. Markets such as Saudi Arabia, UAE, and South Africa saw rising adoption of advanced therapies due to improving healthcare infrastructure. However, rural areas continued to rely heavily on basic supplementation due to affordability constraints. Gradual expansion of hospital facilities and digital-health tools supported steady but modest growth in the region.

Market Segmentations:

By Anemia Type

- Microcytic (Low MCV)

- Normocytic (Normal MCV)

- Macrocytic (High MCV)

By Drug Type

- Dietary Supplements

- Medicines

By Distribution Channel

- Hospitals Pharmacy

- Online Pharmacy

- Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The anemia treatment drugs market features strong competition among major pharmaceutical companies such as Amgen Inc., Hoffmann-La Roche Ltd, Novartis AG, Pfizer Inc, Janssen Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd, AMAG Pharmaceuticals, Rockwell Medical, Akebia Therapeutics, and Vifor Pharma Management Ltd. These companies expand their portfolios through advanced oral supplements, improved intravenous iron therapies, and next-generation erythropoiesis-stimulating agents used for chronic kidney disease and oncology-related anemia. Firms focus on clinical research, safety enhancements, and partnerships with hospitals to strengthen treatment adoption. Many players invest in controlled-release formulations and high-dose IV options to reduce treatment time and improve patient compliance. Expanding global distribution networks, strategic acquisitions, and regulatory approvals continue to shape market dynamics and intensify competition across emerging and developed regions.

Key Player Analysis

- Rockwell Medical

- Novartis AG

- Akebia Therapeutics

- Pfizer Inc

- Teva Pharmaceutical Industries Ltd

- AMAG Pharmaceuticals

- Janssen Pharmaceuticals, Inc.

- Hoffmann-La Roche Ltd

- Vifor Pharma Management Ltd.

- Amgen Inc

Recent Developments

- In June 2025, Hoffmann-La Roche Ltd: Health Canada authorized PiaSky (crovalimab) as the first monthly SC treatment for PNH, a rare hemolytic anemia, enabling home self-injection every four weeks to reduce treatment burden.

- In May 2024, Amgen Inc.: The US FDA approved BKEMV, Amgen’s biosimilar to Soliris, for PNH and atypical hemolytic uremic syndrome, both rare blood disorders that can cause severe anemia and kidney damage.

- In March 2024, Vifor Pharma Management Ltd. (CSL Vifor): Health Canada approved Ferinject (ferric carboxymaltose) for intravenous treatment of iron deficiency anemia in adults and children, including patients with heart failure who need improved exercise capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Anemia Type, Drug Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced IV iron therapies will rise as hospitals adopt faster and safer infusion options.

- Oral iron formulations will improve with better absorption technology and fewer gastrointestinal side effects.

- Erythropoiesis-stimulating agents will see wider use in chronic kidney disease and oncology care.

- Digital tools will support remote monitoring, treatment reminders, and improved patient adherence.

- Nutraceutical-based anemia supplements will expand in retail and online channels.

- Public nutrition programs will strengthen early detection and treatment access in developing regions.

- Research on combination therapies will increase to improve treatment outcomes in complex anemia cases.

- Manufacturers will focus on patient-friendly dosage forms such as liquids, gummies, and sprays.

- Clinical guidelines will evolve to support structured anemia management across all population groups.

- Market competition will intensify as global and regional companies expand their product portfolios.

Key Growth Drivers

Key Growth Drivers