Market Overview

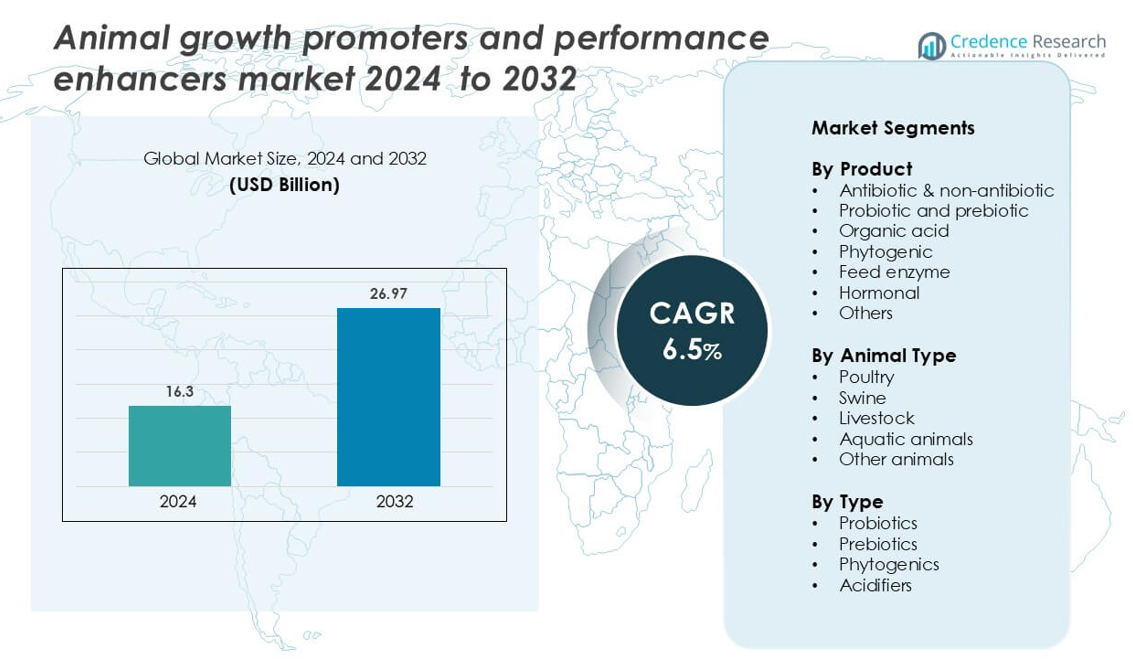

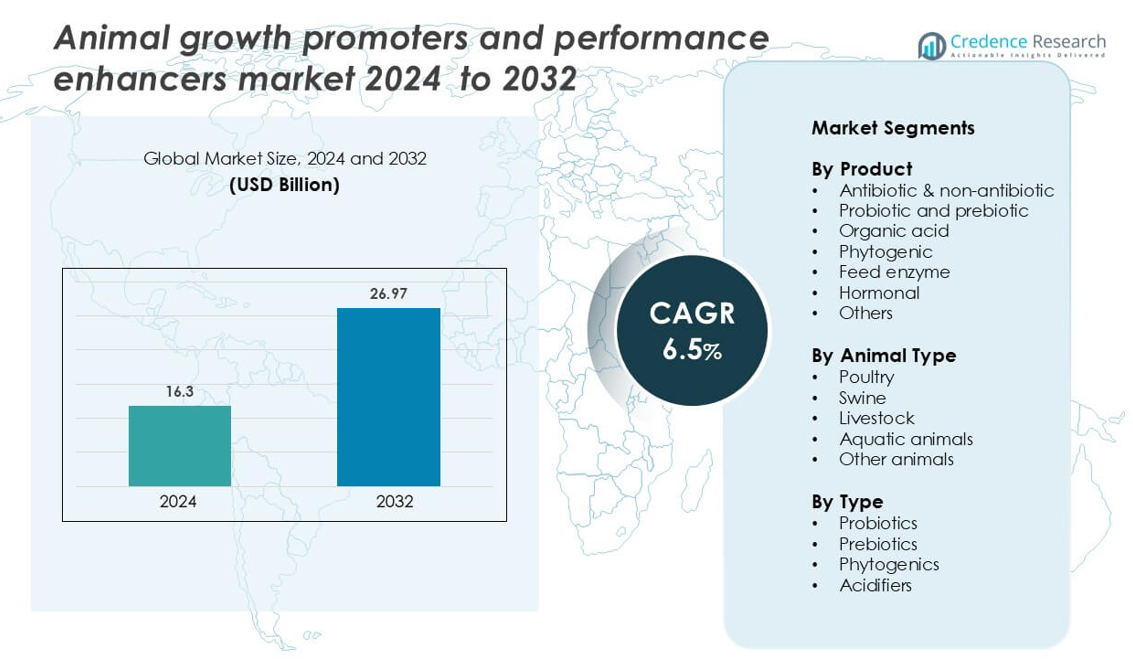

Animal growth promotors and performance enhancers market size was valued USD 16.3 billion in 2024 and is anticipated to reach USD 26.97 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Growth Promotors and Performance Enhancers Market Size 2024 |

USD 16.3 billion |

| Animal Growth Promotors and Performance Enhancers Market, CAGR |

6.5% |

| Animal Growth Promotors and Performance Enhancers Market Size 2032 |

USD 26.97 billion |

The animal growth promotors and performance enhancers market is shaped by leading companies such as Zoetis Inc., Bluestar Adisseo, Novozymes A/S, Alltech Inc., Dupont De Nemours Inc., Kemin Industries Inc., Elanco Animal Health Inc., DSM, Cargill Inc., and Guangdong VTR Bio-Tech Co. Ltd. These players focus on innovation, sustainable product development, and strategic collaborations to expand their global reach. Asia-Pacific leads the market with a 34% share, driven by rising livestock and aquaculture production and strong demand for natural additives. North America and Europe follow, supported by advanced feed technology and strict regulations on antibiotic use. Continuous R&D and investment in probiotics, phytogenics, and enzyme-based solutions enable these companies to maintain a competitive edge and meet evolving regulatory and consumer demands.

Market Insights

- The animal growth promotors and performance enhancers market was valued at USD 16.3 billion in 2024 and is projected to reach USD 26.97 billion by 2032, growing at a CAGR of 6.5%.

- Rising demand for meat, eggs, and dairy products drives strong adoption of probiotics, phytogenics, and organic acids in livestock and poultry farming.

- The market is witnessing a clear shift toward natural and sustainable additives due to stricter regulations on antibiotic use and growing consumer focus on food safety.

- Leading players such as Zoetis Inc., Bluestar Adisseo, Novozymes A/S, Alltech Inc., and DSM focus on product innovation and strategic partnerships to strengthen their market presence.

- Asia-Pacific leads with a 34% regional share, followed by North America at 29% and Europe at 24%, while probiotics dominate the product segment with the largest share, supported by growing demand for antibiotic-free production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The probiotic and prebiotic segment holds the dominant market share in the animal growth promotors and performance enhancers market. Probiotic and prebiotic additives support better gut health and nutrient absorption, enhancing feed efficiency and animal immunity. This drives high adoption among livestock producers seeking natural solutions. Antibiotic and non-antibiotic products are also widely used but face tighter regulations in many countries. Organic acids and phytogenics are gaining popularity as natural alternatives due to rising concerns over antibiotic resistance. These segments benefit from growing demand for sustainable and residue-free animal production systems.

- For instance, Novozymes A/S introduced the microbial solution Balancius, which improves nutrient utilization and gut health in poultry.

By Animal Type

The poultry segment dominates the market share, driven by high global poultry meat and egg production. Poultry farming relies heavily on feed additives to boost growth, improve feed conversion ratios, and enhance disease resistance. Swine and livestock segments also contribute significantly, supported by increasing meat consumption and rising herd sizes in key regions. Aquatic animals and other animals are emerging segments as aquaculture grows steadily. The strong focus on improving productivity and maintaining animal health across poultry farms supports the demand for growth promotors and performance enhancers.

- For instance, another Cargill product line, Grolux, reports a body weight gain improvement of 2–4% and a feed conversion ratio (FCR) decrease of 2–4.5% in its trials.

By Type

The probiotics segment leads the market due to its strong impact on gut health, immunity, and growth performance. Probiotic additives enhance digestion, reduce harmful pathogens, and improve nutrient utilization, which increases their adoption in poultry and livestock feed. Prebiotics and phytogenics are also gaining traction as natural, sustainable alternatives. Acidifiers support better feed preservation and gut pH balance, making them essential in high-density farming. The dominance of probiotics is reinforced by shifting consumer preference toward antibiotic-free meat and the growing awareness of animal welfare in commercial farming.

Key Growth Drivers

Rising Global Demand for Animal Protein

The growing global demand for meat, eggs, and dairy products strongly drives the use of growth promotors and performance enhancers. Rising population, urbanization, and dietary shifts increase pressure on the livestock sector to deliver higher yields. Farmers use feed additives such as probiotics, organic acids, and phytogenics to improve growth rates, feed efficiency, and immunity. This results in faster weight gain, reduced mortality, and shorter production cycles. Poultry and swine farming, in particular, benefit from improved conversion ratios, meeting rising consumer demand. The shift toward sustainable farming practices further supports adoption of non-antibiotic growth promotors. These products also help producers remain competitive in export-driven meat markets that enforce strict safety standards.

- For instance, the meta-analysis found that Actigen “beneficially changed… feed conversion ratio or feed/gain ratio by -0.046 (-2.54%)” when compared to a negative control group.

Shift Toward Natural and Sustainable Additives

Stricter regulations on antibiotic use have accelerated the adoption of natural feed additives such as probiotics, prebiotics, organic acids, and phytogenics. These additives enhance gut health, boost immunity, and support efficient nutrient utilization without leaving residues. Producers see strong economic benefits through better animal performance and higher-quality products. Growing consumer awareness of food safety and antimicrobial resistance is pushing producers to transition to clean-label animal products. Phytogenic additives, in particular, offer strong antioxidant and antimicrobial effects, reducing disease outbreaks. This shift aligns with sustainability goals and supports compliance with international animal welfare and food quality regulations.

- For instance, Delacon Biotechnik GmbH produces Biostrong® 510, a phytogenic feed additive for poultry. The product uses a blend of essential oils and plant extracts, primarily from thyme and anise, along with herbs, spices, and quillaja bark.

Advancements in Feed Technology

Technological advancements in feed formulation and delivery systems are improving the efficiency of growth promotors and performance enhancers. Encapsulation technologies and controlled-release systems help optimize the bioavailability of additives. Digital monitoring tools allow farmers to measure performance metrics and adjust feeding strategies in real time. Such innovation enhances feed conversion rates, reduces wastage, and improves cost-effectiveness. Integration of precision farming technologies also enables targeted use of probiotics, enzymes, and organic acids, improving animal health outcomes. These innovations help producers meet production goals while reducing environmental impact and ensuring consistent product quality.

Key Trend & Opportunity

Growing Adoption of Probiotics and Prebiotics

The shift toward antibiotic-free farming practices is fueling strong growth in probiotic and prebiotic additives. These products enhance gut microbiota balance, improve digestion, and reduce the need for antibiotics. As governments and consumers favor natural solutions, probiotic-based feed is becoming a preferred option for poultry, swine, and dairy sectors. Feed producers are investing in advanced strains with proven performance benefits, further boosting adoption. The rising popularity of functional animal nutrition is opening new opportunities for product innovation. This trend is particularly strong in regions with strict antimicrobial resistance regulations and export-focused livestock industries.

- For instance, Chr. Hansen, founded in Denmark, is a global bioscience company known for its work with probiotics and other natural ingredients. In 2024, it merged with Novozymes to become Novonesis.

Expansion of Aquaculture and Specialty Species

The rapid growth of aquaculture is creating new opportunities for performance enhancers. Farmers in aquaculture use organic acids, probiotics, and phytogenics to improve nutrient absorption, disease resistance, and growth rates. As global demand for fish protein increases, producers are turning to sustainable feed additives to ensure high survival and yield rates. The development of targeted formulations for aquatic species supports industry expansion in Asia-Pacific and Latin America. Specialty segments such as sheep, goats, and rabbits also offer new growth potential for feed additive suppliers. This diversification reduces reliance on traditional livestock markets.

- For instance, AquaStar, developed by BIOMIN (now DSM-Firmenich), is a multi-strain probiotic blend used in aquaculture to enhance fish growth and health.

Integration of Precision Livestock Farming

The integration of precision livestock farming technologies is creating new ways to optimize the use of growth promotors. Digital sensors, AI, and smart feeding systems help producers track animal health, weight gain, and feed intake. This data-driven approach allows targeted application of probiotics, enzymes, and organic acids for maximum effect. Automation improves feeding accuracy and reduces overuse of additives, lowering costs. As producers adopt these systems, demand for technically advanced and compatible feed additive solutions grows. This trend offers suppliers opportunities to develop integrated solutions tailored to precision farming environments.

Key Challenge

Stringent Regulatory Restrictions on Antibiotics

Strict global regulations on antibiotic use pose major challenges for producers dependent on conventional growth promotors. Many countries have banned or restricted antibiotic growth promotors due to concerns about antimicrobial resistance. This forces producers to reformulate feeds and invest in alternative solutions, often at higher costs. Regulatory uncertainty in some regions further complicates long-term planning and product launches. Meeting compliance requirements involves extensive testing, documentation, and certifications, increasing operational costs for manufacturers. This shift demands rapid innovation and strong R&D investments from the industry to remain competitive.

High Cost and Limited Awareness of Alternatives

Although natural feed additives offer strong performance benefits, their high cost limits adoption among small and medium farmers. Many producers in developing regions lack awareness of the benefits of probiotics, prebiotics, and organic acids. Inconsistent supply chains and limited technical support also reduce usage rates. Without proper guidance, farmers may fail to optimize dosages or achieve expected results, leading to reluctance to invest. Educating producers and improving distribution networks are critical to overcome these barriers. This challenge is especially relevant in cost-sensitive livestock markets with minimal regulatory enforcement.

Regional Analysis

North America

North America holds a 29% market share in the animal growth promotors and performance enhancers market. The region’s strong livestock and poultry production drives consistent demand for feed additives. Producers focus on improving feed conversion rates, animal immunity, and weight gain. Strict regulatory frameworks encourage the use of non-antibiotic solutions such as probiotics, organic acids, and phytogenics. Large-scale farms in the U.S. and Canada invest heavily in advanced nutrition and precision farming systems. Rising consumer demand for antibiotic-free meat and dairy products further boosts adoption. The region’s well-developed infrastructure supports steady market expansion.

Europe

Europe accounts for 24% of the global market share, supported by a strong emphasis on sustainable livestock production. Strict regulations limiting antibiotic use have accelerated the adoption of probiotics, phytogenics, and organic acids. Producers focus on improving animal welfare, product quality, and compliance with export standards. The poultry and swine industries are major contributors to demand, particularly in countries like Germany, France, and the Netherlands. Advanced R&D in feed technology and government support for clean-label farming drive innovation. High consumer awareness of food safety further strengthens market growth across the region.

Asia-Pacific

Asia-Pacific leads the global market with a 34% share, driven by rapid growth in livestock and aquaculture production. China, India, and Southeast Asian countries dominate the region’s demand due to rising meat consumption and expanding commercial farms. Producers adopt probiotics, prebiotics, and acidifiers to boost productivity and meet export standards. Governments encourage sustainable farming practices, further promoting natural growth promotors. The region benefits from large-scale investments in feed manufacturing and distribution networks. Growing urbanization and rising incomes increase protein consumption, solidifying Asia-Pacific’s position as the largest market for performance enhancers.

Latin America

Latin America holds a 7% market share, supported by its expanding poultry and beef industries. Brazil and Mexico lead regional adoption with a focus on improving animal productivity and disease resistance. Rising export demand drives the need for feed solutions that meet international safety standards. Probiotic and phytogenic additives gain popularity as producers seek cost-effective, residue-free alternatives to antibiotics. Increasing investments in modern livestock farming and feed production facilities support market expansion. Although regulatory frameworks are less strict than in Europe, voluntary adoption of natural additives is steadily increasing across the region.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global market, showing steady growth potential. Livestock farming expansion in countries such as Saudi Arabia, South Africa, and Egypt drives rising demand for performance enhancers. Producers focus on improving herd health, feed efficiency, and meat yield to support food security goals. The region is witnessing growing adoption of probiotics and organic acids as cost-effective and sustainable solutions. While market maturity is lower than other regions, increasing investments in agriculture and feed infrastructure are expected to boost growth in the coming years.

Market Segmentations:

By Product

- Antibiotic & non-antibiotic

- Probiotic and prebiotic

- Organic acid

- Phytogenic

- Feed enzyme

- Hormonal

- Others

By Animal Type

- Poultry

- Swine

- Livestock

- Aquatic animals

- Other animals

By Type

- Probiotics

- Prebiotics

- Phytogenics

- Acidifiers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the animal growth promotors and performance enhancers market is defined by the strong presence of global players such as Zoetis Inc., Bluestar Adisseo, Novozymes A/S, Alltech Inc., Dupont De Nemours Inc., Kemin Industries Inc., Elanco Animal Health Inc., DSM, Cargill Inc., and Guangdong VTR Bio-Tech Co. Ltd. These companies focus on product innovation, strategic collaborations, and portfolio expansion to strengthen their market positions. Asia-Pacific leads the market with a 34% share, followed by North America at 29% and Europe at 24%, driven by advanced livestock farming and high protein demand. Key players invest in probiotic, phytogenic, and enzyme-based solutions to align with regulatory shifts toward non-antibiotic growth promotors. Continuous R&D, sustainability goals, and digital feed technologies further intensify competition, making innovation and regulatory compliance critical differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zoetis Inc.

- Bluestar Adisseo

- Novozymes A/S

- Alltech Inc.

- Dupont De Nemours Inc.

- Kemin Industries Inc.

- Elanco Animal Health Inc.

- DSM

- Cargill Inc.

- Guangdong VTR Bio-Tech Co. Ltd.

Recent Developments

- In September 2024, Ginkgo Bioworks partnered with NOVUS International to develop advanced feed additives aimed at enhancing livestock health and performance. The collaboration will leverage Ginkgo’s enzyme development platform to create efficient, cost-effective enzymes for animal nutrition. This partnership addresses rising feed costs and aims to improve sustainability in animal agriculture.

- In September 2024, Deloitte has announced a global collaboration with dsm-firmenich to enhance sustainability in the food value chain, focusing on reducing the environmental footprint of animal protein production. Central to the effort is Sustell, a data-driven platform that measures and helps reduce farm-level environmental impacts. Deloitte will support its expansion, advising businesses on implementation, ESG reporting, and strategy. The partnership aims to drive transparency and sustainability across the global food system.

- In July 2022, Cargill, Incorporated launched a new feed additive named “Promote.” The product is designed to improve the gut health of poultry and is expected to enhance the company’s product portfolio in the global market.

Report Coverage

The research report offers an in-depth analysis based on Product, Animal type, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Probiotic and phytogenic solutions will see stronger adoption as antibiotic alternatives.

- Asia-Pacific will remain the largest market, driven by growing meat consumption.

- Precision livestock farming will enhance targeted use of performance enhancers.

- Regulatory pressure will accelerate the shift toward natural and sustainable additives.

- Feed technology innovation will improve nutrient utilization and animal health outcomes.

- Aquaculture will emerge as a key growth segment for performance enhancers.

- Strategic partnerships and acquisitions will strengthen product portfolios of major players.

- Rising consumer demand for antibiotic-free meat will shape product development strategies.

- Digital monitoring systems will support efficient additive use and farm productivity.

- Companies will invest more in R&D to develop advanced and residue-free solutions.