Market Overview

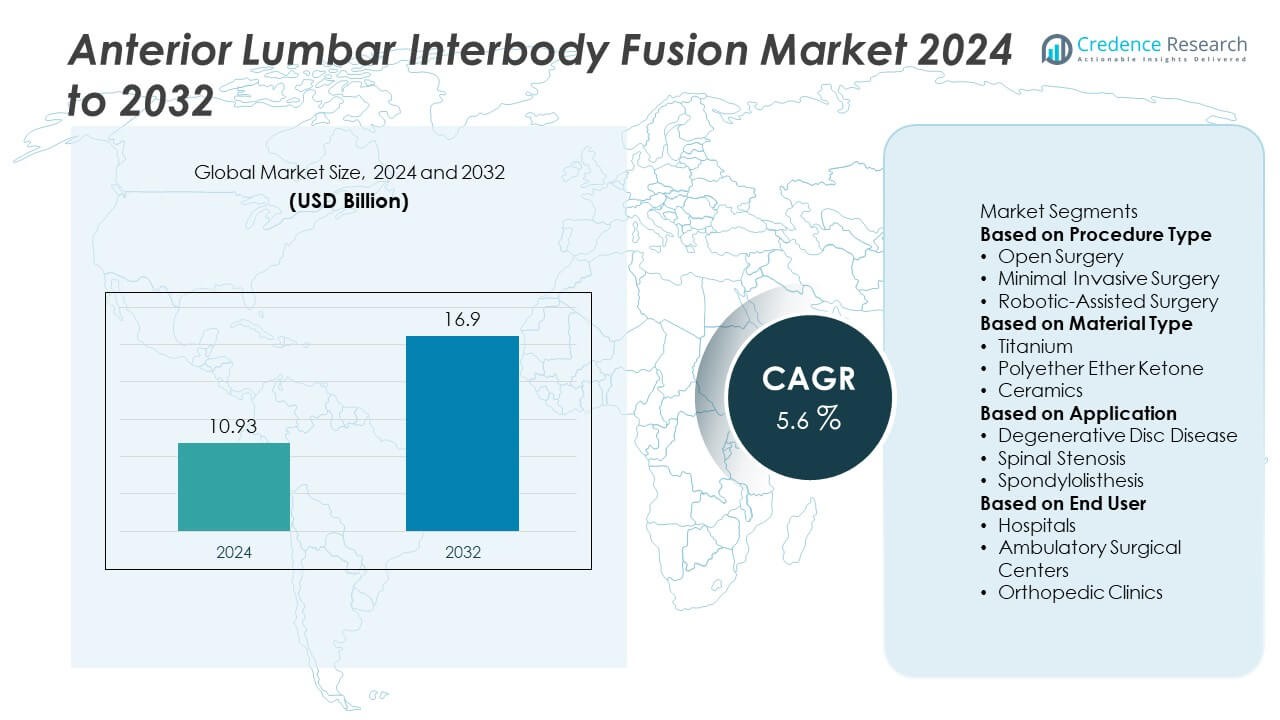

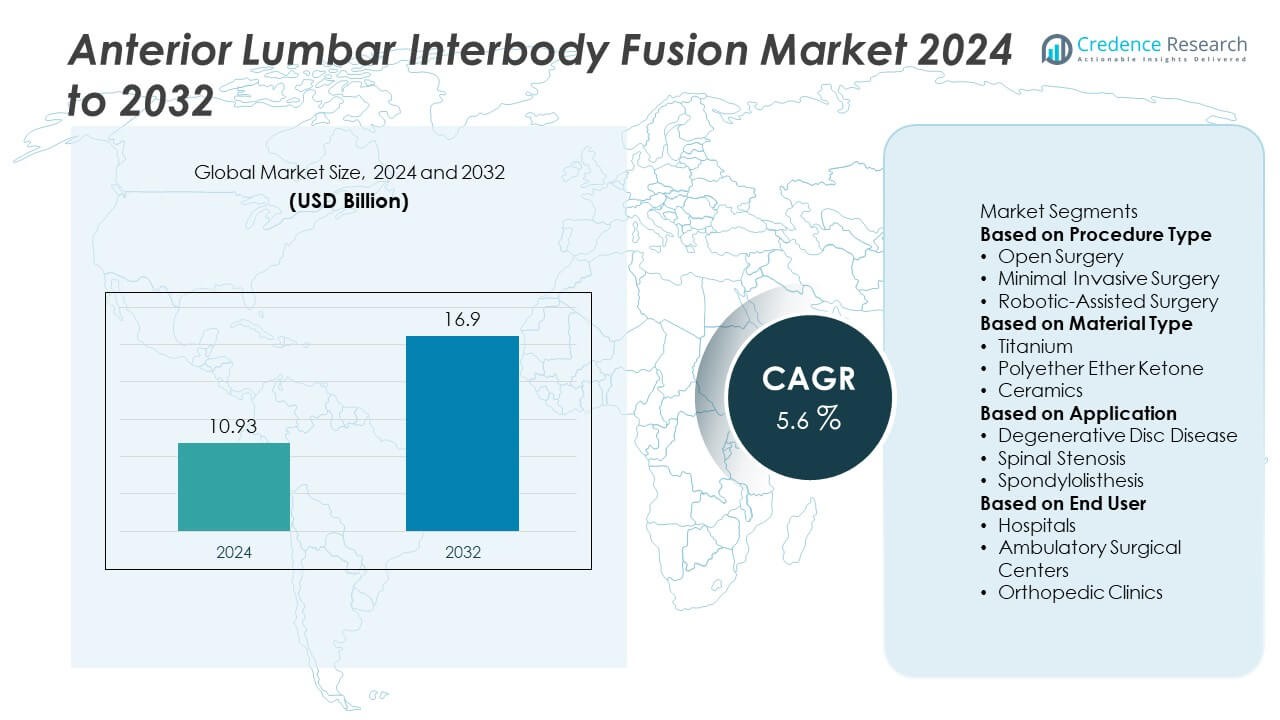

The Anterior Lumbar Interbody Fusion (ALIF) Market was valued at USD 10.93 billion in 2024 and is expected to reach USD 16.9 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anterior Lumbar Interbody Fusion (ALIF) Market Size 2024 |

USD 10.93 Billion |

| Anterior Lumbar Interbody Fusion (ALIF) Market, CAGR |

5.6% |

| Anterior Lumbar Interbody Fusion (ALIF) Market Size 2032 |

USD 16.9 Billion |

The Anterior Lumbar Interbody Fusion Market grows with rising cases of degenerative disc disease, spondylolisthesis, and chronic back pain, supported by an expanding geriatric population and lifestyle-related risk factors. Surgeons adopt minimally invasive and robot-assisted techniques for better alignment, shorter recovery, and improved outcomes.

North America leads the Anterior Lumbar Interbody Fusion Market due to advanced healthcare infrastructure, high adoption of minimally invasive procedures, and strong presence of skilled spine surgeons. Europe follows with growing use of navigation systems and 3D-printed implants to improve outcomes and patient safety. Asia-Pacific shows rapid growth supported by expanding hospital networks, medical tourism, and rising awareness of spinal treatments. Latin America and Middle East & Africa gradually adopt advanced fusion procedures with growing investments in specialty care facilities. Key players shaping the market include Medtronic, Stryker, and NuVasive, which focus on innovative implants, robotic-assisted platforms, and digital navigation tools. Companies such as Orthofix and Alphatec Spine strengthen their portfolios with patient-specific implants and biologics to enhance fusion rates. Precision Spine and SpineGuard drive innovation through smart instrumentation and advanced fixation devices, supporting better surgical precision and clinical outcomes across diverse healthcare settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Anterior Lumbar Interbody Fusion Market was valued at USD 10.93 billion in 2024 and is projected to reach USD 16.9 billion by 2032, growing at a CAGR of 5.6%.

- Rising prevalence of degenerative disc disease, spinal stenosis, and spondylolisthesis fuels procedure demand globally.

- Surgeons adopt minimally invasive and robot-assisted ALIF techniques to improve alignment, reduce complications, and shorten recovery.

- Key players such as Medtronic, Stryker, NuVasive, Orthofix, and Alphatec Spine invest in innovative implants, 3D-printed cages, and navigation technologies to strengthen their market presence.

- High procedure cost, uneven reimbursement in developing economies, and shortage of skilled spine surgeons act as key restraints, limiting access to advanced care.

- North America leads due to strong infrastructure and early adoption, Europe follows with regulatory support and innovation, while Asia-Pacific shows fastest growth driven by rising healthcare investments and medical tourism.

- Expanding outpatient surgical centers and growing use of personalized implants present opportunities to increase patient access and improve clinical outcomes worldwide.

Market Drivers

Rising Incidence of Degenerative Spinal Disorders Driving Demand

The Anterior Lumbar Interbody Fusion Market grows with the rising prevalence of degenerative disc disease, spondylolisthesis, and spinal stenosis. Surgeons prefer ALIF procedures for better fusion rates and improved sagittal balance. It supports reduced pain and faster recovery compared to traditional approaches. Growing awareness among patients about minimally invasive options further fuels adoption. Healthcare providers increasingly recommend early intervention to prevent progression of spinal conditions. This trend creates steady demand for advanced implants and surgical solutions.

- For instance, Medtronic’s INFUSE™ Bone Graft has been implanted in over 1 million patients worldwide since its initial approval in 2002, with clinical trials for FDA-approved single-level Anterior Lumbar Interbody Fusion (ALIF) procedures showing high fusion rates.

Technological Advancements in Surgical Techniques and Implants

Innovations in implant materials and surgical navigation systems boost the adoption of ALIF procedures. Titanium cages, 3D-printed implants, and bioactive coatings enhance fusion success rates. It allows surgeons to achieve greater precision and reduce intraoperative complications. The integration of robotic-assisted platforms improves reproducibility and outcomes. Hospitals invest in advanced imaging and navigation tools to improve surgical accuracy. These developments strengthen the preference for ALIF in complex spinal cases.

- For instance, NuVasive’s Modulus ALIF implant uses 3D-printed porous titanium with an optimized, textured surface architecture to improve bone ingrowth and stability. The device is designed to enhance osseointegration and promote new bone on-growth and in-growth.

Growing Geriatric Population and Lifestyle Risk Factors

An expanding elderly population drives demand for effective spinal fusion procedures. Aging individuals face higher rates of disc degeneration and chronic back pain. The Anterior Lumbar Interbody Fusion Market benefits from the need to restore mobility and quality of life. Rising obesity rates and sedentary lifestyles also contribute to spinal disorders. Healthcare systems prioritize surgical interventions to reduce disability and improve patient outcomes. These factors collectively increase procedural volumes worldwide.

Favorable Reimbursement Policies and Rising Healthcare Investments

Supportive reimbursement frameworks encourage patients to choose surgical treatment over prolonged conservative care. Governments and insurers expand coverage for ALIF procedures to reduce long-term costs of disability. It improves patient access to advanced surgical care across developed and emerging markets. Expanding hospital infrastructure and specialty centers further promote adoption. Investment in training programs ensures availability of skilled spine surgeons. This supportive ecosystem accelerates market penetration and growth.

Market Trends

Adoption of Minimally Invasive and Robot-Assisted ALIF Procedures

The Anterior Lumbar Interbody Fusion Market experiences strong adoption of minimally invasive and robot-assisted techniques. Surgeons use smaller incisions, which reduce blood loss and hospital stay. It improves surgical precision and lowers complication rates. Robotic systems enable consistent screw placement and optimize alignment. Hospitals invest in navigation platforms to support these advanced procedures. This trend drives demand for compatible implants and instruments.

- For instance, Globus Medical’s ExcelsiusGPS robotic navigation system, which surpassed 20,000 procedures as of a July 2021 announcement, has been shown in clinical studies to achieve screw placement accuracy of over 96%.

Shift Toward Biocompatible and Advanced Implant Materials

Manufacturers focus on developing implants made from titanium alloys, PEEK, and porous materials. These innovations enhance osseointegration and fusion rates. It supports better patient outcomes and long-term stability. 3D-printed cages allow for customized designs to match patient anatomy. Surgeons prefer implants that reduce stress shielding and promote bone growth. This shift strengthens the use of next-generation devices across healthcare facilities.

- For instance, Medtronic offers a variety of ALIF systems to match patient-specific anatomy, including the Divergence-L system, which offers cages in various footprints, lordotic options, and has an accompanying anterior plate for integrated fixation.

Integration of Digital Health and Surgical Navigation Systems

Digital navigation tools gain traction for preoperative planning and intraoperative guidance. Real-time imaging and augmented reality solutions assist surgeons in achieving precision. It reduces the risk of revision surgeries and enhances patient safety. Hospitals integrate these systems to improve workflow efficiency. Data-driven insights from connected devices support outcome tracking. The trend encourages collaboration between device makers and software developers.

Expansion of Outpatient and Ambulatory Surgical Centers

Outpatient facilities perform a growing share of ALIF procedures due to faster recovery protocols. The Anterior Lumbar Interbody Fusion Market benefits from lower costs and reduced inpatient burden. It aligns with payer preference for cost-effective care delivery. Enhanced anesthesia techniques and pain management support same-day discharge. Ambulatory centers expand their infrastructure to handle complex spine surgeries. This transition widens patient access to advanced fusion procedures.

Market Challenges Analysis

High Procedure Costs and Limited Reimbursement in Emerging Markets

The Anterior Lumbar Interbody Fusion Market faces challenges from the high cost of implants, navigation systems, and robotic platforms. Many patients in developing regions struggle to afford these advanced procedures. It limits access and slows adoption in price-sensitive markets. Reimbursement coverage remains uneven, especially in low- and middle-income countries. Hospitals often delay adoption of expensive equipment due to budget constraints. These financial barriers restrict market penetration and reduce procedure volumes.

Risk of Surgical Complications and Need for Skilled Surgeons

Complications such as infection, nerve injury, and non-union remain significant concerns for ALIF procedures. It increases the need for experienced surgeons and advanced perioperative care. A shortage of trained spine specialists in rural areas restricts access to quality treatment. Lengthy recovery periods deter some patients from opting for surgery. Hospitals must invest in training programs to improve clinical outcomes. These factors create operational and clinical challenges for market expansion.

Market Opportunities

Expansion of Personalized and Patient-Specific Implants

The Anterior Lumbar Interbody Fusion Market holds strong opportunities in patient-specific implant design. Advances in 3D printing enable production of customized cages tailored to individual anatomy. It improves fusion rates and lowers the risk of implant migration. Surgeons benefit from better fit and enhanced biomechanical performance. Manufacturers invest in bioactive coatings that promote faster bone integration. These innovations create a competitive edge for companies offering personalized solutions.

Rising Demand in Emerging Economies and Outpatient Settings

Growing healthcare investments in Asia-Pacific and Latin America open new growth avenues. The Anterior Lumbar Interbody Fusion Market benefits from expanding hospital infrastructure and government support for advanced spine care. It aligns with rising awareness and willingness to undergo surgical treatment. The shift toward outpatient settings allows providers to perform ALIF procedures at lower costs. Ambulatory surgical centers expand their capabilities to meet this demand. These developments increase procedure volumes and strengthen market presence globally.

Market Segmentation Analysis:

By Procedure Type

The Anterior Lumbar Interbody Fusion Market is segmented by procedure type into open surgery and minimally invasive surgery. Minimally invasive procedures gain traction due to reduced blood loss, faster recovery, and shorter hospital stays. It appeals to patients seeking lower postoperative pain and faster return to activity. Surgeons favor this approach for its precision and improved alignment outcomes. Open surgery remains relevant for complex deformities and multi-level fusions where broader access is required. The rising use of robotic guidance and navigation tools further strengthens the adoption of minimally invasive procedures.

- For instance, Medtronic’s Mazor X Stealth Edition has been used in a large and growing number of minimally invasive spine procedures worldwide since its 2019 launch and has demonstrated screw placement accuracy rates at or above 98% in numerous clinical studies.

By Material Type

Implants used in ALIF procedures include titanium, polyetheretherketone (PEEK), and 3D-printed porous materials. PEEK dominates due to its radiolucent property, allowing better imaging for postoperative assessment. It provides excellent biocompatibility and strength, supporting reliable fusion. Titanium cages remain widely used for their durability and surface texture that promotes bone growth. Emerging 3D-printed implants allow for patient-specific customization and improved osseointegration. Manufacturers focus on developing bioactive coatings to accelerate healing and enhance fusion rates across patient groups.

- For instance, studies have shown that fusion success rates with Stryker Tritanium cages can be above 90% at 12 months in specific spinal fusion procedures, and in some applications, this has been demonstrated to be better than other cage materials like PEEK. Tritanium’s 3D-printed porous structure is designed to promote bone growth, which can contribute to higher fusion rates and lower subsidence, particularly in lumbar fusion.

By Application

Applications of ALIF procedures cover treatment for degenerative disc disease, spondylolisthesis, and spinal deformities. The Anterior Lumbar Interbody Fusion Market sees high demand for degenerative disc disease treatment, driven by aging populations and chronic back pain cases. It helps restore disc height, relieve nerve compression, and improve spinal stability. Spondylolisthesis cases benefit from ALIF for its ability to correct slippage and maintain alignment. Spinal deformity corrections often require multi-level fusions, where ALIF plays a crucial role in restoring sagittal balance. Rising patient awareness and improved access to surgical care expand procedure volumes across all application areas.

Segments:

Based on Procedure Type

- Open Surgery

- Minimal Invasive Surgery

- Robotic-Assisted Surgery

Based on Material Type

- Titanium

- Polyether Ether Ketone

- Ceramics

Based on Application

- Degenerative Disc Disease

- Spinal Stenosis

- Spondylolisthesis

Based on End User

- Hospitals

- Ambulatory Surgical Centers

- Orthopedic Clinics

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Anterior Lumbar Interbody Fusion Market, accounting for nearly 40% of the global market. High prevalence of degenerative spinal disorders and strong adoption of minimally invasive techniques drive demand. It benefits from advanced healthcare infrastructure, well-established reimbursement frameworks, and a high number of skilled spine surgeons. Hospitals and outpatient centers invest heavily in robotic-assisted systems and navigation technologies to improve outcomes. Growing awareness among patients and early diagnosis programs further boost procedure volumes. The region also sees continuous research collaborations and clinical trials that support the adoption of innovative implants and biologics. Increasing demand from ambulatory surgical centers is expected to strengthen the market presence in the coming years.

Europe

Europe represents about 25% of the global market share, supported by an aging population and a strong focus on patient safety. Healthcare systems prioritize minimally invasive procedures that reduce recovery time and hospital costs. It benefits from regulatory support for advanced implants and surgical navigation platforms. Surgeons adopt 3D-printed and bioactive cages to improve fusion rates and outcomes. The presence of leading orthopedic device manufacturers in countries like Germany, Switzerland, and the UK strengthens supply and innovation. Public and private hospital investments in spine care programs further stimulate procedural growth. Rising incidence of chronic lower back pain due to sedentary lifestyles continues to expand the demand for ALIF procedures.

Asia-Pacific

Asia-Pacific accounts for nearly 20% of the global market, driven by rapid healthcare infrastructure development and rising patient awareness. Growing urbanization and higher diagnosis rates contribute to procedural growth across major economies like China, India, and Japan. It benefits from government-backed programs aimed at improving access to advanced surgical care. Local manufacturers invest in cost-effective implants to meet price-sensitive demand while international players expand their presence through partnerships. Medical tourism in countries such as India and Thailand offers affordable ALIF procedures to global patients. Rising disposable income and growing health insurance coverage further encourage patients to undergo surgical interventions. The region shows significant growth potential as hospital networks expand into rural areas.

Latin America

Latin America holds around 8% of the global market share, supported by increasing healthcare investments and rising adoption of advanced spine procedures. Brazil and Mexico lead demand, with expanding private hospital networks offering access to minimally invasive surgeries. It faces challenges related to cost constraints and uneven reimbursement coverage, but growing middle-class populations improve affordability. Surgeons adopt modern navigation and imaging tools to enhance clinical outcomes. Government initiatives to improve access to specialized care encourage market expansion. The trend toward outpatient procedures is gradually emerging, which is expected to lower overall treatment costs.

Middle East & Africa

The Middle East & Africa region accounts for nearly 7% of the global market share, with demand concentrated in Gulf countries and South Africa. Rising investments in healthcare infrastructure and adoption of modern surgical equipment support market growth. It benefits from an increasing prevalence of spinal disorders due to aging and lifestyle-related issues. Leading hospitals in the UAE and Saudi Arabia adopt robotic and navigation technologies to attract medical tourism. Local training initiatives aim to expand the pool of skilled spine surgeons and improve treatment availability. Gradual expansion of insurance coverage is expected to drive patient access to ALIF procedures in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic

- Orthofix

- Stryker

- SpineGuard

- Alphatec Spine

- NuVasive

- Precision Spine

- K2M

- Aesculap

- Braun Melsungen

Competitive Analysis

Competitive landscape of the Anterior Lumbar Interbody Fusion Market features leading players such as Medtronic, Stryker, NuVasive, Orthofix, Alphatec Spine, Precision Spine, SpineGuard, K2M, Aesculap, and Braun Melsungen. These companies focus on developing advanced ALIF implants, 3D-printed cages, and biocompatible materials to improve fusion success rates and patient outcomes. Many invest heavily in robotic-assisted platforms and navigation systems that enhance surgical precision and reduce complications. Strategic partnerships and acquisitions expand product portfolios and strengthen distribution networks in key markets. Continuous research and development efforts introduce bioactive coatings and patient-specific implants, aligning with the shift toward personalized medicine. Companies also emphasize surgeon training programs and educational initiatives to drive adoption of minimally invasive techniques. Growing competition encourages innovation in cost-effective implants for emerging economies, helping capture price-sensitive markets. Overall, strong innovation pipelines, global reach, and focus on clinical outcomes ensure sustained growth and differentiation among market leaders.

Recent Developments

- In July 2025, Medtronic announced that its INFUSE™ Bone Graft / Interbody Fusion Device TLIF study achieved an early success milestone, a development that could lead to a new indication for the bone graft in transforaminal lumbar interbody fusion (TLIF) procedures.

- In July 2025, SpineGuard was granted a U.S. patent for a DSG-enabled active safety stop for bone drilling tools.

- In March 2025, Globus Medical launched the COHERE ALIF Spacer, a Porous PEEK interbody spacer for ALIF with enhanced bone in-growth surface.

- In Septmeber 2024, SpineGuard, The PsiFGuard smart drilling device (with Omnia Medical) received FDA 510(k) clearance.

Report Coverage

The research report offers an in-depth analysis based on Procedure Type, Material Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ALIF procedures will rise with aging populations and increasing spinal disorder cases.

- Minimally invasive and robot-assisted techniques will gain wider acceptance among surgeons.

- 3D-printed and patient-specific implants will become more common for improved outcomes.

- Bioactive coatings and advanced materials will enhance fusion rates and recovery.

- Digital navigation and imaging tools will see higher adoption in hospitals and outpatient centers.

- Outpatient and ambulatory surgical centers will perform more ALIF procedures due to faster recovery protocols.

- Emerging economies will drive strong growth with expanding healthcare infrastructure and insurance coverage.

- Strategic collaborations between device makers and software providers will support innovation.

- Training programs will focus on addressing the shortage of skilled spine surgeons globally.

- Competition will intensify, encouraging companies to launch cost-effective and technologically advanced solutions.