Market Overview

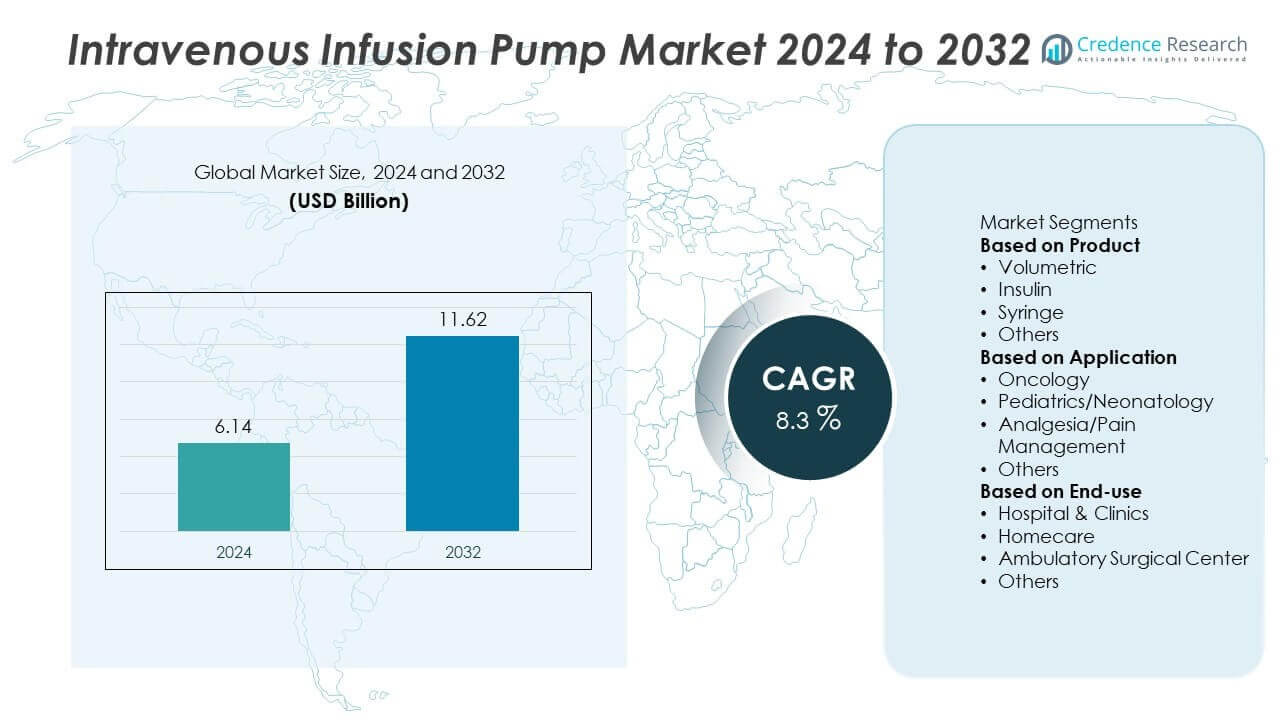

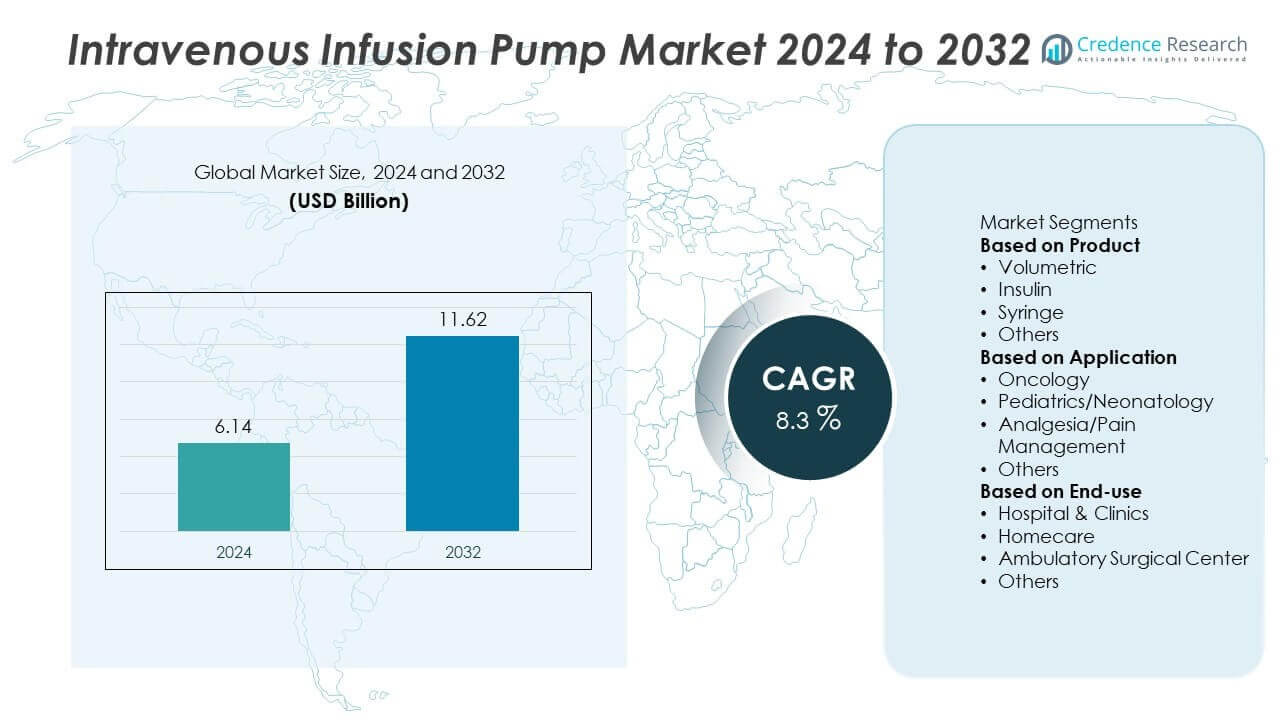

The global Intravenous Infusion Pump Market was valued at USD 6.14 billion in 2024 and is projected to reach USD 11.62 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous Infusion Pump Market Size 2024 |

USD 6.14 Billion |

| Intravenous Infusion Pump Market, CAGR |

8.3% |

| Intravenous Infusion Pump Market Size 2032 |

USD 11.62 Billion |

Intravenous Infusion Pump Market grows with rising demand for precise and controlled drug delivery in hospitals, home care, and ambulatory settings. Increasing prevalence of chronic diseases, cancer, and critical illnesses drives adoption of volumetric and syringe pumps. Intravenous Infusion Pump Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa driven by rising hospital admissions and demand for advanced infusion systems. North America leads adoption with high healthcare spending, strong focus on patient safety, and widespread use of smart pumps in hospitals and home care. Europe benefits from regulatory support and modernization of healthcare infrastructure, boosting demand for digital and wireless-enabled pumps. Asia-Pacific grows rapidly due to expanding healthcare access, rising prevalence of chronic diseases, and increasing government investments in hospital capacity. Latin America and Middle East & Africa witness gradual adoption supported by growing medical device distribution and rising awareness of infusion therapy benefits. Key players shaping the market include Medtronic, Fresenius Kabi, Terumo Corporation, and ICU Medical, who focus on product innovation, wireless integration, and user-friendly designs to meet evolving healthcare needs globally.

Market Insights

- Intravenous Infusion Pump Market was valued at USD 6.14 billion in 2024 and is projected to reach USD 11.62 billion by 2032, growing at a CAGR of 8.3%.

- Rising demand for precise and safe drug delivery solutions in hospitals and home care drives market growth.

- Market trends emphasize adoption of smart infusion systems with wireless connectivity, real-time monitoring, and integration with electronic health records to reduce medication errors.

- Competitive landscape includes Medtronic, Fresenius Kabi, Terumo Corporation, ICU Medical, and Boston Scientific Corporation focusing on innovation, compact designs, and automation.

- High installation and maintenance costs, along with risk of device malfunction, act as restraints limiting adoption in cost-sensitive regions.

- North America shows strong demand driven by advanced healthcare systems and focus on patient safety, while Asia-Pacific emerges as the fastest-growing region due to expanding hospital infrastructure and rising prevalence of chronic diseases.

- Growing shift toward portable, wearable, and ambulatory infusion pumps supports home-based treatment trends and expands patient accessibility to infusion therapy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Chronic Diseases Driving Demand

Intravenous Infusion Pump Market grows with rising cases of chronic diseases such as cancer, diabetes, and cardiovascular disorders. Hospitals rely on infusion pumps to deliver precise doses of medications, fluids, and nutrition. It supports long-term treatment plans for patients requiring continuous drug administration. The aging population increases demand for infusion therapies due to higher incidence of chronic illnesses. Infusion pumps improve treatment accuracy and patient safety compared to manual methods. Growing awareness of early diagnosis and preventive care further boosts adoption across healthcare facilities.

- For instance, the Fresenius Kabi Agilia Connect Volumetric Pump MC model supports a flow rate range of 0.1–1500 mL/hr. This capability, which includes a dedicated “micro mode” for precise delivery in small increments, enables highly accurate continuous drug delivery for a wide range of patients, from neonatal to adult. It is worth noting that other versions of the pump may have different maximum flow rates.

Technological Advancements in Smart Infusion Systems

Intravenous Infusion Pump Market benefits from rapid technological innovation in connected and smart infusion systems. Manufacturers develop pumps with wireless connectivity, drug library integration, and dose error reduction systems. It enables real-time monitoring, remote control, and automatic alerts for clinicians. Integration with electronic medical records enhances workflow efficiency and reduces manual errors. Demand grows for programmable and portable devices suitable for hospital and home care settings. Continuous R&D investment strengthens development of user-friendly and safer infusion solutions.

- For instance, the Agilia Connect range by Fresenius Kabi enables wireless connectivity for up to 4,500 pumps, allows central drug library deployment, and supports a 4- to 8-hour battery life for portable operation.

Expansion of Home Healthcare and Ambulatory Services

Intravenous Infusion Pump Market gains momentum from growing demand for home-based and ambulatory care solutions. Patients prefer receiving infusion therapy in home settings to reduce hospital visits. It reduces healthcare costs and improves patient comfort and compliance. Portable and wearable infusion pumps are increasingly adopted for chemotherapy, pain management, and hydration therapy. Ambulatory care centers expand their capacity, driving need for compact and reliable pump systems. Rising focus on patient-centric care supports steady growth of this segment.

Favorable Healthcare Policies and Rising Expenditure

Intravenous Infusion Pump Market benefits from supportive government initiatives and rising healthcare spending worldwide. Public and private sectors invest in modernizing hospital infrastructure and improving access to infusion therapy. It creates strong demand for advanced pumps in developed and emerging markets. Regulatory agencies encourage adoption of safer devices through stringent quality standards. Healthcare providers upgrade their equipment to meet compliance requirements and improve patient outcomes. Growing insurance coverage and reimbursement policies promote wider use of infusion pumps across multiple care settings.

Market Trends

Market Trends

Adoption of Smart and Connected Infusion Pump Technologies

Intravenous Infusion Pump Market shows a strong shift toward smart and connected systems. Hospitals adopt pumps with wireless connectivity, data logging, and real-time monitoring. It improves clinical decision-making and reduces medication errors. Integration with hospital information systems allows seamless patient data transfer and better workflow management. Demand rises for pumps with automatic dose calculation and alarm systems. These features support patient safety and regulatory compliance in critical care environments.

- For instance, ICU Medical released the Plum Solo and Plum Duo IV pumps that deliver ±3% accuracy under real-world conditions and feature full-color touchscreens (7-inch on Solo, 10-inch on Duo).

Rising Popularity of Portable and Ambulatory Infusion Devices

Intravenous Infusion Pump Market experiences growing demand for portable and lightweight pumps. Patients prefer devices that allow mobility during treatment in home and outpatient settings. It supports continuous drug delivery without disrupting daily activities. Wearable infusion pumps gain adoption for chemotherapy, pain therapy, and insulin infusion. Ambulatory infusion solutions reduce hospital stay duration and healthcare costs. Manufacturers focus on designing compact, user-friendly devices with extended battery life.

- For instance, the optional Wireless Communication Module for ICU Medical’s CADD-Solis Infusion System has a battery capacity of 18.7 Wh, weighs less than 100 grams for its battery pack, and supports about 11 hours of discharge under nominal conditions. The pump itself, however, weighs 595 grams with four AA alkaline batteries.

Integration of Dose Error Reduction and Safety Systems

Intravenous Infusion Pump Market benefits from advances in dose error reduction technologies. Smart pumps feature drug libraries and programmable safety limits that minimize risks of overdosing. It helps healthcare providers maintain consistent accuracy in medication delivery. Systems with real-time alerts allow quick intervention during infusion errors. Compliance with international safety standards drives adoption of these advanced systems. Continuous upgrades in software and interface design improve usability for clinicians.

Growing Use of Multi-Channel and Modular Pump Systems

Intravenous Infusion Pump Market is witnessing increased adoption of multi-channel and modular pumps. These systems enable simultaneous delivery of multiple medications or fluids to a single patient. It enhances treatment efficiency and saves time for caregivers. Modular designs offer scalability, making them suitable for ICUs and operating rooms. Demand grows for pumps that integrate with centralized control stations. Manufacturers innovate to provide systems that reduce space requirements and simplify maintenance.

Market Challenges Analysis

High Equipment Costs and Maintenance Burden

Intravenous Infusion Pump Market faces challenges due to high capital investment required for advanced systems. Hospitals and clinics must allocate significant budgets for procurement, installation, and training. It becomes difficult for small healthcare facilities and those in low-income regions to adopt modern devices. Ongoing maintenance, calibration, and software updates add to operational expenses. Budget constraints often delay replacement of outdated equipment, limiting access to advanced safety features. High total cost of ownership can slow adoption despite proven clinical benefits.

Device Errors, Recalls, and Regulatory Compliance Issues

Intravenous Infusion Pump Market is impacted by device recalls and reports of software or mechanical malfunctions. Infusion errors can lead to patient safety concerns, legal liabilities, and reputational risks for manufacturers. It increases scrutiny from regulatory agencies, which impose strict compliance requirements. Meeting evolving standards for cybersecurity and interoperability poses challenges for developers. Lengthy approval timelines delay product launches and limit market entry for new players. These issues create barriers to rapid adoption of innovative pump technologies worldwide.

Market Opportunities

Growing Demand for Home Healthcare and Ambulatory Infusion Solutions

Intravenous Infusion Pump Market holds strong opportunities with rising preference for home-based care and outpatient treatments. Patients with chronic illnesses such as cancer and diabetes seek portable devices that enable continuous therapy outside hospital settings. It supports healthcare cost reduction by minimizing hospital stays and freeing up clinical resources. Ambulatory pumps with easy-to-use interfaces and wireless monitoring improve patient independence and treatment adherence. Manufacturers can expand offerings by developing compact, wearable, and battery-efficient systems. This trend opens new revenue streams and supports wider adoption across developed and emerging markets.

Technological Innovation and Integration with Digital Health Platforms

Intravenous Infusion Pump Market benefits from opportunities linked to digital health and smart hospital initiatives. Integration with IoT, cloud-based monitoring, and AI-driven analytics enhances precision and predictive maintenance. It allows caregivers to track infusion progress remotely and respond quickly to alerts. Development of pumps with interoperability features supports seamless connection with electronic health records. Innovations in modular and multi-channel pumps create solutions for complex treatment protocols. Continuous investment in R&D strengthens product portfolios and positions companies to capture demand for next-generation infusion technologies.

Market Segmentation Analysis:

By Product

Intravenous Infusion Pump Market is segmented into volumetric pumps, syringe pumps, elastomeric pumps, and ambulatory pumps. Volumetric pumps dominate due to their precision in delivering large volumes of fluids, nutrients, and medications in critical care and surgical settings. Syringe pumps find strong demand in pediatrics, neonatal intensive care, and anesthesia where small-volume accuracy is crucial. Elastomeric pumps are gaining adoption for chemotherapy and pain management in outpatient settings due to their disposable design and portability. Ambulatory pumps are preferred for home healthcare and long-term therapies, offering mobility and ease of use. It benefits from continuous innovation in compact and wireless pump designs that improve patient comfort and workflow efficiency.

- For instance, Terumo’s TE-171/TE-172 Terufusion pumps allow a flow rate range of 0.1 mL/hr to 1,200 mL/hr. The battery’s continuous operating time is approximately three hours, under specific test conditions including a new battery, a 25 mL/hr delivery rate, and a temperature of 25°C.

By Application

Intravenous Infusion Pump Market by application includes chemotherapy, pain management, parenteral nutrition, and others. Chemotherapy accounts for a significant share due to the growing number of cancer cases worldwide and the need for precise drug delivery over long infusion periods. Pain management therapies use infusion pumps to administer opioids and anesthetics in controlled doses, reducing risks of overdose. Parenteral nutrition applications grow with rising cases of gastrointestinal disorders and malnutrition requiring continuous feeding. Other applications include hydration therapy, antibiotic administration, and blood transfusions in both acute and chronic care. It gains momentum from increasing hospital admissions and preference for accurate, programmable delivery systems to ensure patient safety.

- For instance, the Baxter Colleague Volumetric Infusion Pump supports primary infusion rates from 0.1 to 99.9 mL/hr (in 0.1 mL/hr increments) and has a rechargeable battery that operates for about 3 hours when infusing at 100 mL/hr on all three channels.

By End-use

Intravenous Infusion Pump Market serves hospitals, ambulatory surgical centers, and home healthcare settings. Hospitals hold the largest share due to high patient volumes, critical care units, and advanced treatment protocols requiring continuous infusion systems. Ambulatory surgical centers adopt compact and multi-channel pumps to support outpatient surgeries and recovery procedures. Home healthcare is the fastest-growing end-use segment, driven by the shift toward remote care and rising chronic disease prevalence. It is supported by technological advancements in portable pumps and telehealth integration for remote monitoring. Growing investment in healthcare infrastructure and training programs ensures reliable adoption across all end-use segments.

Segments:

Based on Product

- Volumetric

- Insulin

- Syringe

- Others

Based on Application

- Oncology

- Pediatrics/Neonatology

- Analgesia/Pain Management

- Others

Based on End-use

- Hospital & Clinics

- Homecare

- Ambulatory Surgical Center

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 39% market share in the Intravenous Infusion Pump Market, making it the leading regional market. The United States drives growth with high prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders that require continuous infusion therapy. Canada contributes with strong investment in hospital infrastructure and adoption of advanced infusion systems. It benefits from favorable reimbursement policies, government support for healthcare modernization, and early adoption of smart, connected pumps. The region also witnesses strong demand for portable and wireless pumps for home healthcare. Presence of major manufacturers and continuous product launches further strengthen North America’s dominance in this market.

Europe

Europe accounts for 28% market share and demonstrates steady growth supported by well-established healthcare systems. Germany, France, and the U.K. lead the adoption of infusion pumps due to high surgical volumes and strong cancer care programs. It benefits from European Union initiatives to digitize healthcare systems and improve patient safety. Demand rises for infusion systems with advanced alarms and electronic health record (EHR) integration. The region also focuses on reducing hospital errors through adoption of smart and programmable pumps. Increasing geriatric population and rising prevalence of chronic diseases create sustained demand for infusion therapy.

Asia-Pacific

Asia-Pacific captures 25% market share and is the fastest-growing region in the Intravenous Infusion Pump Market. China and India lead growth with rising healthcare expenditure, expanding hospital networks, and growing prevalence of lifestyle-related diseases. Japan, South Korea, and Australia adopt technologically advanced infusion systems to support critical care and oncology treatments. It gains momentum from government initiatives aimed at improving access to modern healthcare devices in rural and semi-urban areas. Local manufacturing and foreign investments drive availability of cost-effective pumps for hospitals and clinics. Rising demand for home-based care and portable infusion devices strengthens regional market expansion.

Latin America

Latin America represents 5% market share with Brazil and Mexico being the key contributors. The region benefits from government programs aimed at improving access to chronic disease treatment and infusion therapies. It sees increasing adoption of volumetric and syringe pumps in public hospitals and private clinics. Growth in medical tourism and expansion of pharmaceutical manufacturing further support infusion pump demand. Challenges include cost constraints and limited access in rural areas, but ongoing investment in healthcare infrastructure addresses these gaps. Partnerships between global manufacturers and local distributors expand market reach.

Middle East & Africa

Middle East & Africa hold 3% market share, driven by demand from Gulf Cooperation Council (GCC) countries and South Africa. Saudi Arabia and UAE invest heavily in modernizing hospitals and adopting advanced medical equipment. It gains demand from rising cases of cancer, diabetes, and critical care requirements in urban centers. Africa shows gradual growth with international aid programs improving availability of essential infusion devices. Expansion of private healthcare facilities and training initiatives for medical staff support adoption. The region remains a key opportunity for manufacturers targeting untapped markets with cost-effective solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fresenius Kabi

- Terumo Corporation

- Shenzhen ENMIND Technology Co., Ltd.

- Tandem Diabetes Care, Inc.

- Medtronic

- ICU Medical

- Micrel Medical Devices SA

- Hoffmann-La Roche Ltd.

- Moog Inc.

- Boston Scientific Corporation

Competitive Analysis

Competitive landscape of the Intravenous Infusion Pump Market features leading players such as Medtronic, Fresenius Kabi, Terumo Corporation, ICU Medical, Boston Scientific Corporation, Moog Inc., Tandem Diabetes Care, Micrel Medical Devices SA, F. Hoffmann-La Roche Ltd., and Shenzhen ENMIND Technology Co., Ltd. competing through technological innovation, global reach, and product reliability. These companies focus on developing advanced infusion systems with smart features, wireless connectivity, and real-time monitoring to enhance patient safety and clinical efficiency. They invest heavily in R&D to create portable and wearable pumps for home-based care and chronic disease management. Strategic partnerships with hospitals, clinics, and healthcare networks strengthen their market presence and enable large-scale product deployment. Manufacturers emphasize integration with electronic health records and automation to support data-driven decision-making and reduce medication errors. Continuous product upgrades, after-sales support, and adherence to global safety standards help these players maintain strong competitiveness and expand market penetration worldwide.

Recent Developments

- In August 2025, Terumo India launched Terufusion Advanced Infusion Systems in India. The system includes a smart syringe pump, a volumetric smart infusion pump, and pump monitoring software.

- In April 2025, ICU Medical received FDA 510(k) clearance for two precision IV pumps, Plum Solo (single-channel) and an updated Plum Duo (dual-channel), plus its LifeShield infusion safety software. These join the IV Performance Platform with ±3% accuracy under real-world conditions.

- In February 2025, ICU Medical’s Plum 360 smart infusion system won the Best in KLAS honor (EMR-Integrated smart pump category) for the eighth consecutive year.

- In January 2025, Fresenius Kabi USA released a software update for its Ivenix Infusion System: Large Volume Pump (LVP) version 5.10 and Infusion Management System (IMS) version 5.2.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and connected infusion pumps will increase to improve medication safety.

- Adoption of portable and wearable pumps will rise for home-based and ambulatory care.

- Integration with electronic health records will become a standard feature across hospitals.

- Use of AI and predictive analytics will enhance real-time monitoring and dosage accuracy.

- Growth in chronic disease cases will drive consistent need for long-term infusion therapy.

- Manufacturers will focus on developing low-maintenance and user-friendly pump designs.

- Emerging markets will see rapid adoption with improved healthcare infrastructure investments.

- Wireless connectivity and remote control capabilities will support telehealth applications.

- Regulatory focus on reducing medication errors will encourage advanced pump adoption.

- Continuous R&D will lead to smaller, more energy-efficient, and precise infusion systems.

Market Trends

Market Trends