Market Overview

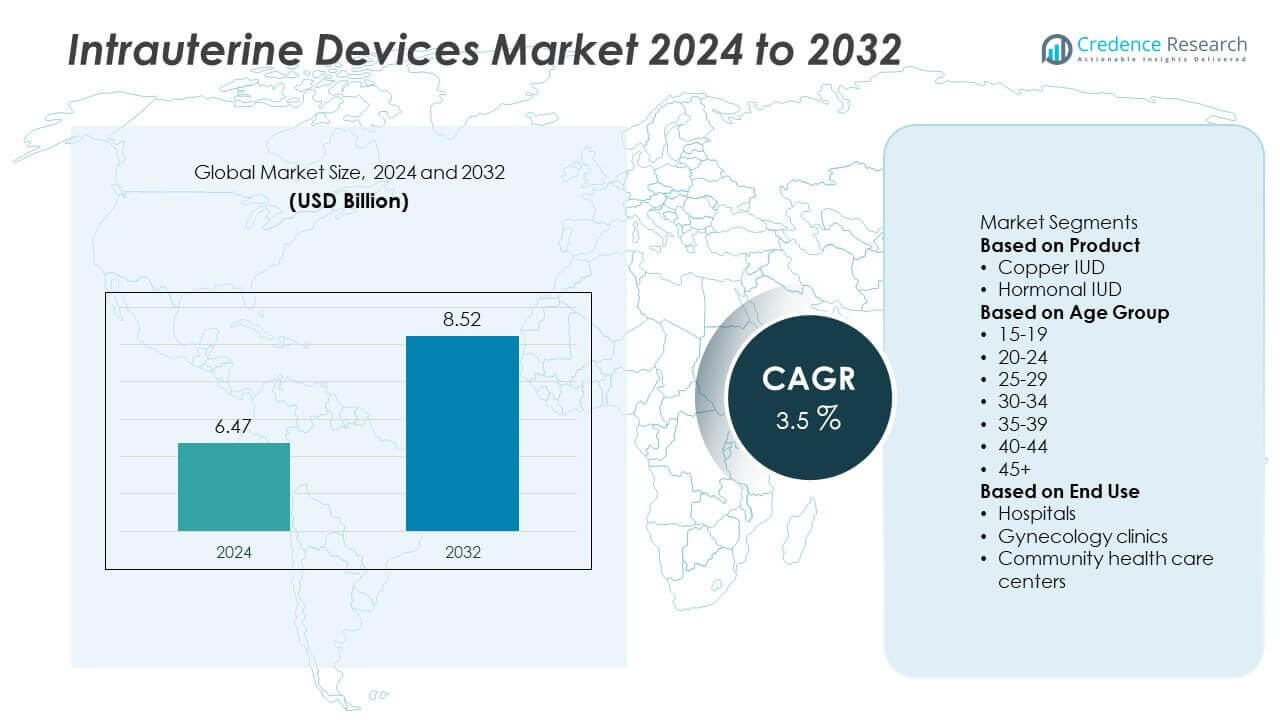

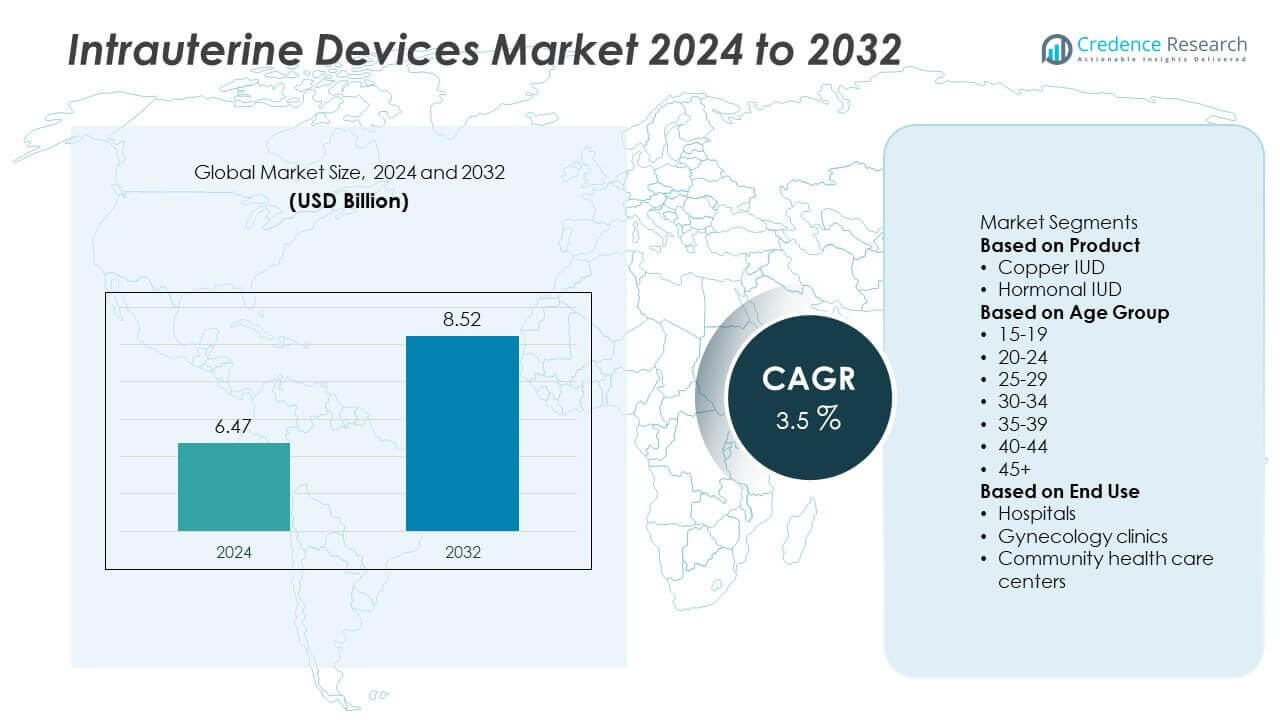

The global Intrauterine Devices Market was valued at USD 6.47 billion in 2024 and is projected to reach USD 8.52 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intrauterine Devices Market Size 2024 |

USD 6.47 Billion |

| Intrauterine Devices Market, CAGR |

3.5% |

| Intrauterine Devices Market Size 2032 |

USD 8.52 Billion |

Intrauterine Devices Market grows with rising demand for long-acting reversible contraceptives and strong focus on reducing unintended pregnancies worldwide. Government programs and public health campaigns promote IUDs as a reliable and cost-effective family planning method. Geographically, the Intrauterine Devices Market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced healthcare infrastructure, insurance coverage, and widespread awareness of long-acting reversible contraception. Europe follows with strong public health programs and government reimbursement policies encouraging adoption. Asia-Pacific is experiencing rapid growth due to government-supported family planning initiatives and rising acceptance of modern contraceptives in countries like China and India. Latin America and Middle East & Africa see gradual adoption supported by NGO-led campaigns and improving gynecological services. Key players driving this market include CooperSurgical, Bayer, Medicines360, and HLL Lifecare Limited, focusing on innovative hormonal and copper IUD designs, extended lifespan products, and improved insertion systems. These companies invest in education programs and partnerships to expand reach, improve patient acceptance, and strengthen their presence in emerging and underserved regions worldwide.

Market Insights

- Intrauterine Devices Market was valued at USD 6.47 billion in 2024 and is projected to reach USD 8.52 billion by 2032, growing at a CAGR of 3.5%.

- Rising demand for long-acting reversible contraception and government-backed family planning programs drive global market growth.

- Market trends highlight increasing adoption of hormonal IUDs, development of smaller and more comfortable devices, and digital education initiatives improving awareness.

- Competitive landscape features CooperSurgical, Bayer, Medicines360, HLL Lifecare Limited, and GIMA focusing on innovative designs, extended lifespan products, and wider geographic reach.

- High upfront cost of devices, limited trained professionals in rural areas, and cultural misconceptions about IUDs act as restraints.

- North America leads growth with strong healthcare infrastructure and reimbursement coverage, while Europe sees steady adoption through robust public health policies.

- Asia-Pacific emerges as the fastest-growing region, supported by government initiatives, expanding healthcare access, and rising acceptance among younger women seeking reliable contraception.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Long-Acting Reversible Contraceptives

Intrauterine Devices Market grows with increasing preference for long-acting reversible contraceptives among women. IUDs provide effective, low-maintenance birth control with high success rates. Growing awareness of family planning and reproductive health drives adoption in both developed and developing regions. It offers extended protection for several years, reducing the need for frequent replacements. Healthcare providers recommend IUDs as a reliable option for women seeking convenience and long-term coverage. Rising government campaigns promoting family planning further boost usage rates.

- For instance, Bayer’s Mirena 52-mg LNG-IUS was shown to maintain contraceptive efficacy over 8 years, with a 3-year cumulative failure rate of 0.68 pregnancies per 100 women from years 6-8.

Supportive Government Initiatives and Public Health Programs

Intrauterine Devices Market benefits from strong government and NGO-backed programs focused on population control and maternal health. Public health agencies include IUDs in subsidized or free contraceptive distribution schemes. It encourages adoption in low- and middle-income countries where access to contraception is limited. International organizations such as WHO and UNFPA promote awareness of IUD benefits. These initiatives expand availability through clinics, hospitals, and community programs. Growing funding for reproductive health strengthens global adoption trends.

- For instance, CooperSurgical’s Paragard copper IUD is indicated for contraception for up to 10 years after insertion; CooperSurgical in September 2024 launched a single-hand inserter to simplify the placement.

Technological Advancements and Product Innovations

Intrauterine Devices Market experiences growth from new designs and materials that improve comfort and reduce side effects. Hormonal IUDs gain popularity due to their ability to regulate menstrual cycles and lower bleeding risk. Non-hormonal copper IUDs remain preferred for women avoiding hormonal options. It benefits from miniaturized designs that are suitable for younger women and those with no prior childbirth. Manufacturers invest in user-friendly inserters and devices with longer life spans. These advancements drive higher acceptance and patient satisfaction.

Growing Focus on Preventing Unintended Pregnancies

Intrauterine Devices Market expands with rising need to reduce unintended pregnancies and abortion rates worldwide. Healthcare systems promote IUDs for their cost-effectiveness and ability to provide immediate return to fertility after removal. It supports national strategies to reduce maternal morbidity and healthcare costs linked to unplanned pregnancies. Educational initiatives by healthcare professionals raise awareness about IUD safety and efficacy. Urbanization and rising participation of women in the workforce fuel demand for reliable contraception. These factors collectively create a favorable environment for market growth.

Market Trends

Market Trends

Growing Adoption of Hormonal IUDs for Dual Benefits

Intrauterine Devices Market shows a clear trend toward hormonal IUDs offering both contraception and menstrual regulation. Women prefer these devices for their ability to reduce heavy bleeding and menstrual pain. It supports better quality of life and improves compliance with long-term use. Healthcare providers increasingly recommend hormonal options for women with dysmenorrhea or irregular cycles. Rising awareness of these dual benefits expands adoption across both developed and emerging markets. Manufacturers invest in extending product lifespan to offer protection for up to 8 years.

- For instance, AbbVie’s LILETTA® IUS had an overall expulsion rate of 4.1 vaginal expulsions per 100 women over 8 years, with 2.4 per 100 women among nulliparous participants and 6.4 per 100 women among parous participants.

Shift Toward Smaller and More Comfortable Devices

Intrauterine Devices Market is witnessing demand for smaller, more comfortable devices suitable for nulliparous women. Mini IUDs make insertion easier and reduce discomfort, encouraging adoption among younger age groups. It broadens the eligible user base and supports wider acceptance of IUDs as a first-choice contraceptive. Clinical studies show improved continuation rates when comfort is prioritized. Manufacturers focus on simplified insertion systems that reduce procedure time for healthcare providers. This trend strengthens patient confidence and encourages repeat usage after device expiry.

- For instance, Medicines360’s LILETTA® 52-mg levonorgestrel IUS was approved in November 2022 by the U.S. FDA for use up to 8 years, based on the ACCESS IUS trial involving 1,751 women.

Expansion of Access Through Public-Private Partnerships

Intrauterine Devices Market benefits from collaborations between governments, NGOs, and manufacturers to improve availability. Public-private partnerships work to provide affordable IUDs and training for healthcare workers. It ensures quality insertion services even in rural and underserved areas. Bulk procurement programs help reduce costs and expand reach through community health centers. Growing focus on universal reproductive health access drives distribution initiatives. These programs strengthen awareness and encourage adoption among low-income populations.

Increased Use of Digital Platforms for Awareness and Education

Intrauterine Devices Market embraces digital health campaigns to educate women about safety, benefits, and side effects. Social media platforms and telehealth consultations are used to address misconceptions about IUDs. It improves decision-making and reduces hesitation to choose long-term contraception. Healthcare providers use digital tools to guide patients through insertion and aftercare. Rising popularity of mobile health apps helps track menstrual cycles and supports contraceptive counseling. This trend fosters informed choices and promotes wider adoption across various demographics.

Market Challenges Analysis

High Upfront Costs and Limited Access in Low-Income Regions

Intrauterine Devices Market faces challenges due to high initial costs of IUDs and insertion procedures. Many women in low- and middle-income countries cannot afford these services without subsidies. It limits adoption despite long-term cost-effectiveness compared to other contraceptives. Lack of trained healthcare providers in rural areas reduces availability and leads to uneven adoption rates. Cultural and social barriers further discourage women from seeking IUDs as a contraceptive option. Limited government funding in some regions slows expansion of public distribution programs.

Concerns About Side Effects and Misconceptions

Intrauterine Devices Market is impacted by patient concerns about pain during insertion, irregular bleeding, and risk of expulsion. Fear of infertility and misconceptions about hormonal effects discourage potential users. It creates hesitation even when IUDs are offered free or at low cost. Inadequate counseling and lack of follow-up care amplify these concerns. Negative experiences shared by peers can influence community perceptions. Addressing these barriers requires education campaigns and improved post-insertion support to boost confidence and long-term adoption.

Market Opportunities

Rising Government Initiatives and Family Planning Programs

Intrauterine Devices Market holds strong opportunities with increasing government focus on population control and reproductive health. Public health campaigns promote IUDs as a cost-effective and reliable contraceptive method. It benefits from large-scale procurement programs and free distribution through community health centers. NGOs and international organizations work to raise awareness and train healthcare providers for safe insertions. Growing investments in family planning initiatives expand access in rural and underserved areas. These efforts create a favorable environment for wider adoption and long-term market growth.

Technological Innovations and Growing Acceptance Among Younger Women

Intrauterine Devices Market gains opportunities from innovations that improve comfort and usability. Smaller, flexible, and hormone-based devices attract younger, first-time users. It supports early adoption and encourages repeat use after device expiry. Manufacturers focus on developing long-lasting devices with minimal side effects, driving patient satisfaction. Rising participation of women in education and workforce fuels demand for convenient, low-maintenance contraception. Partnerships between manufacturers and healthcare providers enhance accessibility and counseling services, further boosting adoption rates.

Market Segmentation Analysis:

By Product

Intrauterine Devices Market is segmented into hormonal IUDs and copper IUDs. Hormonal IUDs hold a significant share due to their dual benefit of providing contraception and regulating menstrual cycles. They reduce heavy bleeding and menstrual pain, making them attractive for women seeking both contraceptive and therapeutic effects. Copper IUDs remain widely used among women preferring non-hormonal options. It offers long-term contraception without affecting hormonal balance and is cost-effective for public health programs. Manufacturers focus on improving comfort, insertion techniques, and lifespan of both device types. Rising awareness of product benefits drives demand across diverse demographics.

- For instance, Medicines360’s LILETTA IUS was studied in 1,751 participants in the ACCESS IUS trial; its cumulative pregnancy rate for the primary efficacy population over 8 years was 1.32% based on life-table analysis.

By Age Group

Intrauterine Devices Market by age group includes women under 20 years, 20–30 years, and above 30 years. Women in the 20–30 age group dominate usage, driven by higher awareness and preference for long-acting reversible contraception during reproductive years. Rising acceptance among adolescents under 20 is supported by availability of smaller, flexible devices designed for first-time users. It helps address concerns about discomfort and insertion difficulties. Women above 30 adopt IUDs for family planning and birth spacing, benefiting from devices with extended lifespan. Educational programs targeting different age groups help improve adoption rates. Growing healthcare provider recommendations also support consistent demand.

- For instance, a 2015 study of a cohort of 1,177 adolescents and young women (aged 13–24) at the Children’s Hospital Colorado found the overall first-attempt placement success rate for all IUDs was 96.2%.

By End Use

Intrauterine Devices Market serves hospitals, clinics, and community health centers. Hospitals account for a large share due to availability of skilled gynecologists and access to advanced insertion tools. Clinics play a key role in offering cost-effective and convenient insertion services for urban and semi-urban populations. It sees increasing adoption in community health centers through public health campaigns and subsidized programs. Training initiatives for healthcare workers improve access and service quality across rural regions. Expanding partnerships between governments and NGOs enhance availability through primary care settings. This diversified distribution network ensures broader patient reach and sustained market growth.

Segments:

Based on Product

Based on Age Group

- 15-19

- 20-24

- 25-29

- 30-34

- 35-39

- 40-44

- 45+

Based on End Use

- Hospitals

- Gynecology clinics

- Community health care centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 34% market share in the Intrauterine Devices Market, supported by strong awareness of long-acting reversible contraception and advanced healthcare systems. The United States leads with robust family planning programs, insurance coverage, and high availability of hormonal and copper IUDs. Canada contributes with public health campaigns and subsidies that encourage wider adoption. It benefits from growing focus on reducing unintended pregnancies and improving women’s reproductive health outcomes. Rising preference for hormonal IUDs among women seeking menstrual regulation supports further growth. Presence of leading manufacturers and strong distribution networks strengthens product accessibility across the region.

Europe

Europe holds 28% market share driven by comprehensive family planning services and well-established sexual health programs. Countries such as Germany, France, and the U.K. lead in adoption rates due to government support and widespread availability of gynecological services. It benefits from increasing preference for smaller, more comfortable devices and a shift toward hormonal IUDs for dual benefits. Public reimbursement schemes make IUDs affordable for a broad demographic, improving adoption across income groups. Growing campaigns promoting reproductive health education among young women further boost demand. Ongoing product innovation by regional manufacturers strengthens market competitiveness and supports steady growth.

Asia-Pacific

Asia-Pacific captures 26% market share and represents one of the fastest-growing regions due to its large population and rising need for family planning solutions. China and India dominate adoption rates through extensive government-supported contraceptive programs and subsidized distribution networks. It benefits from rising awareness about long-acting reversible contraception and growing participation of women in education and the workforce. Japan, South Korea, and Australia also contribute with advanced healthcare systems and growing demand for hormonal devices. Increasing private healthcare spending and availability of smaller, flexible IUDs expand reach to younger women. Collaborations between public health authorities and international organizations further improve accessibility across rural areas.

Latin America

Latin America represents 7% market share, led by Brazil and Mexico where family planning initiatives and reproductive health programs promote IUD use. It gains traction from government-backed campaigns encouraging reduction of unplanned pregnancies. Argentina, Chile, and Colombia show rising demand through improved access to gynecological care. Growing urbanization and rising acceptance of modern contraceptives drive steady market growth. Partnerships between NGOs and local clinics improve insertion services in underserved regions. Manufacturers focus on offering affordable copper IUDs to cater to price-sensitive populations.

Middle East & Africa

Middle East & Africa hold 5% market share with demand concentrated in Gulf countries and parts of North Africa. Saudi Arabia and UAE lead adoption through government programs that promote family planning and maternal health. South Africa and Egypt contribute with rising healthcare investments and focus on reducing maternal mortality rates linked to unplanned pregnancies. It faces cultural and social barriers but benefits from growing education initiatives and NGO involvement. International aid programs expand distribution networks and make IUDs more accessible in remote areas. These efforts gradually improve adoption rates and support future market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Intrauterine Devices Market features leading players such as CooperSurgical, Bayer, Medicines360, HLL Lifecare Limited, GIMA, AbbVie, Meril, eurogine, DKT, and GYNO CARE competing on innovation, affordability, and global outreach. These companies focus on developing advanced hormonal and copper IUDs with improved safety, comfort, and extended lifespan to meet rising demand for long-acting reversible contraception. They invest in R&D to create smaller, flexible, and easy-to-insert devices, catering to younger women and first-time users. Strategic collaborations with governments, NGOs, and healthcare providers expand product availability in both developed and emerging regions. Companies strengthen their market position through bulk procurement agreements, training programs for healthcare workers, and awareness campaigns to improve acceptance. Efforts to reduce side effects and offer devices with longer protection drive patient satisfaction and adoption rates. Intense competition fuels continuous product innovation and supports global growth of reliable contraceptive solutions.

Recent Developments

- In February 2025, Sebela Pharmaceuticals (not on your list, but relevant) got FDA approval for MIUDELLA®, a hormone-free copper intrauterine system effective for three years with a flexible nitinol frame.

- In September 2024, CooperSurgical launched a single-hand inserter for its Paragard® copper IUD.

- In August 2024, CooperSurgical launched a single-hand inserter for its Paragard copper IUD.

- In July 2024, Australia’s Therapeutic Goods Administration (TGA) approved extending the usage duration of Bayer’s Mirena IUD from five years to eight years based on Bayer’s Phase 3 Mirena Extension Trial.

Report Coverage

The research report offers an in-depth analysis based on Product, Age Group, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for long-acting reversible contraception will continue to rise globally.

- Hormonal IUDs with extended lifespan will gain stronger adoption among women.

- Development of smaller and more comfortable devices will expand use among younger users.

- Public-private partnerships will enhance access to IUDs in rural and underserved areas.

- Digital platforms and telehealth programs will improve awareness and counseling for patients.

- Government funding and population control initiatives will drive wider adoption rates.

- Manufacturers will focus on user-friendly inserters and low side-effect designs.

- Emerging markets will contribute significantly to future market expansion.

- Training programs for healthcare professionals will improve insertion quality and patient satisfaction.

- Rising acceptance of IUDs as a first-line contraceptive choice will strengthen long-term market growth.

Market Trends

Market Trends