Market Overview

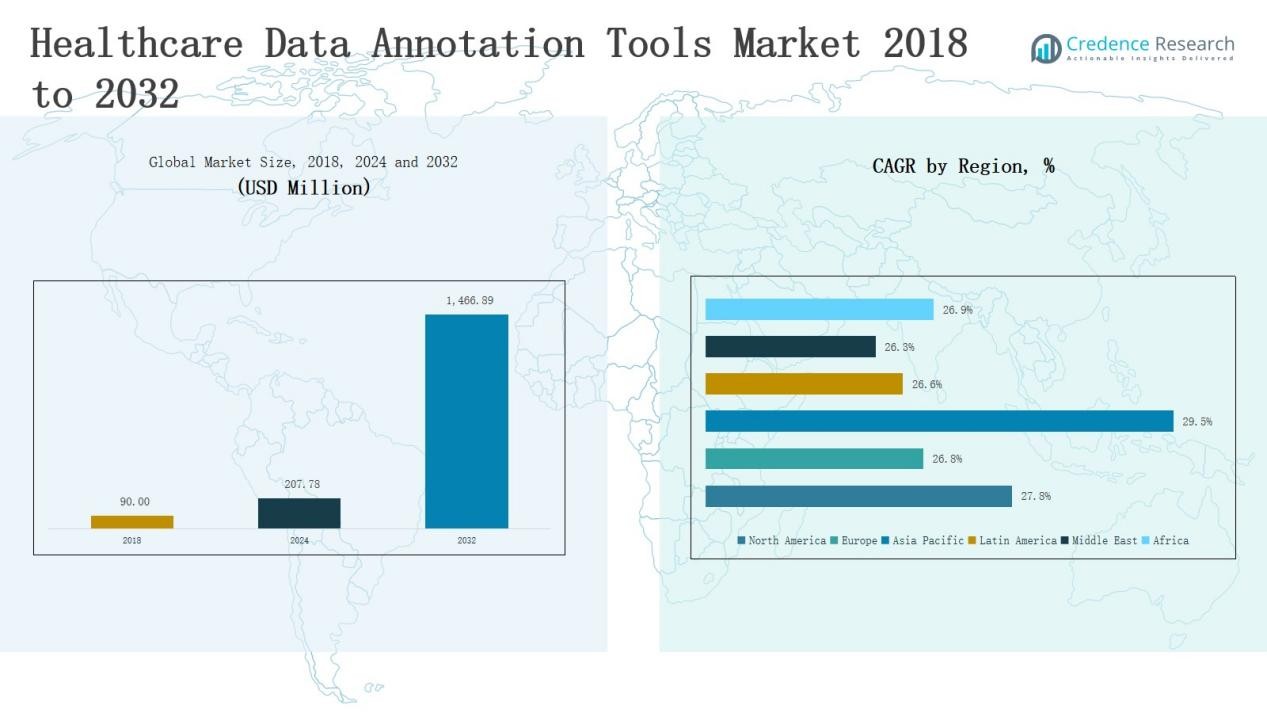

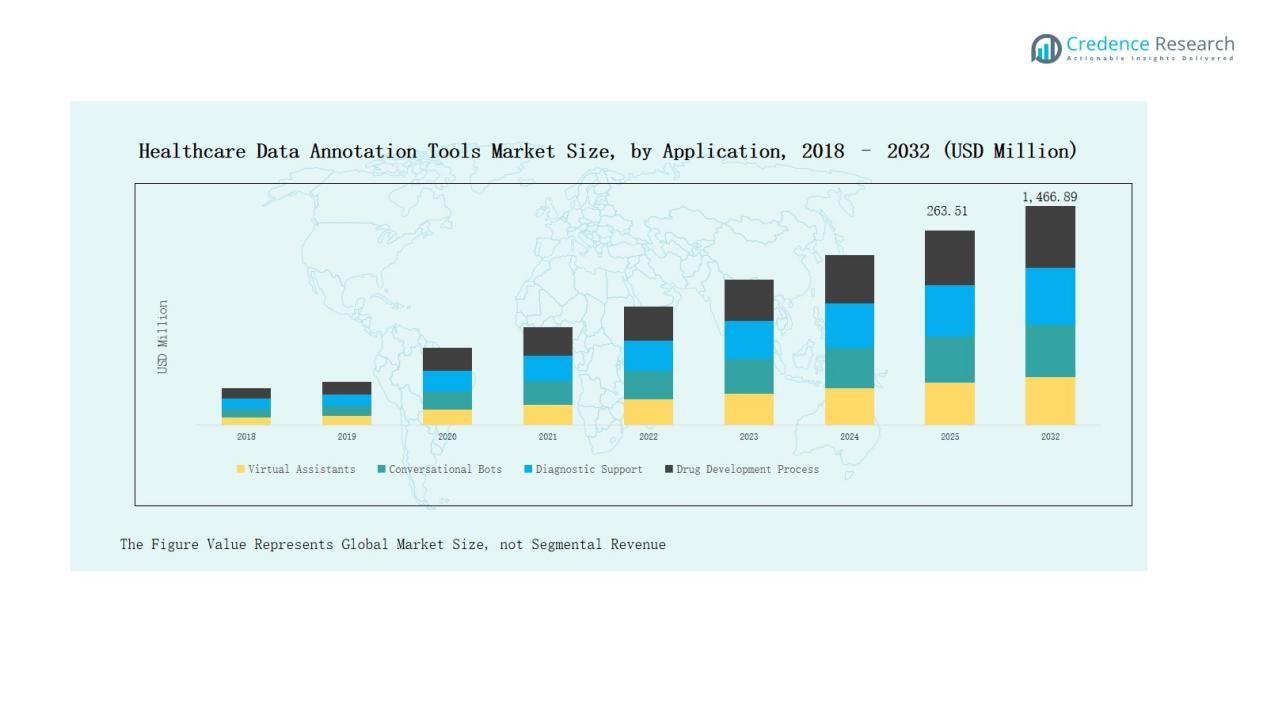

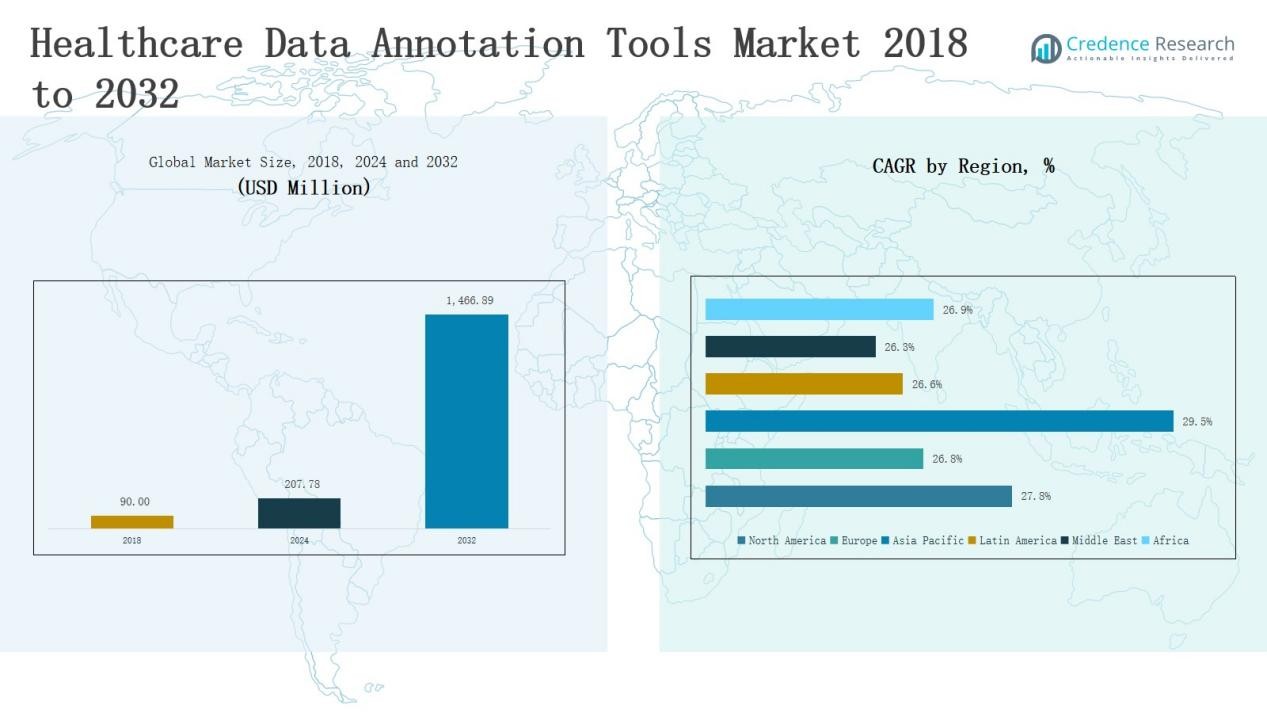

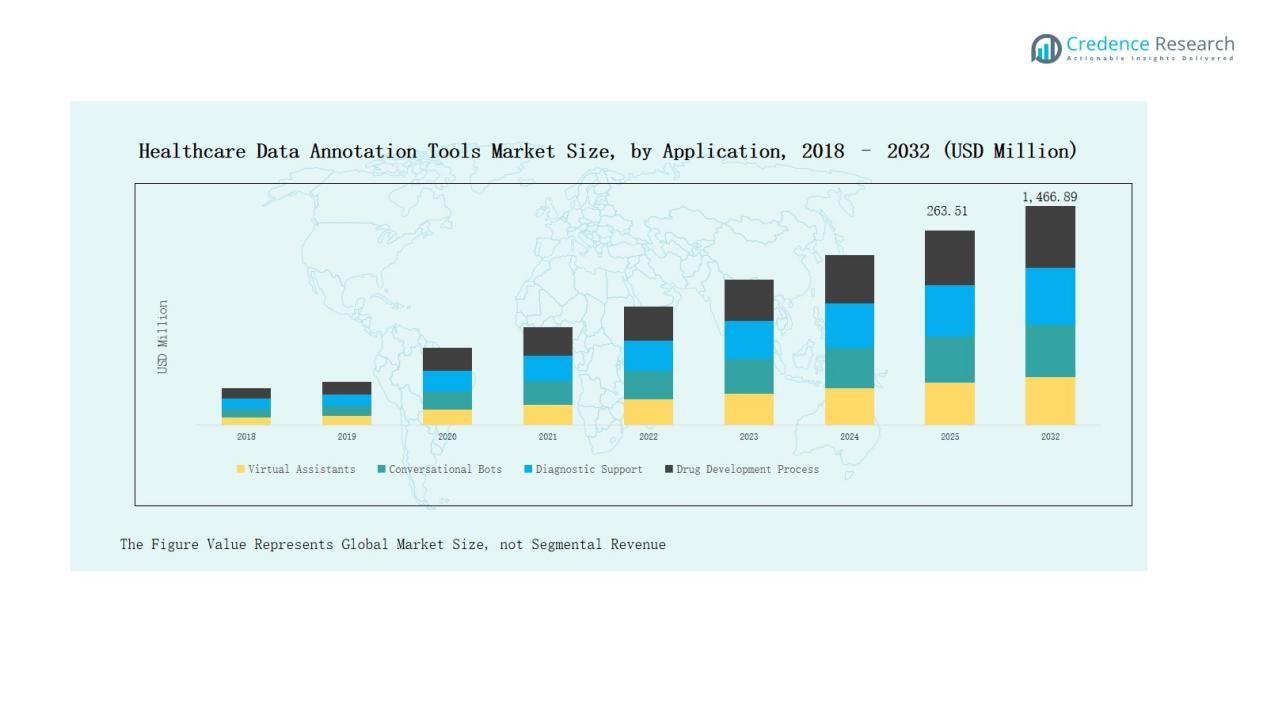

Healthcare Data Annotation Tools Market size was valued at USD 90.00 million in 2018 to USD 207.78 million in 2024 and is anticipated to reach USD 1,466.89 million by 2032, at a CAGR of 27.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Data Annotation Tools Market Size 2024 |

USD 207.78 Million |

| Healthcare Data Annotation Tools Market, CAGR |

27.80% |

| Healthcare Data Annotation Tools Market Size 2032 |

USD 1,466.89 Million |

The Healthcare Data Annotation Tools Market is highly competitive, with top players including Infosys Limited, Shaip, Innodata, Ango AI, Capestart, Lynxcare, iMerit, Anolytics, V7, and SuperAnnotate LLC. These companies focus on expanding portfolios across text, image, video, and audio annotation, while investing in AI-driven platforms, semi-supervised methods, and automated solutions to enhance accuracy and efficiency. Strategic collaborations with hospitals, diagnostic centers, and pharmaceutical companies remain central to their growth strategies. North America emerged as the leading region in 2024, holding 41% of the global market share, supported by advanced healthcare infrastructure, strong AI adoption, and extensive medical imaging usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare Data Annotation Tools Market grew from USD 90 million in 2018 to USD 207.78 million in 2024, and is projected to reach USD 1,466.89 million by 2032.

- Image/Video annotation led the type segment with 60% share in 2023, driven by rising use of annotated X-rays, MRIs, and CT scans for AI-driven diagnostics.

- Manual annotation dominated technology with 52% share in 2023, while semi-supervised methods with 31% share are expanding fastest due to efficiency and cost benefits.

- Hospitals accounted for the largest end-user share at 45% in 2023, followed by diagnostic imaging centers with 28%, highlighting their reliance on annotated scans for accuracy.

- North America led regionally with a 41% share in 2024, supported by advanced healthcare IT infrastructure, strong AI adoption, and heavy investment in medical imaging.

Market Segment Insights

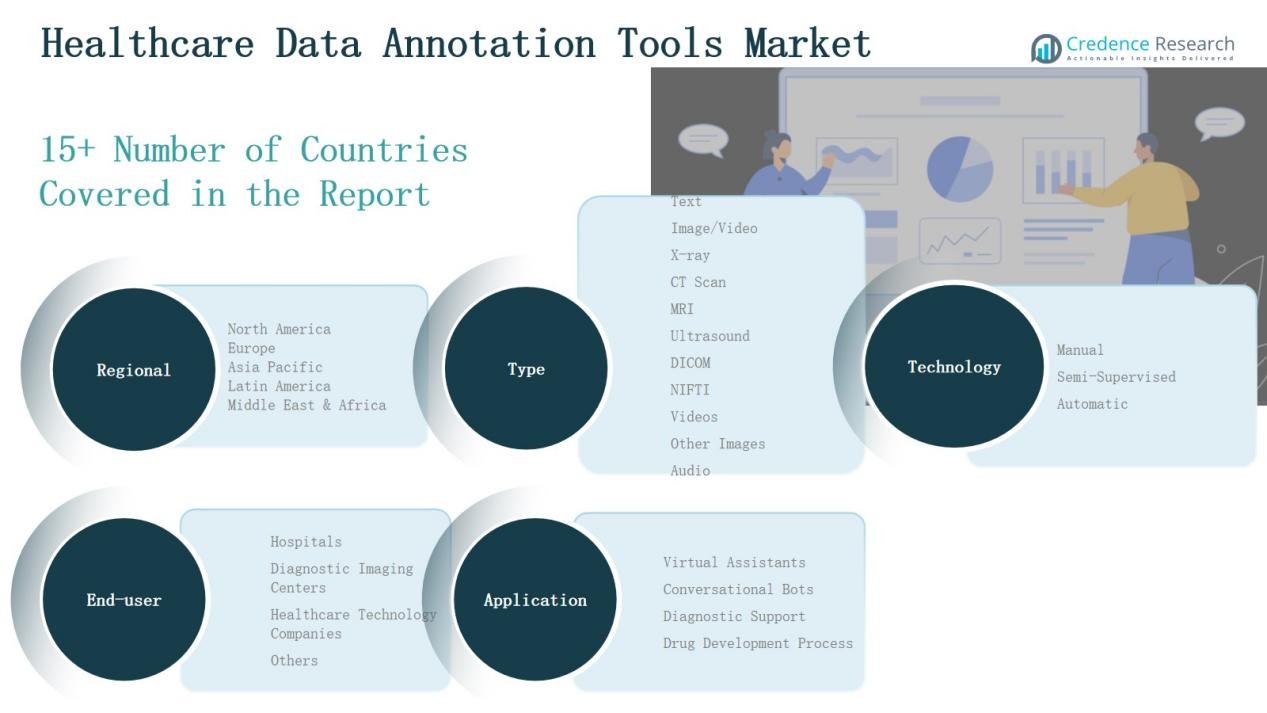

By Type

The Image/Video segment held the largest share of the Healthcare Data Annotation Tools market at 60% in 2023, supported by strong demand for annotated imaging data such as X-ray, MRI, and CT scans for AI-driven diagnostics. Text annotation followed with a 36% share, fueled by structured clinical records and natural language processing needs. Audio annotation accounted for a smaller 4% share, but its importance is rising with telemedicine and voice-based healthcare support.

By Technology

Manual annotation led the market with a 52% share in 2023, as its high accuracy is critical for complex medical images, though it remains labor-intensive. Semi-supervised annotation captured 31% of the market and is the fastest-growing, enabling cost savings and speed by leveraging both labeled and unlabeled data. Automatic annotation tools held a smaller 17% share, but are gaining traction with machine learning advances, especially for repetitive, large-scale data labeling.

- For instance, Scale AI launched its automated medical data labeling platform that integrates machine learning with human validation to accelerate image annotation workflows.

By End-User

Hospitals dominated the market with a 45% share in 2023, benefiting from annotation tools in imaging diagnostics, patient records, and clinical decision support. Diagnostic Imaging Centers followed with a 28% share, driven by reliance on annotated scans for efficiency and accuracy. Healthcare technology companies accounted for 19%, expanding rapidly due to large dataset needs for AI platforms, while research institutions and pharmaceutical firms held a combined 8% share, growing steadily with specialized use cases.

- For instance, Siemens Healthineers integrated AI annotation modules into its Syngo Carbon platform to streamline workflow for hospitals and diagnostic imaging centers.

Key Growth Drivers

Rising Adoption of AI in Healthcare

The growing integration of artificial intelligence across healthcare workflows is a major driver of demand for data annotation tools. AI models used in diagnostic imaging, electronic health records, and predictive analytics rely heavily on accurately annotated data for training. Hospitals and diagnostic centers are increasingly deploying AI-based systems to improve efficiency, detect diseases earlier, and reduce diagnostic errors. This push toward AI-enabled healthcare creates consistent demand for high-quality annotation solutions that can handle diverse modalities such as imaging, text, and audio.

Expansion of Medical Imaging Data

The rapid increase in imaging data generated through X-rays, MRIs, CT scans, and ultrasounds is fueling market growth. Healthcare facilities require annotated image datasets to develop and validate AI algorithms for disease detection and treatment planning. The complexity of medical imaging makes manual annotation vital, yet the need for efficiency drives adoption of semi-supervised and automated solutions. With imaging playing a central role in modern healthcare, annotation tools have become indispensable for ensuring accurate training data for advanced diagnostic support.

- For instance, Quibim, a medical imaging AI company, worked with Microsoft to centralize over 10 million anonymized medical images, to improve its imaging biomarker AI tools.

Growing Focus on Personalized Medicine

Personalized medicine initiatives are creating strong demand for annotated datasets across genomics, clinical trials, and patient records. Accurate annotation allows AI systems to identify patient-specific risk factors and treatment responses. Pharmaceutical companies and research institutions are using annotation tools to structure large volumes of unstructured data from trials and genetic studies. This focus on individualized care enhances the need for reliable annotation solutions that can support complex datasets, ultimately improving outcomes and accelerating the drug development pipeline.

- For instance, in March 2024, the National Human Genome Research Institute emphasized the critical role of annotated genomic and clinical data in precision medicine to guide treatment decisions based on individual patient characteristics.

Key Trends & Opportunities

Shift Toward Semi-Supervised and Automated Annotation

A key trend in the market is the growing shift from purely manual annotation to semi-supervised and automated solutions. These approaches reduce time and costs while still maintaining acceptable accuracy levels. AI-powered annotation platforms are increasingly capable of handling large datasets and supporting advanced medical applications. The move toward automation also creates opportunities for vendors to develop hybrid models that balance speed with reliability, particularly in complex medical imaging, clinical text, and multi-modal data processing environments.

- For instance, Amazon Web Services expanded its SageMaker Ground Truth Plus service with new medical imaging automation features, helping hospitals process thousands of MRI and CT scans with higher efficiency.

Rising Demand from Telehealth and Virtual Assistants

The expansion of telehealth services and AI-powered virtual assistants creates new opportunities for healthcare data annotation tools. Text and audio annotation are critical for training conversational bots that handle patient queries, scheduling, and triage. As telehealth adoption grows, providers require accurate annotation for voice and chat interactions to improve user experience and maintain compliance with medical standards. This trend broadens the market beyond diagnostic imaging, opening opportunities in patient engagement, remote monitoring, and digital health platforms.

- For instance, in June 2025, Encord launched a unified platform to accelerate the development of “Physical AI,” which involved updates related to handling multimodal data, including video, for robotics, autonomous vehicles, and drones.

Key Challenges

High Cost and Time-Intensive Processes

Manual annotation of healthcare data is expensive and labor-intensive, posing a major challenge for widespread adoption. Medical data requires highly trained professionals to ensure accuracy, significantly raising costs and extending project timelines. Even with automation, quality assurance demands additional human oversight. These challenges limit scalability, especially for smaller healthcare organizations and startups, slowing down the deployment of AI systems that rely on large annotated datasets.

Data Privacy and Regulatory Compliance

Healthcare data annotation tools operate in a highly regulated environment where patient data protection is critical. Annotating sensitive medical records and images involves strict adherence to HIPAA, GDPR, and other regional regulations. Ensuring privacy and compliance adds complexity and costs, as vendors must implement robust security frameworks. Any breach or non-compliance could undermine trust and adoption, making regulatory constraints a significant barrier to growth in the healthcare annotation market.

Shortage of Skilled Workforce

The market faces a shortage of skilled professionals who can accurately annotate complex healthcare data. Annotating medical images, genomics datasets, and clinical records requires domain expertise, which is not widely available. This shortage creates bottlenecks in scaling projects and limits the speed of data preparation for AI systems. Training new personnel is time-consuming, and outsourcing often introduces variability in quality, further compounding the challenge of building reliable annotated datasets at scale.

Regional Analysis

North America

North America dominated the Healthcare Data Annotation Tools Market with revenues of USD 39 billion in 2018, reaching USD 90 billion in 2024, and projected to achieve USD 634 billion by 2032, at a CAGR of 27.8%. The region accounted for the largest share at 41% in 2024, driven by strong AI adoption, robust healthcare IT infrastructure, and a high volume of medical imaging data. The U.S. remains the key growth engine, supported by heavy investments in R&D, regulatory compliance, and strategic collaborations between healthcare providers and technology vendors.

Europe

Europe recorded revenues of USD 22 billion in 2018, increasing to USD 48 billion in 2024, and expected to reach USD 321 billion by 2032, with a CAGR of 26.8%. The region represented about 22% of global share in 2024, supported by widespread digitalization of healthcare, strong clinical research activity, and pharmaceutical industry demand for annotated data. Germany, the UK, and France lead the adoption of annotation tools, especially in medical imaging and clinical trials. Favorable regulatory frameworks and government-backed innovation programs continue to support steady growth across Europe.

Asia Pacific

Asia Pacific generated USD 18 billion in 2018, rising to USD 44 billion in 2024, and forecasted to reach USD 343 billion by 2032, the fastest expansion with a CAGR of 29.5%. The region held 20% share in 2024, reflecting rapid growth from large-scale AI deployments, expanding patient bases, and healthcare digitalization. China and India are driving adoption through national digital health strategies, while Japan and South Korea invest heavily in advanced diagnostics. Increasing use of telehealth, personalized medicine, and AI-enabled imaging ensures Asia Pacific remains the most dynamic regional market.

Latin America

Latin America recorded USD 6 billion in 2018, expanding to USD 13 billion in 2024, and projected at USD 83 billion by 2032, with a CAGR of 26.6%. The region contributed 6% of global share in 2024, with Brazil and Mexico leading adoption. Demand is driven by modernization of diagnostic imaging centers and pharmaceutical research activities that require structured datasets. While limited healthcare IT infrastructure presents barriers, rising government and private investments are creating opportunities. Growing partnerships with global healthcare technology companies further enhance adoption of annotation tools across the region.

Middle East

The Middle East generated USD 4 billion in 2018, rising to USD 8 billion in 2024, and is projected to reach USD 52 billion by 2032, at a CAGR of 26.3%. The region maintained a 4% share in 2024, supported by strong digitization efforts in the UAE and Saudi Arabia. Government initiatives focusing on healthcare AI and modern diagnostic imaging are major growth drivers. Private sector investment in hospitals and clinics is further accelerating adoption. Although smaller in scale, the Middle East is steadily building a strong foundation for healthcare annotation solutions.

Africa

Africa registered USD 2 billion in 2018, reaching USD 5 billion in 2024, and projected to grow to USD 34 billion by 2032, with a CAGR of 26.9%. The region accounted for 2% market share in 2024, reflecting its emerging status. South Africa and Egypt lead adoption, supported by increasing use of medical imaging and government-backed digital health programs. Infrastructure limitations continue to challenge growth, but telehealth expansion and international collaborations are creating opportunities. Over the forecast period, Africa is expected to gradually strengthen its role in the global market.

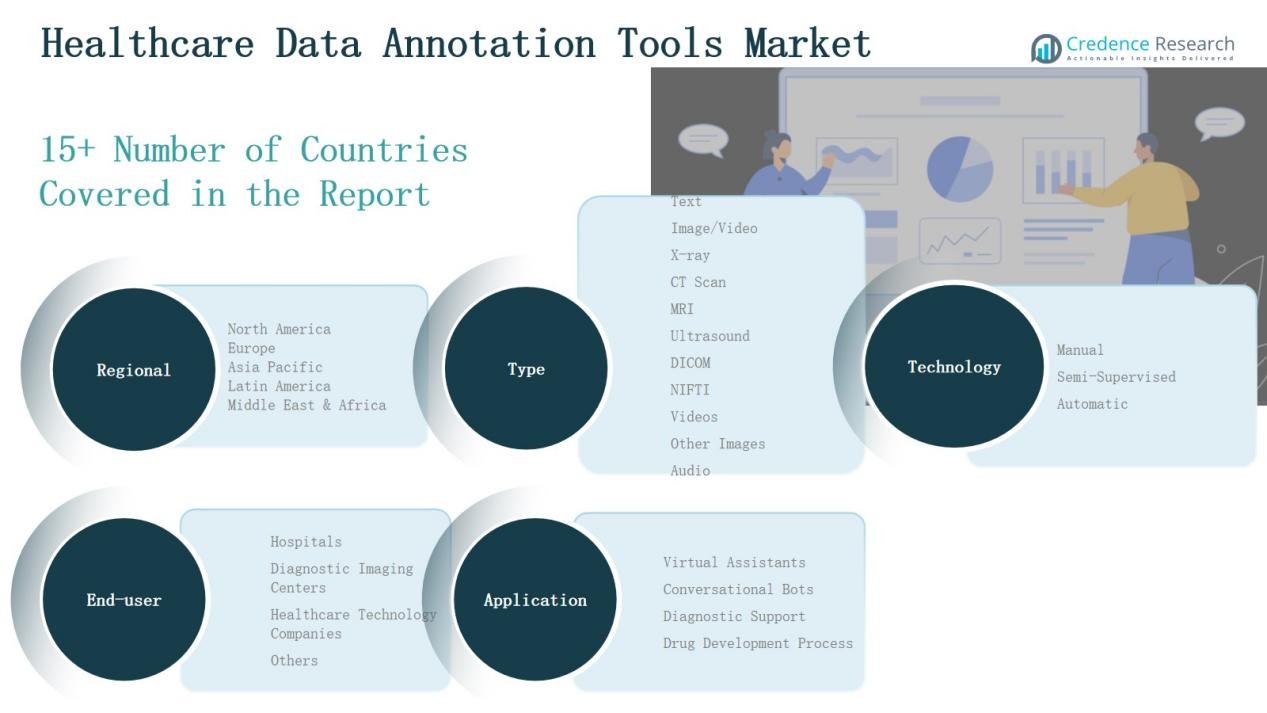

Market Segmentations:

By Type

Text

- Image/Video

- X-ray

- CT Scan

- MRI

- Ultrasound

- DICOM

- NIFTI

- Videos

- Other Images

Audio

By Technology

- Manual

- Semi-Supervised

- Automatic

By End-User

- Hospitals

- Diagnostic Imaging Centers

- Healthcare Technology Companies

- Others

By Application

- Virtual Assistants

- Conversational Bots

- Diagnostic Support

- Drug Development Process

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Healthcare Data Annotation Tools Market is characterized by intense competition among global technology providers and specialized vendors, each striving to deliver scalable, accurate, and cost-efficient solutions. Leading players such as Infosys Limited, Shaip, Innodata, Ango AI, Capestart, Lynxcare, iMerit, Anolytics, V7, and SuperAnnotate LLC focus on expanding their service portfolios across text, image, audio, and video annotation. Many companies emphasize strategic partnerships with hospitals, diagnostic centers, and pharmaceutical firms to strengthen market presence. Innovation is centered on integrating semi-supervised and automated annotation technologies to reduce manual efforts while ensuring accuracy for complex medical imaging. Vendors are also investing in AI-driven platforms to enhance speed and quality while maintaining compliance with stringent data privacy regulations. Smaller niche players compete by offering specialized services, such as medical imaging annotation for MRI, CT, and ultrasound datasets. The competitive environment is further shaped by growing outsourcing trends, collaborations, and M&A activity to capture emerging opportunities in global healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player

Recent Developments

- In September 2023, iMerit launched Ango Hub, a platform giving AI teams access to a broad suite of annotation tools.

- In March 2023, SciBite (an Elsevier company) introduced Workbench, a structured data annotation tool that simplifies data curation to ontology and terminology standards.

- In December 2024, iMerit announced ANCOR, its Annotation Copilot for Radiology, integrated with their Ango Hub product, enhancing image annotation speed and accuracy.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI in healthcare will increase the demand for accurate annotated datasets.

- Medical imaging annotation will remain the largest segment due to diagnostic applications.

- Semi-supervised and automated annotation tools will grow faster than manual methods.

- Hospitals and diagnostic centers will continue to dominate as primary end-users.

- Pharmaceutical companies will increasingly rely on annotation tools for drug development.

- Text and audio annotation will expand with the growth of telehealth and virtual assistants.

- Data privacy and compliance solutions will become key differentiators for vendors.

- Outsourcing of annotation services to specialized providers will rise significantly.

- Emerging regions in Asia Pacific and Africa will present new growth opportunities.

- Strategic collaborations between technology firms and healthcare providers will intensify.