Market Overview:

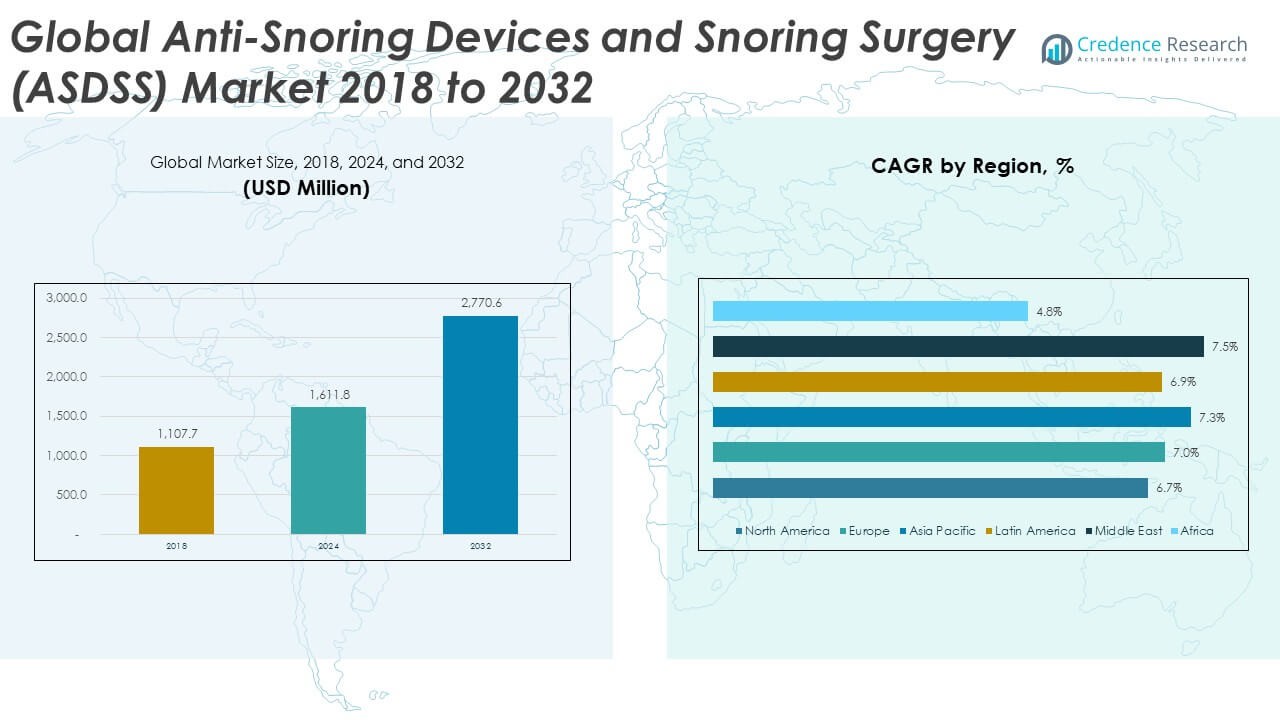

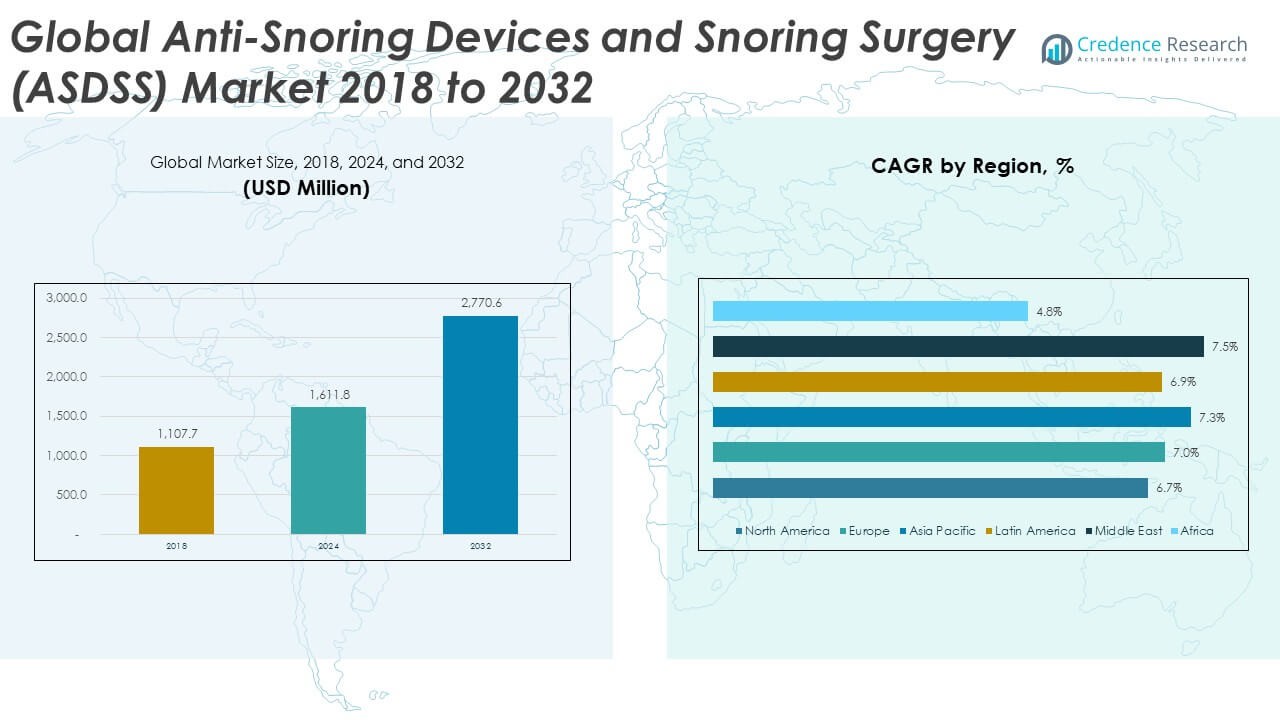

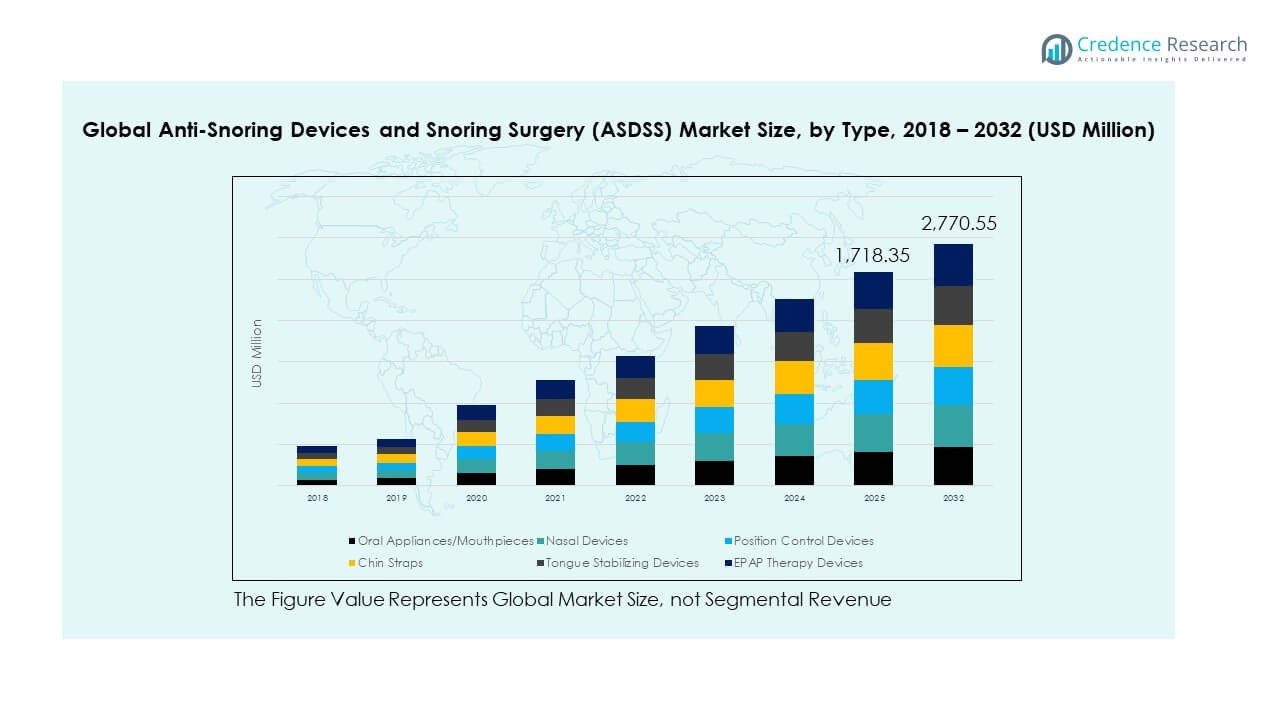

The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 1,107.70 million in 2018 to USD 1,611.80 million in 2024 and is anticipated to reach USD 2,770.60 million by 2032, at a CAGR of 7.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Snoring Devices and Snoring Surgery (ASDSS) Market Size 2024 |

USD 1,611.80 Million |

| Anti-Snoring Devices and Snoring Surgery (ASDSS) Market, CAGR |

7.06% |

| Anti-Snoring Devices and Snoring Surgery (ASDSS) Market Size 2032 |

USD 2,770.60 Million |

Growing focus on sleep wellness drives steady adoption across households and clinical settings. Rising diagnosis of sleep disorders lifts the need for oral appliances, nasal devices, and positional therapy tools. Hospitals and clinics support surgeries that offer long-term relief for chronic snoring. Manufacturers improve device comfort and durability to attract wider users. Awareness campaigns highlight the link between snoring and poor cardiovascular health, which boosts early intervention. This shift strengthens market growth across both device-based and surgical segments.

North America leads due to strong sleep disorder screening, high device acceptance, and advanced clinical infrastructure. Europe follows with broad adoption supported by active wellness programs and strong ENT care networks. Asia Pacific emerges as a fast-growing region driven by rising urban stress, increasing sleep disorder cases, and expanding hospital capacity. Growth in the Middle East and Latin America remains steady as awareness improves and more users seek affordable snoring solutions. Each region shows distinct progress shaped by lifestyle patterns and healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

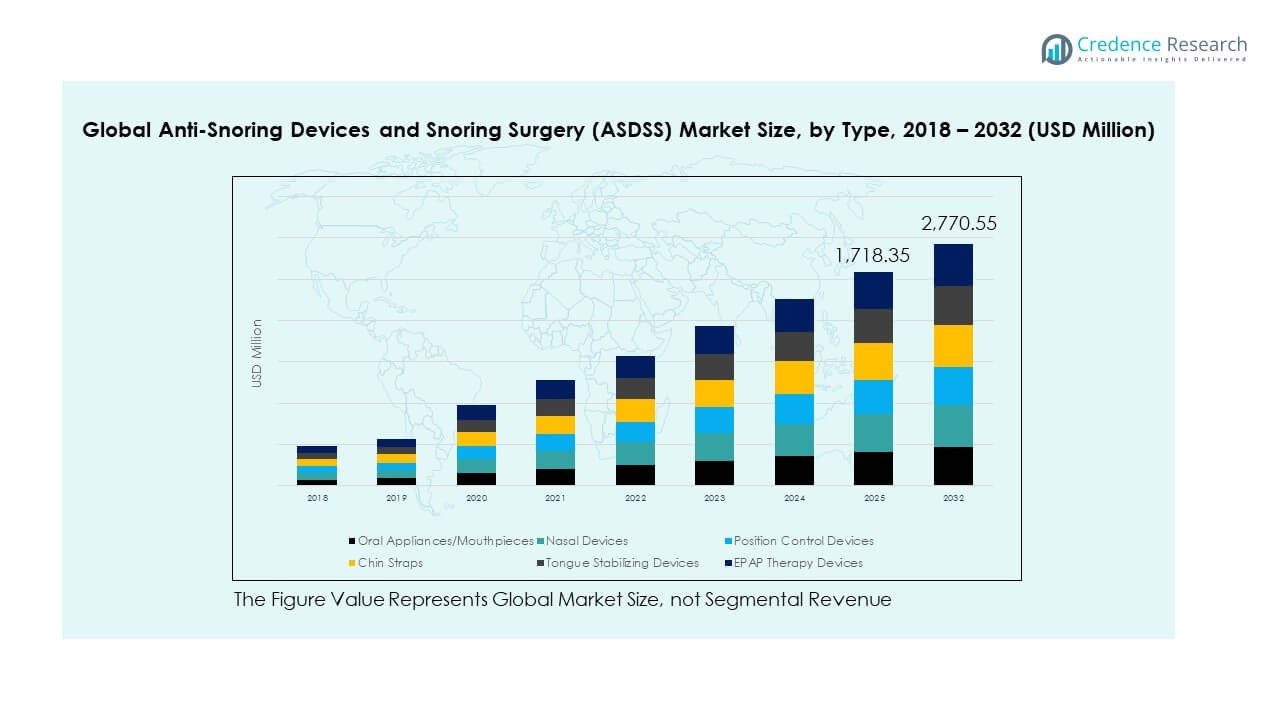

- The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market reached USD 1,107.70 million in 2018, grew to USD 1,611.80 million in 2024, and is projected to hit USD 2,770.60 million by 2032, supported by a steady 06% CAGR, driven by higher awareness of sleep-related breathing issues and greater demand for non-invasive and surgical solutions.

- Asia Pacific (39.00%), Europe (23.77%), and North America (18.02%) hold the top regional shares due to strong diagnosis rates, advanced sleep-health infrastructure, and rising lifestyle stress levels. Their large patient pools and better access to ENT care position them as dominant contributors to global revenue.

- Asia Pacific, the fastest-growing region with 00% share, expands rapidly due to increasing sleep disorder cases, higher urban stress, and improving hospital capacity. Strong adoption of home-based devices further accelerates regional momentum.

- Segment distribution shows Oral Appliances/Mouthpieces representing the largest portion of the chart—roughly 30%, driven by comfort, clinical acceptance, and strong user compliance across mild to moderate snoring cases.

- EPAP therapy devices, nasal devices, and position control devices collectively account for about 45% of the segment distribution, reflecting rising interest in non-invasive self-management tools and broader awareness of airflow-focused treatments.

Market Drivers:

Rising Awareness of Sleep Disorders and Strong Emphasis on Early Intervention

Public awareness of sleep-related breathing issues grows across major regions. Many groups link persistent snoring to cardiovascular risks, which pushes timely screening. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market gains support from strong education programs. Healthcare teams highlight the benefits of early detection during routine visits. ENT clinics record higher walk-ins for snoring assessments. Wellness brands promote simple screening tools for home use. Online platforms influence buying behavior through informative content. The shift toward preventive care strengthens long-term adoption across user groups.

- For instance, the digital SleepCheckapp (developed by ResApp, a company acquired by ResMed) uses smartphone microphones to screen users for their risk of obstructive sleep apnea (OSA), with clinical studies demonstrating high accuracy in identifying moderate to severe cases.

Increasing Preference for Non-Invasive and User-Friendly Treatment Options

Demand rises for non-invasive solutions that avoid complex procedures. Many users choose oral appliances that offer comfort and convenience. Nasal devices remain popular for their simple and quick application. Hospitals report steady interest in positional therapy for mild cases. Manufacturers refine material quality to improve long-term usability. It helps users follow treatment plans with fewer adjustments. Insurance groups expand coverage in select regions, which supports higher uptake. This collective move lifts confidence in device-based care.

- For instance, SomnoMed has reported improving over 1,000,000 patient lives worldwide with its oral appliances, supported by clinical compliance rates that often exceed 80% in studies.

Growing Need for Clinical-Grade Solutions Across ENT and Sleep Therapy Centers

Hospitals and sleep labs invest in clinical tools that support accurate diagnosis. ENT units promote surgeries that provide durable relief for chronic snoring. Teams offer structured pathways that combine evaluation, therapy, and follow-up. Many clinics upgrade their equipment to meet rising patient traffic. Surgeons adopt refined techniques that shorten recovery time. It encourages more adults to consider procedural intervention. Patients trust established centers that maintain high safety standards. The trend boosts long-term commitment toward comprehensive snoring management.

Technological Advances Driving Smarter, Safer, and More Adaptable Devices

Tech upgrades lead to better device precision and comfort. Sensors track airway movement for improved feedback. AI-backed applications help users understand sleep patterns. Manufacturers roll out adjustable features that fit diverse airway structures. ENT experts rely on detailed imaging to plan surgery accurately. It creates stronger alignment between diagnosis and treatment pathways. Digital tools support remote follow-up and guidance. These innovations push the market toward faster adoption of advanced treatment solutions.

Market Trends:

Rapid Expansion of Personalized and Custom-Fit Anti-Snoring Solutions

Custom-fit devices gain a strong user base due to better comfort. Many brands design models shaped through digital impressions. Dentists offer tailored appliances that match oral structure. This approach supports higher treatment adherence across age groups. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market benefits from steady acceptance of personalization. Clinics highlight lower discomfort with tailored devices. Home users trust solutions that match individual needs. This trend drives premium product demand across the sector.

- For instance, ProSomnus manufactures precision-milled devices with sub-50 micron tolerance using medical-grade robotic milling systems, which have been used to treat over 150,000 patients.

Growing Use of Smart Sleep Technologies Integrated With Connected Platforms

Smart devices attract users who want real-time tracking. Sleep apps provide personalized scores and guidance. Sensors allow precise assessment of airway vibration. ENT experts use digital records during consultations to refine therapy. Connected tools offer weekly insights that help users stay consistent. It strengthens engagement through clear progress indicators. Smart platforms encourage long-term participation across routine care. This push reshapes the market through steady digital integration.

- For instance, Philips’ SmartSleep solution leveraged more than 2.6 billion nights of accumulated sleep data to inform the development of its personalized coaching and connected ecosystem.

Increasing Adoption of Minimally Invasive Surgical Techniques Supported by Better Tools

Hospitals prefer techniques that reduce recovery time. Surgeons use refined tools that lower discomfort for patients. Laser procedures draw interest for quick and predictable outcomes. ENT teams adopt approaches with shorter post-procedure restrictions. Many clinics promote day-care surgeries for moderate snoring. It helps users make decisions with fewer lifestyle disruptions. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market benefits from steady demand for safe procedural care. These improvements shape broader acceptance of targeted surgical options.

Rising Influence of Home-Based Sleep Improvement Products and Digital Wellness Brands

Home-based devices gain popularity among first-time buyers. Many users trust solutions promoted by digital wellness channels. Brands highlight quick-start designs that support independent use. Subscription-based guidance models attract younger groups. It helps users track habits with simple daily prompts. ENT experts note rising follow-up visits triggered by home screenings. The market sees stronger engagement from tech-aware consumers. This trend widens access to practical snoring relief tools.

Market Challenges Analysis:

Limited Awareness in Developing Regions and Low Adoption of Clinical Diagnosis

Large sections of developing regions show limited exposure to structured sleep care. Many adults treat snoring as a minor issue rather than a health risk. This mindset slows adoption of clinical diagnosis in early stages. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market faces slower acceptance across rural belts. Hospitals in low-income zones lack strong ENT capacity. It restricts access to advanced procedures and screening tools. Awareness campaigns remain uneven across public health systems. This gap delays timely intervention for many at-risk groups.

High Cost of Advanced Devices and Limited Access to Skilled ENT Surgeons

Premium devices remain expensive for many households. Surgical options require skilled ENT teams that only operate in major cities. It creates wide accessibility gaps across several regions. Insurance coverage remains restricted in many markets. The market faces slow adoption where reimbursement support is weak. Users delay treatment due to high out-of-pocket spending. It limits widespread shift toward advanced snoring solutions. This challenge affects long-term expansion across price-sensitive regions.

Market Opportunities:

Growing Demand for Home-Based Self-Management Tools With Digital Support Features

Demand rises for devices that allow independent use at home. Many users prefer tools supported by simple tracking apps. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market benefits from this shift toward self-guided wellness. Portable devices improve comfort for new buyers across age groups. It supports easy adoption among individuals reluctant to visit clinics. Digital platforms attract younger users seeking quick feedback. Brands can expand reach with subscription-based guidance models. This trend strengthens long-term product penetration.

Rising Focus on Minimally Invasive Solutions Across High-Growth Healthcare Markets

Countries expand ENT care networks to support advanced treatment options. Hospitals invest in safer and faster procedures with shorter downtime. It encourages adults to seek targeted solutions for chronic snoring. Clinics highlight modern tools that improve procedural precision. The market gains traction from regions scaling specialized sleep units. Awareness campaigns support quick consultation in early stages. These shifts open strong opportunities for surgical and hybrid treatment pathways.

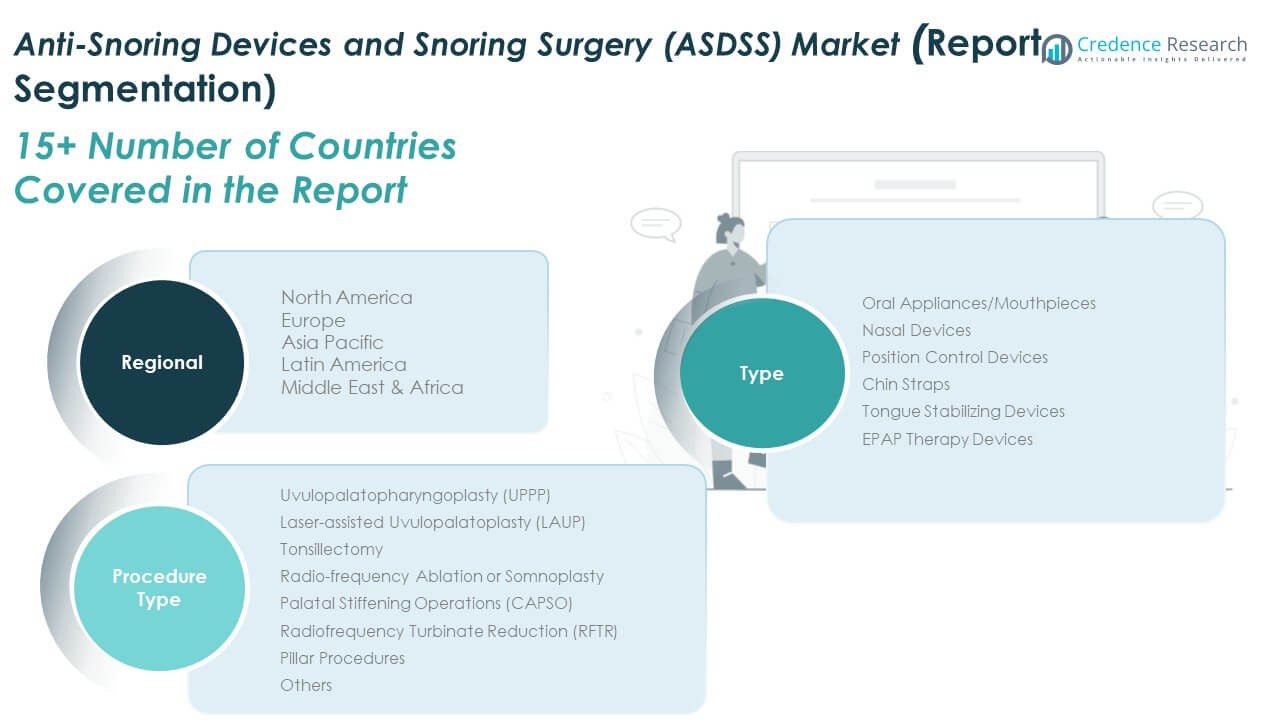

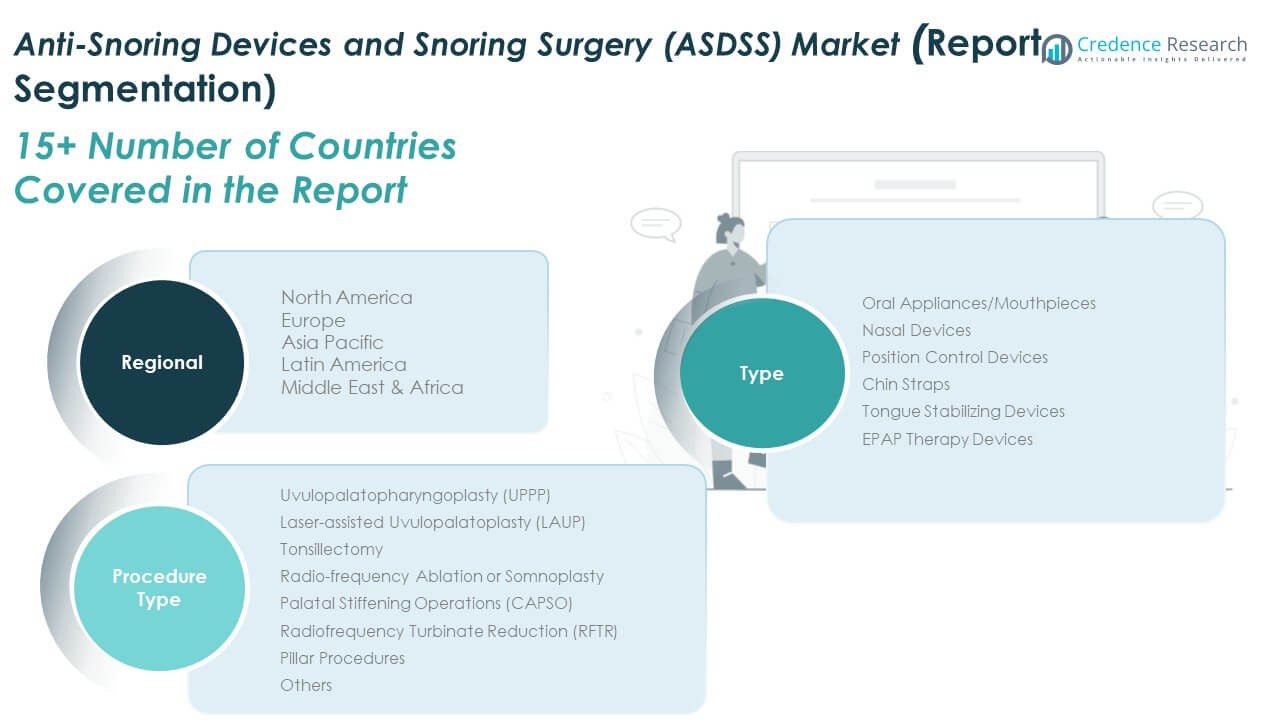

Market Segmentation Analysis:

By Type

The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market shows strong traction across multiple device categories driven by rising demand for non-invasive care. Oral appliances and mouthpieces hold a leading share due to comfort, ease of use, and broad acceptance among mild to moderate snorers. Nasal devices attract users seeking airflow improvement with minimal adjustment. Position control devices gain steady use among patients affected by positional snoring patterns. Chin straps retain a niche audience focused on jaw alignment support. Tongue stabilizing devices appeal to users who require airway retention solutions without complex procedures. EPAP therapy devices show fast growth due to compact designs and rising preference for portable self-management tools. Each type segment serves distinct user needs shaped by comfort, affordability, and therapy expectations.

- For instance, Theravent EPAP devices demonstrated up to a 76% reduction in objective snoring measurements in clinical trials published in peer-reviewed journals, and one study found a 53% median reduction in the Apnea-Hypopnea Index (AHI) in patients with obstructive sleep apnea.

By Procedure Type

Procedure-based care shows meaningful adoption where long-term relief and clinical precision are priorities. Uvulopalatopharyngoplasty (UPPP) remains widely used for structural correction in severe snoring cases. Laser-assisted uvulopalatoplasty (LAUP) attracts patients who prefer shorter recovery periods and quick outcomes. Tonsillectomy supports cases linked to enlarged tissue obstruction. Radio-frequency ablation or somnoplasty gains traction for its lower discomfort profile and targeted tissue reduction. Palatal stiffening operations (CAPSO) offer support for vibration control in soft palate issues. Radiofrequency turbinate reduction (RFTR) is used to improve nasal airflow in selected cases. Pillar procedures serve patients seeking minimally invasive intervention with predictable results. The others category includes evolving techniques that expand clinical choices across diverse patient groups.

- For instance, radiofrequency ablation systems by Coblator use energy delivery at 40–70°C to achieve precise tissue reduction with reduced post-operative pain, as documented in clinical ENT studies.

Segmentation:

By Type

- Oral Appliances / Mouthpieces

- Nasal Devices

- Position Control Devices

- Chin Straps

- Tongue Stabilizing Devices

- EPAP Therapy Devices

By Procedure Type

- Uvulopalatopharyngoplasty (UPPP)

- Laser-assisted Uvulopalatoplasty (LAUP)

- Tonsillectomy

- Radio-frequency Ablation or Somnoplasty

- Palatal Stiffening Operations (CAPSO)

- Radiofrequency Turbinate Reduction (RFTR)

- Pillar Procedures

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

By Country (Under Regional Chapters)

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 209.36 million in 2018 to USD 298.55 million in 2024 and is anticipated to reach USD 499.25 million by 2032, at a CAGR of 6.7% during the forecast period. The region accounts for 18.02% market share. The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market grows steadily in North America due to strong awareness of sleep disorders. Healthcare networks offer structured diagnostic pathways supported by advanced ENT capabilities. Insurance coverage improves access to both device-based and surgical care. Many adults adopt oral appliances due to comfort and prescription-based customization. Clinics witness higher demand for minimally invasive procedures that reduce downtime. It gains further traction from rising obesity rates linked to airway obstruction. Digital wellness tools support early screening and therapy compliance across urban populations. The region maintains strong leadership due to high technology adoption and well-defined clinical infrastructure.

Europe

The Europe Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 267.18 million in 2018 to USD 386.41 million in 2024 and is anticipated to reach USD 658.84 million by 2032, at a CAGR of 7.0% during the forecast period. Europe holds 23.77% market share. The market expands due to broad adoption of wellness programs and strong ENT care networks. National health systems promote early screening for sleep-related breathing issues. Users prefer non-invasive devices designed for long-term comfort and daily use. Clinics observe steady demand for laser-assisted procedures driven by predictable recovery timelines. It benefits from regulatory focus on product safety and performance standards. Digital health integration strengthens patient follow-up and treatment adherence. Growing lifestyle-linked snoring cases drive consistent device purchases. Europe remains a high-value region with balanced demand across both devices and procedures.

Asia Pacific

The Asia Pacific Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 415.95 million in 2018 to USD 615.24 million in 2024 and is anticipated to reach USD 1,080.52 million by 2032, at a CAGR of 7.3% during the forecast period. Asia Pacific leads with 39.00% market share. Large populations and rising diagnosis rates fuel market expansion across major countries. Urban centers report strong interest in home-based devices that support independent management. Hospitals scale ENT capacity to handle rising patient volumes linked to sleep-disordered breathing. It gains traction due to lifestyle stress, poor sleep patterns, and rising obesity rates. Manufacturers introduce affordable models that appeal to cost-sensitive users. Clinics promote minimally invasive surgeries to address moderate snoring cases. Awareness campaigns in China, India, and Southeast Asia build early engagement. The region emerges as the fastest-growing market with strong future potential.

Latin America

The Latin America Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 119.41 million in 2018 to USD 172.16 million in 2024 and is anticipated to reach USD 292.29 million by 2032, at a CAGR of 6.9% during the forecast period. The region accounts for 10.55% market share. Growth improves due to rising awareness of sleep health across urban belts. Many users adopt entry-level devices due to affordability and ease of access. Clinics in Brazil and Mexico expand ENT capabilities to support rising consultations. It benefits from greater adoption of digital wellness tools among young adults. Demand for minimally invasive options grows as recovery expectations shift. Hospitals improve patient pathways that combine diagnosis and therapy alignment. Retail channels expand distribution of consumer-friendly snoring devices. Latin America shows steady growth with strong penetration in key metropolitan areas.

Middle East

The Middle East Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 75.10 million in 2018 to USD 112.39 million in 2024 and is anticipated to reach USD 200.31 million by 2032, at a CAGR of 7.5% during the forecast period. The region holds 7.23% market share. High prevalence of lifestyle-driven sleep disorders raises demand for effective snoring treatments. Clinics invest in modern ENT units with improved diagnostic tools. Users prefer devices that offer comfort and minimal maintenance. It expands further due to rising medical tourism in GCC countries. Hospitals promote quick-recovery surgical procedures that align with patient preferences. Awareness programs gain traction through digital channels and corporate wellness initiatives. Retail growth supports wider access to home-use devices. The region shows strong demand momentum supported by improving healthcare infrastructure.

Africa

The Africa Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market size was valued at USD 20.71 million in 2018 to USD 27.03 million in 2024 and is anticipated to reach USD 39.34 million by 2032, at a CAGR of 4.8% during the forecast period. Africa accounts for 1.42% market share. Awareness of sleep disorders remains limited across rural zones, which slows early diagnosis. Urban centers show improving interest in basic snoring devices. Hospitals expand ENT services in major cities to support structured screening. It gains slow traction due to affordability challenges and limited trained specialists. NGOs and private clinics promote education programs highlighting sleep health risks. Gradual growth emerges in South Africa and Egypt due to rising urbanization. Distribution networks expand slowly but consistently. Africa remains an emerging region with long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic plc

- AccuMED Corp.

- GE Healthcare

- Philips

- Fisher & Paykel Healthcare

- Apnea Sciences Corporation

- ProSomnus Sleep Technologies

- Vivos Therapeutics, Inc.

- SomnoMed

- Other Key Players

Competitive Analysis:

The Global Anti-Snoring Devices and Snoring Surgery (ASDSS) Market features a competitive landscape shaped by device innovators, established medical technology firms, and growing wellness brands. Leading companies focus on advanced oral appliances, nasal devices, and minimally invasive surgical tools that improve comfort and clinical outcomes. Many players invest in digital features that support sleep tracking and therapy adherence. Product portfolios expand through customizable designs aimed at diverse user needs. It gains strength from strategic partnerships between dental clinics, ENT centers, and digital wellness platforms. Competitors enhance distribution networks to meet rising global demand. Pricing strategies focus on balancing accessibility and premium-quality features. Continuous R&D helps firms secure a strong position in both device-based and procedure-driven segments.

Recent Developments:

- In October 2025, GE HealthCare announced the launch of its Carevance™ patient monitoring platform after receiving the CE mark. While broadly focused on acute care, this new platform advances respiratory and cardiac monitoring accessibility by offering a cost-effective, modular solution that tracks key vital signs, including respiration rate and oxygen saturation. The system incorporates GE HealthCare’s proprietary algorithms, such as EK-Pro, to reduce false alarms and streamline clinical workflows, marking a significant step in making advanced monitoring available to a wider range of healthcare facilities.

- In September 2024, Vivos Therapeutics received a groundbreaking FDA 510(k) clearance for its DNA oral appliance to treat moderate to severe obstructive sleep apnea (OSA) in children ages 6 to 17. This approval represents a significant milestone as the first oral appliance clearance of its kind for this pediatric demographic, addressing a critical gap in non-surgical treatment options for children. This follows the company’s earlier clearance for treating severe OSA in adults, positioning Vivos as a versatile player in the airway remodeling space.

- In May 2024, SomnoMed advanced its “Medical Initiative” by publishing new study results highlighting the efficacy of its SomnoDent® Avant™ oral appliance. The study demonstrated that the device’s unique design, which features a passive mouth-closing mechanism, achieved a 70% reduction in the Apnea-Hypopnea Index (AHI), significantly outperforming traditional wing-based devices. The company also integrated new sensor technology into its Avant and Herbst Advance Elite™ devices, enabling objective monitoring of patient compliance and treatment efficacy to better compete with CPAP therapy data capabilities.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Procedure Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for smart connected devices will rise as consumers adopt home-based sleep monitoring.

- Minimally invasive surgeries will gain traction due to shorter recovery periods.

- Hospitals will invest in modern ENT infrastructure to support structured diagnosis.

- Personalized oral appliances will grow due to better comfort and long-term adherence.

- Digital health tools will guide user engagement and therapy optimization.

- Manufacturers will expand in emerging regions with large unmet needs.

- Partnerships between clinics and device makers will strengthen global distribution.

- Portable EPAP devices will find strong adoption among first-time users.

- Regulatory focus on safety standards will refine product quality.

- Clinical evidence supporting early intervention will expand therapy adoption.