Market Overview

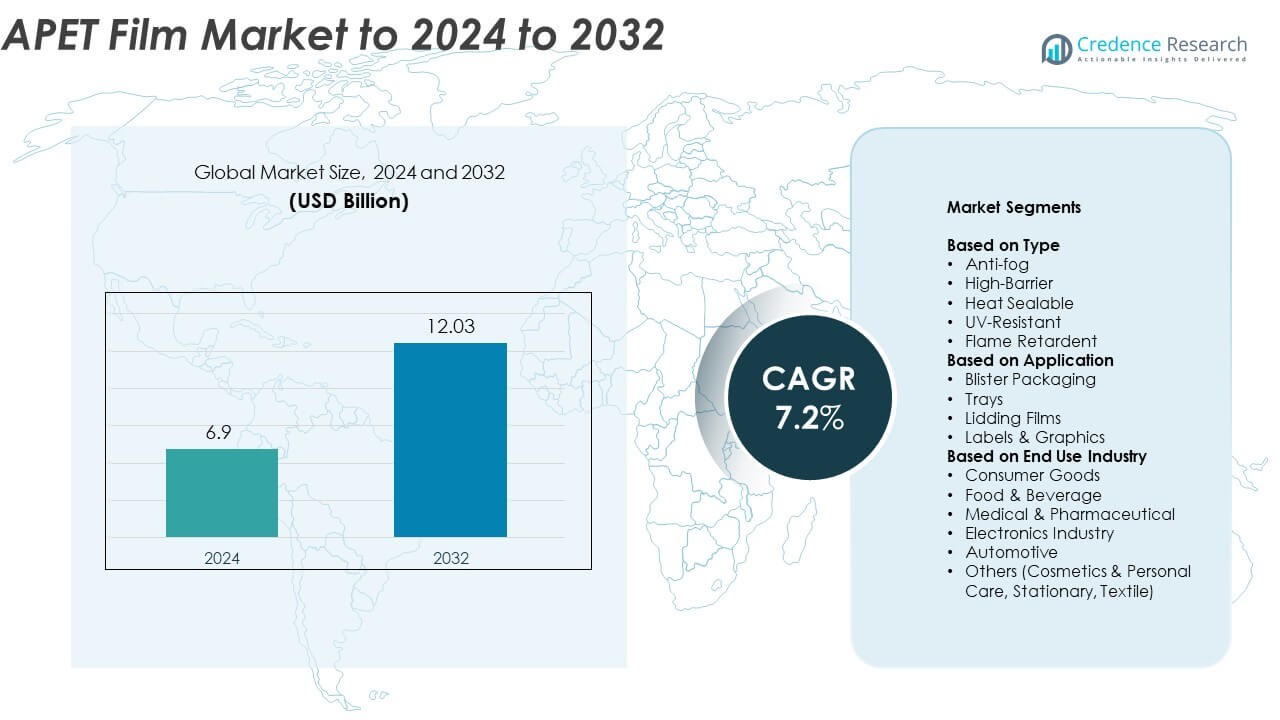

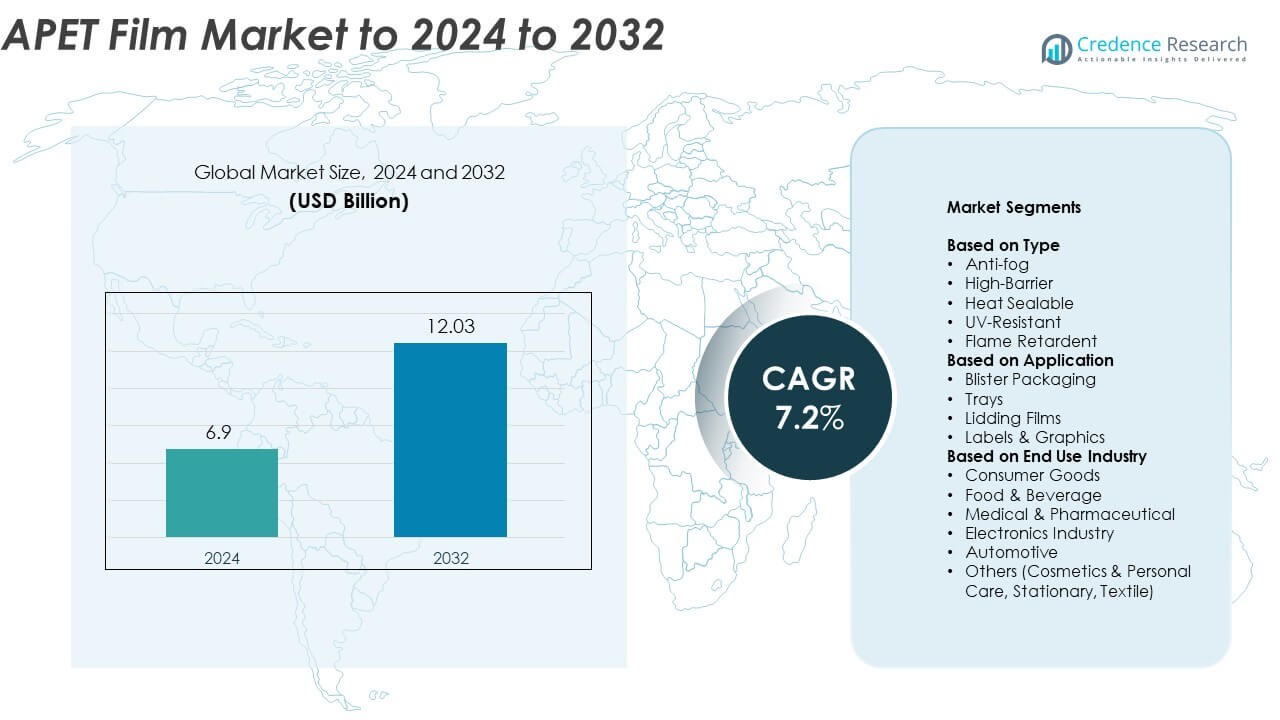

The APET Film Market size was valued at USD 6.9 Billion in 2024 and is anticipated to reach USD 12.03 Billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| APET Film Market Size 2024 |

USD 6.9 Billion |

| APET Film Market, CAGR |

7.2% |

| APET Film Market Size 2032 |

USD 12.03 Billion |

The APET film market features key players such as Covestro, Jindal Poly Films, Klöckner Pentaplast, Toray Plastics, Gascogne Flexible, and Octal, each contributing to product innovation and regional expansion. North America leads the global market with a 32.7% share, supported by strong demand from food packaging and healthcare industries. Europe follows with 28.4% share, driven by strict sustainability regulations and recycling initiatives. Asia Pacific closely trails with 30.9% share, fueled by rapid industrial growth, high consumption of packaged foods, and expanding manufacturing capacity, solidifying its position as the fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The APET film market was valued at USD 6.9 Billion in 2024 and is projected to reach USD 12.03 Billion by 2032, growing at a CAGR of 7.2%.

- Increasing demand for sustainable, recyclable, and high-barrier packaging materials drives market growth across industries such as food, pharmaceuticals, and consumer goods.

- Advancements in film extrusion and coating technologies, along with rising use of recycled PET content, are shaping major trends in the market.

- The competitive landscape features companies focusing on innovation, eco-friendly production, and regional capacity expansion to strengthen their global presence.

- North America leads the market with 32.7% share, followed by Europe at 28.4% and Asia Pacific at 30.9%, while the heat sealable type and food & beverage segments remain dominant contributors globally.

Market Segmentation Analysis:

By Type

The heat sealable segment dominates the APET film market, accounting for around 38.4% share in 2024. Its leadership is driven by strong demand in food packaging, blister packs, and lidding films, where secure sealing and tamper resistance are essential. The segment benefits from growing usage in automated packaging lines, offering enhanced process efficiency and product safety. Increasing adoption in ready-to-eat and perishable food applications further fuels demand. High-barrier and UV-resistant films are also gaining traction due to their superior protection and extended shelf life in outdoor and sensitive packaging uses.

- For instance, RETAL lists 15,000 metric tons per year of APET film for trays and blisters.

By Application

Blister packaging leads the APET film market with nearly 41.6% share in 2024. The dominance is supported by extensive use in pharmaceutical, electronics, and consumer goods sectors for product protection and visibility. Rising adoption of transparent, durable, and recyclable packaging materials enhances its appeal. APET films are preferred for their excellent formability and chemical resistance, ensuring integrity during distribution. Trays and lidding films follow, driven by the rising consumption of packaged food products and the growing focus on hygienic storage solutions in both retail and industrial settings.

- For instance, Klöckner Pentaplast added 15,000 metric tonnes of rPET/PET capacity at Beaver, supporting thermoformed blister and lidding output.

By End Use Industry

The food and beverage segment holds the largest share of about 46.8% in the APET film market in 2024. Its dominance stems from high consumption of packaged and ready-to-eat foods globally. APET films provide clarity, mechanical strength, and strong sealing properties essential for preserving freshness and preventing contamination. Growing emphasis on sustainable and recyclable materials further drives their use across chilled and frozen food packaging. The medical and pharmaceutical sector also contributes significantly, leveraging APET films for blister packs and sterile product protection.

Key Growth Drivers

Rising Demand for Sustainable and Recyclable Packaging

Growing environmental concerns are accelerating the adoption of APET films due to their recyclability and reduced carbon footprint. Industries such as food and beverage and consumer goods increasingly prefer APET over PVC and other plastics. Governments and brands promoting eco-friendly packaging further strengthen this shift. The rising popularity of circular economy initiatives and improved recycling technologies have boosted APET film use across diverse applications, making sustainability the key growth driver for market expansion.

- For instance, Indorama Ventures reported reaching a milestone of 100 billion PET bottles recycled since 2011 as of September 2023. As of a press release in August 2025, that figure has increased to over 150 billion post-consumer PET bottles.

Expansion of the Food and Beverage Packaging Industry

The rapid growth of packaged and convenience food consumption drives strong demand for APET films. Their superior transparency, durability, and barrier properties make them ideal for trays, blister packs, and lidding films. Rising urbanization, extended shelf-life requirements, and hygiene awareness continue to elevate usage in ready-to-eat and frozen food segments. With global food trade and e-commerce expanding rapidly, APET films are increasingly preferred for safe, reliable, and aesthetic product packaging.

- For instance, Faerch’s Cirrec plant opened with 60,000-ton input capacity in 2024, aiming to process up to 3 billion trays yearly across Europe.

Technological Advancements in Film Manufacturing

Advances in extrusion, coating, and lamination technologies have improved the performance and customization of APET films. New formulations offering enhanced heat resistance, clarity, and printability cater to high-barrier and specialized packaging needs. Automation and precision control in film production have improved quality consistency and reduced waste. These innovations enable manufacturers to meet stringent industry standards and serve growing demand from sectors like medical, electronics, and automotive packaging.

Key Trends & Opportunities

Shift Toward Bio-Based and Recycled APET Films

Manufacturers are increasingly investing in bio-based and recycled APET variants to meet sustainability goals. Integration of post-consumer recycled (PCR) content in film production aligns with global sustainability mandates. This trend opens opportunities for companies adopting closed-loop systems and green certifications. Growing acceptance among end users seeking eco-conscious packaging solutions is likely to strengthen market positioning and brand value for sustainable APET film producers.

- For instance, Eastman’s Kingsport plant began 2024 operations to recycle 110,000 metric tons of polyester annually via molecular recycling.

Growth in High-Barrier and Specialty Film Applications

Demand for high-barrier APET films is rising across food preservation, pharmaceuticals, and sensitive electronics packaging. These films provide superior oxygen, moisture, and UV protection, enhancing product stability and shelf life. The expanding healthcare packaging sector and demand for anti-fog and flame-retardant variants present new opportunities. This trend is fostering innovation and diversification within product portfolios, supporting long-term market growth.

- For instance, Toray’s Lumirror portfolio spans 23–350 µm and includes ultra-high-barrier PET grades for retort and medical uses.

Key Challenges

Fluctuating Raw Material Prices

Volatility in prices of raw materials such as PTA and MEG affects production costs of APET films. Dependence on petrochemical feedstocks exposes manufacturers to price instability driven by crude oil fluctuations. This uncertainty pressures profit margins and limits pricing flexibility. Many producers are shifting toward recycled and bio-based materials to mitigate these risks, but high conversion costs remain a challenge.

Stringent Environmental Regulations and Waste Management Issues

Despite being recyclable, APET films face challenges from regional waste management inefficiencies and strict recycling regulations. Inadequate collection systems in developing regions hinder material recovery and recycling effectiveness. Compliance with evolving environmental standards increases operational costs for producers. To overcome these challenges, companies are focusing on advanced recycling infrastructure and developing closed-loop packaging systems.

Regional Analysis

North America

North America holds around 32.7% share of the APET film market in 2024, driven by strong demand from the food and beverage, medical, and consumer goods sectors. The United States leads regional growth due to increasing adoption of recyclable and high-barrier packaging materials. Rising focus on sustainability and strict packaging regulations encourage the use of APET films over conventional plastics. The expanding e-commerce industry further supports demand for protective and transparent packaging formats. Technological advancements and strategic investments by key players continue to strengthen the regional market outlook.

Europe

Europe accounts for nearly 28.4% share of the APET film market in 2024, supported by advanced recycling systems and strong regulatory support for sustainable packaging. The region benefits from high consumption of ready-to-eat foods and pharmaceuticals requiring high-barrier film packaging. Germany, France, and the U.K. are major contributors due to established manufacturing bases and strict compliance standards. The European Green Deal and circular economy policies further promote recycled and bio-based APET usage. Innovation in lightweight and energy-efficient film production enhances the region’s competitiveness globally.

Asia Pacific

Asia Pacific dominates the APET film market with about 30.9% share in 2024, fueled by rapid industrialization, urbanization, and growth in packaged food consumption. China, Japan, India, and South Korea drive the regional expansion through increasing demand from food packaging, electronics, and consumer goods industries. Rising investments in manufacturing facilities and expanding export capacities support market growth. The availability of low-cost raw materials and labor also strengthens production capabilities. Growing awareness of recyclable materials and government support for sustainable packaging are key drivers of regional momentum.

Latin America

Latin America captures around 4.6% share of the APET film market in 2024, with Brazil and Mexico leading regional demand. Rising consumption of packaged foods, beverages, and pharmaceuticals supports steady growth. The region is witnessing a gradual shift toward sustainable packaging solutions amid regulatory reforms and consumer awareness. Increasing investments by multinational packaging firms enhance local production capacity. Though cost sensitivity and limited recycling infrastructure remain challenges, technological collaborations and regional trade integration are expected to improve market performance over the forecast period.

Middle East & Africa

The Middle East and Africa hold approximately 3.4% share of the APET film market in 2024, primarily driven by demand from food packaging, consumer goods, and healthcare industries. Countries such as Saudi Arabia, South Africa, and the UAE are adopting modern packaging technologies to support retail growth. Rising disposable income and urbanization are fueling packaged product consumption. Ongoing infrastructure investments and efforts to diversify economies also contribute to market development. However, limited recycling capacity and fluctuating raw material prices may restrain short-term growth prospects.

Market Segmentations:

By Type

- Anti-fog

- High-Barrier

- Heat Sealable

- UV-Resistant

- Flame Retardent

By Application

- Blister Packaging

- Trays

- Lidding Films

- Labels & Graphics

By End Use Industry

- Consumer Goods

- Food & Beverage

- Medical & Pharmaceutical

- Electronics Industry

- Automotive

- Others (Cosmetics & Personal Care, Stationary, Textile)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Covestro, Jindal Poly Films, Klöckner Pentaplast, Toray Plastics, Gascogne Flexible, and Octal are among the prominent participants shaping the APET film market. The competitive landscape is characterized by strong emphasis on innovation, product differentiation, and sustainable manufacturing. Companies are focusing on expanding their product portfolios with recyclable, high-barrier, and heat-sealable films to meet industry-specific needs. Strategic investments in advanced extrusion and coating technologies are improving operational efficiency and quality consistency. Market leaders are strengthening regional footprints through capacity expansions, partnerships, and acquisitions. Growing regulatory focus on sustainable packaging is encouraging players to adopt eco-friendly production processes and integrate post-consumer recycled content. Continuous R&D efforts and collaboration with end-use industries remain central to maintaining competitiveness and addressing evolving packaging standards across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Klöckner Pentaplast (kp) significantly advanced its kp Tray2Tray® initiative, which involves a strategic partnership model with recyclers, packers, and retailers to enhance the recyclability and use of post-consumer recycled (PCR) APET (amorphous polyethylene terephthalate) film in new food trays.

- In 2023, Jindal Poly Films enhanced its APET film production capabilities with sustainability-driven innovations including recyclable packaging films targeted at food and pharmaceutical sectors.

- In 2022, Toray Plastics launched a new line of recyclable APET films designed for improved sustainability and enhanced barrier properties, targeting advancements in environmental impact and performance.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for recyclable and sustainable APET films will continue to rise across packaging sectors.

- Growing adoption of high-barrier and heat-sealable films will enhance product shelf life and safety.

- Expansion of food and beverage packaging will remain the leading growth contributor globally.

- Technological innovations in film extrusion and coating will improve product performance and efficiency.

- Increased use of post-consumer recycled materials will strengthen circular economy initiatives.

- Pharmaceutical and medical packaging applications will witness steady growth due to hygiene standards.

- Emerging economies in Asia Pacific will become key manufacturing and export hubs.

- Rising e-commerce activities will boost demand for protective and transparent packaging formats.

- Manufacturers will focus on lightweight and energy-efficient film solutions to reduce costs.

- Strategic mergers and sustainability-driven collaborations will shape the competitive landscape ahead.