Market Overview:

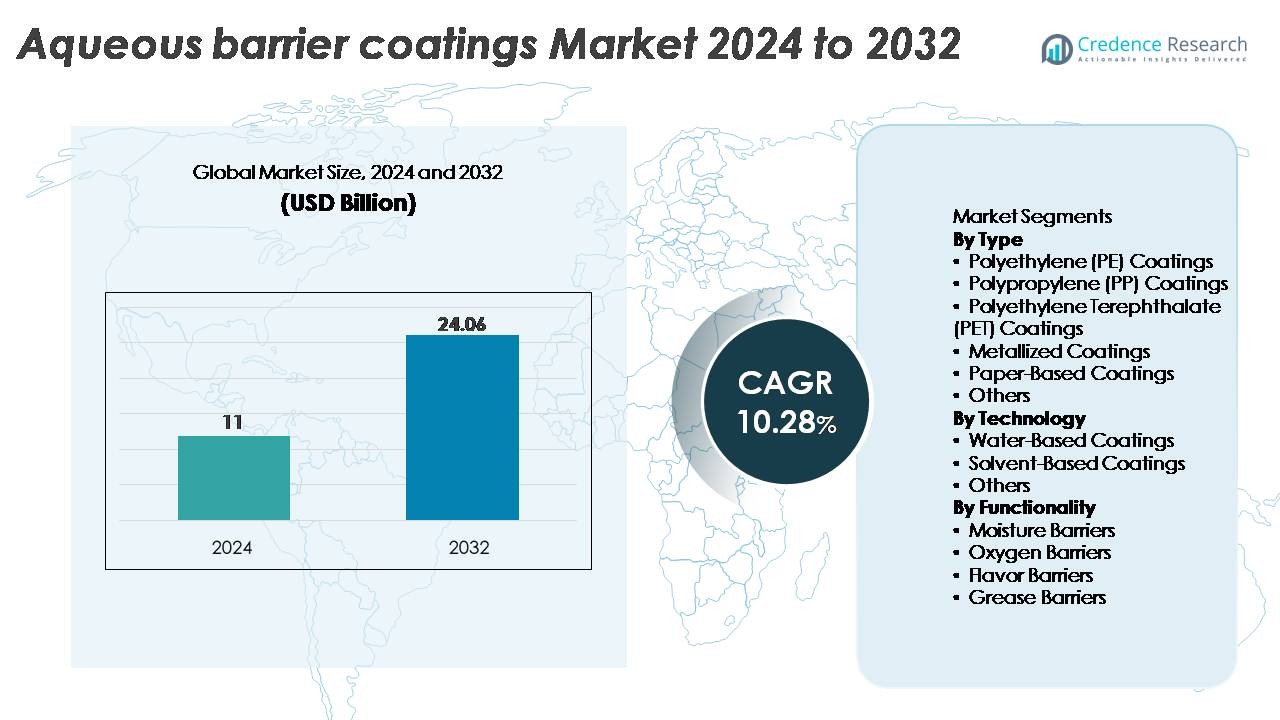

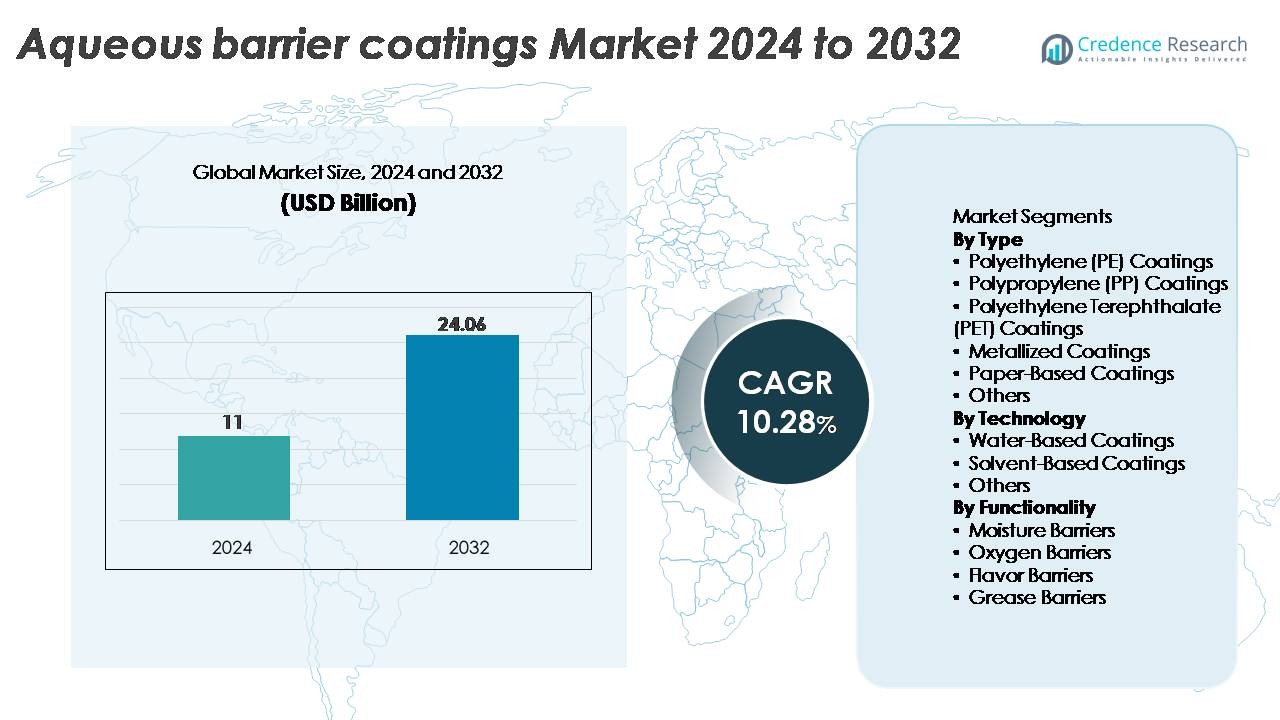

The global aqueous barrier coatings market was valued at USD 11 billion in 2024 and is projected to reach USD 24.06 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.28% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aqueous Barrier Coatings Market Size 2024 |

USD 11 Billion |

| Aqueous Barrier Coatings Market, CAGR |

10.28% |

| Aqueous Barrier Coatings Market Size 2032 |

USD 24.06 Billion |

The aqueous barrier coatings market is shaped by a mix of global chemical leaders and specialized coating manufacturers, including Cork Industries, DuPont, Follmann, Amcor, H.B. Fuller, Chemline Global, Avery Dennison, Cattie Adhesives, Clariant, and Dow Chemical. These companies compete through advancements in water-based polymer dispersions, PFAS-free grease barriers, and recyclable packaging solutions tailored for foodservice, e-commerce, and consumer goods. Regionally, North America leads the market with approximately 32% share, supported by strong regulatory pressure and rapid adoption of repulpable packaging. Asia-Pacific follows closely at about 30%, driven by high-volume packaging production and growing sustainability mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global aqueous barrier coatings market was valued at USD 11 billion in 2024 and is projected to reach USD 24.06 billion by 2032, expanding at a CAGR of 10.28% during the forecast period.

- Strong demand for recyclable, PFAS-free, and repulpable packaging in foodservice, beverages, and e-commerce continues to drive adoption, with polyethylene (PE) coatings holding the largest segment share due to their superior moisture-barrier performance.

- Key trends include the rapid shift toward bio-based dispersions, hybrid barrier chemistries, and high-performance waterborne systems, supported by sustainability mandates across global packaging supply chains.

- The competitive landscape is shaped by major players such as Amcor, DuPont, Clariant, Dow Chemical, H.B. Fuller, and others focusing on technological innovation, capacity expansion, and customized solutions for converters.

- Regionally, North America leads with ~32% share, followed by Asia-Pacific at ~30% and Europe at ~28%, reflecting strong regulatory pressure and increasing adoption of fiber-based, recyclable packaging formats.

Market Segmentation Analysis:

By Type

Polyethylene (PE) coatings represent the dominant segment, accounting for the largest market share due to their strong moisture resistance, excellent film-forming properties, and compatibility with high-speed packaging lines. PE’s widespread use in foodservice cups, paperboard cartons, and flexible packaging strengthens its leadership position. Polypropylene (PP) and PET coatings are gaining traction in applications requiring enhanced heat resistance and clarity, while metallized coatings support premium oxygen-barrier needs. Paper-based coatings continue to expand as brands transition toward recyclable and PFAS-free packaging. The “Others” category includes specialty polymers used in niche barrier formats.

- For instance, Dow’s PE-based barrier coating resins, such as INNATE™ precision packaging polymers, provide exceptional stiffness and toughness that enable the creation of high-performance paper and flexible packaging structures.

By Technology

Water-based coatings dominate the market, driven by regulatory pressure to reduce VOC emissions and the accelerating shift toward sustainable, non-toxic packaging solutions. Their ease of application, strong adhesion to paper substrates, and compatibility with food-contact standards reinforce their widespread adoption. Solvent-based coatings retain relevance in industrial environments requiring high durability and rapid drying, though their share is gradually declining. The “Others” segment includes hybrid and bio-based formulations that appeal to manufacturers pursuing next-generation eco-friendly packaging. Continuous improvements in waterborne barrier chemistries further solidify this segment’s leadership across global packaging lines.

- For instance, H.B. Fuller’s Flextra™ water-based barrier coating exhibits a water vapor transmission rate of as low as 0.3 g/m²·day at 38°C/90% RH, while maintaining heat-seal strengths above 4 N/15 mm on paper substrates, enabling high-performance, repulpable barrier packaging.

By Functionality

Moisture-barrier coatings hold the largest market share, supported by their essential role in safeguarding packaged foods, pharmaceuticals, and consumer goods from humidity-driven degradation. Their dominance stems from robust performance, cost-effectiveness, and broad compatibility with paper and flexible substrates. Oxygen-barrier coatings are expanding in categories requiring extended shelf life, while flavor-barrier technologies address aroma protection in confectionery and beverage packaging. Grease-barrier coatings continue to rise as PFAS-free solutions gain regulatory and consumer favor. The “Others” segment includes multifunctional coatings designed to deliver combined barrier properties for high-performance applications.

Key Growth Drivers:

Rising Demand for Sustainable and Recyclable Packaging Solutions

Sustainability commitments across FMCG, foodservice, and e-commerce sectors are driving rapid adoption of aqueous barrier coatings as brands move away from plastic laminates, wax coatings, and PFAS-based grease barriers. These water-based solutions enable recyclability and repulpability, aligning with global mandates such as EPR policies, single-use plastic restrictions, and corporate net-zero roadmaps. Manufacturers increasingly replace polyethylene or extrusion coatings with aqueous formulations to maintain barrier performance while ensuring compatibility with fiber-recycling systems. Paper cup producers, corrugated packaging manufacturers, and flexible packaging converters benefit from lower carbon footprints and improved end-of-life outcomes. As leading multinationals pledge to transition to fully recyclable or compostable packaging by the end of the decade, demand for aqueous barriers strengthens across high-volume applications such as cartons, wraps, and folding boxes.

- For instance, Stora Enso’s aqueous dispersion-coated Cupforma Natura™ achieved a recyclability rate above 95% in standard mill pulping tests and demonstrated grease-resistance levels up to KIT 12, enabling large beverage brands to transition toward fully repulpable cup solutions.

Expansion of Foodservice and Ready-to-Eat Packaging Applications

Growth in quick-service restaurants, delivery platforms, and convenience-based consumption patterns significantly accelerates the need for grease-resistant, moisture-proof, and food-safe coating technologies. Aqueous barrier coatings are increasingly preferred due to their ability to maintain product integrity without compromising recyclability. In foodservice formats such as clamshells, trays, paper wraps, and drink cups aqueous systems provide durable resistance against oil and vapor migration. As regulations tighten against fluorinated grease-barrier chemicals, food packaging suppliers rapidly adopt PFAS-free aqueous alternatives to ensure compliance while preserving performance. Additionally, the expansion of frozen, chilled, and microwave-ready meals drives demand for coatings with enhanced thermal stability. Growth in bakery, confectionery, and dairy packaging further reinforces adoption as brand owners standardize on safer, eco-friendly barrier chemistries.

- For instance, Solenis’ TOPSCREEN™ family of PFAS-free aqueous barrier coatingsis designed to provide effective oil, grease, and water resistance for paper-based food packaging. These water-based polymer and biowax formulations replace traditional materials like polyethylene (PE) and paraffin wax to enable repulpability, recyclability, and often compostability.

Advances in High-Performance Water-Based Barrier Chemistries

Technological improvements in polymer dispersion, crosslinking, and nanocomposite barrier systems are expanding the functional capabilities of aqueous barrier coatings. Modern formulations now deliver multi-functional protection, combining moisture, oxygen, and grease resistance in a single layer, reducing dependence on multilayer plastic structures. Innovations in bio-based polymers, hybrid acrylic systems, and enhanced film-forming additives enable performance levels comparable to solvent-based or extrusion coatings. Improved runnability on high-speed coaters, better heat-seal performance, and tunable barrier properties allow converters to tailor solutions for applications with stricter shelf-life requirements. As major coating manufacturers invest heavily in R&D for next-generation repulpable, compostable, and migration-compliant coatings, the market benefits from expanding application breadth across both primary and secondary packaging formats.

Key Trends & Opportunities:

Shift Toward PFAS-Free and Regulatory-Compliant Coating Alternatives

Global bans and restrictions on PFAS chemicals have created substantial opportunities for aqueous coating suppliers to develop next-generation grease- and moisture-barrier solutions. Governments in Europe, North America, and parts of Asia are accelerating legislative actions targeting harmful fluorochemicals, pushing converters to transition to compliant alternatives. This regulatory momentum is prompting a surge in adoption of fluorine-free aqueous coatings that deliver excellent oil resistance while maintaining recyclability. Suppliers are capitalizing by launching high-performance grease-barrier solutions for fast-food wrappers, bakery display packs, and molded fiber containers. The transition opens long-term opportunities for companies capable of delivering coatings that meet stringent migration, compostability, and food-contact standards.

- For instance, Michelman’s PFAS-free Hydrastar® 3000 aqueous barrier coating delivers grease resistance up to KIT 12, achieves a Cobb60 water absorption value below 20 g/m², and meets FDA 21 CFR food-contact limits, enabling converters to replace legacy fluorinated barriers without compromising functionality.

Rising Adoption of Fiber-Based Packaging in E-Commerce and Retail

The e-commerce sector’s shift toward curbside-recyclable packaging is creating new avenues for aqueous barrier coatings. As retailers replace plastic mailers, bubble wraps, and laminated pouches with fiber-based mailers and bags, demand for strong moisture and abrasion-resistant coatings increases. Aqueous barriers enhance durability during transit and protect contents from humidity, condensation, and mechanical damage. Additionally, premium retail brands are integrating coated paper solutions to support plastic-free branding strategies. Rapid proliferation of molded fiber packaging such as protective inserts and trays also boosts opportunities for aqueous systems that provide uniform coating performance on complex geometries.

- For instance, Henkel manufactures a variety of water-based barrier coatings within its AQUENCE® FBproduct line that are designed to enhance the water and grease resistance of paper and cardboard packaging, making them suitable for applications such as e-commerce mailers and molded fiber components.

Growth of Bio-Based and Compostable Barrier Technologies

An emerging trend centers on bio-based aqueous coatings derived from starches, polysaccharides, proteins, or plant-based polymers. These materials align with the global move toward compostable packaging for foodservice and single-use applications. Innovations in biodegradable coatings offer enhanced barrier strength, improved water resistance, and compatibility with industrial composting environments. As consumer-facing brands pursue certification pathways such as EN 13432 and ASTM D6400, suppliers developing bio-based coatings are well positioned to capture early-stage growth. The combination of sustainability, regulatory alignment, and growing R&D investment accelerates opportunities in this segment.

Key Challenges:

Performance Limitations Compared to Traditional Plastic-Based Barriers

Despite rapid advancements, aqueous barrier coatings still face constraints when compared with high-performance plastic laminates or metallized films especially in applications requiring extremely low oxygen transmission rates, high thermal endurance, or long shelf life. Products such as high-fat snacks, dehydrated foods, and pharmaceuticals still rely on multilayer barrier structures where aqueous coatings cannot yet match performance. Moisture sensitivity, seal integrity, and durability under extreme storage or processing conditions pose additional challenges. These performance gaps slow adoption in certain premium packaging formats, requiring continued R&D in polymer chemistry, crosslinking technologies, and hybrid barrier systems.

Processing Complexities and Cost Pressures for Converters

Transitioning from traditional extrusion coatings or solvent-based systems to aqueous alternatives often demands capital investment in drying systems, coating equipment upgrades, and process optimization. Aqueous formulations generally require longer drying times, higher energy input, and precise humidity control, affecting throughput on high-speed lines. In cost-sensitive industries, these operational changes create barriers to adoption, particularly for small and mid-sized converters with limited budget flexibility. Fluctuations in raw material pricing for specialty polymers and functional additives also contribute to cost challenges. Balancing sustainability with performance and operational efficiency remains a critical obstacle for large-scale market penetration.

Regional Analysis:

North America

North America leads the aqueous barrier coatings market with approximately 32% share, driven by rapid adoption of recyclable, PFAS-free, and repulpable packaging across foodservice, beverages, and e-commerce. The region’s strong regulatory environment supported by EPA guidelines and state-level bans on fluorinated grease barriers accelerates the transition to water-based coatings. The U.S. commands the majority of demand due to its advanced converting infrastructure and high consumption of coated paper products. Growth is further supported by investments from major packaging converters in fiber-based alternatives for quick-service restaurants, frozen foods, and sustainable retail packaging.

Europe

Europe accounts for around 28% of the market, supported by stringent sustainability directives such as the EU Single-Use Plastics Directive and aggressive PFAS phase-out initiatives. Major economies including Germany, France, Italy, and the Nordics are driving strong demand for water-based coatings in folding cartons, beverage cups, bakery wraps, and premium retail packaging. The region’s well-established recycling systems favor aqueous coatings over multilayer laminates, aiding circularity goals. Innovation in bio-based and compostable barrier chemistries is expanding rapidly, reinforced by corporate commitments to fiber-based packaging across foodservice, confectionery, and personal-care applications.

Asia-Pacific

Asia-Pacific holds nearly 30% of the market and remains the fastest-growing region, propelled by high-volume packaging production and rising demand from food delivery, quick-commerce, and processed food industries. China, India, Japan, and Indonesia are major contributors, with increasing regulatory efforts to curb plastic waste accelerating the shift to repulpable aqueous barrier systems. Export-oriented packaging suppliers in APAC are adopting water-based coatings to meet Western sustainability standards. Growth in molded fiber applications, takeaway packaging, and moisture-resistant food wraps further strengthens demand, positioning the region as a critical hub for long-term market expansion.

Latin America

Latin America represents about 6% of the global market, showing steady adoption as sustainability awareness rises among packaging producers and consumer goods companies. Brazil and Mexico drive most regional demand, transitioning from PE laminates and wax coatings toward recyclable, water-based alternatives. Regulatory initiatives targeting single-use plastics support uptake in foodservice, bakery, and dairy packaging. Although infrastructure modernization progresses slowly, multinational packaging firms are expanding local operations, increasing availability of aqueous barrier solutions. Growth in quick-service restaurants, beverage cups, and fast-moving consumer goods reinforces the region’s gradual but consistent market penetration.

Middle East & Africa

The Middle East & Africa region holds roughly 4% share, with adoption driven by growing packaged food consumption, urbanization, and expanding foodservice chains. Saudi Arabia, the UAE, and South Africa lead demand as companies adopt recyclable, PFAS-free aqueous coatings to align with emerging sustainability frameworks. Moisture- and grease-resistant coatings gain traction in bakery, confectionery, and takeaway packaging. While limited local converting capacity poses challenges, rising investment in modern coating and paper-processing facilities is improving supply availability. Increasing collaboration with global packaging manufacturers supports broader adoption across retail, hospitality, and fast-food sectors.

Market Segmentations:

By Type

- Polyethylene (PE) Coatings

- Polypropylene (PP) Coatings

- Polyethylene Terephthalate (PET) Coatings

- Metallized Coatings

- Paper-Based Coatings

- Others

By Technology

- Water-Based Coatings

- Solvent-Based Coatings

- Others

By Functionality

- Moisture Barriers

- Oxygen Barriers

- Flavor Barriers

- Grease Barriers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the aqueous barrier coatings market is characterized by strong participation from global chemical producers, specialty coating formulators, and major paper-packaging converters focused on delivering recyclable and PFAS-free barrier solutions. Leading players compete on technology innovation, regulatory compliance, film performance, and compatibility with high-speed coating lines. Companies are investing heavily in advanced polymer dispersions, bio-based binders, and hybrid barrier chemistries that enhance moisture, oxygen, and grease resistance while maintaining repulpability. Strategic collaborations between coating manufacturers and packaging converters are strengthening product customization for foodservice, e-commerce, and premium retail applications. Several players are expanding production capacity and regional distribution networks to meet rising demand for sustainable packaging. Continuous R&D investment, performance differentiation, and adherence to evolving global food-contact and environmental standards remain critical factors shaping competitive positioning across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cork Industries

- DuPont

- Follmann

- Amcor

- H.B. Fuller

- Chemline Global

- Avery Dennison

- Cattie Adhesives

- Clariant

- Dow Chemical

Recent Developments:

- In November 2025, Amcor the company announced a new “Amcor Lift-Off Winter 2025/26 Challenge”, inviting start-ups globally to develop high-performance compostable or recyclable barrier coatings for flexible and paper-based packaging.

- In April 2024, Siegwerk has introduced a new mono-PE (polyethylene) pet food bag featuring recyclable barrier coatings. This innovative packaging solution is designed to enhance sustainability in the pet food industry by allowing for easier recycling while maintaining product protection.

- In March 2024, Berry Global and Mitsubishi Gas Chemical Company have collaborated to introduce a recyclable, EVOH-free barrier coating designed for food packaging applications, specifically targeting thermoformed tubes, jars, and bottles. This innovative solution utilizes Mitsubishi’s MXD6 barrier resin, which aims to enhance the recyclability of food packaging while maintaining product freshness and safety.

Report Coverage:

The research report offers an in-depth analysis based on Type, Technology, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for aqueous barrier coatings will accelerate as global brands commit to fully recyclable and PFAS-free packaging formats.

- Water-based barrier technologies will continue replacing plastic laminates and wax coatings in foodservice, retail, and e-commerce applications.

- Advances in polymer dispersions and crosslinking chemistry will enhance moisture, oxygen, and grease resistance across broader packaging categories.

- Bio-based and compostable aqueous coating systems will gain traction as regulators tighten sustainability and end-of-life requirements.

- Adoption of high-speed, energy-efficient coating equipment will improve production efficiency for converters.

- Hybrid barrier systems combining multiple functionalities in a single layer will expand their presence in high-performance packaging.

- More global converters will integrate aqueous coatings to meet export packaging standards aligned with Western recyclability guidelines.

- Partnerships between coating manufacturers and packaging producers will drive customized, application-specific product development.

- Growing molded fiber packaging demand will create new opportunities for uniform and durable aqueous barrier solutions.

- Regulatory pressures targeting fluorochemicals and multilayer plastics will continue strengthening the market’s long-term growth trajectory.