Market overview

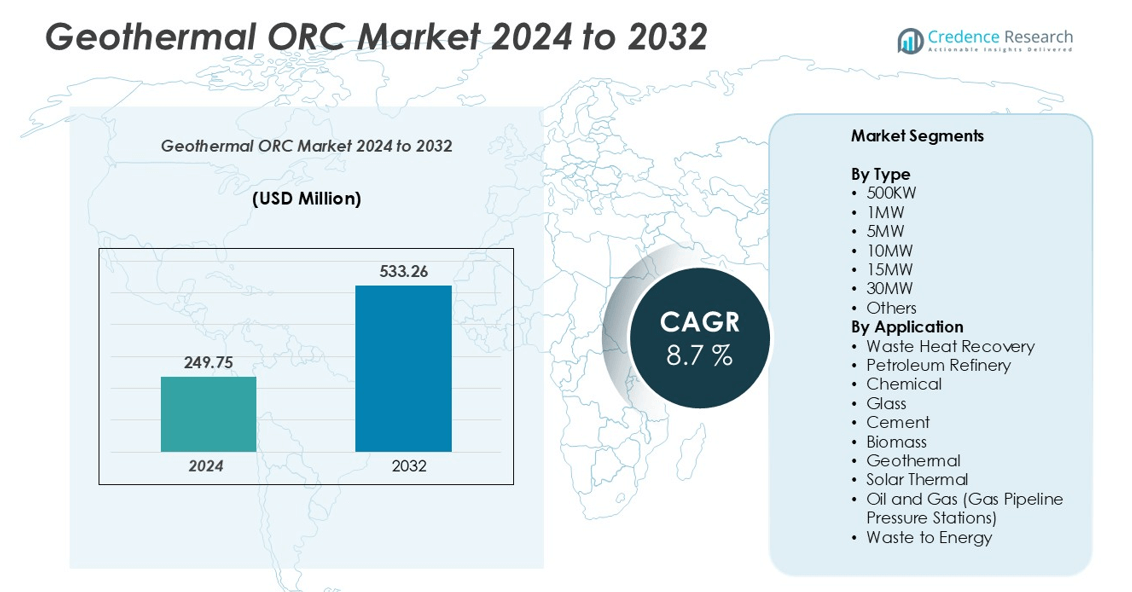

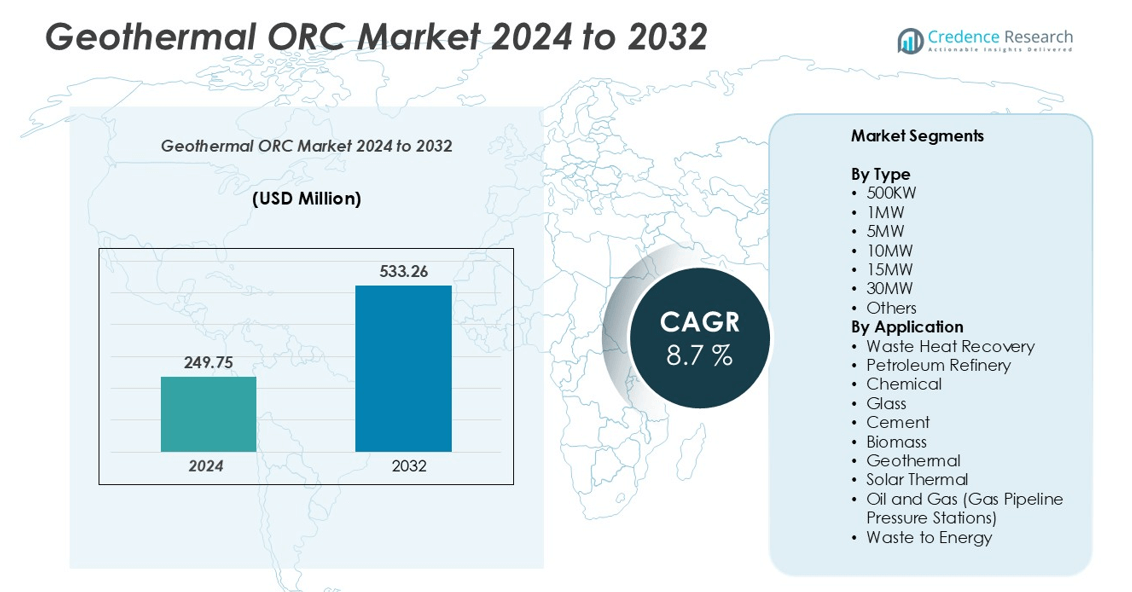

The geothermal ORC market size was valued at USD 249.75 million in 2024 and is anticipated to reach USD 533.26 million by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geothermal ORC Market Size 2024 |

USD 249.75 million |

| Geothermal ORC Market, CAGR |

8.7% |

| Geothermal ORC Market Size 2032 |

USD 533.26 million |

The Geothermal ORC market is dominated by key players such as Access Energy LLC (Calnetix Inc.), Turboden S.p.A., Siemens Energy AG, Exergy International Srl, Orcan Energy AG, Againity AB, Enogia, Triogen, Kaishan Compressor USA, and Elvosolar a.s. These companies leverage advanced ORC technologies, modular designs, and strategic partnerships to strengthen their market positions. North America leads the global market with a 35% share, driven by established industrial infrastructure and supportive renewable energy policies, followed by Europe at 28%, where stringent environmental regulations and adoption of waste heat recovery projects fuel growth. Asia-Pacific holds 22% of the market, supported by emerging industrial demand and abundant geothermal resources. Collectively, these top players focus on technological innovation, efficiency improvements, and regional expansions to capitalize on the growing demand for sustainable and cost-effective geothermal power generation solutions.

Market Insights

- The Geothermal ORC market was valued at USD 249.75 million in 2024 and is projected to reach USD 533.26 million by 2032, growing at a CAGR of 8.7% during the forecast period.

- Rising demand for renewable energy and industrial waste heat recovery is driving market growth, supported by government incentives and energy efficiency regulations across North America, Europe, and Asia-Pacific.

- Key trends include integration with hybrid renewable systems, expansion in emerging markets, and adoption of advanced modular ORC technologies for geothermal, biomass, and industrial applications.

- The market is highly competitive, with top players such as Access Energy LLC (Calnetix Inc.), Turboden S.p.A., Siemens Energy AG, Exergy International Srl, Orcan Energy AG, and Againity AB focusing on innovation, strategic partnerships, and regional expansion.

- Challenges include high initial capital investment and limited availability of suitable geothermal and industrial heat resources, while regional shares show North America 35%, Europe 28%, and Asia-Pacific 22%, with the 5MW capacity segment dominating globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Geothermal ORC market, segmented by capacity, includes 500KW, 1MW, 5MW, 10MW, 15MW, 30MW, and other capacities. Among these, the 5MW segment dominates the market, accounting for a significant share due to its optimal balance between efficiency, cost, and scalability for industrial and small utility-scale applications. Rising demand for mid-sized ORC units in renewable energy and waste-heat recovery projects is driving adoption. Key factors include technological advancements in turbine efficiency, ease of integration into existing power systems, and favorable payback periods for medium-scale installations.

- For instance, Turboden installed two separate 5.6 MWe geothermal Organic Rankine Cycle (ORC) systems for Stadtwerke München (SWM) in the Munich suburbs of Dürrnhaar and Kirchstockach, Germany. These plants produce electricity from renewable geothermal resources sourced from depths of 4 to 5 km. The heat from these plants, and from other SWM geothermal projects, is also used for district heating.

By Application:

In terms of applications, the market is divided into Waste Heat Recovery, Petroleum Refinery, Chemical, Glass, Cement, Biomass, Geothermal, Solar Thermal, Oil and Gas (Gas Pipeline Pressure Stations), and Waste to Energy. Waste Heat Recovery leads the segment, capturing the largest market share due to the high potential for energy recovery from industrial processes. Drivers include growing industrial energy costs, government incentives for energy efficiency, and increasing adoption of sustainable practices in manufacturing and energy-intensive sectors.

- For instance, Turboden has supplied a 29 MW ORC system to Energy Development Corporation in the Philippines, utilizing waste heat from an existing geothermal plant to generate additional power without the need for extra drilling.

Key Growth Drivers

Rising Demand for Renewable Energy

The increasing global emphasis on renewable energy sources is a primary growth driver for the geothermal ORC market. Governments and energy companies are actively promoting low-carbon energy alternatives to reduce greenhouse gas emissions. Geothermal ORC systems offer efficient conversion of low- to medium-temperature geothermal resources into electricity, making them suitable for sustainable power generation. Industrial sectors, particularly those with access to geothermal resources, are increasingly adopting ORC technology to meet renewable energy targets. This trend is further supported by favorable government policies, subsidies, and tax incentives, which enhance the financial viability of geothermal ORC installations. As a result, utilities and industrial players are investing heavily in geothermal ORC projects to diversify their energy mix and improve operational sustainability, driving market expansion.

- For instance, Turboden supplied a 29 MWe Organic Rankine Cycle (ORC) binary power plant to the Energy Development Corporation (EDC) in the Philippines for the Palayan Bayan expansion project. The plant is located at the BacMan geothermal facility on Luzon Island and successfully launched operations in early 2024.

Growth in Industrial Waste Heat Recovery

Industrial sectors are under pressure to improve energy efficiency and reduce operational costs, making waste heat recovery a significant growth driver for the geothermal ORC market. ORC systems can harness low-grade waste heat from industries such as cement, glass, chemical, and metal production, converting it into usable electricity without additional fuel input. Rising energy costs and stricter environmental regulations incentivize industries to implement ORC-based recovery systems. Additionally, technological advancements have improved turbine efficiency, reliability, and modularity, allowing easier integration into existing plants. As industries prioritize decarbonization and operational efficiency, ORC-based waste heat recovery solutions are becoming a preferred choice, significantly boosting the adoption of geothermal ORC technology.

- For instance, Turboden, a Mitsubishi Heavy Industries group company, signed an order to supply a waste heat recovery Organic Rankine Cycle (ORC) unit with a nominal capacity of 6.2 MW to the Düzcecam Glass Plant in Düzce, Turkey. It converts waste heat from the factory’s two float glass production lines into electricity. The plant began commercial operation in September 2018.

Technological Advancements in ORC Systems

Continuous innovation in ORC technology drives the market by enhancing system efficiency, operational flexibility, and reliability. Recent developments include high-efficiency turbines, advanced working fluids, and modular designs that support scalable deployment for industrial, geothermal, and renewable applications. These technological improvements reduce installation and maintenance costs while maximizing power output from low- to medium-temperature heat sources. Additionally, smart monitoring and control systems enable predictive maintenance and real-time performance optimization. Companies are increasingly investing in R&D to improve system adaptability for diverse energy applications, including geothermal, biomass, and solar thermal integration. Such advancements strengthen the market’s growth potential by offering energy-efficient, cost-effective, and sustainable power generation solutions.

Key Trends & Opportunities

Integration with Hybrid Renewable Systems

A notable trend in the geothermal ORC market is the integration of ORC systems with hybrid renewable energy projects, such as combining geothermal, solar thermal, and biomass sources. This approach optimizes energy output by leveraging complementary heat sources, ensuring stable and continuous power generation even during variable conditions. Hybrid systems also improve overall plant efficiency, reduce carbon footprints, and enhance the financial viability of renewable projects. This trend is supported by increasing investments in multi-source renewable plants and government incentives promoting renewable energy adoption. The growing need for decentralized, reliable, and sustainable power generation presents significant opportunities for ORC technology providers to expand their product offerings and capture a broader industrial and utility market share.

- For instance, Turboden supplied a 19 MW Organic Rankine Cycle (ORC) system to Strathcona Resources in Alberta, Canada, for its Steam Assisted Gravity Drainage (SAGD) facility. This system recovers low-grade heat, at approximately 150°C, from produced steam and non-condensable gas.

Expansion in Emerging Markets

Emerging economies are witnessing increasing demand for sustainable energy solutions, creating significant growth opportunities for the geothermal ORC market. Countries in Asia-Pacific, Latin America, and Africa are investing in geothermal exploration and small-scale industrial power projects to meet rising electricity demand. Affordable, modular ORC systems allow these regions to harness untapped geothermal and industrial heat resources efficiently. The availability of government subsidies, favorable regulatory frameworks, and international funding initiatives further accelerates market penetration. Companies entering these regions can benefit from first-mover advantages, establishing partnerships with local energy providers and industrial sectors to promote ORC adoption, driving long-term market growth.

- For instance, Turboden has supplied a 2 MWe ORC system to Ciments Du Maroc in Ait Baha, Morocco, which recovers waste heat from the cement production process to generate electricity.

Focus on Energy Efficiency and Decarbonization

A growing global emphasis on energy efficiency and carbon neutrality is shaping market opportunities. Industries are increasingly seeking solutions that reduce energy consumption and minimize greenhouse gas emissions. Geothermal ORC systems provide a viable method to convert low-grade heat into electricity without additional fuel consumption. Companies offering innovative, high-efficiency ORC solutions are gaining a competitive edge, as businesses strive to meet regulatory compliance and sustainability goals. This focus on energy efficiency opens avenues for technology providers to develop specialized ORC systems tailored to industrial, geothermal, and renewable applications, expanding market adoption and fostering long-term growth.

Key Challenges

High Initial Capital Investment

One of the primary challenges in the geothermal ORC market is the high upfront capital cost of system installation. Although ORC systems offer long-term energy savings and efficiency benefits, the initial investment in turbines, heat exchangers, and associated infrastructure can be significant, particularly for small and medium enterprises. High installation costs may deter widespread adoption, especially in emerging markets with limited access to financing. Additionally, the payback period for certain projects can be longer due to fluctuating energy prices or resource availability. Addressing this challenge requires innovative financing solutions, government incentives, and cost-effective modular ORC systems to encourage broader adoption across industrial and renewable energy sectors.

Resource and Site Limitations

Geothermal ORC deployment is often constrained by the availability of suitable geothermal resources or waste heat sources. Low-temperature geothermal sites and inconsistent industrial heat streams may limit system efficiency and output. Site-specific geological assessments and resource mapping are critical to ensure feasibility and economic viability. Furthermore, remote locations with limited infrastructure can pose logistical and operational challenges, including transportation, installation, and maintenance difficulties. These limitations necessitate careful project planning and technological adaptation to optimize energy recovery while minimizing costs, potentially slowing market growth in regions lacking ideal conditions.

Regional Analysis

North America

North America holds a significant share in the geothermal ORC market, driven by the presence of mature renewable energy infrastructure and supportive government policies promoting low-carbon power generation. The U.S. and Canada lead the region, leveraging abundant geothermal resources and industrial waste heat recovery projects. Rising investments in modular ORC systems for medium-scale power applications and industrial integration have strengthened market adoption. Technological advancements, including high-efficiency turbines and advanced working fluids, enhance operational reliability and reduce costs. The region accounts for approximately 35% of the global market, with growth propelled by industrial decarbonization initiatives and increasing renewable energy mandates.

Europe

Europe represents a substantial portion of the geothermal ORC market, with strong growth attributed to stringent environmental regulations and aggressive renewable energy targets. Countries like Germany, Italy, and Iceland are investing in geothermal and waste heat recovery projects to diversify energy sources and reduce carbon emissions. The region benefits from advanced R&D in ORC technology, focusing on low-temperature geothermal and industrial applications. Industrial sectors such as cement, chemical, and metal production are increasingly adopting ORC systems for energy efficiency. Europe accounts for roughly 28% of the global market, driven by government incentives, high electricity prices, and sustainable energy initiatives.

Asia-Pacific

The Asia-Pacific region is emerging as a high-growth market for geothermal ORC systems, supported by rising industrialization, growing energy demand, and increasing focus on renewable energy deployment. Countries such as China, Japan, Indonesia, and the Philippines are leveraging abundant geothermal resources and expanding industrial ORC applications. Rapid urbanization, industrial expansion, and government policies promoting clean energy adoption are fueling market penetration. The region’s share is estimated at 22% of the global market, with growth accelerated by low-cost modular ORC units, cross-sector industrial applications, and supportive financing models for renewable energy projects.

Latin America

Latin America is witnessing steady growth in the geothermal ORC market due to increasing adoption of renewable energy and availability of geothermal and biomass resources. Nations like Mexico, Chile, and Brazil are implementing ORC systems for geothermal power generation and industrial waste heat recovery. The region benefits from supportive government frameworks, investment incentives, and growing awareness of sustainable energy solutions. Industrial applications, particularly in the cement, glass, and metal sectors, are gradually integrating ORC systems to improve energy efficiency. Latin America accounts for around 9% of the global market, driven by emerging renewable energy infrastructure and increasing industrial energy efficiency initiatives.

Middle East & Africa

The Middle East and Africa region represents a developing market for geothermal ORC systems, with growth opportunities emerging from industrial waste heat recovery and renewable energy diversification. Countries such as South Africa, UAE, and Saudi Arabia are gradually adopting ORC technology in energy-intensive industries and pilot geothermal projects. The region faces challenges related to infrastructure and resource availability but benefits from growing energy demand and government initiatives to reduce carbon emissions. Middle East & Africa currently contribute approximately 6% of the global market, with future growth expected from investments in industrial energy efficiency, renewable integration, and strategic partnerships with ORC technology providers.

Market Segmentations:

By Type

- 500KW

- 1MW

- 5MW

- 10MW

- 15MW

- 30MW

- Others

By Application

- Waste Heat Recovery

- Petroleum Refinery

- Chemical

- Glass

- Cement

- Biomass

- Geothermal

- Solar Thermal

- Oil and Gas (Gas Pipeline Pressure Stations)

- Waste to Energy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Geothermal ORC market is highly competitive, characterized by the presence of established multinational companies and innovative niche players. Key market participants such as Access Energy LLC (Calnetix Inc.), Turboden S.p.A., Siemens Energy AG, Exergy International Srl, Orcan Energy AG, Againity AB, Enogia, Triogen, Kaishan Compressor USA, and Elvosolar a.s. are actively investing in R&D to enhance turbine efficiency, develop low-temperature ORC systems, and expand modular solutions for industrial and renewable applications. Strategic initiatives, including partnerships, joint ventures, and regional expansions, are strengthening their market positions. Companies focus on improving system reliability, reducing operational costs, and integrating smart monitoring technologies to gain a competitive edge. Increasing demand for sustainable energy solutions, industrial waste heat recovery, and geothermal applications drives intense innovation and technology differentiation, positioning these players to capture significant market share and capitalize on growing opportunities across North America, Europe, and Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Againity AB

- Access Energy LLC (Calnetix Inc.)

- Elvosolar a.s.

- Enogia

- Exergy International Srl (Nanjing TICA ENERGY Technology Co., Ltd.)

- Kaishan Compressor USA

- Orcan Energy AG

- Siemens Energy AG

- Triogen

- Turboden S.p.A.

Recent Developments

- In October 2024, Turboden announced the first project in the Kingdom of Saudi Arabia: a 13 MWe ORC power plant at Riyadh Cement Company. In alignment with the nation’s ambitious Vision 2030, the project is pivotal in advancing the Kingdom’s decarbonization agenda.

- In February 2024, Orcan Energy increased its production capacity by establishing a production unit in Kiel, Germany. The expansion will enable the company to manufacture modular systems and cater to customers globally completely.

- In January 2024, Turboden S.p.A. was awarded a contract by Strathcona Resources Ltd. to design and manufacture a single-shaft turbine Organic Rankine Cycle (ORC) system with a gross nameplate capacity of up to 19 megawatts.

- In May 2023, Turboden S.p.A. provided 2 ORC systems of 13.6 MWe each to Wood Based Panels facilities in Turkey, which will enable the generation of electricity from wood waste and residuals from the production processes

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness strong growth driven by increasing demand for renewable energy solutions.

- Industrial adoption of ORC systems for waste heat recovery will expand across cement, chemical, glass, and metal sectors.

- Mid-capacity ORC units, particularly 5MW systems, will continue to dominate due to their efficiency and cost-effectiveness.

- Technological advancements in turbines, working fluids, and modular designs will improve system performance and reliability.

- Integration with hybrid renewable energy systems, including solar thermal and biomass, will create new market opportunities.

- Emerging economies in Asia-Pacific and Latin America will drive regional market expansion.

- Smart monitoring and automation in ORC plants will enhance operational efficiency and predictive maintenance.

- Companies will increasingly pursue strategic partnerships and joint ventures to strengthen regional presence.

- Focus on decarbonization and energy efficiency will accelerate ORC adoption across industries.

- Growth will be supported by favorable government policies, incentives, and regulatory frameworks promoting sustainable energy.