Market overview

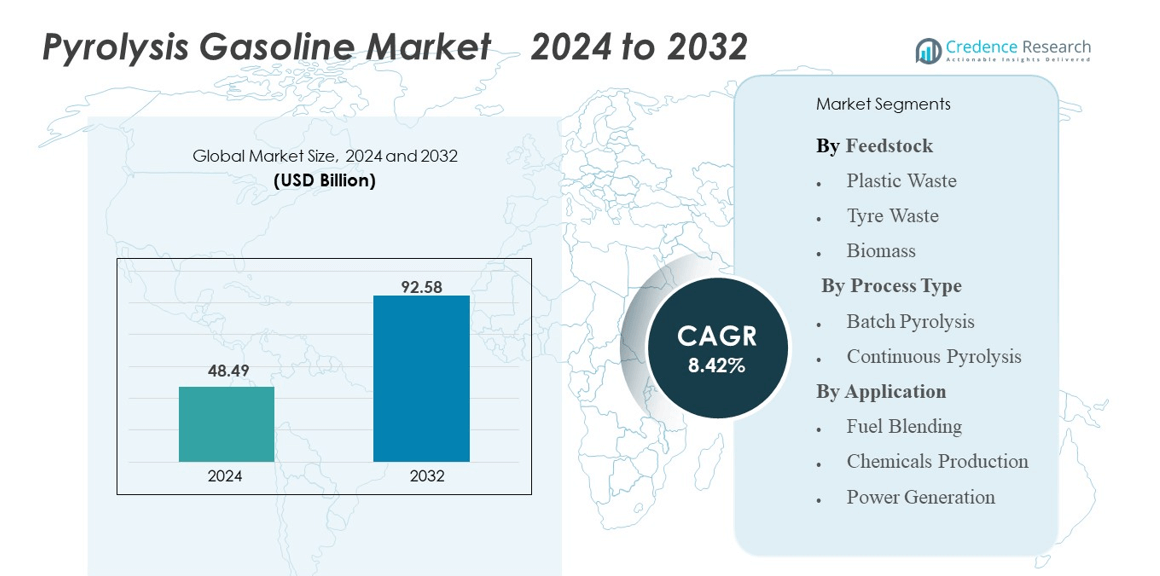

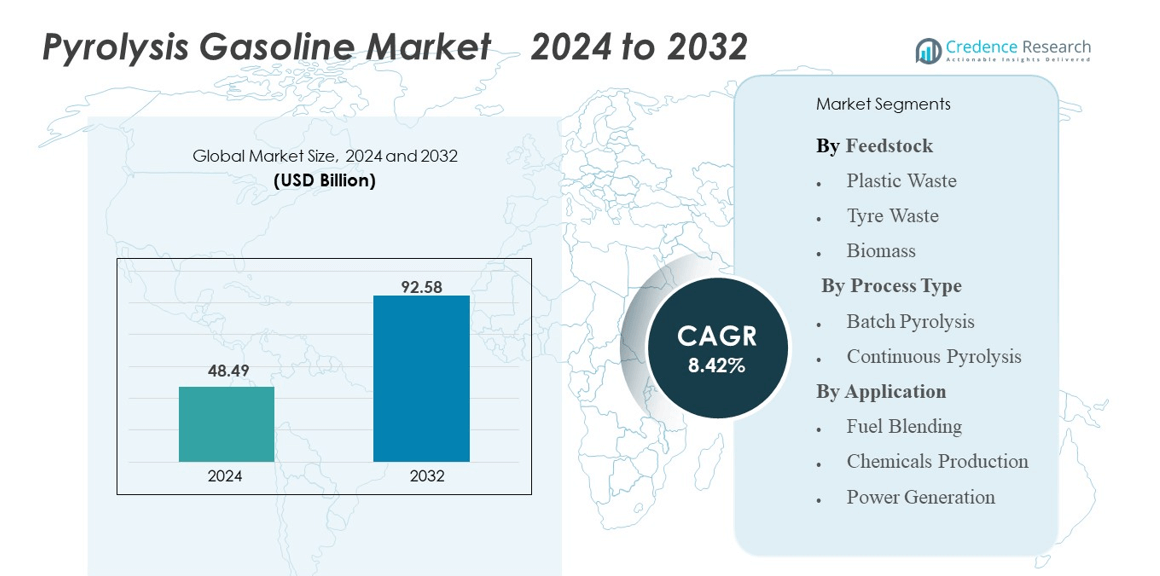

The pyrolysis gasoline market was valued at USD 48.49 billion in 2024 and is anticipated to reach USD 92.58 billion by 2032, growing at a CAGR of 8.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pyrolysis Gasoline Market Size 2024 |

USD 48.49 billion |

| Pyrolysis Gasoline Market, CAGR |

8.42% |

| Pyrolysis Gasoline Market Size 2032 |

USD 92.58 billion |

The pyrolysis gasoline market is driven by key players including Exxon Mobil Corporation, Haldia Petrochemicals Limited, Shell, ONGC Petro additions Limited, and SABIC. These companies focus on technological advancements, large-scale production, and strategic partnerships to strengthen their global footprint. Their efforts center on enhancing feedstock conversion efficiency and integrating sustainable processes to meet rising fuel demand. Asia-Pacific leads the market with a 33% share, supported by rapid industrialization, high plastic waste generation, and expanding refinery capacities. North America follows with a 31% share, backed by strong environmental regulations and advanced infrastructure. This regional leadership, combined with active industry participation, accelerates global market growth.

Market Insights

- The Pyrolysis Gasoline Market size was valued at USD 48.49 billion in 2024 and is anticipated to reach USD 92.58 billion by 2032, at a CAGR of 8.42% during the forecast period.

- Rising plastic and tyre waste generation drives strong market demand, supported by global sustainability goals and circular economy initiatives.

- Continuous pyrolysis technology leads the process segment with a dominant share, driven by high operational efficiency and stable output quality.

- The market is highly competitive, with major players such as Exxon Mobil Corporation, Haldia Petrochemicals Limited, Shell, ONGC Petro additions Limited, and SABIC investing in advanced technologies and strategic partnerships.

- Asia-Pacific holds a 33% share, North America 31%, and Europe 28%, supported by regulatory backing and infrastructure growth, while fuel blending remains the leading application segment, driving consistent market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Feedstock

Plastic waste dominates the feedstock segment with the highest market share. This dominance is driven by the growing volume of post-consumer plastics and the rising need for sustainable disposal methods. Pyrolysis of plastic waste produces high-value gasoline fractions, making it a preferred choice for refineries and chemical producers. The segment benefits from regulatory pushes to reduce landfill waste and support circular economy initiatives. Tyre waste and biomass follow, with increasing investments in advanced pyrolysis technologies that enhance conversion efficiency and reduce emissions, further strengthening their role in diversifying feedstock sources.

- For instance, ExxonMobil’s Exxtend program aims to process up to 1 billion pounds of plastic waste annually by 2027, with a projected capacity of 500 million pounds by 2026.

By Process Type

Continuous pyrolysis holds the dominant market share due to its higher operational efficiency and scalability. This process enables uninterrupted feedstock conversion, resulting in stable output quality and lower operating costs compared to batch systems. The adoption of automated controls and heat recovery systems further enhances energy efficiency and reduces carbon footprints. Batch pyrolysis remains relevant for small-scale or pilot operations but faces limitations in large-scale commercial deployment. The continuous process segment is supported by increasing investments in industrial-scale plants and growing demand for consistent pyrolysis gasoline output.

- For instance, Niutech Environment Technology Corporation’s continuous pyrolysis reactors can process 30 tons of feedstock per day and achieve thermal conversion efficiency above 85%.

By Application

Fuel blending is the leading application segment, accounting for the largest market share. The segment benefits from the growing use of pyrolysis gasoline as a blend stock in transportation fuels, driven by its high octane value and low sulphur content. Its integration into refinery streams reduces reliance on conventional crude sources and supports emission reduction goals. Chemical production is another major application, where pyrolysis gasoline serves as a feedstock for aromatics like benzene and toluene. Power generation applications are expanding gradually, supported by interest in renewable energy solutions and energy security goals.

Key Growth Drivers

Rising Plastic and Tyre Waste Generation

The rapid increase in plastic and tyre waste volumes is a major growth driver for the pyrolysis gasoline market. Landfills and incineration are becoming unsustainable due to environmental regulations and limited disposal capacity. Pyrolysis offers an efficient waste-to-fuel solution, converting non-recyclable plastic and rubber into high-value gasoline fractions. Governments and industries are adopting this process to reduce waste and support circular economy models. For instance, several large-scale facilities now process thousands of tons of waste annually, producing cleaner fuels with lower emissions. This shift reduces dependency on crude oil and aligns with global decarbonization goals. Strong regulatory backing, coupled with corporate sustainability initiatives, is accelerating investment in pyrolysis projects across developed and emerging economies.

- For instance, LD Carbon’s Dangjin plant is automated with 99.9 % of its processes monitored from the control room, enabling 24-hour continuous operation.

Growing Demand for Alternative and Cleaner Fuels

The rising need for cleaner, cost-effective fuel sources is boosting pyrolysis gasoline adoption. This fuel offers high octane value and low sulphur content, making it suitable for blending with conventional fuels. As governments tighten emission standards, industries are shifting to low-carbon fuels to meet regulatory targets. Pyrolysis gasoline supports these goals while providing an economically viable option for refineries and petrochemical producers. Its compatibility with existing infrastructure allows smooth integration into fuel supply chains. For instance, advanced pyrolysis technologies now deliver consistent quality, reducing refining costs and emissions. This advantage positions pyrolysis gasoline as a strategic solution in the energy transition. Increasing investments in renewable energy pathways further amplify its market potential.

- For instance, Shell Catalysts & Technologies offers a full line of catalysts for both the first and second-stage hydrotreatment of pyrolysis gasoline.

Advancements in Pyrolysis Technology

Technological innovation plays a critical role in driving market expansion. Modern pyrolysis systems offer higher conversion efficiency, better yield quality, and lower operational costs compared to older setups. Advanced continuous pyrolysis units can process large volumes of feedstock while ensuring stable product output. Integration of automated controls, heat recovery systems, and emission management solutions enhances system performance and environmental compliance. These innovations also attract industrial investments by improving project feasibility and scalability. For instance, several commercial plants now operate with improved energy recovery rates, reducing overall carbon footprints. The development of modular and flexible designs allows decentralized deployment in waste-heavy regions. Such advancements strengthen the commercial viability of pyrolysis gasoline and expand its application scope.

Key Trends & Opportunities

Integration with Circular Economy Models

The global shift toward circular economy principles presents major opportunities for pyrolysis gasoline producers. Governments and corporations are prioritizing recycling and resource recovery to reduce waste and carbon emissions. Pyrolysis fits this model by converting discarded plastics and tyres into valuable gasoline fractions. Integration with circular systems ensures continuous feedstock availability and stable market demand. Several industries are adopting closed-loop systems, where waste generated during production is reprocessed into fuel or chemical feedstock. This approach reduces raw material dependency and aligns with sustainability goals. Additionally, policy incentives and green certifications encourage investment in circular pyrolysis projects. As ESG goals grow in importance, companies using pyrolysis gasoline benefit from regulatory support, public trust, and competitive positioning.

- For instance, Clean Vision Corporation has begun developing a Clean-Seas facility in Belle, West Virginia, with initial plans for a processing capacity of 50 tons per day and intentions to scale up to 200 tons per day.

Expansion of Industrial and Energy Applications

The demand for pyrolysis gasoline is expanding beyond fuel blending into chemicals and energy generation. Refineries use it as a feedstock for aromatics like benzene and toluene, supporting chemical and petrochemical industries. Power generation facilities are also exploring pyrolysis gasoline as a renewable energy source due to its clean-burning properties. This diversification of end-use applications broadens market opportunities and stabilizes demand. Technological enhancements improve fuel quality, making it suitable for advanced energy systems. Additionally, strategic partnerships between waste management firms, chemical companies, and energy producers accelerate market expansion. As industries seek cost-effective, sustainable inputs, pyrolysis gasoline offers a flexible solution across multiple sectors, strengthening its long-term market position.

- For instance, Pyrocell’s value chain from forestry residue to refinery feedstock covers sawdust conversion and fuel production with about 12 employees initially operating the plant.

Regulatory Support and Incentive Programs

Strong policy frameworks and government incentives play a key role in promoting pyrolysis gasoline adoption. Many countries are implementing extended producer responsibility (EPR) schemes, emission reduction targets, and renewable energy mandates. These measures encourage industries to invest in pyrolysis facilities and integrate cleaner fuels into their operations. Financial incentives such as tax credits, subsidies, and carbon offset programs further enhance the commercial appeal. International collaborations are also driving technology transfer and large-scale project development. As climate commitments tighten, regulatory support for advanced waste-to-fuel solutions is expected to increase. This favorable policy environment creates a strong foundation for sustained market growth and technological innovation.

Key Challenges

High Capital and Operational Costs

One of the key challenges in the pyrolysis gasoline market is the high upfront investment required for commercial-scale plants. Advanced pyrolysis systems involve costly equipment, emission control units, and automation technologies. These expenses can limit adoption, especially in regions with limited financial resources or weak policy incentives. Additionally, operational costs related to energy consumption, maintenance, and skilled workforce further affect profitability. Smaller operators face difficulties achieving economies of scale, making it harder to compete with established players. Although technological advancements are gradually reducing costs, capital intensity remains a major barrier to rapid market expansion. Overcoming this challenge requires innovative financing models, stronger public-private partnerships, and targeted policy support.

Feedstock Supply and Quality Variability

Securing a stable and consistent feedstock supply is another major challenge for pyrolysis gasoline producers. Plastic and tyre waste streams often vary in composition, moisture content, and contamination levels, affecting process efficiency and fuel quality. Inconsistent input leads to fluctuating output yields, making it harder to maintain commercial-scale operations. Many regions also lack organized waste collection and segregation systems, which limits feedstock availability. Establishing reliable supply chains requires collaboration between waste management companies, municipalities, and industrial players. Developing standardized sorting and pre-processing methods can mitigate quality issues. However, until these systems mature globally, feedstock variability will remain a critical operational risk for the pyrolysis gasoline industry.

Regional Analysis

North America

North America holds a 31% market share in the pyrolysis gasoline market, supported by strong environmental regulations and advanced waste management infrastructure. The region focuses on converting plastic and tyre waste into high-value fuels, driven by circular economy initiatives. The U.S. leads the market with large-scale commercial pyrolysis projects backed by public-private partnerships. Canada also invests in renewable fuel technologies to meet emission reduction targets. High R&D spending, strong regulatory frameworks, and early adoption of advanced pyrolysis systems strengthen the region’s leadership position. Strategic collaborations among energy, chemical, and waste management companies further enhance market growth.

Europe

Europe accounts for a 28% market share, driven by strict waste reduction laws and green energy targets. Countries such as Germany, France, and the Netherlands are adopting pyrolysis technology to address plastic waste challenges and support circular economy goals. Strong government incentives and carbon neutrality targets encourage large-scale investments in pyrolysis plants. Europe benefits from a mature recycling infrastructure and well-defined regulatory frameworks, ensuring stable feedstock availability. Collaborative efforts between technology developers and energy producers accelerate commercialization. The region’s commitment to renewable energy transitions continues to position Europe as a major growth hub for pyrolysis gasoline.

Asia-Pacific

Asia-Pacific dominates the market with a 33% share, making it the largest regional segment. Rapid industrialization, rising plastic waste generation, and growing energy demand drive strong market adoption. China, India, Japan, and South Korea lead with increasing investments in pyrolysis facilities to manage waste sustainably and reduce fossil fuel dependence. Supportive government policies, expanding refinery capacities, and urbanization boost market expansion. The region’s large population and infrastructure development create consistent feedstock availability. In addition, technology partnerships with global players are accelerating commercial deployment, positioning Asia-Pacific as a key engine for market growth.

Latin America

Latin America holds an 5% market share, with Brazil and Mexico at the forefront of regional growth. Increasing waste generation and a shift toward sustainable energy solutions drive the adoption of pyrolysis technologies. Governments are promoting renewable fuel initiatives and circular economy practices to reduce environmental impact. Although infrastructure development is still evolving, growing investments from private players are enhancing production capabilities. Cross-border collaborations and pilot projects are setting the foundation for wider market penetration. As policy frameworks strengthen and technologies become more accessible, Latin America is expected to experience steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3% market share, with growth supported by rising interest in waste-to-energy solutions. Countries like the UAE and South Africa are investing in advanced pyrolysis plants to address mounting waste challenges and diversify energy sources. Limited infrastructure and funding remain constraints, but government-led sustainability programs are improving adoption rates. Strategic partnerships with international technology providers are enabling the development of efficient processing facilities. As awareness grows and regulatory support strengthens, the region is expected to become a more active participant in the global pyrolysis gasoline market.

Market Segmentations:

By Feedstock

- Plastic Waste

- Tyre Waste

- Biomass

By Process Type

- Batch Pyrolysis

- Continuous Pyrolysis

By Application

- Fuel Blending

- Chemicals Production

- Power Generation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pyrolysis gasoline market is shaped by major players such as Exxon Mobil Corporation, Haldia Petrochemicals Limited, Shell, ONGC Petro additions Limited, and SABIC. These companies focus on advancing pyrolysis technologies to enhance conversion efficiency, reduce emissions, and improve fuel quality. Strategic investments in large-scale plants, R&D collaborations, and integration with existing refinery operations strengthen their market presence. Many players are forming partnerships with waste management and energy firms to secure consistent feedstock supply and expand capacity. Technological innovation, such as continuous pyrolysis systems and advanced catalytic processes, gives them a competitive edge. Additionally, global sustainability initiatives and regulatory incentives encourage these companies to scale operations in high-growth regions. This consolidation of technological capabilities, strategic alliances, and global expansion strategies enables leading players to capture significant market share and set high entry barriers for new entrants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, Neste Corporation successfully finished its inaugural processing run with pyrolysis oil sourced from waste tires. The experiment carried out at Neste’s refinery located in Porvoo, Finland, resulted in high-quality raw materials intended for plastics and chemicals. This initiative underscores Neste’s endeavours to broaden the reach of chemical recycling beyond just plastics.

- In February 2024, APChemi opened its PUREMAXT Pyrolysis Oil Purification Plant in Mumbai, India, in February 2024. This facility is designed to upcycle plastic waste from single-use items by using TRL9 pyrolysis oil purification technology. With the launch of this plant, APChemi reaffirms its dedication to promoting chemical recycling and tackling the challenges posed by plastic waste in India.

Report Coverage

The research report offers an in-depth analysis based on Feedstock, Process Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for pyrolysis gasoline will grow steadily due to rising waste-to-fuel initiatives.

- Technological advancements will improve conversion efficiency and reduce emissions.

- Continuous pyrolysis systems will dominate future commercial-scale production.

- Fuel blending will remain the largest application, supported by clean energy policies.

- Circular economy models will ensure stable feedstock availability across industries.

- Strategic collaborations between energy and waste management firms will increase.

- Regulatory support and green incentives will accelerate market expansion.

- Asia-Pacific will continue to lead, with North America and Europe following closely.

- Large players will invest in R&D to gain a competitive edge.

- Decentralized pyrolysis plants will grow in emerging markets to meet local energy demand.