Market Overview

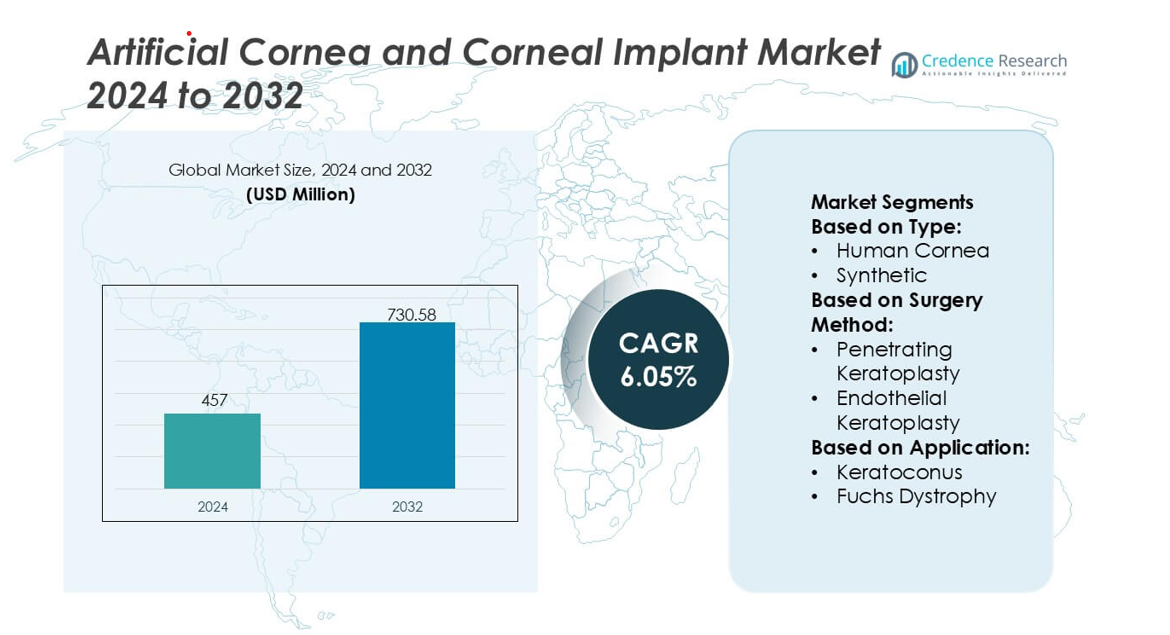

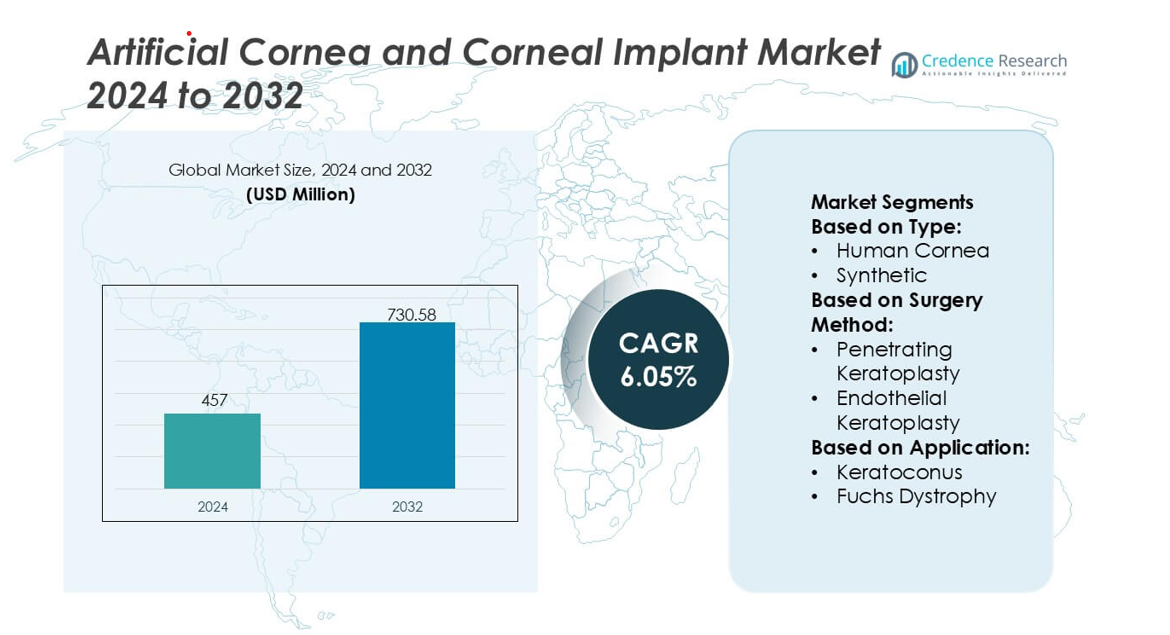

Artificial Cornea and Corneal Implant Market size was valued USD 457 million in 2024 and is anticipated to reach USD 730.58 million by 2032, at a CAGR of 6.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Cornea and Corneal Implant Market Size 2024 |

USD 457 million |

| Artificial Cornea and Corneal Implant Market, CAGR |

6.05% |

| Artificial Cornea and Corneal Implant Market Size 2032 |

USD 730.58 million |

North America stands as the leading region in the Artificial Cornea and Corneal Implant Market, holding an exact 41% market share, supported by advanced ophthalmic infrastructure, high adoption of keratoprosthesis technologies, and strong clinical participation in corneal research. The region benefits from well-established surgical training networks and consistent investment in innovation focused on biocompatible materials and long-term implant stability. Growing demand for alternatives to donor tissue and increasing prevalence of corneal disorders further reinforce its dominance. Continuous regulatory alignment and expanding access to specialized corneal transplantation centers position North America as the central hub for next-generation artificial corneal solutions within the global market.

Market Insights

- The Artificial Cornea and Corneal Implant Market was valued at USD 457 million in 2024 and is projected to reach USD 730.58 million by 2032 at a 6.05% CAGR, reflecting rising global demand for synthetic and bioengineered corneal solutions.

- Increasing cases of corneal blindness and limited donor tissue availability drive adoption of artificial corneas that offer enhanced durability, reduced rejection risk, and wider accessibility across surgical centers.

- Technological trends focus on bioengineered scaffolds, next-generation keratoprosthesis designs, and minimally invasive implantation techniques that improve long-term stability and patient outcomes.

- Competitive activity intensifies as manufacturers refine optical performance, strengthen clinical trial pipelines, and expand global distribution to meet growing procedural volume.

- North America leads with 41% market share, supported by strong research and surgical capabilities, while synthetic corneal implants represent the fastest-growing segment due to improved biocompatibility and expanding use in high-risk corneal disease cases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Human cornea implants remain the dominant segment, holding an estimated 72% market share, driven by strong clinical success rates, established donor networks, and long-term graft viability. Demand rises as eye banks improve preservation methods and global donor programs expand cross-border tissue availability. Synthetic corneas gain traction in regions with donor shortages, supported by innovations in biocompatible polymers and hydrogel-based constructs that reduce rejection risks. Growing R&D investments in biosynthetic scaffolds and 3D-printed corneal substitutes further enhance adoption, but human donor tissue continues to lead due to superior surgical familiarity and proven outcomes.

- For instance, tissue banks reported processing more than 140,000 donor tissues in a single year, supported by cell viability exceeding 2,500 cells/mm² in standard preservation workflows, reinforcing the reliability of human donor grafts.

By Surgery Method

Penetrating keratoplasty (PK) remains the leading surgery method, accounting for an estimated 58% market share, supported by its broad applicability across advanced corneal diseases and its ability to restore full-thickness structural integrity. Surgeons prefer PK for complex scarring, traumatic damage, and multi-layer degeneration, sustaining procedural volume in both developed and emerging markets. Endothelial keratoplasty (EK), including DMEK and DSAEK, continues to grow rapidly as surgeons adopt tissue-sparing techniques offering faster visual recovery, fewer sutures, and reduced postoperative complications. Its rising uptake is fueled by surgical training advances and availability of pre-stripped endothelial grafts.

- For instance, Presbia PLC demonstrated precise micro-refractive device integration with its Flexivue Microlens platform, engineered with a 3.2-mm diameter and a central 0.15-mm (or 150 µm) aperture, manufactured using sub-micron laser lathe technology that maintains optical tolerances within 0.5 µm showing how advanced micro-fabrication improves intraoperative alignment and postoperative optical clarity in corneal implant procedures.

By Application

Keratoconus represents the dominant application segment with an estimated 41% market share, supported by increasing early-stage diagnosis and rising treatment demand among younger populations. Progressive corneal thinning and irregular astigmatism drive the need for transplantation when cross-linking or corrective lenses fail to stabilize the condition. Fuchs dystrophy also shows strong growth as demographic aging expands the pool of patients requiring endothelial replacement. Infectious keratitis and corneal ulcers contribute significant demand in low- and middle-income regions, where delayed treatment and high pathogen exposure increase the likelihood of corneal scarring, necessitating advanced implant intervention.

Key Growth Drivers

Rising Global Burden of Corneal Blindness

Increasing incidence of corneal blindness caused by keratoconus, Fuchs dystrophy, trauma, and infectious keratitis drives strong demand for artificial corneas and corneal implants. Many regions face limited donor tissue availability, prompting accelerated adoption of synthetic and biosynthetic alternatives. Expanding screening programs detect corneal disorders earlier, increasing surgical intervention rates. Hospitals and ophthalmic centers invest in advanced transplantation technologies to manage growing patient volumes, strengthening market expansion. With unmet needs highest in emerging economies, manufacturers benefit from widening therapeutic gaps and rising surgical accessibility.

- For instance, AJL Ophthalmic S.A. reports that its Keraring intrastromal corneal ring segments engineered with arc lengths ranging from 90° to 210° and thickness options between 150 µm and 350 µm are manufactured from UV-transparent polymethyl methacrylate with a precision tolerance under 5 µm, enabling reproducible corneal reshaping in advanced keratoconus cases.

Advancements in Synthetic Biomaterials and Implant Design

Continuous innovation in biocompatible polymers, collagen-based scaffolds, and hydrogel constructs enhances implant durability and reduces rejection risks, strengthening clinical acceptance. Next-generation artificial corneas now integrate micro-perforated designs and surface-engineered interfaces that promote epithelial cell adhesion and natural tear film interaction. These improvements improve long-term graft stability and broaden eligibility for patients unsuitable for donor corneas. Enhanced material science, combined with rapid prototyping and simulation platforms, accelerates design cycles and regulatory approvals, creating strong momentum for synthetic and hybrid implant adoption in diverse corneal pathologies.

- For instance, CorneaGen’s Nano-Thin DMEK grafts are precision-prepared to thickness levels consistently measured between 10 µm and 20 µm, with endothelial cell counts exceeding 2,800 cells/mm² at release; the company’s micro-pressurized preparation protocol maintains graft scroll widths under 1.2 mm, significantly improving handling efficiency and reducing intraoperative manipulation times.

Growing Adoption of Minimally Invasive Corneal Surgery

Demand rises as endothelial keratoplasty techniques such as DMEK and DSAEK gain widespread clinical adoption for their faster recovery, reduced complications, and higher visual acuity outcomes. Surgeons increasingly prefer targeted tissue replacement over full-thickness transplants, driving uptake of engineered endothelial grafts and compatible artificial implant systems. Surgical training programs and pre-loaded tissue solutions improve procedural efficiency, enabling broader global adoption. Healthcare facilities prioritize minimally invasive interventions to enhance patient throughput and reduce postoperative burden, reinforcing demand for technologically advanced corneal implant solutions.

Key Trends & Opportunities

Expansion of Regenerative and Tissue-Engineered Corneal Solutions

Growing investment in stem-cell therapies, decellularized matrices, and bioengineered stromal layers presents strong commercial opportunities. Emerging platforms aim to regenerate damaged corneal tissue rather than replace it, reducing long-term graft complications. Advances in induced pluripotent stem cells and 3D-bioprinting enable creation of personalized corneal constructs with improved biomechanical properties. These innovations attract collaborations between biotech firms, academic institutions, and ophthalmic manufacturers. As clinical validation strengthens, regenerative solutions are expected to transform treatment pathways and open new revenue streams across high-need markets.

- For instance, Aurolab’s Aurovue hydrophobic intraocular lens materials are engineered with a refractive index of 1.47 and optimized surface properties below 5 nanometers in roughness to ensure high optical clarity and reduce chromatic aberration in implanted lenses.

Increasing Government and NGO Support for Corneal Transplantation Programs

Public health programs and international eye-care initiatives expand access to transplantation services, particularly in Asia, Africa, and Latin America. Governments invest in eye-banking infrastructure, surgeon training, and cross-border tissue distribution systems to address severe donor shortages. NGOs such as eye foundations and vision-restoration charities support awareness campaigns, subsidize surgical procedures, and sponsor technology adoption in underserved regions. These coordinated efforts broaden treatment coverage, reducing preventable blindness and increasing demand for both donor corneas and artificial implant alternatives.

- For instance, KeraMed, Inc. reports that its KeraKlear® non-penetrating keratoprosthesis designed for use in regions with limited donor tissue availability is manufactured with an overall diameter of 7.0 mm, a central optic thickness of available options between 200 µm and 700 µm (such as 400 µm), and an optical zone measuring 4.0 mm.

Digital Surgery Integration and AI-Assisted Corneal Diagnostics

Growing adoption of AI-enabled imaging tools and digital surgical planning systems creates new opportunities for precision corneal intervention. Platforms that integrate OCT data, endothelial cell mapping, and predictive analytics improve graft selection and reduce postoperative failures. Robotic-assisted micro-manipulation systems and navigation tools further enhance surgical consistency in complex keratoplasty cases. As digital ecosystems mature, manufacturers can integrate implants with smart surgical workflows, increasing product differentiation and improving clinical outcomes while strengthening surgeon confidence in advanced corneal technologies.

Key Challenges

Limited Donor Tissue Availability and Regional Inequity

Despite increasing awareness, global donor cornea availability remains insufficient, especially in low- and middle-income regions. Unequal access delays treatment and forces reliance on imported tissues or synthetic options, often increasing procedural costs. Eye banks face challenges in tissue preservation, logistics, and regulatory variability across borders, slowing distribution efficiency. These disparities hinder timely surgical intervention and create operational uncertainty for providers. Manufacturers must navigate fragmented supply chains and develop scalable synthetic alternatives to address persistent tissue shortages.

High Procedural Costs and Complex Regulatory Requirements

Artificial cornea and advanced implant systems involve high manufacturing, testing, and certification costs, limiting affordability for many patients and healthcare systems. Strict regulatory pathways for biocompatibility, safety, and long-term durability lengthen approval timelines, particularly for next-generation synthetic and regenerative constructs. Reimbursement gaps further constrain adoption, especially in developing markets. In addition, surgical specialization requirements raise training burdens and facility upgrade costs. These factors collectively challenge market penetration and require coordinated industry, regulatory, and clinical initiatives to reduce barriers.

Regional Analysis

North America

North America leads the market with 41% share, supported by strong ophthalmic infrastructure, widespread adoption of endothelial keratoplasty, and high availability of donor corneal tissue through established eye-banking networks. Advanced reimbursement systems and steady uptake of synthetic implants strengthen procedural accessibility across specialized centers. Research institutions and biotech firms accelerate innovation in biomaterials and regenerative corneal models, further shaping product development. Rising prevalence of Fuchs dystrophy and keratoconus contributes to sustained surgical demand. Training programs and early adoption of digital surgery tools ensure the region maintains its leadership in clinical outcomes and innovation.

Europe

Europe holds an estimated 30% market share, driven by high clinical adoption of minimally invasive keratoplasty techniques and well-regulated eye-banking frameworks across Western countries. Strong public healthcare support ensures broader patient access to transplantation, while collaborative research programs enhance development of synthetic and bioengineered corneal materials. Increasing aging demographics elevate the incidence of endothelial disorders such as Fuchs dystrophy, reinforcing procedural volume. Eastern Europe experiences growing demand as surgical capabilities expand and donor tissue distribution improves. Regulatory harmonization across the region accelerates product approvals and encourages greater uptake of next-generation artificial corneal implants.

Asia-Pacific

Asia-Pacific accounts for 21% market share, propelled by a high burden of corneal blindness, large unmet surgical need, and rapidly improving ophthalmic care capacity. Countries such as India and China witness rising demand due to increased screening rates and investment in advanced corneal surgery training. Limited donor tissue availability accelerates interest in synthetic implants and tissue-engineered substitutes. Government and NGO-led eye-care initiatives broaden access to corneal transplantation in underserved populations. Growing private-sector hospital networks and expanding adoption of keratoplasty techniques position the region as one of the fastest-growing markets globally.

Latin America

Latin America captures approximately 5% market share, influenced by expanding ophthalmic service capacity and gradual improvements in donor tissue availability through regional eye-bank collaborations. Adoption of penetrating and endothelial keratoplasty is increasing in urban centers, though disparities persist in rural areas. Rising prevalence of infectious keratitis and traumatic corneal injuries contributes to procedural demand. Budget constraints limit widespread use of premium synthetic implants, but targeted government programs and NGO partnerships support treatment expansion. Strengthening surgical training and investments in advanced diagnostic tools gradually enhance market penetration across the region.

Middle East & Africa

The Middle East & Africa region holds roughly 3% market share, shaped by severe donor tissue shortages and a high incidence of corneal blindness, particularly from infectious keratitis. Wealthier Gulf nations adopt advanced corneal transplant procedures through specialized ophthalmology centers, while many African countries rely heavily on imported donor tissue and NGO-supported surgical missions. Growing partnerships with international eye banks and investments in mobile eye-care units help improve treatment access. Limited reimbursement frameworks and infrastructure gaps challenge adoption of artificial implants, yet rising awareness and training programs slowly improve regional surgical capacity.

Market Segmentations:

By Type:

By Surgery Method:

- Penetrating Keratoplasty

- Endothelial Keratoplasty

By Application:

- Keratoconus

- Fuchs Dystrophy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Artificial Cornea and Corneal Implant Market features a focused group of specialized organizations and technology innovators, including San Diego Eye Bank, Presbia PLC, AJL Ophthalmic S.A., CorneaGen, Alcon Inc., Aurolab, KeraMed, Inc., Florida Lions Eye Bank, Massachusetts Eye and Ear, and DIOPTEX. the Artificial Cornea and Corneal Implant Market is shaped by companies and institutions that emphasize advancements in biomaterials, implant design, and tissue engineering to improve long-term visual outcomes and reduce postoperative complications. Market participants continually refine synthetic corneal substitutes, enhance optical clarity, and develop interfaces that promote stable tissue integration. A strong focus on regulatory-aligned clinical trials, surgeon training programs, and patient-centric implant innovations supports wider adoption across emerging and developed healthcare systems. Research collaborations with academic ophthalmology centers accelerate breakthroughs in hydrogel-based implants, collagen cross-linked scaffolds, and minimally invasive transplantation methods. Organizations also invest in scalable manufacturing, sterilization technologies, and worldwide distribution networks to increase implant accessibility. As innovation intensifies, firms differentiate through durability, biocompatibility, and procedural ease, contributing to a highly progressive and technology-driven competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- San Diego Eye Bank

- Presbia PLC

- AJL Ophthalmic S.A.

- CorneaGen

- Alcon Inc.

- Aurolab

- KeraMed, Inc.

- Florida Lions Eye Bank

- Massachusetts Eye and Ear

- DIOPTEX

Recent Developments

- In December 2025, Eurofins Medical Device Services launched a new GMP (Good Manufacturing Practices) PFAS testing solution for medical devices aiming to help manufacturers navigate complex global regulations and ensure patient safety by screening for these persistent chemicals, which involves advanced techniques like combustion Ion Chromatography (CIC) for total fluorine and detailed extractables & leachables (E&L) studies.

- In July 2025, ZimVie and Osstem Implant establish a strategic agreement to enhance dental implant distribution in China. ZimVie Inc. announced a strategic distribution partnership with Osstem Implant Co., Ltd. (“Osstem Implant”), a prominent provider of high-quality dental implants and integrated dental technologies worldwide.

- In July 2025, BVI (BVI Medical) won four Medical Device Network Excellence Awards for Innovation, R&D, Investments, and Product Launches, highlighting their advancements in eye care, including SERENITY IOLs and the Leos glaucoma system a significant capital raise.

- In June 2025, Straumann Group (referred to in the snippet as INSTITUT STRAUMANN AG, its official registered name) announced a major investment and strategic plan for its Villeret site.

Report Coverage

The research report offers an in-depth analysis based on Type, Surgery Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for artificial corneas will rise as the global shortage of donor tissue continues to challenge corneal transplantation volumes.

- Advancements in biomimetic polymers and hydrogel-based materials will improve implant durability and biocompatibility.

- Surgeons will adopt minimally invasive implantation techniques that reduce recovery time and surgical risks.

- Regulatory approvals for next-generation keratoprosthesis systems will accelerate market expansion in both developed and emerging regions.

- Increased investment in tissue engineering will enable scalable production of lab-grown corneal constructs.

- Integration of AI-assisted surgical planning will enhance precision and help standardize implant outcomes.

- Cross-industry collaborations will support innovation in optical performance and long-term device stability.

- Hospitals will prioritize implants with reduced rejection rates to improve patient satisfaction and procedural efficiency.

- Rising prevalence of corneal diseases will encourage greater adoption of synthetic and hybrid corneal solutions.

- Expansion of training programs for ophthalmic surgeons will support broader market penetration and patient access.