Market Overview

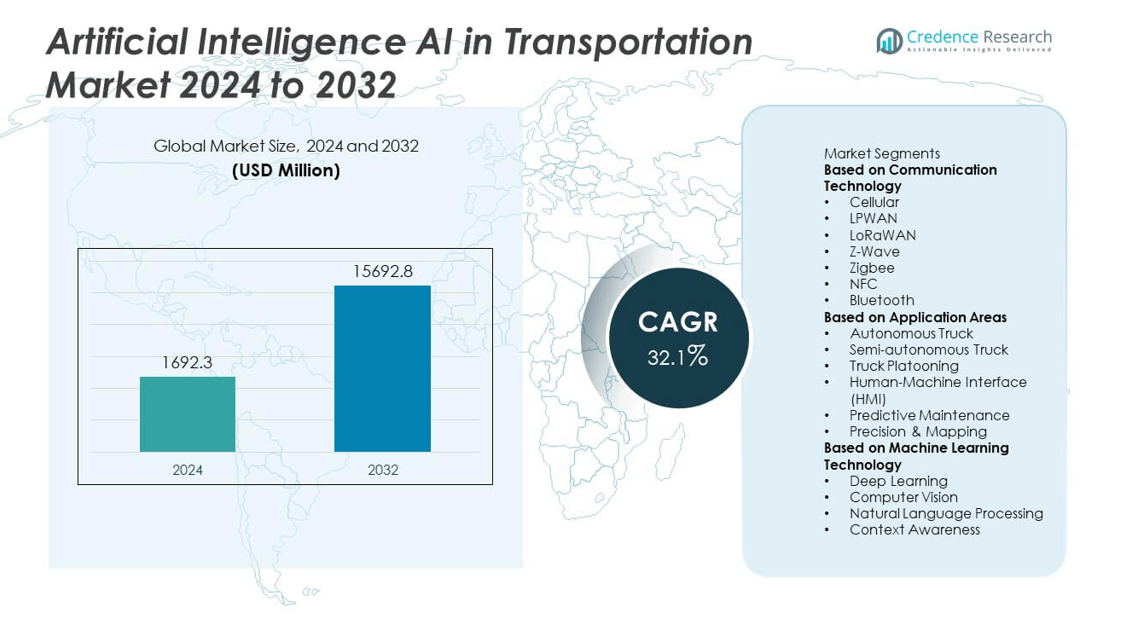

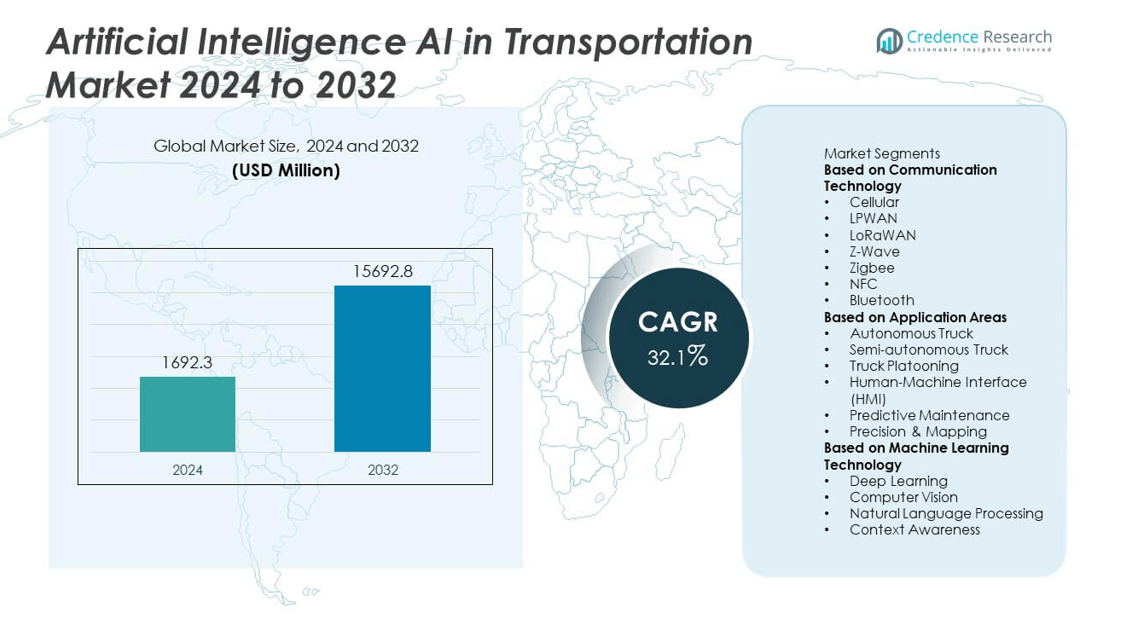

The Artificial Intelligence (AI) in Transportation Market was valued at USD 1,692.3 million in 2024 and is projected to reach USD 15,692.8 million by 2032, expanding at a CAGR of 32.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Intelligence (AI) in Transportation Market Size 2024 |

USD 1,692.3 million |

| Artificial Intelligence (AI) in Transportation Market, CAGR |

32.1% |

| Artificial Intelligence (AI) in Transportation Market Size 2032 |

USD 15,692.8 million |

The Artificial Intelligence (AI) in Transportation Market advances with rising demand for autonomous driving, predictive maintenance, and real-time traffic management. It gains momentum from increasing adoption of AI-powered analytics to optimize fleet operations, enhance safety, and reduce operational costs. Growing integration of connected vehicle technologies and smart infrastructure strengthens market expansion. Trends highlight rapid development in computer vision and natural language processing.

The Artificial Intelligence (AI) in Transportation Market shows strong adoption across North America, Europe, Asia-Pacific, and emerging regions, driven by advancements in smart mobility infrastructure and supportive government policies. North America leads with early integration of autonomous vehicle systems, AI-powered traffic management, and connected logistics platforms. Europe focuses on sustainable transport initiatives, with AI enhancing electric mobility, predictive maintenance, and public transit efficiency. Asia-Pacific sees rapid expansion due to large-scale smart city projects, high urbanization, and investment in autonomous freight and passenger solutions. Key players shaping the market include Siemens Mobility, Huawei Technologies Co., Ltd., Intel Corporation, and Robert Bosch GmbH, all of which invest heavily in AI algorithms, IoT integration, and cloud-based transportation platforms to improve safety, efficiency, and environmental performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Artificial Intelligence (AI) in Transportation Market was valued at USD 1692.3 million in 2024 and is projected to reach USD 15692.8 million by 2032, growing at a CAGR of 32.1% during the forecast period.

- Rising adoption of AI-based predictive analytics, autonomous driving technologies, and intelligent traffic management systems drives market growth by improving operational efficiency and safety.

- Growing integration of AI with IoT, cloud computing, and edge analytics supports advancements in real-time fleet tracking, route optimization, and automated maintenance scheduling.

- Leading companies such as Siemens Mobility, Huawei Technologies Co., Ltd., Intel Corporation, and Robert Bosch GmbH focus on developing AI-powered solutions for autonomous vehicles, connected infrastructure, and logistics automation.

- High implementation costs, data privacy concerns, and the need for extensive infrastructure upgrades restrain market expansion, particularly in developing economies.

- North America leads the market with strong investments in AI transportation infrastructure, Europe emphasizes sustainability and regulatory compliance, and Asia-Pacific experiences rapid growth driven by smart city initiatives and high urbanization rates.

- The market benefits from global collaboration between governments, OEMs, and technology providers to accelerate the adoption of AI-based transportation solutions, enabling improved efficiency, reduced emissions, and enhanced passenger safety across regions.

Market Drivers

Advancement in Autonomous and Semi-Autonomous Vehicle Technologies

The Artificial Intelligence AI in Transportation Market expands with the growing integration of AI into autonomous and semi-autonomous vehicle systems. It enables real-time perception, decision-making, and navigation by processing vast volumes of sensor and camera data. Advanced driver assistance systems (ADAS) powered by AI enhance safety and reduce human error in complex traffic environments. Leading automotive manufacturers invest heavily in AI-based algorithms to improve lane detection, adaptive cruise control, and collision avoidance. The demand for higher levels of automation in passenger and commercial vehicles strengthens the adoption rate. Continuous improvement in deep learning models supports greater accuracy and reliability in autonomous driving functions.

- For instance, VW’s software arm Cariad and Bosch jointly pilot SAE Level 2 and Level 3 autonomy features—such as hands‑off, eyes‑off object recognition—in vehicles like the ID. Buzz, targeting consumer‑ready deployment by mid‑2026

Optimization of Fleet Management and Logistics Operations

AI-driven solutions in fleet management transform route optimization, predictive maintenance, and fuel efficiency strategies. It allows transportation companies to reduce operational costs and improve delivery timelines through advanced analytics. Machine learning models forecast vehicle wear and tear, minimizing downtime through proactive servicing. Real-time tracking systems integrated with AI provide dynamic rerouting based on traffic, weather, and delivery constraints. Logistics providers gain competitive advantage through automated scheduling and resource allocation. The efficiency gains in large-scale freight and passenger transport encourage wider deployment of AI-enabled platforms.

- For instance, a U.S. logistics company reduced unplanned downtime by 73% and saved $1.7 million annually by deploying an AI-powered predictive maintenance solution across a fleet of 450 trucks.

Enhancement of Traffic Management and Smart Infrastructure

The Artificial Intelligence AI in Transportation Market benefits from its role in modernizing traffic control systems and urban mobility planning. It processes data from traffic sensors, connected vehicles, and surveillance cameras to optimize signal timings and reduce congestion. Predictive analytics support traffic flow adjustments in response to changing road conditions. Governments deploy AI-powered platforms to manage incidents, improve road safety, and enhance public transport efficiency. Integration with smart city infrastructure enables coordinated transportation networks. The focus on sustainable mobility drives investment in AI systems that reduce emissions and improve travel time reliability.

Growth in Safety, Compliance, and Risk Mitigation Applications

AI plays a crucial role in enhancing safety standards and regulatory compliance in the transportation sector. It supports driver monitoring systems that detect fatigue, distraction, and unsafe driving behavior. Predictive safety analytics identify high-risk areas and potential hazards before incidents occur. Transportation companies use AI to ensure adherence to safety regulations through automated reporting and incident analysis. The technology helps insurers and fleet operators assess risk profiles more accurately. Increased emphasis on accident prevention and liability reduction strengthens the demand for AI-powered safety tools. The scalability of such solutions across diverse transportation modes ensures long-term market relevance.

Market Trends

Expansion of AI-Powered Autonomous Mobility Solutions

The Artificial Intelligence AI in Transportation Market advances with increasing deployment of AI in autonomous vehicles and mobility services. It enhances perception, mapping, and decision-making, enabling safer and more efficient transportation systems. Autonomous taxis, shuttles, and delivery vehicles integrate AI-driven sensor fusion and path planning technologies. Leading OEMs and tech firms collaborate to refine autonomous driving algorithms for diverse urban and highway environments. Pilot projects in multiple cities accelerate consumer acceptance and regulatory readiness. The trend strengthens the role of AI as a core enabler of future mobility ecosystems.

- For instance, Waymo expanded its commercial robotaxi service in March 2025 to Silicon Valley and Austin, deploying over 1,500 self-driving vehicles and providing over 200,000 fully autonomous paid trips weekly across multiple U.S. cities.

Integration of AI with Internet of Things (IoT) in Smart Transportation

AI integration with IoT platforms transforms real-time monitoring, predictive analytics, and connected infrastructure operations. It processes data from vehicles, roadside units, and infrastructure sensors to optimize traffic management and fleet operations. AI-powered IoT networks support predictive maintenance by analyzing engine health and component performance. Cities deploy integrated systems for adaptive traffic signaling, parking management, and incident detection. The combination of AI and IoT improves energy efficiency and reduces congestion across transportation networks. This synergy drives large-scale adoption in both public and private mobility services.

- For instance, the city of Nagpur has deployed AI-powered speed radar systems, incorporating radar sensors and ANPR cameras on the Omkar Nagar–Manewada stretch that detect speeding vehicles in real-time—even at night—and transmit violation data instantly to the central command center, with plans to deploy such systems across 32 major roads.

Adoption of AI for Sustainability and Emission Reduction Goals

The Artificial Intelligence AI in Transportation Market aligns with global sustainability targets through AI-enabled energy management and eco-driving solutions. It analyzes driving patterns, vehicle loads, and route conditions to minimize fuel consumption and emissions. AI platforms support electric vehicle fleet optimization by managing charging schedules and battery health. Transportation agencies use AI to assess environmental impact and improve compliance with emission regulations. The focus on low-carbon mobility encourages investment in AI tools that enable greener transportation systems. This shift supports long-term adoption in both urban and intercity transport operations.

Growth of AI-Driven Predictive Analytics in Mobility Planning

Predictive analytics powered by AI plays a central role in optimizing transportation networks and planning future mobility infrastructure. It forecasts passenger demand, traffic patterns, and resource allocation with high accuracy. Public transit authorities use AI models to adjust routes and schedules based on demand fluctuations. Freight operators apply predictive insights to reduce delivery times and improve asset utilization. Integration with digital twins allows simulation of traffic scenarios and infrastructure projects before implementation. The expanding role of predictive analytics enhances operational efficiency and supports data-driven transportation policies.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Artificial Intelligence AI in Transportation Market faces significant barriers from high deployment costs and the complexity of integrating AI systems into existing transportation infrastructure. It requires substantial investments in hardware, software, and skilled personnel to ensure seamless operation. Retrofitting older vehicles or infrastructure with AI-enabled technologies often demands extensive customization and system compatibility adjustments. Smaller operators and developing regions struggle to justify the expenditure against short-term returns. Integration with legacy systems introduces risks of operational disruption and data inconsistencies. These factors slow adoption rates and create disparities in technology penetration across different markets.

Regulatory Uncertainty and Data Privacy Concerns

The regulatory environment for AI-powered transportation remains fragmented, with varying safety, liability, and compliance requirements across jurisdictions. It complicates the rollout of autonomous systems and predictive analytics platforms on a global scale. Data privacy concerns intensify as AI solutions rely on continuous collection and analysis of sensitive operational and personal information. Breaches or misuse of such data can damage public trust and stall adoption efforts. Establishing clear liability in accidents involving AI-driven vehicles remains unresolved in many regions. These regulatory and ethical challenges require coordinated policy frameworks to ensure safe, transparent, and equitable deployment of AI in transportation.

Market Opportunities

Expansion of Autonomous and Connected Vehicle Ecosystems

The Artificial Intelligence AI in Transportation Market offers strong growth potential through advancements in autonomous and connected vehicle technologies. It benefits from the rising demand for self-driving solutions that enhance safety, reduce congestion, and improve fuel efficiency. AI-powered systems enable real-time decision-making, route optimization, and predictive maintenance, supporting fleet operators and logistics providers. Increasing deployment of vehicle-to-everything (V2X) communication strengthens traffic coordination and hazard detection capabilities. Collaborations between automakers, AI developers, and infrastructure providers accelerate technology integration. Expanding 5G networks further improve the performance and reliability of connected transportation systems.

Adoption in Intelligent Traffic Management and Predictive Logistics

Opportunities emerge from the growing implementation of AI in traffic management, urban mobility, and logistics optimization. It enables smart traffic signal control, dynamic congestion management, and real-time rerouting to enhance urban transport efficiency. AI-driven predictive analytics support accurate demand forecasting, inventory management, and delivery scheduling for logistics companies. Smart infrastructure integration with AI improves safety monitoring and incident response times. Governments and municipalities invest in AI-enabled transport planning to support sustainability goals and reduce emissions. The combination of AI with IoT and cloud platforms creates scalable solutions for both public and private sector transportation networks.

Market Segmentation Analysis:

By Communication Technology

The Artificial Intelligence AI in Transportation Market segments by communication technology into vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and other advanced connectivity frameworks. V2V technology supports the exchange of real-time data between vehicles to improve safety, reduce collisions, and enhance traffic flow. V2I communication enables integration with smart traffic lights, toll systems, and roadway sensors, facilitating coordinated transport management. It leverages 5G and edge computing to ensure low latency in data transmission, which is essential for autonomous driving and high-speed mobility applications. The adoption of hybrid communication systems combining multiple channels ensures resilient and uninterrupted operations across diverse transport environments.

- For instance, Qualcomm Technologies completed trials of its C-V2X direct communication platform with Audi and Ducati, achieving sub-20 millisecond latency for collision warning alerts and lane-change assistance across a 40 km urban test route in Ingolstadt, Germany.

By Application Areas

The Artificial Intelligence AI in Transportation Market serves applications in autonomous driving, traffic management, predictive maintenance, freight operations, and passenger mobility services. Autonomous driving applications rely on AI for object detection, decision-making, and route optimization. Traffic management uses AI algorithms to analyze real-time conditions and dynamically adjust traffic flows, reducing congestion. Predictive maintenance systems detect potential vehicle or infrastructure failures before they occur, lowering downtime and operational costs. In freight operations, AI supports load optimization, fuel management, and efficient delivery scheduling. Passenger mobility services integrate AI for personalized travel planning, dynamic pricing, and seamless multimodal transport experiences.

- For instance, Siemens Mobility deployed its AI-powered Railigent X platform for Deutsche Bahn, processing over 6 billion sensor data points per month from train components to predict failures up to 21 days in advance, reducing unscheduled downtime by 12% across its high-speed ICE fleet.

By Machine Learning Technology

The Artificial Intelligence AI in Transportation Market divides by machine learning technology into supervised learning, unsupervised learning, reinforcement learning, and deep learning. Supervised learning dominates in predictive analytics for traffic patterns, vehicle diagnostics, and logistics demand forecasting. Unsupervised learning identifies patterns in unlabelled transport data, supporting anomaly detection and network optimization. Reinforcement learning plays a key role in autonomous navigation by enabling vehicles to adapt to changing environments through trial-and-error strategies. Deep learning excels in image recognition for lane detection, pedestrian identification, and object classification. It supports the development of sophisticated AI models that process vast datasets from onboard sensors, cameras, and connected infrastructure to deliver highly accurate, real-time transport intelligence.

Segments:

Based on Communication Technology

- Cellular

- LPWAN

- LoRaWAN

- Z-Wave

- Zigbee

- NFC

- Bluetooth

Based on Application Areas

- Autonomous Truck

- Semi-autonomous Truck

- Truck Platooning

- Human-Machine Interface (HMI)

- Predictive Maintenance

- Precision & Mapping

Based on Machine Learning Technology

- Deep Learning

- Computer Vision

- Natural Language Processing

- Context Awareness

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 36.2% of the global Artificial Intelligence AI in Transportation Market share, driven by early adoption of autonomous driving technologies, advanced telematics, and strong investment in connected infrastructure. The United States leads regional demand with extensive pilot programs for AI-based public transit optimization, autonomous truck deployment, and predictive traffic control systems. Federal and state-level initiatives, such as the U.S. Department of Transportation’s ITS Joint Program Office, encourage AI integration into urban and highway networks. Canada contributes with investments in AI-enabled fleet management systems, particularly in long-haul freight operations across challenging terrains. High penetration of 5G and edge computing infrastructure supports low-latency AI applications, ensuring real-time decision-making for both passenger and freight mobility.

Europe

Europe accounts for 29.4% of the market share, supported by strict safety regulations, sustainable mobility goals, and extensive deployment of smart transportation projects. Countries such as Germany, the United Kingdom, France, and the Netherlands lead in AI-driven traffic management, autonomous public buses, and connected freight corridors. The European Union’s Horizon Europe program funds AI research in multi-modal transport integration and vehicle safety automation. AI applications extend to cross-border freight monitoring systems, reducing customs delays and optimizing route planning. The presence of established automotive and logistics hubs accelerates collaboration between AI developers, OEMs, and mobility service providers. Advanced public transport systems, combined with urban congestion management initiatives, further expand AI deployment across the region.

Asia-Pacific

Asia-Pacific captures 23.8% of the Artificial Intelligence AI in Transportation Market share, fueled by rapid urbanization, large-scale smart city projects, and growing demand for AI-enabled mobility solutions. China leads adoption with substantial investments in autonomous buses, AI-driven traffic enforcement, and nationwide intelligent highway systems. Japan integrates AI in logistics robotics, last-mile delivery optimization, and advanced driver-assistance systems (ADAS) for both passenger and freight vehicles. India experiences growth in AI-based fleet tracking, dynamic route planning for ride-hailing platforms, and real-time traffic analytics in congested urban areas. Government-backed infrastructure upgrades, coupled with widespread 5G rollout in countries like South Korea and Singapore, enable faster AI adoption across public and private transport sectors.

Latin America

Latin America represents 6.1% of the market share, driven by emerging investments in AI-powered fleet management and public transportation modernization. Brazil leads the region with AI-based smart ticketing systems, predictive bus scheduling, and cargo monitoring platforms for port-to-hinterland logistics. Mexico deploys AI-enhanced route optimization in commercial trucking and urban mobility solutions for megacities. The region benefits from partnerships between local transport authorities and global AI solution providers, enabling the gradual integration of connected infrastructure. Limited 5G penetration and budget constraints slow adoption, but increasing digital transformation programs create growth opportunities for AI in transport operations.

Middle East & Africa

The Middle East & Africa holds 4.5% of the Artificial Intelligence AI in Transportation Market share, with growth concentrated in Gulf Cooperation Council (GCC) countries and select African economies. The UAE and Saudi Arabia lead in deploying AI-enabled autonomous taxis, smart traffic control centers, and integrated transport data platforms as part of their national Vision 2030 strategies. South Africa implements AI for freight tracking, predictive road maintenance, and urban mobility management. Infrastructure modernization, combined with rising investments in smart ports and airport logistics, expands AI’s application scope. Government-led smart city initiatives and private sector collaborations continue to drive adoption in both passenger and freight transport networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Robert Bosch GmbH

- Scania AB

- Huawei Technologies Co.,Ltd.

- Microsoft

- Intel Corporation

- Daimler AG

- NEC Corporation

- Siemens Mobility

- Valeo

Competitive Analysis

The Artificial Intelligence (AI) in Transportation Market features strong competition among global technology leaders, automotive manufacturers, and mobility solution providers. Key players include Siemens Mobility, Huawei Technologies Co., Ltd., Intel Corporation, NEC Corporation, Microsoft, IBM, Robert Bosch GmbH, Valeo, Daimler AG, and Scania AB. These companies focus on integrating AI technologies such as machine learning, computer vision, and predictive analytics into transportation systems to enhance efficiency, safety, and sustainability. Siemens Mobility leverages AI for traffic flow optimization and predictive maintenance in rail and urban transport. Huawei Technologies Co., Ltd. develops AI-enabled 5G communication networks to support connected and autonomous vehicles. Intel Corporation offers AI chipsets and edge computing platforms to process real-time transportation data. Robert Bosch GmbH and Valeo lead in AI-based advanced driver assistance systems (ADAS) and autonomous driving solutions for commercial and passenger vehicles. Microsoft and IBM provide AI-powered cloud platforms for fleet management, traffic analytics, and logistics optimization. Daimler AG and Scania AB integrate AI into smart truck and bus operations, improving fuel efficiency and predictive servicing. Competitive differentiation lies in advanced R&D capabilities, strategic partnerships with OEMs and governments, and the ability to scale AI solutions across diverse transportation ecosystems. This dynamic competition accelerates innovation and market expansion.

Recent Developments

- In July 2025, Intel completed the spin‑out of its RealSense division into an independent company, backed by $50 million in Series A funding. RealSense depth cameras currently feature in 60% of the world’s autonomous mobile robots and humanoid robots.

- In April 2025, Daimler Truck North America began delivering its autonomous-ready Fifth Generation Freightliner Cascadia trucks to Torc Robotics’ testing fleet. These trucks incorporated redundant steering and braking systems and serve as a platform for advanced autonomy trials.

- In March 2025, the logistics industry is expected to see significant benefits from the adoption of generative and agentic AI solutions. These AI-powered technologies are predicted to drive down costs by 15%, optimize inventory by 35%, and improve service levels by 65%.

Market Concentration & Characteristics

The Artificial Intelligence (AI) in Transportation Market demonstrates a moderately high concentration, with a few global technology leaders and specialized mobility solution providers dominating innovation and deployment. It benefits from the integration of AI algorithms into traffic management, autonomous driving, fleet optimization, and predictive maintenance systems. Leading companies focus on proprietary AI platforms, sensor fusion technologies, and real-time analytics to enhance operational safety and efficiency. The market exhibits strong technological differentiation, with advancements in deep learning, computer vision, and edge computing shaping competitive positioning. It is characterized by long-term partnerships between AI developers, automotive OEMs, and logistics operators to accelerate adoption. High capital investment requirements, regulatory compliance complexity, and the need for robust data infrastructure create significant barriers to entry. Continuous R&D, coupled with integration of AI into electric and connected vehicle ecosystems, reinforces the market’s growth potential and establishes a framework for sustained technological leadership.

Report Coverage

The research report offers an in-depth analysis based on Communication Technology, Application Areas, Machine Learning Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered autonomous driving systems will accelerate in passenger and commercial vehicle fleets.

- Integration of AI in predictive maintenance will reduce downtime and optimize fleet performance.

- Expansion of AI-driven traffic management systems will enhance urban mobility efficiency.

- Growth in connected vehicle ecosystems will strengthen AI-based communication and safety features.

- Development of AI-enabled logistics platforms will improve route planning and cargo tracking accuracy.

- Implementation of AI in public transportation will increase operational reliability and passenger satisfaction.

- Advancements in computer vision will enhance object detection and collision avoidance systems.

- Deployment of AI-powered energy optimization tools will support electric and hybrid vehicle adoption.

- AI-based demand forecasting will improve transport scheduling and resource allocation.

- Collaboration between AI developers, automakers, and governments will drive regulatory frameworks for safer AI integration in transportation.