Market Overview:

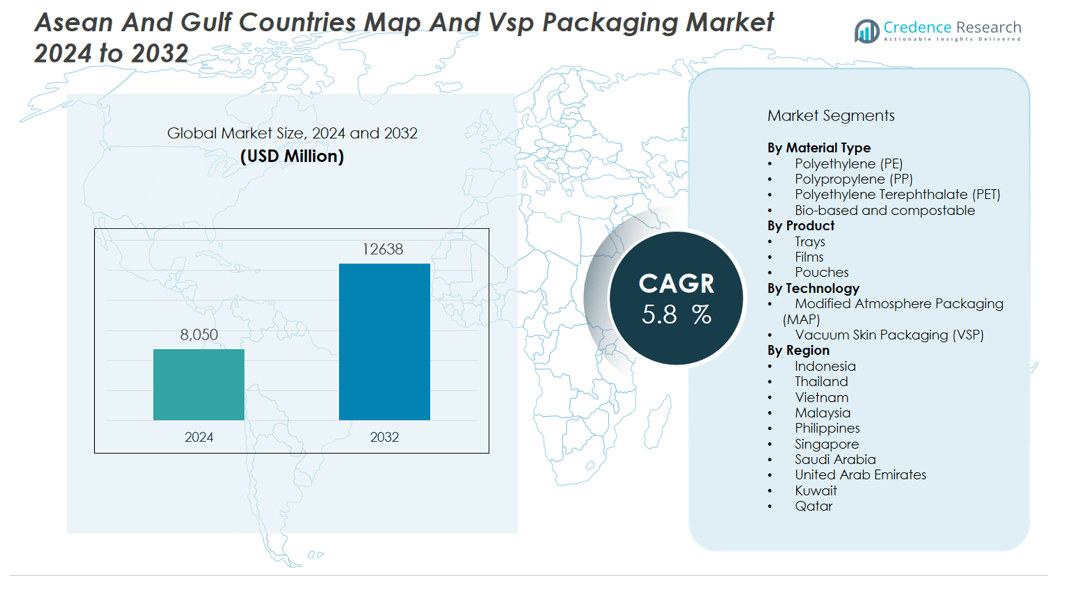

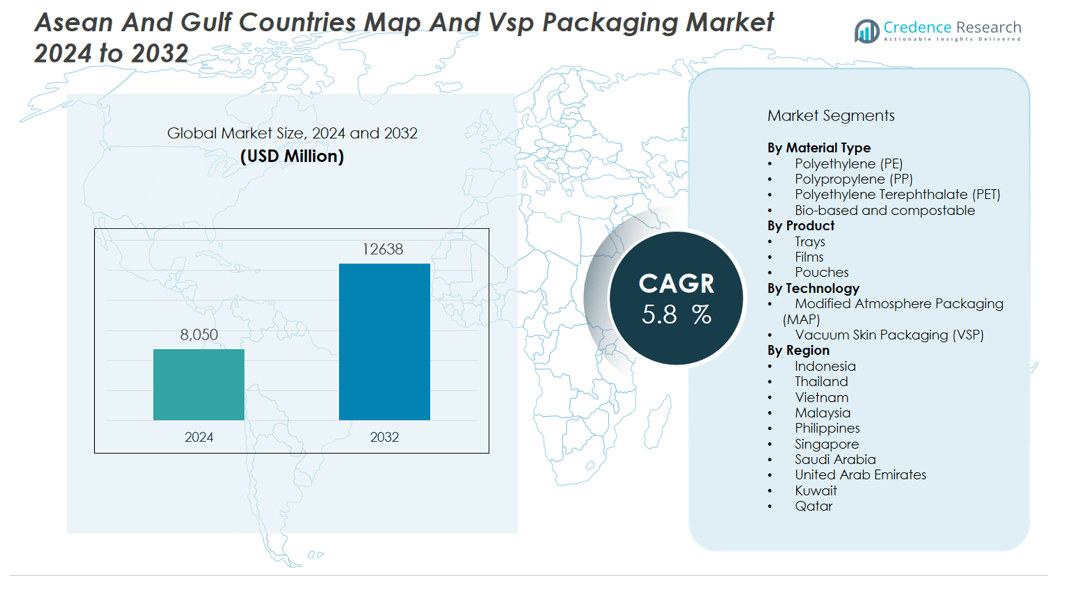

The Asean and gulf countries map and vsp packaging market size was valued at USD 8,050 million in 2024 and is anticipated to reach USD 12638 million by 2032, at a CAGR of 5.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASEAN and Gulf Countries Map and VSP Packaging Market Size 2024 |

USD 8,050 million i |

| ASEAN and Gulf Countries Map and VSP Packaging Market, CAGR |

5.8% |

| ASEAN and Gulf Countries Map and VSP Packaging Market Size 2032 |

USD 12638 million |

Key drivers shaping this market include the rising emphasis on food safety, stringent government regulations on food quality, and the need to reduce food wastage through innovative packaging. MAP and VSP technologies preserve the freshness, color, and nutritional value of perishable products by controlling the atmospheric composition inside the package. The increased adoption of ready-to-eat meals, seafood, and meat products, combined with expanding urban populations, is accelerating the shift toward advanced packaging formats. Investments in automation, packaging equipment, and cold chain logistics are further supporting market growth, with manufacturers focusing on sustainable and recyclable materials to address environmental concerns.

Regionally, the ASEAN market is led by Indonesia, Thailand, and Vietnam, where urbanization, rising incomes, and food exports drive demand for MAP and VSP solutions. In the Gulf, the United Arab Emirates and Saudi Arabia lead adoption, supported by strong foodservice, tourism, and health awareness. Companies such as Mondi Group Plc, Berry Global Inc., Klöckner Pentaplast Group, Amcor plc, Plastissimo Film Co., Ltd, and Luban Pack are expanding their presence through partnerships, capacity growth, and eco-friendly packaging innovations.

Market Insights:

- The ASEAN and Gulf countries MAP and VSP packaging market reached USD 8,050 million in 2024 and will grow to USD 12,638 million by 2032.

- Demand rises with a focus on food safety, strict regulations, and the need to reduce food wastage using advanced packaging.

- MAP and VSP solutions help preserve freshness, color, and nutrition in ready-to-eat meals, seafood, and meat, meeting urban market needs.

- Investments in automation, new equipment, and cold chain infrastructure support expansion and promote sustainable, recyclable packaging.

- Indonesia, Thailand, and Vietnam account for 53% of market share, driven by food processing, export activity, and urbanization.

- The UAE and Saudi Arabia, with a 32% share, lead in the Gulf due to tourism, foodservice growth, and food security programs.

- Malaysia, the Philippines, Singapore, Kuwait, and Qatar offer innovation and niche growth opportunities, targeting premium packaging and local food security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Food Safety and Shelf Life Extension Drives Advanced Packaging Adoption:

The ASEAN and Gulf countries MAP and VSP packaging market is advancing due to a heightened focus on food safety and longer shelf life requirements. Governments in both regions are enforcing stricter regulations to minimize food contamination and waste. Manufacturers rely on MAP and VSP technologies to ensure perishable foods remain safe, fresh, and visually appealing. This demand for secure, tamper-evident, and hygienic packaging directly supports the widespread use of these solutions. End users, especially in the meat, seafood, and dairy sectors, prioritize packaging that protects product integrity throughout supply chains. Retailers and food processors view extended shelf life as essential for reducing losses and meeting export standards.

- For instance, a study on advanced vacuum skin packaging of retail beef cuts demonstrated that bacterial growth rates were slowed by up to 2.07 log CFU/g for aerobic mesophiles, preserving meat safety and quality better than traditional vacuum packaging throughout storage at 4°C.

Urbanization, Rising Disposable Incomes, and Shifting Consumer Preferences Stimulate Market Growth:

Urbanization and higher disposable incomes in ASEAN and Gulf countries are fueling the need for convenient, ready-to-eat, and packaged foods. Modern consumers value quality, freshness, and packaging transparency, prompting rapid adoption of MAP and VSP formats. The growth of organized retail and expansion of international food brands into these markets reinforce this trend. It is enabling consumers to access a wider range of safe, attractively packaged products. Younger, health-conscious populations drive demand for minimally processed foods with clear labeling and longer shelf life. Supermarkets and hypermarkets are increasing their reliance on advanced packaging to differentiate products and maintain quality.

- For instance, Indofood, one of Indonesia’s largest food brands, launched the “Green Warmindo” program in 2023 that directly recycles flexible sachet packaging through partnerships with 350+ local food stalls, contributing to measurable reductions in post-consumer waste and supporting sustainability at the community level.

Expansion of Food Processing, Export, and Logistics Infrastructure Enhances Demand:

The expansion of food processing industries and export-oriented manufacturing in ASEAN and Gulf countries boosts the MAP and VSP packaging market. Local and international food producers invest in state-of-the-art packaging lines and automation to meet growing demand for packaged products. Improved logistics and cold chain infrastructure in both regions support efficient transportation and storage of temperature-sensitive goods. Exporters rely on MAP and VSP solutions to comply with international food safety standards and extend product shelf life during transit. This drive for operational efficiency and compliance pushes packaging companies to innovate and scale their offerings.

Sustainability Initiatives and Technological Innovations Accelerate Market Penetration:

Growing sustainability concerns and the shift toward eco-friendly materials are accelerating the adoption of advanced MAP and VSP packaging. Regional governments and corporations implement initiatives to reduce single-use plastics and promote recyclable or biodegradable options. It is leading packaging manufacturers to focus on research and development for greener solutions. Technological innovations, such as intelligent packaging and automation, increase efficiency and lower operational costs. These factors enable producers to respond quickly to market trends and regulatory requirements, securing a competitive edge. The focus on sustainability and technology integration supports long-term market expansion in both regions.

Market Trends:

Adoption of Sustainable Packaging Materials and Circular Economy Practices Intensifies:

The ASEAN and Gulf countries MAP and VSP packaging market is witnessing a decisive shift toward sustainable materials and circular economy models. Regional governments and industry leaders are prioritizing the reduction of single-use plastics, driving manufacturers to introduce recyclable, biodegradable, and compostable packaging alternatives. It has led to the launch of new product lines that meet evolving regulatory standards and align with growing consumer awareness of environmental issues. Packaging companies are forming partnerships with material suppliers to accelerate the use of bio-based polymers and eco-friendly films. Major food processors and retailers are setting clear sustainability targets and demanding packaging solutions that minimize carbon footprint. This trend is strengthening the competitive landscape and encouraging innovation across the value chain.

- For instance, Campbell Soup Company relaunched its Kettle Brand Krinkle Cut chips with new packaging that uses 43% less material, helping cut the company’s annual greenhouse gas emissions from packaging in half and preventing more than 2 million pounds of plastic waste from entering landfills each year.

Growth of E-commerce, Ready-to-Eat Foods, and Advanced Packaging Formats Shapes Demand:

Rapid expansion of e-commerce platforms and rising demand for ready-to-eat meals are transforming the ASEAN and Gulf countries MAP and VSP packaging market. It is fueling the adoption of packaging formats that deliver product freshness, safety, and extended shelf life during long distribution cycles. The integration of intelligent packaging features—such as QR codes for traceability, freshness indicators, and anti-tampering elements—improves consumer engagement and supply chain transparency. Companies are investing in flexible packaging technologies to accommodate a wider range of product sizes and formats for online retail channels. The foodservice sector is also driving demand for convenient, high-barrier, and visually appealing packaging that supports premiumization. The combined influence of digital retail and food innovation continues to shape the strategic direction of packaging manufacturers in these regions.

- For instance, Nestlé introduced QR codes on KitKat packaging, which increased customer engagement by 3-4 times and delivered direct access to nutritional details and interactive digital content to over 20 million consumers in one year.

Market Challenges Analysis:

Regulatory Complexity and Cost Pressures Restrict Market Expansion:

The ASEAN and Gulf countries MAP and VSP packaging market faces regulatory complexity across multiple jurisdictions, creating challenges for standardization and compliance. Diverse food safety laws, environmental regulations, and labeling requirements increase the burden on packaging manufacturers. It often leads to higher operational costs and delays in market entry for new products. Many small and medium-sized enterprises struggle to invest in advanced technologies and comply with evolving standards. Cost pressures from raw material price fluctuations and currency volatility further strain profit margins. Market participants must continually adapt to meet both local and international regulatory expectations.

Limited Awareness, Infrastructure Gaps, and Skill Shortages Impede Growth:

Limited awareness among smaller food producers and fragmented adoption of MAP and VSP technologies hinder full market penetration. The ASEAN and Gulf countries MAP and VSP packaging market also contends with gaps in cold chain infrastructure, especially in remote or rural regions. It restricts the effectiveness of packaging solutions designed for temperature-sensitive products. A shortage of skilled labor and technical expertise hampers the implementation and maintenance of modern packaging systems. Companies must invest in workforce development and education to address these barriers. These challenges slow the pace of innovation and reduce the market’s ability to capture emerging opportunities.

Market Opportunities:

Expansion of Premium Food and Export Markets Presents Growth Opportunities:

The ASEAN and Gulf countries MAP and VSP packaging market stands to benefit from the rising demand for premium, value-added, and export-oriented food products. Rapid urbanization and higher disposable incomes support growth in ready-to-eat meals, organic produce, and high-value seafood exports. It enables packaging suppliers to deliver advanced solutions that ensure product safety, extend shelf life, and meet stringent export standards. Opportunities exist for companies to collaborate with food processors and retailers in developing customized MAP and VSP formats. High-growth sectors such as processed meats, dairy, and bakery products are driving the need for innovation in packaging technologies. Expansion of international trade agreements further stimulates the market’s potential.

Technological Innovation and Sustainability Initiatives Drive Long-Term Value:

Investments in automation, digitalization, and sustainable materials create significant prospects for the ASEAN and Gulf countries MAP and VSP packaging market. Companies are developing intelligent packaging with freshness indicators, anti-counterfeiting features, and enhanced traceability. It improves supply chain transparency and strengthens consumer trust. The push for recyclable and biodegradable packaging solutions opens new avenues for differentiation and market leadership. Regional governments support these trends with incentives for local manufacturing and research. Early adopters of cutting-edge technologies are well-positioned to capitalize on evolving industry standards and regulatory frameworks.

Market Segmentation Analysis:

By Material Type:

The ASEAN and Gulf countries MAP and VSP packaging market records high demand for polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) films from leading producers such as Amcor, Sealed Air, and Mondi Group. It also observes rapid growth in the use of bio-based and compostable materials, with companies like NatureWorks and BASF developing sustainable alternatives. Regulatory pressures and rising consumer preference for eco-friendly packaging accelerate this segment’s evolution.

- For instance, Sealed Air’s StealthWrap film technology secures packages at speeds of up to 20 packs per minute while eliminating the need for outer shipping boxes, boosting operational efficiency.

By Product:

Trays, films, and pouches dominate product adoption in the region. MAP trays supplied by LINPAC, Berry Global, and Winpak are widely used for fresh meat and seafood. Flexible films and pouches from Flexopack and Coveris serve sliced foods, cheese, and convenience meals. It highlights strong demand for resealable, easy-to-use, and visually attractive packaging, supporting both retail and food service channels.

- For Instance, Coveris developed the MonoFlex BE pouch for grated cheese, which reduces plastic weight by 680mg per bag and enables the recycling of 411 tonnes of plastic annually, demonstrating major environmental and operational benefits for cheese packaging.

By Technology:

Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP) are the primary technology segments. MAP solutions from Multivac, ULMA Packaging, and Sealpac enhance shelf life and product freshness for a wide range of food items. VSP technology, represented by Bemis Company, G. Mondini, and Sealed Air, finds growing use in premium and export-driven food categories, valued for its product visibility, leak resistance, and ability to seal irregular shapes. It supports safety, branding, and international trade requirements.

Segmentations:

By Material Type:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Bio-based and compostable materials

By Product:

By Technology:

- Modified Atmosphere Packaging (MAP)

- Vacuum Skin Packaging (VSP)

By Region:

- Indonesia

- Thailand

- Vietnam

- Malaysia

- Philippines

- Singapore

- Saudi Arabia

- United Arab Emirates

- Kuwait

- Qatar

Regional Analysis:

Strong Demand and Export Growth Propel ASEAN Market Leadership:

Indonesia, Thailand, and Vietnam collectively account for 53% of the market share in the ASEAN and Gulf countries MAP and VSP packaging market. Rapid expansion of food processing, strong export activity, and urban population growth drive demand in these countries. Indonesia’s robust seafood and poultry industries lead the region in packaging adoption. Thailand’s role as a global food exporter supports ongoing investment in advanced MAP and VSP solutions. Vietnam’s dynamic retail sector and emerging middle class further boost demand for packaged foods. The regulatory focus on food safety and alignment with international standards enhances regional competitiveness.

Gulf Countries Accelerate Premiumization and Food Security Initiatives:

Saudi Arabia and the United Arab Emirates capture 32% of the market share within the region, propelled by strong economic diversification strategies and investments in food security. The UAE’s hospitality, tourism, and retail sectors rely on MAP and VSP technologies to deliver premium quality and safety in both domestic and export markets. Saudi Arabia’s Vision 2030 program promotes modernization of local food processing and packaging capabilities. Both countries invest in cold chain logistics and high-barrier packaging to support perishable goods and reduce food loss. The influx of multinational food brands and growth in organized retail channels intensify demand for innovative packaging formats. Government incentives for local manufacturing support regional supply chains.

Niche Growth and Innovation Opportunities in Smaller ASEAN and Gulf Markets:

Malaysia, the Philippines, Singapore, Kuwait, and Qatar collectively contribute 15% of the total market share in the ASEAN and Gulf countries MAP and VSP packaging market. Malaysia and Singapore act as innovation hubs for sustainable materials and premium packaging solutions. The Philippines’ growing middle class increases adoption of convenience foods and value-added packaging. Kuwait and Qatar prioritize food security through investments in import substitution and modern retail infrastructure. It creates targeted opportunities for companies offering tailored packaging and logistics solutions. Local players and international entrants compete by addressing evolving consumer preferences and regulatory expectations in these developing markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mondi Group Plc

- Berry Global Inc.

- Klöckner Pentaplast Group

- Amcor plc; Plastissimo Film Co., Ltd

- Luban Pack

- Sealed Air Corporation

- Swiss Pack Europe

- Al Borj Plastic Industries

- FRAGSTAR CORPORATION SDN. BHD.

- SOLOS POLYMERS PVT. LTD.

Competitive Analysis:

The ASEAN and Gulf countries MAP and VSP packaging market features a mix of global and regional competitors, each leveraging strong portfolios and regional expertise. Key players include Mondi Group Plc, Berry Global Inc., Klöckner Pentaplast Group, Amcor plc, Plastissimo Film Co., Ltd, and Luban Pack. It witnesses intense competition as companies prioritize innovation in barrier materials, sustainability, and automation. Market leaders invest in capacity expansion and new product development to capture opportunities in premium and export-oriented food segments. Regional firms focus on cost efficiency and supply chain flexibility to address local market needs. Strategic partnerships and mergers help companies strengthen distribution networks and enhance their technological capabilities. The market rewards those able to adapt quickly to evolving regulatory standards, consumer preferences, and shifts in retail and export dynamics.

Recent Developments:

- In June 2025, Mondi Group Plc launched the re/cycle PaperPlus Bag Advanced, a sustainable, high-barrier paper bag targeting humidity-sensitive products.

- In December 2024, Berry Global Inc. and VOID Technologies commercialized a new high-performance polyethylene (PE) film for pet food packaging, enabling all-PE recyclable packaging and reduced plastic density and emissions.

- In June 2024, Mondi Group Plc and Saga Nutrition launched recyclable mono-material packaging for dry pet food in France to promote circular economy practices.

Market Concentration & Characteristics:

The ASEAN and Gulf countries MAP and VSP packaging market demonstrates moderate concentration, with leading multinational and regional players controlling a significant portion of total revenues. It features a mix of established packaging conglomerates and dynamic local firms, each driving innovation through advanced materials, automation, and sustainability initiatives. Key players invest in R&D, expand production capacities, and form partnerships to address evolving food safety standards and consumer demands. The market favors companies with strong technical expertise, robust distribution networks, and the ability to offer customized solutions for diverse end-use sectors. Rapid shifts in regulatory frameworks and consumer preferences push continuous product development and competitive differentiation.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Product, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Manufacturers will expand use of recyclable and compostable materials to align with environmental policies and consumer demand.

- Companies will invest in intelligent packaging, including freshness sensors and traceability features, to support food safety.

- Firms will integrate automated MAP and VSP production lines to improve efficiency and reduce labor costs.

- Regional collaboration will increase, with joint ventures between local and global players to share expertise and drive innovation.

- Cold chain infrastructure will receive focused investment to support high-barrier packaging applications and reduce spoilage.

- Export-oriented food processors will adopt customized packaging formats to comply with international quality and shelf-life requirements.

- Governments will launch incentives and regulations promoting sustainable packaging adoption and local manufacturing capabilities.

- E-commerce expansion will push packaging providers to develop flexible, durable formats for delivery and shelf visibility.

- Small and medium enterprises will gradually adopt MAP and VSP solutions through leasing models and packaging-as-a-service offerings.

- Technological convergence of packaging and supply chain systems will improve operational transparency and strengthen brand trust.