Market Overview:

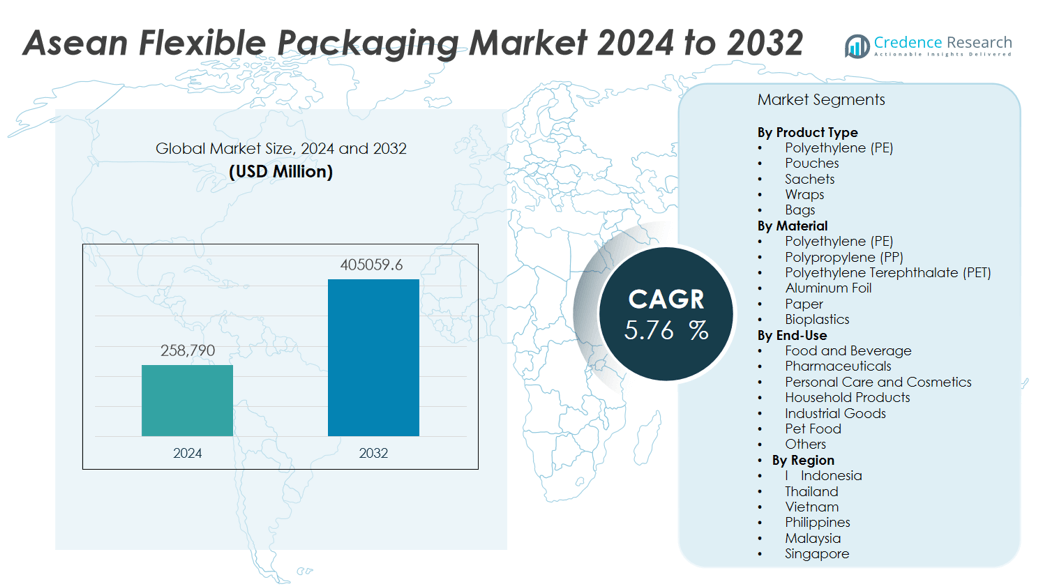

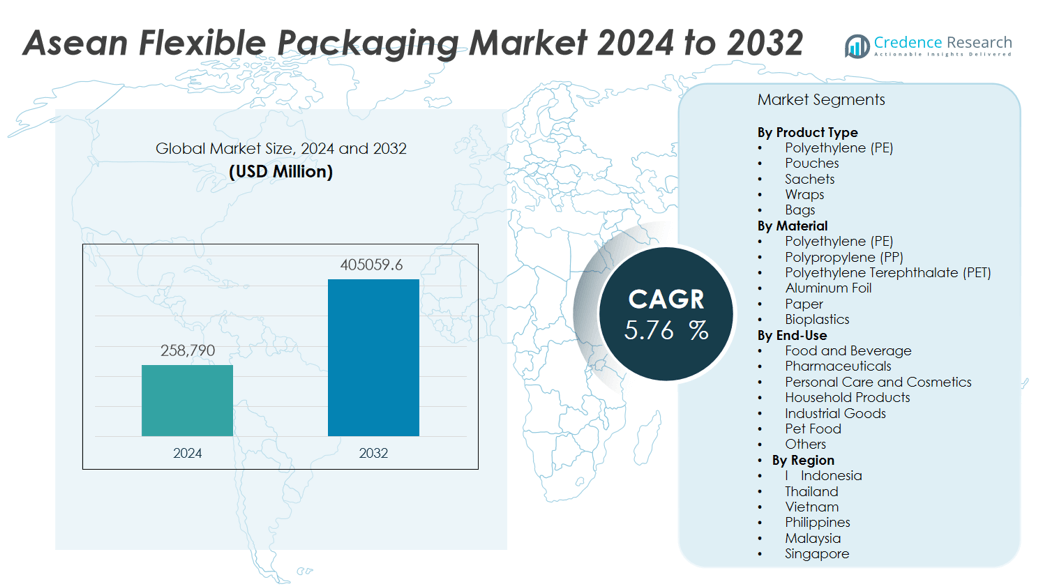

The Asean flexible packaging market size was valued at USD 258,790 million in 2024 and is anticipated to reach USD 405059.6 million by 2032, at a CAGR of 5.76 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ASEAN Flexible Packaging Market Size 2024 |

USD 258,790 million |

| ASEAN Flexible Packaging Market, CAGR |

5.76% |

| ASEAN Flexible Packaging Market Size 2032 |

USD 405059.6 million |

Market drivers include a surge in packaged and processed food consumption, increasing adoption of sustainable and recyclable materials, and heightened demand for extended shelf life and product safety. Consumer preferences are shifting towards flexible pouches, sachets, and films due to their portability, resealability, and lower environmental footprint compared to rigid alternatives. Regulatory focus on reducing plastic waste is pushing companies to invest in recyclable, biodegradable, and mono-material flexible packaging solutions. In addition, the expansion of organized retail and e-commerce channels has accelerated the need for efficient and versatile packaging formats, further boosting market growth.

Regionally, Indonesia and Thailand lead the ASEAN flexible packaging market, supported by high population densities, active food processing, and expanding retail sectors, with key players such as Prepack Thailand Co., Ltd., Mondi Group, Sealed Air Corporation, and Berry Global, Inc. Vietnam and the Philippines show rapid growth as multinational FMCG companies invest in local packaging infrastructure. Malaysia and Singapore, while smaller, contribute with advanced manufacturing and demand for specialized packaging solutions. The market remains highly competitive, with a strong focus on innovation and sustainability.

Market Insights:

- The ASEAN flexible packaging market reached USD 258,790 million in 2024 and is set to hit USD 405,059.6 million by 2032.

- Rising demand for packaged and processed foods, along with urbanization, is driving market expansion across Southeast Asia.

- Companies focus on sustainable materials, such as recyclable and biodegradable films, to meet environmental regulations and shifting consumer preferences.

- Flexible pouches, sachets, and films are gaining popularity due to portability, resealability, and a lower environmental footprint than rigid options.

- Indonesia (31% share) and Thailand (21% share) lead the market, while Vietnam and the Philippines grow rapidly due to strong FMCG investments.

- Key challenges include stricter regulations on plastic waste, volatile raw material prices, and supply chain disruptions.

- Major players such as Prepack Thailand Co., Ltd., Mondi Group, Sealed Air Corporation, and Berry Global, Inc. focus on innovation, sustainability, and high-value packaging solutions to stay competitive.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Packaged and Processed Foods:

Growth in the packaged and processed foods sector is fueling expansion in the ASEAN flexible packaging market. Urbanization and changes in consumer lifestyles are increasing the preference for ready-to-eat meals, snacks, and convenience foods. Food manufacturers are turning to flexible packaging for its ability to preserve freshness, extend shelf life, and enhance product safety. Its lightweight structure and adaptability make it ideal for a wide range of food products, including snacks, beverages, dairy, and frozen foods. The market is experiencing strong demand from multinational and local food producers. Quick turnaround times and cost efficiency further support its widespread adoption. Flexible packaging also allows for creative design and branding, strengthening shelf appeal.

- For instance, Amcor Limited, active in ASEAN, launched its LifeSpan Copper Based Film technology that improves packaging barrier performance—this solution helped extend shelf life of packaged fruits such as bananas up to 36days compared to 15days without flexible packaging.

Shift Toward Sustainable and Eco-Friendly Packaging Materials:

Rising environmental awareness is accelerating the adoption of sustainable materials in the ASEAN flexible packaging market. Companies are prioritizing recyclable, biodegradable, and compostable solutions to meet consumer and regulatory expectations. It is important for brands to demonstrate commitment to reducing plastic waste, prompting investments in innovative materials such as bio-based films and mono-material laminates. Government initiatives and industry collaborations are supporting the transition toward greener packaging. Shoppers are gravitating toward products with eco-friendly claims, influencing buying behavior. This shift is reinforcing the importance of sustainability in packaging strategies across the region.

- For instance, Storopack, serving the ASEAN region from its Singapore hub, released AIRplus® Bio Home Compostable air cushions, capable of completely composting in home settings, meeting rigorous EN 13432 certification standards.

Growth of E-Commerce and Organized Retail Channels:

Expansion of e-commerce platforms and organized retail is intensifying demand for versatile packaging formats. The ASEAN flexible packaging market benefits from increasing online sales of groceries, personal care, and household products. Flexible packaging offers protection, tamper evidence, and lightweight shipping advantages required for e-commerce fulfillment. Retailers and brand owners seek packaging that maintains product quality throughout the distribution chain. The rise of quick commerce and direct-to-consumer models calls for packaging solutions that are easy to handle, reseal, and dispose of. It also ensures efficient inventory management and enhances the unboxing experience for customers.

Technological Advancements in Materials and Printing:

Continuous advancements in packaging materials and digital printing are elevating product differentiation and performance. The ASEAN flexible packaging market is leveraging new barrier films, advanced coatings, and smart packaging features to address evolving customer needs. Innovations such as easy-peel seals, resealable closures, and interactive packaging elements add value to consumer goods. Enhanced printing capabilities allow for high-quality graphics, personalization, and anti-counterfeit features. It is enabling manufacturers to offer premium packaging experiences while ensuring functionality and safety. These technological improvements are supporting competitiveness in both local and export markets.

Market Trends:

Adoption of Sustainable and Circular Packaging Solutions:

The drive toward sustainability is redefining product development in the ASEAN flexible packaging market. Companies are investing in recyclable, compostable, and bio-based films to reduce environmental impact and comply with tightening regulations. It is common for brands to highlight sustainable packaging credentials on product labels to attract eco-conscious consumers. The use of mono-material structures is gaining ground, helping brands achieve recyclability and simplify the supply chain. Packaging producers are also implementing closed-loop recycling initiatives and collaborating with waste management organizations. Consumer demand for reduced plastic content and minimalistic designs continues to influence innovation and procurement decisions. These trends signal a strong shift toward a circular economy in packaging.

- For instance, PepsiCo achieved a milestone by incorporating 10% recycled content in its plastic packaging, and in over 30 markets, its products now use 100% recycled PET (excluding caps and labels), setting a benchmark for adoption of recycled materials in the beverage industry.

Integration of Smart Packaging and Digital Printing Technologies:

Smart packaging and digital printing technologies are driving innovation and value addition in the ASEAN flexible packaging market. Brands are incorporating QR codes, RFID tags, and NFC chips to enhance traceability, product authentication, and consumer engagement. It is now possible for manufacturers to personalize packaging with high-resolution graphics and variable data, boosting product differentiation and marketing flexibility. Advanced printing technologies support anti-counterfeit features, helping safeguard brand reputation in competitive markets. Interactive packaging elements enable real-time promotions and connect consumers directly to digital content. The market is moving toward solutions that combine visual appeal, security, and supply chain transparency. These developments are elevating the role of packaging as a key marketing and information tool.

- For instance, HP’s Indigo digital presses allow high-speed personalization for packaging, where a single HP Indigo 200K press can print up to 5,400 linear meters per hour of fully customized packaging, enabling on-demand, high-volume production runs for flexible packaging clients.

Market Challenges Analysis:

Regulatory Pressures and Sustainability Mandates:

Increasing regulatory scrutiny on plastic use and waste management is posing a major challenge for the ASEAN flexible packaging market. Governments across the region are introducing strict guidelines on recyclability, material composition, and extended producer responsibility. It creates significant compliance costs for manufacturers, who must upgrade processes and invest in sustainable alternatives. Meeting evolving eco-labeling and certification requirements remains a persistent hurdle. Rapid shifts in environmental policy often lead to uncertainty for both suppliers and brand owners. The pressure to align with global sustainability goals complicates sourcing and supply chain planning.

Volatility in Raw Material Prices and Supply Chain Disruptions:

Volatility in raw material prices continues to affect production costs and margin stability. The ASEAN flexible packaging market is vulnerable to fluctuations in polymer and resin prices, largely driven by changes in global oil markets. It faces recurring supply chain disruptions, particularly during periods of geopolitical tension or economic slowdown. Import restrictions and freight delays can cause lead times to spike, impacting inventory management for converters and end-users. Market participants must manage these risks through diversified sourcing and agile logistics strategies. This volatility constrains long-term investment and growth planning.

Market Opportunities:

Expansion in High-Growth End-Use Sectors:

Strong opportunities exist in high-growth sectors such as food and beverage, pharmaceuticals, and personal care. The ASEAN flexible packaging market can benefit from rising demand for packaged and processed products, driven by urbanization and a growing middle class. It enables brand owners to offer portion-controlled, convenient, and innovative packaging formats tailored to evolving consumer needs. The rise of health-conscious and on-the-go lifestyles supports new launches in snack, dairy, and nutraceutical segments. Brand owners seek advanced packaging features to improve shelf appeal, functionality, and product safety. This growth creates space for material innovations and value-added packaging solutions.

Acceleration of Digitalization and Smart Packaging Solutions:

Rapid advances in digital printing and smart packaging technologies offer untapped potential for differentiation and consumer engagement. The ASEAN flexible packaging market stands to gain from investments in traceability, product authentication, and personalized marketing enabled by QR codes, RFID tags, and interactive graphics. It allows brands to enhance transparency and build trust with tech-savvy consumers. Supply chain optimization through intelligent packaging also supports operational efficiency. The convergence of packaging and digital experiences presents manufacturers with new revenue streams and partnership opportunities. These developments position flexible packaging as an essential tool in the region’s digital transformation.

Market Segmentation Analysis:

By Product Type

The ASEAN flexible packaging market offers a broad range of product types, including pouches, sachets, wraps, bags, and films. Pouches hold the largest share due to their versatility, reclosability, and suitability for both solid and liquid products. Sachets and wraps gain traction in single-serve and on-the-go segments. Bags and films support bulk packaging and secondary containment, meeting the needs of food, beverage, and industrial applications.

- For instance, Mondi’s re/cycle PaperPlus Bag Advanced integrates a high-barrier 20-micron protective film to safeguard humidity-sensitive products; in trials, these bags protected 25kg of industrial powder per unit during month-long storage and transport, while meeting recyclability criteria verified by CEPI and 4Evergreen protocols.

By Material

Plastic remains the dominant material in the ASEAN flexible packaging market, with polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) leading use cases. Paper-based flexible packaging solutions are growing rapidly due to consumer demand for sustainability and regulatory support. Aluminum foil holds value in high-barrier applications for food and pharmaceutical products, ensuring shelf life and product integrity. The shift toward recyclable and bio-based materials is reshaping material selection.

- For instance, Avani Eco in Indonesia manufactures cassava-based biodegradable bags that dissolve completely in water within 150 days, with the product passing certified toxicity tests and being safe for animal consumption.

By End-Use

Food and beverage represent the largest end-use segment, supported by rising consumption of packaged, processed, and ready-to-eat products. The pharmaceutical sector adopts flexible packaging to ensure product safety and compliance with regulatory standards. Personal care and household products also utilize flexible packaging for portability, protection, and visual appeal. The ASEAN flexible packaging market responds to each end-use segment with tailored solutions to optimize performance and brand differentiation.

Segmentations:

By Product Type:

- Pouches

- Sachets

- Wraps

- Bags

- Films

- Stick Packs

- Labels

By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Aluminum Foil

- Paper

- Bioplastics

- Other Laminates

By End-Use:

- Food and Beverage

- Pharmaceuticals

- Personal Care and Cosmetics

- Household Products

- Industrial Goods

- Pet Food

- Others

By Region:

- Indonesia

- Thailand

- Vietnam

- Philippines

- Malaysia

- Singapore

- Rest of ASEAN

Regional Analysis:

Indonesia and Thailand :

Indonesia commands a 31% share and Thailand holds 21% share of the ASEAN flexible packaging market, together representing the region’s largest hubs for packaging production and consumption. Robust growth in food processing, expanding retail channels, and a rising middle class contribute to the strength of both markets. Indonesia benefits from a rapidly urbanizing population and investments in modern manufacturing facilities. Thailand serves as a regional base for multinational FMCG companies seeking high-quality packaging solutions. It remains a key supplier to the regional export market, particularly for processed foods, beverages, and personal care products. Both countries focus on sustainability and innovation, driving demand for eco-friendly materials and advanced printing technologies.

Vietnam and the Philippines :

Vietnam accounts for a 13% share and the Philippines represents a 9% share of the ASEAN flexible packaging market. Vietnam’s dynamic manufacturing sector and export-oriented economy are supporting fast adoption of flexible packaging across food, personal care, and pharmaceutical applications. The Philippines is seeing steady gains, driven by the popularity of small-format and single-serve packaging suited to local consumption habits. Both countries benefit from foreign direct investment and government incentives to develop packaging infrastructure. It is common for multinational brands to expand operations and localize production in these markets. This growth is also stimulating demand for smart packaging and digital printing solutions to address brand differentiation and regulatory compliance.

Malaysia and Singapore :

Malaysia holds a 7% share and Singapore accounts for a 5% share of the ASEAN flexible packaging market, serving distinct roles within the region. Malaysia is recognized for its strong manufacturing base and focus on high-barrier films and specialty laminates for export markets. Singapore, as a logistics and innovation hub, supports demand for premium, value-added packaging for healthcare, electronics, and luxury food applications. Both markets attract leading global packaging suppliers seeking advanced capabilities and strong quality standards. It is increasingly important for producers in Malaysia and Singapore to invest in automation, sustainability, and digital transformation to stay competitive. This focus on high-value segments positions both countries as key contributors to regional market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Prepack Thailand Co., Ltd.

- Mondi Group

- Sealed Air Corporation

- Berry Global, Inc.

- Amcor plc

- HEXACHASE GROUP

- Sonoco Products Company

- Constantia Flexibles GmbH

- SCIENTEX

- AR Packaging Group

Competitive Analysis:

The ASEAN flexible packaging market features a competitive landscape shaped by a mix of multinational corporations and strong regional players. Leading companies such as Prepack Thailand Co., Ltd., Mondi Group, Sealed Air Corporation, and Berry Global, Inc. drive innovation, scale, and product development across the region. It remains essential for participants to focus on sustainable materials, customized solutions, and digital printing to capture market share. Companies compete on product quality, supply reliability, and responsiveness to customer needs. Regional firms leverage deep market understanding and agile production to serve local brands, while global leaders invest in advanced manufacturing, automation, and R&D. Strategic alliances, capacity expansion, and acquisitions further intensify competition in the market.

Recent Developments:

- In April 2025, Mondi Group completed the acquisition of the Western Europe assets of Schumacher Packaging, significantly expanding its corrugated packaging capacity, product portfolio, and vertical integration.

- In March 2025, Berry Global presented new beauty packaging innovations, including the launch of the Grace actuator and new refillable product lines, at Cosmoprof 2025 in Bologna.

- In May 2025, Amcor plc and Metsä Group announced a partnership to develop molded fiber-based food packaging solutions focused on sustainability .

Market Concentration & Characteristics:

The ASEAN flexible packaging market demonstrates moderate concentration, with a mix of large multinational corporations and regional players competing for share. It features leading companies such as Amcor, Mondi Group, and Huhtamaki alongside strong local firms like SCG Packaging and Thai Containers Group. Competitive dynamics focus on innovation, customization, and rapid response to shifting consumer demands. Barriers to entry remain moderate due to high initial investment in technology, compliance, and supply chain capabilities. The market rewards firms that prioritize sustainable materials, advanced printing, and flexible production processes. Partnerships, capacity expansions, and product differentiation drive ongoing competition, while regulatory compliance and sustainability initiatives shape market characteristics.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Materia, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- ASEAN flexible packaging market will integrate more mono-material laminates to enhance recyclability and streamline recycling processes.

- Leading companies will invest in closed-loop systems that recover and reuse packaging waste within production networks.

- Manufacturers will expand smart packaging adoption by embedding QR codes, NFC chips, and anti-counterfeit markers.

- Production facilities will embrace automation and Industry 4.0 technologies to increase throughput while reducing labor dependency.

- Partnerships between packaging converters and waste management firms will accelerate infrastructure for material recovery in emerging markets.

- Brands will elevate product differentiation through enhanced graphic quality, tactile features, and on-pack consumer engagement tools.

- Regulatory alignment across ASEAN member states will clarify standards, reducing compliance complexity and driving regional harmonization.

- E-commerce growth will fuel demand for robust, lightweight pouches and sachets tailored to last-mile logistics.

- Startups and material innovators will introduce bio-based films and compostable options designed specifically for tropical climates.

- Investments in digital printing will grant shorter-run customization, enabling local brands and limited-edition packaging with rapid market entry.