Market Overview:

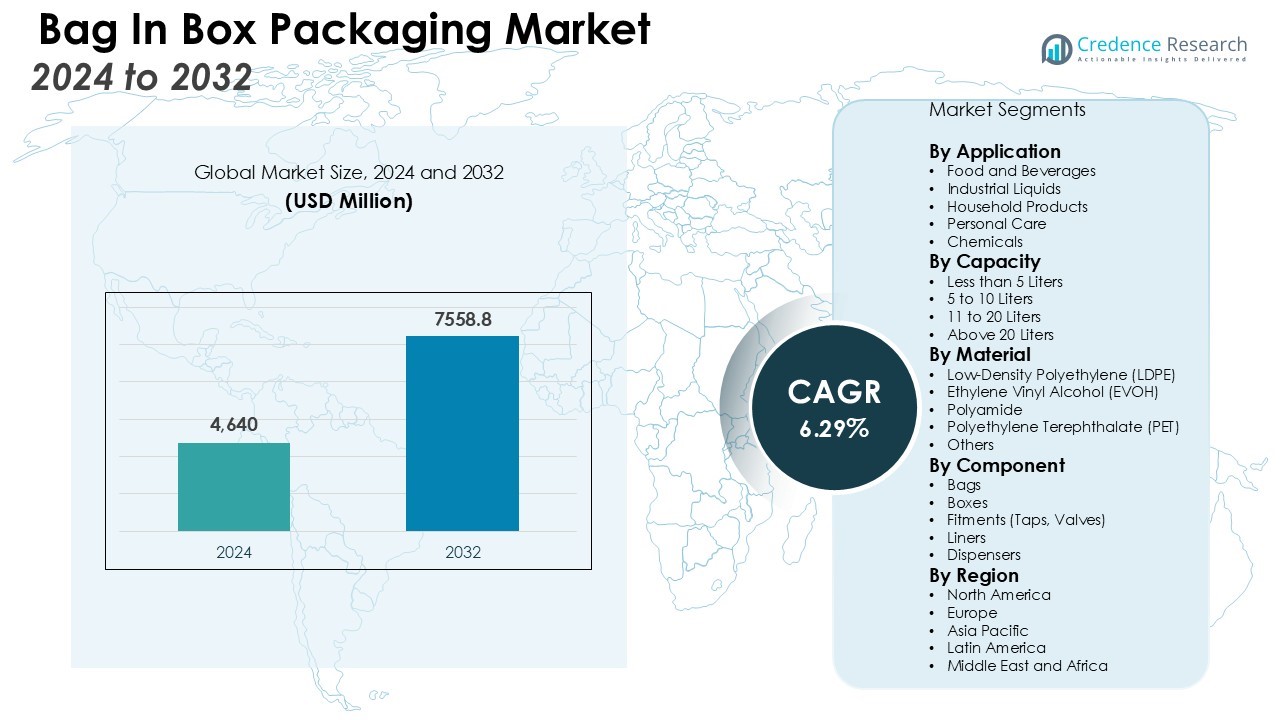

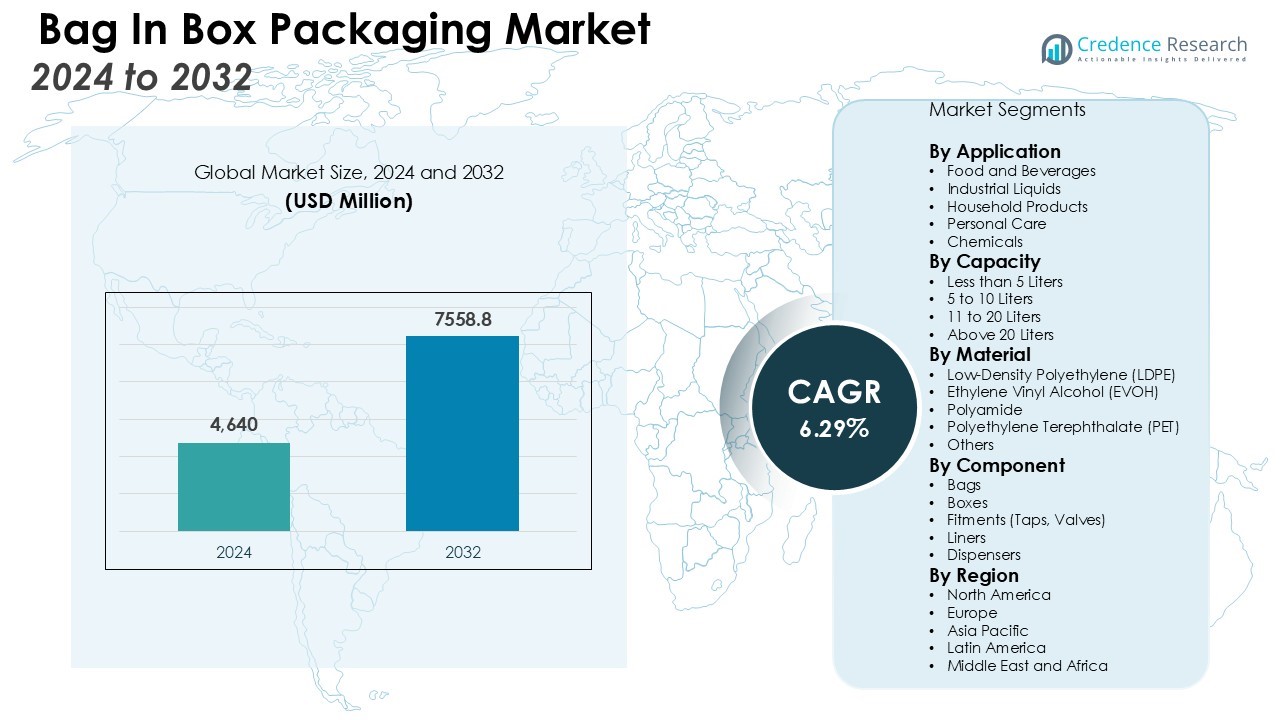

The Bag in Box Packaging Market size was valued at USD 4,640 million in 2024 and is anticipated to reach USD 7558.8 million by 2032, at a CAGR of 6.29% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bag in Box Packaging Market Size 2024 |

USD 4,640 Million |

| Bag in Box Packaging Market, CAGR |

6.29% |

| Bag in Box Packaging Market Size 2032 |

USD 7558.8 Million |

The market is primarily driven by the rising adoption of eco-friendly packaging solutions and the increasing focus on reducing carbon footprint. As environmental concerns and regulations intensify, manufacturers are shifting toward recyclable and low-impact materials used in bag-in-box systems. In the beverage sector, particularly for wine, juice, and dairy, bag-in-box formats are gaining popularity due to their ease of dispensing and preservation benefits. Growth in e-commerce and institutional food service channels further supports demand, as bag-in-box solutions enhance product handling and transportation efficiency.

Regionally, Europe leads the bag-in-box packaging market due to strong environmental policies, widespread wine consumption, and well-established supply chains. North America follows, supported by rising demand in the foodservice and household cleaning sectors and the presence of key players such as Amcor Ltd., Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, and CDF Corporation. The Asia-Pacific region is expected to register the fastest growth over the forecast period, fueled by expanding urban populations and increasing demand for packaged beverages in countries such as China, India, and Japan. Latin America and the Middle East & Africa represent emerging markets, where adoption is accelerating due to economic growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The bag in box packaging market was valued at USD 4,640 million in 2024 and will reach USD 7,558.8 million by 2032.

- Rising adoption of eco-friendly and lightweight packaging formats is driving demand across food, beverage, and industrial sectors.

- The beverage industry, especially wine, juice, and dairy, prefers bag-in-box solutions for easy dispensing and extended shelf life.

- E-commerce and institutional channels rely on these formats to improve transport efficiency and reduce breakage risks in bulk orders.

- Technological advancements in barrier films, dispensing taps, and filling systems are expanding application scope and product integrity.

- Europe leads the market with a 32% share due to strong environmental policies and high wine consumption, while North America holds a 27% share with robust innovation and e-commerce growth.

- Asia Pacific, holding a 22% share, records the fastest growth, fueled by urbanization, lifestyle changes, and increasing focus on sustainable packaging solutions.

Market Drivers:

Rising Demand for Sustainable and Lightweight Packaging Solutions:

The bag in box packaging market is witnessing strong growth due to the increasing shift toward sustainable and lightweight alternatives to rigid packaging. It offers reduced material usage and lower transportation emissions, aligning with global sustainability goals. Manufacturers across food, beverage, and industrial sectors are adopting these formats to meet environmental regulations and corporate ESG commitments. The compact design lowers packaging waste while improving shelf life and product protection. Consumer awareness of environmental issues also contributes to the rising preference for recyclable and minimal-waste formats. It allows companies to reduce packaging costs while demonstrating eco-conscious practices.

Expanding Application Across Beverage, Food, and Industrial Sectors:

The bag in box packaging market benefits from its growing adoption across multiple industries, including alcoholic beverages, dairy, edible oils, and chemicals. Wine producers in particular use this format for bulk distribution due to its extended preservation qualities. In foodservice and catering, it supports convenient dispensing and reduces spillage and product loss. The packaging format also finds applications in detergents, motor oils, and industrial lubricants, where secure storage and controlled dispensing are essential. Its versatility supports wide-scale adoption across both consumer and commercial segments. It delivers functional performance while maintaining cost-efficiency.

- For instance, Liquibox supplies industrial clients with 6-gallon (23L) bag-in-box packaging that directly replaces 24 one-quart oil bottles, drastically reducing plastic use and simplifying handling for automotive service locations.

Growth in E-commerce and Institutional Distribution Channels:

The growth of e-commerce and bulk distribution in institutional channels such as restaurants, hotels, and hospitals supports the bag in box packaging market. These channels demand packaging that reduces storage space, ensures leak-proof transport, and offers convenience in high-usage environments. Bag-in-box solutions meet these criteria while improving operational efficiency. Online grocery delivery services use them for liquid products to reduce breakage risk and ensure tamper resistance. It suits high-volume orders due to its compatibility with automated handling systems. This demand will continue to increase with rising digital retail penetration.

- For instance, SIG’s industrial bag-in-box system has demonstrated safe transport of up to 1,300 liters of liquid per bulk container, ensuring efficient supply to institutional clients such as food processing and catering operations.

Technological Advancements in Barrier Films and Dispensing Systems:

Advancements in barrier film technology and dispensing mechanisms enhance the performance of the bag in box packaging market. New multilayer films extend product shelf life by protecting against oxygen and moisture ingress. Tap and valve systems improve user convenience and ensure hygienic, drip-free dispensing. Packaging machinery innovations allow for faster, more precise filling and sealing, supporting scale and customization. These technologies expand use in sensitive products like liquid food and pharmaceuticals. It ensures product integrity across longer supply chains. Continuous innovation strengthens the competitive edge of this packaging format.

Market Trends:

Increased Adoption of Recyclable and Bio-Based Materials Across Industries:

Sustainability is shaping key trends in the bag in box packaging market, with manufacturers accelerating the use of recyclable, compostable, and bio-based films. Brands are incorporating plant-based polymers and recycled content to meet regulatory mandates and rising consumer expectations for eco-friendly solutions. The shift to mono-material structures improves recyclability while maintaining product protection. Food and beverage companies are partnering with material innovators to create packaging that reduces environmental impact without sacrificing shelf life or barrier performance. It drives demand for bag-in-box formats in premium and organic product categories. Major players are investing in R&D to advance green packaging technologies that enhance circularity.

- For instance, Liquibox, a Mondi company, launched a fully recyclable bag-in-box film called “Liquipure®,” which was adopted by WestRock for use in a commercial bag-in-box solution handling liquid volumes of up to 20 liters across dairy and beverage applications.

Expansion into New Application Areas and Customization for Brand Differentiation:

Diversification beyond traditional markets is another prominent trend in the bag in box packaging market. It now sees growing demand in non-food sectors such as personal care, homecare, and industrial chemicals. Customization options—including printed graphics, ergonomic dispensing taps, and tamper-evident features—allow brands to enhance shelf presence and user experience. The format’s compatibility with e-commerce supports new product launches and subscription-based delivery models. Rising investments in smart packaging features, such as QR codes and traceability tags, further strengthen its value proposition. It offers brands opportunities to communicate product authenticity, usage instructions, and sustainability credentials directly to consumers.

- For instance, Nestlé’s KitKat two-finger multipacks in the UK and Ireland feature packaging with an accessible Quick Response (QR) code, enabling consumers to instantly access product information, including nutritional facts, allergens, and origin details, directly from the package—a rollout that began with over 47 million packs.

Market Challenges Analysis:

Concerns Over Material Compatibility and Product Safety in Sensitive Applications:

The bag in box packaging market faces challenges regarding material compatibility with certain food and chemical products. Some products require high-performance barriers to prevent migration and contamination. It must address concerns about shelf life, flavor retention, and potential chemical leaching, especially in sensitive or high-value applications. Regulatory compliance adds complexity, demanding rigorous testing and certification of materials. Brands hesitate to switch from traditional formats without assurance of consistent quality and safety. Meeting stringent requirements while maintaining sustainability goals remains a critical challenge.

Supply Chain Complexities and Limited Consumer Perception in Emerging Regions:

The market encounters logistical hurdles in terms of storage, filling equipment, and distribution infrastructure, particularly in developing economies. The adoption of bag-in-box solutions often requires investment in specialized machinery and training. It can increase operational costs for manufacturers and suppliers unfamiliar with the format. Limited consumer awareness and preference for conventional rigid packaging slow adoption rates in some regions. Addressing these challenges requires coordinated efforts between manufacturers, distributors, and end-users to unlock the full potential of this packaging format.

Market Opportunities:

Expansion in Emerging Economies and Growth of E-Commerce Channels:

The bag in box packaging market holds significant opportunities in emerging economies, where rapid urbanization and changing consumer lifestyles fuel demand for convenient and cost-effective packaging. Growth in online grocery, foodservice, and home delivery platforms supports broader adoption. It can help manufacturers tap into new customer segments by offering efficient, lightweight, and leak-proof packaging for bulk liquids and semi-liquids. Investments in local production and distribution infrastructure will further accelerate market penetration. Brands that educate consumers about the benefits can drive preference for this innovative format. The trend toward digitized retail supports its expansion in high-volume applications.

Innovation in Smart Packaging and Sustainable Material Solutions:

Advancements in smart packaging technologies create opportunities to differentiate in the bag in box packaging market. It can integrate features such as QR codes, sensors, and interactive labels to improve product traceability, safety, and consumer engagement. The development of high-barrier, bio-based films and mono-material structures aligns with growing sustainability mandates. Customization options allow brands to enhance shelf appeal and convey environmental credentials. Partnerships with material innovators and technology providers enable the introduction of next-generation formats. These innovations support both premium positioning and regulatory compliance across diverse industries.

Market Segmentation Analysis:

By Application:

The bag in box packaging market serves a diverse range of applications, with the food and beverage sector holding the largest share. It is widely used for wine, juices, dairy products, and edible oils due to its efficiency in dispensing, preserving freshness, and minimizing waste. The format supports growth in non-food segments such as chemicals, household cleaning agents, and personal care, where safe storage and controlled dispensing are critical. The expanding use in institutional catering and foodservice strengthens its position across commercial channels.

- For instance, The Coca-Cola Company supplies 5-gallon bag-in-box syrup containers to thousands of restaurants and foodservice establishments in North America, with each 5-gallon box yielding approximately 30 gallons of finished Coca-Cola beverage when mixed.

By Capacity:

Capacity segmentation in the bag in box packaging market spans from small packs under 5 liters to large formats above 20 liters. Packs between 5 to 10 liters are most popular in retail and household settings, offering ease of handling and storage. Larger capacities meet the needs of bulk consumers such as restaurants, hotels, and industrial users who require cost efficiency and operational convenience. It allows for flexibility in packaging solutions to suit various volume requirements and distribution models.

- For instance, Vigo Ltd offers a 20-litre bag-in-box solution made with EVOH multilayer bags, each equipped with a Vitop tap that maintains the integrity of liquid foods such as juice or milk for several months after opening, while allowing hot fill up to 70°C.

By Material:

Material selection is a key factor, with the market predominantly using low-density polyethylene (LDPE), ethylene vinyl alcohol (EVOH), and other multi-layer barrier films. These materials ensure product safety, extend shelf life, and maintain flavor integrity. The market sees increasing use of bio-based and recyclable films to address sustainability demands. It emphasizes the importance of innovative material technologies for performance, compliance, and reduced environmental impact.

Segmentations:

By Application:

- Food and Beverages

- Industrial Liquids

- Household Products

- Personal Care

- Chemicals

By Capacity:

- Less than 5 Liters

- 5 to 10 Liters

- 11 to 20 Liters

- Above 20 Liters

By Material:

- Low-Density Polyethylene (LDPE)

- Ethylene Vinyl Alcohol (EVOH)

- Polyamide

- Polyethylene Terephthalate (PET)

- Others

By Component:

- Bags

- Boxes

- Fitments (Taps, Valves)

- Liners

- Dispensers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe :

Europe holds a 32% share in the bag in box packaging market, supported by robust environmental policies and mature supply chains. It benefits from the region’s high wine consumption and preference for sustainable packaging among both producers and consumers. Major economies such as France, Italy, Germany, and Spain drive demand through established food and beverage industries and advanced logistics. Regulatory frameworks push manufacturers toward recyclable and eco-friendly materials, supporting innovation. Strong partnerships between packaging converters and beverage brands fuel new product development. The region continues to set benchmarks in sustainable practices, shaping trends across the global market.

North America :

North America accounts for 27% share in the bag in box packaging market, driven by product innovation and expanding use in institutional and foodservice sectors. The United States leads with rising adoption in restaurants, hospitality, and household cleaning products, driven by cost savings and operational efficiency. The presence of major packaging companies and rapid uptake of e-commerce channels strengthen the region’s position. Manufacturers invest in advanced filling, sealing, and dispensing technologies to cater to high-volume clients. It also benefits from consumer preferences for convenient, lightweight packaging formats. Supportive regulatory policies further encourage the transition to sustainable alternatives.

Asia Pacific :

Asia Pacific holds a 22% share in the bag in box packaging market and records the fastest growth rate globally. Economic expansion, rapid urbanization, and increasing demand for packaged beverages and liquid foods drive market momentum. China, India, and Japan lead in both production and consumption, supported by a growing middle class and shifting lifestyle patterns. Government focus on sustainability and investment in modern retail formats encourage adoption of flexible packaging solutions. Local manufacturers expand their capabilities to meet rising demand from food, beverage, and industrial sectors. It remains a key region for future investment and innovation in this segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Ltd.

- Liquibox

- Scholle IPN

- Smurfit Kappa

- DS Smith

- CDF Corporation

- Accurate Box Company, Inc

- TPS Rental System Ltd

- Arlington Packaging (Rental) Limited

- CENTRAL PACKAGE & DISPLAY

- Optopack Ltd

Competitive Analysis:

The bag in box packaging market features a dynamic and competitive landscape shaped by leading companies such as Amcor Ltd., Smurfit Kappa, DS Smith, Liquibox, Scholle IPN, and CDF Corporation. These key players invest heavily in product innovation, sustainable materials, and advanced dispensing solutions to strengthen their market position. It drives competition through differentiation in quality, customization, and cost efficiency. Companies form strategic alliances and expand global footprints to access new markets and customer segments. Focus on regulatory compliance, flexible manufacturing, and supply chain optimization enables rapid response to evolving industry needs. The market rewards organizations that prioritize eco-friendly solutions and continuous technological advancement.

Recent Developments:

- In June 2025, Amcor launched a first-of-its-kind, more sustainable shrink bag for turkey breast, designed for Butterball, LLC.

- In November 2024, Amcor and Kolon Industries announced a collaboration to develop sustainable polyester packaging materials.

- In January 2024, Liquibox introduced the VINIflow® Secure Tap, a tamper-protected, recycle-ready dispensing tap designed for bag-in-box and pouch packaging.

Market Concentration & Characteristics:

The bag in box packaging market features moderate concentration, with a mix of global players and regional manufacturers shaping its competitive landscape. Leading companies focus on product innovation, sustainable material development, and strategic partnerships to expand market reach and customer base. It attracts new entrants with advancements in barrier films, dispensing systems, and automation technology. The market emphasizes cost efficiency, lightweight design, and regulatory compliance, which influences purchasing decisions across food, beverage, and industrial applications. Industry players invest in R&D and flexible production capabilities to address evolving consumer demands and regulatory requirements. Competitive differentiation hinges on quality, customization, and sustainability credentials.

Report Coverage:

The research report offers an in-depth analysis based on Application, Capacity, Material, Component and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Global adoption of eco-friendly films will accelerate, with brands investing heavily in recyclable and compostable materials.

- Suppliers will intensify efforts to optimize barrier performance while reducing plastic use to meet evolving sustainability standards.

- Technology providers will deploy smart packaging enhancements like QR codes and freshness sensors to boost traceability and user engagement.

- Beverage and foodservice sectors will shift toward bag‑in‑box formats for cost-effective, leak‑proof solutions in high‑volume dispensing.

- E‑commerce platforms will increasingly adopt bag‑in‑box packaging to minimize shipping damage and improve logistic efficiency.

- Manufacturers will expand capacity in developing markets, enhancing local production and reducing dependency on imports.

- Partnerships between material developers, converters, and brand owners will create new hybrid structures tailored to specific applications.

- Automation in filling and sealing lines will improve speed and consistency, enabling higher throughput and lower per‑unit costs.

- Industrial and chemical sectors will explore bag‑in‑box for safer handling and controlled dispensing of lubricants and cleaning agents.

- Regulatory trends will drive uniform standards for food‑contact safety, motivating manufacturers to adopt certified bag‑in‑box systems.