Market Overview:

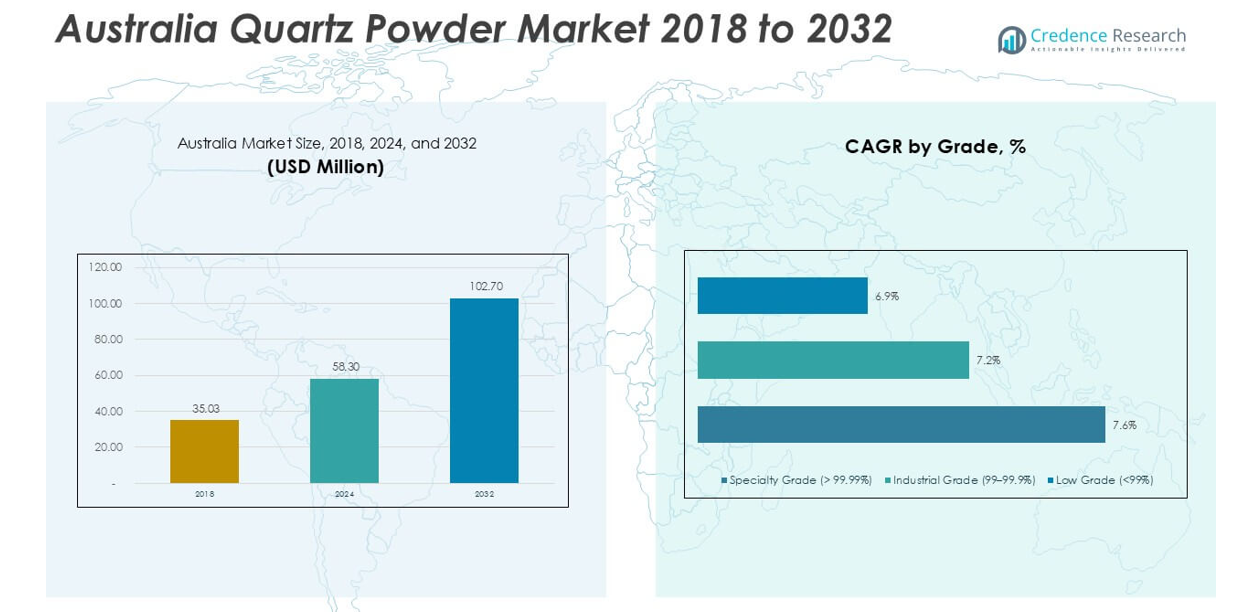

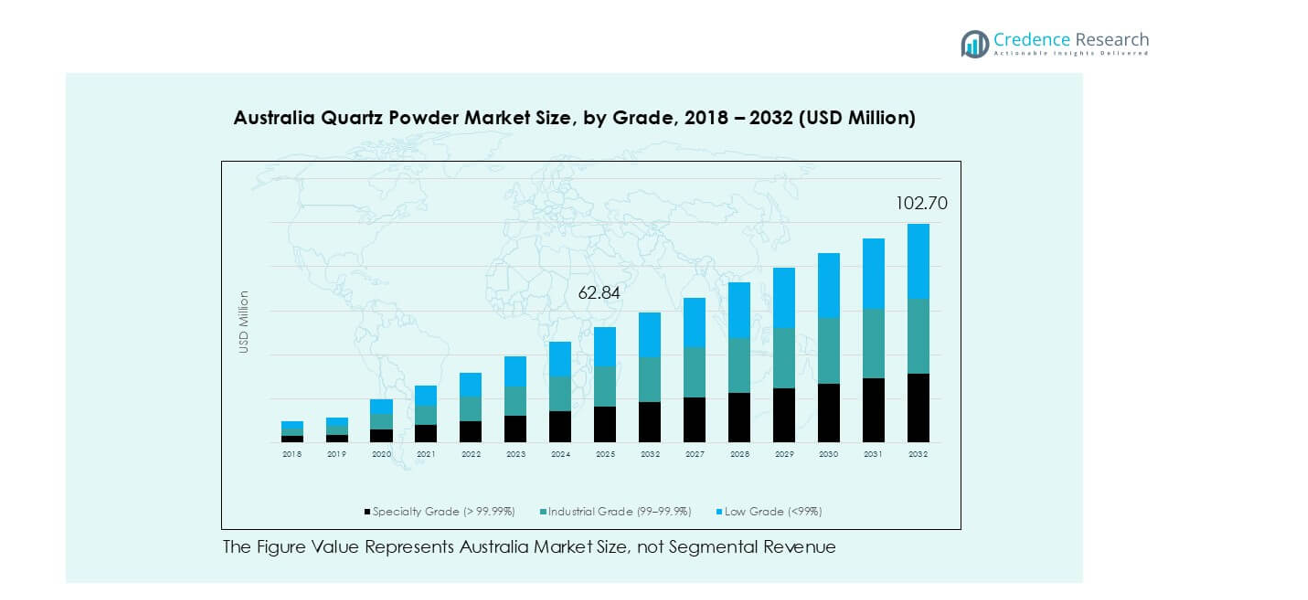

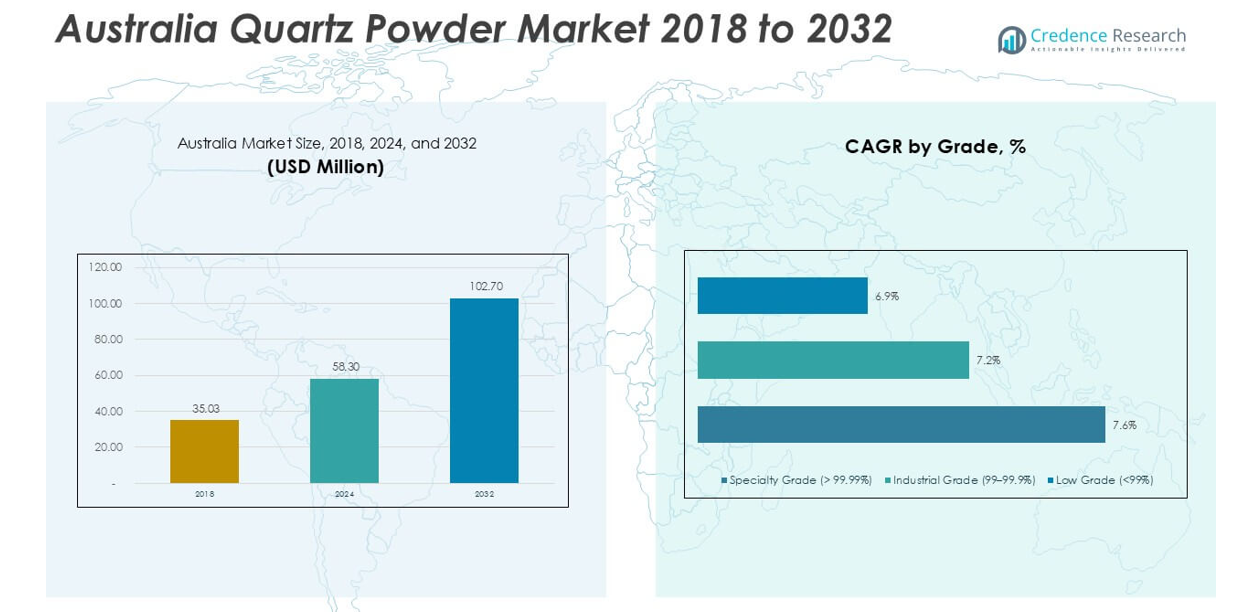

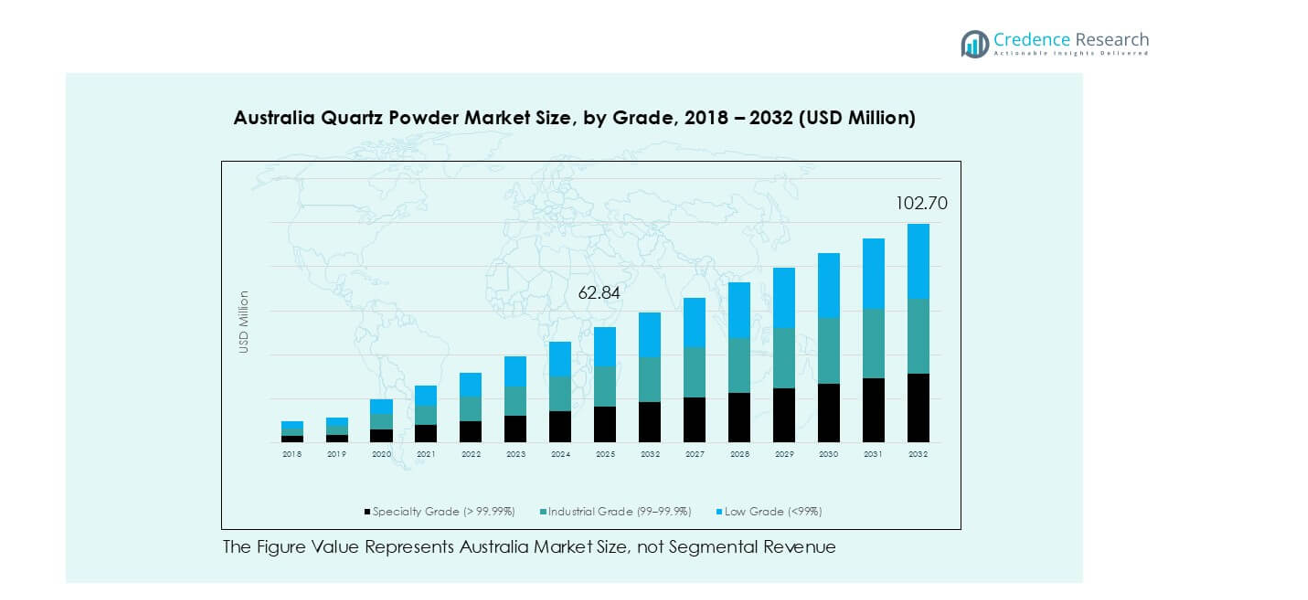

Australia Quartz Powder market size was valued at USD 35.03 million in 2018, increased to USD 58.30 million in 2024, and is anticipated to reach USD 102.70 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Powder Market Size 2024 |

USD 58.30 million |

| Australia Quartz Powder Market, CAGR |

7.4% |

| Australia Quartz Powder Market Size 2032 |

USD 102.70 million |

The Australia quartz powder market features strong competition among domestic and international manufacturers. Leading companies such as Ultra HPQ, Sibelco, and Imerys S.A. dominate the market through advanced purification technologies, wide distribution networks, and supply reliability. Local producers like Speciality Geochem and The Sharad Group focus on industrial-grade applications, ensuring steady demand in construction and manufacturing sectors. Global suppliers such as Momentive Technologies and Quarzwerke Group strengthen market presence through technological expertise and partnerships in high-purity quartz production. Regionally, New South Wales leads with a 31% market share, driven by robust industrial infrastructure and rising electronics manufacturing activities.

Market Insights

- The Australia quartz powder market was valued at USD 58.30 million in 2024 and is projected to reach USD 102.70 million by 2032, growing at a CAGR of 7.4%.

- Growing demand from electronics and semiconductor industries drives market expansion, supported by increasing production of silicon wafers and optical components.

- Key trends include the adoption of high-purity quartz in solar energy applications and the use of advanced refining technologies to meet global purity standards.

- Competition is moderate, with major players such as Ultra HPQ, Sibelco, and Imerys S.A. investing in high-purity processing and capacity expansion.

- Regionally, New South Wales leads with a 31% share, followed by Victoria at 24% and Queensland at 19%, driven by strong industrial bases and mineral resource availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The specialty grade segment dominated the Australia quartz powder market in 2024 with a 46% share. This segment leads due to its high purity levels exceeding 99.99%, essential for electronics, optics, and solar applications. Manufacturers prefer this grade for producing high-performance semiconductors and photovoltaic materials. Growing investments in renewable energy and advanced electronics further strengthen demand. The industrial grade segment follows, supported by applications in glass, ceramics, and foundry molds where moderate purity suffices. Low-grade quartz powder continues to serve construction and abrasive uses with stable demand in bulk applications.

- For instance, Sibelco upgraded its processing plant in Spruce Pine, North Carolina, to increase production of its IOTA® brand high-purity quartz (some grades exceed 99.995% purity), supplying the semiconductor and photovoltaic industries.

By Application

The electronics and semiconductors segment held the largest share of 39% in 2024, driven by rising use of ultra-pure quartz powder in silicon wafer production. Its superior dielectric and thermal stability make it vital in microelectronics fabrication. The glass and ceramics segment also shows strong growth due to demand for high-clarity glass and precision ceramics in construction and automotive industries. Paints, coatings, and adhesives benefit from quartz’s reinforcement properties, while construction materials and oil and gas applications sustain consistent consumption for their durability and chemical resistance.

- For instance, Shin-Etsu Chemical, a major global supplier of semiconductor materials, utilizes high-purity quartz to manufacture crucibles and other equipment essential for producing silicon wafers. The company’s subsidiary, Shin-Etsu Handotai, is a leading producer of ultra-pure polycrystalline silicon, which is melted in these quartz crucibles to grow massive single-crystal ingots.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Manufacturing

Australia’s quartz powder market is expanding due to increasing use in electronics and semiconductor fabrication. Ultra-pure quartz powder serves as a critical raw material in producing silicon wafers, optical fibers, and microchips. The surge in demand for high-performance computing devices, 5G components, and photovoltaic cells drives steady consumption. Domestic and international semiconductor manufacturers are sourcing high-grade quartz to ensure precision and purity in chip production. As Australia strengthens its advanced manufacturing ecosystem, demand for locally processed quartz powder with >99.99% purity continues to grow, supporting both export and domestic value chains.

- For instance, Siltronic AG operates multiple wafer fabs using quartz crucibles capable of sustaining temperatures above 1,420°C during crystal growth for 300 mm silicon wafers.

Growth in Glass and Ceramics Production

The glass and ceramics industry is a significant growth driver, fueled by construction and consumer goods expansion. Quartz powder enhances glass transparency, thermal stability, and surface hardness, making it vital in architectural, automotive, and specialty glass applications. Rising infrastructure projects and residential developments are boosting consumption of high-quality glass products. In ceramics, quartz acts as a fluxing agent, improving strength and reducing thermal expansion. Increasing investments in smart glass and decorative ceramics manufacturing are further accelerating local production. This sustained industrial expansion continues to strengthen quartz powder demand across key Australian cities and export markets.

- For instance, Saint-Gobain utilizes fused quartz materials with hardness levels reaching 7 on the Mohs scale to manufacture scratch-resistant decorative and technical ceramics for building applications.

Expanding Use in Paints, Coatings, and Construction Materials

The paints, coatings, and construction industries are becoming major contributors to market growth. Quartz powder is widely used as a filler to improve coating durability, abrasion resistance, and color stability. In construction, it enhances concrete strength and longevity under harsh climatic conditions. The sector benefits from Australia’s ongoing infrastructure programs and urban redevelopment initiatives. Demand for eco-friendly, high-performance coatings incorporating finely milled quartz powder is rising in residential and industrial projects. The shift toward sustainable building materials is encouraging local producers to supply customized quartz formulations meeting green construction standards.

Key Trends & Opportunities

Growing Adoption of High-Purity Quartz for Renewable Energy Applications

Australia’s renewable energy investments are fueling the use of high-purity quartz powder in solar-grade silicon manufacturing. The shift toward solar energy projects requires ultra-clean quartz to produce photovoltaic cells with higher efficiency. Companies are developing advanced refining and beneficiation technologies to meet stringent purity standards for solar glass and wafers. This trend creates opportunities for domestic producers to move up the value chain and supply international solar equipment manufacturers. As solar deployment accelerates, demand for specialty quartz powder in renewable energy components will expand significantly.

- For instance, LONGi Green Energy Technology employs fused quartz crucibles that withstand melting points above 1,700°C in its wafer production lines, ensuring defect-free crystal growth and improved photovoltaic conversion performance.

Emergence of Advanced Processing and Refining Technologies

Technological advancements in mineral refining are transforming the Australian quartz powder industry. Producers are adopting precision grinding, magnetic separation, and plasma purification to achieve >99.99% purity levels. These processes reduce impurities such as iron and aluminum, essential for semiconductor and optical glass applications. Automation and AI-driven quality monitoring systems are improving production consistency and efficiency. The integration of sustainable processing methods also aligns with environmental standards, opening export opportunities to high-tech markets like Japan, South Korea, and Germany. These innovations position Australia as a competitive supplier in global high-purity quartz production.

Key Challenges

Limited Domestic Refining Infrastructure

Despite abundant quartz reserves, Australia faces constraints in processing infrastructure for high-purity applications. Most raw quartz is exported in unprocessed form due to limited advanced refining facilities capable of meeting semiconductor-grade standards. Establishing new purification plants requires substantial capital and technology transfer, often relying on foreign expertise. This dependency restricts the country’s ability to capture full value from its mineral resources. Expanding domestic beneficiation and value-added manufacturing capacity is essential to strengthen supply chain resilience and reduce import reliance for high-purity quartz materials.

Environmental and Regulatory Compliance Issues

Environmental regulations surrounding quartz mining and processing present ongoing challenges for industry players. Dust emissions, water consumption, and land restoration obligations require strict adherence to state and federal policies. Meeting sustainability standards increases operational costs and complicates project approvals. Companies must invest in dust suppression, wastewater recycling, and eco-friendly processing technologies to maintain compliance. Failure to meet environmental guidelines can lead to fines or delays, impacting profitability. As environmental awareness grows, balancing economic growth with ecological responsibility remains a central challenge for the Australian quartz powder market.

Regional Analysis

New South Wales

New South Wales held the largest share of 31% in the Australia quartz powder market in 2024. The region’s dominance stems from its strong presence of electronics, glass, and construction industries. Growing infrastructure development across Sydney and Newcastle drives demand for high-purity quartz used in ceramics, paints, and coatings. The state’s advanced industrial base supports consistent consumption of specialty and industrial-grade quartz. Ongoing investments in semiconductor manufacturing and renewable energy materials production are further enhancing regional growth, positioning New South Wales as a key processing and distribution hub within the national market.

Victoria

Victoria accounted for a 24% share in the Australia quartz powder market in 2024. The region benefits from a diverse manufacturing sector and expanding glass and ceramics production in Melbourne and Geelong. High-purity quartz is extensively utilized in electronic components, building materials, and specialty glass manufacturing. Increasing investments in residential construction and sustainable infrastructure projects are boosting local consumption. Moreover, government-backed clean energy initiatives are encouraging use of quartz powder in solar applications. Continuous advancements in refining capabilities and supply chain efficiency strengthen Victoria’s role as a major secondary production center.

Queensland

Queensland captured a 19% market share in 2024, driven by abundant quartz reserves and a growing construction sector. The region’s mining-friendly policies and proximity to export ports support large-scale extraction and supply operations. Rising infrastructure development across Brisbane and the coastal belt enhances demand for quartz-based concrete and coatings. Industrial-grade quartz powder finds wide use in paints, adhesives, and glass products. Emerging investment in mineral processing technologies and exploration of new high-purity quartz deposits are expected to strengthen Queensland’s contribution to both domestic and export markets in the coming years.

Western Australia

Western Australia held a 16% share in the Australia quartz powder market in 2024, supported by its rich mineral base and expanding mining activities. The region serves as a major source of raw quartz for domestic processing and export to Asian markets. Perth’s industrial zones are witnessing rising consumption in construction materials and ceramics. Increasing exploration of high-purity quartz deposits in the Pilbara and Gascoyne regions enhances future production potential. Continued government support for value-added mineral processing is likely to position Western Australia as a strategic supplier in the national quartz value chain.

South Australia and Others

South Australia and other smaller territories collectively accounted for a 10% share in the 2024 market. The region’s demand is led by the construction, paints, and coatings industries, particularly in Adelaide and surrounding areas. Growing interest in sustainable materials is driving the use of quartz powder in green building projects. Although the refining base remains limited, ongoing mineral exploration initiatives aim to improve resource utilization. Smaller states such as Tasmania and the Northern Territory contribute modestly through niche applications in glass and ceramics, complementing overall market stability across Australia.

Market Segmentations:

By Grade

- Specialty Grade (> 99.99%)

- Industrial Grade (99–99.9%)

- Low Grade (<99%)

By Application

- Electronics & Semiconductors

- Glass & Ceramics

- Paints, Coatings & Adhesives

- Construction Materials

- Oil and Gas

- Others

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others

Competitive Landscape

The Australia quartz powder market is moderately consolidated, with several regional and international players competing through product quality, purity, and advanced processing technologies. Leading companies such as Ultra HPQ, Sibelco, and Imerys S.A. dominate through their strong mining bases, refined purification processes, and consistent supply to high-tech industries. Local producers like The Sharad Group and Speciality Geochem focus on catering to industrial and construction-grade applications, maintaining stable domestic demand. Global suppliers including Momentive Technologies and Quarzwerke Group leverage technological integration and global distribution to strengthen their presence. Key strategies across the competitive landscape include capacity expansion, vertical integration, and investments in high-purity quartz production. Increasing partnerships with electronics and solar component manufacturers highlight the sector’s shift toward advanced and value-added quartz applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ultra HPQ

- Lianyungang Dong Hai Bo Tech Silica Powder Co., Ltd.

- Advanced Ceramics

- Sibelco

- The Sharad Group

- Speciality Geochem

- Quarzwerke Group

- Imerys S.A

- Xuzhou Sainuo Quartz Co., Ltd.

- Momentive Technologies

- Other Key Players

Recent Developments

- In August 2024, Caesarstone introduced The Time Collection, which included ten new items, seven of which were new Porcelain colors and three Mineral Surfaces. These Mineral Surfaces represent a big step forward in surface design and are a testament to Caesarstone’s latest innovation. Using its vast expertise and advanced technology, the company has developed surfaces that combine minerals like Feldspar and Quartz with recycled content to create surfaces that are better performing and better for the environment.

- In January 2023, Caesarstone Ltd. declared the launch of its line of multi-material surfaces, which includes porcelain and natural stone in addition to outdoor quartz.

- In December 2022, Kyocera Corporation announced its purpose to invest 1.3 trillion yen ($9.78 billion), or through March 2026, in novel chip component manufacturing and the evolution of other sectors of its capabilities.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption of high-purity quartz in advanced electronics.

- Increasing semiconductor and photovoltaic manufacturing in Asia-Pacific will boost Australia’s export potential.

- Investments in refining infrastructure will enhance domestic value addition and global competitiveness.

- Demand from the glass and ceramics industry will remain strong due to ongoing construction growth.

- Eco-friendly and low-emission processing technologies will shape sustainable production trends.

- Strategic partnerships between miners and technology firms will accelerate process innovation.

- Regional leaders such as New South Wales and Victoria will continue to dominate production capacity.

- Advancements in nanotechnology and renewable energy components will open new application avenues.

- Rising environmental compliance costs may encourage technological upgrades and operational efficiency.

- The long-term outlook remains positive as industrial diversification strengthens Australia’s quartz supply chain.