Market Overview:

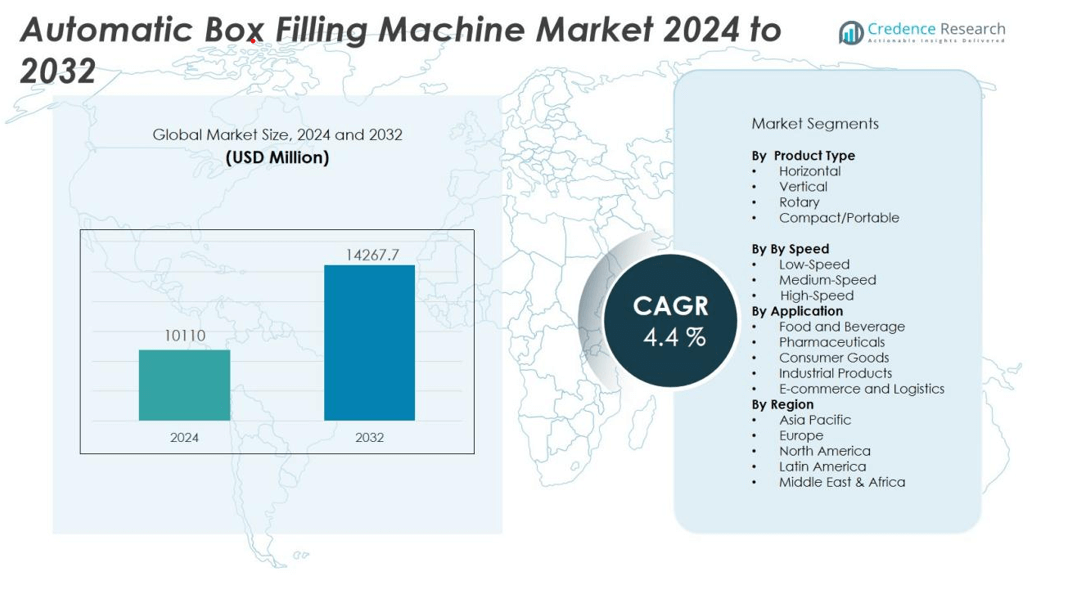

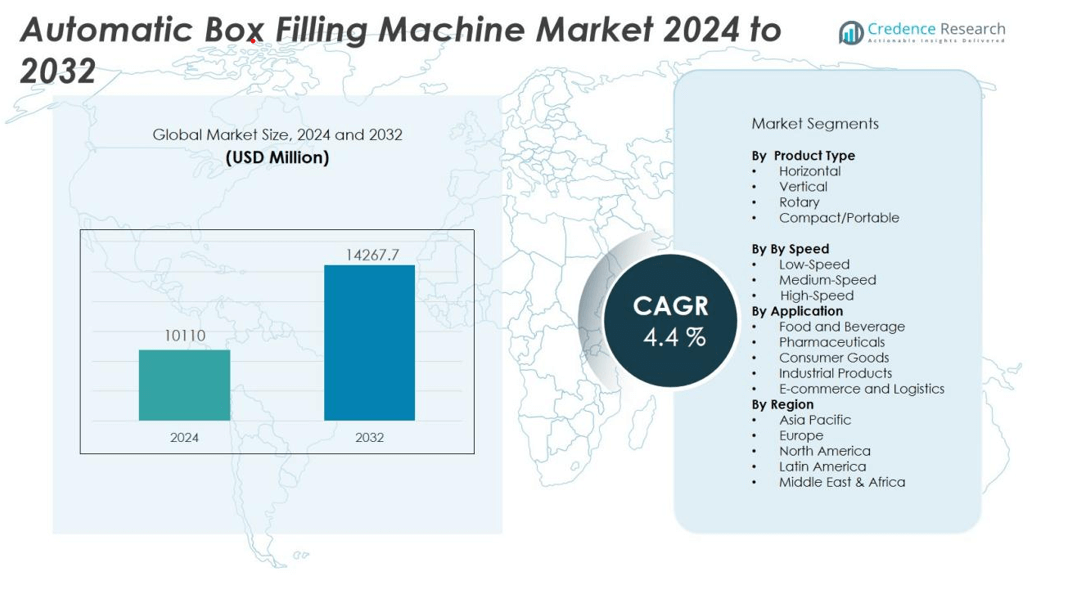

The automatic box filling machine market size was valued at USD 10110 million in 2024 and is anticipated to reach USD 14267.7 million by 2032, at a CAGR of 4.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automatic Box Filling Machine Market Size 2024 |

USD 10110 million |

| Automatic Box Filling Machine Market, CAGR |

4.4% |

| Automatic Box Filling Machine Market Size 2032 |

USD 14267.7 million |

Market growth is primarily driven by the increasing need for streamlined packaging operations and the growing trend of factory automation worldwide. Stringent regulations for packaging hygiene and traceability, rising consumer demand for packaged goods, and rapid expansion of online retail channels further stimulate demand for advanced box filling equipment. Companies continue to invest in smart packaging technologies and digital control systems, which boost productivity and enable real-time process monitoring.

Regionally, Asia Pacific leads the automatic box filling machine market, accounting for the largest market share in 2024 due to robust manufacturing activity in China, India, and Southeast Asia. North America and Europe follow, supported by established food, pharmaceutical, and logistics sectors, along with an increasing focus on sustainable and efficient packaging solutions. Key companies operating in these regions include Ishida Co., Ltd., Bosch Packaging, Viking Masek, Tetra Pak, IMA Group, Combi Packaging System, and Optima Packaging Group.

Market Insights:

- The market was valued at USD 10,110 million in 2024 and is projected to reach USD 14,267.7 million by 2032.

- Growing e-commerce and organized retail sectors drive demand for automated, high-speed box filling solutions.

- Companies invest in automation to boost operational efficiency, reduce labor costs, and maintain consistent quality output.

- Stringent regulations for hygiene, safety, and traceability accelerate adoption across food, pharmaceutical, and cosmetics industries.

- Technological advancements, such as IoT-enabled control systems and real-time monitoring, improve machine flexibility and productivity.

- Asia Pacific leads the market with a 33% share, followed by North America (31%) and Europe (27%), supported by strong manufacturing and automation adoption.

- Key players include Ishida Co., Ltd., Bosch Packaging, Viking Masek, Tetra Pak, IMA Group, Combi Packaging System, and Optima Packaging Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Expansion of E-Commerce and Retail Sectors:

The global rise in e-commerce and organized retail channels directly fuels demand for automated packaging solutions. The automatic box filling machine market benefits from increasing order volumes, fast delivery expectations, and diverse product packaging requirements. It enables companies to handle large-scale operations while maintaining speed and accuracy. E-commerce leaders invest in automation to improve supply chain efficiency and reduce turnaround times.

- For instance, JD Logistics’ fulfillment facility in California leverages advanced robotics to achieve picking efficiency with 99 percent accuracy and supports up to 600 picks per hour per operator, allowing the system to handle approximately 2,100 orders per hour at full throughput.

Growing Focus on Operational Efficiency and Labor Cost Reduction:

Manufacturers prioritize automation to address rising labor costs and labor shortages. The automatic box filling machine market supports seamless, high-speed packaging with minimal human intervention. It offers precise filling, reduced wastage, and lower error rates. Automation helps businesses achieve higher output with consistent quality, which directly impacts profitability.

- For instance, the B’BOOSTER TOP 780 automatic filling machine by Technibag is capable of filling up to 780 3L bag-in-box units per hour with high accuracy, demonstrating significant improvements in productivity for large-scale manufacturers.

Stringent Regulatory Standards and Packaging Hygiene Requirements:

Strict regulations regarding product safety, packaging hygiene, and traceability drive the adoption of automatic box filling machines. It ensures compliance by minimizing manual handling and facilitating clean, controlled filling environments. Traceability features integrated in these machines support regulatory reporting and recall management. Companies use automation to meet industry-specific standards for food, pharmaceuticals, and cosmetics.

Continuous Technological Advancements and Integration of Smart Features:

Ongoing innovation in sensor technology, IoT connectivity, and digital control systems enhances the performance of automatic box filling machines. The market benefits from features such as real-time monitoring, predictive maintenance, and flexible production settings. It enables remote operation, quick format changes, and integration with smart manufacturing lines. These advancements increase productivity and appeal to companies seeking long-term competitiveness.

Market Trends:

Adoption of Smart Automation and Industry 4.0 Solutions:

The automatic box filling machine market reflects a clear shift toward smart automation and integration of Industry 4.0 principles. Manufacturers increasingly deploy machines equipped with IoT sensors, AI-powered vision systems, and cloud-based controls. These features support real-time process monitoring, predictive maintenance, and adaptive production settings. Companies leverage data analytics to optimize machine uptime, reduce unplanned downtime, and improve overall equipment effectiveness. The ability to connect machines with broader manufacturing execution systems enables seamless workflow integration and remote management. This trend empowers packaging facilities to meet growing demand while maintaining high standards of productivity and traceability.

- For instance, Schneider Electric’s EcoStruxure solution was adopted by a packaging plant, allowing operators to monitor over 120 connected machines remotely, leading to enhanced operational visibility and response times.

Emphasis on Sustainability, Flexibility, and Customization in Packaging:

Sustainability and versatility remain at the forefront of packaging industry trends, directly influencing the automatic box filling machine market. Companies seek machines that handle eco-friendly materials, recyclable packaging, and varied box formats without sacrificing speed or accuracy. It drives investment in flexible machines with modular designs and quick changeover capabilities. Machine manufacturers respond by offering equipment that accommodates smaller batch sizes and customized packaging, supporting niche brands and personalized products. The focus on resource efficiency and reduced packaging waste aligns with global environmental goals and consumer preferences. This trend shapes equipment specifications and guides purchasing decisions for both large enterprises and small manufacturers.

- For instance, MULTIVAC’s Cooling@Packing system, which recently won the Sustainable Packaging News Award, integrates a cooling process within the packaging machine, reducing energy consumption and production space while enabling bakery products to be packed fresh in seconds—cooling them from 95°C down to 30°C within the packaging line itself.

Market Challenges Analysis:

High Initial Investment and Maintenance Complexity:

High upfront costs present a significant barrier for many small and medium-sized enterprises entering the automatic box filling machine market. It requires substantial capital for equipment acquisition, installation, and integration with existing production lines. The complexity of advanced machines, combined with the need for skilled technicians, increases ongoing maintenance expenses. Companies often face challenges aligning these investments with tight operating budgets. Frequent technological upgrades also necessitate further capital allocation, creating financial strain for budget-conscious manufacturers. Smaller players may hesitate to invest, slowing adoption rates across certain sectors.

Customization Demands and Limited Technical Expertise:

Rising demand for customized packaging solutions poses operational challenges for manufacturers and suppliers in the automatic box filling machine market. It must accommodate frequent product and packaging format changes, which can require extensive machine adjustments and operator training. Limited technical expertise within some organizations slows the adaptation process and increases the risk of operational downtime. The need to meet diverse regulatory standards across industries further complicates machine selection and integration. Companies must balance the need for flexibility with reliability and cost efficiency, which often complicates procurement and deployment strategies.

Market Opportunities:

Rising Demand for Automation and Smart Manufacturing Drives New Avenues:

The automatic box filling machine market offers significant opportunities driven by the global shift toward smart manufacturing and Industry 4.0 practices. Manufacturers in food, beverage, pharmaceuticals, and e-commerce sectors are investing in automated systems to streamline operations, reduce labor costs, and enhance production efficiency. Companies are adopting digital integration, IoT connectivity, and machine learning capabilities to enable real-time monitoring and predictive maintenance of filling lines. These trends create strong potential for solution providers to deliver advanced, customized systems that support evolving packaging formats and volumes. The need to meet stringent hygiene and safety regulations further accelerates the demand for high-precision, contamination-free automated solutions. Suppliers can capitalize on these developments by offering innovative machines with enhanced speed, accuracy, and data analytics.

Expansion in Emerging Markets and Sustainable Packaging Solutions:

The automatic box filling machine market presents growth opportunities in emerging economies where industrialization and urbanization are expanding manufacturing capacities. Companies in Asia Pacific, Latin America, and Africa seek cost-effective, scalable automation to address rising consumer demand and changing logistics requirements. It offers potential for manufacturers to deliver compact, energy-efficient machines that suit space-constrained facilities and diverse packaging needs. Growing emphasis on sustainability encourages development of systems compatible with recyclable materials and minimal-waste processes. Strategic partnerships with local integrators and after-sales service providers further support market entry and long-term adoption. Manufacturers that align with green initiatives and regional business models stand to gain a competitive edge in the evolving market landscape.

Market Segmentation Analysis:

By Product Type:

The automatic box filling machine market features several product types, including horizontal, vertical, and rotary machines. Horizontal box fillers dominate high-volume packaging environments, offering efficiency for larger, uniform boxes in food, beverage, and logistics sectors. Vertical machines find strong adoption in industries requiring space-saving solutions and handling of smaller, irregular items. Rotary machines provide flexibility and support specialized applications in pharmaceuticals and cosmetics.

- For instance, PMI Kyoto’s vertical cartoners are engineered with a compact design and maintain peak efficiency for years, helping clients achieve high-speed packing in space-restricted environments while processing up to 60 cartons per minute in continuous operations.

By Speed:

Market segmentation by speed includes low-speed, medium-speed, and high-speed automatic box filling machines. High-speed machines lead demand in large manufacturing units and e-commerce distribution centers due to their ability to maximize throughput and reduce downtime. Medium-speed models cater to mid-sized operations balancing cost and performance, while low-speed machines remain suitable for niche and small-batch production needs where product variation and customization matter.

- For instance, the Alfa Laval Aseptic HSL filler can process up to 12,000 liters per hour, filling 10-liter bags at a rate of 8–10 bags per minute in continuous operation.

By Application:

The automatic box filling machine market covers applications across food and beverage, pharmaceuticals, consumer goods, and industrial products. Food and beverage applications drive significant demand for automated filling, prioritizing hygiene, efficiency, and compliance with regulatory standards. Pharmaceutical manufacturers rely on these machines for precise, contamination-free packaging. Consumer goods companies seek flexibility for diverse product lines, while industrial product applications value durability and operational consistency.

Segmentations:

By Product Type:

- Horizontal

- Vertical

- Rotary

- Compact/Portable

By Speed:

- Low-Speed

- Medium-Speed

- High-Speed

By Application:

- Food and Beverage

- Pharmaceuticals

- Consumer Goods

- Industrial Products

- E-commerce and Logistics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a 31% share of the automatic box filling machine market, driven by its established manufacturing sector and strict regulatory landscape. It benefits from high adoption rates of automation technologies across industries such as food, beverage, pharmaceuticals, and logistics. Leading companies invest in R&D and smart manufacturing solutions to boost productivity and maintain compliance with safety requirements. The presence of robust distribution channels and strong after-sales support strengthens regional market performance. E-commerce growth fuels further demand for efficient, scalable filling systems. The United States remains the key contributor, supported by large-scale manufacturing facilities and advanced supply chain infrastructure.

Europe :

Europe accounts for 27% share of the automatic box filling machine market, reflecting its emphasis on sustainable production practices and digitalization. Regulatory directives encourage manufacturers to invest in eco-friendly, energy-efficient packaging solutions and automation. Regional companies deploy advanced technologies to achieve higher accuracy, flexibility, and data transparency in their operations. Countries such as Germany, France, and Italy lead in machine exports and innovation, leveraging strong engineering capabilities. Demand from the food, pharmaceutical, and personal care sectors continues to support new installations. Collaborations between machine suppliers and packaging firms accelerate the transition to smart factories across Western and Central Europe.

Asia Pacific:

Asia Pacific commands a 33% share of the automatic box filling machine market, propelled by rapid industrialization and expanding manufacturing capacity. It attracts investments from domestic and multinational companies seeking to automate operations and meet rising consumer demand. China, Japan, and India act as growth engines, benefiting from government initiatives that promote industrial automation and infrastructure development. Manufacturers target diverse end-use industries, ranging from packaged foods to electronics, leveraging a large workforce and evolving logistics systems. Demand for flexible, cost-effective filling machines intensifies with the growth of e-commerce and urbanization. The region’s dynamic business environment creates opportunities for market participants to develop localized, innovative solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ishida Co., Ltd.

- Bosch Packaging

- Viking Masek

- Tetra Pak

- IMA Group

- Combi Packaging System

- Optima Packaging Group

- Douglas Machine Inc.

- Delkor Systems

Competitive Analysis:

The automatic box filling machine market features intense competition among established players and emerging manufacturers. Major companies such as Ishida Co., Ltd., Bosch Packaging, Viking Masek, Tetra Pak, IMA Group, Combi Packaging System, and Optima Packaging Group lead the market with extensive product portfolios, global distribution networks, and a focus on innovation. It witnesses rapid technological advancements, with companies investing in smart automation, digital controls, and modular machine designs to meet evolving customer demands. Leading firms prioritize partnerships and acquisitions to expand geographic reach and strengthen market share. Customization, reliability, and after-sales service remain critical differentiators, as end users seek tailored solutions and operational efficiency. The automatic box filling machine market rewards companies capable of delivering high-performance machines that address a wide range of packaging requirements across industries.

Recent Developments:

- In March 2024, Ishida Europe acquired South Africa’s National Packaging Systems (NPS), strengthening its presence in Africa and providing access to a broader range of automated weighing and packaging solutions.

- In January 2025, Bosch Packaging Technology continued its transformation under the Syntegon Technology brand, focusing efforts on sustainable and intelligent packaging after acquisition by CVC Capital Partners.

- In April 2025, Tetra Pak, in collaboration with Schoeller Allibert, introduced transport crates made from up to 50% polyAl recycled from used beverage cartons, with the full launch at the Plastics Recycling Show Europe in Amsterdam.

Market Concentration & Characteristics:

The automatic box filling machine market demonstrates moderate to high concentration, with a mix of global and regional players dominating sales across major geographies. It features established companies recognized for their technological expertise, comprehensive product portfolios, and strong distribution networks. Leading manufacturers invest in research and development to deliver advanced, energy-efficient, and customizable solutions tailored to evolving industry requirements. The market is characterized by rising demand for automation, integration of smart technologies, and a shift toward sustainable packaging formats. End users prioritize reliability, speed, and after-sales service, driving competition on quality and innovation. Stringent safety and hygiene regulations also influence design and manufacturing standards in this market.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Speed, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Automation adoption continues across logistics, pharmaceutical, food and beverage, and e-commerce sectors, driving demand for advanced filling systems.

- Smart integration with IoT platforms and Industry 4.0 architectures enhances real-time production visibility and operational control.

- Machine builders design more flexible equipment to support frequent format changes and diverse package types.

- Predictive maintenance capabilities and remote diagnostics extend equipment uptime and simplify support.

- Equipment stages shift toward energy-efficient, low-waste solutions supporting sustainable packaging initiatives.

- Regional manufacturers focus on cost-competitive systems tailored to local production volumes and infrastructure.

- Innovations in servo-driven actuators and vision inspection systems boost filling precision and speed.

- Collaboration between suppliers and systems integrators increases to deliver turnkey packaging lines.

- Software platforms evolve to include data analytics, production dashboards, and performance benchmarking tools.

- Emphasis on user-friendly interfaces and automated setup features simplifies operation for a wider labor base.