Market Overview:

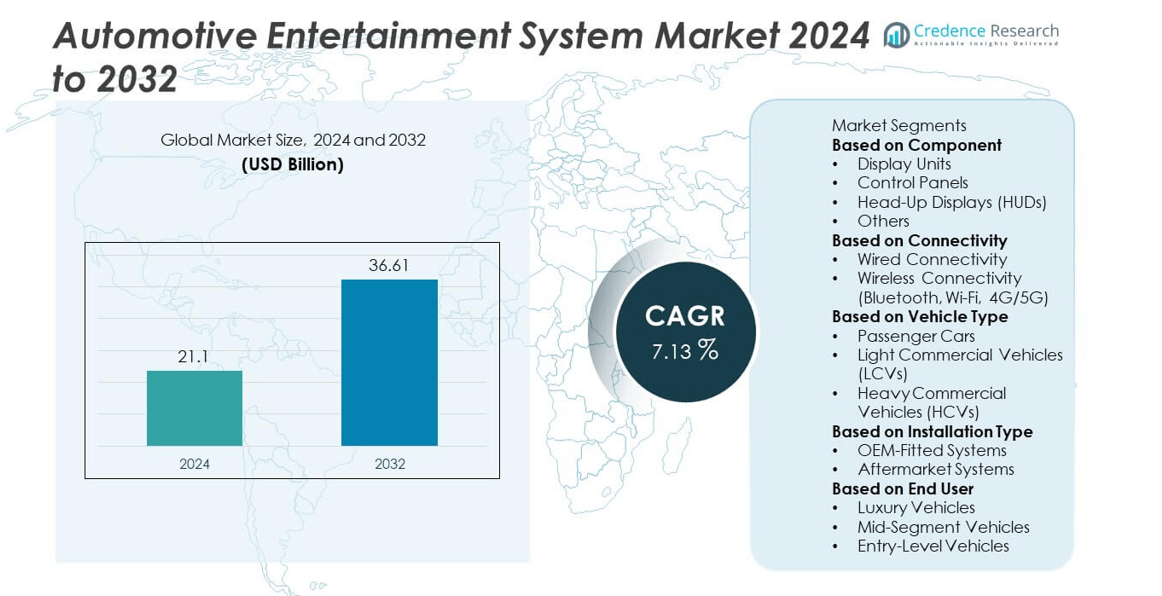

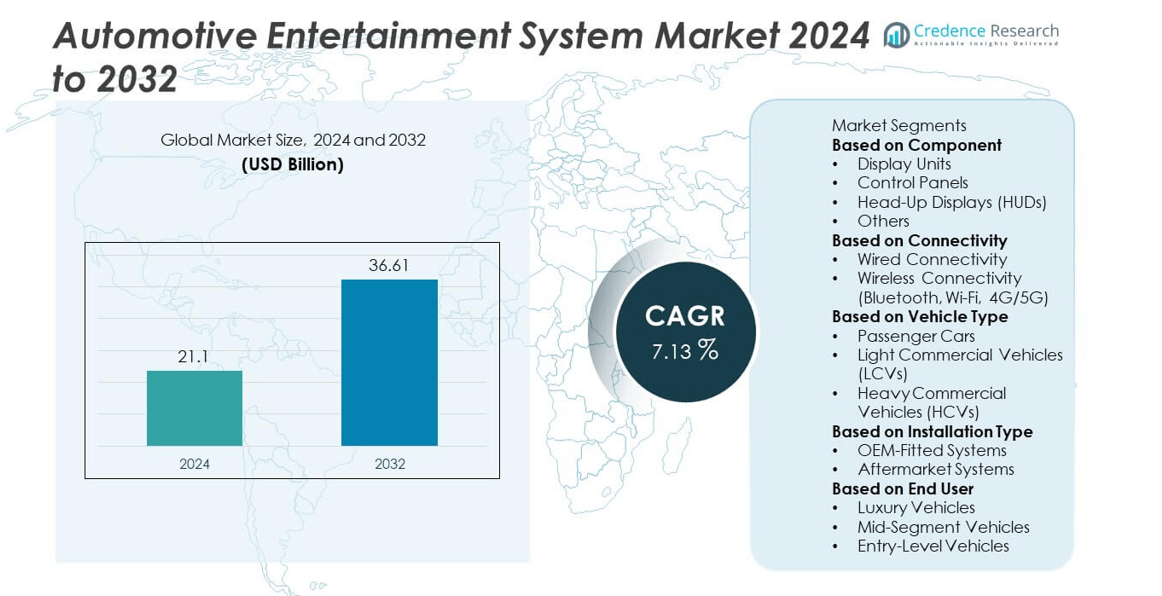

The automotive entertainment system market was valued at USD 21.1 billion in 2024 and is projected to reach USD 36.61 billion by 2032, growing at a CAGR of 7.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Entertainment System Market Size 2024 |

USD 21.1 billion |

| Automotive Entertainment System Market, CAGR |

7.13% |

| Automotive Entertainment System Market Size 2032 |

USD 36.61 billion |

The automotive entertainment system market is led by major companies such as Panasonic Corporation, Harman International Industries, Inc., Robert Bosch GmbH, Continental AG, and Pioneer Corporation. These players dominate through advanced infotainment solutions integrating connectivity, navigation, and multimedia technologies. Asia-Pacific emerged as the leading region, holding a 32.4% market share in 2024, driven by rapid vehicle production, growing consumer preference for connected cars, and expansion of 5G infrastructure. North America followed with a 31.6% share, supported by strong adoption of in-vehicle digital systems, while Europe held 28.7%, backed by premium automakers emphasizing AI-powered infotainment and sustainable innovations.

Market Insights

- The automotive entertainment system market was valued at USD 21.1 billion in 2024 and is projected to reach USD 36.61 billion by 2032, growing at a CAGR of 7.13%.

- Rising demand for connected and infotainment-equipped vehicles drives market growth, with the display units segment holding a 42.6% share due to increasing integration of touchscreens and digital dashboards.

- Advancements in wireless connectivity, including 5G and IoT, are shaping market trends, enabling real-time streaming, cloud updates, and voice-controlled operations.

- The market is competitive, with key players such as Panasonic Corporation, Harman International, and Bosch focusing on smart entertainment, AI-based interfaces, and strategic partnerships with automakers.

- Asia-Pacific led with a 32.4% share in 2024, followed by North America at 31.6% and Europe at 28.7%, supported by rising vehicle production, premium model launches, and growing consumer preference for digital in-car experiences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The display units segment dominated the automotive entertainment system market in 2024, accounting for a 42.6% share. This dominance is driven by the growing adoption of large touchscreens, digital dashboards, and advanced user interfaces in modern vehicles. Consumers prefer immersive visual experiences supported by HD and OLED displays for navigation, media, and vehicle information. Automakers are integrating multi-screen setups and voice-assisted controls to enhance user convenience. The rising demand for connected and infotainment-rich vehicles, particularly in premium and mid-segment models, continues to fuel the expansion of this segment globally.

- For instance, for the Mercedes-Benz EQS, LG Display supplies P-OLED technology used in the optional 56-inch MBUX Hyperscreen. The Hyperscreen features a single curved glass pane covering three integrated displays: a 12.3-inch LCD instrument cluster, a 17.7-inch central OLED, and a 12.3-inch passenger-side OLED.

By Connectivity

The wireless connectivity segment held the largest 58.4% share of the automotive entertainment system market in 2024. Increasing adoption of Bluetooth, Wi-Fi, and 4G/5G technologies enables seamless smartphone integration, hands-free control, and cloud-based streaming. Automakers prioritize wireless solutions for convenience, flexibility, and real-time connectivity. The rise of over-the-air software updates, online navigation, and voice assistants like Alexa and Google Assistant strengthens this segment’s dominance. Growing demand for in-car entertainment and smart connectivity features among tech-savvy consumers further supports its rapid expansion.

- For instance, Qualcomm Technologies launched its Snapdragon Digital Chassis with integrated 5G modem achieving download speeds up to 10 Gbps, enabling ultra-fast in-vehicle connectivity.

By Vehicle Type

The passenger cars segment led the automotive entertainment system market in 2024, capturing a 69.1% share. This segment’s leadership is attributed to the rising installation of infotainment and connectivity systems across both premium and mid-range vehicles. Increasing consumer focus on comfort, convenience, and digital interaction while driving propels market growth. Automakers integrate advanced entertainment systems, multi-speaker audio, and personalized interfaces to enhance driving experience. The surge in electric and autonomous vehicles further accelerates system integration, as manufacturers emphasize high-quality entertainment and communication capabilities in next-generation passenger vehicles.

Key Growth Drivers

Increasing Demand for In-Vehicle Connectivity and Infotainment

The growing consumer preference for connected vehicles is fueling the demand for advanced automotive entertainment systems. Drivers and passengers seek real-time navigation, music streaming, and smartphone integration for enhanced convenience. Automakers integrate Android Auto, Apple CarPlay, and voice-activated systems to meet these expectations. The rise in long-distance travel and shared mobility also supports in-car infotainment adoption. This growing demand for connectivity and entertainment is reshaping vehicle interiors and driving innovation in infotainment technologies.

- For instance, Harman International has equipped its telematics control units with 5G connectivity, which is designed to provide high-speed data for seamless streaming and cloud-based services.

Rising Adoption of Advanced Display and Audio Technologies

Improved display resolutions, touchscreen controls, and immersive audio experiences are propelling market growth. Modern vehicles now feature OLED dashboards, multi-screen setups, and surround-sound systems for a premium feel. Leading OEMs are integrating gesture and voice control to enhance user interaction. As consumers associate advanced infotainment with vehicle value, manufacturers increasingly use entertainment systems as key differentiators. This trend aligns with the premiumization of mid-range and luxury vehicle segments.

- For instance, Continental AG unveiled its MFC 500 platform featuring integrated gesture control sensors capable of processing up to 1,200 hand movements per second.

Integration of 5G and IoT in Automotive Systems

The introduction of 5G connectivity and Internet of Things (IoT) integration is transforming in-car entertainment capabilities. Faster data speeds enable real-time streaming, cloud gaming, and over-the-air software updates. Automakers are leveraging IoT networks for personalized entertainment and predictive maintenance services. This digital transformation allows continuous system upgrades and enhances user experience, positioning connected vehicles as mobile digital ecosystems.

Key Trends & Opportunities

Rise of Voice-Activated and AI-Based Infotainment Systems

Automotive entertainment systems are increasingly incorporating AI-driven voice assistants and predictive personalization. Features such as Amazon Alexa, Google Assistant, and proprietary OEM voice controls allow hands-free operation and seamless connectivity. AI algorithms analyze driver preferences and habits to suggest media or adjust settings automatically. This trend enhances safety and convenience while offering opportunities for technology providers to collaborate with automakers.

- For instance, Mercedes-Benz introduced its MBUX infotainment, powered by NVIDIA technology for AI processing capabilities, supporting real-time voice and gesture recognition.

Expansion of Cloud-Based and Subscription Entertainment Models

Cloud connectivity and subscription-based entertainment services are reshaping user engagement. Consumers now access streaming platforms, gaming services, and live navigation updates directly through the vehicle interface. Manufacturers are partnering with entertainment providers to introduce monthly subscription plans and premium digital content. This approach enhances customer retention and creates recurring revenue streams for OEMs.

- For instance, BMW launched its ConnectedDrive Store hosting over 30 digital service subscriptions, including navigation, real-time traffic, and in-car entertainment.

Key Challenges

High Cost of Integration and System Maintenance

The integration of advanced infotainment and connectivity features significantly increases vehicle manufacturing costs. Premium hardware components, complex software, and cybersecurity systems require substantial investment. These costs are often passed to consumers, limiting adoption in low- and mid-priced segments. Continuous software updates and component maintenance also increase operational expenses for manufacturers.

Data Security and Privacy Concerns

The growing interconnectivity of vehicles raises concerns about data protection and privacy. Entertainment systems collect user data for personalization, making them potential targets for cyberattacks. Unauthorized access to infotainment or vehicle control systems poses safety risks. Automakers must invest in robust encryption, regular updates, and compliance with global cybersecurity regulations to ensure consumer trust and system security.

Regional Analysis

North America

North America accounted for a 31.6% share of the automotive entertainment system market in 2024. The region’s dominance is driven by strong consumer demand for connected vehicles, advanced infotainment features, and luxury interiors. The U.S. leads the market with widespread adoption of in-car connectivity, voice assistants, and integrated navigation systems. High spending capacity and technological innovation from automakers such as Ford, General Motors, and Tesla strengthen market growth. Continuous upgrades in 5G connectivity and collaboration with tech companies further support North America’s leadership in vehicle entertainment advancements.

Europe

Europe held a 28.7% share of the automotive entertainment system market in 2024. The region benefits from a strong automotive manufacturing base and high adoption of in-vehicle digital technologies. Germany, France, and the U.K. are key contributors, focusing on enhancing user experience through AI-driven infotainment and premium audio systems. Stringent safety regulations encourage integration of display and connectivity systems that minimize driver distraction. Growing demand for electric and luxury vehicles supports steady market expansion. European automakers are also emphasizing sustainable production and advanced human-machine interface technologies for next-generation vehicles.

Asia-Pacific

Asia-Pacific led the automotive entertainment system market with a 32.4% share in 2024, emerging as the fastest-growing region globally. Rapid urbanization, rising disposable incomes, and expanding automotive production in China, Japan, and India drive growth. The region’s consumers increasingly prefer vehicles equipped with touchscreens, navigation, and smart connectivity. Local and global manufacturers are investing in affordable infotainment solutions for mass-market vehicles. The rise of electric vehicles and government initiatives promoting intelligent mobility further accelerate adoption. Expanding 5G infrastructure and consumer demand for in-car digital entertainment solidify Asia-Pacific’s dominant position.

Latin America

Latin America captured a 4.2% share of the automotive entertainment system market in 2024. Growth is supported by rising vehicle sales, improved connectivity infrastructure, and growing consumer interest in comfort-oriented vehicles. Brazil and Mexico lead regional adoption, with automakers introducing infotainment systems in mid-range passenger cars. However, high costs and limited technology integration in entry-level models restrict wider penetration. Expanding smartphone connectivity and the adoption of wireless communication standards are expected to drive further growth in the region’s automotive entertainment market over the forecast period.

Middle East & Africa

The Middle East & Africa region accounted for a 3.1% share of the automotive entertainment system market in 2024. Rising disposable income, growing luxury vehicle imports, and expanding automotive dealerships contribute to market growth. The UAE and Saudi Arabia dominate due to strong consumer demand for premium in-car features. Increasing integration of wireless connectivity, navigation systems, and multilingual voice assistants enhances user experience. Despite limited vehicle manufacturing capacity, the region shows steady potential through expanding electric and connected vehicle adoption supported by government-led digital transformation initiatives.

Market Segmentations:

By Component

- Display Units

- Control Panels

- Head-Up Displays (HUDs)

- Others

By Connectivity

- Wired Connectivity

- Wireless Connectivity (Bluetooth, Wi-Fi, 4G/5G)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Installation Type

- OEM-Fitted Systems

- Aftermarket Systems

By End User

- Luxury Vehicles

- Mid-Segment Vehicles

- Entry-Level Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The automotive entertainment system market is highly competitive, featuring key players such as Panasonic Corporation, Harman International Industries, Inc., Robert Bosch GmbH, Continental AG, Pioneer Corporation, Alpine Electronics, Inc., Garmin Ltd., Denso Corporation, Visteon Corporation, and Sony Corporation. These companies focus on developing advanced infotainment platforms that integrate connectivity, navigation, and multimedia functions. Strategic collaborations with automakers and tech firms enable them to enhance user experience through AI-driven interfaces, 5G connectivity, and cloud-based entertainment solutions. Market leaders invest heavily in R&D to deliver personalized and voice-controlled infotainment systems. Continuous innovation in head-up displays, premium sound systems, and smartphone integration strengthens their global presence. Furthermore, the shift toward electric and autonomous vehicles has intensified competition, as manufacturers prioritize seamless integration of digital entertainment with safety and driver-assist systems to differentiate their offerings in a rapidly evolving automotive landscape.

Key Player Analysis

Recent Developments

- In May 2025, Panasonic Corporation launched an in-vehicle TOUGHBOOK Screen Mirroring solution which enables mirroring from a TOUGHBOOK tablet onto an OEM touchscreen.

- In January 2025, Sony Corporation (via the joint venture Sony Honda Mobility Inc.) introduced the “AFEELA 1” EV with an advanced entertainment-rich cabin featuring displays and immersive audio system.

- In 2024, Robert Bosch GmbH revealed its cockpit & ADAS integration platform that unites infotainment and driver-assistance functions on a single system-on-chip (SoC)

Report Coverage

The research report offers an in-depth analysis based on Component, Connectivity, Vehicle Type, Installation Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for connected and intelligent infotainment systems will continue to rise globally.

- Integration of 5G and IoT technologies will enhance real-time streaming and connectivity.

- AI-based voice assistance and personalization will redefine user experience in vehicles.

- Electric and autonomous vehicles will drive higher adoption of advanced entertainment systems.

- Automakers will focus on multi-screen and augmented reality-based display solutions.

- Strategic collaborations between tech firms and OEMs will boost innovation in in-car systems.

- Cloud-based software updates will improve system performance and user engagement.

- Premium sound systems and immersive entertainment will become standard in luxury vehicles.

- Data security and privacy solutions will gain importance in infotainment design.

- Asia-Pacific will remain the key growth hub, supported by rising vehicle production and connectivity adoption.