| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

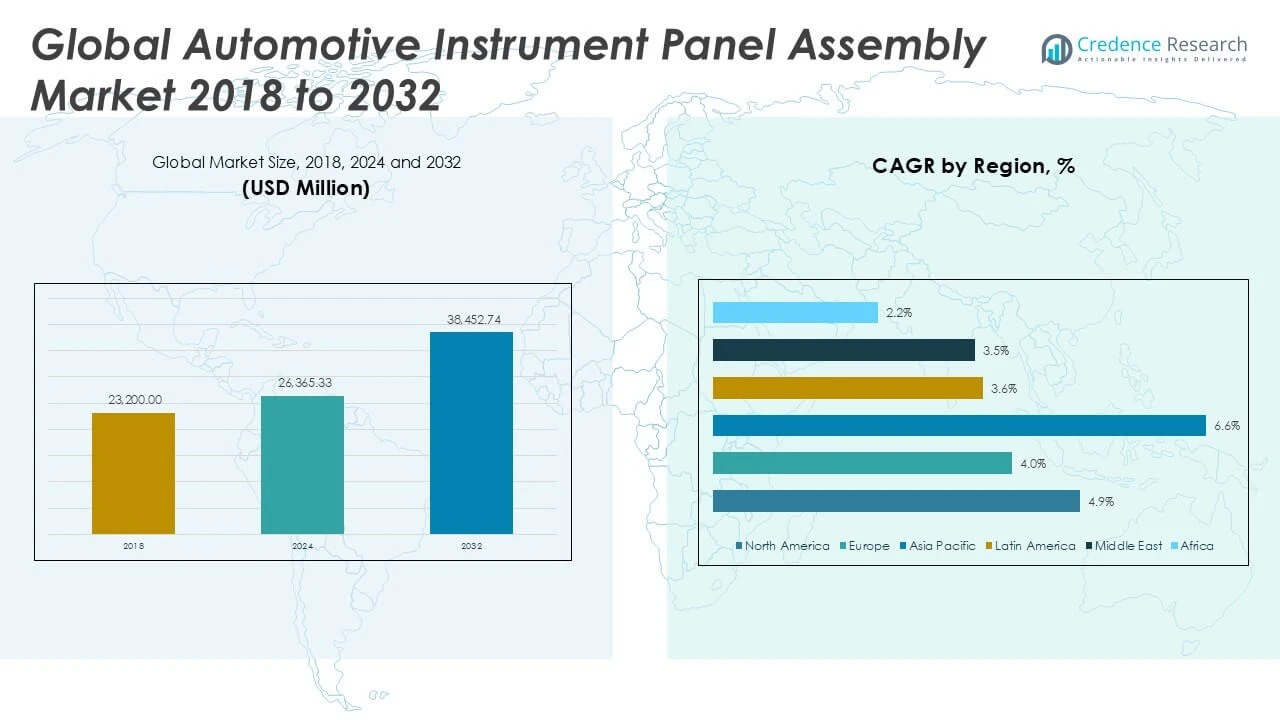

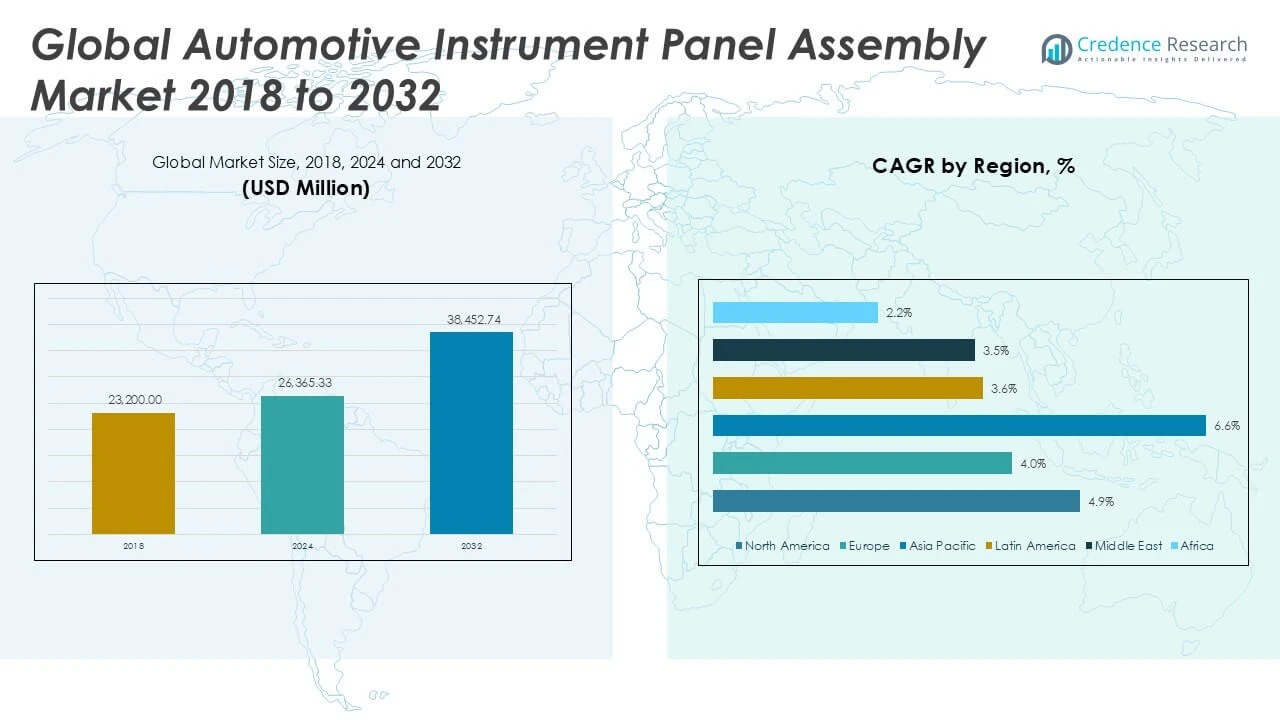

| Automotive Instrument Panel Assembly Market Size 2024 |

USD 26,365.33 Million |

| Automotive Instrument Panel Assembly Market, CAGR |

4.87% |

| Automotive Instrument Panel Assembly Market Size 2032 |

USD 38,452.74 Million |

Market Overview

The Global Automotive Instrument Panel Assembly Market is projected to grow from USD 26,365.33 million in 2024 to an estimated USD 38,452.74 million by 2032, with a compound annual growth rate (CAGR) of 4.87% from 2025 to 2032.

Key factors propelling market growth include rising demand for connected and autonomous vehicles, growing integration of infotainment systems, and stringent safety regulations requiring improved dashboard designs. Manufacturers are investing in advanced materials and production technologies to enhance aesthetics, reduce weight, and increase durability. Moreover, the increasing penetration of electric vehicles (EVs) is encouraging the development of custom instrument clusters optimized for battery performance metrics and driving data. Trends such as head-up displays and AI-enabled interfaces are shaping the future of instrument panels.

Geographically, the Asia-Pacific region dominates the global automotive instrument panel assembly market, driven by high vehicle production volumes in China, Japan, and India. North America and Europe follow, supported by the presence of major OEMs and increasing adoption of advanced driver assistance systems (ADAS). Key players in the market include Faurecia SE, Continental AG, Visteon Corporation, Magna International Inc., Toyoda Gosei Co., Ltd., and IAC Group, all actively engaged in innovation, strategic collaborations, and product development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market is projected to grow from USD 26,365.33 million in 2024 to USD 38,452.74 million by 2032, registering a CAGR of 4.87%.

- Rising demand for connected and autonomous vehicles drives adoption of advanced instrument panel technologies.

- Increasing penetration of electric vehicles fuels development of specialized dashboards with battery and energy monitoring features.

- High production costs and complex integration pose challenges for widespread adoption in entry-level vehicle segments.

- Asia-Pacific leads the market, accounting for a significant share due to large-scale vehicle manufacturing in China, India, and Japan.

- North America and Europe follow, supported by established automotive industries and growing demand for safety and infotainment features.

- Stringent regulatory standards on vehicle safety and emissions influence design innovation and material usage in instrument panels.

Market Drivers

Rising Demand for Advanced Driver Assistance Systems (ADAS) Accelerates Panel Integration

The growing focus on vehicle safety and automation is pushing automakers to integrate advanced driver assistance systems into instrument panels. These systems require digital displays, real-time feedback interfaces, and intuitive user controls, all embedded within the dashboard. The Global Automotive Instrument Panel Assembly Market is responding to this shift by aligning panel design with ADAS functionality. It enables seamless interaction between the driver and system alerts, ensuring minimal distraction. Automakers are increasingly embedding sensors, warning lights, and interactive clusters within the panel for quick accessibility. This evolution enhances the overall safety and responsiveness of vehicles.

For instance, over 81 million vehicles were produced globally in 2022, highlighting the scale of assembly operations worldwide

Increased Adoption of Connected and Smart Vehicle Technologies

Connectivity is transforming the automotive industry, and the instrument panel is central to delivering real-time vehicle data. The Global Automotive Instrument Panel Assembly Market benefits from this trend by integrating features such as navigation, vehicle diagnostics, and multimedia into centralized displays. It supports the demand for intelligent human-machine interfaces that adapt to user behavior and preferences. Cloud integration and over-the-air updates require adaptable dashboard architectures. Automakers are prioritizing seamless communication between the driver and vehicle systems, reinforcing the panel’s strategic importance. Instrument panels now serve as command hubs for the digital driving experience.

For instance, the automotive industry has seen over 90% of global automobile production concentrated in Asia, Europe, and North America, with China leading as the largest automobile-producing country

Shift Toward Lightweight and Sustainable Materials in Dashboard Construction

Automotive OEMs are prioritizing fuel efficiency and emissions reduction, which drives the use of lightweight materials in vehicle components. The Global Automotive Instrument Panel Assembly Market is incorporating composites, bio-based plastics, and recyclable materials to reduce weight and environmental impact. It contributes to improving vehicle range and lowering carbon footprint. Sustainability is also becoming a differentiator in consumer preferences, pushing suppliers to innovate responsibly. Material selection now influences both aesthetic appeal and regulatory compliance. Lightweight dashboards are gaining traction across both internal combustion and electric vehicle platforms.

Growth of Electric Vehicles Drives Custom Instrument Panel Design

The expansion of electric vehicles creates new requirements for dashboard displays and control systems. The Global Automotive Instrument Panel Assembly Market is adapting to EV-specific needs by incorporating battery level indicators, energy consumption metrics, and regenerative braking feedback. It demands modular and highly customizable layouts to suit varying EV architectures. Automakers seek distinctive designs that reflect the futuristic appeal of electric mobility. This trend enhances the role of instrument panels in brand positioning and user engagement. Manufacturers are adjusting production lines to accommodate these specialized panel configurations.

Market Trends

Integration of Digital Instrument Clusters Enhances Driver Information Access

Automakers are replacing traditional analog gauges with fully digital instrument clusters to improve driver interaction and information delivery. These displays support customizable layouts, real-time navigation, and dynamic alerts, tailored to driver preferences. The Global Automotive Instrument Panel Assembly Market is evolving to accommodate these clusters through flexible panel designs and advanced display technologies. It enables the incorporation of high-resolution graphics, adaptive brightness, and touch-sensitive inputs. Consumers expect a seamless user experience that mirrors smartphone functionality. This trend is redefining dashboard aesthetics and functionality across all vehicle segments.

For instance, more than 3.5 million vehicles globally were equipped with digital instrument clusters in 2024, reflecting the increasing adoption of advanced display technologies in modern automobiles

Head-Up Displays (HUDs) Gain Prominence in Premium and Mid-Range Vehicles

HUDs are transitioning from luxury features to essential tools in safety and navigation. Automakers are increasingly embedding HUD systems within the dashboard to project critical driving data onto the windshield. The Global Automotive Instrument Panel Assembly Market is aligning with this trend by supporting HUD components through structural design and material innovation. It allows clear visibility of speed, directions, and warnings without diverting driver attention. Manufacturers are focusing on compact, integrated HUD units to conserve dashboard space. The push for distraction-free driving is accelerating this trend across various car categories.

For instance, over 1.4 million vehicles were fitted with HUD systems in 2023, highlighting their growing presence in mid-range and premium car models

Personalization Features Shape the Future of Dashboard Functionality

Drivers seek personalized experiences that reflect individual preferences for lighting, display configuration, and control layouts. The Global Automotive Instrument Panel Assembly Market is adapting to this demand through modular and programmable interfaces. It supports features such as ambient lighting, customizable themes, and driver profile memory. Automakers use personalization to enhance customer satisfaction and vehicle differentiation. These features also improve convenience by automatically adjusting settings for different users. The trend supports the shift toward smart, connected, and user-centric interiors.

Minimalist and Seamless Dashboard Designs Influence Aesthetic Direction

Vehicle interiors are moving toward clean and cohesive dashboard designs that reduce clutter while maximizing functionality. Automakers are eliminating physical buttons in favor of capacitive touch panels and integrated screens. The Global Automotive Instrument Panel Assembly Market is responding by streamlining panel construction and eliminating segmented components. It emphasizes uniform materials, hidden displays, and intuitive surfaces. This minimalist trend aligns with modern design preferences and supports ease of manufacturing. OEMs are focusing on dashboards that balance aesthetics with technology integration.

Market Challenges

High Development Costs and Complex Integration Limit Accessibility for Lower-End Models

Instrument panel assemblies now involve advanced electronics, high-resolution displays, and intelligent control modules, which significantly increase development and production costs. The Global Automotive Instrument Panel Assembly Market faces challenges in scaling these innovations for entry-level and mid-range vehicles. It must balance advanced functionality with affordability to maintain competitiveness across diverse vehicle segments. Integrating multiple components—such as infotainment systems, ADAS interfaces, and HVAC controls—into a single unit requires complex design and engineering. OEMs must ensure quality and durability while managing tight cost constraints. The need for customization across vehicle models further complicates standardization efforts.

For instance, digital instrument clusters now account for over 50% of newly manufactured vehicles, reflecting the industry’s shift toward high-resolution displays and intelligent control modules.

Supply Chain Disruptions and Component Shortages Hinder Production Efficiency

Global supply chain instability continues to affect the availability of semiconductors, display panels, and electronic modules used in dashboard assemblies. The Global Automotive Instrument Panel Assembly Market depends heavily on timely component sourcing and reliable supplier networks. It struggles to maintain consistent output levels amid fluctuating raw material costs and logistical constraints. Production delays disrupt OEM schedules and impact vehicle rollout timelines. Companies must invest in inventory buffers or diversify suppliers to manage risks effectively. These pressures increase operational costs and limit flexibility in product development cycles.

Market Opportunities

Expansion of Electric and Autonomous Vehicles Unlocks New Design Possibilities

The rise of electric and autonomous vehicles offers a significant opportunity to reimagine dashboard architecture and user interfaces. The Global Automotive Instrument Panel Assembly Market can benefit from this shift by introducing flexible layouts that support centralized displays and voice-controlled features. It allows the integration of advanced driver monitoring systems, navigation aids, and environmental controls into seamless panel designs. With fewer mechanical controls needed, automakers have more freedom to innovate aesthetically and functionally. The demand for EV-specific dashboards featuring energy consumption metrics and driving analytics continues to grow. This creates new revenue streams for manufacturers that can deliver adaptable and scalable solutions.

Emerging Markets and Growing Middle-Class Demand Fuel Product Diversification

Automotive sales are increasing in emerging economies, driven by a rising middle class and improving infrastructure. The Global Automotive Instrument Panel Assembly Market has the opportunity to expand its footprint by offering cost-effective solutions tailored to regional needs. It can target markets in Asia, Africa, and Latin America with durable, modular, and digitally enabled panels. Growing consumer awareness of vehicle technology and connectivity creates room for upgraded dashboard features, even in budget models. Localization of production and partnerships with regional OEMs can reduce costs and improve market access. These strategies enhance competitiveness and position suppliers for long-term growth.

Market Segmentation Analysis

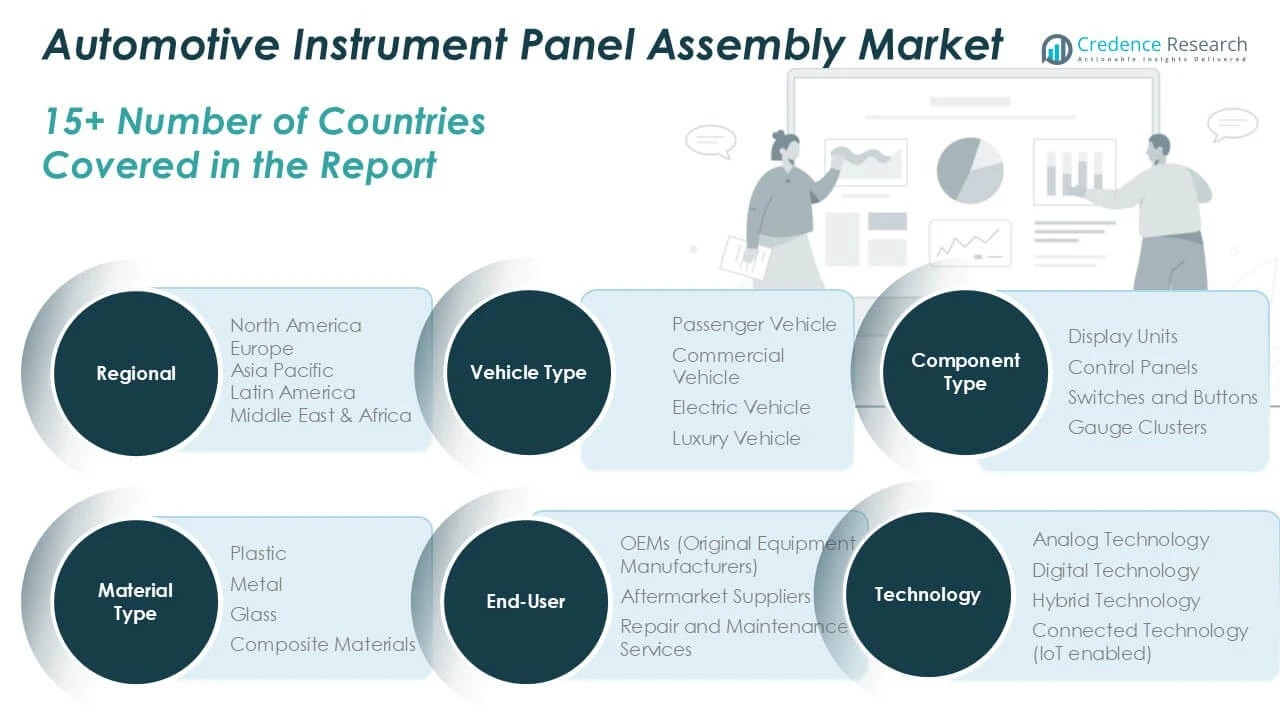

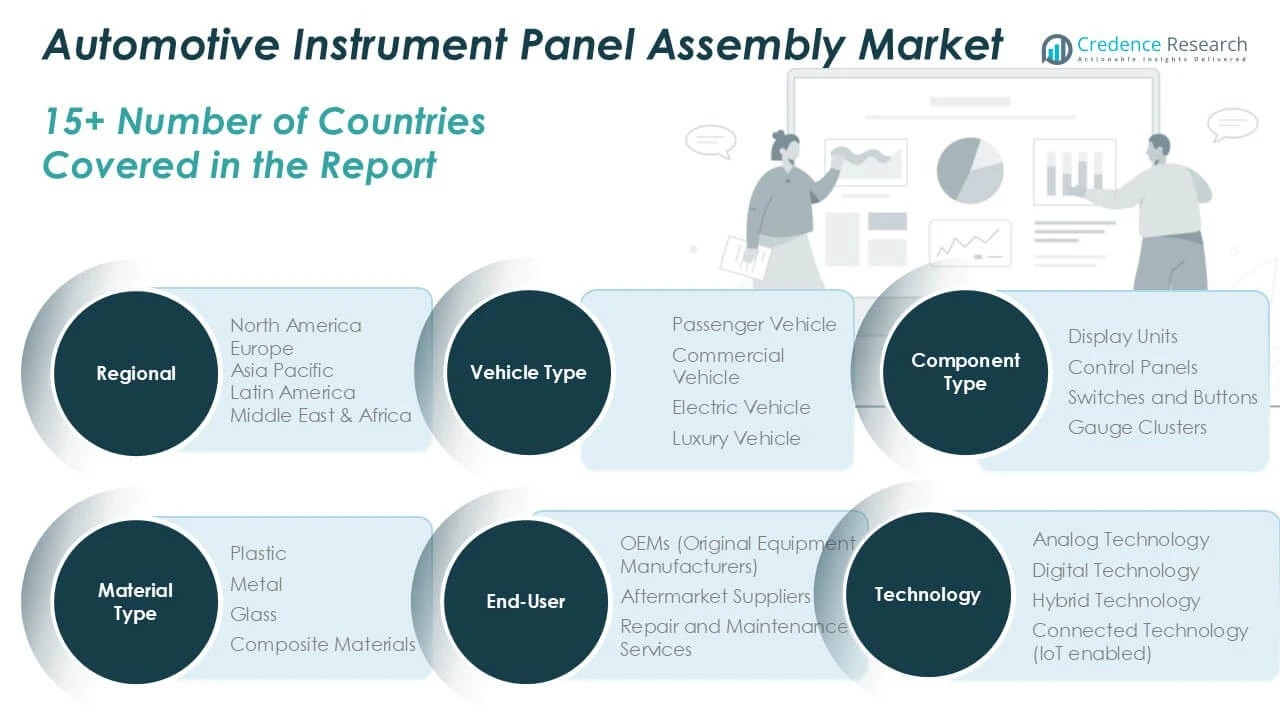

By Vehicle Type

The Global Automotive Instrument Panel Assembly Market is segmented into passenger vehicles, commercial vehicles, electric vehicles, and luxury vehicles. Passenger vehicles account for the largest share due to high production volumes and rising demand for enhanced infotainment and driver interface features. Commercial vehicles are integrating more robust and functional dashboards to improve driver productivity and safety. Electric vehicles present strong growth potential with their unique dashboard requirements, including battery performance indicators and digital controls. Luxury vehicles continue to drive innovation in aesthetics, materials, and technology integration, pushing suppliers to offer premium-grade panels with advanced functionalities.

By Component Type

The market includes display units, control panels, switches and buttons, and gauge clusters. Display units dominate the segment with increasing adoption of digital screens and multifunctional displays. Control panels are evolving to support integrated functions like HVAC, audio, and navigation within a single interface. Switches and buttons are transitioning toward touch-based or capacitive alternatives for a cleaner dashboard layout. Gauge clusters remain essential, with growing preference for digital and hybrid formats offering customizable views and real-time data.

By End-User

OEMs lead the end-user segment, accounting for the majority of demand due to direct integration during vehicle manufacturing. Aftermarket suppliers serve vehicle owners looking to upgrade or replace dashboard components, especially in older models. Repair and maintenance services support consistent demand through periodic dashboard repairs and replacement of defective components, helping extend vehicle life.

By Material Type

The material segment includes plastic, metal, glass, and composite materials. Plastic remains the most widely used due to cost efficiency, design flexibility, and ease of manufacturing. Metal is preferred for structural reinforcement and premium aesthetics. Glass use is growing in digital displays and touch interfaces. Composite materials offer strength, lightweight benefits, and design innovation opportunities.

By Technology

The market is segmented into analog, digital, hybrid, and connected technology. Analog technology is declining as automakers move toward more advanced solutions. Digital technology leads with its ability to deliver real-time information, customization, and integration. Hybrid panels combine analog and digital elements to balance cost and functionality. Connected technology is gaining traction with IoT-enabled features that support data sharing, remote diagnostics, and cloud integration.

Segments

Based on Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

- Luxury Vehicles

Based on Component Type

- Display Units

- Control Panels

- Switches and Buttons

- Gauge Clusters

Based on End-user

- OEMs (Original Equipment Manufacturers)

- Aftermarket Suppliers

- Repair and Maintenance Services

Based on Material Type

- Plastic

- Metal

- Glass

- Composite Materials

Based on Distribution Channel

- Analog Technology

- Digital Technology

- Hybrid Technology

- Connected Technology (IoT enabled)

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Instrument Panel Assembly Market

North America held the largest share of the global Automotive Instrument Panel Assembly Market in 2024, accounting for 32.91% of total revenue. The market in this region is projected to grow from USD 8,677.46 million in 2024 to USD 12,702.99 million by 2032, registering a CAGR of 4.9%. High demand for advanced safety systems, digital dashboards, and infotainment integration in the United States and Canada continues to drive market expansion. It is supported by the strong presence of leading automotive OEMs and high consumer preference for connected and luxury vehicles. Regulatory mandates for in-vehicle safety also support the growth of intelligent instrument panel designs. The region remains a hub for innovation in dashboard materials and embedded technology.

Europe Automotive Instrument Panel Assembly Market

Europe captured 25.44% of the global market share in 2024, with revenues expected to grow from USD 6,703.98 million in 2024 to USD 9,162.24 million by 2032, at a CAGR of 4.0%. The European market is driven by strong automotive manufacturing bases in Germany, France, and the UK, along with rising demand for electric and premium vehicles. The Automotive Instrument Panel Assembly Market here is evolving with increased adoption of sustainable materials and digital cockpit designs. It benefits from advanced R\&D facilities and government regulations pushing for smarter, more efficient vehicle interiors. OEMs in the region are focusing on integrating adaptive lighting, touch control, and customizable displays into their models. Consumer preference for refined and functional interiors continues to shape product development.

Asia Pacific Automotive Instrument Panel Assembly Market

Asia Pacific accounted for 25.28% of the global market share in 2024 and is expected to rise from USD 6,663.56 million in 2024 to USD 11,020.88 million by 2032, the highest regional CAGR of 6.6%. The region is experiencing rapid growth due to expanding vehicle production in China, India, South Korea, and Japan. It benefits from low production costs, growing urbanization, and rising disposable incomes. The Automotive Instrument Panel Assembly Market in Asia Pacific is advancing with strong demand for digital displays and compact vehicle dashboards. Regional OEMs are focusing on affordability without compromising technology or design. This positions the region as a key contributor to global volume and innovation in instrument panel production.

Latin America Automotive Instrument Panel Assembly Market

Latin America held 5.92% of the global market share in 2024, with the market expected to grow from USD 1,560.56 million in 2024 to USD 2,069.91 million by 2032, registering a CAGR of 3.6%. Brazil and Mexico are the major contributors to regional growth, supported by rising vehicle ownership and local manufacturing capabilities. The Automotive Instrument Panel Assembly Market here is driven by demand for durable and cost-effective dashboard solutions. It remains price-sensitive, leading to a focus on basic yet reliable components. Growth opportunities lie in the gradual shift toward vehicle digitization and improved interior aesthetics. Regional suppliers are starting to adopt flexible production models to serve both OEMs and aftermarket demands.

Middle East Automotive Instrument Panel Assembly Market

The Middle East represented 4.08% of the global market in 2024, with the market growing from USD 1,075.53 million in 2024 to USD 1,414.81 million by 2032, at a CAGR of 3.5%. The region shows steady demand for luxury and utility vehicles, particularly in the UAE and Saudi Arabia. The Automotive Instrument Panel Assembly Market in this region benefits from the growth of the premium automotive segment and high-end custom interiors. It reflects a preference for advanced design and integration of infotainment systems. However, limited local production poses challenges for large-scale growth. Imports dominate the market, although regional assembly facilities are beginning to expand.

Africa Automotive Instrument Panel Assembly Market

Africa accounted for 6.39% of the global market share in 2024, with market size projected to rise from USD 1,684.23 million in 2024 to USD 2,081.91 million by 2032, reflecting a CAGR of 2.2%. The Automotive Instrument Panel Assembly Market in Africa is still emerging, with growth driven by increasing automotive penetration and infrastructure development. South Africa leads regional demand, supported by both domestic manufacturing and vehicle imports. It is marked by a need for basic, rugged dashboard designs suitable for varying road and climate conditions. Low vehicle electrification levels slow the adoption of advanced panel technologies. However, long-term development plans and international investments offer potential for steady growth.

Key players

- Faurecia

- Toyoda Gosei Co. Ltd.

- Grupo Antolin-Irausa

- Marelli Corporation

- IAC Automotive Systems

- Prima Sole Components

- Novem Car Interior Design

- DaikyoNishikawa Auto Part

- IO Industry Co. Ltd.

- Suiryo Plastics Co. Ltd.

Competitive Analysis

The global Automotive Instrument Panel Assembly Market is highly competitive, characterized by the presence of established multinational players and specialized regional manufacturers. It features strong competition in product innovation, cost-efficiency, and technology integration. Key companies such as Faurecia, Toyoda Gosei, and Grupo Antolin lead the market by offering advanced instrument panels with digital interfaces, lightweight materials, and enhanced safety features. Companies compete to secure long-term contracts with OEMs through global supply capabilities and modular design offerings. Smaller players like Suiryo Plastics and IO Industry focus on niche markets, emphasizing customization and cost control. Strategic alliances, acquisitions, and investments in R\&D are central to strengthening market positions.

Recent Developments

- On March 12, 2025, Toyoda Gosei has developed a thinner register for car air conditioning. This new, ultra-thin register will meet the increasing demand for thinner instrument panels that contributes to more spacious cabin and better forward visibility.

- In April 2025, Novem Car Interior Design announced an investment of over US\$15.5 million to expand its plant in Querétaro, Mexico, enhancing production capabilities for decorative interior components.

Market Concentration and Characteristics

The global Automotive Instrument Panel Assembly Market exhibits moderate to high market concentration, with a few dominant players holding significant shares and driving innovation. It is characterized by high entry barriers due to complex manufacturing requirements, strict quality standards, and the need for long-term partnerships with OEMs. The market emphasizes continuous advancement in design, material innovation, and integration of digital technologies. It relies heavily on customization to meet diverse vehicle specifications across regions and segments. Consolidation through mergers and strategic collaborations is common, reinforcing competitive positions. Suppliers must maintain agility, invest in R&D, and align with evolving vehicle electrification and connectivity trends to remain competitive.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Cartilage, Treatment Modalities, Treatment Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Instrument panels will feature more integrated digital technologies, including AI-driven interfaces and voice control, enhancing the overall in-vehicle user experience.

- OEMs will prioritize customizable dashboards that align with driver preferences, offering modular components and programmable displays across vehicle models.

- Growth in electric vehicles will push the development of specialized dashboards equipped with energy monitoring and EV-specific display features.

- Rising middle-class populations and urbanization in Asia, Latin America, and Africa will drive demand for affordable and efficient panel assembly solutions.

- Manufacturers will increase the use of lightweight composites and sustainable materials to improve vehicle fuel efficiency and meet environmental regulations.

- Automotive interiors will continue to trend toward sleek, minimalist instrument panel designs, removing physical buttons in favor of touch or gesture-based controls.

- Connected technologies will become standard, requiring dashboards to support cloud communication, real-time diagnostics, and over-the-air updates.

- Market players will form alliances with tech companies to accelerate dashboard innovation, focusing on software integration and digital user experience.

- Instrument panels will evolve to improve driver attention and safety through better screen placement, HUDs, and intuitive control layouts.

- The aftermarket segment will grow with increasing demand for dashboard upgrades in older vehicles, supporting digital conversions and feature enhancements.