| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Camshaft Market Size 2024 |

USD 10,165.11 million |

| Automotive Camshaft Market, CAGR |

3.87% |

| Automotive Camshaft Market Size 2032 |

USD 13,733.50 million |

Market Overview:

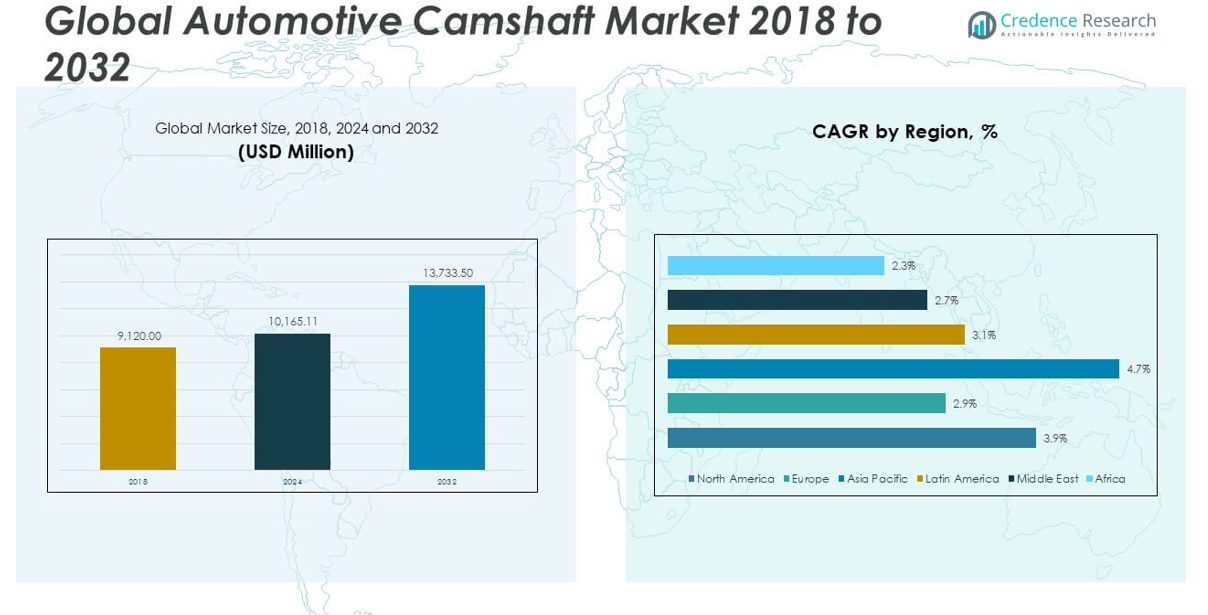

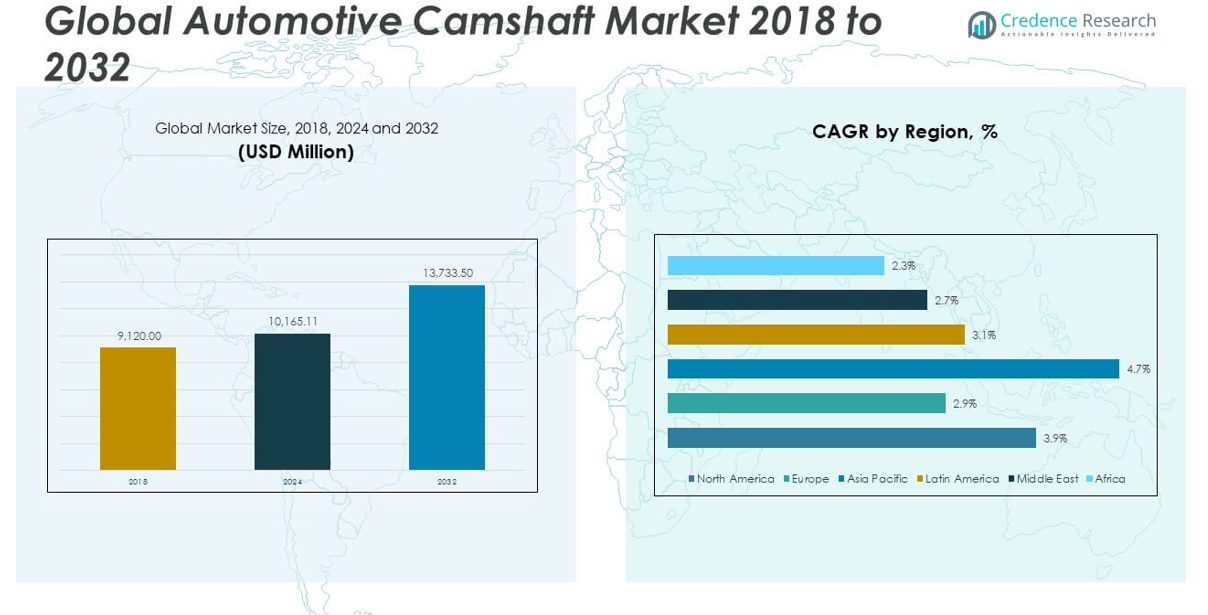

The Global Automotive Camshaft Market size was valued at USD 9,120.00 million in 2018 to USD 10,165.11 million in 2024 and is anticipated to reach USD 13,733.50 million by 2032, at a CAGR of 3.87% during the forecast period.

The market’s growth is primarily fueled by several interrelated drivers. Engine performance optimization, fuel efficiency, and regulatory compliance are compelling automakers to invest in camshaft designs that support variable valve timing (VVT) and enhance powertrain performance while reducing emissions. Rising global vehicle production—particularly in emerging economies—further supports demand across light and heavy-duty vehicle categories. In parallel, the aftermarket segment benefits from aging vehicle fleets and the increasing demand for performance upgrades and replacement parts. Advances in materials such as forged steel, chilled iron, and composite alloys, along with precision manufacturing techniques like forging and additive manufacturing, are leading to the development of lighter, more durable camshafts that meet modern engine design standards. Moreover, ongoing investments in hybrid vehicle technology sustain camshaft relevance, even as the market prepares for long-term electrification trends.

Regionally, North America dominates the Global Automotive Camshaft Market, accounting for over one-third of the total market share in 2024. This leadership position is supported by a strong base of automotive OEMs, high penetration of advanced ICE and hybrid technologies, and a mature aftermarket ecosystem. Europe follows as the second-largest market, driven by strict emissions regulations and sustained innovation among premium vehicle manufacturers. Countries such as Germany, the UK, and France play a critical role in camshaft design and manufacturing. The Asia-Pacific region is the fastest-growing market, led by high-volume production in China, India, and Japan. Rapid urbanization, rising disposable income, and supportive government initiatives are boosting automotive sales and component manufacturing in the region. Latin America, the Middle East, and Africa represent emerging opportunities, with gradual growth supported by expanding automotive assembly operations and increasing demand for personal and commercial vehicles.

Market Insights:

- The Global Automotive Camshaft Market was valued at USD 9,120.00 million in 2018, reached USD 10,165.11 million in 2024, and is projected to hit USD 13,733.50 million by 2032, growing at a CAGR of 3.87% during the forecast period.

- Demand is rising due to the push for fuel-efficient and high-performance engines, prompting OEMs to adopt variable valve timing (VVT) systems that require precision-engineered camshafts.

- Growth in vehicle production across emerging economies such as India, China, and Brazil is supporting OEM demand, while the aftermarket benefits from aging fleets and rising performance upgrade needs.

- Camshaft manufacturers are using advanced materials like forged steel, chilled iron, and composites, alongside precision manufacturing processes, to meet modern engine design requirements.

- Hybrid vehicle adoption helps sustain demand for camshafts, as internal combustion components remain necessary in transitional powertrains despite the shift toward electrification.

- The increasing penetration of electric vehicles poses a long-term threat to the market since battery electric vehicles do not use camshafts, pushing manufacturers to explore diversification strategies.

- North America leads the market with over one-third share, followed by Europe, while Asia-Pacific is the fastest-growing region, driven by strong automotive production and supportive government policies in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Fuel-Efficient and High-Performance Engines:

The Global Automotive Camshaft Market is driven by the increasing demand for fuel-efficient and high-performance engines across both passenger and commercial vehicles. Original equipment manufacturers (OEMs) are focusing on optimizing engine output through technologies such as variable valve timing (VVT), which require precision-engineered camshafts. These advanced camshaft systems help regulate airflow and combustion efficiency, thereby improving power delivery and fuel economy. Automakers are under pressure to meet regulatory mandates on emissions and fuel consumption, which further accelerates the adoption of such technologies. The integration of advanced valvetrain systems continues to boost camshaft replacement and upgradation demand. It reflects a broader shift toward high-efficiency engine platforms.

- For instance, Toyota’s Dynamic Force engines employ VVT-iE camshaft systems that contribute to thermal efficiency ratings up to 41%, setting benchmarks for mainstream gasoline engines.

Rising Global Vehicle Production and Aftermarket Growth:

The Global Automotive Camshaft Market benefits from the steady rise in vehicle production, especially in emerging economies such as India, China, and Brazil. These markets are experiencing rapid industrialization and urbanization, which increase the need for personal mobility and logistics support. Alongside OEM demand, the aftermarket segment remains robust, fueled by the aging vehicle fleet and growing interest in performance tuning and repair. Consumers are investing in durable and upgraded camshaft systems to improve vehicle longevity. Workshops and service centers continue to stock replacement camshafts due to recurring wear-and-tear, supporting recurring sales. It makes the camshaft a critical component for both first-fit and replacement markets.

Stringent Emissions Regulations Fuel Technological Innovation:

The Global Automotive Camshaft Market is influenced by tightening global emissions regulations that require lower carbon outputs and cleaner engine operation. Compliance with standards such as Euro 6, BS-VI, and China 6 compels manufacturers to redesign powertrain components, including camshafts, to optimize engine breathing and combustion efficiency. Camshafts with advanced profiles and materials are engineered to align with these mandates while retaining durability. Regulatory bodies encourage adoption of technologies that reduce hydrocarbon and NOx emissions through improved mechanical control. This push fosters continuous innovation in camshaft geometry and metallurgy. It directly enhances demand for precision-engineered camshaft products.

Sustained Relevance of Hybrid Powertrains:

Despite rising electrification, hybrid vehicles continue to hold significant market share, sustaining the relevance of internal combustion components. The Global Automotive Camshaft Market leverages this trend as hybrids require efficient, lightweight, and compact camshaft systems. OEMs are incorporating dual overhead cam (DOHC) systems in hybrid engines to optimize thermal efficiency and engine response. This maintains demand for camshafts across transitional powertrain technologies. Manufacturers are developing camshafts with integrated sensors and actuators to support smarter engine controls. It reinforces the component’s importance in hybrid propulsion systems.

- For instance, Toyota’s Dynamic Force engines, which power several hybrid models, utilize high-strength camshafts combined with VVT-iE (Variable Valve Timing–intelligent Electric) systems, contributing to thermal efficiency levels up to 41% in production hybrid engines, according to Toyota’s 2023 official performance disclosures.

Market Trends:

Integration of Smart Camshaft Systems:

The Global Automotive Camshaft Market is experiencing a shift toward smart camshaft systems with embedded electronics and sensors. These innovations support real-time valve timing adjustments and engine diagnostics, contributing to predictive maintenance and enhanced performance. Manufacturers are developing camshafts integrated with actuators and microcontrollers to optimize timing during variable engine loads. This trend aligns with the broader move toward digitalization and intelligent vehicle systems. Smart camshafts allow OEMs to collect engine data and fine-tune performance. It brings mechanical components into the era of connected mobility and smart powertrains.

- For instance, Schaeffler’s UniAir system, as adopted in Fiat’s MultiAir engines, achieves up to 25% reduction in CO2 emissions and enables 10% higher power output through electronically controlled variable valve actuation.

Adoption of Lightweight Composite Materials:

Material advancements are reshaping the design of automotive camshafts to reduce engine weight and increase efficiency. The Global Automotive Camshaft Market is seeing greater adoption of lightweight composites and aluminum-based alloys over traditional cast iron. These materials offer improved strength-to-weight ratios and heat resistance. Weight reduction in engine components directly supports fuel efficiency and meets emission targets. Suppliers are also experimenting with carbon-fiber reinforced plastics (CFRP) for high-performance applications. It pushes camshaft development toward higher performance with lower environmental impact.

- For instance, Thyssenkrupp’s composite camshafts, utilized by BMW in select high-performance engines, deliver over 40% weight reduction compared to conventionally cast iron camshafts while maintaining durability under high-load conditions.

Expansion of Custom-Built Camshaft Applications:

The rise in demand for customized engine performance is leading to growth in custom-built camshaft solutions. The Global Automotive Camshaft Market benefits from increased interest among automotive tuners, motorsport teams, and niche OEMs that require camshafts with unique profiles and timing characteristics. These applications often involve low-volume production but high margins, offering a strategic growth path for specialized manufacturers. Digital modeling and CNC-based production techniques have made it easier to develop custom camshaft geometries. It supports the growing trend of vehicle personalization and performance optimization.

OEMs Reshaping Supply Chains with In-House Production:

OEMs are increasingly exploring in-house camshaft manufacturing to gain better control over cost, quality, and innovation. The Global Automotive Camshaft Market is seeing a gradual shift from full dependency on external suppliers toward strategic integration of machining and casting operations. Companies are investing in automated production lines and forging capabilities to reduce turnaround time and strengthen IP protection. This move helps OEMs align camshaft design more closely with engine development cycles. It marks a strategic consolidation trend across the powertrain supply chain.

Market Challenges Analysis:

Threat from Electrification and EV Adoption:

The Global Automotive Camshaft Market faces growing pressure from the accelerating adoption of electric vehicles (EVs), which do not require camshafts or traditional ICE components. Pure battery electric vehicles (BEVs) utilize electric motors and power electronics, eliminating the need for mechanical valvetrain parts. As governments and OEMs invest heavily in EV infrastructure and model rollouts, demand for ICE-related components may decline over time. This structural shift forces camshaft manufacturers to diversify into hybrid platforms or explore non-automotive markets to sustain revenue.

High Manufacturing Complexity and Cost Pressures:

Camshaft production involves advanced metallurgical processes, precision machining, and quality control, contributing to high operational costs. The Global Automotive Camshaft Market contends with fluctuating raw material prices, such as steel and alloy metals, which impact profitability. Small and medium-sized manufacturers often struggle to maintain margins while meeting OEM specifications and volume requirements. Regulatory compliance, particularly in emissions and materials sourcing, increases the complexity of product development. It adds to financial strain and limits scalability for emerging players.

Market Opportunities:

Rising Demand for Hybrid Powertrains and Performance Upgrades:

The Global Automotive Camshaft Market has strong opportunities emerging from the growing hybrid vehicle segment, where internal combustion engines still play a key role. OEMs are increasing investments in hybrid engine platforms that require compact, lightweight, and high-efficiency camshaft systems. This shift opens new avenues for camshaft innovation, especially in dual overhead cam (DOHC) and variable valve timing (VVT) applications. The performance aftermarket is also expanding, driven by consumer interest in vehicle tuning and engine optimization. Manufacturers offering customizable or high-durability camshafts can tap into niche segments with strong margins. It positions the market to grow despite broader EV transitions.

Expansion in Developing Markets and Low-Cost Manufacturing Hubs:

Emerging economies present a significant opportunity for the Global Automotive Camshaft Market. Rapid urbanization, rising vehicle ownership, and expanding automotive assembly plants in countries such as India, Indonesia, and Mexico are creating sustained demand for camshaft systems. Local manufacturing capabilities and government incentives attract OEMs and component suppliers, encouraging regional production. Suppliers investing in cost-effective manufacturing and regional partnerships can gain long-term contracts with global automakers. It allows manufacturers to scale production and reduce costs while maintaining access to high-growth markets.

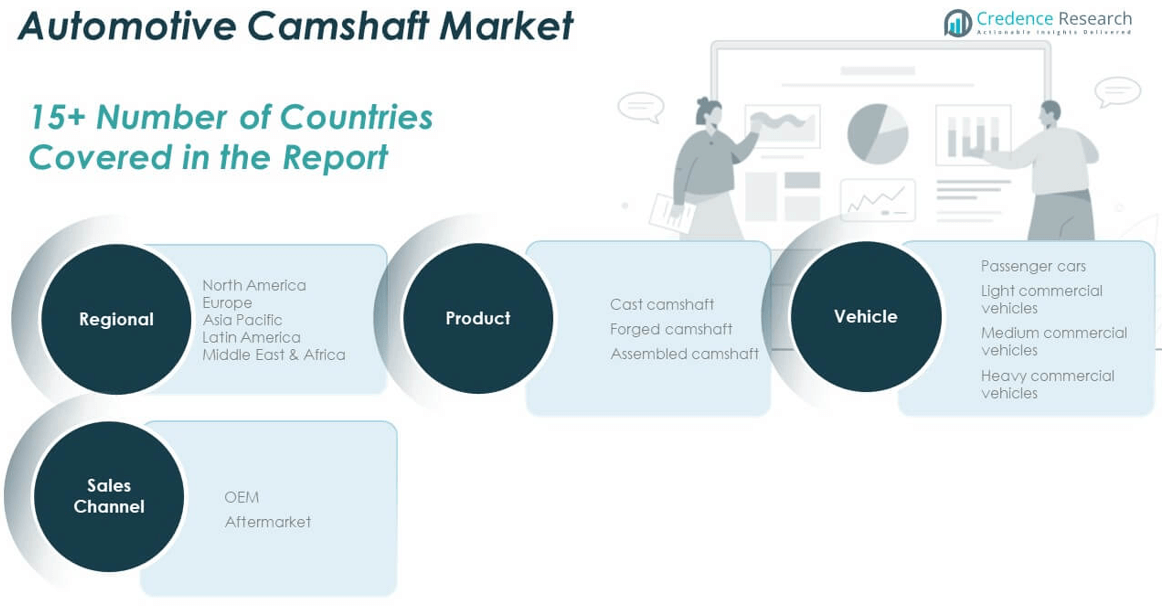

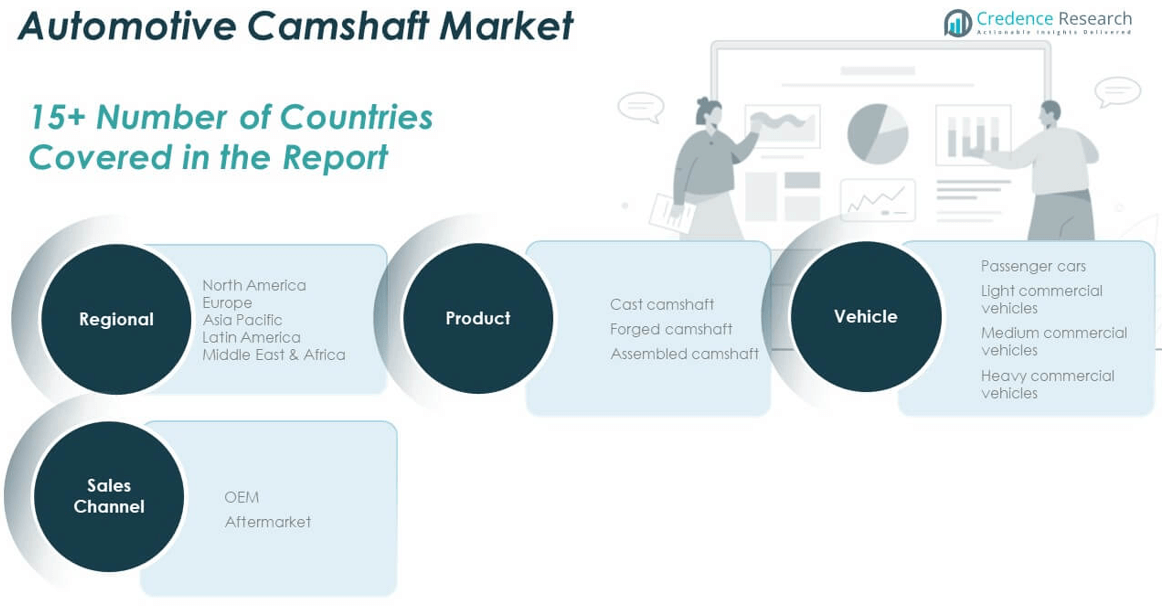

Market Segmentation Analysis:

By Product

The Global Automotive Camshaft Market includes cast, forged, and assembled camshafts. Cast camshafts lead the segment due to their cost-efficiency and suitability for mass production, especially in passenger vehicles. Forged camshafts are preferred in high-performance and commercial vehicles for their superior strength and durability. Assembled camshafts cater to specialized applications that require design flexibility, lightweight structure, and improved dynamic response.

- For instance, MAHLE produces cast camshafts annually, supplying major automakers globally, while Sumitomo Electric focusses on forged camshafts for heavy commercial engines, with their forged product lines accounting for over 60% of camshafts delivered to Japanese truck OEMs in 2023.

By Application (Vehicle Type)

Passenger cars account for the largest share in the Global Automotive Camshaft Market, driven by high production volumes and rising consumer demand for fuel-efficient, high-performance engines. Light commercial vehicles form the second-largest category, supported by growing logistics, e-commerce, and small business operations. Medium and heavy commercial vehicles demand camshafts with higher fatigue resistance and performance reliability, contributing to stable market share within the segment.

- For instance, Hyundai integrates advanced camshaft designs in its commercial and passenger vehicles, focusing on features like SOHC and DOHC architectures with variable valve timing (VVT) for better performance and efficiency.

By Sales Channel

OEMs dominate the sales channel segment in the Global Automotive Camshaft Market. Their integration of camshafts during vehicle assembly ensures quality control and compatibility with engine systems. The aftermarket segment is expanding steadily, driven by replacement needs in older vehicles, maintenance demand, and interest in engine tuning and performance upgrades. It remains vital in regions with large aging vehicle fleets and active service networks.

Segmentation:

By Product Segment

- Cast Camshaft

- Forged Camshaft

- Assembled Camshaft

By Application (Vehicle Type) Segment

- Passenger Cars

- Light Commercial Vehicles

- Medium Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel Segment

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Automotive Camshaft Market size was valued at USD 2,489.76 million in 2018 to USD 2,730.29 million in 2024 and is anticipated to reach USD 3,681.98 million by 2032, at a CAGR of 3.9% during the forecast period. The Global Automotive Camshaft Market holds a significant presence in North America due to robust automotive manufacturing and strong aftermarket demand. It benefits from the established presence of major OEMs and high adoption of advanced engine technologies. The demand for high-performance camshafts in light-duty and commercial vehicles continues to rise. Investments in cleaner and fuel-efficient powertrains further support regional market growth. The United States accounts for the majority of the market share within this region. North America represents approximately 21% of the Global Automotive Camshaft Market.

Europe

The Europe Automotive Camshaft Market size was valued at USD 1,869.60 million in 2018 to USD 1,979.89 million in 2024 and is anticipated to reach USD 2,482.37 million by 2032, at a CAGR of 2.9% during the forecast period. In the Global Automotive Camshaft Market, Europe maintains steady growth backed by its strong engineering legacy and premium vehicle segment. Germany, France, and the UK are major contributors, driving innovation in fuel-efficient engine technologies. It continues to witness consistent demand from both luxury car and commercial vehicle manufacturers. Transition to hybrid and electric powertrains has slightly moderated the growth in conventional camshaft systems. OEM relationships and aftermarket demand remain key drivers. Europe accounts for nearly 15% of the Global Automotive Camshaft Market.

Asia Pacific

The Asia Pacific Automotive Camshaft Market size was valued at USD 3,332.45 million in 2018 to USD 3,824.58 million in 2024 and is anticipated to reach USD 5,530.49 million by 2032, at a CAGR of 4.7% during the forecast period. Asia Pacific leads the Global Automotive Camshaft Market, driven by large-scale vehicle production across China, India, Japan, and South Korea. It benefits from strong OEM presence, low manufacturing costs, and rising internal combustion engine (ICE) demand. It is the fastest-growing region due to increasing vehicle ownership and expanding automotive exports. Government policies supporting ICE and hybrid vehicle development aid further expansion. The region dominates the global market with a share exceeding 43%.

Latin America

The Latin America Automotive Camshaft Market size was valued at USD 722.30 million in 2018 to USD 798.88 million in 2024 and is anticipated to reach USD 1,017.24 million by 2032, at a CAGR of 3.1% during the forecast period. Latin America shows moderate growth in the Global Automotive Camshaft Market, led by Brazil and Mexico. These countries serve as regional hubs for automotive assembly and export. OEM activities and aftermarket demand are growing steadily. Economic recovery and supportive trade agreements improve production volumes. Price sensitivity limits premium product adoption, but standard camshaft systems remain in demand. Latin America captures nearly 8% of the global market share.

Middle East

The Middle East Automotive Camshaft Market size was valued at USD 393.98 million in 2018 to USD 414.67 million in 2024 and is anticipated to reach USD 512.34 million by 2032, at a CAGR of 2.7% during the forecast period. The Global Automotive Camshaft Market in the Middle East remains stable, with demand largely influenced by commercial and utility vehicle sectors. Regional dependence on imported vehicles impacts the growth of local manufacturing. Aftermarket services and replacements support a consistent revenue stream. The adoption of modern engine technologies remains gradual. GCC countries contribute the majority of the regional demand. The Middle East accounts for about 4% of the global market.

Africa

The Africa Automotive Camshaft Market size was valued at USD 311.90 million in 2018 to USD 416.81 million in 2024 and is anticipated to reach USD 509.09 million by 2032, at a CAGR of 2.3% during the forecast period. Africa holds a minor but gradually expanding share in the Global Automotive Camshaft Market. It benefits from growth in used vehicle imports and rising urbanization. The lack of large-scale automotive manufacturing limits OEM camshaft demand. However, aftermarket and replacement sales maintain consistent momentum. Local assembly initiatives and trade agreements are slowly improving market dynamics. Africa represents nearly 3% of the global camshaft market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aichi Forge

- Crane Cams

- Estas Camshaft

- Linamar

- MAHLE

- Musashi Seimitsu Industry

- Precision Camshafts

- Riken

- Schaeffler

- Thyssenkrupp

Competitive Analysis:

The Global Automotive Camshaft Market features a mix of global manufacturers and regional suppliers competing on product quality, cost-efficiency, and technological innovation. Leading companies focus on lightweight materials, advanced manufacturing techniques, and performance optimization. It sees continuous investment in R&D to support stricter emission norms and engine efficiency goals. Key players such as MAHLE GmbH, Linamar Corporation, and Thyssenkrupp AG maintain a strong presence through OEM partnerships and diversified portfolios. Emerging players are targeting aftermarket demand with cost-effective solutions. The market remains highly competitive, with OEM supply agreements and long-term contracts shaping market share distribution.

Recent Developments:

- In June 2025, Precision Camshafts secured substantial new orders for camshafts with future deliveries scheduled up to 2030, enhancing its long-term pipeline. The company also progressed on its new greenfield site to produce assembled camshafts, with production planned to commence in the next fiscal year. In addition, Precision Camshafts reported advances in electrified camshaft solutions targeted at heavy commercial vehicles.

- On May 22, 2025, RIKEN TECHNOS CORPORATION executed a significant treasury share repurchase, acquiring 364,900 of its own shares as part of a broader capital management initiative. The share buyback, completed through Japan’s ToSTNeT-3 system, aims to improve capital efficiency and enhance shareholder returns, reflecting Riken’s evolving corporate strategy.

- In January 2025, MAHLE took center stage at CES 2025 by unveiling innovative products in thermal management and electrification. Key highlights included a new technology kit for electric motors, a bionic battery cooling plate, a bionic fan, and a globally standardized wireless charging positioning system. These launches strengthen MAHLE’s commitment to supporting e-mobility and automotive system efficiency.

Market Concentration & Characteristics:

The Global Automotive Camshaft Market is moderately concentrated, with a few dominant players holding a substantial share through OEM contracts and global production networks. It is characterized by high entry barriers due to technological complexity, capital intensity, and long-term supplier relationships. Camshaft manufacturers emphasize durability, precision engineering, and compliance with evolving fuel efficiency and emission standards. The market exhibits steady growth supported by ICE vehicle demand in emerging regions and sustained investments in hybrid engine platforms. Competition remains intense across both OEM and aftermarket channels.

Report Coverage:

The research report offers an in-depth analysis based on product type, vehicle application, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Hybrid vehicle adoption will increase demand for advanced camshaft designs with improved thermal resistance.

- OEMs will prioritize suppliers that deliver lightweight and durable camshaft solutions.

- Asia Pacific will remain the dominant region, driven by high vehicle production and local sourcing.

- R&D spending will intensify to meet tightening global emission regulations.

- Aftermarket sales will grow due to aging vehicle fleets in developing countries.

- Automation and precision machining will enhance production efficiency and quality.

- Strategic partnerships between OEMs and component suppliers will strengthen supply chain resilience.

- Demand for camshafts in commercial vehicles will remain steady, driven by freight and logistics growth.

- Integration of smart materials and surface treatment technologies will gain traction.

- Regulatory shifts toward electric vehicles will gradually impact long-term market volumes.