Market Overview:

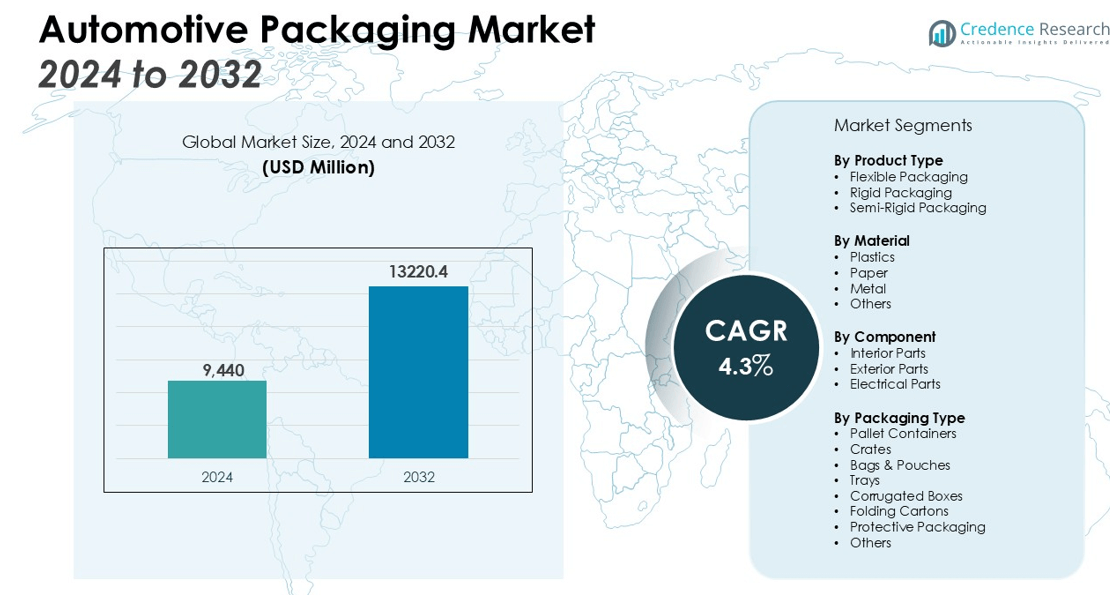

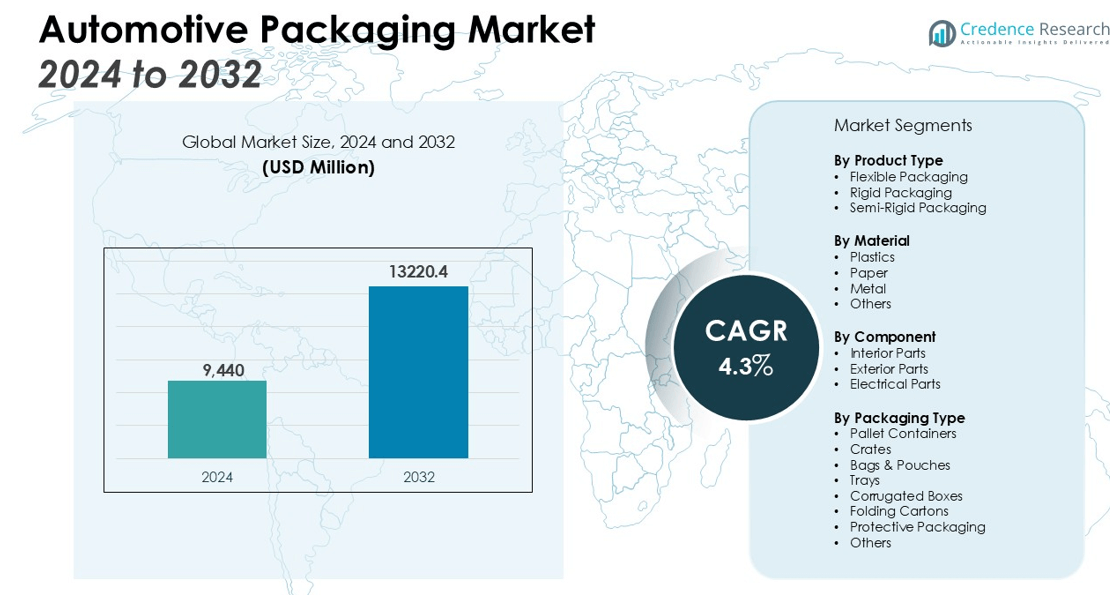

The Automotive Packaging Market size was valued at USD 9,440 million in 2024 and is anticipated to reach USD 13220.4 million by 2032, at a CAGR of 4.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Packaging Market Size 2024 |

USD 9,440 million |

| Automotive Packaging Market, CAGR |

4.3% |

| Automotive Packaging Market Size 2032 |

USD 13220.4 million |

Key drivers of market growth include the rising adoption of lightweight and eco-friendly packaging materials, which help reduce overall costs and environmental impact. The need for safer and more efficient packaging solutions to protect automotive components during transport is also a significant factor. Furthermore, the growth in e-commerce and the push toward automation in the automotive supply chain are further propelling demand for specialized packaging solutions.

Regionally, North America holds a substantial share of the automotive packaging market, driven by the high concentration of automotive manufacturers and suppliers in the region. The demand for innovative packaging solutions for automotive components and parts is also growing due to the region’s technological advancements in packaging materials. Europe also represents a significant market share due to the robust automotive industry and the growing demand for sustainable packaging solutions. The region’s regulatory policies favoring environmental sustainability are contributing to the adoption of eco-friendly packaging alternatives. The Asia Pacific region is expected to experience the highest growth rate, propelled by the rapid expansion of the automotive industry in countries like China and India.

Market Insights:

- The automotive packaging market is valued at USD 9,440 million in 2024 and is projected to reach USD 13,220.4 million by 2032, with a CAGR of 4.3% during the forecast period.

- Lightweight and eco-friendly packaging solutions are increasingly sought after, as they help reduce operational costs and environmental impact, driving significant growth in the market.

- The need for safer and more efficient packaging to protect automotive components during transport is another major driver, with demand for specialized solutions rising as automotive parts become more intricate.

- Technological advancements such as robotics and automation are transforming the automotive packaging market, enhancing efficiency, reducing human error, and ensuring consistent packaging quality.

- The rapid growth of e-commerce and global supply chains is creating new packaging demands, particularly for aftermarket parts and components that must withstand various shipping methods.

- Increasing material costs and supply chain disruptions pose a challenge, forcing companies to find cost-effective solutions while maintaining high-quality standards and sustainability goals.

- North America, Europe, and Asia Pacific dominate the market, with North America holding 35% of the market share, driven by advanced manufacturing capabilities, technological innovations, and the rise of electric vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Lightweight and Eco-Friendly Packaging Solutions

The automotive packaging market is experiencing significant growth due to the rising demand for lightweight and eco-friendly packaging materials. Manufacturers are increasingly seeking solutions that reduce both operational costs and the environmental footprint of their packaging. Materials such as recycled plastics and biodegradable films are gaining popularity due to their ability to lower transportation costs while meeting sustainability goals. These materials help decrease fuel consumption during transportation and minimize waste generation, making them ideal for environmentally conscious manufacturers. The shift towards lightweight packaging also aligns with the automotive industry’s broader goal of reducing vehicle weight for improved fuel efficiency. Consequently, packaging that supports these objectives is becoming a critical factor in the decision-making process.

- For instance, Ford Motor Company uses about 1.2 billion recycled plastic bottles annually in its vehicles, averaging 250 bottles per car, to create underbody shields and wheel liners, reducing solid plastic use and supporting lightweight construction.

Rising Focus on Safety and Protection of Automotive Components

The need for safer and more efficient packaging solutions plays a crucial role in the growth of the automotive packaging market. Packaging must be robust enough to protect automotive components during long-distance transport, particularly for fragile or high-value parts. The use of durable packaging materials and innovative designs ensures that parts remain intact and undamaged, reducing the risk of product loss and ensuring that components reach manufacturers or end-users in optimal condition. These requirements have led to an increase in demand for specialized packaging options such as protective films, cushioning, and shock-absorbing materials. Companies are prioritizing packaging that enhances safety and minimizes the potential for damage, helping reduce costs associated with returns and replacements.

Technological Advancements in Packaging Systems

The automotive packaging market benefits from advancements in automation and technology. The integration of robotics and machine learning into packaging systems allows for faster, more accurate packaging processes. This shift to automated systems helps reduce human error and labor costs, ensuring higher efficiency in packaging production lines. Moreover, the automation of packaging operations leads to more consistent packaging quality, reducing product damage during transportation. By adopting these technologies, manufacturers are able to streamline their packaging processes, improve throughput, and maintain higher levels of quality control. The adoption of such innovations is essential for businesses that are looking to stay competitive in a rapidly evolving market.

- For instance, the Universal Robots UR20 collaborative robot, when integrated into automotive packaging and palletizing lines, has enabled a handling capacity of up to 20kg payload per package and a reach of 1,750mm, allowing for the stacking of packages up to 2 meters high on standard pallets.

Expansion of E-Commerce and Global Supply Chains

The increasing expansion of e-commerce and global supply chains is another key driver for the automotive packaging market. As more automotive components are sourced from various regions worldwide, the demand for effective packaging solutions that ensure the safe and efficient transportation of these parts has surged. Packaging must accommodate various shipping methods, from air freight to sea transport, ensuring that parts are secure, easy to handle, and able to withstand various transit conditions. The growth of online sales, particularly in automotive aftermarket parts, further accelerates the demand for packaging solutions that can cater to small and large shipments alike. Companies in the automotive sector are focusing on packaging innovations that improve logistical efficiency and facilitate quick delivery to meet consumer expectations.

Market Trends:

Increasing Adoption of Sustainable Packaging Solutions

The automotive packaging market is witnessing a growing trend toward the adoption of sustainable and eco-friendly materials. Companies are focusing on packaging solutions that minimize environmental impact by using recyclable, biodegradable, and reusable materials. The automotive industry’s increasing emphasis on sustainability, driven by both regulatory requirements and consumer preferences, is pushing manufacturers to prioritize packaging solutions that reduce carbon footprints. Packaging made from recycled materials, such as plastics and paper, is gaining traction due to its ability to minimize waste and contribute to a circular economy. The integration of green packaging technologies is not only helping manufacturers meet sustainability targets but also improving their brand image. Packaging innovations such as edible and plant-based materials are also emerging as viable alternatives, further aligning with the industry’s sustainability objectives.

- For instance, CEVA Logistics prevented 38,000 tons of CO₂ emissions in 2024 by deploying closed-loop reusable packaging systems for European automotive manufacturers.

Evolution of Smart and Automated Packaging Technologies

Smart and automated packaging solutions are increasingly being integrated into the automotive packaging market to enhance efficiency and reduce operational costs. The adoption of technologies like RFID tags, QR codes, and sensors is transforming packaging into a tool for real-time monitoring and tracking. These smart packaging systems provide valuable data about the condition of automotive components during transit, allowing manufacturers to monitor temperature, humidity, and shock levels. Automation in packaging production is also on the rise, with robotics and machine learning streamlining packaging processes. These advancements contribute to faster turnaround times, reduced human error, and improved quality control. By incorporating these technologies, the automotive packaging market is evolving toward more intelligent and cost-effective packaging solutions that support global supply chain management.

- For instance, Volvo uses RAIN RFID tags attached to the chassis of each vehicle in its Belgium and China facilities, enabling the real-time tracking of over 2 million cars through the production process to ensure custom orders are built correctly.

Market Challenges Analysis:

Rising Material Costs and Supply Chain Disruptions

One of the key challenges facing the automotive packaging market is the increasing cost of raw materials. The rising prices of plastics, metals, and other essential packaging components are putting pressure on manufacturers to maintain cost-effective solutions. These price hikes are often a consequence of global supply chain disruptions and fluctuating demand. Packaging materials must meet stringent safety and sustainability standards, which further complicates cost management. Companies must navigate these challenges while balancing the need for high-quality, protective packaging with the financial constraints of production. This situation requires innovative approaches to reduce costs without compromising the performance or environmental impact of the packaging solutions.

Adapting to Evolving Industry Demands

The rapid pace of technological advancements and the shifting needs of the automotive sector present another significant challenge for the automotive packaging market. Manufacturers must continually adapt packaging designs and materials to accommodate new automotive components, such as electric vehicle batteries or lightweight parts. These evolving demands require packaging solutions that offer enhanced protection, efficiency, and sustainability. However, this constant innovation can strain resources, as companies must invest in research and development while maintaining their existing packaging infrastructure. As the market grows and diversifies, staying ahead of these trends and anticipating future packaging needs is a persistent challenge for automotive packaging suppliers.

Market Opportunities:

Expansion of Electric Vehicle Market

The automotive packaging market presents significant opportunities with the growing adoption of electric vehicles (EVs). As the demand for EVs increases, manufacturers are seeking packaging solutions tailored to the unique components of electric vehicles, such as batteries and electric drivetrains. These parts require specialized protection during transportation and storage, which opens avenues for innovative packaging designs. Companies can capitalize on this trend by offering packaging solutions that are lightweight, durable, and efficient, addressing the specific needs of the EV sector. The rise of the EV market will likely drive the demand for sustainable and high-performance packaging materials, providing a promising growth opportunity for packaging suppliers.

Growth in Aftermarket Automotive Parts

Another key opportunity lies in the expansion of the automotive aftermarket industry. The increasing demand for replacement parts and accessories presents an ongoing need for effective and cost-efficient packaging solutions. As e-commerce grows, the packaging of automotive parts for direct-to-consumer shipments will continue to rise. Companies can capitalize on this by offering packaging solutions that cater to the needs of online retailers, ensuring safe delivery of parts while optimizing packaging size for cost-efficiency. The growth in the aftermarket sector provides a lucrative avenue for automotive packaging market players to expand their product offerings and improve their competitive position.

Market Segmentation Analysis:

By Product Type

The automotive packaging market is segmented by product type into flexible packaging, rigid packaging, and semi-rigid packaging. Flexible packaging, including pouches and films, holds a significant share due to its lightweight nature and cost-effectiveness. Rigid packaging, such as containers and boxes, is commonly used for high-value or fragile automotive components that require added protection during transit. Semi-rigid packaging solutions, which combine durability and flexibility, are gaining traction for their ability to safeguard parts while reducing packaging costs. These segments are driven by manufacturers’ need for secure, cost-efficient solutions that balance protection and weight.

- For instance, DS Smith’s optimized corrugated packaging for a major car manufacturer enabled 24 units to fit on a single pallet for auto components weighing 8kg each, accommodating a total weight of 160kg per pallet box for BMW wheel carriers.

By Material

The market is segmented by material into plastics, paper, metal, and others. Plastics dominate due to their versatility, durability, and ability to be molded into various shapes, making them ideal for automotive parts packaging. Paper-based packaging, known for being eco-friendly and lightweight, is increasingly popular as manufacturers shift toward sustainable practices. Metal packaging, while less common, is used for specific components that require extra protection. The growing demand for recyclable and biodegradable materials is influencing this segment, with manufacturers focusing on sustainable alternatives to reduce their environmental footprint.

- For instance, Smurfit WestRock introduced its all-paper stretch wrap, which enabled Encirc—a leading glass manufacturer—to completely replace plastic pallet wrap with paper-based alternatives for shipping over three billion glass containers annually.

By Component

The automotive packaging market is segmented by component into interior parts, exterior parts, and electrical parts. Interior parts packaging demands solutions that provide adequate cushioning and protection from damage. Exterior parts require packaging that offers enhanced durability to withstand harsh shipping conditions. Electrical components, such as batteries and wiring, require specialized packaging that ensures safety during transit and storage. These components require tailored solutions, and as the automotive industry evolves, packaging needs are shifting to accommodate new, specialized parts such as those used in electric vehicles.

Segmentations:

By Product Type

- Flexible Packaging

- Rigid Packaging

- Semi-Rigid Packaging

By Material

- Plastics

- Paper

- Metal

- Others

By Component

- Interior Parts

- Exterior Parts

- Electrical Parts

By Packaging Type

- Pallet Containers

- Crates

- Bags & Pouches

- Trays

- Corrugated Boxes

- Folding Cartons

- Protective Packaging

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading the Market with Strong Demand for Automotive Packaging Solutions

North America holds a dominant share of 35% in the automotive packaging market, driven by the presence of major automotive manufacturers in the United States, Mexico, and Canada. The region’s advanced manufacturing capabilities and high production volumes create a strong demand for packaging solutions that can efficiently support the transport and protection of automotive parts. Companies in this region are increasingly focusing on packaging that aligns with sustainability goals, such as the use of recyclable and eco-friendly materials. The growing adoption of electric vehicles (EVs) also influences the market, as specialized packaging solutions are required for EV components like batteries and powertrains. North America’s strong regulatory environment and technological innovations further propel the demand for innovative packaging solutions.

Europe: Strong Focus on Sustainability and Innovative Packaging Practices Driving Growth

Europe holds a market share of 30% in the automotive packaging sector, driven by its focus on sustainable practices and regulatory standards. The automotive industry in countries like Germany, France, and Italy prioritizes eco-friendly packaging, driven by strict environmental regulations and growing consumer demand for greener solutions. Companies are adopting lightweight, recyclable, and biodegradable packaging materials to comply with sustainability targets while maintaining packaging efficiency. The shift towards electric vehicles in Europe also creates opportunities for new packaging solutions tailored to the specific needs of EV components. Europe’s strong automotive industry and its push toward innovative packaging materials continue to contribute to the market’s growth in the region.

Asia Pacific: Rapid Growth in Automotive Manufacturing and E-Commerce Boosting Packaging Demand

The Asia Pacific region accounts for 25% of the automotive packaging market, with rapid expansion in countries like China, India, and Japan. The growing middle class and increased urbanization have led to a surge in vehicle demand, boosting the need for efficient packaging solutions. Packaging systems that offer cost-effective, durable, and sustainable options are in high demand to meet the growing volume of automotive parts production. The rise of e-commerce in the region further propels the market, especially in the aftermarket parts sector, where secure and efficient packaging is critical for timely deliveries. As automotive manufacturing continues to expand in this region, the market for automotive packaging solutions will remain strong and dynamic.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sealed Air Corporation

- Mondi Group Plc

- DS Smith Plc

- Sonoco Products Company

- Smurfit Kappa Group

- Deufol SE

- The Nefab Group

- Pratt Industries, Inc.

- Schoeller Allibert

- WestRock Company

- Pacific Packaging Products

- Sunbelt Paper & Packaging

Competitive Analysis:

The automotive packaging market is highly competitive, with numerous key players driving innovation and growth. Companies like Sealed Air Corporation, Mondi Group, and Sonoco Products Company dominate the landscape, offering a range of packaging solutions that meet the demands of automotive manufacturers. These companies focus on providing lightweight, durable, and eco-friendly materials that reduce costs and environmental impact. Innovation in packaging technology, such as the integration of automation and robotics, plays a crucial role in maintaining competitive advantage. Firms are also investing in sustainable practices to align with the increasing regulatory pressure for environmental responsibility. Smaller players are adopting niche strategies, offering specialized packaging solutions for specific automotive components. The market’s competitive dynamics are shaped by advancements in packaging materials, sustainability initiatives, and the need to streamline the global supply chain. As the industry evolves, the focus on providing customized, cost-effective solutions remains a key differentiator.

Recent Developments:

- In August 2024, Sealed Air introduced Bubble Wrap® brand Ready-To-Roll Embossed Paper, a curbside-recyclable, paper-based protective packaging solution for shipment protection and sustainability.

- In August 2024, Deufol SEadvanced its project logistics segment by acquiring Deufol Doehle Projects Ltd. in Bangkok, Thailand, directly related to the joint venture initiated with Menzell Döhle at the end of 2023, as part of its strategy for global expansion in heavy goods and project logistics.

- In April 2024, Nefab Group, via its U.S. division, completed the acquisition of Plastiform Inc. and its subsidiary Precision Formed Plastics, based in Texas.

Market Concentration & Characteristics:

The automotive packaging market is moderately concentrated, with a few key players holding significant market share, including Sealed Air Corporation, Mondi Group, and Sonoco Products Company. These companies dominate due to their extensive product portfolios, technological innovations, and strong global presence. However, the market also features a number of regional and smaller players who focus on niche segments and specialized packaging solutions. The market is characterized by continuous innovation in materials, such as the adoption of lightweight and eco-friendly packaging options, to meet the growing demand for sustainability. Companies are increasingly investing in automation and advanced technologies to improve packaging efficiency and reduce costs. The market’s dynamics are shaped by strong competition, regulatory pressures on environmental impact, and the need to cater to diverse automotive manufacturing needs. As a result, companies strive to maintain flexibility and adaptability in their offerings.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material, Component, Packaging Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The adoption of sustainable materials will continue to rise as manufacturers seek eco-friendly packaging options to meet environmental regulations and consumer preferences.

- Smart packaging technologies, including RFID and sensors, will gain traction for real-time tracking and monitoring of automotive parts during transit.

- The growth of e-commerce will drive demand for packaging solutions that ensure safe, cost-effective, and efficient delivery of automotive components.

- The expansion of electric vehicle production will create a need for specialized packaging solutions designed to protect batteries and other sensitive parts.

- Automation in packaging processes will improve efficiency, reduce labor costs, and increase consistency in packaging quality.

- Manufacturers will focus on offering customized packaging solutions to cater to the specific needs of different automotive components and enhance supply chain management.

- Reusable packaging systems will become more popular as a way to reduce waste and lower long-term operational costs.

- Advanced materials, such as biodegradable plastics and molded pulp, will replace traditional packaging to align with sustainability goals.

- Lightweight packaging will remain a priority to reduce shipping costs and minimize environmental impact.

- Collaboration between manufacturers and suppliers will intensify to streamline packaging processes and enhance product protection across the supply chain.