Market Overview

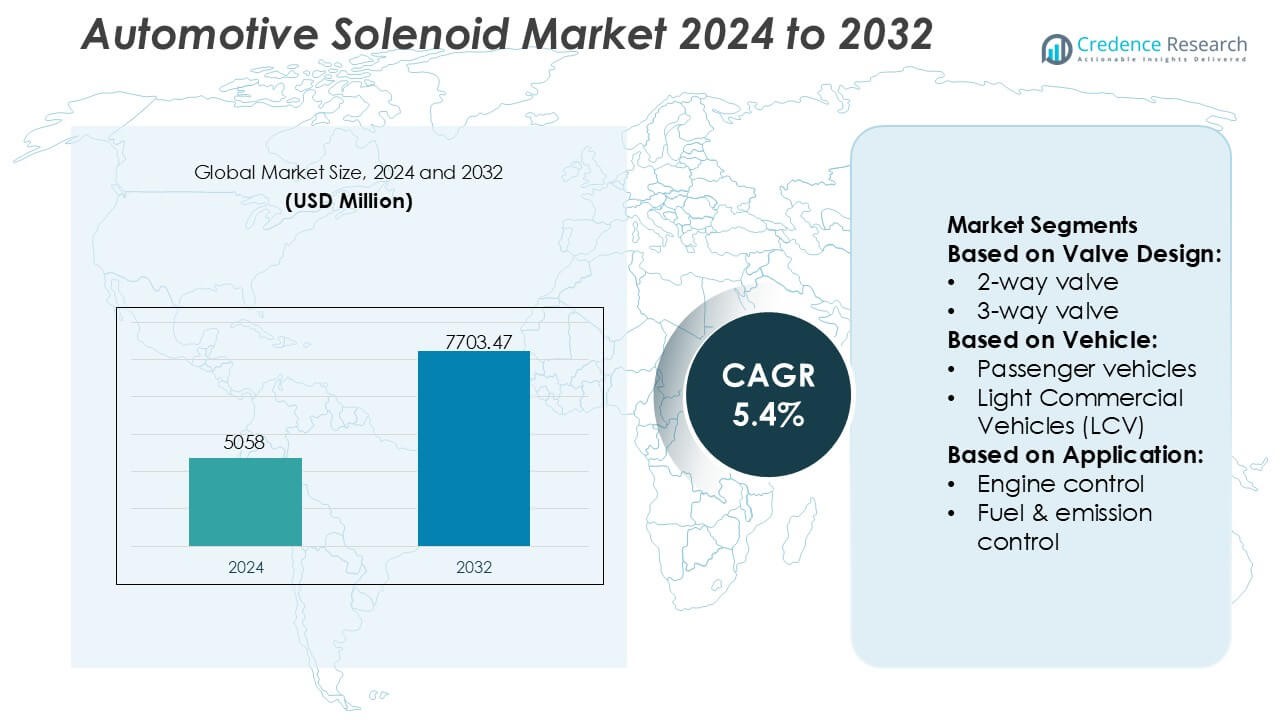

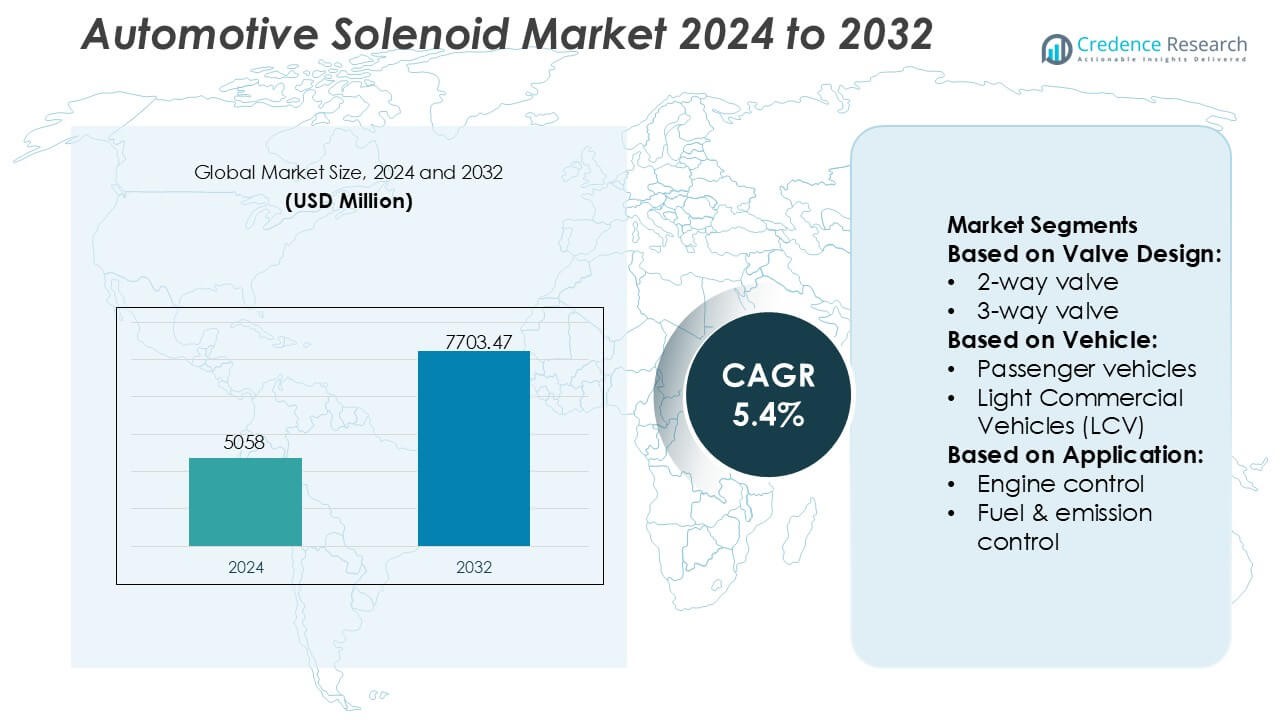

Automotive Solenoid Market size was valued USD 5058 million in 2024 and is anticipated to reach USD 7703.47 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Solenoid Market Size 2024 |

USD 5058 Million |

| Automotive Solenoid Market, CAGR |

5.4% |

| Automotive Solenoid Market Size 2032 |

USD 7703.47 Million |

The Automotive Solenoid Market is shaped by a strong mix of global manufacturers whose portfolios span engine control, transmission actuation, braking systems, and EV thermal management solutions. Key participants include Curtiss Wright Corporation, Danfoss Industries Ltd, SMC Corporation, AirTAC International Group, Emerson Electric Co., Anshan Solenoid Valve Co. Ltd, IMI Process Automation, CEME Group, Parker Hannifin Corporation, and KANEKO SANGYO Co. Ltd, each advancing miniaturized, high-efficiency solenoid technologies to meet evolving OEM requirements. North America leads the market with an exact 34% share, supported by rapid adoption of advanced powertrains, strong regulatory compliance needs, and expanding electrification initiatives across regional automotive platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Solenoid Market reached USD 5058 million in 2024 and is projected to hit USD 7703.47 million by 2032 at a 5.4% CAGR, reflecting stable demand across engine control, transmission, braking, and EV thermal systems.

- Rising adoption of electrified and turbocharged powertrains drives the need for high-efficiency solenoids that support precise fluid, pressure, and airflow control in modern vehicle architectures.

- Advancements in miniaturization, low-power actuation, and durable coil materials strengthen competition as leading players enhance portfolios for EV, hybrid, and automated transmission applications.

- Cost pressures, high-temperature performance limitations, and complex OEM validation requirements restrain growth, especially for solenoids operating in extreme under-hood environments.

- North America leads with a 34% share, while 2-way valves hold the dominant segment share at 41%, supported by widespread deployment in fuel, emission, and cooling circuits across passenger and light commercial vehicle platforms.

Market Segmentation Analysis:

By Valve Design

The 2-way valve segment dominates the Automotive Solenoid Market with an exact 41% share, supported by its broad compatibility with fuel circuits, engine actuators, and thermal management systems. Automakers prefer 2-way designs due to their compact geometry, fast switching response, and lower integration cost across combustion and hybrid platforms. Demand rises further as OEMs expand electronically controlled fuel delivery and cooling subsystems, increasing the need for high-cycle solenoids with enhanced sealing performance. Growing electrification also reinforces adoption as battery and inverter cooling loops rely on efficient 2-way flow-control architectures.

- For instance, Curtiss-Wright Corporation’s solenoids and solenoid valves are designed for high-reliability, safety-critical applications within the aerospace, defense, and nuclear power industries. These components are engineered and tested to meet stringent military and industry standards, such as those within MIL-STD-810, and can be built for continuous duty in demanding environments like engine bleed air systems or nuclear plant safety applications.

By Vehicle

Passenger vehicles lead the market with an exact 57% share, driven by high production volumes and rapid incorporation of electronically controlled subsystems. Solenoid demand strengthens as passenger models integrate advanced emission systems, active safety technologies, automated transmissions, and intelligent HVAC controls. Expanding hybrid and mild-hybrid variants further increase solenoid density per vehicle, particularly for turbo bypass control, vacuum switching, and thermal regulation components. Continuous platform upgrades across compact, mid-size, and premium segments reinforce the dominance of passenger vehicles in both OEM and replacement channels.

- For instance, Danfoss produces high-performance solenoid valves for industrial refrigeration applications, such as the EVR series (e.g., EVR 15, 032L1228), which utilize robust designs to achieve a maximum working pressure of approximately 45.2 bar (4,520 kPa).

By Application

Engine control emerges as the dominant application with an exact 33% share, propelled by stringent global emission regulations and OEM focus on combustion optimization. Modern engines rely extensively on solenoids for variable valve timing, turbocharger wastegate actuation, exhaust gas recirculation, and precise fuel modulation. Increasing adoption of downsized turbocharged engines intensifies the requirement for high-temperature, fast-response solenoids capable of supporting real-time calibration strategies. Even with rising electrification, hybrid powertrains preserve engine-control solenoid demand due to continued reliance on complex thermal, air-management, and fuel-handling subsystems.

Key Growth Drivers

- Rising Electrification and Advanced Powertrain Adoption

Electrification accelerates solenoid demand as hybrid and plug-in hybrid vehicles incorporate multiple electronically controlled actuators for thermal regulation, battery cooling, brake vacuum creation, and transmission modulation. Automakers integrate high-cycle solenoids to support downsized turbocharged engines that require precise boost control and exhaust management. Regulatory pressure to reduce emissions strengthens the use of solenoids in EGR, purge, and valve-timing systems. As electrified platforms expand globally, OEMs rely on compact, energy-efficient solenoids that maintain reliability under high temperature and vibration stress.

- For instance, SMC Corporation produces highly efficient direct-acting 5-port solenoid valves, such as those in the JSY series, which achieve low coil power consumption of approximately 0.4 watts (standard type, with an optional power-saving circuit reaching 0.1 W) and are rated for a long service life exceeding 55 million switching cycles (B10 reliability data).

- Increasing Integration of Safety and Comfort Systems

Modern vehicles incorporate advanced braking, ADAS, and comfort-enhancing systems that depend on rapid-response solenoid valves. Electronic stability control, anti-lock braking, seat-adjustment assemblies, active suspension, and automated door-locking systems use solenoids to ensure accurate and repeatable actuation. Growth in premium and mid-segment passenger vehicles expands solenoid content per vehicle across body control, HVAC regulation, and driver-assist modules. As OEMs enhance automation and comfort features, solenoids play a critical role in enabling precise mechanical responses within compact electronic architectures.

- For instance, AirTAC International Group specifies that its 4V and 2V electropneumatic solenoid valve platforms deliver response times as low as 50 milliseconds, operate reliably across pressure ranges from 150 kPa to 800 kPa, and achieve endurance ratings above 50 million switching cycles.

- Expansion of Emission-Control and Fuel-Efficiency Technologies

Global emissions regulations encourage automakers to adopt solenoid-based solutions that optimize combustion and reduce evaporative losses. Engine management systems increasingly use solenoids in variable valve timing, fuel vapor purge, NOx reduction, and exhaust after-treatment circuits. These components deliver fast modulation, tight sealing, and high thermal endurance, supporting OEM efforts to meet regulatory thresholds. Increasing adoption of GDI and turbocharged engines drives further usage in wastegate actuators, pressure-control circuits, and air path management, reinforcing solenoids as critical components in efficiency-focused powertrain designs.

Key Trends & Opportunities

- Growing Adoption of Smart and Miniaturized Solenoid Technologies

Manufacturers develop compact, lightweight solenoids with high force density, extended cycle life, and lower power consumption to meet the evolving needs of electrified vehicles. Integration of embedded sensors enables real-time diagnostics, predictive maintenance, and improved control accuracy. Miniaturization supports dense packaging in EV battery systems, ADAS modules, and multi-function mechatronic units. As OEMs shift toward space-efficient E/E architectures, suppliers offering intelligent solenoid solutions gain opportunities in next-generation thermal, braking, and transmission platforms.

- For instance, Emerson’s high-performance ASCO solenoid valves are engineered across various product series to meet specific industrial needs. The ASCO Series 188 miniature solenoid valves achieve power consumption as low as 1.0 to 1.3 watts for DC versions and offer response times under 10 milliseconds for pneumatic applications.

- Expansion of EV Thermal Management and Battery Safety Applications

Electric vehicles require complex thermal and coolant distribution loops, creating new opportunities for solenoids that manage refrigerant flow, coolant routing, and heat-pump switching. High-pressure, fast-switching solenoids support battery protection systems, inverter cooling, and motor thermal regulation. Growth in fast-charging infrastructure further increases demand for precision flow-control components in battery conditioning systems. As EV manufacturers enhance thermal efficiency and safety, specialized solenoids designed for non-flammable fluids, high-voltage isolation, and silent operation gain strategic relevance.

- For instance, IMI Process Automation’s ICO3S Direct-Acting Hydraulic Solenoid Poppet Valve is rated for continuous operation at pressures up to 350 bar (or up to 700 bar in other variants) with a typical flow capacity of approximately 6 to 14 liters per minute (L/min), and supports multiple coil voltage options tailored to specific control environments.

- Increasing Use of Modular and Multi-Function Actuation Units

Automakers transition toward modular actuation systems that combine multiple solenoid functions into unified units to improve reliability, reduce weight, and simplify assembly. Multi-function solenoid blocks support modern transmission control systems, brake boosters, and body electronics. Suppliers offering integrated modules gain competitive advantage as OEMs adopt zonal architectures and reduce wiring complexity. This shift also drives opportunities for solenoids with improved electromagnetic efficiency, adaptive force profiles, and compatibility with software-based calibration strategies.

Key Challenges

- Performance Degradation Under High Thermal and Mechanical Stress

Automotive solenoids operate in demanding environments where extreme heat, vibration, fuel exposure, and pressure fluctuations can impair functionality. High-temperature zones in turbocharged engines accelerate material fatigue and shorten service life. Ensuring coil insulation stability, magnetic strength retention, and sealing integrity becomes a major engineering challenge. OEMs face increasing responsibility to validate long-cycle durability while maintaining compact designs. These constraints pressure manufacturers to adopt advanced alloys, high-temperature polymers, and enhanced electromagnetic designs to ensure reliability.

- Cost Pressures Amid Rapid Technological Advancements

Automakers seek high-performance solenoids while maintaining strict cost targets, creating tension between material quality and affordability. Electrification and ADAS expansion increase solenoid count per vehicle, amplifying procurement cost sensitivity. Suppliers must invest in precision manufacturing, automation, and advanced testing while keeping unit costs low to stay competitive. Fluctuating raw material prices and global supply chain disruptions add further constraints. This challenge intensifies as OEMs demand smarter, smaller, and more efficient solenoids without significant cost escalation.

Regional Analysis

North America

North America leads the Automotive Solenoid Market with an exact 34% share, supported by strong adoption of advanced powertrain systems, stringent emission regulations, and high penetration of safety-enhanced vehicle platforms. OEMs in the region integrate solenoids extensively in engine optimization, EV thermal management, and ADAS-related actuation systems. The presence of established automotive manufacturers and technology suppliers accelerates product innovation, particularly in high-temperature, fast-response solenoid designs. Increasing EV production in the United States and Canada enhances demand for compact, energy-efficient solenoids used in battery cooling, braking, and electronic transmission modules.

Europe

Europe holds an exact 29% share, driven by its strong regulatory framework for emission control and rapid expansion of electrified mobility. Automakers in Germany, France, and the U.K. deploy high-density solenoid architectures in turbocharged engines, DSG and DCT transmissions, and advanced exhaust after-treatment systems. Rising EV adoption increases the requirement for precision solenoids supporting coolant routing, cabin heat pumps, and regenerative braking functions. The region’s established Tier-1 supplier ecosystem strengthens innovation in lightweight and thermally stable solenoid materials. Continuous investment in sustainable automotive technologies further elevates Europe’s position in high-efficiency solenoid integration.

Asia-Pacific

Asia-Pacific accounts for an exact 31% share, driven by high vehicle production in China, Japan, South Korea, and India. Expanding manufacturing capacity, rising adoption of compact passenger cars, and fast growth of hybrid and electric models sustain strong solenoid demand. OEMs deploy solenoids across engine control, transmission management, HVAC, and emission systems to meet tightening regional fuel-efficiency regulations. Cost-effective component production and large-scale automotive exports strengthen APAC’s market leadership. Local suppliers increasingly adopt miniaturized and high-flow solenoid technologies, supporting applications in turbo engines, automated gearboxes, and advanced thermal systems in EV platforms.

Latin America

Latin America captures an exact 4% share, supported by steady growth in passenger and light commercial vehicle production in Brazil, Mexico, and Argentina. Demand for automotive solenoids increases as regional automakers enhance emission-control systems and adopt electronically controlled transmissions and braking technologies. The aftermarket also contributes significantly due to the region’s aging vehicle fleet, driving replacement of fuel, purge, and brake-related solenoids. Although technology penetration remains moderate compared to mature markets, rising investments from global OEMs and tightening emission norms create opportunities for advanced solenoids with improved durability and cost-efficient designs.

Middle East & Africa

The Middle East & Africa region holds an exact 2% share, shaped by modest yet growing adoption of electronically controlled vehicle systems. Demand is supported by increasing sales of SUVs, pickups, and light commercial vehicles across Gulf countries and South Africa. Solenoid usage expands as manufacturers incorporate improved fuel-management, HVAC, and braking systems to meet evolving safety and efficiency standards. Harsh operating environments drive preference for high-temperature, corrosion-resistant solenoids. Although automotive manufacturing remains limited, rising vehicle imports and maintenance needs strengthen the aftermarket’s contribution to solenoid consumption across the region.

Market Segmentations:

By Valve Design:

By Vehicle:

- Passenger vehicles

- Light Commercial Vehicles (LCV)

By Application:

- Engine control

- Fuel & emission control

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Solenoid Market features a diverse mix of global manufacturers and specialized regional suppliers, including Curtiss Wright Corporation, Danfoss Industries Ltd, SMC Corporation, AirTAC International Group, Emerson Electric Co., Anshan Solenoid Valve Co. Ltd, IMI Process Automation, CEME Group, Parker Hannifin Corporation, and KANEKO SANGYO Co. Ltd. the Automotive Solenoid Market is shaped by a mix of global technology manufacturers and specialized component suppliers that focus on developing high-precision, durable, and energy-efficient actuation systems for modern vehicle architectures. Companies strengthen their positions by investing in advanced electromagnetic design, high-temperature insulation materials, and miniaturized valve structures that meet the needs of turbocharged engines, hybrid powertrains, and EV thermal systems. Continuous innovation in fast-response actuators, smart diagnostic capabilities, and integrated mechatronic modules enhances system reliability and supports OEM efforts to meet stringent emission, safety, and efficiency standards. Additionally, expanded automation in manufacturing and greater emphasis on quality control enable suppliers to deliver consistent performance while scaling production for global automotive platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Emerson partnered with Laramie Energy to deploy ASCO zero-emissions electric dump valves, drastically cutting energy use by 98.75% and stopping methane venting to meet tough environmental rules, boosting production by stabilizing pressure. This innovation, using ultra-low power valves, helps oil and gas producers comply with EPA mandates, reducing operating costs and improving efficiency.

- In October 2024, Solero Technologies (backed by Atar Capital) announced the agreement to buy Kendrion’s EU & US automotive business, with the acquisition completing significantly boosting Solero’s global footprint and sustainable product offerings, adding transmission solenoids and engine components to their portfolio.

- In January 2024, Nidec Power Train Systems announced the first-ever solenoid valve designed for diagnosing blow-by gas leaks in engines, a key innovation to meet tough OBD-II standards (like CARB’s) requiring better detection of gases escaping past piston rings, helping engines run cleaner and meet emissions rules.

Report Coverage

The research report offers an in-depth analysis based on Valve Design, Vehicle, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as hybrid and electric vehicles increase solenoid adoption for thermal, braking, and coolant flow control.

- Automakers will integrate more compact and energy-efficient solenoids to support advanced powertrain downsizing.

- Intelligent solenoids with embedded sensors will gain traction for real-time diagnostics and predictive maintenance.

- Demand will rise for high-temperature, corrosion-resistant solenoids used in turbocharged and high-pressure engine systems.

- EV battery protection and heat-pump systems will create new opportunities for specialized solenoid designs.

- Suppliers will adopt advanced manufacturing automation to improve precision and reduce defect rates.

- Modular solenoid assemblies will grow as OEMs transition to zonal vehicle architectures.

- Regulatory pressure on emissions will continue to increase solenoid deployment in fuel and exhaust systems.

- Asia-Pacific will strengthen its role as a key production hub for cost-efficient solenoid manufacturing.

- Collaboration between solenoid suppliers and OEM engineering teams will accelerate platform-specific innovation.