Market Overview

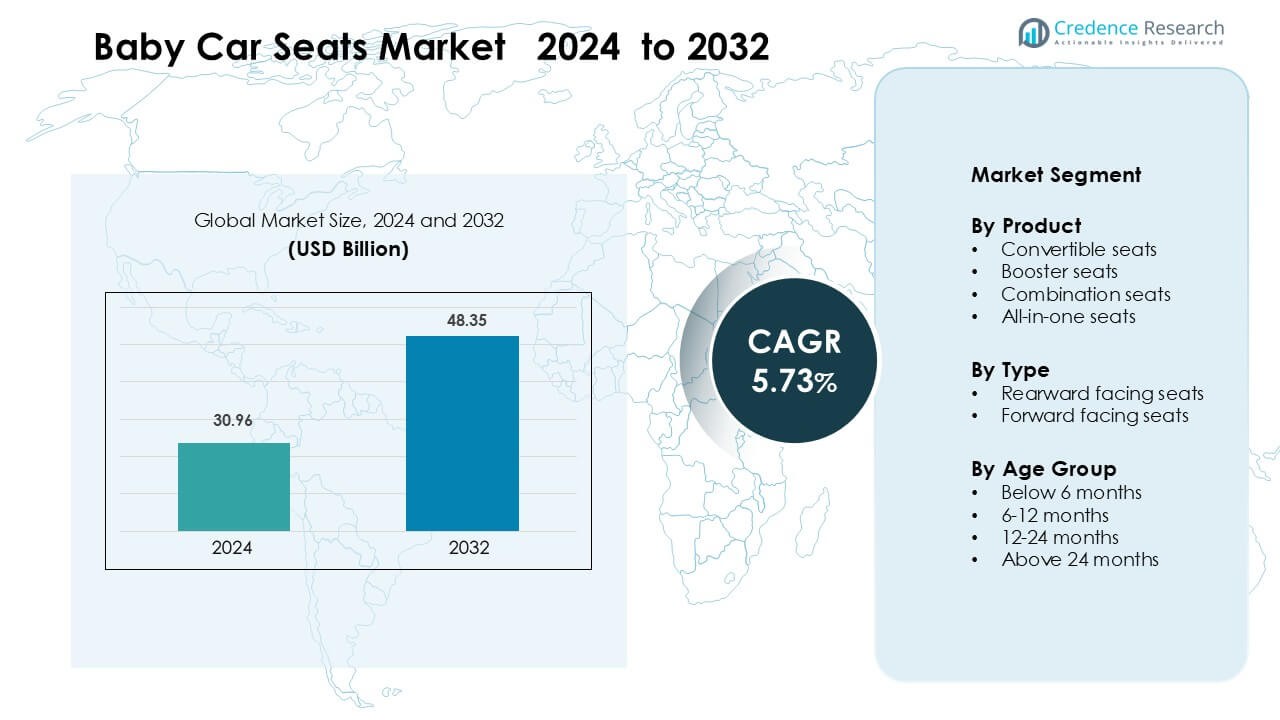

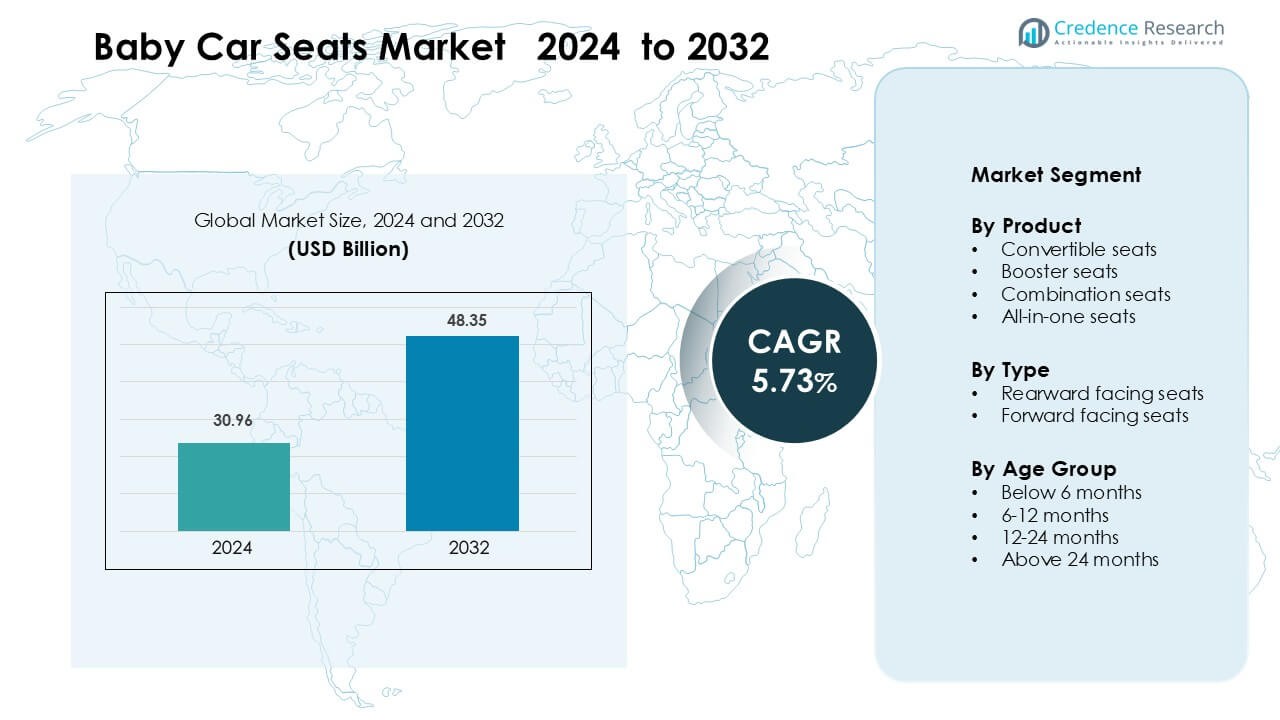

Baby Car Seats Market was valued at USD 30.96 billion in 2024 and is anticipated to reach USD 48.35 billion by 2032, growing at a CAGR of 5.73 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Baby Car Seats Market Size 2024 |

USD 30.96 Billion |

| Baby Car Seats Market, CAGR |

5.73 % |

| Baby Car Seats Market Size 2032 |

USD 48.35 Billion |

The Baby Car Seats Market is shaped by established players such as Chicco, Joie, Graco, Evenflo, Diono, Britax, Cybex, Cosco, Kidsembrace, and Clek. These brands compete through advanced safety engineering, multi-stage convertible models, and enhanced side-impact protection to meet rising regulatory and parental expectations. Companies also expand online availability and introduce ergonomic, lightweight, and comfort-focused designs to strengthen consumer appeal. North America leads the global market with about 38% share in 2024, driven by strict child-safety regulations, high awareness, and strong adoption of certified rearward-facing and convertible seats across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Baby Car Seats Market reached about USD 30.96 billion in 2024 and is projected to grow at nearly 5.73 % CAGR through 2032.

- Strong safety regulations and high parental awareness drive demand, with rearward-facing seats holding about 57% share and convertible seats leading products with around 43% share.

- Trends include rising interest in ergonomic padding, smart-alert features, and eco-friendly materials as brands focus on comfort and sustainability.

- Competition intensifies as Chicco, Joie, Graco, Evenflo, Diono, Britax, Cybex, Cosco, Kidsembrace, and Clek offer advanced crash-tested designs and expand online presence.

- North America leads with about 38% share, followed by Europe at nearly 32%, while Asia Pacific grows fastest with about 22% share due to rising vehicle ownership and evolving child-safety norms.

Market Segmentation Analysis:

By Product

Convertible seats hold the dominant share at about 43% in 2024. These seats gain demand because parents prefer long-term usability and adjustable safety features. The design supports both rearward and forward setups, which reduces replacement needs and boosts value. Booster seats follow due to growing use among older toddlers who need safe belt positioning. Combination seats serve families seeking extended flexibility, while all-in-one seats grow as consumers look for simplified purchase options that cover multiple stages.

- For instance, according to the NHTSA’s National Child Restraint Use Special Study (NCRUSS), the estimated misuse rate for rear-facing convertible car seats was 44% among observed seats nationwide. This highlights the need for continuous efforts by organizations, including manufacturers like Britax and Graco, to reinforce installation guides and recline angle indicators.

By Type

Rearward facing seats lead this segment with around 57% share in 2024. This position gains strong support from global safety guidelines that recommend rearward travel for infants due to improved head and spine protection. Rising awareness through hospital programs and parenting platforms sustains adoption. Forward-facing seats still hold steady demand among older toddlers who transition after reaching weight and height limits. Growth continues as manufacturers add energy-absorbing shells, improved harness systems, and crash-tested side-impact protection.

- For instance, FMVSS 213 regulatory proposals in the U.S. now recommend that child restraints may only be turned forward for children weighing at least 12 kg (26.5 lb) a constraint many rear‑facing seat makers, including Chicco and Maxi‑Cosi, are already engineering into their convertible and all-in-one models.

By Age Group

The above 24 months category leads with nearly 39% share in 2024. Parents in this group prioritize boosters and combination seats that support belt alignment and growing mobility needs. Demand rises as children stay longer in regulated car seat stages due to updated safety norms. The 12-24 months group follows closely because this stage often shifts from rearward to forward setups. Seats for 6-12 months and below 6 months remain essential but smaller in share due to shorter usage periods.

Key Growth Drivers

Growing Enforcement of Child Passenger Safety Regulations

Stricter child passenger safety laws across major regions drive strong growth in the Baby Car Seats Market. Governments now mandate age-specific restraint systems, periodic compliance checks, and certified installation standards. These rules encourage parents to adopt regulated seats that meet crash-test benchmarks and protect infants across multiple age groups. Rising penalties for non-compliance also increase responsible adoption. Hospitals, NGOs, and road-safety bodies run awareness programs that explain correct installation and seat selection, which improves user confidence and boosts replacement cycles. As new standards evolve with better side-impact and head-protection requirements, manufacturers upgrade materials, harness designs, and shell structures, which strengthens market expansion.

- For instance, in the European Union, child restraint systems must meet UN ECE Regulation R129 (“i‑Size”) by September 1, 2024, after which older R44‑only approved seats can no longer be sold pushing manufacturers like Cybex and Maxi‑Cosi to redesign all new models for side‑impact protection and ISOFIX installation.

Rising Parental Focus on Road Safety and Injury Prevention

Parents now prioritize infant safety due to increased awareness of accident risks and pediatric injury patterns. Growing access to online guidance, parenting platforms, and real-world crash data reinforces the importance of using certified car seats consistently. This awareness pushes families to invest in advanced rearward-facing designs, robust boosters, and all-in-one seats with extended protection. Improved disposable income in developing regions further supports adoption among first-time parents. Retailers also promote expert-led demonstrations and training modules that guide correct seat installation, reducing misuse cases. As families travel more frequently in private vehicles, demand grows for portable, ergonomic, and lightweight seats that meet daily mobility needs.

- For instance, a nationally representative survey by NHTSA found that 46% of car seats and booster seats had at least one major misuse (e.g., loose installation or slack harness) that could reduce protection in a crash.

Expansion of E-Commerce and Product Availability

Wider online availability strengthens market penetration as parents access detailed product comparisons, reviews, and virtual demos. E-commerce platforms offer transparent pricing, fast delivery, and certified seat options across multiple categories, improving access in urban and semi-urban areas. Brands leverage digital channels to showcase safety tests, installation videos, and compatibility guides, which build trust and shorten purchase decisions. Subscription and replacement programs offered online also encourage upgrades. Global expansion of retail networks and baby-product chains further supports availability of compliant seats, especially in emerging economies. As manufacturers collaborate with online marketplaces for exclusive models and safety bundles, the Baby Car Seats Market benefits from higher visibility and stronger customer engagement.

Key Trends & Opportunities

Growing Adoption of Smart and Ergonomic Designs

Manufacturers invest in smart features and ergonomic designs to meet rising expectations from parents who want comfort and safety in one solution. Innovations include temperature-regulating fabrics, impact-absorbing foam, lightweight shells, and sensors that alert caregivers about incorrect installation or buckling errors. Premium brands explore connectivity options that sync with mobile apps to offer usage reminders and safety insights. This trend creates strong opportunities in the mid-to-premium segment as parents increasingly value convenience. More companies also introduce breathable materials and adjustable headrests to enhance long-duration travel comfort, expanding the appeal of advanced models.

- For instance, Cybex GmbH integrates SensorSafe technology in models like the Sirona S i‑Size, which monitors unbuckling, child presence, and temperature and sends real‑time alerts to a paired smartphone.

Rising Demand in Emerging Economies

Developing regions show strong opportunity as private vehicle ownership rises and governments tighten child-safety norms. Middle-income households increasingly invest in branded car seats as awareness spreads through hospitals, retail chains, and digital platforms. International companies expand distribution networks by partnering with local retailers, while domestic players introduce budget-friendly models that meet basic compliance standards. Growing birth rates in large markets such as India, Indonesia, and Brazil strengthen long-term demand. As awareness programs and installation clinics scale up, emerging markets present a major growth frontier for manufacturers targeting volume expansion.

- For instance, in India, the Central Motor Vehicles Rules (CMVR) require a child restraint system for children under 135 cm or up to 12 years, and the Automotive Industry Standard AIS‑072 defines four weight (mass) groups (0, 0+, I, II, III) for child seats, pushing more affordable home‑market car seat manufacturers to enter.

Sustainability-Driven Product Innovation

Eco-friendly baby car seats gain attention as parents look for reduced environmental impact. Manufacturers introduce recyclable plastics, bio-based foam, and toxin-free fabrics that meet safety standards without compromising durability. Brands highlight sustainability certifications and transparent material sourcing to attract environmentally conscious families. Circular models, including refurbishing programs and return-and-reuse schemes, create new business opportunities. As regulations encourage lower chemical emissions in children’s products, companies accelerate development of greener materials. This focus on sustainability creates a competitive advantage and shapes the next wave of product differentiation.

Key Challenges

High Cost of Premium Safety Features

Advanced safety technologies such as side-impact protection, energy-absorbing structures, and multi-layer cushioning increase manufacturing costs, which raises retail prices. Many parents, especially in developing countries, find premium models expensive, limiting adoption. This cost barrier slows penetration of high-protection seats and results in continued reliance on low-spec or improperly used alternatives. Price disparities across regions also affect brand competitiveness, as import duties and certification expenses further push up prices. Manufacturers struggle to balance affordability with regulatory compliance and feature-rich design, making cost a major challenge for market growth.

Installation Complexity and Misuse Issues

Many parents struggle with correct installation, which reduces the safety effectiveness of certified seats. Complex harness adjustments, seat-belt routing, and compatibility issues with different vehicles often lead to misuse. Studies show that a large share of car seats are incorrectly installed, increasing risk in accidents. Lack of awareness, minimal training, and absence of standardized anchor systems in older vehicles worsen the problem. Brands attempt to address this challenge with clearer manuals, ISOFIX/LATCH systems, and instructional videos, but misuse remains a barrier to optimal safety outcomes and continues to affect market confidence.

Regional Analysis

North America

North America leads the Baby Car Seats Market with around 38% share in 2024. Strong enforcement of child passenger safety laws and high awareness among parents support sustained demand across all product types. Hospitals, pediatric networks, and safety organizations run installation programs that boost correct usage and encourage timely upgrades. Premium rearward-facing and convertible seats gain steady adoption due to strict crash-test standards. Broad availability through specialty stores and e-commerce channels further accelerates purchases. Continuous product innovation, including smart alerts and ergonomic materials, helps manufacturers maintain strong market penetration across the region.

Europe

Europe holds about 32% share in 2024, driven by stringent UNECE safety regulations and widespread adoption of i-Size (R129) standards. Parents prioritize side-impact protection, extended rearward-facing use, and height-based classification, which supports strong demand for convertible and all-in-one seats. Government-backed awareness campaigns and child safety inspection clinics improve installation accuracy and replacement cycles. High income levels and strong trust in certified brands encourage purchases of advanced models with improved comfort and eco-friendly materials. Well-established retail networks and rising online sales enhance accessibility across major markets such as Germany, France, and the United Kingdom.

Asia Pacific

Asia Pacific accounts for nearly 22% share in 2024 and shows the fastest growth due to rising urbanization and increasing private vehicle ownership. Governments in China, Japan, India, and Australia strengthen child passenger safety norms, encouraging wider adoption. Growing middle-class income levels and rising birth rates expand the buyer base. International brands expand distribution through partnerships with baby-product chains and online marketplaces, improving access to certified models. Awareness campaigns by hospitals and road-safety groups help parents understand the benefits of rearward-facing and combination seats, driving long-term market expansion across the region.

Latin America

Latin America holds around 5% share in 2024, supported by gradual improvement in child safety laws and a growing shift toward regulated car seats. Brazil, Mexico, and Argentina lead adoption as urban families invest in compliant models for everyday travel. Expansion of retail chains and online channels increases access to branded seats, although price sensitivity remains high. Awareness programs by NGOs and hospitals encourage proper installation and promote the use of age-appropriate systems. While adoption rates lag behind developed regions, demand rises steadily due to improving economic conditions and enhanced regulatory enforcement.

Middle East & Africa

Middle East & Africa captures nearly 3% share in 2024, with adoption concentrated in high-income urban centers such as the UAE, Saudi Arabia, and South Africa. Rising disposable income and growing awareness of infant road safety drive interest in certified seats. Governments introduce updated child-restraint regulations and invest in road-safety campaigns to improve compliance. Retail expansion through supermarkets and online platforms increases availability, though overall penetration remains low due to cost and limited awareness in rural areas. As safety norms strengthen and private vehicle ownership grows, the region shows steady long-term potential.

Market Segmentations:

By Product

- Convertible seats

- Booster seats

- Combination seats

- All-in-one seats

By Type

- Rearward facing seats

- Forward facing seats

By Age Group

- Below 6 months

- 6-12 months

- 12-24 months

- Above 24 months

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Baby Car Seats Market features strong participation from Chicco, Joie, Graco, Evenflo, Diono, Britax, Cybex, Cosco, Kidsembrace, and Clek. These companies compete by offering seats that meet strict crash-test standards, extended rearward-facing compatibility, and improved side-impact protection. Leading brands invest in ergonomic padding, energy-absorbing shells, and multi-stage adjustability to attract safety-conscious parents. Many players expand product lines with all-in-one and convertible seats to cover longer age spans and reduce replacement needs. E-commerce partnerships strengthen visibility, while retailers provide expert installation support to build trust. Sustainability also shapes competition as manufacturers adopt recyclable materials and low-emission fabrics. Continuous innovation in harness design, latch mechanisms, and smart alert systems helps key brands differentiate and maintain strong market positions across global regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Chicco

- Joie

- Graco

- Evenflo

- Diono

- Britax

- Cybex

- Cosco

- Kidsembrace

- Clek

Recent Developments

- In October 2025, Joie ADAC’s latest child seat test ranked the Joie i-Level Pro among the best infant carriers. The seat earned a “good” overall rating for crash safety and handling.

- In February 2025, Graco Graco introduced the EasyTurn 360 2-in-1 rotating convertible car seat on its site. The model offers 360° rotation and is promoted as a new “turning” car seat line.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more countries tighten child passenger safety laws.

- Rearward-facing and convertible seats will gain wider adoption across age groups.

- Smart-alert systems will become common to reduce installation and buckling errors.

- Manufacturers will expand eco-friendly materials to meet sustainability expectations.

- Online retail growth will increase access to certified seats in developing regions.

- Premium models will grow as parents prefer advanced side-impact and comfort features.

- Awareness programs by hospitals and NGOs will improve correct seat usage rates.

- All-in-one seats will gain traction due to longer lifecycle value for families.

- Partnerships with automotive brands will support better compatibility and safety fit.

- Emerging markets will show strong potential as vehicle ownership and awareness increase.